Free Loan Agreement Form for Texas

In the realm of financial transactions within Texas, the Texas Loan Agreement form occupies a pivotal position, serving as a foundational document that outlines the terms, conditions, and obligations associated with a loan between two parties. This comprehensive document ensures clarity and legal accountability, safeguarding the interests of both the lender and the borrower. It typically encompasses critical details such as the loan amount, repayment schedule, interest rate, and any collateral involved. Additionally, it addresses legal remedies in cases of default, thereby providing a structured path for dispute resolution. The importance of this form extends beyond mere documentation; it embodies the mutual understanding and agreement between parties, making it an essential tool for both personal and business finance transactions. Its application is broad, accommodating various types of loans from traditional bank loans to private lending arrangements. Understanding the nuances of the Texas Loan Agreement form is imperative for anyone engaging in lending activities in the state, ensuring that all financial transactions are conducted within a safe, legal framework.

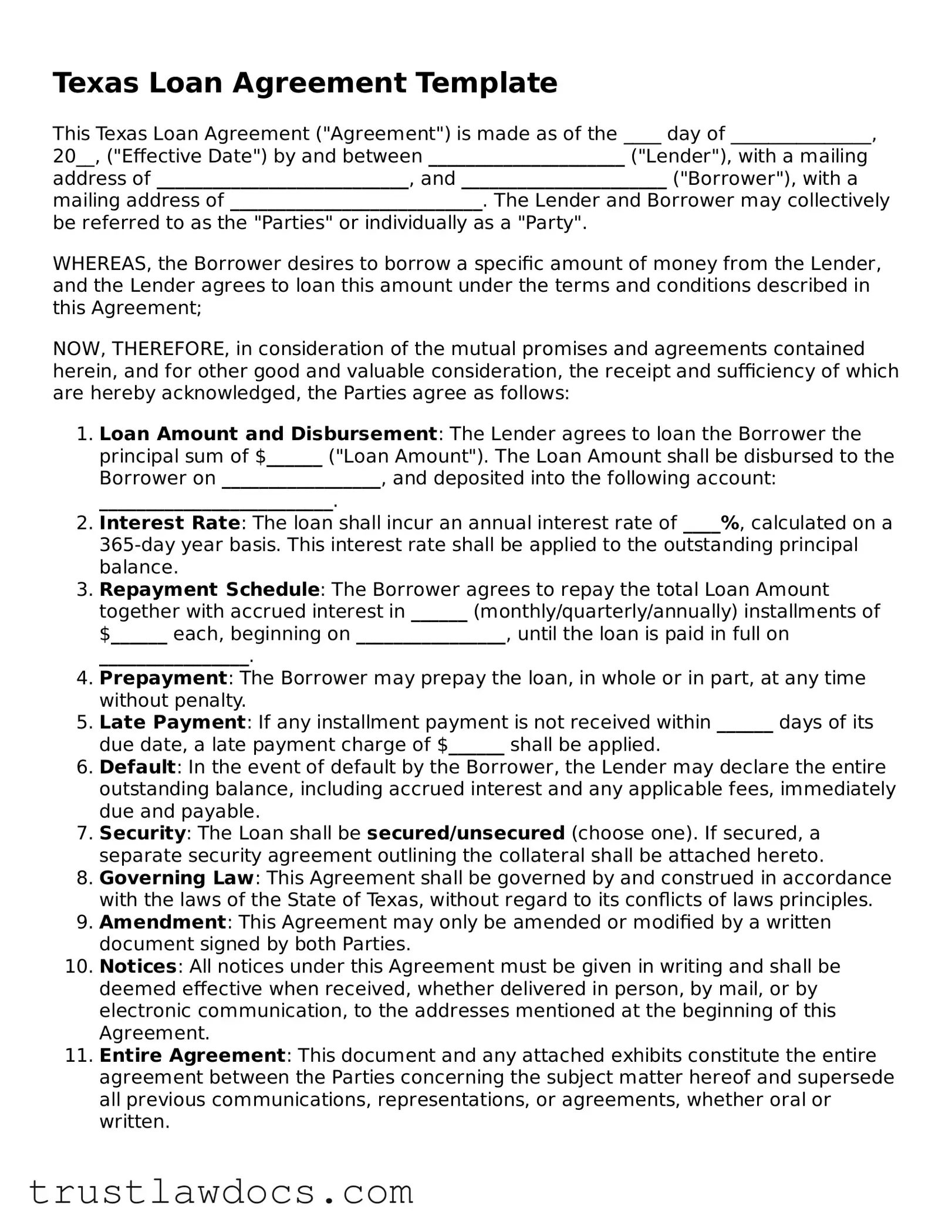

Form Example

Texas Loan Agreement Template

This Texas Loan Agreement ("Agreement") is made as of the ____ day of _______________, 20__, ("Effective Date") by and between _____________________ ("Lender"), with a mailing address of ___________________________, and ______________________ ("Borrower"), with a mailing address of ___________________________. The Lender and Borrower may collectively be referred to as the "Parties" or individually as a "Party".

WHEREAS, the Borrower desires to borrow a specific amount of money from the Lender, and the Lender agrees to loan this amount under the terms and conditions described in this Agreement;

NOW, THEREFORE, in consideration of the mutual promises and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Loan Amount and Disbursement: The Lender agrees to loan the Borrower the principal sum of $______ ("Loan Amount"). The Loan Amount shall be disbursed to the Borrower on _________________, and deposited into the following account: _________________________.

- Interest Rate: The loan shall incur an annual interest rate of ____%, calculated on a 365-day year basis. This interest rate shall be applied to the outstanding principal balance.

- Repayment Schedule: The Borrower agrees to repay the total Loan Amount together with accrued interest in ______ (monthly/quarterly/annually) installments of $______ each, beginning on ________________, until the loan is paid in full on ________________.

- Prepayment: The Borrower may prepay the loan, in whole or in part, at any time without penalty.

- Late Payment: If any installment payment is not received within ______ days of its due date, a late payment charge of $______ shall be applied.

- Default: In the event of default by the Borrower, the Lender may declare the entire outstanding balance, including accrued interest and any applicable fees, immediately due and payable.

- Security: The Loan shall be secured/unsecured (choose one). If secured, a separate security agreement outlining the collateral shall be attached hereto.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without regard to its conflicts of laws principles.

- Amendment: This Agreement may only be amended or modified by a written document signed by both Parties.

- Notices: All notices under this Agreement must be given in writing and shall be deemed effective when received, whether delivered in person, by mail, or by electronic communication, to the addresses mentioned at the beginning of this Agreement.

- Entire Agreement: This document and any attached exhibits constitute the entire agreement between the Parties concerning the subject matter hereof and supersede all previous communications, representations, or agreements, whether oral or written.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date first above written.

_________________________

Lender: _________________

_________________________

Borrower: _________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement form is governed by the laws of the State of Texas, including but not limited to the Texas Finance Code, which regulates interest rates and lending practices. |

| Usury Warning | It contains a warning about usury laws, protecting borrowers from exorbitant interest rates, as mandated by Texas statutes. |

| Recording Requirement | In Texas, loan agreements tied to real property must be recorded with the county to ensure enforceability against third parties. |

| Default and Remedies | The form outlines specific conditions under which a borrower is considered in default and the remedies available to the lender, adhering to Texas legal requirements. |

| Prepayment | It includes provisions related to the prepayment of the loan, detailing any penalties or conditions associated with early repayment, as influenced by state law. |

| Signature Requirements | All parties involved must sign the Texas Loan Agreement, and it's recommended to have these signatures notarized to add a layer of authentication and reduce the risk of disputes. |

How to Write Texas Loan Agreement

When preparing to fill out a Texas Loan Agreement form, individuals are making a crucial step towards formalizing the terms of a financial transaction between a borrower and lender. This legal document outlines the amount of the loan, interest rates, repayment schedule, and other important terms. Ensuring that this agreement is filled out thoroughly and accurately is essential for protecting the interests of both parties involved. Here's how to proceed effectively:

- Start by gathering all necessary information, including the legal names and addresses of both the borrower and the lender, the principal loan amount, the loan's interest rate, and the scheduled repayment plan.

- Enter the full legal names of the parties involved at the top of the form, specifying who is the borrower and who is the lender.

- Detail the loan amount in words and then in numbers to prevent any misinterpretation. Ensure that both parties agree on this amount before proceeding.

- Clearly specify the interest rate agreed upon. If the loan does not have an interest rate, it should be explicitly stated as well.

- Outline the repayment schedule. Include specific dates for when repayments will start and the frequency of payments (e.g., monthly). Also, clarify how long the borrower has to repay the loan in full.

- Discuss if there will be any collateral securing the loan. If so, provide a detailed description of the collateral within the agreement.

- Include clauses about late fees or penalties for missed payments to ensure both parties understand the consequences of non-compliance with the repayment schedule.

- Specify any conditions under which the loan agreement can be modified or if prepayment is allowed without penalty.

- Both parties should review the entire agreement carefully to ensure all information is accurate and reflects their understanding.

- Finally, both the borrower and the lender must sign and date the agreement. It's beneficial to have a witness or notary public present during the signing to add an extra layer of legal protection.

Once the Texas Loan Agreement form is completed and signed, it becomes a legally binding document that holds both the borrower and lender to the terms outlined. Keeping a copy of the agreement is important for both parties, should any disputes arise. Remember, when in doubt, seeking legal advice can ensure the form is filled out correctly and reflects the intentions of everyone involved.

Get Answers on Texas Loan Agreement

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legally binding document between a lender and a borrower, outlining the terms and conditions of a loan within the state of Texas. This includes the loan amount, interest rate, repayment schedule, and any other conditions or obligations both parties have agreed upon. It serves to protect the interests of both the borrower and the lender under Texas state law.

Who needs to sign the Texas Loan Agreement form?

Typically, the form requires signatures from both the lender and the borrower to be considered valid and enforceable. Witnesses or a notary public may also be required to sign, depending on the loan amount and the requirements of the parties involved. It's a common practice to have the signatures notarized to add an extra layer of legal protection and authenticity.

Can amendments be made to a Texas Loan Agreement form after it's been signed?

Yes, amendments can be made to the loan agreement after it has been signed, but any changes require the consent of both the lender and the borrower. The amendment should be made in writing and attached to the original agreement as an addendum. It's crucial for the addendum to be signed by both parties and, if applicable, witnessed or notarized in a similar manner to the original agreement.

Is a verbal agreement just as valid as a written Texas Loan Agreement form?

While verbal agreements can be legally binding, proving the terms and enforcement of such agreements in court can be challenging without written documentation. A written Texas Loan Agreement form adds clarity, reduces misunderstandings, and provides a physical record of the agreed terms, making it significantly more enforceable than a verbal agreement. As such, it's highly recommended to document loan agreements in writing.

Common mistakes

Filling out a Texas Loan Agreement form is a significant step in formalizing a loan between two parties. It is a process that requires meticulous attention to detail. Unfortunately, individuals often make a variety of mistakes that can hinder the effectiveness of the agreement or even render it invalid. Understanding these common errors can help in avoiding them and ensuring a smooth, legally binding loan process.

One common mistake is not specifying the full legal names of the parties involved. This might seem like a minor oversight, but failing to use the full legal name can lead to ambiguity about who is bound by the terms of the agreement. As a result, it could become challenging to enforce the agreement in a court of law if the need arises.

Another error to watch for is neglecting to detail the loan amount in clear terms. It is not enough to just state the amount; it should be written both in numerals and words to prevent any confusion or alteration. This double clarification acts as a safeguard against misunderstandings or disputes over the exact amount of the loan.

Ignoring the inclusion of an interest rate is also a common pitfall. Texas law permits loans to carry interest, but the rate must be explicitly stated in the agreement. A failure to do so not only complicates the repayment terms but might also infringe upon state usury laws, potentially voiding the agreement or subjecting parties to legal penalties.

A critical yet often overlooked detail is the repayment plan. Many individuals forget to outline a specific schedule for repayment, including due dates and whether payments will be made in installments or a lump sum. This omission can lead to disagreements and confusion, impeding the lender's ability to enforce timely repayment.

Moreover, failing to define the loan’s purpose is another mistake. Explaining how the loan will be used can lend clarity to the agreement and set expectations for the lender about how their money will be utilized. This can be particularly important if the loan is for a specific project or investment.

Another error that diminishes the agreement's legal standing is not including clauses related to late payments or defaults. Such clauses protect the lender by outlining the consequences if the borrower fails to make payments on time or defaults on the loan entirely. Without these provisions, the lender has limited recourse in managing delinquencies.

Furthermore, many people sidestep the necessity of defining the governing law. Since laws vary from state to state, explicitly stating that Texas law governs the agreement can prevent legal ambiguities and simplify any legal disputes.

Omitting signatures is a surprisingly common error. A loan agreement must be signed by both parties to be legally binding. Sometimes, individuals fill out all the necessary information but forget this final, crucial step, leaving the agreement unenforceable.

Not having the agreement witnessed or notarized is another misstep. Although not always required, having a third party witness or a notary public attest to the signatures can add an extra layer of validity and can be critical in cases where the agreement's authenticity is questioned.

Lastly, a significant mistake is not retaining a copy of the fully executed agreement. Both parties should keep a copy for their records to ensure that there is a reference document in case of disputes. Losing the only copy of the loan agreement can lead to significant legal and financial headaches.

Avoiding these mistakes when filling out a Texas Loan Agreement form can save individuals from potential legal issues and financial disputes. By paying careful attention to the details and ensuring all aspects of the loan are clearly documented, parties can help ensure that their financial dealings proceed smoothly and without dispute.

Documents used along the form

When entering into a loan agreement in Texas, participants are often required to prepare and submit additional forms and documents. These documents provide vital information, offer legal protections, and ensure the agreement aligns with state laws and regulations. Understanding these supplementary forms can make the loan agreement process smoother and more efficient.

- Promissory Note: This document serves as a formal promise by the borrower to pay back the loan amount plus interest. It outlines the payment schedule, interest rate, and what happens in case of default.

- Amortization Schedule: An amortization schedule breaks down the payments on the loan over time, showing how much of each payment goes to the principal amount versus interest.

- Deed of Trust: In Texas, a deed of trust is often used in place of a mortgage. It involves a trustee, who holds the property's title until the loan is paid in full.

- Guaranty: This document is a commitment by a third party to assume the debt obligation if the original borrower fails to fulfill the terms of the loan.

- Security Agreement: If the loan is secured, this agreement details the collateral that the borrower pledges to the lender to secure the loan.

- Disclosure Statement: Federal and state laws require certain disclosures to be provided to the borrower, detailing the loan's terms, including the annual percentage rate (APR), total costs, and other charges.

- Personal Financial Statement: Lenders often require a detailed report of the borrower's financial status, including assets, liabilities, income, and expenses.

- UCC Financing Statement: For loans involving personal property as collateral, a UCC-1 Financing Statement is filed to perfect the lender's interest in the collateral.

- Loan Modification Agreement: Should the terms of the original loan agreement need adjustments, this document outlines the modifications agreed upon by the lender and borrower.

- Compliance Agreement: This document ensures that all parties are aware of, and agree to comply with, the relevant local, state, and federal laws and regulations.

While this list covers many documents commonly associated with a Texas loan agreement, the specific forms and documents required may vary based on the loan type, the parties involved, and the specific terms and conditions of the loan agreement. Professionals involved in the loan process should carefully review and understand each document to ensure compliance and protect their interests.

Similar forms

The Texas Loan Agreement form shares similarities with a Promissory Note in its function to document the terms under which money is borrowed. Both documents outline the amount of the loan, the repayment schedule, interest rates, and the consequences of default. The primary distinction lies in their structure and detail; while a loan agreement typically encompasses broader financial arrangements and might include clauses on dispute resolution, a promissory note often is simpler, focusing mainly on the repayment terms.

Similarly, a Mortgage Agreement is closely related to the structure of a Texas Loan Agreement, especially when real estate is used as collateral. The mortgage agreement secures the loan by linking it to the property in question, detailing the legal ramifications should the borrower fail to repay. Like loan agreements, they specify the loan terms, but they additionally include legal descriptions of the property and conditions for foreclosure, making them more intricate in matters of real property.

Deed of Trust documents also bear resemblance but differ in their operational mechanics within the United States. In states like Texas, deeds of trust replace traditional mortgages by involving a third party, the trustee, who holds the legal title to the property until the loan is repaid. Like loan agreements, they delineate the loan's terms and conditions but introduce a neutral entity to manage the foreclosure process, should it become necessary, which simplifies the lender's efforts to reclaim the property.

A Line of Credit Agreement shares the foundational premise of establishing lending terms between a borrower and a lender but differs in its flexibility. Unlike the more static loan agreement that discusses a single sum and its repayment, a line of credit agreement provides for a maximum amount the borrower can withdraw, the time frame for withdrawals, and the repayment conditions, offering a dynamic financial tool for ongoing projects or businesses.

The Personal Guarantee Agreement complements a loan agreement by involving an additional party who agrees to fulfill the debt obligations if the original borrower defaults. This document is crucial in providing lenders with an extra layer of security, especially in situations where the borrower's ability to repay the loan is uncertain. It mirrors the loan agreement's commitment to repay a borrowed sum but expands the responsibility beyond the primary borrower.

An Installment Agreement connects with the Texas Loan Agreement through their shared emphasis on repayment structure. These agreements break down the total amount owed into smaller, manageable payments over a defined period. While both documents establish a schedule for repayment, installment agreements are generally used for more specific types of debt repayment like tax liabilities, showcasing a narrow focus compared to the broader application of loan agreements.

Lastly, a Security Agreement is closely linked to the Texas Loan Agreement when loans involve collateral beyond real estate. It details the assets pledged as security for the loan, effectively ensuring the lender has a claim to the borrower's property if they default. Both agreements concern the stipulations under which money is lent and repaid, but security agreements specifically cater to the conditions under which personal or business property can be used to secure a loan.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it's important to follow certain guidelines to ensure that the agreement is valid, clear, and legally binding. Below is a detailed list of dos and don'ts to help you complete the form accurately.

Things You Should Do

- Review the entire form before you start filling it out to understand all the requirements.

- Write clearly and legibly to ensure all parties can easily read the terms and conditions.

- Provide accurate and complete information for both the lender and the borrower, including full legal names and addresses.

- Specify the loan amount in words and numbers to avoid any confusion about the exact amount being lent.

- Clearly outline the repayment schedule, including due dates, amounts, and final payment date, to ensure there are no misunderstandings.

- Include the interest rate, specifying whether it's fixed or variable, to make sure both parties understand the financial charges involved.

- State the collateral, if any, that will secure the loan, detailing what it is and the conditions under which it can be seized.

- Have all parties sign and date the document in front of a witness or notary public, to lend credibility and enforceability to the agreement.

- Keep a copy of the finalized agreement for your records to refer back to in case any issues arise.

- Consult with a legal professional if there are any terms or clauses you don't understand, to ensure your rights are protected.

Things You Shouldn't Do

- Don't leave any sections blank. If a section doesn’t apply, write “N/A” to indicate this.

- Don’t rush through reading the document; misunderstanding the terms can lead to serious legal issues.

- Avoid using informal language or jargon that could be misinterpreted or isn’t legally sound.

- Don’t backdate or postdate the agreement, as this could invalidate the document or cause legal problems down the line.

- Do not sign the agreement without ensuring that all parties have a clear understanding of their obligations and rights.

- Do not forget to specify a governing law (the laws of the state of Texas) to clarify which state’s laws will interpret the agreement.

- Avoid altering the document after it has been signed without written consent from all parties involved.

- Do not ignore the need for a witness or notary public, as their endorsement can add legal weight to the agreement.

- Avoid keeping the only copy for yourself; ensure that all parties have their own copy of the signed agreement.

- Do not underestimate the importance of consulting with a legal expert, especially for complex loan situations.

Misconceptions

Texas Loan Agreement forms are essential documents used in financing and lending transactions across the state. They establish the terms and conditions under which money is lent, to be repaid by the borrower, along with any interest and fees. Despite their widespread use, there are several misconceptions about these forms.

- All Texas Loan Agreement forms are the same. This is a common misconception. The reality is that loan agreements can vary significantly based on the type of loan, the parties involved, and specific terms negotiated. Customization is often necessary to address the unique aspects of each loan.

- Verbal agreements are just as valid as written loan agreements in Texas. While verbal contracts can be enforceable, a written loan agreement is crucial for clarity and enforceability, especially when disputes arise. Texas law particularly values written agreements in financial matters for their clear terms and conditions.

- Only banks and financial institutions can issue a Texas Loan Agreement form. Actually, any individual or entity can lend money and should use a loan agreement to outline the terms and ensure repayment. This includes private lenders, family members, or businesses providing loans.

- A Texas Loan Agreement doesn't need a witness or notarization. While not always legally required, having the agreement witnessed or notarized can add a layer of protection and authenticity, making it easier to enforce and reducing the risk of fraud.

- Interest rates can be as high as the lender decides. Texas has specific usury laws in place that cap interest rates to protect borrowers from excessive charges. Lenders need to be mindful of these limits when drafting loan agreements.

- You don't need a lawyer to draft a Texas Loan Agreement form. While you can draft a loan agreement without legal assistance, consulting with an attorney ensures that the document complies with Texas law and adequately protects your interests.

- Electronic signatures aren't valid on Texas Loan Agreement forms. Electronic signatures are generally acceptable and legally binding in Texas, as long as they meet certain requirements and both parties consent to their use.

- All you need is the loan amount and repayment schedule in the agreement. A comprehensive loan agreement should include much more, such as interest rates, penalty fees, the governing law, and what happens in the event of a default. These details prevent future disputes.

- Loan agreements are only necessary for large sums of money. No matter the sum, a loan agreement is prudent. It sets clear expectations and legal obligations, safeguarding both the lender and borrower, even in transactions involving smaller amounts.

Understanding these misconceptions can prevent costly mistakes and ensure the loan process goes smoothly for both parties. Whether lending or borrowing, a well-constructed Texas Loan Agreement form is a powerful tool to delineate rights and responsibilities, providing peace of mind throughout the term of the loan.

Key takeaways

When it comes to filling out and using the Texas Loan Agreement form, there are several key takeaways that individuals and businesses alike should keep in mind. The process, while straightforward, requires meticulous attention to detail to ensure that both parties are protected and that the agreement is enforceable under Texas law.

- Complete Information is Critical: Every section of the Texas Loan Agreement form should be filled out with accurate information. This includes the legal names of the parties involved, the loan amount, interest rates, repayment schedule, and any collateral securing the loan. Inaccurate or incomplete information can lead to disputes or legal challenges down the line.

- Interest Rates Must Comply with State Laws: The interest rate stated in the loan agreement cannot exceed the maximum rate allowed under Texas law. Before setting the interest rate, it is essential to review current statutes to ensure compliance and avoid the imposition of penalties.

- Clearly Define Repayment Terms: The agreement must detail how and when the loan will be repaid. This typically includes the repayment schedule, any grace periods, and the consequences of late payments. Clear terms help prevent misunderstandings and provide a straightforward path for both parties.

- Collateral Should Be Described Specifically: If the loan is secured by collateral, the agreement should include a detailed description of this collateral. Identifying the collateral clearly is essential for enforcing the security interest in the event of a default.

- Signatures Are Mandatory: For the loan agreement to be legally binding in Texas, it must be signed by both the lender and the borrower. Electronic signatures may be acceptable, but it’s important to verify that they comply with Texas law.

- Notarization Enhances Legal Standing: While not always required, having the loan agreement notarized can provide additional legal standing. Notarization confirms the identity of the parties and their agreement to the terms, making the document more robust in legal proceedings.

By adhering to these key points when filling out and using a Texas Loan Agreement form, parties can ensure that their interests are safeguarded and that the agreement serves as a solid foundation for their financial transaction. It’s always advisable to consult with a legal professional to address any specific concerns or to tailor the agreement to particular needs.

Popular Loan Agreement State Forms

Loan Agreement Template California - It's useful in setting a professional tone and expectation for financial transactions.