Free Operating Agreement Form for New York

In the bustling business landscape of New York, crafting a solid foundation for your company begins with the creation of a New York Operating Agreement. This legal document is not just a formality but a crucial tool that clearly delineates the operational mechanisms, financial arrangements, and overall governance of the business. Aimed primarily at Limited Liability Companies (LLCs), this agreement spells out the rights, powers, duties, liabilities, and obligations of each member and the company itself. It serves not only to establish a structured framework for decision-making and conflict resolution but also to protect the personal assets of its members by reinforcing the company's limited liability status. Additionally, while New York State does require LLCs to adopt an operating agreement, it's noteworthy that the specifics of this agreement provide ample flexibility, allowing members to tailor the provisions to suit the specific needs and goals of their business. Thus, the New York Operating Agreement form emerges as a pivotal document that supports the formation, operation, and future growth of LLCs while ensuring compliance with state legal requirements.

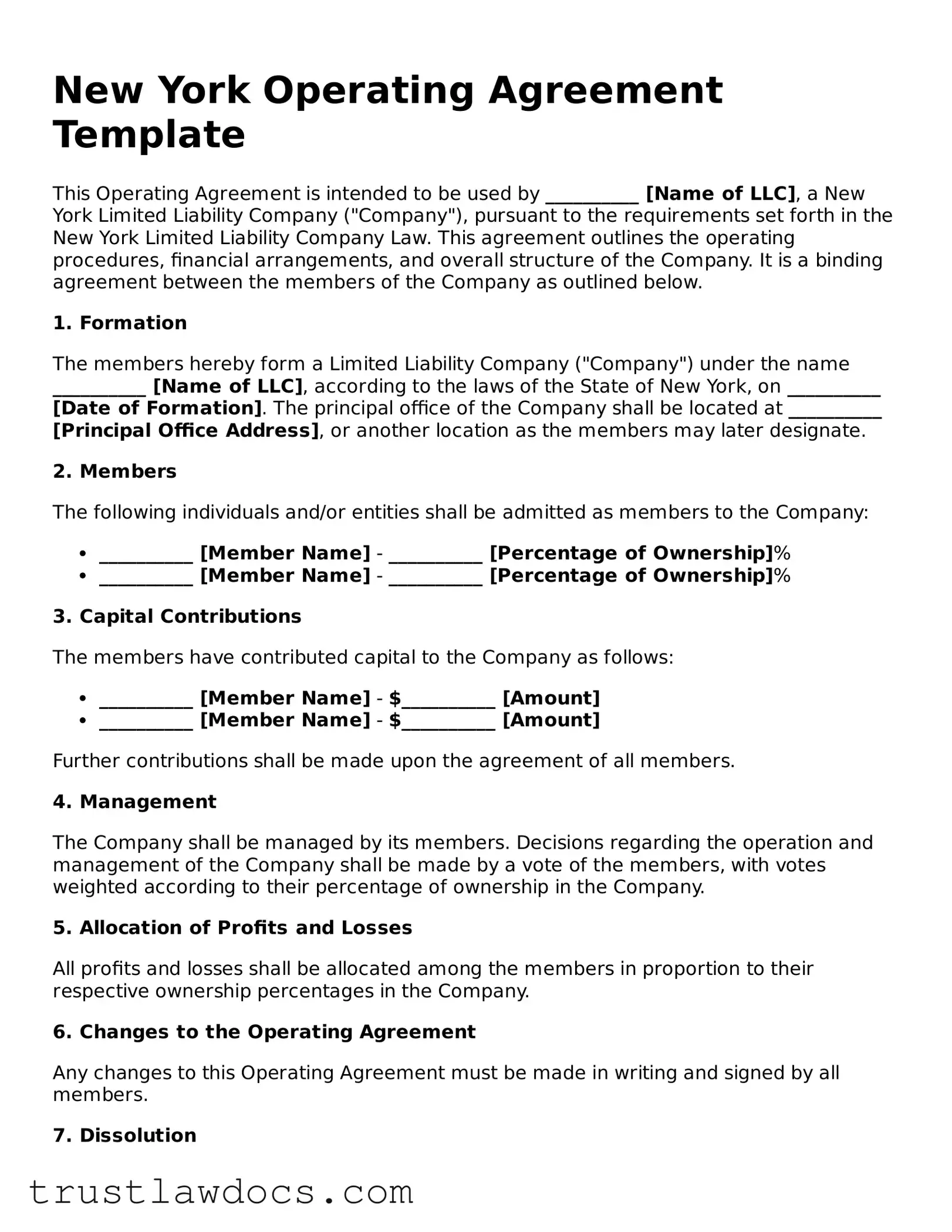

Form Example

New York Operating Agreement Template

This Operating Agreement is intended to be used by __________ [Name of LLC], a New York Limited Liability Company ("Company"), pursuant to the requirements set forth in the New York Limited Liability Company Law. This agreement outlines the operating procedures, financial arrangements, and overall structure of the Company. It is a binding agreement between the members of the Company as outlined below.

1. Formation

The members hereby form a Limited Liability Company ("Company") under the name __________ [Name of LLC], according to the laws of the State of New York, on __________ [Date of Formation]. The principal office of the Company shall be located at __________ [Principal Office Address], or another location as the members may later designate.

2. Members

The following individuals and/or entities shall be admitted as members to the Company:

- __________ [Member Name] - __________ [Percentage of Ownership]%

- __________ [Member Name] - __________ [Percentage of Ownership]%

3. Capital Contributions

The members have contributed capital to the Company as follows:

- __________ [Member Name] - $__________ [Amount]

- __________ [Member Name] - $__________ [Amount]

Further contributions shall be made upon the agreement of all members.

4. Management

The Company shall be managed by its members. Decisions regarding the operation and management of the Company shall be made by a vote of the members, with votes weighted according to their percentage of ownership in the Company.

5. Allocation of Profits and Losses

All profits and losses shall be allocated among the members in proportion to their respective ownership percentages in the Company.

6. Changes to the Operating Agreement

Any changes to this Operating Agreement must be made in writing and signed by all members.

7. Dissolution

The Company may be dissolved upon the agreement of __________ [Percentage]% of the members. Upon dissolution, the assets of the Company shall be liquidated, and the proceeds distributed to the members according to their respective ownership percentages after all debts and liabilities of the Company have been paid.

8. Governing Law

This Operating Agreement shall be governed by and construed in accordance with the laws of the State of New York.

This Operating Agreement has been executed on __________ [Date] by the members below:

- __________ [Member Name & Signature]

- __________ [Member Name & Signature]

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The New York Operating Agreement form is used by LLCs in New York to outline the operating procedures and the financial and functional decisions of the business. |

| Governing Law | This form is governed by the New York Limited Liability Company Law. |

| Requirement | While not required by law, it's strongly recommended for LLCs to have an Operating Agreement in place. |

| Customization | This document can be customized to fit the specific needs of the LLC, including provisions for management, distribution of profits, and membership changes. |

| Flexibility | The agreement offers flexibility for the LLC, allowing it to establish its own governance and operational procedures outside of default state laws. |

How to Write New York Operating Agreement

Embarking on a business adventure in New York with a Limited Liability Company (LLC) is an exciting journey. To ensure this journey starts off on the right foot, drafting an Operating Agreement is a crucial step. This document outlines the ownership, structure, and operational guidelines of your business, ensuring all members are on the same page. Here's a simple guide to help you fill out the New York Operating Agreement form, keeping things clear and straightforward.

- Begin by gathering all necessary information about your LLC, including the official business name (exactly as registered), the principal place of business, and any DBA (Doing Business As) names the company might use.

- Decide on the management style of your LLC. You will need to state whether your LLC is Member-Managed, where all members participate in the decision-making process, or Manager-Managed, where specific members or outside individuals are designated to run the LLC.

- Identify all members of the LLC and their contributions. List each member's name, address, and the capital they contribute to the LLC. This could be in the form of cash, property, or services.

- Outline the distribution of profits and losses. Here, you will specify how the LLC's profits and losses are divided among the members. This is usually based on the percentage of each member's contribution to the company.

- Describe the voting rights of the members. Indicate whether voting is proportional to ownership interest or if members have equal voting rights regardless of their contribution size.

- Include any provisions for admitting new members or what happens if a member wishes to leave the LLC. This includes buyout procedures, how new members can be added, and the process for dissolving the LLC if necessary.

- Set forth the duties and powers of the managers if your LLC is Manager-Managed. This should clearly state who has the authority to make decisions on behalf of the LLC and what those decisions can include.

- Detail any restrictions on the transfer of membership interests, ensuring there's a clear process for how members can sell or pass on their shares in the company.

- Establish a protocol for meetings, including how often they will occur, how they will be called, quorum requirements, and the method for recording minutes.

- Finally, all members should sign the agreement. Depending on the LLC's requirements and state laws, you might need these signatures to be notarized. Ensure every member reviews the agreement thoroughly before signing to confirm they understand and agree to all its terms.

Filling out the New York Operating Agreement is a step-by-step process that provides a solid foundation for your LLC. With careful attention to detail and a clear understanding between members, this document will be a guiding star for your business's operations and management. Remember, while the process might seem straightforward, taking time to ensure accuracy and completeness is key to avoiding future conflicts and confusion. This agreement is not just a formality; it’s the backbone of your business relationship with your partners and the state of New York.

Get Answers on New York Operating Agreement

What is an Operating Agreement in New York?

An Operating Agreement is a legal document that outlines the ownership structure and operational guidelines for a Limited Liability Company (LLC) in New York. It includes provisions on how the business will be run, how decisions will be made, and how profits and losses will be distributed among the members. Although not mandatory in every state, New York law requires all LLCs to have a written Operating Agreement in place.

Why do I need an Operating Agreement for my New York LLC?

Having an Operating Agreement for your New York LLC is legally required. Beyond compliance, this document plays a crucial role in preventing misunderstandings between members by clearly defining each member's rights, responsibilities, and the distribution of profits. Additionally, it provides a level of protection for the members’ personal assets against the company’s debts and liabilities and helps to ensure that the business is run according to the members' consensus rather than default state laws.

What should be included in a New York Operating Agreement?

A New York Operating Agreement should include details such as the LLC's name and primary place of business, the names of its members, how the LLC will be managed, the contributions of each member, and how profits and losses will be shared. It should also define the process for adding or removing members, how meetings are convened and votes are cast, and procedures for dissolving the business. It's important to cover all potential business operations and member interactions to minimize future disputes.

Can I write my own Operating Agreement for my New York LLC?

Yes, you can draft your own Operating Agreement. While template agreements are available, it's beneficial to customize your agreement to suit the specific needs and structure of your LLC. However, due to the legal significance of this document, consulting with a legal professional to review or help draft your Agreement is often recommended. This ensures that the Agreement complies with New York state laws and best protects your interests.

How do I file my Operating Agreement in New York?

Unlike the Articles of Organization, your Operating Agreement does not need to be filed with the state. Instead, it should be kept on file by the LLC members and updated as necessary to reflect changes in the operation of the company or its membership. It’s important to have the Agreement easily accessible, as it may need to be presented to financial institutions, potential investors, or in legal situations.

Can an Operating Agreement be changed or amended?

Yes, an Operating Agreement can be changed or amended as needed. Typically, the original Agreement will outline the process for making amendments, which usually requires a majority or unanimous vote by the LLC members. Changes should be documented in writing, agreed upon by all members, and attached to the original Agreement to ensure that the document remains current and accurate.

Common mistakes

One common mistake people make when filling out the New York Operating Agreement form is neglecting to customize the agreement to fit their specific business needs. Most templates provide a general outline, but they may not cover every aspect unique to your business situation. It's important to tailor the agreement to reflect the actual operations, management structure, and ownership details of your LLC to ensure it accurately represents your business operations.

Another frequent oversight is failing to specify the roles and responsibilities of each member clearly. An Operating Agreement should precisely outline who is responsible for what within the company. Without clear definitions, misunderstandings and conflicts can arise, potentially disrupting the smooth running of the business. This section should be detailed to prevent any ambiguity regarding each member's duties and obligations.

Many individuals also forget to detail the process for adding or removing members in the Operating Agreement. Businesses evolve, and the need to change the membership structure can arise. A lack of clear guidelines on how to handle these changes can lead to conflicts and legal challenges, making transitions harder than they need to be.

A critical mistake is not properly outlining the distribution of profits and losses. While it might seem straightforward to split profits equally, reality is often more complex. The agreement should specify how profits and losses are distributed to avoid any confusion or disagreements among members, paying special attention to any contributions that members might make outside of initial investments.

Failing to plan for the dissolution of the LLC is another oversight. While it may seem pessimistic to consider the end of the business at its inception, outlining a dissolution process in the Operating Agreement prepares all members for a potential orderly shutdown, guiding them on how assets and liabilities should be handled.

Not updating the Operating Agreement is a common error as well. As businesses grow and evolve, so should their operating agreements. Amendments should be made to reflect new operations, member changes, or adjustments in profit sharing arrangements to ensure the document remains relevant and accurate.

Lastly, a surprisingly frequent mistake is not having the Operating Agreement reviewed by a legal professional. While it's tempting to save on costs by skipping professional reviews, this can lead to significant legal issues down the line. A professional can identify potential problems or omissions you might overlook, ensuring the agreement is sound and enforceable.

Documents used along the form

When setting up a Limited Liability Company (LLC) in New York, an Operating Agreement is a foundational document that outlines the operational structure and financial decisions of the business. However, to fully establish and safeguard your LLC, other forms and documents are typically used alongside the Operating Agreement. These documents help to ensure compliance with state laws and protect the LLC's interests. Below is a list of four such documents that are often important for LLC owners to consider.

- Articles of Organization: This is a mandatory document for officially registering your LLC with the State of New York. It includes basic information about your LLC, such as the company name, address, and the names of its members. Filing this document with the New York Department of State legally establishes your business.

- Employer Identification Number (EIN): Although not a document in the traditional sense, obtaining an EIN from the Internal Revenue Service (IRS) is crucial. This number is essentially a social security number for your business, required for opening bank accounts, hiring employees, and filing taxes. It's a critical step for operational and tax purposes.

- Operating Agreement Amendment: Over time, changes to the original Operating Agreement may be necessary due to shifts in membership, management structure, or operational procedures. This document officially logs any amendments to the initial Operating Agreement, ensuring that all changes are legally recognized and enforceable.

- Compliance Documents: These are various forms or notices required by New York State or local governments to maintain good standing. They may include annual reports, tax documents, and any other filings required to comply with state laws and regulations. The specific nature of these documents can vary significantly depending on your LLC's activities and location.

Understanding and managing these documents is essential for the smooth operation and legal compliance of your LLC in New York. Each plays a significant role in defining the structure, responsibilities, and legal standings of your business. It's important to regularly review and update these documents as necessary to reflect the current state of your LLC and ensure compliance with any changes in laws or regulations.

Similar forms

The New York Operating Agreement shares similarities with the Partnership Agreement. Both documents outline the business structure, roles, responsibilities, and profit-sharing among the members or partners involved. While the Operating Agreement is used by Limited Liability Companies (LLCs) to govern their operations, a Partnership Agreement serves a similar purpose for partnerships, detailing the terms of the relationship between partners, including decision-making processes, capital contributions, and the distribution of earnings or losses.

Similar to the Bylaws of a Corporation, the Operating Agreement for an LLC in New York establishes internal operating procedures. Bylaws are essential for corporations as they outline directors' and officers' roles, meeting schedules, and the handling of corporate affairs. Although they serve different entity types, both documents are integral for outlining governance and operational guidelines, ensuring smooth internal management within the respective business structures.

The Employment Agreement also bears resemblance to the Operating Agreement, as both set terms for relationships within a business context. The Operating Agreement specifies the relationship between owner-members and the management structure of the LLC, while the Employment Agreement outlines the terms of employment, including responsibilities, compensation, and grounds for termination, between an employer and an employee.

A Shareholder Agreement, used by corporations, has similar functions to the New York Operating Agreement, with both aiming to protect the interests of the business’s stakeholders. While the Shareholder Agreement focuses on the rights and obligations of shareholders, such as voting rights and dividend policies, the Operating Agreement addresses LLC members' rights, responsibilities, and profit shares, fostering a clear understanding and smooth collaboration among parties.

The Buy-Sell Agreement parallels the Operating Agreement by planning for future scenarios that may affect the structure of a business, like the departure of a key member. In LLCs, the Operating Agreement can include provisions for what happens when a member leaves, covering buyout procedures or redistribution of interest. Similarly, a Buy-Sell Agreement provides a strategy for the transfer of business ownership, ensuring the continuity and stability of the business through unforeseen changes.

Loan Agreements and the New York Operating Agreement also share common ground regarding their function of setting clear terms between parties in a business context. A Loan Agreement specifies the terms under which one party lends money to another, including repayment schedule, interest, and default terms. The Operating Agreement, while more focused on the operational and governance aspects of an LLC, similarly establishes agreed-upon conditions among its members, promoting transparency and accountability.

Lastly, the Non-Disclosure Agreement (NDA) and the Operating Agreement contain elements designed to protect business information. An NDA is a legal contract establishing a confidential relationship, with parties agreeing not to disclose information shared with them. In an Operating Agreement, confidentiality clauses can safeguard proprietary business information by outlining what members can share outside the company, thereby protecting sensitive internal data from competitors and the public.

Dos and Don'ts

When filling out the New York Operating Agreement form, attention to detail is crucial for ensuring the agreement accurately represents the company's operational structure and member responsibilities. Below are important dos and don’ts to consider.

Do:

- Thoroughly review every section of the form to ensure understanding of what information is required and how it affects the company's operations.

- Ensure all members' information is accurately represented, including full legal names, addresses, and capital contributions, to prevent any misunderstandings or legal issues.

- Consult with a legal professional if any aspect of the agreement is unclear. This step can help in resolving ambiguities and ensuring the agreement complies with New York State law.

- Keep a signed copy of the Operating Agreement in a secure location where all members can access it if needed, aiding in resolving any disputes or questions about the company's operations.

Don’t:

- Overlook any sections of the form or leave them incomplete, as every part of the Operating Agreement has legal implications for the company and its members.

- Allow anyone other than the members or an authorized legal representative to fill out the form, which ensures that the information is accurate and agreed upon by all parties.

- Ignore state-specific requirements that may not be explicitly covered in the form but are necessary for compliance with New York laws governing limited liability companies.

- Forget to update the Operating Agreement as changes occur within the company, such as the addition or departure of members, to keep the document current and relevant.

Misconceptions

All businesses need an Operating Agreement. Not every business in New York is required to have an Operating Agreement. Sole proprietorships do not use Operating Agreements, and this form is specifically for Limited Liability Companies (LLCs).

An Operating Agreement is filed with the state. While it's crucial for an LLC, the Operating Agreement is not filed with New York State. Instead, it is an internal document that outlines the operations and procedures of the business.

It’s the same as Articles of Organization. This is incorrect. The Articles of Organization officially register the LLC with the state. In contrast, the Operating Agreement details how the LLC operates, including the rights and responsibilities of its members.

The law requires it to be complicated. There's a common belief that legal documents must be complex. However, an Operating Agreement should be clear and understandable to all members of the LLC. The goal is to ensure everyone knows the business operations and their roles within the company.

You need a lawyer to create one. While it can be beneficial to consult with a lawyer, especially for complex structures or to ensure compliance with state laws, it’s entirely possible to create an Operating Agreement without one. Many resources and templates are available to help business owners draft their agreements.

One size fits all. Every LLC is unique, and its Operating Agreement should reflect that. Using a generic template without modifications might not cover the specific needs or preferences of your business. Tailor your Agreement to suit your company's operations, member roles, and management structure.

It’s only necessary if you have multiple members. Even single-member LLCs benefit from having an Operating Agreement. It helps solidify the business's structure, operations, and can enhance the owner's liability protection by clearly separating personal and business assets.

Amendments are rare and difficult. Businesses evolve, and an Operating Agreement can too. Amendments can be made as the company grows or changes. The process for amendments should be outlined within the Agreement itself, making it easier to implement changes when necessary.

Key takeaways

An Operating Agreement serves as a critical document for any LLC operating in New York, outlining the business's financial and functional decisions including rules, regulations, and provisions. The purpose of this agreement is to govern the internal operations of the business in a way that suits the specific needs of the business owners (members). Here are key takeaways about filling out and using the New York Operating Agreement form:

- It’s not mandatory, but highly recommended. While New York state law does not require LLCs to have an Operating Agreement, having one in place is highly advised. It can protect the business from default state rules that may not be in the business's best interest.

- Single-member LLCs should also draft an agreement. Even if an LLC has only one member, a formal Operating Agreement can provide crucial legal distinctions between the personal assets and the assets of the business.

- Details matter. When filling out the form, be meticulous about the details to avoid any ambiguity. This includes full business name, details of each member, and how profits and losses are distributed.

- Flexibility is key. An Operating Agreement can (and should) be tailored to fit the unique needs of your LLC. This flexibility allows you to craft rules that are in your and your business's best interest, not just a default set of statutes.

- Update as necessary. As your business evolves, so too should your Operating Agreement. This document is not meant to be static. Amendments can be made to reflect changes in ownership, management structure, or operational procedures.

- Defines the financial and managerial structure. Clearly outline the management structure and financial arrangements, including how decisions are made, the roles of members/managers, and how profits and losses are distributed.

- Legal protection. Operating Agreements can offer members legal protection by demonstrating to courts that the LLC is a separate legal entity, especially important in maintaining limited liability status.

In conclusion, the New York Operating Agreement is a fundamental component for any LLC, offering not just a guide for operational and financial decisions but also providing a shield of legal protection for its members. Thoughtfully drafting and regularly updating this document ensures that it accurately reflects the business's needs and operations, thus safeguarding the business's and members' interests.

Popular Operating Agreement State Forms

Llc Operating Agreement Texas - An Operating Agreement sets forth a succession plan, detailing how members' interests are handled in case of their death or incapacity.

How to Create an Operating Agreement - This document not only defines the business structure but also outlines the ethical guidelines and governing principles of the company.

Form Llc Indiana - Includes non-compete and confidentiality clauses to protect the company's interests and trade secrets.