Official IOU Document

When it comes to acknowledging debt in its simplest form, the IOU document plays a pivotal role by providing a written promise from one party, the borrower, to repay a sum of money to another, the lender. Unlike more complex legal agreements, an IOU is straightforward, outlining the essential details of the loan without the inclusion of interest rates or repayment schedules that formal loan agreements typically feature. This document serves as a tangible acknowledgment of debt, although it does not detail the extent of the legal obligations or the steps for repayment as more comprehensive contracts do. Its utility lies in its simplicity, making it suitable for informal loan arrangements between individuals who prefer minimal formalities. However, the basic nature of an IOU also means that its enforceability and the protection it offers can be limited compared to more detailed financial contracts. As such, understanding the scope and limitations of an IOU form is crucial for both parties involved in the transaction to ensure clarity and prevent potential disputes regarding the debt acknowledgment.

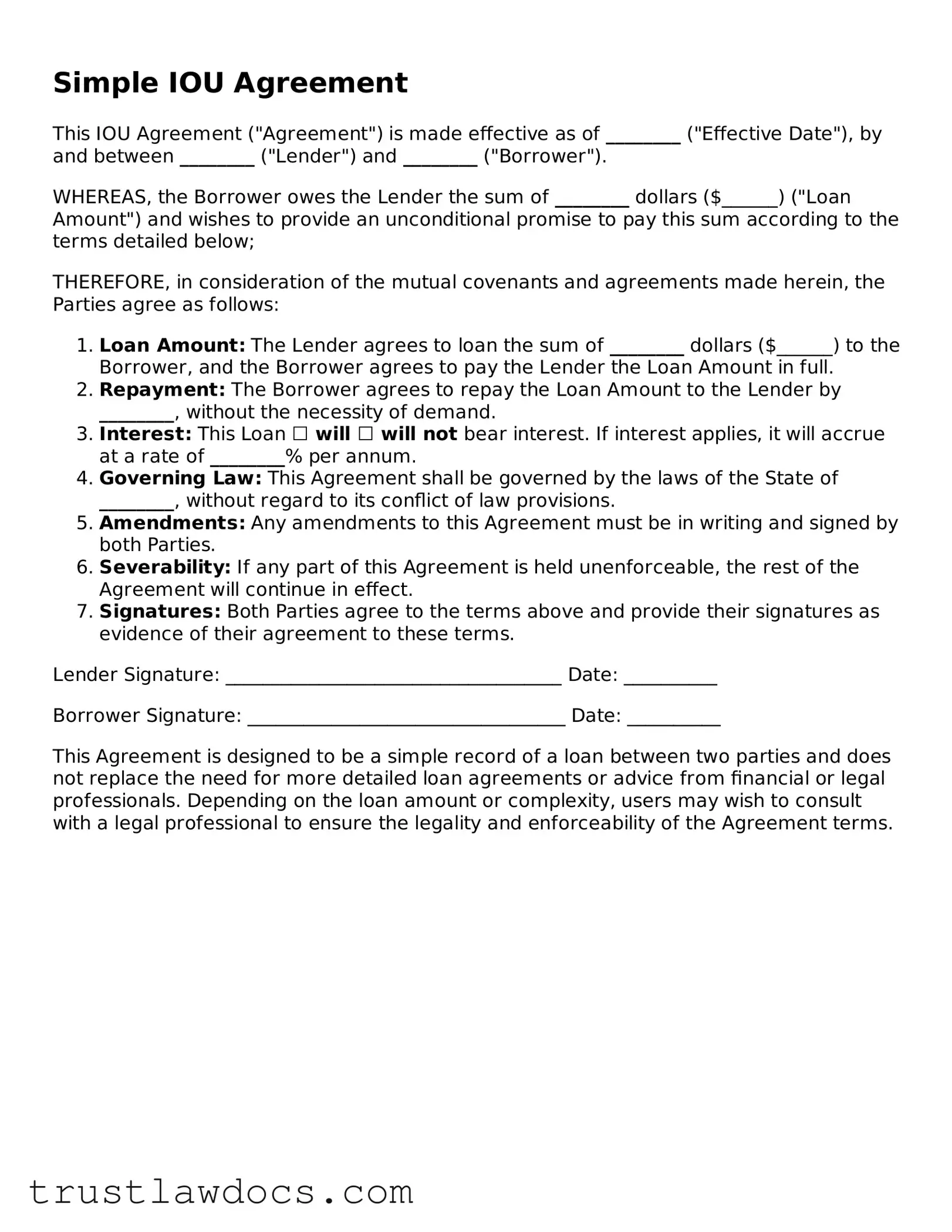

Form Example

Simple IOU Agreement

This IOU Agreement ("Agreement") is made effective as of ________ ("Effective Date"), by and between ________ ("Lender") and ________ ("Borrower").

WHEREAS, the Borrower owes the Lender the sum of ________ dollars ($______) ("Loan Amount") and wishes to provide an unconditional promise to pay this sum according to the terms detailed below;

THEREFORE, in consideration of the mutual covenants and agreements made herein, the Parties agree as follows:

- Loan Amount: The Lender agrees to loan the sum of ________ dollars ($______) to the Borrower, and the Borrower agrees to pay the Lender the Loan Amount in full.

- Repayment: The Borrower agrees to repay the Loan Amount to the Lender by ________, without the necessity of demand.

- Interest: This Loan ☐ will ☐ will not bear interest. If interest applies, it will accrue at a rate of ________% per annum.

- Governing Law: This Agreement shall be governed by the laws of the State of ________, without regard to its conflict of law provisions.

- Amendments: Any amendments to this Agreement must be in writing and signed by both Parties.

- Severability: If any part of this Agreement is held unenforceable, the rest of the Agreement will continue in effect.

- Signatures: Both Parties agree to the terms above and provide their signatures as evidence of their agreement to these terms.

Lender Signature: ____________________________________ Date: __________

Borrower Signature: __________________________________ Date: __________

This Agreement is designed to be a simple record of a loan between two parties and does not replace the need for more detailed loan agreements or advice from financial or legal professionals. Depending on the loan amount or complexity, users may wish to consult with a legal professional to ensure the legality and enforceability of the Agreement terms.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition of IOU | An IOU is a document that acknowledges a debt owed by one party to another. |

| Key Components | An IOU typically includes the creditor's and debtor's names, the amount owed, and sometimes the repayment deadline. |

| Legal Enforceability | While simple, an IOU is considered a legally binding contract in many jurisdictions. |

| Interest Terms | IOUs might specify if the debt bears interest, though not all do. |

| State-Specific Laws | Governing laws vary by state, affecting how IOUs are interpreted and enforced. |

| Limitations | Without detailed terms of agreement, IOUs may be seen as less formal and may lack comprehensive legal protections. |

| Advantages | They are quick and easy to create, serving as straightforward proof of a debt that can facilitate personal or informal loans. |

How to Write IOU

An IOU form is an important paper that records a promise made by one person to pay back money to another person. This straightforward tool can help prevent misunderstandings and provide clear details about the debt. Filling out an IOU form correctly ensures that all vital information is documented. Below, you'll find simple steps to complete this form, ensuring both parties understand their rights and responsibilities in the transaction.

- Start by including the date at the top of the form. This date should reflect when the IOU is being created.

- Write the full name and address of the borrower—the person who owes money.

- Add the full name and address of the lender—the person who is lending the money or has already given the money.

- Specify the amount of money being borrowed. Write this amount in both words and numbers to avoid any confusion.

- Detail the repayment plan. Include specific dates if there are multiple payments planned, or state the due date for a lump sum payment.

- If there is interest, clearly mention the rate and how it will be calculated. If no interest is being charged, explicitly state this on the form.

- Both the borrower and lender should sign the form. Signatures are necessary to show that both parties agree to the terms documented in the IOU.

- Date the signatures, placing the date next to or below each signature to indicate when the agreement was signed by each party.

After completing these steps, both the borrower and lender should keep a copy of the IOU for their records. This document serves as proof of the agreement and can be used if any disputes arise over the terms of the loan. Remember, an IOU form is a simple but legally binding agreement, so make sure to fill it out carefully and accurately.

Get Answers on IOU

What is an IOU form?

An IOU form is a written agreement that confirms someone's promise to pay back a debt to another person. It stands for "I owe you," signifying an acknowledgment of owed debt. This form generally includes details like the amount owed, the names of the involved parties, and the repayment schedule.

Is an IOU form legally binding?

Yes, an IOU form can be legally binding if it contains all the necessary details and both parties have agreed to its terms. However, its enforceability can vary by jurisdiction and the presence of signatures from both the borrower and lender. It's considered a simple form of agreement acknowledging debt but might need additional criteria to be fully enforceable in a court of law.

What details should be included in an IOU form?

An effective IOU form should include the name and contact information of both the borrower and the lender, the total amount of money borrowed, the date the agreement is made, and any repayment terms such as the repayment schedule. It’s also advisable to include the date by which the full amount should be repaid and any interest charges if applicable.

Can an IOU form include payment terms?

Yes, an IOU form can and often should include payment terms. This might specify the frequency of payments (monthly, quarterly, on a specific date, etc.), the amount of each payment, and the total number of payments. Additionally, including the interest rate, if any, provides clarity on the total amount to be repaid.

What happens if someone fails to adhere to the terms of an IOU form?

If a borrower fails to meet the repayment terms outlined in an IOU form, the lender has the right to pursue legal action to recover the owed amount. The steps involved can vary depending on local laws but may include mediation, small claims court, or other legal procedures. It is often advisable for the lender to attempt to contact the borrower and seek a resolution before taking formal legal actions.

Common mistakes

One common mistake made when filling out an IOU form is the omission of clear repayment terms. It's crucial to specify not only the amount owed but also the repayment schedule, including any interest rates or penalties for late payments. This omission can lead to confusion and disputes down the line, making it difficult to enforce the terms of the agreement. By clearly stating the repayment terms, both parties have a clear understanding of the expectations, preventing misunderstandings.

Another issue often encountered is neglecting to include the full names and contact information of both the lender and the borrower. This information is vital for the validity and enforceability of the document. Without it, the IOU lacks the necessary detail to identify the parties involved, potentially making it useless in a legal setting. Detailed information ensures that both parties are easily contactable and identifiable, reducing the risk of ambiguity.

Failing to sign the document is a simple yet critical mistake. A signature from both the borrower and the lender validates the IOU, signifying agreement to the terms. An unsigned IOU raises questions about its authenticity and the commitment of the parties to the terms outlined. Making sure the document is signed by all parties involved solidifies its standing as a binding agreement.

Not specifying the purpose of the loan can also lead to problems. Including a brief description of why the money is being lent adds clarity to the transaction and can be crucial in legal contexts to demonstrate the intent behind the loan. This detail helps in understanding the nature of the agreement and can provide important context if there is a dispute or misunderstanding in the future.

Finally, a common error is the failure to have the document witnessed or notarized, depending on the requirements of the jurisdiction. While not always mandatory, having a third party witness or a notary public sign the document can add an extra layer of validity and enforceability. This step can be particularly important if the agreement is contested in court, as it provides an additional level of verification to the signatures and terms agreed upon.

Documents used along the form

An IOU form is a document acknowledging a debt owed by one party to another. It is a simple yet crucial piece of paper in both personal and business finance, outlining the borrower's promise to repay the lender. Surrounding this essential document, various other forms and documents often come into play to ensure the enforceability, clarity, and completeness of financial agreements. These documents can range from detailed loan agreements to statements that secure the lender's interest in the borrower's assets. Understanding these documents is vital for both parties involved in a financial transaction.

- Promissory Note: This document goes beyond an IOU by including detailed information about the loan’s repayment plan, interest rate, and the consequences of non-payment. Unlike an IOU, a promissory note is more formal and comprehensive.

- Loan Agreement: A loan agreement is a contract between the lender and the borrower that outlines all the terms and conditions of the loan. This document is more detailed than an IOU and includes clauses about repayment schedules, collateral, and what happens in case of default.

- Mortgage Agreement: This is used when the loan is secured against a property. The mortgage agreement gives the lender a claim against the house if the borrower fails to repay the loan as agreed.

- Security Agreement: A security agreement details the assets provided by the borrower as collateral for the loan. It grants the lender a security interest in the specified assets, ensuring they can be seized if the borrower defaults.

- Guaranty: This is a legal commitment by a third party to assume the debt obligation of the borrower if they default on their loan. It provides an additional layer of security for the lender.

- Payment Plan Agreement: For loans that will be repaid in installments, a payment plan agreement specifies the schedule of payments, including the due dates and amounts for each installment.

- Debt Settlement Agreement: If the borrower is unable to repay the loan according to the original terms, a debt settlement agreement can outline new terms for repayment, often at a reduced amount.

- Lien Waiver: In construction or renovation, contractors or suppliers may use a lien waiver to relinquish their right to file a lien on a property, typically upon receiving payment.

- Release of Liability: This document is often used to absolve a party (usually the lender) from future claims or lawsuits related to the agreement. It's particularly common in settlements or when a debt is forgiven.

Together, these documents form a robust legal framework that supports the initial IOU form, creating a secure and legally binding understanding between the involved parties. Each document serves a specific purpose, either offering protection to the lender by securing the loan, providing clear terms for repayment, or defining the consequences of default. Ensuring these documents are correctly drafted and understood is essential for the smooth execution of financial agreements and the protection of all parties' interests.

Similar forms

A Promissory Note is closely related to an IOU. Like an IOU, a Promissory Note is a written agreement where one party promises to pay another a specific sum of money by a certain date. However, it goes a step further by detailing the repayment schedule, interest rates, and what happens if the borrower fails to repay the money. Essentially, it's a more formal and detailed IOU that provides greater legal protection for the lender.

A Loan Agreement shares similarities with an IOU in that it is a contract between a borrower and a lender where the borrower agrees to pay back the lent amount. The key difference is that a Loan Agreement is much more comprehensive, outlining terms and conditions, repayment plans, interest rates, collateral (if any), and legal recourse for default. This document is preferred for larger loans where both parties seek clear, legally binding terms and conditions beyond the simple acknowledgment of debt found in an IOU.

A Bill of Sale is somewhat akin to an IOU, in the sense that it acknowledges a transaction between two parties. However, its focus is on the transfer of ownership of goods, vehicles, or other property from a seller to a buyer, often indicating the purchase price. Unlike an IOU, which acknowledges debt, a Bill of Sale serves as evidence of a completed transaction and the transfer of ownership, stipulating the item sold, the sale amount, and signatures of both parties involved.

A Mortgage Agreement shares a core concept with an IOU, as it involves a promise to pay. Specifically, it is an agreement where a borrower promises to repay a lender the borrowed amount to purchase real estate, but the property itself serves as collateral for the loan. This document outlines the loan amount, interest rate, repayment schedule, and the lender’s rights in case of default. While an IOU acknowledges a debt, a Mortgage Agreement ties that debt to a physical asset and includes detailed terms governing the loan.

An Equity Agreement, common in business financing, parallels the IOU in its fundamental acknowledgment of a financial obligation. This agreement details the equity, or ownership interest, given to an investor in exchange for capital investment in a company. Although it doesn't typically involve a direct promise to repay a sum by a certain date, it acknowledges the investor's contribution and specifies their ownership percentage, rights, and obligations. Unlike an IOU, it is used in equity financing and involves exchanging capital for company stock or interest rather than a debt acknowledgment.

Dos and Don'ts

Filling out an IOU (I Owe You) form requires careful attention to detail and a clear understanding of the agreement between the involved parties. To ensure the process is handled correctly and that the document is legally binding, follow these guidelines.

- Do ensure all parties' full names and addresses are accurately recorded. This establishes the identity of the creditor and debtor clearly, minimizing confusion.

- Do specify the amount of money borrowed in words and figures. This eliminates any ambiguity about the sum owed.

- Do define the repayment terms clearly, including any installment arrangements or due dates, to prevent misunderstandings.

- Do include the interest rate, if applicable, specifying whether it is a fixed or variable rate to avoid future disputes over additional amounts owed.

- Do include a clause about what will happen if the agreement is breached to have a predefined resolution plan.

- Do ensure both parties sign and date the form in the presence of a witness or notary to solidify the document's validity.

- Do keep the language simple and concise, avoiding legal jargon that might confuse the parties involved.

- Don't leave any fields blank on the form; if a section does not apply, mark it with N/A (Not Applicable) to demonstrate it was considered but deemed inapplicable.

- Don't skip including a clause that specifies any collateral or security agreed upon for the loan, which is crucial for secured loans.

- Don't forget to each keep a copy of the signed document for your records, ensuring that both parties have evidence of the agreement.

Following these dos and don'ts will help to create an IOU form that clearly outlines the loan details, repayment expectations, and any consequences of failing to meet those expectations. This careful preparation can prevent future legal disputes and maintain a positive relationship between the debtor and creditor.

Misconceptions

An IOU form, often seen as an informal document to acknowledge a debt, is surrounded by a number of misconceptions. These misunderstandings can lead to confusion and mismanagement of financial agreements between parties. Here, we aim to clarify some of the common misconceptions to provide a better understanding of IOU forms.

IOUs are not legally binding: Contrary to common belief, IOUs can be legally binding, provided they contain essential elements like the amount borrowed and acknowledgment from the borrower that the debt is owed. However, including additional details such as repayment terms and interest rates might strengthen the document's enforceability.

IOUs must be notarized to be valid: While notarization can add an official layer of verification to the document, IOUs do not need to be notarized to be considered valid. The key aspect is the acknowledgment of the debt by the borrower, not the notarization of the document.

Only written IOUs are valid: Although it is highly advisable to have a written record of a loan, verbal agreements are also recognized under the law. However, written IOUs are more straightforward to enforce because they provide clear evidence of the agreement.

IOUs and loans are the same: IOUs are indeed a form of loan document but are generally more simplistic and might not include details commonly found in formal loan agreements, such as repayment schedules or collateral.

IOUs do not require witnesses: While not a strict requirement, having a witness sign the IOU along with the involved parties can bolster its credibility. A witness can play a crucial role if the agreement is contested or brought to court.

All IOUs are informal personal loans: IOUs might be commonly used for personal loans between friends or family, but they can also be employed in more formal contexts, such as business transactions, to acknowledge debt obligations.

A verbal agreement to repay is as good as an IOU: Verbal agreements can be legally binding, but proving the terms and existence of such agreements can be challenging. An IOU provides a tangible record of the agreement, making it easier to uphold in disputes.

Editing an IOU after it's been signed invalidates it: Modifications to an IOU can be made if all parties involved agree to the changes. It is crucial to document any amendments clearly and have all parties initial any edits to ensure the document remains valid and enforceable.

In essence, an IOU serves as a simple yet effective way to document a debt. Misconceptions around its use and legality can hinder its effectiveness in clear documentation of financial transactions. Understanding the reality behind these misconceptions enables individuals to utilize IOUs effectively and responsibly.

Key takeaways

Filling out and using an IOU form can seem straightforward, but ensuring its effectiveness involves understanding key principles. The purpose of an IOU, which stands for "I owe you," is to create a simple document that acknowledges debt between two parties. Here are some takeaways you should keep in mind:

- Clearly identify both parties: The full legal names of the lender and the borrower should be clearly mentioned to avoid any ambiguity about who is involved in the transaction.

- Specify the loan amount: The exact amount of money being loaned should be written in numbers and spelled out in words to eliminate confusion.

- Include repayment terms: Outline how and when the loan will be repaid. It could be in installments, a lump sum, on a specific date, or upon the occurrence of a certain event.

- State the interest rate, if applicable: If the loan involves interest, specify the rate, how it's calculated, and how it will be paid to avoid potential disputes.

- Document signatures: Both the lender and the borrower should sign the IOU. A dated signature makes the document more credible and can be important if legal enforcement is necessary.

- Consider having witnesses or a notary: While not always required, having witnesses sign or getting the document notarized can add an extra layer of validity and may help in legal enforcement.

- Keep it simple but thorough: Avoid using complex legal jargon. Clearly state all necessary terms in straightforward language to ensure both parties understand their obligations.

- Record any payments made: Maintain a log of all payments received towards the debt. This helps in tracking the remaining balance and can prevent misunderstandings.

By meticulously completing and using an IOU form, both the lender and borrower can protect their interests and ensure clarity around the terms of the loan. Remember, while an IOU acknowledges debt, the document itself should be safeguarded as proof of the loan and its conditions. Handling financial matters with this level of care demonstrates respect and trust between the parties involved.

Consider More Types of IOU Forms

Family (Friends) Personal Loan Agreement - Offers a peace of mind by formalizing the loan process and detailing the repayment strategy.