Free Operating Agreement Form for Florida

The significance of having a well-drafted Operating Agreement when establishing a Limited Liability Company (LLC) in Florida cannot be overstated. This document serves as a cornerstone for setting forth the internal operations, financial decisions, and the structure of management within the LLC. It is tailored to suit the specific needs of its members, providing a clear framework for governance and conflict resolution, while also ensuring compliance with state legal requirements. Despite its not being mandated by the state law, the importance of this agreement becomes evident in its ability to offer protection and clarity for the business owners. This document distinguishes the personal liabilities and assets from those of the business, thus safeguarding the members' personal assets against business debts and obligations. Furthermore, it plays a critical role in preventing and resolving internal disputes by stipulating methods for decision-making and conflict resolution. The Florida Operating Agreement form, though not provided by the state, must be crafted with meticulous attention to detail to ensure it encompasses all necessary provisions for effectively running the LLC.

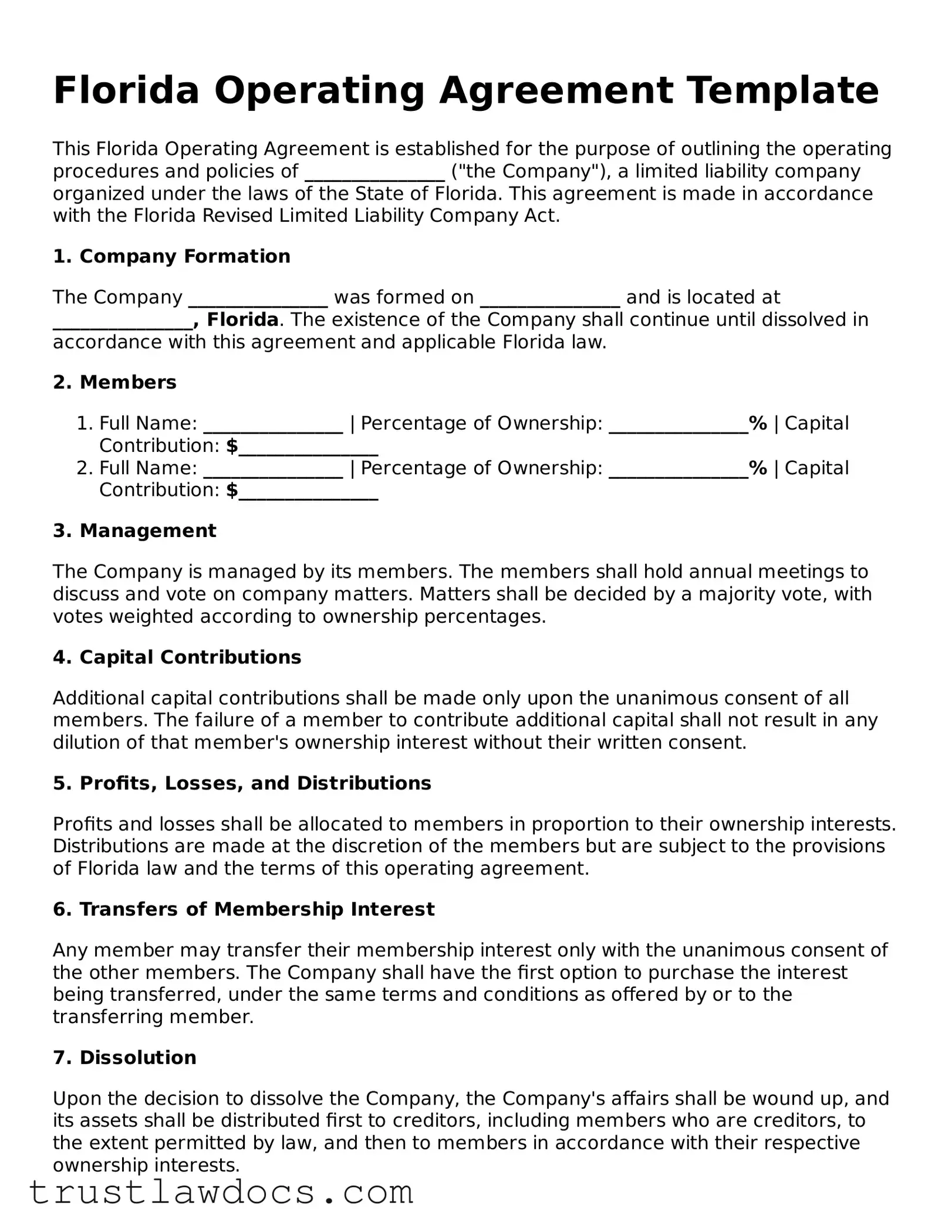

Form Example

Florida Operating Agreement Template

This Florida Operating Agreement is established for the purpose of outlining the operating procedures and policies of _______________ ("the Company"), a limited liability company organized under the laws of the State of Florida. This agreement is made in accordance with the Florida Revised Limited Liability Company Act.

1. Company Formation

The Company _______________ was formed on _______________ and is located at _______________, Florida. The existence of the Company shall continue until dissolved in accordance with this agreement and applicable Florida law.

2. Members

- Full Name: _______________ | Percentage of Ownership: _______________% | Capital Contribution: $_______________

- Full Name: _______________ | Percentage of Ownership: _______________% | Capital Contribution: $_______________

3. Management

The Company is managed by its members. The members shall hold annual meetings to discuss and vote on company matters. Matters shall be decided by a majority vote, with votes weighted according to ownership percentages.

4. Capital Contributions

Additional capital contributions shall be made only upon the unanimous consent of all members. The failure of a member to contribute additional capital shall not result in any dilution of that member's ownership interest without their written consent.

5. Profits, Losses, and Distributions

Profits and losses shall be allocated to members in proportion to their ownership interests. Distributions are made at the discretion of the members but are subject to the provisions of Florida law and the terms of this operating agreement.

6. Transfers of Membership Interest

Any member may transfer their membership interest only with the unanimous consent of the other members. The Company shall have the first option to purchase the interest being transferred, under the same terms and conditions as offered by or to the transferring member.

7. Dissolution

Upon the decision to dissolve the Company, the Company's affairs shall be wound up, and its assets shall be distributed first to creditors, including members who are creditors, to the extent permitted by law, and then to members in accordance with their respective ownership interests.

8. Amendments

This Operating Agreement can only be amended by a written agreement signed by all members. Any amendments shall comply with applicable Florida law.

9. Governing Law

This Operating Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first above written.

- Member Name: _______________ | Signature: _______________ | Date: _______________

- Member Name: _______________ | Signature: _______________ | Date: _______________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a document used by LLCs in Florida to outline the business operations and the agreements between its members. |

| Governing Law | The Florida Revised Limited Liability Company Act, specifically Chapter 605 of the Florida Statutes, governs the preparation and enforcement of Operating Agreements in Florida. |

| Not Legally Required but Recommended | While not mandated by Florida law, having an Operating Agreement is highly recommended to protect the LLC's operations and its members' interests. |

| Flexibility in Content | Florida law offers flexibility regarding what can be included in an Operating Agreement, allowing LLCs to tailor the document to their specific needs. |

| Can Be Oral or Written | In Florida, Operating Agreements can be oral, written, or implied based on the company's operations, though written agreements provide clearer proof of the agreed terms. |

How to Write Florida Operating Agreement

Filling out an operating agreement is a key step for any new LLC in Florida. This document sets the groundwork for your business's financial and functional decisions. Completing it accurately ensures that all members understand their rights and responsibilities, which can prevent conflicts down the road. The actual form isn't provided here, but the following steps will guide you through creating a comprehensive operating agreement for your Florida LLC.

- Start by gathering all necessary information about your LLC, including the official company name as registered with the State of Florida, the principal place of business, and the names and addresses of all members.

- Define the ownership structure. List each member’s ownership percentage, which is typically based on the amount of their initial contributions.

- Outline the members' voting rights and responsibilities. Specify how decisions are made, such as by majority vote, and detail the process for meetings and voting procedures.

- Describe how profits and losses will be distributed among members. This is usually in proportion to ownership percentages, but your agreement can specify a different arrangement if all members agree.

- Set forth the process for adding or removing members, including any conditions such as a vote of the remaining members.

- Discuss the management structure. Indicate whether your LLC will be member-managed or manager-managed, and detail the scope of the managers' authority and responsibility.

- Plan for the future. Include provisions for what happens if a member wants to exit the LLC, how their share will be valued, and whether the remaining members will have the option to buy out the departing member’s interest.

- Address dissolution criteria. Specify under what conditions the LLC may be dissolved, and outline the process for distributing assets among members in such an event.

- Once all sections are completed, ensure each member reviews the entire document for accuracy and completeness. Members should discuss and resolve any disagreements before finalizing.

- Have each member sign the agreement. Although not always required by law, having a notary public witness the signatures can add a layer of authenticity and help resolve potential disputes in the future.

After the operating agreement is fully executed, keep it in a safe but accessible location along with your other important business documents. While the state of Florida does not require you to file this document, it serves as a critical internal record that outlines how your LLC operates and how decisions are made. Review and update your operating agreement periodically, especially as your business grows or experiences changes in membership.

Get Answers on Florida Operating Agreement

What is a Florida Operating Agreement?

An Operating Agreement is a legal document outlining the ownership and operating procedures of an LLC in Florida. The form specifies the company's structure, policies, and the roles and responsibilities of its members. It serves to safeguard the business's limited liability status, reduce conflicts by setting clear rules, and ensure that the business operates according to the members' wishes rather than default state laws.

Do I need an Operating Agreement for my Florida LLC?

While the state of Florida does not require LLCs to have an Operating Agreement, it is highly recommended. Having an Operating Agreement provides legal clarity and protection for your business operations. It defines the management structure, prevents misunderstandings among members by laying down the operational and financial decisions-making processes, and helps in establishing your LLC as a separate legal entity.

Can I create an Operating Agreement by myself?

Yes, you can draft an Operating Agreement yourself. Many resources and templates are available to help create a comprehensive Operating Agreement that meets the specific needs of your LLC. However, considering the legal importance of this document, you may also seek advice from a legal professional to ensure that your Operating Agreement fully covers all necessary aspects and complies with Florida law.

What are the key components of a Florida Operating Agreement?

An Operating Agreement typically includes details about the LLC’s membership structure, capital contributions, distribution of profits and losses, management and voting rights, rules for meetings and decision-making processes, and procedures for adding or removing members. It should also outline how the LLC will be dissolved if necessary. These components ensure that all potential scenarios regarding the business's operations and management are addressed.

How does an Operating Agreement protect my Florida LLC?

An Operating Agreement protects your LLC by setting forth the governance structure and operating rules that can help prevent disputes between members. It reinforces your LLC’s limited liability status by showing that your business operates independently from its owners. In the event of legal scrutiny, having a tailored Operating Agreement proves that your LLC is a legitimate business entity running in accordance with its specific operational framework, further safeguarding your assets.

Common mistakes

One common mistake people make when filling out the Florida Operating Agreement form is not providing complete details of each member's contributions. Members might forget to include the full extent of what they have committed to the business, whether it be cash, property, or services. This oversight can lead to disputes or confusion about the ownership percentage each member holds, affecting the distribution of profits and losses.

Another error is failing to specify the process for admitting new members. Without a clear procedure outlined in the Operating Agreement, it can lead to misunderstandings or conflicts when the business wants to expand. It's important to determine how new members can join and what they are required to contribute to the company.

Often, people neglect to detail the duties and powers of managers in the Operating Agreement. This lack of clarity can result in managerial inefficiency or disputes regarding decision-making authority. It's crucial to specify who is responsible for daily operations and how decisions are made within the company.

Skipping the section on how profits and losses will be distributed is another frequent mistake. Without a clear agreement, the default state laws will apply, which may not align with the members' intentions. A well-drafted Operating Agreement should explicitly state how the company's financials are handled, ensuring fairness and transparency among members.

Forgetting to include dispute resolution mechanisms in the Operating Agreement is a common oversight. When conflicts arise, having a predefined process for resolution can save the company time and money. Whether through mediation, arbitration, or another method, outlining how disputes will be handled is essential for the smooth operation of the business.

Last but not least, failing to regularly update the Operating Agreement is a mistake that can lead to significant legal and operational issues. As the business evolves, so too should its governing documents. Members must review and amend the Operating Agreement as necessary to reflect changes in the company's structure, operations, and membership.

Documents used along the form

When you're setting up a business entity like a Limited Liability Company (LLC) in Florida, you'll quickly realize that an Operating Agreement, while vital, is just one part of a larger puzzle. This document outlines the LLC's ownership and operating procedures, setting the foundation for your business's legal and financial structure. However, to fully establish and protect your LLC, there are several other forms and documents that you should be aware of and consider incorporating into your business setup process. Let's dive into some of these key documents to give you a clearer picture.

- Articles of Organization: This is the cornerstone document required to officially form an LLC in Florida. Filed with the Florida Division of Corporations, it legally establishes your business by outlining essential information such as your LLC's name, address, and the names of its members and manager(s).

- Employer Identification Number (EIN): Often considered the social security number for your business, an EIN is necessary for tax purposes. Issued by the IRS, it's required for opening business bank accounts, hiring employees, and filing tax returns.

- Florida Business Licenses and Permits: Depending on the nature of your business and its location, various state or local licenses and permits may be required to operate legally. These could range from a general business license to more specific professional licenses, health permits, or zoning permits.

- Annual Reports: To keep your LLC in good standing, Florida requires that you file an Annual Report with the state. This report updates or confirms the details of your business, such as addresses and current management, and is essential for maintaining your company's active status.

Understanding the role and requirement of each document in the context of your Florida LLC can significantly influence how smoothly and effectively your business operates. These documents not only comply with legal obligations but also establish a clear framework for your business's management and operations, guiding it toward success while minimizing legal and financial risks. Getting these documents in order early on can give you peace of mind and a solid foundation as you focus on growing your business.

Similar forms

The Florida Operating Agreement shares similarities with the Partnership Agreement. Both documents outline the business structure, roles, and responsibilities of the involved parties. Specifically, they detail how profits and losses will be distributed, how the business will be managed, and the process for adding or removing partners. The clarity these agreements provide helps in preventing conflicts among business owners by establishing clear guidelines and operating procedures from the outset.

Similar to the Bylaws used in corporations, the Florida Operating Agreement serves a crucial role in LLCs. Bylaws set forth the internal rules and procedures for corporations, including the organization's structure, the duties of directors and officers, and guidelines for shareholder meetings. Like the Operating Agreement, bylaws are fundamental in guiding the entity's day-to-day operations and ensuring that all members are on the same page regarding the business's governance and administrative processes.

The Buy-Sell Agreement is another document with functions comparable to those found in an Operating Agreement. It outlines what happens to a partner's share of the business if they wish to leave, become incapacitated, or die. Similarly, the Operating Agreement may contain provisions for these situations, ensuring there's a predetermined pathway for transfer of interests that protects the business and its owners' investments.

Member Control Agreements, specifically used in member-managed LLCs, closely resemble the Operating Agreement in structure and purpose. They define the members' voting rights, share of profits, and responsibilities within the LLC. Just like an Operating Agreement, they serve to solidify the operational framework within which the members interact and make decisions, providing a clear roadmap for handling internal matters.

Employment Agreements also share a common purpose with sections of an Operating Agreement, particularly concerning roles and responsibilities. Whereas Employment Agreements detail the job description, compensation, and expectations between an employer and employee, an Operating Agreement may delineate similar information for the members or managers of an LLC, encapsulating their duties and benefits within the company structure.

The Shareholders' Agreement in a corporation mirrors the Florida Operating Agreement in its approach to outlining how a business is run, but from a shareholder perspective. It includes provisions on the transfer of shares, dispute resolution, and management decisions, akin to how an Operating Agreement spells out the operations, member contributions, and decision-making processes within an LLC.

Lastly, the Non-Disclosure Agreement (NDA) shares a protective purpose similar to certain provisions that might be found in an Operating Agreement. While an NDA specifically aims to protect proprietary and sensitive information from being disclosed, Operating Agreements can include clauses that mandate confidentiality regarding the LLC's internal affairs and proprietary data, thus safeguarding business secrets and strategies within a legal framework.

Dos and Don'ts

When crafting an Operating Agreement for a Limited Liability Company (LLC) in Florida, adhering to certain best practices can ensure the document meets legal standards while accurately reflecting the intentions of its members. The Operating Agreement serves as a critical component of your LLC's organizational structure, guiding decisions, and resolving any disagreements that may arise.

Here are some guidelines to follow:

Do:- Personalize the Agreement to fit your LLC. Ensure that it reflects the specific operations, management structure, and financial arrangements of your business.

- Include detailed descriptions of each member's responsibilities, rights, and percentage of ownership in the LLC.

- Outline the process for adding or removing members, including any necessary approval from existing members and adjustments to ownership percentages.

- Detail the decision-making process, specifying which decisions require a majority vote, unanimous decision, or can be made by a single member or manager.

- Specify the distribution of profits and losses, which might not necessarily align with the percentage of ownership.

- Include a dissolution procedure to address how the LLC will be wound up should the time come.

- Review state requirements. Ensure your Operating Agreement is in compliance with Florida state law, even though the state does not require the agreement to be filed.

- Consult with an attorney to ensure that the Agreement complies with both state and federal laws and that all members' interests are adequately protected.

- Regularly update the agreement as the LLC grows and evolves.

- Ensure all members sign the document, making it legally binding and acknowledging that they agree to its terms.

- Use a generic template without customizing it to your LLC's specifics, as this may not adequately cover your unique situation or meet Florida's specific legal requirements.

- Omit any verbal agreements from the written document. All agreements between members should be included in the Operating Agreement to avoid future disputes.

- Forget to address potential conflicts of interest among members, which should be managed transparently in the Agreement.

- Ignore tax considerations when outlining the financial arrangements within the Agreement, as this could lead to issues with the IRS.

- Fail to specify the method for amending the Agreement, which can lead to challenges when changes need to be made.

- Assume one size fits all regarding dispute resolution. Tailor the dispute resolution procedures to fit the needs and preferences of the LLC members.

- Overlook the requirement for records maintenance and reporting, which are critical for both legal compliance and effective management.

- Underestimate the importance of confidentiality clauses, especially concerning the handling of sensitive information about the business and its members.

- Delay the creation of an Operating Agreement, assuming it can wait until after the company begins operations.

- Rely solely on online resources or advice without consulting a knowledgeable attorney to ensure the document's legality and effectiveness.

Misconceptions

When it comes to managing a Limited Liability Company (LLC) in Florida, an Operating Agreement serves as a crucial document that outlines the operational procedures and financial arrangements among its members. However, there are several common misconceptions about the Florida Operating Agreement form that need to be addressed:

It's legally required to have one: Many believe that holding an Operating Agreement is a legal requirement for Florida LLCs. While highly recommended for clearly delineating the structure and rules governing the business, Florida law does not mandate LLCs to have an Operating Agreement in place.

One size fits all: Another misconception is that Operating Agreements are one-size-fits-all. In reality, these documents should be tailored to meet the specific needs of each LLC, considering its unique operational procedures and member agreements.

It's only for multi-member LLCs: People often think Operating Agreements are unnecessary for single-member LLCs. However, having one can provide clarity and protection by detailing the business's operational processes and separating the member's personal liabilities from those of the business.

It doesn't need to be in writing: Though Florida law allows Operating Agreements to be oral or even implied based on the LLC's practices, having a written Operating Agreement is crucial. It prevents misunderstandings among members and provides a reference point for resolving disputes.

Once it's written, it cannot be changed: The belief that Operating Agreements are set in stone once signed is misplaced. These documents should evolve with the business and can be amended as required, provided all members agree to the changes.

It only covers the distribution of profits and losses: Many think that Operating Agreements solely address the distribution of profits and losses. While this is a vital element, these agreements also cover governance, voting rights, management, and procedures for adding or removing members, among other operational aspects.

It's too complicated and requires a lawyer: The perception that drafting an Operating Agreement is complex and necessarily involves costly legal fees can deter LLC members. While legal advice can be beneficial, especially for complex structures, resources and templates are available to help draft a basic Operating Agreement without direct legal help.

The state has a default agreement that is usually sufficient: Relying on the state's default rules governing LLC operations might seem like an easy path. However, this can lead to undesirable default decisions not aligned with the members' intentions, making a customized Operating Agreement crucial.

Clearing up these misconceptions can help ensure that LLC members in Florida fully understand the importance and flexibility of Operating Agreements and take the necessary steps to implement one that suits their business's needs.

Key takeaways

The Florida Operating Agreement form is an important document for any Limited Liability Company (LLC) formed in the state. Here are some key takeaways to ensure you fill out and use this form correctly and effectively:

- Define the LLC's Ownership Structure: The Operating Agreement allows members to clearly state their ownership percentages. This clarity is crucial for the fair distribution of profits and losses.

- Outline the Management Structure: Decide whether your LLC will be member-managed or manager-managed and document this decision in the Operating Agreement. This delineation will guide the operational roles and responsibilities within the organization.

- Describe Member Roles and Responsibilities: A well-drafted Operating Agreement should detail the roles, voting rights, and responsibilities of each member. This helps in managing expectations and mitigating disputes.

- Plan for the Future: Including provisions for adding or removing members, and what happens if the LLC dissolves, prepares your business for future changes and challenges.

- Document Profit and Loss Distribution: Your Operating Agreement should specify how profits and losses will be distributed among members. This is typically proportional to ownership percentages but can be adjusted as agreed upon by all members.

- Enhance Credibility: Having a formal Operating Agreement can enhance your LLC's credibility with lenders, investors, and potential partners. It signifies that your business is well-organized and professionally managed.

- Protect Your LLC's Limited Liability Status: Clearly separating the members' personal affairs from the business's operations within the Operating Agreement helps in maintaining your LLC's limited liability protection.

- Meet State Requirements: While Florida does not legally require LLCs to have an Operating Agreement, having one fulfills internal documentation requirements and can help prevent misunderstandings among members or with third parties.

Remember, even though an Operating Agreement is not filed with the state, it's a legally binding document among members. Ensure all members review and agree to the terms before signing. Consulting with a legal professional can also help tailor the Agreement to your LLC's specific needs and ensure compliance with all relevant laws and regulations.

Popular Operating Agreement State Forms

Form Llc Indiana - While not always required by law, having an Operating Agreement can provide legal protection and clarity for LLC members.

How to Create an Operating Agreement - The Operating Agreement acts as a safeguard, ensuring that the business can operate effectively even if ownership changes.

Llc Operating Agreement Texas - The document can detail the process for making major business decisions, ensuring everyone knows how such decisions are made.

Does California Require an Operating Agreement for an Llc - Having an Operating Agreement can facilitate easier resolution of disputes among members.