Official Multiple Members Operating Agreement Document

When embarking on a business venture with partners, clarity and structure are paramount. The Multiple Members Operating Agreement form steps into this space, providing a solid foundation for any multi-member limited liability company (LLC). This document is crucial as it outlines the operational procedures, financial contributions, and responsibilities of each member, ensuring that all parties have a clear understanding of their roles within the company. Beyond defining day-to-day operations, the agreement also addresses how to handle disputes, member exits, and the dissolution of the company, should it ever come to that. Additionally, it safeguards members' personal assets from the company's liabilities and helps to prevent potential legal issues by setting a clear framework for the business's operations. Tailored to fit the unique needs of its members, this agreement is a cornerstone of successful partnership, fostering transparency and mutual respect among its members.

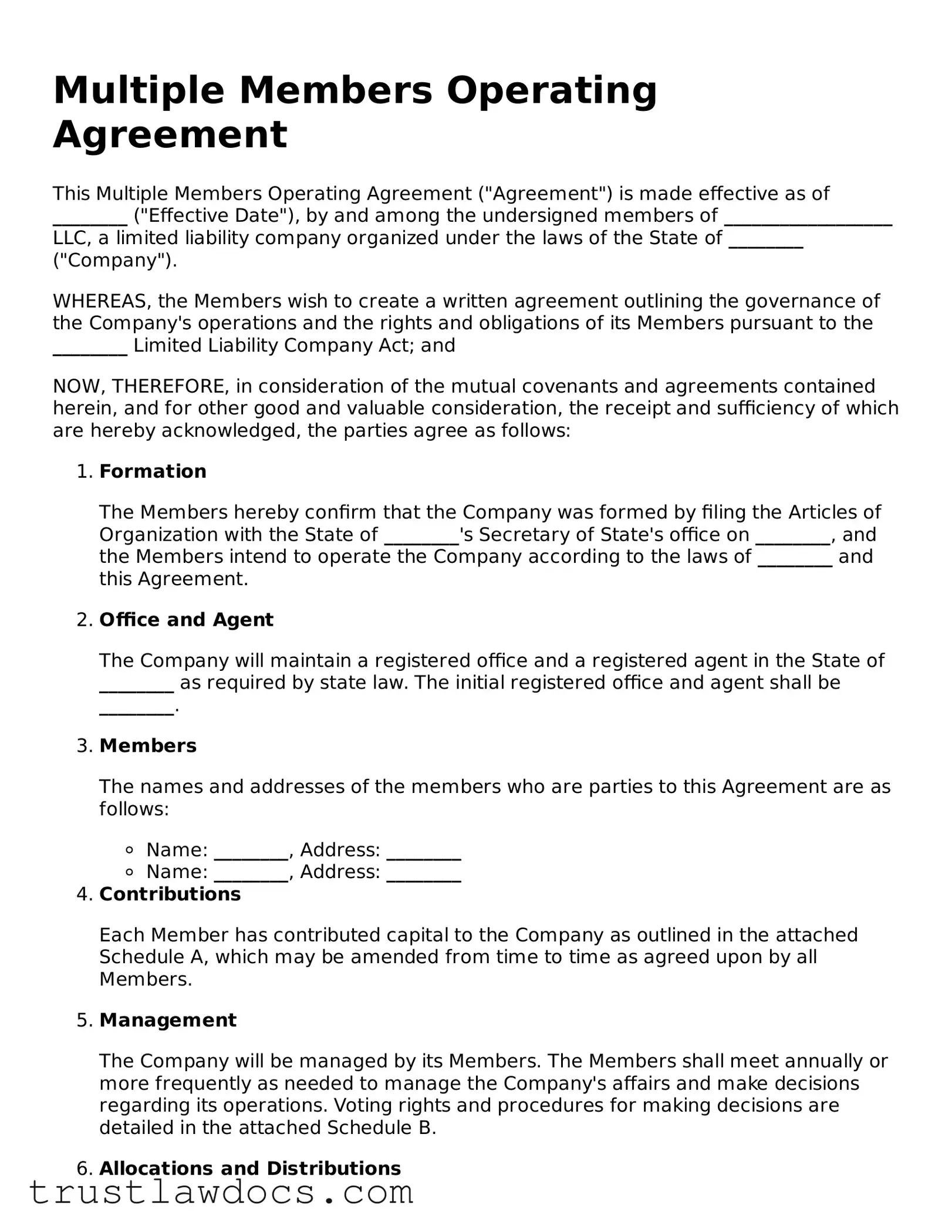

Form Example

Multiple Members Operating Agreement

This Multiple Members Operating Agreement ("Agreement") is made effective as of ________ ("Effective Date"), by and among the undersigned members of __________________ LLC, a limited liability company organized under the laws of the State of ________ ("Company").

WHEREAS, the Members wish to create a written agreement outlining the governance of the Company's operations and the rights and obligations of its Members pursuant to the ________ Limited Liability Company Act; and

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Formation

The Members hereby confirm that the Company was formed by filing the Articles of Organization with the State of ________'s Secretary of State's office on ________, and the Members intend to operate the Company according to the laws of ________ and this Agreement.

- Office and Agent

The Company will maintain a registered office and a registered agent in the State of ________ as required by state law. The initial registered office and agent shall be ________.

- Members

The names and addresses of the members who are parties to this Agreement are as follows:

- Name: ________, Address: ________

- Name: ________, Address: ________

- Contributions

Each Member has contributed capital to the Company as outlined in the attached Schedule A, which may be amended from time to time as agreed upon by all Members.

- Management

The Company will be managed by its Members. The Members shall meet annually or more frequently as needed to manage the Company's affairs and make decisions regarding its operations. Voting rights and procedures for making decisions are detailed in the attached Schedule B.

- Allocations and Distributions

Profit and loss shall be allocated among the Members in accordance with the percentages listed in Schedule A. Distributions shall be made at the discretion of the Members according to the Company's financial status and in compliance with the ________ Limited Liability Company Act.

- Dissolution

The Company may be dissolved in accordance with the ________ Limited Liability Company Act and the agreement of a majority of the Members. Upon dissolution, assets of the Company will be distributed to the Members in accordance with their capital accounts after paying or making provision for all debts and obligations.

- Modifications to the Agreement

This Agreement may be amended or modified only by a written agreement signed by all Members.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ________, without giving effect to any choice or conflict of law provision or rule.

IN WITNESS WHEREOF, the undersigned have executed this Multiple Members Operating Agreement as of the Effective Date above.

Member Signature: __________________

Print Name: __________________

Date: __________________

Member Signature: __________________

Print Name: __________________

Date: __________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Defines the rights and responsibilities of multiple members within a Limited Liability Company (LLC). |

| Governing Law | Varies by state, as each state has its own statutes regulating LLCs. |

| Key Components | Includes sections on membership structure, capital contributions, profit and loss distribution, management, voting rights, and procedures for adding or removing members. |

| Flexibility | Allows members to customize management and financial arrangements to suit their specific needs. |

| Operating Rules | Establishes daily operations and decision-making processes within the LLC. |

| Protection | Helps protect individual members by clarifying their liabilities and obligations, reducing the potential for internal conflicts. |

| Amendments | Includes provisions on how to amend the agreement, allowing the LLC to adapt to changes over time. |

| Dispute Resolution | Outlines methods for resolving disputes among members, such as arbitration or mediation, to avoid litigation. |

How to Write Multiple Members Operating Agreement

Successfully completing the Multiple Members Operating Agreement form is a crucial step for any group entering into business together. It lays the foundation for the internal operations of the business and outlines the responsibilities and rights of each member. To make this process as smooth as possible, a clear understanding of each section and what information is required will be helpful. Following the below steps will guide members through completing the form accurately.

- Start with the basics: Fill in the name of the limited liability company (LLC) at the top of the document. This must match the name registered with your state.

- Specify the date: Enter the date on which the agreement is being made.

- List the members: Provide the full legal names and addresses of all members who are part of the LLC.

- Contribution details: Clearly outline what each member is contributing to the LLC, whether it be cash, property, or services. Also, detail the value of these contributions.

- Profit, Loss, and Distribution: Describe how profits and losses will be divided among members. This should include how often distributions will occur.

- Management structure: Define whether the LLC will be managed by members or by appointed managers. If managers are appointed, specify their roles and decision-making powers.

- Duties and powers of members and managers: Go into detail about the responsibilities, rights, and powers of the members and any managers.

- Meetings: Set out how and when meetings will be held, including how decisions are made and voting rights.

- Transfer of membership interest: Explain the process for a member to transfer their interest in the LLC to someone else, including any restrictions or conditions.

- Withdrawal or exit strategy: Outline the circumstances under which a member can withdraw from the LLC and any buyout procedures.

- Dissolution: Specify the conditions under which the LLC may be dissolved.

- Amendments: State how this agreement can be amended in the future.

- Signatures: Ensure every member signs and dates the agreement. Include space for the date next to each signature.

Filling out the Multiple Members Operating Agreement form correctly is essential for ensuring that all members are on the same page about the operation and structure of the LLC. Through careful completion of each step, members can prevent misunderstandings and provide a clear path forward for their business endeavors. Following the listed steps, members can confidently create a comprehensive and legally sound operating agreement.

Get Answers on Multiple Members Operating Agreement

What is a Multiple Members Operating Agreement?

A Multiple Members Operating Agreement is a legal document used by businesses that have more than one owner. It outlines how the business will be run, detailing the rights, responsibilities, and financial arrangements between the members. It's a crucial framework that guides decision-making processes, conflict resolution, and the overall operation of a business.

Why is it important to have a Multiple Members Operating Agreement?

Having this agreement in place is critical because it helps prevent misunderstandings between members by clearly defining each member's role and stake in the company. It also protects the business's interests by establishing processes for handling disputes, making decisions, and dividing profits and losses. Additionally, it ensures that the business operates in accordance with the agreed-upon terms, rather than default state laws that may not suit the members' preferences.

What should be included in a Multiple Members Operating Agreement?

This document should cover a range of topics, including but not limited to: the percentage of ownership each member holds, voting rights and procedures, distribution of profits and losses, management structure and duties, guidelines for adding or removing members, handling of disputes, and dissolution procedures for the business. Essentially, it includes any information that governs the internal operations of the company and the relationships between members.

Is a Multiple Members Operating Agreement legally required?

While not always legally required, having a Multiple Members Operating Agreement is highly recommended. Some states do require an operating agreement for multi-member LLCs, and even if your state doesn’t, having one can provide legal protection and ensure smoother operation. It serves as a binding contract between members that can be referred to in legal disputes.

Can the Multiple Members Operating Agreement be modified?

Yes, the agreement can be modified, but the process for doing so should be outlined within the agreement itself. Typically, changes require a certain percentage of votes from the members. It's crucial that any amendments are documented and agreed upon in writing by all members to maintain clarity and avoid future conflicts.

Who should draft the Multiple Members Operating Agreement?

While members can draft their agreement, it is wise to seek advice or services from a legal professional. An experienced lawyer can ensure that the agreement complies with state laws and is tailored to the specific needs and structure of the business. This professional guidance helps in identifying and covering all necessary aspects that members might overlook.

What happens if there is no Multiple Members Operating Agreement?

Without this agreement, any disputes or decisions regarding the operation of the company will be subject to state default laws. These laws may not align with the owners' wishes and can lead to outcomes that are unfavorable for some or all members. Additionally, the absence of a clear agreement can result in conflicts and misunderstandings, potentially harming the business's overall health and success.

Are there any tax implications tied to the Multiple Members Operating Agreement?

While the agreement itself doesn't directly affect taxes, it outlines the financial relationships and profit-sharing among members, which do have tax implications. The way a business and its members decide to distribute profits affects how taxes are filed and paid. Therefore, it's important to consult with a tax professional to understand the potential tax consequences of the arrangements detailed in the agreement.

How does a new member get added to the Multiple Members Operating Agreement?

The agreement should specify the procedure for adding new members, which typically includes a vote among current members and an amendment to the agreement to include the new member. The new member must agree to the terms of the existing agreement, and their ownership stake, contributions, responsibilities, and rights must be clearly defined and documented.

Common mistakes

When entrepreneurs come together to form a limited liability company (LLC), they are often advised to draft a Multiple Members Operating Agreement. This critical document outlines the management structure, financial arrangements, and operational procedures of the business. However, even with the best intentions, people can make mistakes when filling out this form, leading to potential conflicts or legal issues down the line.

One common mistake is not being specific enough in defining the roles and responsibilities of each member. This agreement is an opportunity to detail who is responsible for what within the LLC, from daily operations to financial decisions. When these roles are not clearly defined, it can lead to misunderstandings and disputes among members, impacting the smooth running of the business.

Another area where errors often occur is in the allocation of profits and losses. Members sometimes neglect to specify how the LLC's profits and losses will be divided. This oversight can create significant financial and tax implications. Ensuring that the agreement explicitly states how these are to be shared among members is critical.

Frequently, members fail to outline the procedures for adding or removing members. Businesses evolve; members may wish to leave, or the LLC may want to bring in new members. Without a clear process for these changes, the LLC can face complex legal challenges, potentially harming its operations and reputation.

Ignoring the necessity of a detailed dispute resolution plan is another oversight. Conflicts, both minor and significant, can arise in any business venture. A Multiple Members Operating Agreement should include a mechanism for resolving disputes among members to avoid costly and time-consuming litigation.

Members often forget to plan for the dissolution of the LLC. While it's not pleasant to think about the end of the business, having a strategy in place for winding down is essential. This should include how assets will be distributed and debts paid off, helping to avoid legal entanglements during an already challenging time.

Last but not least, failing to have the agreement reviewed by a legal professional can be a critical mistake. While templates and forms can provide a good starting point, every business is unique. Professional legal advice can ensure that the agreement fully protects the interests of all members and complies with state laws.

In conclusion, while filling out a Multiple Members Operating Agreement might seem straightforward, attention to detail and foresight can prevent future problems. By avoiding these common mistakes, members can ensure their LLC is built on a solid foundation, ready to tackle the challenges of the business world.

Documents used along the form

When businesses are formed with more than one owner, a Multiple Members Operating Agreement is critical. This document details the owners' rights, responsibilities, and share of profits. However, several other forms and documents often accompany this agreement to ensure comprehensive coverage of legal and operational matters. These documents play various roles, from clarifying the structure of the business to laying down rules for resolution. Below is a list of some key documents often used alongside the Multiple Members Operating Agreement.

- Articles of Organization: This is a foundational legal document required to form an LLC in the United States. It includes basic information about the LLC, such as its name, purpose, and the address of its principal place of business, and it's filed with the state.

- Employer Identification Number (EIN) Application: An EIN, similar to a social security number for a business, is necessary for tax purposes. This IRS document is required for hiring employees, opening business bank accounts, and filing taxes.

- Buy-Sell Agreement: This agreement outlines what happens to an owner's share of the business if they choose to leave the company, die, or become incapacitated. It is vital for ensuring the smooth continuation of the business.

- Membership Certificates: These certificates serve as proof of ownership in an LLC. They detail the member's name, the company, and their percentage of ownership.

- Operating Rules: While the Operating Agreement covers broad aspects of the LLC's operations, Operating Rules can detail day-to-day operations, specific procedures for meetings, and other administrative protocols.

- Conflict Resolution Agreement: This document specifies the methods for resolving disputes among members that might arise, aiming to handle such situations internally without going to court.

- Capital Contribution Agreement: Members may contribute cash, property, or other assets to the LLC. This document outlines the amount, method, and timing of such contributions.

- Non-Disclosure Agreement (NDA): To protect sensitive business information, an NDA requires that members and employees do not disclose confidential information.

- Management Agreement: This outlines the roles, responsibilities, and compensation of the managers of the LLC, whether they are members or external managers.

- Statement of Authority: Filed with state authorities, this document specifies who has the power to enter into contracts and make decisions on behalf of the LLC.

Together, these documents complement the Multiple Members Operating Agreement by covering the full spectrum of the company's legal, operational, and financial aspects. Incorporating these documents can provide clarity, prevent conflicts, and ensure the smooth operation of a multi-member LLC. Each plays a crucial role in the foundation and ongoing management of the business, making them indispensable tools for business owners.

Similar forms

The Multiple Members Operating Agreement form is similar to a Partnership Agreement, as both set out the structure and rules for a business entity with more than one owner. They outline the division of profits and losses, decision-making processes, and what happens if a partner wants to leave the business. These agreements are foundational for ensuring all members or partners are on the same page regarding the operation and governance of the business.

It also closely resembles a Shareholders' Agreement in corporations. This document specifies the rights and obligations of shareholders, regulates the sale of shares, protects minority positions, and outlines how decisions are made among shareholders. Like the Multiple Members Operating Agreement, it serves to align the interests of all parties involved in the ownership and management of a corporation, ensuring smooth operation.

A Buy-Sell Agreement is another document that shares similarities, particularly in how it handles the change of ownership when a member wishes to exit the company. This agreement can dictate the conditions under which a member may sell their shares, who can buy them, and at what price. It is essential for business continuity planning, just as provisions within a Multiple Members Operating Agreement ensure the business can operate smoothly if membership changes.

Similarly, an Employment Agreement between a company and its employees outlines the roles, responsibilities, and compensation of the workforce, which mirrors the detail a Multiple Members Operating Agreement goes into regarding the contributions and distributions for its members. While focusing on different relationships within the business, both documents serve to clarify expectations and responsibilities to prevent disputes.

The Company Bylaws for a corporation share similarities with the Multiple Members Operating Agreement in that both establish the company’s internal management structure, though the Bylaws focus more on the governance of a corporation rather than an LLC. Bylaws detail the procedures for holding meetings, electing officers, and other corporate governance matters, providing a framework within which corporate decisions must be made.

A Non-Disclosure Agreement (NDA) might seem distinct but is related in its purpose of protecting sensitive business information. Within a Multiple Members Operating Agreement, provisions might be included to prevent members from sharing proprietary information outside of the business, similar to how an NDA explicitly prohibits the disclosure of confidential information to protect the company's interests.

Lastly, the Business Plan document, while not a legal agreement, is related in its role of guiding the direction of the business. A Business Plan outlines the company’s objectives, strategies, market analysis, and financial projections. Elements of the business plan might be reflected in the Multiple Members Operating Agreement, particularly in sections detailing the business purpose, goals, and operational plans, helping members maintain alignment toward common objectives.

Dos and Don'ts

When filling out the Multiple Members Operating Agreement form, it's important to follow some dos and don'ts to ensure that the form is completed accurately and effectively. This agreement is crucial for outlining the operational and financial arrangements of an LLC, as well as the rights and responsibilities of its members. Below are essential tips to guide you through the process:

Do's:

- Review state requirements: Before you start filling out the form, make sure to review any specific requirements or provisions that your state may have regarding LLC operating agreements. Compliance with state laws is essential.

- Provide accurate information: Ensure that all the details you provide, such as the names of the members, the business address, and capital contributions, are accurate. This will prevent any potential legal issues or disputes in the future.

- Discuss with all members: It's crucial to have a thorough discussion with all members of the LLC about the terms of the agreement. This ensures that everyone is on the same page and agrees with the contents of the document.

- Include dispute resolution methods: Clearly outline procedures for resolving disputes among members. This will help in managing conflicts effectively if they arise.

- Sign in the presence of a notary: Having the document notarized can add an extra layer of legality and authenticity. It ensures that all signatures are verified.

Don'ts:

- Don't skip sections: Even if certain parts seem not to apply to your LLC, it's important to review and fill out every section of the agreement thoroughly. Skipping sections could lead to ambiguities or disputes later on.

- Don't use vague language: Clearly define all terms and responsibilities in the agreement. Vague or ambiguous language can lead to misunderstandings and legal complications.

- Don't forget to update the document: The agreement should evolve with your LLC. If there are changes in membership, structure, or operations, update the document to reflect these changes.

- Don't ignore legal advice: Consulting with a legal professional can provide valuable insights and help ensure that the agreement complies with all relevant laws and best protects the interests of all members.

- Don't underestimate the importance of the agreement: The Multiple Members Operating Agreement is a foundational document for your LLC. Treat it with the seriousness it deserves and ensure it's completed with the utmost care and consideration.

Misconceptions

Understanding the Multiple Members Operating Agreement form is crucial for those entering into a business partnership under the limited liability company (LLC) structure. However, several misconceptions can lead to confusion or misinterpretation. Clarifying these misconceptions is essential for forming a solid foundation for your business.

All members must have equal shares and responsibilities. This is incorrect. The agreement allows for flexibility in how members allocate ownership percentages, responsibilities, and profits and losses. It's tailored to the specific needs and agreements of the members involved.

It's not legally required, so it's not important. While not all states require an operating agreement, having one is critically important. It provides a clear framework for decision-making, conflict resolution, and the division of profits and losses, which can prevent misunderstandings and legal disputes.

Any template will work just as well. Not all templates are created equal. A one-size-fits-all approach may not cover specific arrangements or preferences of your LLC. Customizing the agreement to fit the unique aspects of your business is often necessary.

It only matters if there's a dispute among members. While an operating agreement is indeed vital in resolving disputes, its importance extends far beyond conflict resolution. It also governs day-to-day operations, member duties, and financial decisions, thereby setting the stage for a smoothly running business.

It's too complicated to change once it's made. An operating agreement should be a living document that evolves with your business. Though amendments require agreement among members, these changes are often necessary to reflect the growth and evolving needs of the LLC.

The operating agreement is only between the members. While the agreement primarily outlines the relationship between members, it also affects interactions with external entities like banks and potential investors. It serves as a key document to establish credibility and operational guidelines for outsiders.

Setting it up early on is not necessary. Creating an operating agreement early in the life of an LLC ensures that all members are on the same page from the beginning and can help avoid more significant issues down the line. It's an essential step in starting a business on the right foot.

It's only beneficial for large, multi-member LLCs. Regardless of size, an operating agreement benefits all types of LLCs by providing clear rules and expectations. Even smaller LLCs can face disputes or operational challenges that can be effectively managed through a well-drafted operating agreement.

Demystifying these misconceptions allows LLC members to appreciate the significance of a Multiple Members Operating Agreement. Tailoring this document to suit the unique needs of the business can pave the way for smoother operations and help in establishing a robust foundation for the company's future.

Key takeaways

The Multiple Members Operating Agreement is a critical document for businesses operated by more than one person. It outlines the structure, policies, and operations of the business, serving as a blueprint for managing various situations. Here are key takeaways to consider when filling out and using the Multiple Members Operating Agreement form:

- Detail the Ownership Percentages: It's essential to clearly state each member's ownership percentage in the business. These percentages often reflect the capital contribution of each member but can also be adjusted to account for sweat equity or other non-monetary contributions. Clearly defining these percentages helps prevent disputes over profits and losses.

- Define the Distribution of Profits and Losses: The agreement should specify how profits and losses will be distributed among members. This can align with ownership percentages or be structured differently if all members agree. Setting this out in advance minimizes disagreements and ensures a fair process for everyone involved.

- Outline Management and Voting Rights: Members need to decide on a management structure - whether the LLC will be member-managed or manager-managed. The agreement should detail the decision-making process, including how votes are allocated, what types of decisions require voting, and the necessary majority for different decisions. This clarity supports effective and democratic management practices.

- Detail Procedures for Adding or Removing Members: Over time, it may become necessary to add new members or to allow current members to exit. The agreement must include procedures for both scenarios, including how valuations will be determined and the process for transferring or selling membership interests. These guidelines can prevent potential disputes and ensure a smooth transition for all parties involved.

By carefully addressing these elements, the Multiple Members Operating Agreement forms a strong foundation for business operations, enhances transparency among members, and provides a clear path for resolving potential conflicts.

Consider More Types of Multiple Members Operating Agreement Forms

Single-member Llc Operating Agreement - Offers flexibility in managing business affairs, allowing adjustments to be made as the company grows and evolves.