Free Operating Agreement Form for Indiana

When forming a limited liability company (LLC) in Indiana, one of the critical steps involves crafting an Operating Agreement. This legal document plays a pivotal role in outlining the operational procedures, financial arrangements, and overall governance of the business. While the state of Indiana does not mandate the filing of this agreement, the absence of a comprehensive Operating Agreement leaves the company vulnerable to generic state laws that may not align with the owners' intentions. It grants the members of the LLC a written framework that governs their rights, responsibilities, and proportional interests in the company. Additionally, it delineates the procedures for managerial decisions, profit distribution, and the resolution of disputes. Crucially, an Operating Agreement serves to uphold the limited liability status of the company, safeguarding members' personal assets from business liabilities. The form, though not filed with the state, should be meticulously drafted and agreed upon by all members to ensure the smooth operation and management of the LLC. In essence, the Indiana Operating Agreement form is an indispensable tool for articulating the vision and structure of the company, aiming to prevent conflicts and provide clarity for legal and financial relationships within an LLC.

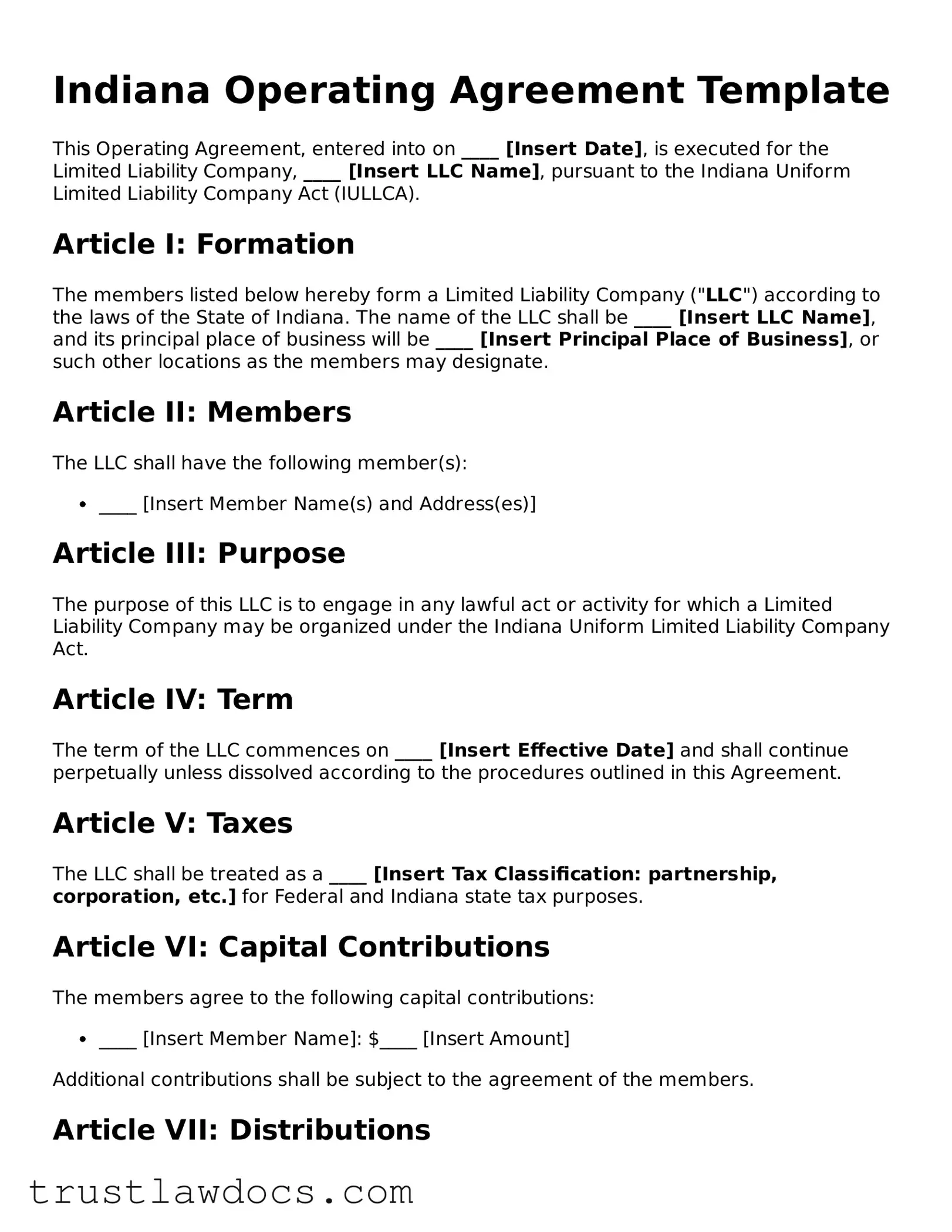

Form Example

Indiana Operating Agreement Template

This Operating Agreement, entered into on ____ [Insert Date], is executed for the Limited Liability Company, ____ [Insert LLC Name], pursuant to the Indiana Uniform Limited Liability Company Act (IULLCA).

Article I: Formation

The members listed below hereby form a Limited Liability Company ("LLC") according to the laws of the State of Indiana. The name of the LLC shall be ____ [Insert LLC Name], and its principal place of business will be ____ [Insert Principal Place of Business], or such other locations as the members may designate.

Article II: Members

The LLC shall have the following member(s):

- ____ [Insert Member Name(s) and Address(es)]

Article III: Purpose

The purpose of this LLC is to engage in any lawful act or activity for which a Limited Liability Company may be organized under the Indiana Uniform Limited Liability Company Act.

Article IV: Term

The term of the LLC commences on ____ [Insert Effective Date] and shall continue perpetually unless dissolved according to the procedures outlined in this Agreement.

Article V: Taxes

The LLC shall be treated as a ____ [Insert Tax Classification: partnership, corporation, etc.] for Federal and Indiana state tax purposes.

Article VI: Capital Contributions

The members agree to the following capital contributions:

- ____ [Insert Member Name]: $____ [Insert Amount]

Additional contributions shall be subject to the agreement of the members.

Article VII: Distributions

Distributions shall be made to the members annually, at the discretion of the members, based on their respective percentages of ownership in the LLC.

Article VIII: Management

The LLC shall be managed by:

- ____ [Manager-managed or Member-managed]

Article IX: Meetings

The annual meeting of members shall be held on ____ [Insert Date], or at such other time and place as may be agreed upon by the members. Special meetings may be called by any member who holds more than 20% of the ownership interest.

Article X: Amendments

This Operating Agreement may be amended only by the written consent of all members.

Article XI: Dissolution

The LLC may be dissolved at any time with the consent of members owning more than 50% of the ownership interest. Upon dissolution, assets shall be distributed according to the members' ownership percentages after settling all debts and obligations.

Signatures

This Operating Agreement has been agreed to and accepted by the members on the date first mentioned.

____ [Member Name] ____________________________ [Signature]

____ [Member Name] ____________________________ [Signature]

PDF Form Details

| Fact Name | Detail |

|---|---|

| Purpose | An Operating Agreement outlines the operations of an LLC in Indiana, establishing the rules and structure of the business. |

| Governing Law | Indiana Code § 23-18 governs Operating Agreements and LLCs in Indiana. |

| Legality | While not required by Indiana state law, it is legally binding for members if created. |

| Flexibility | The agreement offers flexibility in management and profit sharing among members. |

| Financial Provisions | It includes provisions for distributions, allocations of profits and losses, and rules for financial and accounting matters. |

| Dispute Resolution | The agreement can include methods for dispute resolution among members or management. |

| Customization | Operating Agreements can be customized to fit the specific needs of the LLC. |

| Protection | Provides members with protection from personal liability for the actions of the LLC. |

How to Write Indiana Operating Agreement

Once you've decided to create a Limited Liability Company (LLC) in Indiana, an Operating Agreement is a crucial document that outlines the operational aspects and the members' financial interests in the company. Even though Indiana doesn't require LLCs to have an Operating Agreement, having one ensures clarity and reduces potential conflicts between members. Now, let’s walk through filling out the Indiana Operating Agreement form, a straightforward process to safeguard your business and its members.

- Start by entering the name of the LLC exactly as it appears in your Articles of Organization, ensuring legal consistency across documents.

- Specify the effective date of the agreement. This can be the date of formation or another specified date when the agreement will become active.

- List the names and addresses of all members. Ensure accuracy for official records and future contact needs.

- Define the business purpose of the LLC, keeping the description clear and within the legal scope of operations in Indiana.

- Detail the capital contributions made by each member, including the amounts and the form of contribution (cash, property, services, etc.).

- Outline the profit distribution method. This should align with members’ contributions unless otherwise agreed upon, and details on when profits will be distributed.

- Describe the management structure of the LLC. Specify whether it is member-managed or manager-managed and list the names of those in management roles.

- Set forth the decision-making process. Clarify how decisions are made, including voting rights and any required majority for different types of decisions.

- Address the membership changes procedure, including the addition of new members, the exit of existing members, and transfer of membership interest.

- Include provisions for dissolution of the LLC, detailing the conditions under which the LLC may be dissolved and the process for winding up its affairs.

- Insert a severability clause, ensuring that if any part of the agreement is found to be invalid, the rest of the agreement remains effective.

- Explain the amendment process for the Operating Agreement, including how amendments can be proposed and approved by the members.

- Close the document with a signing section for all members. Make sure each member signs and dates the agreement, which validates their acceptance of its terms.

Filling out the Indiana Operating Agreement form might seem like a procedural step, but it's a critical one. It not only fortifies your business’s operational foundation but also protects the interests of all members involved. Take your time to ensure accuracy and completeness, and consider consulting with a legal professional if you have any questions or customization needs.

Get Answers on Indiana Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership and member duties of a Limited Liability Company (LLC). It sets forth the rules and regulations for the LLC's operations as well as the financial and working relationships among the business owners (members). This agreement is crucial for ensuring that all members are on the same page regarding how the company is run, which can help avoid conflicts in the future.

Is an Operating Agreement required in Indiana?

While Indiana law does not require LLCs to have an Operating Agreement, it is highly recommended. Having an Operating Agreement can protect the company's limited liability status, help guard against misunderstandings, and ensure that your business runs according to your own rules—not just the default state laws.

What are the key elements of an Operating Agreement?

An Operating Agreement typically includes sections on the company’s structure, membership, management, how profits and losses will be shared, rules for meetings and votes, and procedures for adding or removing members. Additionally, it may set forth the initial contributions of each member and any duties beyond financial investment, such as services or expertise.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if changes are needed. The process for making amendments should be outlined within the agreement itself, including how many votes are required to make changes. This ensures the document remains relevant and up-to-date with the changing needs of the business and its members.

Do single-member LLCs need an Operating Agreement?

Even single-member LLCs can benefit from having an Operating Agreement. While it might seem unnecessary since there is only one owner, an Operating Agreement can help in legitimizing your LLC, clearly separating the business from the individual for legal and financial purposes. It also prepares your business for future growth or changes in ownership.

How does an Operating Agreement protect members' limited liability status?

By clearly establishing the LLC as a separate business entity with its own rules and structure, an Operating Agreement can help reinforce the members' limited liability status. This helps ensure that members are not personally liable for the company’s debts and obligations, provided they follow the protocols outlined in the agreement.

What happens if an LLC does not have an Operating Agreement in Indiana?

If an Indiana LLC does not have an Operating Agreement, its operations will be governed by default state laws. These default rules may not suit your business's unique needs or the members' preferences. Without an Operating Agreement, resolving disputes among members or managing changes in membership can also become more complex and challenging.

Where can I get help with drafting an Operating Agreement?

For assistance with drafting an Operating Agreement, it's advisable to consult with a legal professional who understands Indiana's specific requirements and can provide customized advice for your LLC. Legal services and online resources tailored for LLCs can also offer templates and guidance, but personalized legal advice is best for addressing your business's unique needs.

Can an Operating Agreement be used to resolve disputes among members?

Absolutely. An Operating Agreement can serve as a valuable reference in resolving disputes among members. By having agreed-upon procedures for handling disagreements, decision-making, and changes in ownership, an Operating Agreement can help prevent conflicts and provide a clear path for resolution. Thus, it acts as a crucial tool for maintaining business harmony and continuity.

Common mistakes

When individuals embark on the journey of filling out an Indiana Operating Agreement form for their Limited Liability Company (LLC), navigating the complexities can be daunting. One common mistake is neglecting to clearly define the distribution of profits and losses. Operators often assume a simple equal split will suffice or inadvertently omit this critical section, leading to disputes and confusion in the future. It's imperative that the agreement specifies how profits and losses are to be allocated among members, taking into account any contributions that might impact these shares.

Another error frequently encountered is failing to outline the process for adding or removing members. Many assume this can be easily managed with a verbal agreement or simple majority vote. However, without a formal process detailed in the Operating Agreement, changing the membership structure can become complicated, potentially harming the LLC's operations and member relationships. It is essential to have clear, written procedures in place for these significant changes.

A critical oversight in completing the Operating Agreement is not specifying the roles and responsibilities of each member. Without clear definitions, members may have unrealistic expectations about their involvement or dispute over decision-making authority. This can lead to operational inefficiencies and interpersonal conflicts. Detailing each member's responsibilities, rights, and duties helps ensure the smooth functioning of the LLC and protects the business's interests.

Imprecise or missing dispute resolution procedures is another common mistake. In the optimism of starting a new venture, the possibility of disputes might seem remote. However, disagreements among members are not uncommon and can escalate into major issues if not managed appropriately. An Operating Agreement should include a defined process for handling internal disputes, whether through mediation, arbitration, or another method, to avoid costly litigation and preserve the business relationship among members.

Last but not least, neglecting to specify the terms for dissolving the LLC is a major oversight. While this may be an uncomfortable topic to consider at the outset, it's crucial for an Operating Agreement to address how dissolution will be handled, including the distribution of assets and handling of debts. This foresight can save members a significant amount of stress and disagreement if the business must be dissolved in the future.

In sum, avoiding these common mistakes when crafting an Indiana Operating Agreement can safeguard the LLC from future disputes, ensure operational clarity, and protect the interests of all members involved. It's prudent to approach this legal document with thorough consideration and, if possible, the guidance of a legal professional.

Documents used along the form

Ensuring that a business complies with state laws and maintains proper records is crucial for its success and legal protection. In Indiana, alongside the Operating Agreement for LLCs, there are several important forms and documents that businesses typically need to manage. These documents play a vital role in the formation, operation, and maintenance of a business entity within the state. Below is a list of forms and documents often used together with the Indiana Operating Agreement form, each described briefly for better understanding.

- Articles of Organization: This is the primary document required to form an LLC in Indiana. It establishes the existence of the LLC and includes basic information such as the LLC's name, address, and the names of its members.

- Employer Identification Number (EIN) Application: An EIN, or Federal Tax Identification Number, is required for tax purposes. Businesses obtain it from the IRS, and it's necessary for hiring employees, opening business bank accounts, and filing taxes.

- Indiana Business Entity Report: Filed with the Indiana Secretary of State, this report is due biennially and updates the state on crucial information such as the business's address, directors, and officers.

- Operating Agreement Amendment: If members of an LLC decide to change any terms of the original Operating Agreement, those changes are documented in an amendment. This ensures the document remains accurate and up-to-date.

- Buy-Sell Agreement: This outlines what happens to a member's share of the LLC if they die, become disabled, or wish to sell their interest. It is crucial for ensuring the smooth continuation of the business under unforeseen circumstances.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive business information by requiring that employees or third parties not disclose confidential material, knowledge, or information.

- Employment Agreement: Outlines the terms of employment for any employees, including job responsibilities, salary information, and terms of termination. It helps in avoiding future disputes by making expectations clear.

- Independent Contractor Agreement: For businesses that hire contractors, this agreement details the terms of the contractor’s work, payment, and confidentiality requirements, distinguishing them from regular employees.

- Member Resignation Form: When a member of an LLC decides to leave, this form documents their resignation and initiates the transfer of their interest in the LLC according to the terms of the Operating Agreement or state law.

Each of these documents serves a specific purpose and contributes to the comprehensive governance and legal foundation of an LLC in Indiana. Efficient management of these documents ensures the business operates smoothly and remains in good standing with regulatory authorities. Considering the importance of legal compliance and thorough documentation, businesses should regularly review and update these documents as needed to reflect current operations and membership.

Similar forms

The Indiana Operating Agreement shares similarities with a Partnership Agreement, in that both lay out the governance structure for a business venture. Specifically, these documents outline the roles, responsibilities, and profit-sharing mechanisms among the parties involved. The main difference lies in their applicability; whereas an Operating Agreement is used by Limited Liability Companies (LLCs), a Partnership Agreement is tailored to partnerships. Both serve to ensure clarity and prevent disputes among the business owners by setting clear rules for the operation of the business.

Similarly, a Shareholder Agreement found in corporations, particularly S-corporations and C-corporations, resembles an Indiana Operating Agreement. Both documents regulate the relationship among the business owners and detail the management and financial arrangements, including the distribution of profits and the process for resolving disputes. However, the Shareholder Agreement specifically deals with the rights and obligations of shareholders and the operations of a corporation, diverging in terminology and the legal framework it operates under as compared to an LLC's Operating Agreement.

Bylaws serve as another comparable document, especially for non-profit organizations and corporations, establishing the rules that govern the entity's internal management. Like an Operating Agreement, bylaws outline the roles of directors and officers, meeting protocols, and other critical operational details. The distinction between them primarily centers on their use; bylaws are utilized by corporations and non-profit organizations, while Operating Agreements are specific to LLCs.

A Buy-Sell Agreement can also be compared to an Operating Agreement, as both deal with the continuity of the business in the event of a member's departure, death, or divorce. This type of agreement is crucial for outlining the parameters for buying out a member's interest in the company, serving a similar purpose to provisions often included in Operating Agreements regarding the change in ownership and membership interests.

The Joint Venture Agreement is another document with parallels to the Indiana Operating Agreement. Both are used to establish the terms of a business enterprise between two or more parties. They detail the scope of the project, the contributions of each party, and how profits and losses will be shared. While Joint Venture Agreements are used for specific projects or ventures, Operating Agreements are designed for the overall governance and operation of an LLC.

Lastly, the Terms of Service Agreement, often used by online businesses, shares the aim of governing relationships and responsibilities, albeit between a company and its customers or users rather than between business owners. This document sets forth the rules and guidelines for using a service or platform, whereas an Operating Agreement focuses on the internal management and operation of an LLC. Despite this difference in focus, both are fundamental to defining roles and responsibilities within their respective domains.

Dos and Don'ts

When it comes to organizing and managing an LLC in Indiana, drafting a comprehensive Operating Agreement is critical. This document outlines the governance structure, operational protocols, and financial arrangements among the members of the LLC. Whether you are establishing a new business or updating an existing one, it is essential to approach this task with diligence and awareness of best practices. Below are lists of what you should and shouldn't do when filling out an Indiana Operating Agreement form.

Things You Should Do:

Review State Requirements: Ensure you understand Indiana's specific requirements for LLC Operating Agreements. Though not always required by law, having a solid agreement in place is advisable for clarity and the protection of all members involved.

Detail Ownership and Member Responsibilities: Clearly delineate each member's percentage of ownership, voting rights, and specific responsibilities within the company. This clarity can prevent misunderstandings and conflicts.

Outline the Distribution of Profits and Losses: Specify how the LLC's profits and losses will be distributed among members. This should reflect the ownership percentages unless otherwise agreed upon by all members.

Plan for the Future: Include provisions for adding new members, resolving disputes, and the procedure for dissolving the LLC. Anticipating future changes can save time and mitigate potential issues.

Things You Shouldn't Do:

Ignore State Laws: Failing to align your Operating Agreement with Indiana's legal requirements can lead to legal complications. It is crucial to ensure your document does not conflict with state law.

Be Vague about Member Contributions: Avoid ambiguity about what each member is contributing, whether in the form of capital, assets, services, or other resources. Precise contributions should be documented to prevent disputes.

Omit Dispute Resolution Methods: Not including a clear mechanism for resolving internal disputes can lead to lengthy and costly legal battles. It is more efficient to have a predetermined method of resolution.

Forget to Update the Agreement: As your LLC grows and evolves, so too should your Operating Agreement. Neglecting to update this document can cause operational and legal issues down the line.

Misconceptions

When discussing the Indiana Operating Agreement form for LLCs, several misconceptions frequently arise. Clearing up these misunderstandings is crucial for business owners to protect their interests and ensure legal compliance. Below are eight common misconceptions.

The Operating Agreement is not mandatory in Indiana. While Indiana law does not require LLCs to have an Operating Agreement, having one is highly advisable. It outlines the members' rights, responsibilities, and profit distributions, which can prevent disputes and offer legal protection.

Any template will do. While templates can serve as a starting point, each LLC is unique. Customizing the Operating Agreement to fit the specific needs and wishes of the business and its members is essential for thorough protection and clarity.

Only multi-member LLCs need an Operating Agreement. Even single-member LLCs benefit from an Operating Agreement. It adds credibility, helps in legal disputes, and clearly separates personal and business assets.

Once created, it does not need to be updated. As businesses grow and evolve, so should their Operating Agreements. Regular updates ensure that the agreement accurately reflects the current state of the business, member responsibilities, and financial arrangements.

It's too complex for non-lawyers to understand. While legal documents can be complex, Operating Agreements should be written in clear, concise language. Members need to understand their contents fully, possibly with legal advice, to ensure they serve their intended purpose.

The Operating Agreement is purely internal and has no real legal standing. This document, while internal, is legally binding and can be crucial in legal disputes, tax assessments, and when seeking investors. It is a legitimate legal document that outlines the governance of the LLC.

Online Operating Agreements are as effective as those drafted by an attorney. While online resources can provide valuable guidance, a customized Operating Agreement drafted by a legal professional can ensure that all specific legal nuances and state-specific requirements are addressed.

Filing the Operating Agreement with the Indiana Secretary of State is necessary. In Indiana, the Operating Agreement is an internal document and does not need to be filed with the state. However, maintaining an up-to-date copy within company records is critical for legal and operational clarity.

Key takeaways

When filling out and using the Indiana Operating Agreement form, there are several key takeaways to keep in mind to ensure the process is completed accurately and effectively. These insights will aid in understanding the importance of the document and how it should be properly handled.

The Operating Agreement is a vital document for any Indiana LLC, defining the business structure and operating procedures. It is fundamental in ensuring a clear understanding of the management and financial arrangement among members.

Although Indiana law does not require LLCs to have an Operating Agreement, it is strongly advised to create one. It serves as a critical internal document that can help prevent misunderstandings between members by laying out the rules and expectations.

The agreement should cover capital contributions, profit distribution, decision-making processes, and member responsibilities. This clarity helps in the smooth operation of the LLC.

Consider the future of the LLC when drafting the Operating Agreement. Including clauses for events like the addition or departure of members ensures the LLC can adapt without needing a complete rewrite of the agreement.

Operating Agreements can be tailored to fit the specific needs of the LLC. They are not one-size-fits-all, so ensure the document reflects the actual operating practices and principles of your business.

Every member should have the opportunity to review the Operating Agreement before it is finalized. This ensures that all members understand and agree to the terms, which is crucial for future operations and disputes.

Once the Operating Agreement is agreed upon and signed, each member should receive a copy for their records. Keeping the document accessible ensures that members can refer to it as needed.

It's important to review and possibly update the Operating Agreement regularly or when significant changes to the LLC occur. This keeps the document relevant and in line with the current operations of the business.

Legal advice might be beneficial when drafting or reviewing your Operating Agreement. A professional can provide insights into legal requirements and help ensure that the document best protects the interests of all members and the LLC.

Properly filling out and using the Indiana Operating Agreement form is crucial for the functionality and legal protection of your LLC. Keeping these key takeaways in mind can help guide you through the process, making it as straightforward and beneficial as possible.

Popular Operating Agreement State Forms

How to Create an Operating Agreement - By establishing the management structure in the agreement, members have a blueprint for how decisions are made within the company.

Florida Operating Agreement - It allows for customizable management structures, which can be invaluable for businesses with unique or evolving needs.

Does California Require an Operating Agreement for an Llc - A well-drafted Operating Agreement reflects the consensus among members on the LLC’s operations, values, and goals.