Official Operating Agreement Document

An Operating Agreement form serves as a foundational document for any Limited Liability Company (LLC), meticulously outlining the operational procedures, ownership percentages, profit distributions, and managerial structures among members. This critical agreement acts as an invaluable roadmap guiding the LLC through various business scenarios, from routine decisions to complex disputes or the unexpected departure of a member. It not only establishes clear rules and expectations for all members but also ensures the company is governed by its own customized rules rather than default state laws, which might not always align with the owners' intentions. Additionally, the Operating Agreement can provide a layer of protection for the members' personal assets against the company's debts and liabilities, reinforcing the distinction between personal and business obligations. Crafting a comprehensive Operating Agreement requires careful consideration of the business's unique needs and goals, making it an indispensable tool for securing the stability and prosperity of the LLC.

Operating Agreement Document Types

Form Example

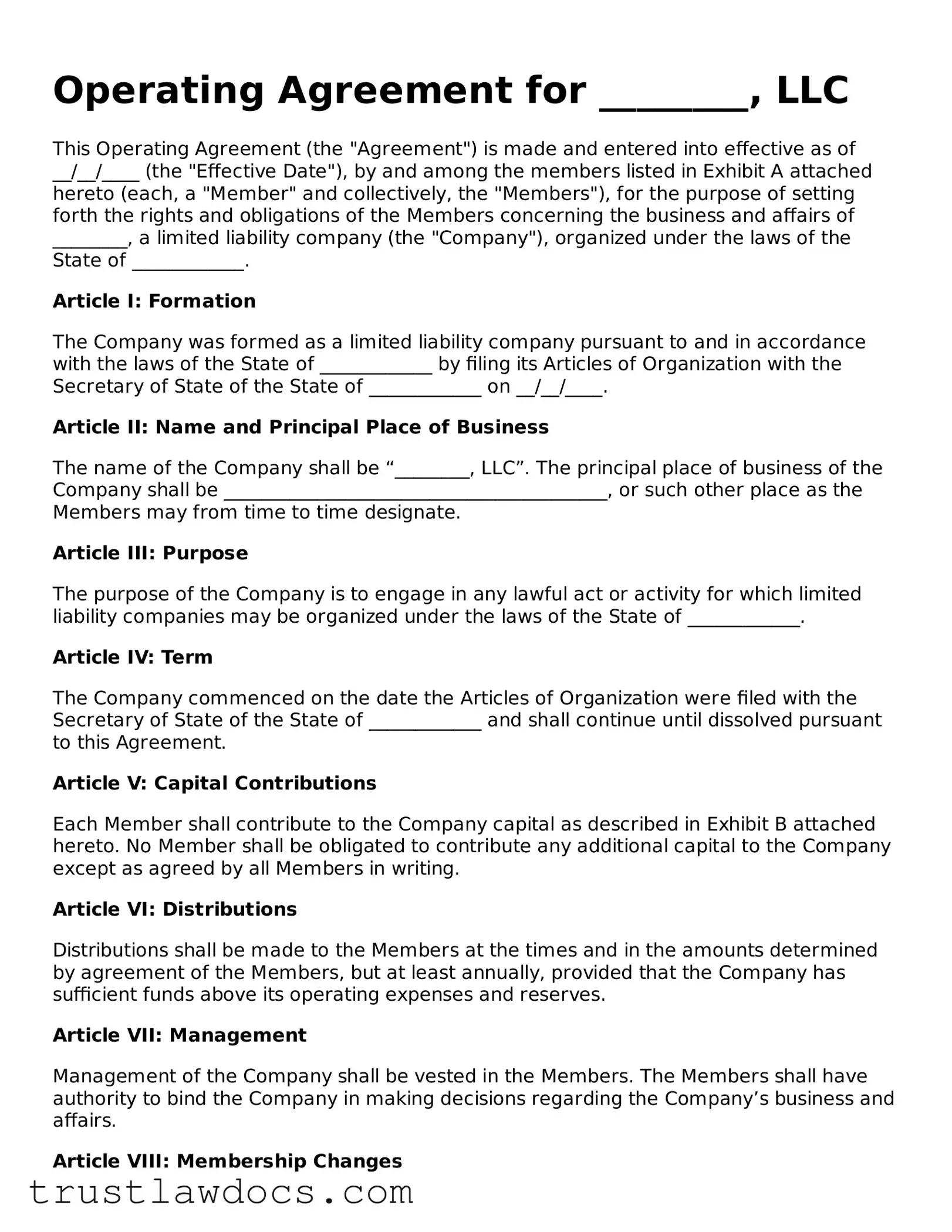

Operating Agreement for ________, LLC

This Operating Agreement (the "Agreement") is made and entered into effective as of __/__/____ (the "Effective Date"), by and among the members listed in Exhibit A attached hereto (each, a "Member" and collectively, the "Members"), for the purpose of setting forth the rights and obligations of the Members concerning the business and affairs of ________, a limited liability company (the "Company"), organized under the laws of the State of ____________.

Article I: Formation

The Company was formed as a limited liability company pursuant to and in accordance with the laws of the State of ____________ by filing its Articles of Organization with the Secretary of State of the State of ____________ on __/__/____.

Article II: Name and Principal Place of Business

The name of the Company shall be “________, LLC”. The principal place of business of the Company shall be _________________________________________, or such other place as the Members may from time to time designate.

Article III: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the laws of the State of ____________.

Article IV: Term

The Company commenced on the date the Articles of Organization were filed with the Secretary of State of the State of ____________ and shall continue until dissolved pursuant to this Agreement.

Article V: Capital Contributions

Each Member shall contribute to the Company capital as described in Exhibit B attached hereto. No Member shall be obligated to contribute any additional capital to the Company except as agreed by all Members in writing.

Article VI: Distributions

Distributions shall be made to the Members at the times and in the amounts determined by agreement of the Members, but at least annually, provided that the Company has sufficient funds above its operating expenses and reserves.

Article VII: Management

Management of the Company shall be vested in the Members. The Members shall have authority to bind the Company in making decisions regarding the Company’s business and affairs.

Article VIII: Membership Changes

The addition or replacement of Members, and the transfer of Membership interests, shall be in accordance with the terms set forth in this Agreement and the laws of the State of ____________.

Article IX: Dissolution

The Company may be dissolved as agreed upon by the Members or as required by the laws of the State of ____________. Upon dissolution, the assets of the Company shall be distributed first to satisfy any liabilities of the Company and then to the Members in accordance with their respective interests in the Company.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the Effective Date first above written.

Members:- Name: ________________________________________

- Address: ______________________________________

- Signature: ____________________________________

- Date: __/__/____

Exhibit A - List of Members

Exhibit B - Capital Contributions

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | An Operating Agreement is a key document used by LLCs to outline the business's financial and functional decisions. |

| 2 | It includes information on the allocation of profits and losses, provisions for the management structure, and members' rights and responsibilities. |

| 3 | Though not legally required in all states, having an Operating Agreement is highly recommended for providing clear guidelines for the operation of the LLC. |

| 4 | In states like New York, California, and Delaware, an Operating Agreement is mandatory for LLCs. |

| 5 | The Operating Agreement helps to ensure that courts uphold the limited liability status of the LLC, separating personal member assets from the business’s liabilities. |

| 6 | This document can be amended as the LLC grows and evolves, allowing for flexibility in business operations. |

| 7 | For state-specific forms, the Operating Agreement is governed by the state's LLC statutes and regulations. |

| 8 | Operating Agreements can include clauses for dispute resolution, such as arbitration or mediation provisions, providing a roadmap for handling internal disputes. |

| 9 | It's critical that all members review, agree upon, and sign the Operating Agreement to ensure each member understands their rights, duties, and investments within the LLC. |

How to Write Operating Agreement

After making the exciting decision to start a business venture, taking the step to document the structure, rules, and agreements between members of an LLC is crucial. The Operating Agreement serves as a cornerstone for any LLC, ensuring that all members are on the same page and helping to prevent future disputes. The process of filling out an Operating Agreement requires attention to detail and a clear understanding of the business's operational and financial arrangements. Here are the step-by-step instructions to guide you through this critical process.

- Gather all necessary information including the business name, addresses of all members, and the principal place of business.

- Determine the LLC's management structure. Decide whether it will be member-managed or manager-managed and document the names and responsibilities of the managers or managing members.

- Outline the capital contributions of each member. Include the amount and the method of contribution.

- Describe the distribution of profits and losses among members. This should align with their respective contributions or as agreed upon by all members.

- Set forth the rules for meetings and voting. This includes how decisions are made, the frequency of meetings, and the necessary quorum for decisions.

- Detail the process for admitting new members. Include any necessary qualifications and the process for current members to approve new members.

- Establish the protocol for transferring membership interest. Should a member decide to leave or is forced out, this section will guide the process and potential buyout procedures.

- Include stipulations for dissolving the LLC. Outline the conditions under which the LLC may be dissolved and the steps for winding up its affairs.

- Review the Operating Agreement with all members. It's crucial that all members agree on the terms before proceeding.

- Have all members sign the Operating Agreement. Depending on the state, this might need to be done in the presence of a notary.

Once the Operating Agreement is filled out and signed by all members, it becomes the guiding document for the LLC. It’s not typically required to file this document with the state, but it should be kept with the company's records and accessible to all members. This Agreement will play a pivotal role in resolving any future disagreements and guiding the business's operations. Therefore, ensuring its clarity, comprehensiveness, and alignment with the members' vision and agreement is essential for the LLC's smooth operation.

Get Answers on Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a fundamental document used by LLCs that outlines the business's financial and functional decisions including rules, regulations, and provisions. The purpose of this agreement is to govern the internal operations of the business in a way that suits the specific needs of the business owners. It lays out the ownership and membership duties, so there's clarity and less potential for conflict.

Is an Operating Agreement required?

While not all states require an Operating Agreement to form an LLC, it is highly advisable for LLCs of any size to create one. This agreement is essential for clarifying verbal agreements amongst members and protecting the business in the face of legal scrutiny. Even in states where it's not required, having one can ensure smoother internal operations and provide clarity during disputes.

What happens if an LLC does not have an Operating Agreement?

If an LLC operates without an Operating Agreement, it is subject to the default state rules that govern LLCs. These default rules may not be in the best interest of the LLC members as they are generic and not tailored to the specific needs of the LLC. Without this agreement, there can also be more risk of misunderstandings and disputes among members, affecting the smooth operation and potentially the reputation of the business.

What should be included in an Operating Agreement?

An Operating Agreement should include details such as the members' percentage interests in the LLC, their rights and responsibilities, their voting powers, how profits and losses will be allocated, and how the LLC will be managed. It should also cover procedures for bringing in new members, handling the departure of a member, and dissolving the business, amongst other provisions tailored to the specific needs of your business.

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be amended as the business evolves and its needs change. It is wise to include provisions within the agreement itself on how changes can be made, such as requiring a majority vote or unanimous consent among members. Having a clear amendment process helps ensure changes are thoughtfully considered and agreed upon by all members.

Who should keep a copy of the Operating Agreement?

All members of the LLC should have a copy of the Operating Agreement to ensure that everyone understands their rights, obligations, and the operational framework of the business. It's also advisable to keep a copy with important business records, and a lawyer or legal advisor should have a copy to assist with any related legal matters that may arise.

How does an Operating Agreement differ from Articles of Organization?

The Articles of Organization is a public document filed with the state to legally form the LLC. It typically includes basic information such as the name of the LLC, its address, and the names of its members. In contrast, the Operating Agreement is a private document that outlines the comprehensive rules and agreements between members about the LLC's operations and governance. Think of the Articles of Organization as the birth certificate of the LLC, while the Operating Agreement serves as the rulebook for running the business.

Is an Operating Agreement needed for a single-member LLC?

Even for a single-member LLC, an Operating Agreement is recommended. It helps reinforce the separation between the owner and the business for legal and financial purposes. This can be particularly important for liability protection and when dealing with banks, creditors, or in legal situations. It delineates the business structure in a formal, written document, which can be beneficial for establishing credibility and authority.

Where can I get an Operating Agreement?

Operating Agreements can be drafted with the assistance of an attorney familiar with your state's laws and your specific business needs. Alternatively, there are online templates and software that can help guide you in creating your own agreement. However, it is important to ensure that any template or software used is tailored to comply with state-specific requirements and includes provisions relevant to your particular business situation.

Common mistakes

When individuals come together to form a limited liability company (LLC), they are often required to draft an Operating Agreement. This document, fundamental in nature, outlines the governance of the business, detailing the rights, duties, and obligations of the members. As essential as this document is to the smooth operation and legal health of an LLC, errors in its preparation are not uncommon. These mistakes can range from omissions to incorrect assumptions, each carrying potential repercussions for the future of the enterprise.

One of the most significant errors occurs when members fail to create an Operating Agreement at all. Some states may not legally require an Operating Agreement for LLCs, leading some business owners to overlook its importance. This oversight can lead to misunderstandings and disputes among members, as there is no clear agreement on how various situations should be handled.

Another common mistake is not customizing the Operating Agreement to fit the specific needs of the business. Relying on a generic template without adjustments fails to capture the unique structure, goals, and procedures of the LLC, potentially leaving gaps in the agreement that could lead to issues down the line.

Incorrectly assuming that all members understand the terms and conditions laid out in the Operating Agreement is another pitfall. This document can contain complex legal language and concepts that may not be clear to everyone. Without ensuring that each member has a solid understanding of the agreement, disputes can easily arise.

A lack of specificity can also plague Operating Agreements. For instance, not clearly defining the roles and responsibilities of each member, or failing to outline the process for dispute resolution, can lead to operational inefficiencies and conflicts. This level of detail is crucial in ensuring that all members understand their duties and the mechanisms in place for dealing with disagreements.

Failing to address the addition or removal of members is a mistake often made in Operating Agreements. Businesses evolve, and so do their ownership structures. An Operating Agreement that doesn't account for the potential change in membership can cause significant legal headaches when trying to facilitate these changes.

Not amending the Operating Agreement as the business evolves is another critical oversight. As businesses grow and change, their Operating Agreements should reflect these developments. Neglecting to update the document can leave the LLC operating under guidelines that no longer serve its best interests.

Finally, ignoring state-specific requirements can fatally undermine an Operating Agreement. Each state has its own laws regarding LLCs, and failing to incorporate these requirements into the Operating Agreement can result in non-compliance and legal issues. It’s imperative that the document is drafted with a keen eye toward meeting these state-specific mandates.

Overall, the preparation of an Operating Agreement requires careful consideration, a tailored approach, and regular updates to ensure it remains effective. Avoiding these common pitfalls can help secure the LLC’s operational integrity and legal compliance, safeguarding the business’s future.

Documents used along the form

When establishing or running a business entity such as a Limited Liability Company (LLC), the Operating Agreement is fundamental. However, to thoroughly address the spectrum of legal, financial, and operational needs, several other documents often accompany the Operating Agreement. These documents play crucial roles in ensuring the business is well-structured, compliant with laws, and prepared for future opportunities and challenges.

- Articles of Organization: This document is necessary to legally form the LLC in the state. It includes basic information such as the name of the LLC, its address, and the names of its members.

- Employer Identification Number (EIN) Application: Almost every LLC needs an EIN for tax purposes, banking, and hiring employees. The application is submitted to the IRS.

- Membership Certificates: Similar to stock certificates in a corporation, these documents certify an individual's membership interest in the LLC.

- Operating Agreement Amendments: Over time, the original Operating Agreement may need updates or changes. Amendments are formally written changes that are agreed upon by members.

- Minutes of Meeting: Keeping records of major decisions made during members' meetings is not only a good practice but also a requirement in some states.

- Buy-Sell Agreement: This document outlines what happens if a member wants to sell their interest, dies, or becomes incapacitated. It’s crucial for the smooth continuation or dissolution of the business under unforeseen circumstances.

- Annual Reports: Many states require LLCs to submit an annual report that updates the company’s information, such as address and member information.

- Business Licenses and Permits: Depending on the type of business and location, various licenses and permits may be necessary to operate legally.

Together, these documents form a comprehensive legal and operational framework for an LLC. They not only ensure compliance with laws and regulations but also help in managing internal operations, member relations, and the overall strategy of the business. It's vital for members or their legal representatives to understand the purpose and requirement of each document to maintain the health and legal standing of the business.

Similar forms

An operating agreement is closely related to a partnership agreement, which serves as a roadmap for how a partnership operates. Both documents outline the roles, responsibilities, and financial contributions of the involved parties. They also describe the process for decision-making and dispute resolution, ensuring that all partners are on the same page regarding the business’s management. While operating agreements are used for LLCs, partnership agreements serve a similar purpose for businesses registered as partnerships.

Bylaws are another type of document similar to an operating agreement but are used by corporations. Both set forth the rules for the internal governance of the business entity. Bylaws detail the procedures for holding meetings, electing directors, and executing other corporate formalities, similar to how an operating agreement dictates the operational guidelines for an LLC. The main difference lies in the type of business structure they apply to, with bylaws being specific to corporations.

The shareholder agreement is akin to an operating agreement but for corporations with multiple shareholders. It outlines the rights, responsibilities, and obligations of shareholders, much like how the operating agreement does for LLC members. This includes how shares can be bought, sold, or transferred, as well as how decisions are made among shareholders. Both documents thus serve as fundamental frameworks for managing the internal affairs of the business entity.

A buy-sell agreement, while more specific in scope, shares similarities with an operating agreement. It is a contract that outlines what happens to an owner’s share of the business if they die, wish to sell, or undergo another major life event. Much like certain provisions in operating agreements, it helps protect the business’s and owners’ interests by controlling changes in ownership and ensuring smooth transitions under different circumstances.

Employment contracts, though focusing more on the relationship between employers and individual employees, have parallels with operating agreements. Both establish essential terms between parties, such as duties, compensation, and grounds for termination. However, employment contracts are entered into between the company and its employees, whereas an operating agreement outlines the relationship among members or owners of an LLC.

The franchise agreement shares similarities with an operating agreement as it governs the relationship between a franchisor and franchisee. Like an operating agreement, it includes terms related to management structures, financial arrangements, and operational protocols. The key difference is that franchise agreements set the tone for the operation of a franchise unit, while operating agreements focus on the internal workings of an LLC.

A joint venture agreement is somewhat similar to an operating agreement in that it covers the formation and operation of a business entity created by two or more parties. These documents lay out the contributions, responsibilities, and profit-sharing among the participants, along with how decisions are made. Unlike operating agreements, which are for ongoing business operations, joint venture agreements are typically for a specific project or limited duration.

Service agreements and operating agreements also share common ground. A service agreement outlines the terms of service between a provider and a client, including duties, timelines, and payment terms, similar to how operating agreements describe the functions and financial arrangements within an LLC. However, service agreements are external, client-facing documents, whereas operating agreements focus on internal company operations and member relations.

Finally, a membership interest purchase agreement is similar to certain aspects of an operating agreement when it comes to buying and selling membership interests in an LLC. It specifies the terms, conditions, and process of the transaction, akin to provisions within an operating agreement that may govern changes in ownership. While the focus is narrower, both documents provide a framework for handling shifts in membership interest.

Dos and Don'ts

When filling out the Operating Agreement form for your LLC, there are several best practices to follow. This document plays a vital role in defining your business structure, financial arrangements, and how decision-making processes are handled. Specifically, it outlines the rights and responsibilities of the members, the distribution of profits and losses, and other important procedures that guide the daily operations of your business. Below are eight dos and don'ts to consider:

- Do review examples of Operating Agreements related to your industry to ensure your document is comprehensive.

- Do clearly outline the ownership percentages of each member to prevent misunderstandings or conflicts in the future.

- Do specify the process for adding or removing members to keep the company flexible and secure.

- Do include detailed descriptions of members' roles and responsibilities for clarity and accountability.

- Don't rush through the process. Take the necessary time to think through each provision to ensure it aligns with your business goals and member expectations.

- Don't overlook dispute resolution methods. Having a plan in place can save significant time and resources.

- Don't use overly technical terms without explanations. Your Operating Agreement should be understandable to all members.

- Don't forget to have all members sign the Operating Agreement. An unsigned agreement may not be enforceable.

Misconceptions

When discussing an Operating Agreement, especially in the context of small businesses or Limited Liability Companies (LLCs), there are several misconceptions that often arise. Understanding these misconceptions is vital for anyone looking to establish clear, legal, and effective governance structures for their enterprise. Here are four common misunderstandings:

- Operating Agreements are optional. One common misconception is that creating an Operating Agreement is an optional step for LLCs. While not all states require an Operating Agreement, having one is crucial for defining the structure and operations of your business. It provides clarity on the distribution of profits, management responsibilities, and procedures for resolving disputes, among other important aspects. Without such an agreement, state LLC laws will govern these and other issues, which may not align with the company owners' preferences.

- All Operating Agreements are the same. Another misunderstanding is the idea that there is a one-size-fits-all Operating Agreement. In reality, these agreements should be tailored to the specific needs and circumstances of the business. Factors such as the number of members, the nature of the business, and the goals of the company owners should shape the content of the Operating Agreement. A generic agreement may not adequately cover the unique aspects of your business or protect your interests.

- An Operating Agreement once created is fixed. Many believe that once an Operating Agreement is drafted and signed, it cannot be modified. This is not true. Operating Agreements should be viewed as living documents that can and often should be updated as the business evolves, new members are admitted, or when other significant changes occur. Regular reviews and updates to the agreement can ensure it remains relevant and effective in governing the company's operations.

- Only multi-member LLCs need an Operating Agreement. The presumption that single-member LLCs do not need an Operating Agreement is another common misconception. Even single-member LLCs can benefit greatly from having an Operating Agreement. It adds an extra layer of protection to the owner's personal assets, clarifies the business’s operational procedures for legal and financial matters, and can increase the business's credibility with banks and potential investors. Furthermore, it provides clear guidelines for how the business will be managed in the absence of the owner due to death or incapacity.

Key takeaways

The Operating Agreement form plays a crucial role in defining the framework for the internal operations of a Limited Liability Company (LLC). Proper completion and utilization can safeguard the interests of its members and enhance the company's operational clarity.

-

It is imperative for all members to thoroughly review the Operating Agreement to ensure it aligns with their expectations and the company's objectives. An Operating Agreement, once finalized, guides the LLC's operational decisions and conflict resolutions.

-

Amendments to the Operating Agreement require consensus among members or adherence to the amendment process outlined in the agreement itself. This ensures the agreement remains relevant and accommodating to the evolving nature of the business.

-

Clarity in outlining the distribution of profits and losses among members is crucial. The Operating Agreement should specify the methodology used for calculating each member's share to prevent disputes and misunderstandings.

-

Including detailed roles and responsibilities of members can significantly aid in the operational efficiency of the LLC. Clear definitions help in accountability and streamline decision-making processes.

-

Dispute resolution mechanisms within the Operating Agreement can provide a clear path forward in case conflicts arise among members. Opting for mediation or arbitration can save time and resources compared to court settlements.

-

Provisions for the addition or departure of members are essential components of the Operating Agreement. These clauses ensure the LLC can continue operating smoothly during member transitions, safeguarding the entity's and remaining members' interests.

-

Ensure the Operating Agreement complies with state laws where the LLC is formed. Each state may have unique requirements or default rules that apply in the absence of specific provisions within the agreement.

A meticulously drafted Operating Agreement facilitates not only the immediate functioning of an LLC but also lays down the groundwork for its long-term success and adaptability. Attention to detail and foresight in its creation can significantly mitigate potential legal hurdles and internal conflicts.

Other Templates:

Separate Bill of Sale for Furniture - The inclusion of a description of the furniture’s condition in the document can help in resolving any disagreements about its state at the time of sale.

Commercial Real Estate Letter of Intent Template - This form is adaptable to various types of commercial real estate transactions, whether it involves land, buildings, or both.

Bill of Sale for a Horse - It's an essential piece of documentation for insurance purposes, showing the horse's value at the time of purchase.