Free Operating Agreement Form for California

In the bustling world of business, particularly in a state as dynamic and competitive as California, the pathway to success is often paved with diligent preparation and comprehensive planning. Integral to this process for any limited liability company (LLC) is the creation of an Operating Agreement, a document that may not be mandated by state law but is invaluable in outlining the structure of your business, the responsibilities of its members, and the procedures for resolving disputes. This form serves as the backbone of your LLC, providing clarity and security by detailing every aspect of your company's operational aspects, from the allocation of profits and losses to the governance structure and membership rights. Given its significance, drafting this document requires thoughtful consideration of the unique dynamics of your business, ensuring that it not only conforms to California law but also aligns with the vision and goals of your business. It's a crucial step in safeguarding the integrity and future of your enterprise, offering a clear roadmap that guides all members through the intricacies of business operation and decision-making. Consequently, understanding the comprehensive components and the strategic value of the California Operating Agreement form is the first step towards establishing a solid foundation for your LLC.

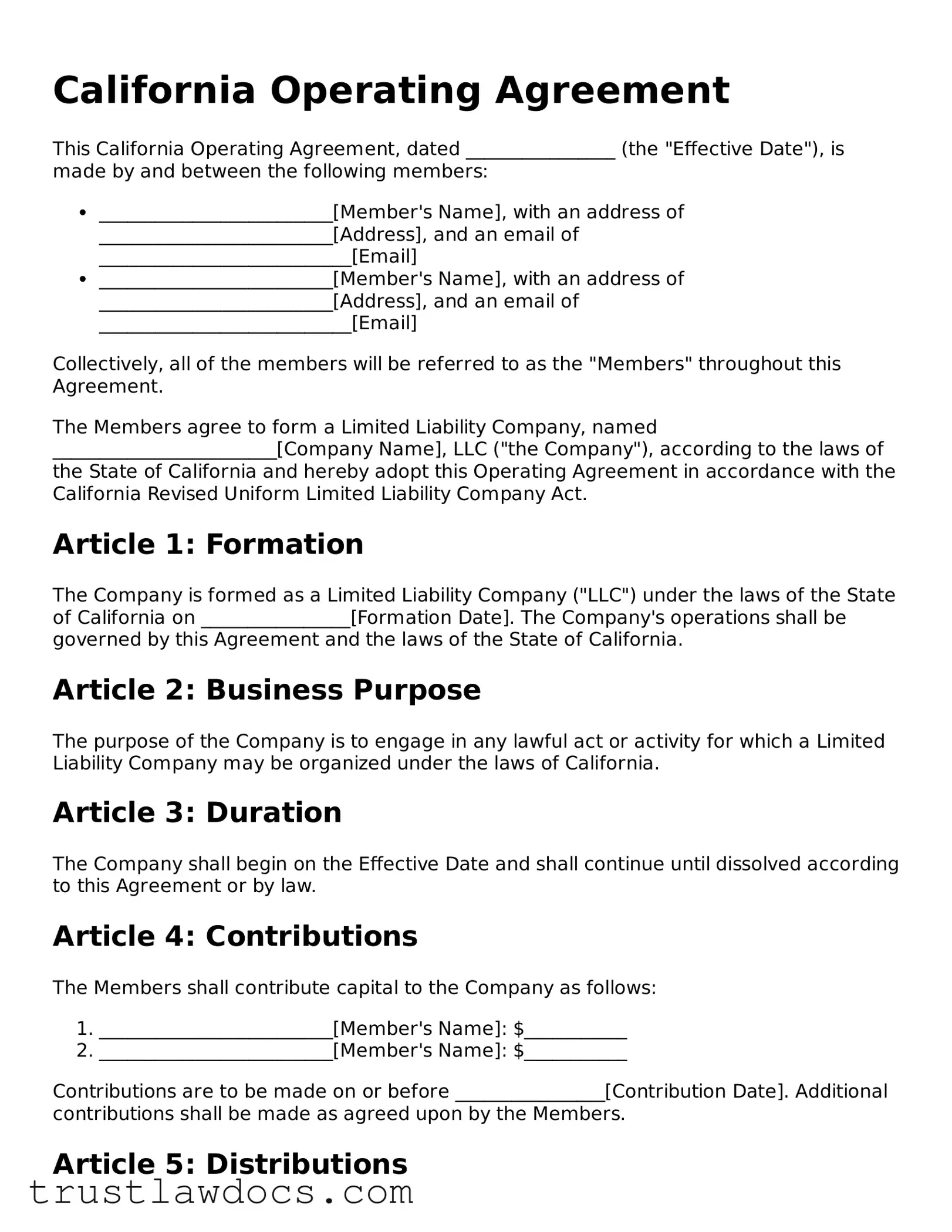

Form Example

California Operating Agreement

This California Operating Agreement, dated ________________ (the "Effective Date"), is made by and between the following members:

- _________________________[Member's Name], with an address of _________________________[Address], and an email of ___________________________[Email]

- _________________________[Member's Name], with an address of _________________________[Address], and an email of ___________________________[Email]

Collectively, all of the members will be referred to as the "Members" throughout this Agreement.

The Members agree to form a Limited Liability Company, named ________________________[Company Name], LLC ("the Company"), according to the laws of the State of California and hereby adopt this Operating Agreement in accordance with the California Revised Uniform Limited Liability Company Act.

Article 1: Formation

The Company is formed as a Limited Liability Company ("LLC") under the laws of the State of California on ________________[Formation Date]. The Company's operations shall be governed by this Agreement and the laws of the State of California.

Article 2: Business Purpose

The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized under the laws of California.

Article 3: Duration

The Company shall begin on the Effective Date and shall continue until dissolved according to this Agreement or by law.

Article 4: Contributions

The Members shall contribute capital to the Company as follows:

- _________________________[Member's Name]: $___________

- _________________________[Member's Name]: $___________

Contributions are to be made on or before ________________[Contribution Date]. Additional contributions shall be made as agreed upon by the Members.

Article 5: Distributions

Distributions of the Company's assets shall be made to the Members annually or at other intervals as decided upon by the Members. Distributions shall be in proportion to the Members' respective contributions unless otherwise agreed upon.

Article 6: Management

The Company shall be managed by its Members. Decisions shall be made by a majority vote unless otherwise stipulated in this Agreement.

Article 7: Changes to the Agreement

Any changes to this Agreement must be in writing and signed by all Members.

Article 8: Governing Law

This Agreement and the operation of the Company shall be governed by and construed in accordance with the laws of the State of California.

Article 9: Dissolution

The Company may be dissolved by a unanimous vote of the Members or as required by California law.

Signatures

This Agreement has been entered into by the Members as of the Effective Date.

- _________________________[Member's Signature] Date: ________________

- _________________________[Member's Signature] Date: ________________

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The California Operating Agreement is a document used by LLCs (Limited Liability Companies) to outline the business's financial and functional decisions including rules, regulations, and provisions. |

| 2 | Though not required by California law, having an Operating Agreement is highly recommended for LLCs operating within the state. |

| 3 | The document helps to establish the LLC as a separate legal entity, which can be crucial for protecting members' personal assets from the business's liabilities. |

| 4 | The Operating Agreement can be amended or repealed as agreed upon by the LLC members, providing flexibility as the business grows or changes. |

| 5 | The Agreement should cover the allocation of profits and losses, each member's contributions, responsibilities, and rights, as well as provisions for joining or leaving the LLC. |

| 6 | It is governed by the California Corporations Code, which includes specific requirements for the formation and operation of LLCs within the state. |

| 7 | An Operating Agreement does not need to be filed with the state; however, it should be kept on file by the LLC and made available to all members. |

| 8 | Without an Operating Agreement, the LLC will be governed by the default rules set forth in the California state statutes, which may not align with the members' preferences for the operation of the LLC. |

How to Write California Operating Agreement

To establish a clear understanding of the operations, responsibilities, and financial distributions within a Limited Liability Company (LLC) in California, an Operating Agreement is essential. This document, although not legally required in California, provides a framework for the business's internal structure and helps prevent misunderstandings among members. The process of filling out the California Operating Agreement form is straightforward if you follow these steps carefully. Doing so ensures that everyone involved knows their roles, share of profits, and other important policies of the LLC.

- Gather necessary information: Before starting, ensure you have all the relevant information about your LLC, including the company name, principal place of business, names and addresses of all members, the percentage of their ownership, and the roles and responsibilities of each member.

- Decide the management structure: Determine whether your LLC will be managed by members or by appointed managers. This decision will influence how decisions are made within the company.

- Outline the distribution of profits and losses: Agree on how the LLC's profits and losses will be shared among members. This typically relates to the percentage of ownership but can be adjusted as members see fit.

- Fill in the membership details: This includes the names of members, their addresses, their contribution to the LLC (whether in cash, property, or services), and their ownership percentage.

- Define rights and responsibilities: Clearly define each member's rights and responsibilities within the LLC, such as voting rights, duties, and obligations.

- Delineate the process for adding or removing members: Outline the process for changes in membership, including how new members can join and the circumstances under which a member can be removed.

- Specify dispute resolution methods: Decide on and document how internal disputes will be resolved among members to avoid future conflicts.

- Outline the dissolution process: Include details on how the LLC will be dissolved if necessary, detailing the distribution of assets among members after debts and obligations have been settled.

- Signatures: Ensure that all members sign the agreement to make it effective. Date the signatures to document when the agreement was made.

- Keep the document safe: Keep the Operating Agreement in a secure location and provide copies to all members. While it's not submitted to the state, it's crucial for the smooth operation of your LLC.

Completing the Operating Agreement is a foundational step in establishing your LLC's operations and structure. While this document is not filed with any government agency in California, it serves as a private contract between the members. Following these steps to carefully draft your Operating Agreement will lay down a strong foundation for your business's operational conduct, responsibilities, and conflict resolution methods.

Get Answers on California Operating Agreement

What is a California Operating Agreement?

An Operating Agreement is a key legal document used by Limited Liability Companies (LLCs) in California. It outlines the ownership structure, operating procedures, and financial arrangements among the members (owners). Although not legally required in California, creating an Operating Agreement is highly recommended as it provides a clear framework for business operations and helps protect members' personal assets.

Do I need an Operating Agreement for my California LLC?

While the state of California does not legally require LLCs to have an Operating Agreement, having one is crucial. It helps to establish your financial and operational rules, preventing misunderstandings among members. It also reinforces the limited liability status of your company by showing that your LLC operates independently from its members.

What information should be included in a California Operating Agreement?

A comprehensive California Operating Agreement should include: the LLC's name and principal address, members' names and capital contributions, ownership percentages, management structure and voting rights, profit and loss distribution, rules for adding or removing members, buyout and buy-sell rules, and dissolution procedures. It's important to tailor your Operating Agreement to fit your business's specific needs.

Can I write my own Operating Agreement, or do I need a lawyer?

Although it's possible to write your own Operating Agreement, consulting with a legal professional can provide valuable insights and ensure that your document complies with California law and thoroughly covers all aspects of your business operations. However, for simpler LLC structures, various templates and resources are available online to guide you through the process.

How do I file my Operating Agreement in California?

In California, Operating Agreements are not filed with any state agency. Instead, it should be kept on file by the LLC internally. Make sure every member has a copy of the Operating Agreement and understands its contents. Although it's not submitted to the state, it's a critical document for defining your LLC's operating rules and procedures.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if the existing terms allow for amendments and the members agree to the changes. The Agreement should include a provision detailing the process for making amendments. Typically, a certain percentage of member votes is required to approve any changes. It's important that any amendments are documented in writing and distributed to all members.

What happens if I don’t have an Operating Agreement for my California LLC?

Without an Operating Agreement, your LLC will be governed by the default state laws of California. These default rules might not suit your business’s needs and could lead to disputes among members. Additionally, the lack of an Operating Agreement may jeopardize your LLC's limited liability status, as it demonstrates a lack of formality in your business operations.

Are single-member LLCs in California required to have an Operating Agreement?

Even though single-member LLCs in California are not legally required to have an Operating Agreement, it’s still recommended. An Operating Agreement can help in establishing the separation between the owner's personal and business assets, thus strengthening the limited liability protection. It also comes in handy when opening business bank accounts or dealing with legal matters.

Common mistakes

When individuals embark on the journey of filling out a California Operating Agreement form for their LLC, errors are not uncommon. These mistakes can range from minor oversights to significant errors that might affect the validity of the agreement or cause legal issues down the line. Recognizing and avoiding these common pitfalls is essential for ensuring a smooth business operation.

One prevalent error is not customizing the agreement to fit the specific needs of the business. Many people use a one-size-fits-all approach, neglecting the unique aspects of their operation. This can lead to problems in decision-making processes, distribution of profits, and in the event of a dispute among members. Tailoring the agreement to reflect the dynamics and aspirations of the business entity is crucial.

Failing to define the roles and responsibilities of each member clearly is another oversight. Without clear definitions, misunderstandings and conflicts can arise, hampering the effectiveness of the LLC's operation. It's essential to outline each member's duties, rights, and expectations to ensure smooth business operations and mitigate potential internal conflicts.

Omitting dispute resolution procedures is another common mistake made when completing the California Operating Agreement. In the absence of predefined dispute resolution mechanisms, resolving disputes can become time-consuming and costly. By establishing procedures in advance, members can handle disagreements efficiently, saving time and resources.

Some individuals also neglect to specify the procedure for amending the agreement. As businesses evolve, so too may the need to modify the operating agreement. Without a clear amendment process, making necessary changes can become a source of contention among members.

A significant error is inadequate planning for the dissolution of the LLC. While no one likes to think about the end of their business, having a clear exit strategy in case of dissolution is critical. This includes detailing the distribution of assets and handling of debts, ensuring a smooth and equitable winding up of the business.

Overlooking the importance of signatures is another misstep. All members must sign the Operating Agreement for it to be legally binding. Failing to obtain all necessary signatures might lead to disputes about the agreement's enforceability.

Failing to keep the agreement updated is a mistake that can render previous efforts null. As changes occur within the membership or operations of the LLC, the Operating Agreement should be revised to reflect such changes, ensuring its relevance and effectiveness.

An error often made by many is not seeking legal advice. While templates and DIY forms can be convenient and cost-effective, they may not cover all legal nuances specific to the business or the latest legal developments. Consulting with a legal professional can prevent potential legal pitfalls.

Misunderstanding the legal weight of the document is a critical mistake. Some individuals might treat the Operating Agreement as a mere formality without realizing it is a legally binding document that governs the operations of the LLC and the relationships among its members. Underestimating its importance can lead to significant legal and operational issues.

Last but not least, a common oversight is failure to file the agreement or keep it on record properly. While the Operating Agreement itself does not need to be filed with the California Secretary of State, maintaining an accessible, updated version is necessary for legal and operational reference. This ensures that all members are aware of the terms and helps in legal disputes or audits.

Documents used along the form

When forming a Limited Liability Company (LLC) in California, the Operating Agreement is a crucial document that outlines the operational and financial arrangements of the business, as well as the relationships among the members. However, this is not the only important document needed during the formation and ongoing operation of an LLC. To ensure compliance and smooth operation, a number of other documents are often used alongside the California Operating Agreement.

- Articles of Organization: This is the initial formation document filed with the California Secretary of State to legally establish the LLC. It includes basic information such as the LLC's name, address, agent for service of process, and sometimes, the members' names.

- Employer Identification Number (EIN): Issued by the IRS, the EIN is essentially a Social Security number for the business. It's necessary for tax filing and reporting purposes, as well as opening a business bank account.

- Statement of Information: Required by the California Secretary of State, this document provides up-to-date information about the LLC's address, management, and agent for service of process. It must be filed periodically, usually every two years.

- Operating Agreement Amendments: Over the life of an LLC, changes may occur that necessitate altering the original Operating Agreement. Amendments should be documented and agreed upon by all members to keep the agreement current.

- Buy-Sell Agreement: Although not mandatory, this agreement is crucial for regulating the transfer of ownership interests in the business. It outlines what happens if a member wishes to sell their part, dies, or becomes incapacitated.

Together with the Operating Agreement, these documents provide a solid legal foundation for your LLC. They not only help in maintaining compliance with state and federal regulations but also in ensuring that the business operates smoothly and according to the agreed-upon terms among its members. Keeping these documents up-to-date and readily accessible can prevent potential legal issues and help during significant business transitions.

Similar forms

The California Operating Agreement form is notably similar to the Partnership Agreement form in its structure and purpose. Both serve as foundational documents that outline the operational blueprint and financial arrangements among the owners of a business. However, while the Operating Agreement is specific to Limited Liability Companies (LLCs) in California, Partnership Agreements are utilized by Partnerships. Each document details the rights, responsibilities, and profit-sharing mechanisms among the parties involved, aimed at preventing future disputes.

Similar to the Bylaws of a Corporation, the California Operating Agreement provides a framework for the operation of an LLC. Bylaws are essential for corporations as they outline the governance structure, including the roles of directors and officers, along with meeting protocols and other corporate formalities. In contrast, Operating Agreements cater to LLCs, offering a comparable guide for internal operations, including management duties and member relations, tailoring to the flexible nature of LLCs.

The Shareholders' Agreement shares commonalities with the California Operating Agreement, inasmuch as it governs the shareholders' relationships within a corporation and outlines specifics regarding shares, ownership transfer, and decision-making processes. However, the Shareholders' Agreement pertains specifically to corporations and their shareholders, whereas the Operating Agreement is used by LLCs to manage the operations and member interactions within the company structure.

The Buy-Sell Agreement is another document with similarities to the California Operating Agreement. Often included as a component of the Operating Agreement or as a separate agreement, it specifies what happens to a member's share of the LLC in the event of death, disability, or departure. Both documents serve to safeguard the business's continuity and protect the interests of its owners by preparing for future contingencies.

The Business Plan, while not a legal document per se, bears resemblance to the California Operating Agreement in its function of outlining the strategic direction and operational management of a business. However, a Business Plan is broader, covering aspects such as marketing strategies, financial projections, and competitive analysis, and is used primarily for guiding the business and securing financing rather than dictating member roles and responsibilities.

The Employment Agreement is akin to the California Operating Agreement as they both define terms between parties within a business context. While an Employment Agreement lays out the terms of employment between a company and its employee, including duties, salary, and termination conditions, the Operating Agreement outlines the workings of the LLC itself, including member responsibilities and profit distribution. Both are vital in clarifying expectations and responsibilities to prevent future conflicts.

Similarly, a Non-Disclosure Agreement (NDA) and the California Operating Agreement have parallels in their emphasis on confidentiality. NDAs protect sensitive business information by restricting disclosure, typically used with employees, contractors, or partners. Operating Agreements can also contain confidentiality clauses, safeguarding the private workings of the LLC from being disclosed to outsiders, thus protecting the company’s proprietary information and trade secrets.

The Member-Managed LLC Agreement, a variant of the Operating Agreement, is specifically tailored for LLCs where all members actively participate in the business's daily management. This is directly comparable to the more general California Operating Agreement, with the key difference being the management structure it specifies. Both documents lay out member duties, voting rights, and profit shares, but the Member-Managed LLC Agreement focuses on a collective management approach.

The Independent Contractor Agreement bears similarity to the California Operating Agreement in terms of regulating relationships within the business framework. It outlines the terms between a company and an independent contractor, specifying the services to be performed, payment, and confidentiality requirements. Although targeting different relationships within and around the business, both documents aim to clear ambiguities by defining roles, expectations, and protections.

Lastly, the Commercial Lease Agreement, while primarily a real estate document, shares the trait of defining terms and conditions between parties for the use of property, similar to how the California Operating Agreement sets out the operational structure for an LLC. Whereas the Commercial Lease Agreement focuses on the tenant-landlord relationship regarding physical property, the Operating Agreement addresses the management and operational aspects of the LLC’s business conduct and the relationship between members.

Dos and Don'ts

When filling out the California Operating Agreement form, individuals should pay close attention to the accuracy and completeness of the information provided. This document is essential for defining the operations of a limited liability company (LLC), detailing the members' rights and responsibilities, and laying out the procedural aspects of the company. To ensure the process is handled correctly, here are some recommended dos and don'ts.

What You Should Do:

- Ensure all members' names and contact information are accurate and complete. This helps to avoid any confusion or legal issues that could arise from incorrect details.

- Clearly outline each member's contribution and ownership percentage. Accurate records of these commitments are crucial for the financial and operational structure of the LLC.

- Include detailed descriptions of members' roles, rights, and responsibilities. This clarity helps prevent conflicts within the LLC by setting clear expectations for each member.

- Review and update the agreement regularly. As the company grows or changes, the operating agreement should evolve to reflect current operations and member agreements.

What You Shouldn't Do:

- Don’t overlook the importance of specifying the process for adding or removing members. Failing to include these provisions can lead to complications if changes in membership occur.

- Don’t leave any sections incomplete. Every part of the agreement serves a purpose, and omitting information can lead to ambiguities that complicate the LLC's operations and legal standing.

- Don’t use ambiguous language. The wording should be clear and specific to avoid misinterpretations and potential legal disputes among members.

- Don’t forget to have all members review and sign the agreement. An operating agreement is not fully effective until it has been agreed upon and signed by all parties involved.

Misconceptions

In discussing the California Operating Agreement form, several misconceptions frequently arise, impacting business owners who operate Limited Liability Companies (LLCs) within the state. It's important to dispel these misconceptions to ensure compliance and proper organization of your business affairs.

Only Multi-Member LLCs Need an Operating Agreement: A common misunderstanding is that only LLCs with more than one member require an Operating Agreement. However, California law suggests that even single-member LLCs prepare an operating agreement. This document aids in separating personal and business assets, providing crucial legal protection.

The State Provides the Operating Agreement: Another misconception is that the state provides a standardized Operating Agreement form for LLCs. The truth is, while the state requires LLCs to have an Operating Agreement, it does not provide a template or form. Each LLC must create its own agreement that complies with California law and suits its specific needs.

An Operating Agreement Isn't Legally Required: Some believe that an Operating Agreement isn't a legal necessity. Though not all states mandate having an Operating Agreement, California does. This document is crucial for outlining the LLC’s financial and functional decisions, providing a clear guideline for business operations.

Online Templates Are Always Sufficient: Relying solely on online templates can be risky. Each business is unique, and while online templates can serve as a starting point, they often require significant adjustments to fully meet an LLC's specific needs and ensure compliance with California laws. Professional legal advice is recommended for drafting or reviewing your Operating Agreement.

Understanding and addressing these misconceptions is vital for the efficient operation and legal protection of your LLC in California. Ensuring that your Operating Agreement is correctly drafted and in compliance with state laws is crucial for your business's success and longevity.

Key takeaways

An Operating Agreement is crucial for any California LLC as it outlines the business's framework and prevents future conflicts by setting clear expectations and rules. Here are key takeaways about filling out and using the California Operating Agreement form:

- The Operating Agreement should be completed and signed by all members at the start of the LLC to ensure every member's roles, responsibilities, and financial contributions are documented.

- Although the State of California does not require LLCs to file their Operating Agreement with the state government, it’s important to keep the document on file for internal records and potential legal needs.

- Amendments to the Operating Agreement should be made with the consent of all LLC members. Any changes should be documented and attached to the original agreement.

- The document outlines the distribution of profits and losses, which is essential for financial management and tax purposes.

- It’s advisable to have a lawyer review the Operating Agreement to ensure that it complies with California law and fully covers the LLC's operational needs.

- In the case of disputes among LLC members, the Operating Agreement serves as a reference to resolve conflicts according to the agreed-upon terms and conditions.

Overall, the California Operating Agreement is a foundational document that supports the smooth operation and governance of an LLC. It not only provides legal protection but also establishes clear protocols for the business’s management and operational processes.

Popular Operating Agreement State Forms

Form Llc Indiana - An Operating Agreement outlines the internal management structures and operating procedures of a limited liability company (LLC).

Llc Operating Agreement Texas - An Operating Agreement could include non-compete clauses, restricting members from engaging in competitive activities.

Llc New York State - The Operating Agreement can also outline procedures for amending the agreement itself, allowing for adaptability as the business grows and changes.