Official Single-Member Operating Agreement Document

Embarking on the journey of entrepreneurship through a limited liability company (LLC) presents thrilling possibilities and a spectrum of decisions to be made, one of which includes the creation of a Single-Member Operating Agreement. This agreement lays the foundational framework of operations, delineating the solo owner's rights, responsibilities, and the procedural elements of their business. Even in the absence of multiple members to negotiate terms with, establishing this agreement stands as a pivotal step towards legitimizing the entity, safeguarding the owner's personal assets from business liabilities, and guiding the LLC through potential legal or financial challenges. It offers clarity on the separation between the individual and the business entity in the eyes of the law, and it ensures that the owner maintains control over decision-making processes. Moreover, in situations where the business's operational or ownership dynamics change, this document serves as a critical point of reference, providing structured guidance on how such transitions should be navigated. Its significance does not wane with the solitary nature of the enterprise but rather bolsters the integrity and longevity of the business, making it an indispensable tool in the entrepreneur's toolbox.

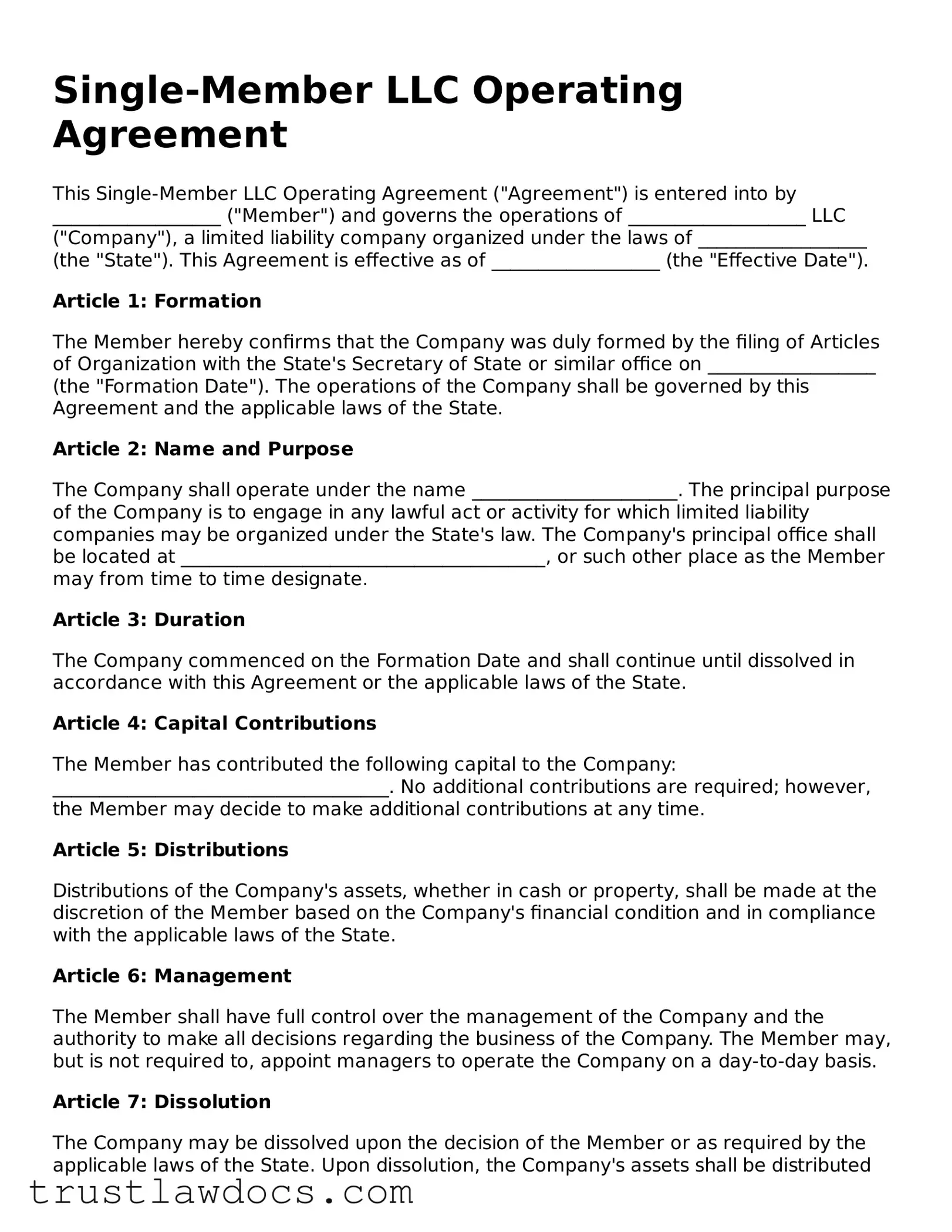

Form Example

Single-Member LLC Operating Agreement

This Single-Member LLC Operating Agreement ("Agreement") is entered into by __________________ ("Member") and governs the operations of ___________________ LLC ("Company"), a limited liability company organized under the laws of __________________ (the "State"). This Agreement is effective as of __________________ (the "Effective Date").

Article 1: Formation

The Member hereby confirms that the Company was duly formed by the filing of Articles of Organization with the State's Secretary of State or similar office on __________________ (the "Formation Date"). The operations of the Company shall be governed by this Agreement and the applicable laws of the State.

Article 2: Name and Purpose

The Company shall operate under the name ______________________. The principal purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the State's law. The Company's principal office shall be located at _______________________________________, or such other place as the Member may from time to time designate.

Article 3: Duration

The Company commenced on the Formation Date and shall continue until dissolved in accordance with this Agreement or the applicable laws of the State.

Article 4: Capital Contributions

The Member has contributed the following capital to the Company: ____________________________________. No additional contributions are required; however, the Member may decide to make additional contributions at any time.

Article 5: Distributions

Distributions of the Company's assets, whether in cash or property, shall be made at the discretion of the Member based on the Company's financial condition and in compliance with the applicable laws of the State.

Article 6: Management

The Member shall have full control over the management of the Company and the authority to make all decisions regarding the business of the Company. The Member may, but is not required to, appoint managers to operate the Company on a day-to-day basis.

Article 7: Dissolution

The Company may be dissolved upon the decision of the Member or as required by the applicable laws of the State. Upon dissolution, the Company's assets shall be distributed first to satisfy any liabilities and then to the Member in proportion to their capital contributions, if applicable.

Article 8: Modifications to the Agreement

This Agreement may only be amended or modified in writing with the consent of the Member.

Article 9: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State, without regard to its conflict of laws principles.

In witness whereof, the undersigned has executed this Single-Member LLC Operating Agreement as of the date first above written.

__________________________________

Member's Signature

__________________________________

Member's Printed Name

__________________________________

Date

PDF Form Details

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Definition | A Single-Member Operating Agreement is a document used by the sole owner of an LLC to establish the guidelines and operations of the business. |

| 2 | Legal Protection | This agreement helps to reinforce the legal separation between the owner's personal and business assets. |

| 3 | Flexibility | The document provides flexibility in business operations and management structures, tailored to the owner's preferences. |

| 4 | State-Specific Regulations | Varying state laws may dictate specific requirements or provisions that need to be included in the agreement. |

| 5 | Customization | It allows for customization in terms of decision-making processes, financial arrangements, and business succession plans. |

| 6 | Governing Law | The agreement is governed by the state law where the LLC is formed, impacting how disputes are resolved and how the agreement is interpreted. |

| 7 | Ease of Use | Templates and samples can be easily modified to meet the specific needs of the LLC owner. |

| 8 | Financial Clarity | Details about capital contributions, profit distribution, and financial reporting are clarified within the agreement. |

| 9 | Operational Control | The sole member retains full control over daily operations, though the agreement can outline procedures for hiring managers or other employees. |

How to Write Single-Member Operating Agreement

Filling out a Single-Member Operating Agreement is an important step for anyone running their own business as the sole owner. This document helps to establish the financial and operational guidelines of your business. It's a straightforward process, but attention to detail will ensure that everything is in order for your business's smooth operation. Here's how you can fill out the form efficiently.

- Start by entering the date the agreement is being made at the top of the form.

- Next, fill in your full legal name as the sole member and the name of your business in the respective fields.

- Add your business address, including the city, state, and zip code where the principal place of business is located.

- Specify the purpose of your business. Try to be as clear and concise as possible. This section describes the nature of your business activities.

- Outline the capital contributions. This includes any initial assets or funds you are putting into the business. List the type and value of each contribution.

- Detail the management structure of your business. Even as a single member, it's essential to specify how business decisions are made and who is responsible for them.

- Describe how profits and losses will be allocated. As the sole member, you typically receive 100% of the profits and are responsible for losses, but this should still be stated explicitly.

- Decide on the terms for membership changes, such as the addition of new members or transfer of ownership, and document these in the agreement.

- Review the dissolution section. This part outlines the conditions under which your business may be dissolved and how assets would be distributed.

- Don't forget to sign and date the agreement at the bottom. Your signature is crucial as it indicates your acknowledgment and acceptance of the terms outlined in the agreement.

Once you've completed these steps, your Single-Member Operating Agreement should be fully executed and in effect. It's a good idea to keep a copy of this document for your records and possibly another with a legal advisor or in a safe deposit box. This agreement not only establishes the legitimacy of your business operations but also serves as a critical reference should any legal questions arise in the future.

Get Answers on Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document designed for a lone entrepreneur who decides to establish a Limited Liability Company (LLC). This agreement outlines the ownership and operating procedures of their LLC, ensuring that the company’s operations are aligned with the owner's intentions and legal requirements.

Why is having a Single-Member Operating Agreement important?

Even though it's not mandatory in every state, having this agreement is critical. It helps in reinforcing the legal separation between the owner's personal assets and the business's liabilities, offering protection against personal accountability for the company's debts or legal challenges. Furthermore, it serves as an official document that can clarify business operations to financial institutions or in legal situations.

What should be included in a Single-Member Operating Agreement?

The agreement should cover essential aspects of the LLC’s operation such as the LLC's name and principal place of business, the nature of the business, how the business will be managed, the owner's contributions, distribution of profits and losses, procedures for transferring interest in the case of the owner’s death or dissolution of the LLC, and any other provisions governing the business's operations.

Can I write my own Single-Member Operating Agreement, or do I need an attorney?

You can write your own Single-Member Operating Agreement. Many resources and templates are available to guide individuals through the process. However, consulting with an attorney can provide personalized advice and ensure that the agreement meets all legal requirements and appropriately protects the owner’s interests.

Is the Single-Member Operating Agreement filed with the state?

Typically, the Single-Member Operating Agreement is not filed with the state. It is an internal document that you should keep for your records. However, it's important to check with your state's specific requirements as some states may have unique regulations.

How does a Single-Member Operating Agreement protect me?

It protects you by setting clear boundaries between your personal and business assets and liabilities, which is essential for personal asset protection. In the event of legal action taken against the business, having this agreement can help demonstrate that the LLC is a separate business entity, potentially safeguarding the owner's personal assets from business debts or liabilities.

Can modifications be made to the Single-Member Operating Agreement?

Yes, modifications can be made to the agreement as your business grows or changes. It's recommended to review and update the agreement regularly to reflect any significant changes in the business's operation or structure. Ensure that any amendments to the agreement are documented and properly executed.

What happens if I don't have a Single-Member Operating Agreement for my LLC?

Without this agreement, your business operations and disputes may be governed by generic state laws, which may not align with your preferences for managing your business. Potentially, it could also weaken your liability protection since the separation between personal and business assets may not be as clearly defined.

How does a Single-Member Operating Agreement differ from a multi-member LLC Operating Agreement?

The core difference lies in the number of members involved. A Single-Member Operating Agreement is tailored for an LLC owned by one person, focusing on that individual's rights, obligations, and the separation of personal and business affairs. A multi-member LLC Operating Agreement, however, addresses the relationships between multiple members, including how decisions are made, how profits and losses are shared, and how membership interests are transferred, among other aspects relevant to a multi-owner business entity.

Common mistakes

When individuals embark on filling out the Single-Member Operating Agreement form, several common mistakes can occur. One common error is not specifying the purpose of the LLC in enough detail. Many assume a broad description suffices, but being specific can prevent legal complications and clarify the business's scope to third parties.

Another error is overlooking the section that details the procedures for amending the agreement. People often forget that businesses evolve over time, and having a clear, predetermined method for making amendments to the agreement is crucial. Neglecting this could complicate the process of adapting the agreement to future changes in the business.

Some individuals inadvertently skip the sections that require personal information, assuming it's clear from context or unnecessary since it's a single-member LLC. This omission can lead to unclear legal documentation, making it more challenging to assert ownership or protect personal assets.

Another frequent mistake is not fully describing the financial contributions and the process for additional contributions. Even in a single-member LLC, detailing these financial aspects clarifies the separation between personal and business finances, which is essential for tax purposes and personal liability protection.

Inadequately defining the succession plan in the event of the member's death or incapacitation is a critical oversight. Without clear instructions, the business could face legal challenges or dissolution, rather than seamlessly transferring to a chosen successor.

Not setting clear boundaries for the separation of personal and business assets is yet another common misstep. This lack of clarity can lead to difficulties in maintaining the legal protections offered by the LLC structure, potentially endangering personal assets in the event of a lawsuit against the business.

Choosing to omit details about how decisions are made is a mistake. Even in a single-member LLC, outlining the decision-making process, especially for significant changes or investments, is vital. It serves as a record of the owner's intentions and business approach.

Forgetting to date and sign the agreement at the end is surprisingly common. This oversight can invalidate the document or at least call into question its applicability, as the effective date of the agreement is crucial for various legal and business reasons.

Last but certainly not least, failing to keep the agreement updated to reflect current laws and business practices is a risk. Laws and regulations change, and an outdated agreement could lead to unintentional non-compliance or missed opportunities for better legal protections.

Documents used along the form

When forming a single-member limited liability company (LLC), the Single-Member Operating Agreement is a crucial document that outlines the structure, policies, and operational guidelines of the business. This foundational document is often accompanied by other forms and documents that are important for legal compliance, financial management, and overall business operations. Below is a list of forms and documents frequently used alongside the Single-Member Operating Agreement to ensure a well-rounded legal and operational framework for the LLC.

- Articles of Organization: This document officially registers the LLC with the state. It includes basic information such as the name of the LLC, its purpose, and the registered agent’s information.

- Employer Identification Number (EIN) Application: Often required for opening a bank account and handling employee payroll, the EIN is a unique nine-digit number assigned by the IRS to businesses operating in the United States.

- Operating Agreement Amendment: This document is used if there are any changes to the initial Single-Member Operating Agreement, ensuring that the LLC's operational procedures and member's responsibilities are up-to-date.

- Annual Report: Many states require LLCs to submit an annual report to update or confirm the company’s information, such as addresses, management structure, and registered agent details.

- Business License Application: Depending on the type of business and its location, various federal, state, or local business licenses may be required to legally operate.

- DBA Registration Form (Doing Business As): If the single member chooses to operate under a name different from the officially registered LLC name, a DBA form must be filed with the appropriate governmental body.

- Membership Certificates: Although not mandatory, these certificates can formalize the ownership of the LLC, serving as physical evidence of the member's ownership interest.

- Bank Resolution: This document authorizes the opening of a bank account in the name of the LLC and designates who has the power to conduct banking transactions on behalf of the LLC.

- Operating Agreement for Future Members: In case the single member plans to add more members to the LLC in the future, a revised or entirely new operating agreement accommodating multiple members might be prepared in advance.

In addition to these documents, it is advisable for business owners to stay informed about any legal requirements specific to their industry or jurisdiction. Proper documentation is essential for the smooth operation and legal compliance of an LLC, protecting the business and its owner(s) from potential legal issues and clarifying the operational procedures and policies of the business. Consulting with a legal professional can help ensure that all necessary documents are in order and tailored to the specific needs of the business.

Similar forms

The Single-Member Operating Agreement form closely resembles a Partnership Agreement. Both documents regulate the internal operations of a business entity, but the former is for a sole proprietor within a Limited Liability Company (LLC), while the latter applies to enterprises owned by two or more individuals. These agreements outline the responsibilities, profit sharing, and decision-making processes, helping prevent disputes among the owners or between the owner and the business itself.

Similarly, a Shareholder Agreement is akin to a Single-Member Operating Agreement, as it serves businesses structured as corporations rather than LLCs. This document dictates the rights and responsibilities of the shareholders, the distribution of dividends, and procedures for buying and selling shares. Despite the difference in business structure, both aim to establish a clear operational framework for the entity.

A Founder's Agreement is another document related to a Single-Member Operating Agreement, particularly for startups with more than one founder. It outlines the founders' roles, ownership percentages, and contributions, along with how decisions are made, profits are shared, and dispute resolution is handled. For businesses with a single founder, the Single-Member Operating Agreement serves a similar purpose but tailored to a solitary business owner context.

The Terms of Service Agreement, commonly found on websites and apps, also shares similarities with a Single-Member Operating Agreement by setting forth the rules and guidelines for the service's use. Although it focuses more on the relationship between the service provider and its users, rather than the internal operations of a company, both documents are crucial for defining acceptable conduct and protecting the entity's interests.

The Employment Agreement is another document that, while primarily outlining the relationship between an employer and an employee, shares common ground with the Single-Member Operating Agreement in terms of specifying roles, responsibilities, and expectations. Both documents are vital for ensuring mutual understanding and agreement on the terms of engagement, whether it be employment or business operations.

A Confidentiality Agreement, or Non-Disclosure Agreement (NDA), while focusing on the protection of sensitive information, similarly establishes agreements between two parties. Like the Single-Member Operating Agreement, which may include clauses on confidentiality, NDAs ensure that proprietary information is safeguarded, illustrating the importance of securing business operations and interests.

The Business Plan is a comprehensive document that outlines a company's objectives, strategies for achieving them, market analysis, and financial projections. Although not a legal agreement like the Single-Member Operating Agreement, it provides a strategic framework for the business, highlighting the parallel in their purposes of guiding the business's operations and goals.

Loan Agreements bear resemblance to Single-Member Operating Agreements when a business borrows money. They detail the terms of the loan, including payment schedule, interest rates, and collateral, if applicable. Both types of agreements are fundamental in delineating the specifics of financial transactions, one concerning the operations within the company and the other with external financial arrangements.

Lastly, the Buy-Sell Agreement, relevant in businesses with multiple owners, is comparable for its role in defining what happens if an owner wants to sell their interest, dies, or becomes disabled. For a Single-Member LLC, the Operating Agreement might outline succession or dissolution plans, serving a similar function in planning for future changes or unforeseen events.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it's essential to be thorough and accurate to ensure that the document correctly reflects your business operations and intentions. Here are important dos and don’ts to consider:

- Do:

- Read the form carefully before you start filling it out to understand all the requirements and implications.

- Provide accurate and comprehensive information about your business, including the official business name and the address where it operates.

- Review the specifics regarding how profits and losses will be handled within your business.

- Specify the process for making significant business decisions.

- Ensure that the document includes your plan for succession or what happens if the business is sold or if you're unable to manage it.

- Don't:

- Rush through the filling process without understanding the implications of what you're agreeing to.

- Skip sections that seem unimportant. Every part of the agreement has its purpose and helps protect your interests.

- Use vague language. Be clear and specific to avoid misunderstandings and disputes over the agreement’s interpretation.

Overall, taking the time to fill out the Single-Member Operating Agreement form carefully and thoughtfully can save you from potential legal headaches in the future. If you’re unsure about any part of the agreement, seeking advice from a legal professional could be beneficial.

Misconceptions

When it comes to the Single-Member Operating Agreement form, misunderstandings can cloud the judgment of even the most savvy entrepreneurs. Here are seven common misconceptions:

It's not necessary for a single-member LLC. Many believe that if there's only one member in an LLC, an operating agreement is superfluous. However, this document provides a clear outline of the business’s financial and functional decisions, offering protection and clarity.

It has no legal standing. Contrary to what some might think, the Single-Member Operating Agreement is a legally binding document that can be critical in protecting the member’s assets from legal troubles and in disputes over the separateness of the entity.

All templates are the same. Each business is unique, and a template grabbed off the internet may not cover specific needs or meet legal requirements in every state. Tailoring the agreement to the business is essential.

It’s too complicated to create. While legal documents can be daunting, the Single-Member Operating Agreement does not have to be complex. Assistance from a professional or using a state-specific guide can simplify the process.

There's no need to update it. As the business evolves, so should the agreement. Regular updates reflect changes in operations, management, or the legal environment, ensuring that the document remains relevant.

It's only about the finances. While financial management is a significant component, the agreement also covers roles, responsibilities, and procedures for various business scenarios, making it a comprehensive management tool.

Having one means relinquishing personal control. Some fear that formalizing operations through such an agreement could limit their flexibility. In reality, it allows the owner to define the rules on their terms, enhancing rather than limiting control.

Key takeaways

When embarking on the journey of setting up a Limited Liability Company (LLC), it's crucial to anchor your business with a solid foundation. For single-member LLCs, this foundation often starts with a Single-Member Operating Agreement. This document might seem straightforward at first glance, but its nuances and importance cannot be overstated. Here are key takeaways about filling out and using this form:

- Defines the LLC's Structure: The Operating Agreement lays down the organizational structure of your business, outlining its operational processes, member duties, and financial decisions. This clarity is crucial for both the member and any future disputes or legal matters.

- Protects Personal Liability: By clearly separating the owner's personal assets from the business's liabilities, this agreement reinforces the liability protection offered by the LLC structure. It's a declaration that the business and personal financials are independent.

- Enhances Business Credibility: Having a formal Operating Agreement boosts your LLC's credibility with banks, potential investors, and partners. It demonstrates that your business is well-organized and professionally managed.

- Flexible Management: The agreement allows you to specify your management structure. Even as a single member, establishing your preferred management style in writing sets clear expectations for operational procedures and decision-making.

- Succession Planning: It helps in outlining what happens to the business if the member decides to sell, or if unforeseen circumstances occur. This ensures a smooth transition and clarity for the future of the LLC.

- Tax Clarification: Though single-member LLCs are typically taxed as sole proprietorships, the Operating Agreement can specify if you choose to be taxed as a corporation. This flexibility is beneficial for tax planning and financial organization.

- State Requirements: Some states require an Operating Agreement for single-member LLCs, while others do not. Even in states where it's not required, having one in place is highly advisable for all the reasons mentioned above.

- Customizable Document: Unlike the more rigid articles of organization, the Operating Agreement offers flexibility. You can tailor it to fit the unique needs of your business, including provisions for operation, dissolution, and the management of assets.

- Future Amendments: As your business grows and evolves, your Operating Agreement can be amended to reflect changes in the LLC's operation or the owner's wishes. This ensures that the document remains relevant and accurate over time.

In sum, the Single-Member Operating Agreement is not just a formality but an essential tool for clarifying the operation of your LLC, safeguarding your liability protection, and providing a clear road map for your business's future. Take the time to understand and carefully craft this document; it will serve as a cornerstone for your business's legal and operational framework.

Consider More Types of Single-Member Operating Agreement Forms

Multi Member Operating Agreement - Defines the process for adjudicating any legal actions against the LLC, protecting members and the LLC from unwarranted claims.