Free Loan Agreement Form for New York

Entering into a loan agreement in New York is a significant event, whether you're borrowing money to achieve a personal goal or providing someone else with the financial assistance they need. The New York Loan Agreement form serves as a critical document in this process, ensuring clarity and protection for both parties involved. It meticulously outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. Furthermore, it addresses legal requirements specific to New York state, setting a clear framework for what happens if the borrower fails to repay the loan according to the agreed terms. This form not only legalizes the transaction but also acts as a safeguard, aiming to prevent misunderstandings and disputes, ensuring that both the lender and the borrower are on the same page from the outset. Understanding its components and the vital role it plays can make a significant difference in how smoothly and securely a loan agreement progresses.

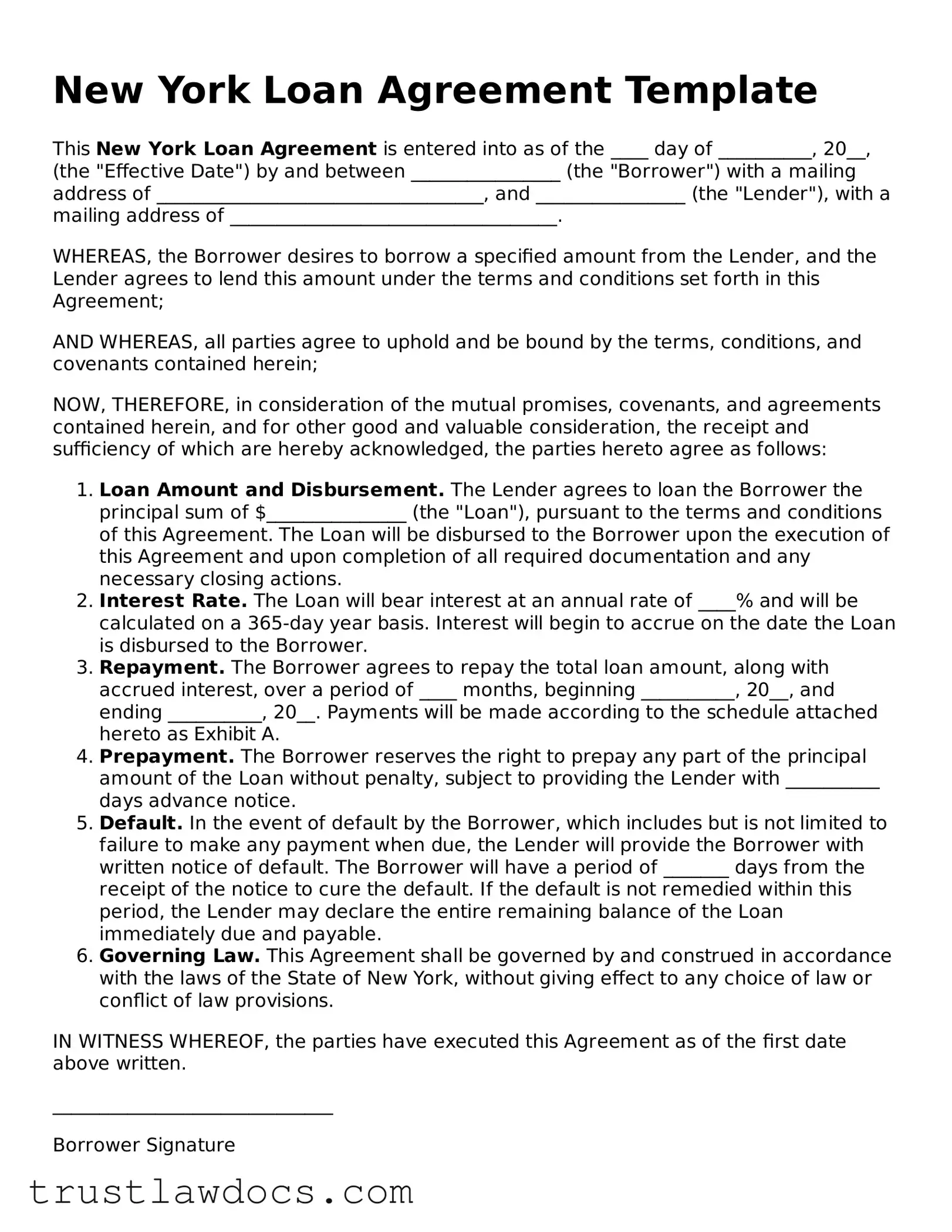

Form Example

New York Loan Agreement Template

This New York Loan Agreement is entered into as of the ____ day of __________, 20__, (the "Effective Date") by and between ________________ (the "Borrower") with a mailing address of ___________________________________, and ________________ (the "Lender"), with a mailing address of ___________________________________.

WHEREAS, the Borrower desires to borrow a specified amount from the Lender, and the Lender agrees to lend this amount under the terms and conditions set forth in this Agreement;

AND WHEREAS, all parties agree to uphold and be bound by the terms, conditions, and covenants contained herein;

NOW, THEREFORE, in consideration of the mutual promises, covenants, and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

- Loan Amount and Disbursement. The Lender agrees to loan the Borrower the principal sum of $_______________ (the "Loan"), pursuant to the terms and conditions of this Agreement. The Loan will be disbursed to the Borrower upon the execution of this Agreement and upon completion of all required documentation and any necessary closing actions.

- Interest Rate. The Loan will bear interest at an annual rate of ____% and will be calculated on a 365-day year basis. Interest will begin to accrue on the date the Loan is disbursed to the Borrower.

- Repayment. The Borrower agrees to repay the total loan amount, along with accrued interest, over a period of ____ months, beginning __________, 20__, and ending __________, 20__. Payments will be made according to the schedule attached hereto as Exhibit A.

- Prepayment. The Borrower reserves the right to prepay any part of the principal amount of the Loan without penalty, subject to providing the Lender with __________ days advance notice.

- Default. In the event of default by the Borrower, which includes but is not limited to failure to make any payment when due, the Lender will provide the Borrower with written notice of default. The Borrower will have a period of _______ days from the receipt of the notice to cure the default. If the default is not remedied within this period, the Lender may declare the entire remaining balance of the Loan immediately due and payable.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to any choice of law or conflict of law provisions.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the first date above written.

______________________________

Borrower Signature

______________________________

Lender Signature

PDF Form Details

| Fact | Description |

|---|---|

| 1. Purpose | The New York Loan Agreement form is used to outline the terms and conditions under which money is loaned from one party to another in the State of New York. |

| 2. Parties Involved | This form is typically between a borrower, who receives the loan, and a lender, who provides the funds. |

| 3. Governing Law | It is governed by the laws of the State of New York, including usury laws that restrict the amount of interest that can be charged. |

| 4. Collateral | The agreement may require the borrower to pledge assets as collateral, securing the loan in case of default. |

| 5. Interest and Fees | The document outlines the interest rate, as well as any fees associated with the loan, such as late fees or prepayment penalties. |

| 6. Repayment Terms | Details including the loan amount, repayment schedule, and maturity date are specified, clarifying when and how the loan must be repaid. |

| 7. Default Provisions | The agreement includes provisions on what happens in the event of a default, such as acceleration of the debt or repossession of collateral. |

How to Write New York Loan Agreement

Filling out the New York Loan Agreement form is a crucial step in formalizing the terms under which money will be lent and repaid. This document not only protects the interests of both the lender and the borrower but also ensures that there is a legal record of the loan and its conditions. Before getting started, ensure you have all necessary information at hand, including the full names and addresses of both parties, the amount to be lent, the interest rate (if any), repayment schedule, and any collateral involved. Follow these steps carefully to ensure the agreement is correctly completed.

- Start by entering the date the agreement is being made at the top of the form.

- Fill in the full legal names and addresses of both the lender and the borrower in the respective sections.

- Specify the principal amount of the loan in the section provided. Make sure to write out the amount in words followed by the figure in parentheses to avoid any confusion.

- If applicable, enter the interest rate. Ensure this rate complies with New York's usury laws to avoid rendering the agreement unenforceable.

- Detail the repayment schedule. Include specific dates or benchmarks for when payments are due and describe the form in which payments will be made (e.g., check, cash, bank transfer).

- Describe any collateral that will secure the loan, if applicable. This section should clearly specify what the collateral is and the conditions under which the lender can take possession of it should the borrower default on the loan.

- List any additional covenants or agreements between the lender and borrower. This might include requirements for insurance on the collateral, penalties for late payments, or conditions under which the loan must be repaid immediately.

- Both the lender and the borrower should sign and date the form. Witness signatures may also be required depending on the specifics of the loan and local regulations.

Once the form is fully completed and signed, make sure both parties receive a copy for their records. This document will serve as a binding agreement, ensuring that the terms of the loan are clearly understood and agreed upon by both parties. It's also highly recommended to consult with a legal advisor before finalizing the loan agreement to ensure that it complies with all federal and state regulations and fully protects your rights and interests.

Get Answers on New York Loan Agreement

What is a New York Loan Agreement form?

A New York Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is provided. It specifies the obligations of the borrower and the rights of the lender. The form is used to ensure clarity and legal protection for both parties involved in the loan transaction. This includes the loan amount, interest rate, repayment schedule, and any other relevant details particular to the loan agreement.

Where can one obtain a New York Loan Agreement form?

The form can be obtained from various sources including legal services providers, online legal document platforms, or through consultation with an attorney who specializes in financial agreements. Some financial institutions may also provide their own version of a loan agreement form for transactions occurring within New York. It’s important to ensure that the form complies with the current laws and regulations of New York State.

Is it necessary to have a lawyer review the New York Loan Agreement form?

While it is not legally required to have a lawyer review your New York Loan Agreement form, it is highly advisable. A lawyer can provide valuable insight into the terms of the agreement, ensuring that it is fair and legally binding. They can also help in identifying any potential issues that could arise from the agreement, thereby protecting all parties involved.

Can the New York Loan Agreement form be modified after both parties have signed it?

Yes, the New York Loan Agreement form can be modified after signing, but any modifications must be agreed upon by both the borrower and the lender. It is crucial that any amendments to the agreement are documented in writing and signed by both parties. This ensures that the modifications are legally binding and enforceable. It is often advisable to have these modifications reviewed by a legal professional to ensure they are consistent with the original terms and with any applicable laws.

Common mistakes

One common mistake individuals make when filling out the New York Loan Agreement form is not clearly defining the terms of the loan. This includes the loan amount, interest rate, repayment schedule, and any late fees. When these critical details are vague or omitted, it can lead to misunderstandings and disputes down the line. It's crucial for both the lender and the borrower to have a clear, mutual understanding of the obligations and expectations set forth in the loan agreement.

Another frequent oversight is forgetting to include personal identification information for both parties involved. A complete loan agreement should have the full legal names, addresses, and contact information for the lender and the borrower. This information is vital for the enforceability of the agreement, should there be a need for legal recourse. Without it, the agreement might not hold up in court, rendering it ineffective in resolving any disputes that arise.

Many also overlook the importance of specifying the purpose of the loan. While it might seem unnecessary at the time of agreement, explicitly stating how the loaned funds will be used adds an extra layer of protection for the lender. This clause helps ensure that the funds are used as intended and can limit the borrower's use of the funds for purposes outside the agreed-upon scope.

Not defining the conditions for early repayment or default is another mistake to avoid. Borrowers may find themselves in a position to repay the loan earlier than expected, and without clear terms regarding early repayment, they might incur unnecessary penalties or fees. Similarly, the agreement should outline the consequences of default, providing a clear roadmap for recourse in the event that the borrower fails to meet the repayment terms. These details help protect both parties and make the terms of the agreement fair and transparent.

Finally, failing to sign the loan agreement is a surprisingly common error. For the document to be legally binding, both the lender and the borrower must sign and date the agreement. A witness or notarization can further strengthen the document's validity, though not always required, it adds a layer of verification and seriousness to the agreement. Without these signatures, the document holds no legal weight, making it merely a piece of paper with no enforceability behind it.

Documents used along the form

When entering into a loan agreement in New York, parties often find it necessary to supplement the main contract with additional forms and documents. These additional documents help provide clarity, fulfill legal requirements, and ensure that both lender and borrower are protected. Below is a list of up to ten other forms and documents commonly used alongside the New York Loan Agreement form, each with a brief description to help understand its purpose.

- Promissory Note: This document outlines the borrower's promise to repay the loan under the agreed terms and conditions. It includes details about the loan amount, interest rate, repayment schedule, and consequences of non-payment.

- Personal Guarantee: Often required for business loans, this legal document ensures that an individual (usually a business owner or executive) personally guarantees the repayment of the loan, should the business fail to do so.

- Security Agreement: This document provides the lender with a security interest in a specific asset or property (collateral) of the borrower, which can be claimed in case of default on the loan.

- UCC-1 Financing Statement: Frequently associated with the Security Agreement, this form is filed with the state to publicly declare the lender's interest in the collateral mentioned in the security agreement.

- Mortgage Agreement: If the loan is secured by real property, a Mortgage Agreement is used to create a lien on the property, which grants the lender the right to take ownership if the loan is not repaid.

- Deed of Trust: Similar to a Mortgage Agreement, this document involves an additional party, a trustee, who holds the title to the secured property until the loan is fully repaid.

- Amendment Agreement: Should terms of the original loan agreement need to be modified, an Amendment Agreement is used to make and record such changes.

- Subordination Agreement: This agreement changes the priority order of claims on the borrower's assets, usually making a new creditor subordinate to others.

- Prepayment Agreement: To outline the terms under which the borrower can pay off the loan before its due date, including any prepayment penalties or discounts.

- Release of Loan Agreement: Upon the full repayment of the loan, this document releases the borrower from any further obligations under the original loan agreement.

Each of these documents plays a specific role in ensuring the loan process is thorough and legally binding. While some may not be necessary in every loan transaction, understanding their functions can greatly enhance the security and clarity of financial agreements for all parties involved. When drafting or entering into a loan agreement, parties are strongly encouraged to consider which of these additional documents might be applicable or beneficial to their particular situation.

Similar forms

The New York Loan Agreement form shares similarities with the Promissory Note in that both are binding legal documents between a borrower and lender. The Promissory Note is a straightforward agreement wherein the borrower promises to repay the lender a specified amount of money, either on demand or at a determined future date. Like the New York Loan Agreement, it details the loan amount, interest rate, repayment schedule, and the consequences of default, making it essential for ensuring the borrower's accountability.

Mortgage Agreements are another type of document closely related to the New York Loan Agreement, particularly because they both involve loans secured by collateral. In a Mortgage Agreement, the collateral is real property. This agreement specifies the loan's terms, including repayment schedule, interest rate, and the lender's rights if the borrower fails to repay the loan. While a New York Loan Agreement can cover various types of loans, both documents serve to protect the lender's investment and outline the borrower's obligations.

The Personal Loan Agreement is similar to the New York Loan Agreement as both are used between individuals, often known to each other, for personal loans. They outline the loan amount, interest rate, repayment terms, and consequences of non-repayment. The key difference typically lies in the formality and the specifics of the terms, with the New York Loan Agreement possibly being more comprehensive and formal, given the diverse legal and financial contexts it may be used in.

Deeds of Trust share a foundational principle with the New York Loan Agreement, especially when securing a loan with property. Like a Mortgage Agreement, a Deed of Trust involves a borrower (trustor), a lender (beneficiary), and a third party (trustee) who holds the property title until the loan is repaid. The similarities lie in the protection it offers to the lender and the detailed stipulations regarding loan repayment, interest rates, and the handling of defaults.

Business Loan Agreements, similar to the New York Loan Agreement, are specifically tailored towards lending for business purposes. These agreements detail the loan's terms, such as the amount, interest rate, repayment schedule, and collateral, if any. The business aspect often introduces additional complexities, such as clauses on business performance or use of the loan, distinguishing these agreements with a focus on business operations and objectives.

Credit Facility Agreements resemble the New York Loan Agreement because they provide a borrower access to a specified amount of funds from a lender, which can be used over time. These agreements outline the terms under which funds can be borrowed, repaid, and re-borrowed, including interest rates and repayment schedules. The flexibility in borrowing and repayment under a Credit Facility Agreement parallels the structured yet adaptable nature of New York Loan Agreements in accommodating various loan scenarios.

Student Loan Agreements, while designed for a specific purpose, share key components with the New York Loan Agreement. They outline the loan amount, interest rate, repayment terms, and deferment options, focusing on the borrower's commitment to repay the education-related expenses. Both types of agreements are geared towards ensuring the borrower understands their repayment obligations and the terms under which the loan must be repaid.

Lastly, the Lease-Purchase Agreements bear resemblance to the New York Loan Agreement in the sense that they both involve a form of financing for the acquisition of goods or property. In a Lease-Purchase Agreement, the lessee makes regular payments in exchange for the use of an asset, with an option to purchase at the end of the term. This agreement outlines payment amounts, schedules, and the purchase option terms, similar to how a New York Loan Agreement specifies loan repayment conditions and obligations.

Dos and Don'ts

When filling out the New York Loan Agreement form, it is crucial to follow specific dos and don'ts to ensure the process is carried out smoothly and effectively. Here are five essential tips to keep in mind:

Do's:

- Read the entire form carefully before beginning to fill it out. Understanding all the sections and instructions can help avoid mistakes.

- Use black or blue ink for filling out the form if doing so by hand to ensure legibility and to adhere to standard document filing protocols.

- Provide accurate information about the borrower and the lender, including full legal names and addresses, to avoid any confusion or legal issues down the line.

- Clearly specify the loan amount and the interest rate, if applicable, to ensure both parties are fully aware of their obligations.

- Review the form for any errors or missing information before submitting it. This step is critical to prevent delays or complications.

Don'ts:

- Do not leave any fields blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty to show that you did not overlook it.

- Avoid using white-out or making extensive corrections. If you make a mistake, it is better to start over with a new form to maintain the document's clarity and professionalism.

- Do not sign the form without reviewing it with the other party involved. Both the borrower and the lender should agree on all terms before signing.

- Refrain from informal agreements not reflected in the form. All terms and conditions related to the loan should be included in the agreement to be enforceable.

- Do not delay in submitting the completed form to the appropriate party or legal entity. Prompt submission can prevent any misunderstandings and ensure the agreement is in effect when needed.

Misconceptions

When it comes to the New York Loan Agreement form, there are quite a few misconceptions that can trip up both borrowers and lenders. It's crucial to debunk these myths to ensure all parties enter into loan agreements with clarity and confidence. Here are five common misunderstandings:

- It's only for big businesses: Many people believe that the New York Loan Agreement form is designed solely for large corporations or business transactions. However, this form can be just as relevant for small businesses or personal loans. It serves to formalize the agreement between any two parties, ensuring that the terms are clear and legally binding, regardless of the loan's size.

- It's too complicated for the average person: There's a common myth that navigating through the New York Loan Agreement form requires a legal background. However, the form is structured to be comprehensible. Key sections are clearly labeled to help non-experts understand important details like repayment terms, interest rates, and any collateral involved.

- You don't need it if you trust the other party: Trust is a vital component of any loan agreement, but relying solely on trust can lead to misunderstandings or disputes down the line. The New York Loan Agreement form helps by documenting all terms and conditions, providing a clear framework and reference for both parties. This documentation is crucial, not only for maintaining personal relationships but also for legal protection if any issues arise.

- Using a template means you don't need to customize: While it's true that the New York Loan Agreement form offers a comprehensive outline, it's essential to customize the document to your specific situation. Not all loans are alike, and details like interest rates, repayment schedules, and penalties for late payments should reflect the unique aspects of each loan. Customization ensures the agreement is accurately tailored to the needs and expectations of both parties involved.

- Signing the form is all you need to do: Although signing the loan agreement is a critical step in formalizing the loan, it's not the end of the process. Both parties should keep a signed copy for their records, monitor payments, and communicate openly throughout the term of the loan. Keeping detailed records and adhering to the agreement's terms are fundamental to a successful lending relationship.

Understanding these misconceptions can lead to more effective and legally sound loan agreements. It's all about ensuring that you're as informed as possible, whether you're lending money to a friend or borrowing for your small business. The New York Loan Agreement form, when used correctly, can provide a strong foundation for these financial transactions.

Key takeaways

Filling out and using the New York Loan Agreement form is an essential process for both lenders and borrowers within the state. It encapsulates the terms and conditions under which money is lent, providing a legal framework that ensures clarity and security for all parties involved. Here are some key takeaways about this process:

- Accuracy is critical: Every detail in the New York Loan Agreement form must be accurate and complete. This includes the names and addresses of the parties involved, the loan amount, interest rate, repayment schedule, and any collateral securing the loan. Mistakes or omissions can lead to disputes or legal challenges.

- Understand the terms: Both the borrower and the lender should fully understand every term and condition outlined in the agreement. This includes the interest rate, repayment schedule, late fees, and consequences of default. If there's anything unclear, consult a legal professional before signing.

- Adhere to New York laws: The agreement should comply with all relevant New York state laws, including those governing interest rates (usury laws) and the legal requirements for a valid contract. Non-compliance can render the agreement unenforceable and could potentially lead to legal penalties.

- Secured vs. Unsecured Loans: Determine whether the loan will be secured by collateral. If so, the agreement should clearly describe the collateral and the conditions under which it can be seized in case of default. This is particularly important in New York, where specific laws govern secured transactions.

- Signatures are essential: The agreement must be signed by both parties to be legally binding. Depending on the loan amount and terms, it may also need to be witnessed or notarized. This formalizes the agreement and can offer additional legal protections.

- Keep records: Both the borrower and the lender should keep a copy of the signed agreement. It's advisable to also keep records of all payments made or received, as well as any other communications related to the loan. These documents can be invaluable in case of a dispute or misunderstanding.

In sum, the New York Loan Agreement form is a vital document that should be approached with care and thoroughness. Proper attention to detail, adherence to state laws, and clear communication between the parties can help ensure a smooth lending process and minimize potential legal issues.

Popular Loan Agreement State Forms

Free Promissory Note Template Florida - Supports lenders in performing due diligence by documenting the borrower's commitment to repay.