Free Operating Agreement Form for Michigan

In the state of Michigan, the Operating Agreement form plays a pivotal role for Limited Liability Companies (LLCs) by outlining the structure of the organization, the roles of its members, and the rules by which it will operate. Although not mandated by state law, the creation of this document is highly recommended as it provides a clear framework for the operation of the LLC, potentially averting conflicts among members by detailing policies on profit sharing, responsibilities, and procedures for adding or removing members. Furthermore, it serves as a demonstration of the LLC's operational and managerial autonomy, essential for maintaining the liability protection that is a hallmark of the LLC structure. This agreement also allows members to customize the operating rules of their entity, rather than defaulting to the state's generic laws, thus giving members greater control over their business practices. By carefully drafting an Operating Agreement, members of a Michigan LLC can ensure a well-organized governance structure, contributing to the smooth operation and long-term success of the business.

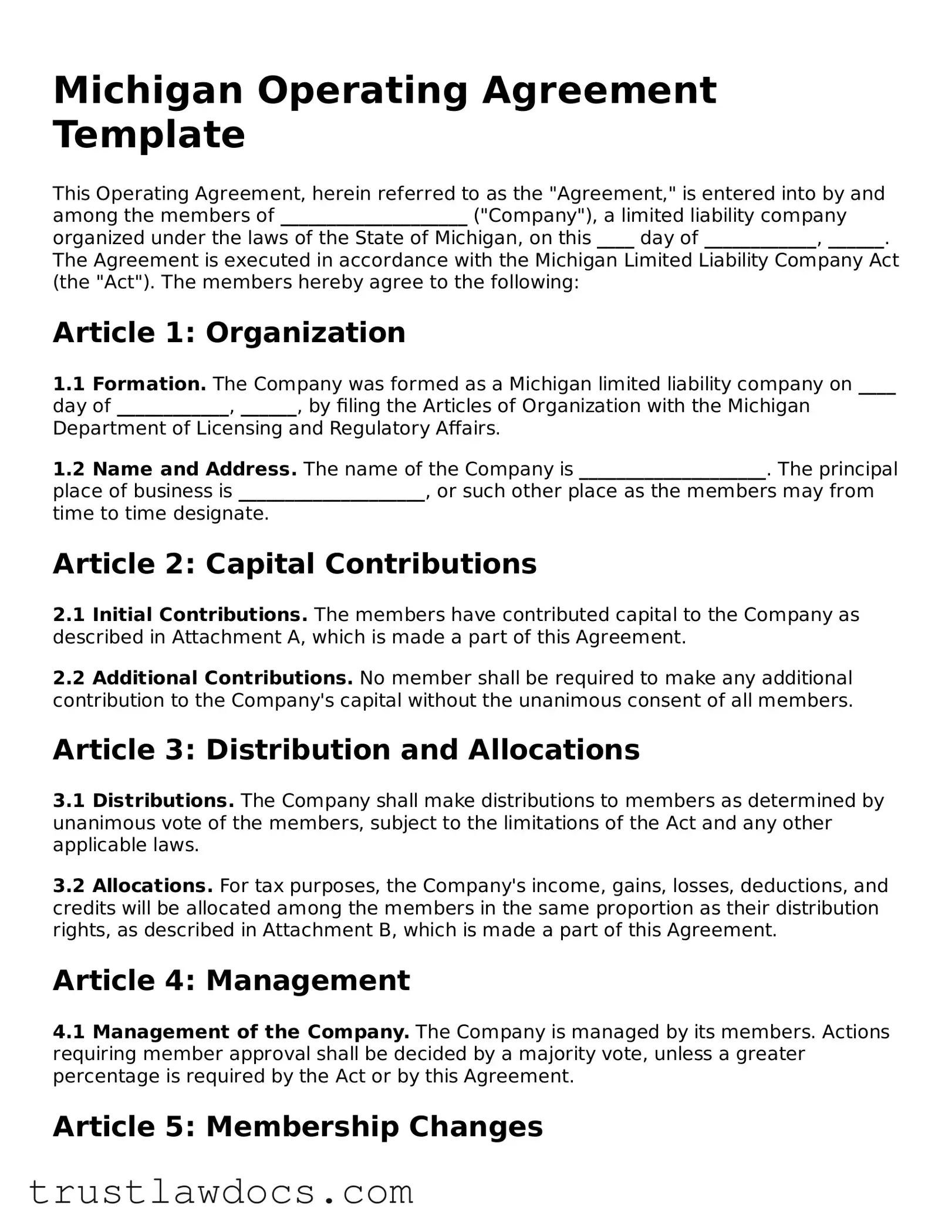

Form Example

Michigan Operating Agreement Template

This Operating Agreement, herein referred to as the "Agreement," is entered into by and among the members of ____________________ ("Company"), a limited liability company organized under the laws of the State of Michigan, on this ____ day of ____________, ______. The Agreement is executed in accordance with the Michigan Limited Liability Company Act (the "Act"). The members hereby agree to the following:

Article 1: Organization

1.1 Formation. The Company was formed as a Michigan limited liability company on ____ day of ____________, ______, by filing the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs.

1.2 Name and Address. The name of the Company is ____________________. The principal place of business is ____________________, or such other place as the members may from time to time designate.

Article 2: Capital Contributions

2.1 Initial Contributions. The members have contributed capital to the Company as described in Attachment A, which is made a part of this Agreement.

2.2 Additional Contributions. No member shall be required to make any additional contribution to the Company's capital without the unanimous consent of all members.

Article 3: Distribution and Allocations

3.1 Distributions. The Company shall make distributions to members as determined by unanimous vote of the members, subject to the limitations of the Act and any other applicable laws.

3.2 Allocations. For tax purposes, the Company's income, gains, losses, deductions, and credits will be allocated among the members in the same proportion as their distribution rights, as described in Attachment B, which is made a part of this Agreement.

Article 4: Management

4.1 Management of the Company. The Company is managed by its members. Actions requiring member approval shall be decided by a majority vote, unless a greater percentage is required by the Act or by this Agreement.

Article 5: Membership Changes

5.1 Admission of New Members. New members may be admitted to the Company with the unanimous consent of the existing members, upon such terms and conditions as they may agree.

5.2 Withdrawal or Transfer of Membership. A member may withdraw or transfer his, her, or their membership only with the unanimous consent of the remaining members, except as otherwise provided under the Act.

Article 6: Dissolution

6.1 Events of Dissolution. The Company shall dissolve upon the occurrence of any one of the following events: a unanimous vote of the members, the sale of substantially all of the Company's assets, or any event that makes it unlawful for the business of the Company to continue.

6.2 Winding Up. Upon dissolution of the Company, the affairs of the Company shall be wound up, and its assets distributed in accordance with the Act and the terms of this Agreement.

Signatures

The members have executed this Agreement as of the date first above written:

__________________________________

Member Name: ______________________

Date: __________

__________________________________

Member Name: ______________________

Date: __________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Operating Agreement form is designed for use by limited liability companies (LLCs) to outline operating procedures and ownership agreements among members. |

| Legal Requirement | While not legally required by Michigan state law, drafting an Operating Agreement is highly recommended for all LLCs. |

| Governing Law | The agreement is governed by the Michigan Limited Liability Company Act. |

| Flexibility | The form allows LLC members to customize their operational and financial arrangements, providing flexibility in management and profit distribution. |

How to Write Michigan Operating Agreement

Filling out the Michigan Operating Agreement form is an essential step for any new LLC in Michigan. It outlines the ownership structure and operating procedures, playing a crucial role in the legal and financial organization of your business. This document isn't filed with the state but is kept on record by the members of the LLC. The following instructions are designed to assist you in completing this important document accurately and thoroughly.

- Begin by entering the official name of your LLC exactly as it appears on your Articles of Organization, including the LLC designation.

- Specify the effective date of the Agreement, which is usually the date the LLC was formed unless stated otherwise.

- List the full names and addresses of each member (owner) of the LLC.

- Detail the contributions (could be monetary, physical assets, or services) made by each member to the LLC.

- Clarify the distribution of profits and losses among members. This typically aligns with the percentage of ownership.

- Define the management structure of the LLC: whether it is member-managed or manager-managed and identify the managers or managing members.

- Describe the voting rights of members, including how decisions are made and what constitutes a majority or unanimous decision.

- Outline the procedures for adding or removing members, transferring membership interest, and what occurs in the event of a member's death or withdrawal.

- Include any clauses related to meetings, such as how often they occur, how they're called, and what constitutes a quorum.

- Specify any restrictions on members' authority to bind the LLC in contracts or other obligations.

- Detail the procedures for amending the Operating Agreement should it be necessary in the future.

- Explain the dissolution process for the LLC, including the distribution of assets upon dissolution.

- Provide a section for members to sign and date the Agreement, therefore acknowledging their understanding and acceptance of its terms.

Upon completion, ensure that each member receives a copy of the Operating Agreement for their records. While the state of Michigan does not require the filing of this document, it serves as a vital internal manual guiding the operations and decision-making processes within your LLC. Properly documenting the agreement between members can prevent misunderstandings and provide a clear path forward for the business.

Get Answers on Michigan Operating Agreement

What is a Michigan Operating Agreement?

An Operating Agreement is a document used by LLCs (Limited Liability Companies) in Michigan to outline the business structure, the roles of members, and how the LLC will operate. While it's not required by the state, having one can help protect your business's limited liability status, help in disputes among members, and ensure your business operates under your own rules rather than default state laws.

Do I have to file my Operating Agreement with the state of Michigan?

No, the Operating Agreement is an internal document. This means you do not have to file it with the state. However, it should be kept on file by the LLC as an important record of the agreed-upon terms between members.

What should be included in a Michigan Operating Agreement?

A Michigan Operating Agreement should include details such as the LLC’s operating procedures, ownership percentages among members, management structure, how profits and losses will be distributed, rules for adding or removing members, and procedures for dissolving the LLC. It can also outline any other agreements among members related to the business operations.

Can I write my own Operating Agreement, or do I need an attorney?

While you can write your own Operating Agreement, consulting with an attorney experienced in Michigan business law can ensure that your Operating Agreement complies with state laws and fully protects your interests. An attorney can provide valuable insight into important provisions that should be included and how to address complex issues within your LLC.

Is an Operating Agreement necessary for a single-member LLC in Michigan?

Yes, even single-member LLCs can benefit from having an Operating Agreement. It helps to establish the separation between the owner's personal assets and the business's liabilities, which is crucial for maintaining your limited liability protection. Additionally, it can provide clarity and formal structure for your business operations, which can be especially helpful in dealings with banks and potential investors.

What happens if an LLC in Michigan does not have an Operating Agreement?

If an LLC in Michigan does not have an Operating Agreement, state default laws will determine how the LLC operates. This may not always be in line with the owner's wishes or the best interests of the business, especially in matters of financial distribution and business decisions. To avoid this, creating an Operating Agreement that specifically outlines how you want your LLC to operate is recommended.

Common mistakes

Filling out the Michigan Operating Agreement form is a crucial step for LLC owners, ensuring that the business's operations are clear and legally sound. However, mistakes can easily be made during this process, leading to potential confusion or legal issues down the line. One common mistake is not providing detailed descriptions of each member's responsibilities. Members may have different roles, such as managing day-to-day operations or making financial decisions, and these should be explicitly stated in the agreement to avoid any future disputes.

Another error often encountered is neglecting to outline the process for adding or removing members. Businesses evolve, and the possibility of changing membership is real. Without a clear process, these transitions can become complicated, potentially harming the business or its members' relationships. It's crucial to include procedures for changes in membership, including any necessary approvals and how they affect the distribution of profits and losses.

A third mistake is failing to specify the method for distributing profits and losses. It's not uncommon for businesses to default to an equal distribution among members, but this might not always reflect the members' initial investments or ongoing contributions. The Operating Agreement should clearly define how profits and losses are shared to prevent misunderstandings or resentment among members.

Ignoring the need for a dispute resolution mechanism is yet another oversight. Disagreements among members are inevitable, but without a predefined way to handle them, conflicts can escalate and jeopardize the business. Incorporating a clause that outlines steps for conflict resolution, such as mediation or arbitration, can save businesses from potential deadlock or litigation.

Last but not least, some members fail to update the Operating Agreement as the business grows and changes. An agreement that reflects the business's current situation is vital for maintaining clarity and continuity among members. Regularly reviewing and amending the Operating Agreement ensures that it remains relevant and effective, safeguarding the LLC and its members against future issues.

Documents used along the form

When forming a Limited Liability Company (LLC) in Michigan, an Operating Agreement is a foundational document outlining the business's financial and functional decisions, including rules, regulations, and provisions. The goal is to guide the internal operations of the business in a way that suits the specific needs of its members. However, to comprehensively set up and run an LLC in Michigan, a variety of other legal documents and forms are often required alongside the Operating Agreement. These documents play crucial roles in establishing, maintaining, and ensuring the smooth operation of a business entity. Below is an exploration of five such documents typically used in conjunction with the Michigan Operating Agreement.

- Articles of Organization: This is the primary document required to formally establish an LLC in the state of Michigan. It is filed with the Michigan Secretary of State and includes vital information such as the LLC's name, purpose, duration, and the name and address of its registered agent. The Articles of Organization legally recognize the company as a business entity under state law.

- Employer Identification Number (EIN) Application: Often, after forming an LLC, obtaining an EIN from the Internal Revenue Service (IRS) is a necessary step. This federal employer identification number is essentially a social security number for the business, required for tax purposes, hiring employees, and opening a business bank account.

- Membership Certificates: While not legally required, Membership Certificates can serve as a formal representation of ownership in the LLC. These documents, akin to stock certificates in a corporation, specify each member's ownership stake and can be useful for records and in transactions involving ownership interest.

- Operating Agreement Amendment Form: As businesses evolve, so do their operational and organizational needs. An Operating Agreement Amendment Form is used whenever members decide to make changes to the original Operating Agreement. This ensures that the document remains current and reflective of the business’s operations.

- Annual Statement: Michigan requires LLCs to file an Annual Statement (sometimes referred to as an Annual Report) with the Secretary of State. This document updates or confirms the company’s information on record, such as the name and address of the registered agent, principal office address, and current business activities.

In conclusion, while the Operating Agreement serves as the keystone document for an LLC's internal governance, these associated forms and documents are integral to establishing, operationalizing, and maintaining compliance with both federal and state requirements. Together, they contribute to the legal foundation and smooth operation of the LLC, ensuring that it remains in good standing and is capable of achieving its business objectives.

Similar forms

When considering the structure and purpose of a Michigan Operating Agreement, several other documents come to mind due to their similarities in function and intent. One such document is the Partnership Agreement. Much like the Operating Agreement, which outlines the operational guidelines and financial arrangements of an LLC, a Partnership Agreement specifies the roles, responsibilities, and profit-sharing ratios among partners in a business partnership. Both serve as internal documents that provide a framework for the governance of the business entity, guiding decision-making processes and conflict resolution mechanisms.

Another analogous document is the Bylaws of a corporation. Bylaws, akin to an Operating Agreement, establish the rules under which a corporation operates. While Operating Agreements are tailored for LLCs, Bylaws perform a similar function for corporations, delineating the structure of the organization, the duties of directors and officers, and the procedures for holding meetings and issuing stock. Both documents play a crucial role in establishing the internal management practices of a business entity, although they cater to different types of organizations.

The Shareholders’ Agreement also shares common ground with the Operating Agreement. This document outlines the rights and obligations of the shareholders in a corporation, covering aspects such as the transfer of shares, dividend policies, and decision-making processes. Like an Operating Agreement, a Shareholders' Agreement is central to defining the business relationship among the owners of an entity, specifying how authority and profits are distributed within the company. Despite their focus on different types of business structures, both documents are instrumental in ensuring clarity and accord among the proprietors.

Similarly, the Buy-Sell Agreement, often a component of both Partnership Agreements and Shareholders’ Agreements, has parallels with an Operating Agreement. It governs the conditions under which an owner's interest in a business can be sold or transferred, addressing scenarios such as retirement, divorce, bankruptcy, or death. Whether within an LLC, partnership, or corporation, this type of agreement is vital for planning succession and ensuring the continuity of the business, much like certain provisions that can be included in an Operating Agreement to address similar concerns.

Last but not least, the Employment Agreement, while generally focused on the relationship between an employer and an employee, contains elements that mirror aspects of an Operating Agreement. This document outlines the duties, responsibilities, compensation, and conditions of employment. Similar to an Operating Agreement that defines the roles and financial arrangements of members within an LLC, an Employment Agreement seeks to clarify the expectations and obligations within the employment relationship, contributing to the overall governance and operational efficiency of the business.

Dos and Don'ts

When filling out the Michigan Operating Agreement form, it's crucial to pay attention to detail and follow specific guidelines to ensure the document is legally binding and effective. Below are lists outlining what you should and shouldn't do during this process.

Things You Should Do

- Ensure all members' names and contact information are accurately entered. This critical information identifies the parties involved in the LLC and how they can be reached for legal or business matters.

- Clearly outline the ownership percentages of each member. This precision prevents future disputes regarding profit distribution and ownership rights within the company.

- Describe the specific roles and responsibilities of each member. Doing so clarifies the operational structure of the LLC and sets expectations for all members.

- Review the agreement carefully before signing. This final review helps catch any errors or omissions that could lead to misunderstandings or legal complications down the line.

Things You Shouldn't Do

- Omit any member's information. Even inadvertently leaving out a member can lead to serious legal ramifications and operational confusion.

- Ignore state-specific requirements. Michigan may have unique stipulations that need to be incorporated into the agreement to be considered valid and enforceable.

- Utilize overly complex language or legal jargon that may confuse members. The agreement should be accessible and understandable to all parties involved.

- Forget to update the agreement as the LLC grows or changes. It is necessary to reflect any significant alterations in the company's structure or membership within the document.

Misconceptions

The Operating Agreement is a crucial document for Limited Liability Companies (LLCs) in Michigan, encompassing the essence of their operational, financial, and functional methodologies. Despite its importance, several misconceptions persist about its usage, applicability, and necessity. Clarifying these misconceptions is vital for LLC owners and members to ensure they maintain compliance while safeguarding their business interests. Below are seven common misconceptions about Michigan Operating Agreement forms:

- All Michigan LLCs are legally required to have an Operating Agreement. While highly recommended for the smooth operation of an LLC and to protect the business entity's limited liability status, Michigan state law does not mandatorily require LLCs to have an Operating Agreement.

- Operating Agreements are only for multi-member LLCs. Even single-member LLCs can benefit significantly from having an Operating Agreement. It helps in delineating the business structure, reinforcing the separate legal status of the LLC, and providing a guideline for operational procedures, which is beneficial for both legal protection and business clarity.

- State-provided templates are sufficient for every LLC. While Michigan might provide generic Operating Agreement templates, relying solely on these could be limiting. Every business has unique needs, and a generic template might not cover specific arrangements, members' rights, or operational details that are unique to an individual LLC.

- Once created, the Operating Agreement need not be updated. As businesses evolve, so do their operational, financial, and management needs. It is crucial for LLCs to review and, if necessary, update their Operating Agreements regularly to ensure they reflect current business practices and member agreements.

- An attorney is not necessary for drafting an Operating Agreement. While it's true that an LLC can draft an Operating Agreement without an attorney, seeking professional legal advice ensures that the document complies with Michigan law and effectively protects member interests. Legal consultation can also help in addressing complex situations or in customizing the agreement to fit the business model perfectly.

- All Operating Agreements are public documents. In Michigan, Operating Agreements are internal documents. They are not required to be filed with the state and do not become part of the public record. This confidentiality allows LLCs to maintain privacy over their operational and ownership structure.

- Operating Agreements are only beneficial in case of legal dispute. While it's invaluable in dispute resolution, the Operating Agreement also serves to prevent disputes from arising. By clearly outlining the rights, responsibilities, and expectations of members, these agreements can provide guidance and structure for decision-making, reducing the potential for conflicts.

Understanding these misconceptions about Michigan Operating Agreements can empower LLC members to make informed decisions regarding the crafting, maintenance, and utility of this essential document. With the correct knowledge and approach, LLCs can ensure their operational stability and legal safety, fostering a conducive environment for business growth and success.

Key takeaways

When forming a Limited Liability Company (LLC) in Michigan, creating an Operating Agreement is a crucial step that outlines the structure, policies, and operational procedures of your business. While the state does not legally require an LLC to have an Operating Agreement, having one in place provides a clear framework for the management of the LLC and protection for its members. Here are several key takeaways to consider when filling out and utilizing the Michigan Operating Agreement form:

- Customization is Key: The Operating Agreement should be tailored to fit the specific needs of your LLC. Michigan offers flexibility in how LLCs can structure their Operating Agreement, so take advantage of this to create a document that reflects the unique aspects of your business.

- Detail the LLC's Financial and Functional Decisions: Clearly outlining how financial and functional decisions are made within the LLC can help prevent conflicts among members down the road. This includes provisions for allocating profits and losses, processes for making major business decisions, and procedures for handling changes in membership.

- Member Protections: An Operating Agreement can provide members with protections beyond those afforded by state law. By defining the responsibilities and liabilities of members, the agreement can help shield individual members from legal disputes and financial risks.

- Succession Planning: It’s important to address what happens if a member decides to leave the LLC or if new members are admitted. The Operating Agreement can specify terms for buying out members' interests, thus simplifying transitions and ensuring the continuity of the LLC.

- Dispute Resolution: Including a method for resolving disputes among members within the Operating Agreement can save significant time, money, and stress. This could include arbitration procedures or other forms of dispute resolution.

- Flexibility for Changes: Businesses evolve, and your Operating Agreement should be able to accommodate changes. Make sure the document outlines a clear process for making amendments, allowing your LLC to adapt and grow over time.

Don’t forget, while the Operating Agreement doesn't need to be filed with the state, it's crucial to keep it updated and readily accessible to all members of the LLC. This document will serve as a guiding framework for your business operations and can be invaluable in protecting the interests of each member.

Popular Operating Agreement State Forms

Llc Operating Agreement Texas - This document lays the groundwork for a business continuity plan, addressing what happens in the event of a member's death or withdrawal.

Form Llc Indiana - This document is crucial for defining the financial and working relationships among business owners (members) in an LLC.

Llc New York State - Gives members the option to specify particular officers (e.g., CEO, CFO) and define their roles and responsibilities within the LLC.

Florida Operating Agreement - This document can stipulate the conditions under which the business may be dissolved, providing a clear exit strategy.