Free Loan Agreement Form for Florida

In the financial landscape of Florida, a critical document that both lenders and borrowers must familiarize themselves with is the Florida Loan Agreement form. This form serves as a legally binding contract between two parties, outlining the terms and conditions of the loan, payment schedules, interest rates, and any collateral involved. It plays a pivotal role in ensuring clarity and setting expectations right from the outset, thereby minimizing potential disputes. The importance of this document cannot be overstated; it not only provides legal protection for the involved parties but also establishes a clear framework for the financial transaction. Whether it's for personal loans, business ventures, or real estate transactions, the Florida Loan Agreement form is essential for securing a mutual understanding and agreement between the lender and the borrower. Understanding its major aspects is crucial for anyone looking to navigate the complexities of lending or borrowing in the state, ensuring that all financial dealings are conducted smoothly and with full transparency.

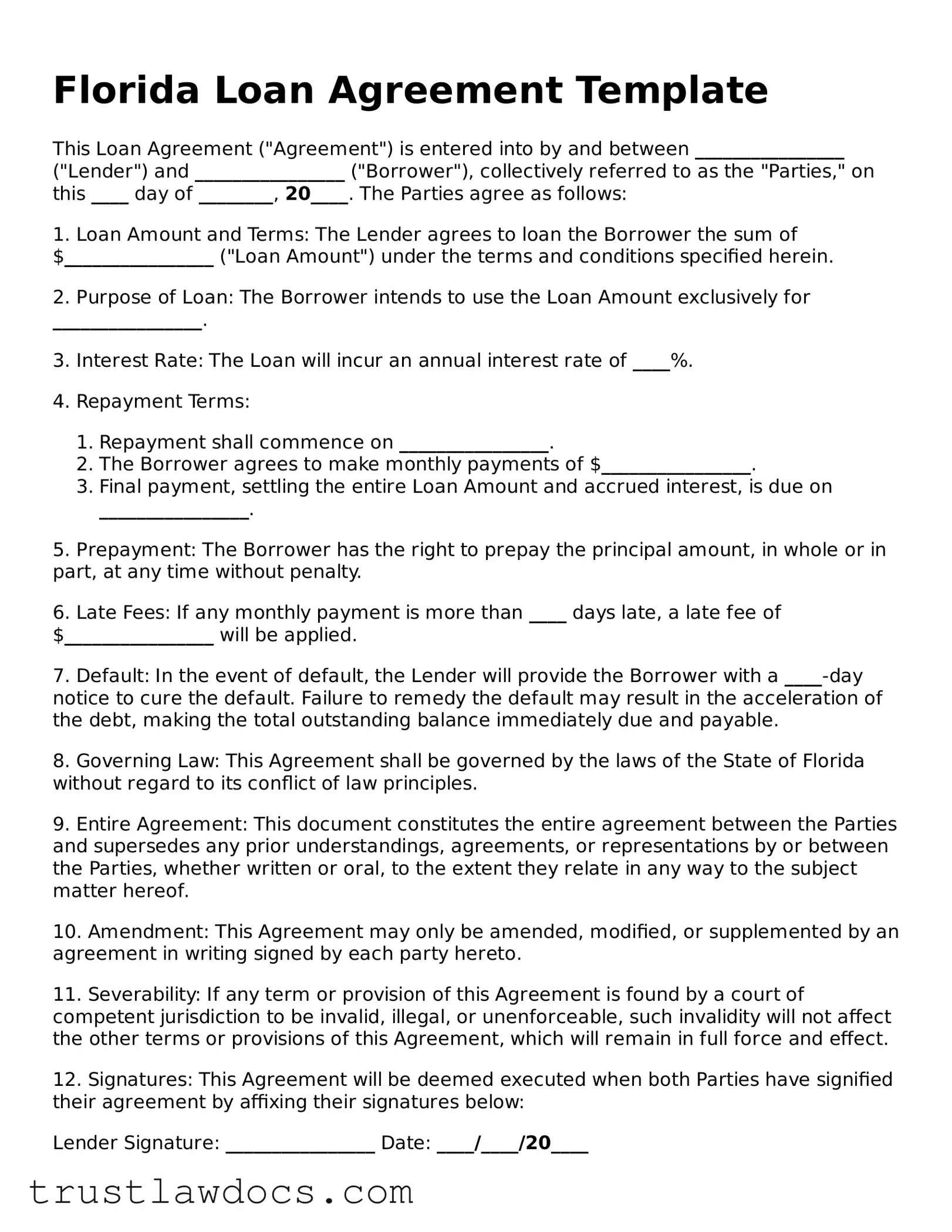

Form Example

Florida Loan Agreement Template

This Loan Agreement ("Agreement") is entered into by and between ________________ ("Lender") and ________________ ("Borrower"), collectively referred to as the "Parties," on this ____ day of ________, 20____. The Parties agree as follows:

1. Loan Amount and Terms: The Lender agrees to loan the Borrower the sum of $________________ ("Loan Amount") under the terms and conditions specified herein.

2. Purpose of Loan: The Borrower intends to use the Loan Amount exclusively for ________________.

3. Interest Rate: The Loan will incur an annual interest rate of ____%.

4. Repayment Terms:

- Repayment shall commence on ________________.

- The Borrower agrees to make monthly payments of $________________.

- Final payment, settling the entire Loan Amount and accrued interest, is due on ________________.

5. Prepayment: The Borrower has the right to prepay the principal amount, in whole or in part, at any time without penalty.

6. Late Fees: If any monthly payment is more than ____ days late, a late fee of $________________ will be applied.

7. Default: In the event of default, the Lender will provide the Borrower with a ____-day notice to cure the default. Failure to remedy the default may result in the acceleration of the debt, making the total outstanding balance immediately due and payable.

8. Governing Law: This Agreement shall be governed by the laws of the State of Florida without regard to its conflict of law principles.

9. Entire Agreement: This document constitutes the entire agreement between the Parties and supersedes any prior understandings, agreements, or representations by or between the Parties, whether written or oral, to the extent they relate in any way to the subject matter hereof.

10. Amendment: This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto.

11. Severability: If any term or provision of this Agreement is found by a court of competent jurisdiction to be invalid, illegal, or unenforceable, such invalidity will not affect the other terms or provisions of this Agreement, which will remain in full force and effect.

12. Signatures: This Agreement will be deemed executed when both Parties have signified their agreement by affixing their signatures below:

Lender Signature: ________________ Date: ____/____/20____

Borrower Signature: ________________ Date: ____/____/20____

This Florida Loan Agreement Template is provided as a general guide and for informational purposes only. It is recommended that Parties consult with a legal professional before entering into any agreement.

PDF Form Details

| Fact Name | Description |

|---|---|

| Applicable Law | Florida Loan Agreements are governed by the laws of Florida, including the Florida Uniform Commercial Code. |

| Interest Rate Limit | In Florida, the maximum interest rate for personal loans is set by the state usury laws, which is 18% on loans over $500,000 and 25% on loans under that amount. |

| Requirement for Written Agreement | For a loan to be legally enforceable in Florida, it must be documented in a written agreement signed by both parties. |

| Late Payment Penalties | The agreement can include provisions for late payment penalties, but these must also comply with Florida's usury laws to be enforceable. |

| Prepayment | Borrowers in Florida have the right to prepay their loans without penalty unless the loan agreement specifically imposes a prepayment penalty. |

| Default and Repossession | In the event of a default, the terms of the Florida Loan Agreement determine the process and rights related to repossession or collection actions. |

How to Write Florida Loan Agreement

In the state of Florida, individuals or entities entering into a borrowed money agreement must complete a comprehensive Florida Loan Agreement form. This document serves as a binding contract between the lender and the borrower, outlining the loan's terms, repayment schedule, interest rates, and other pertinent information to protect both parties’ interests. By following a clear, step-by-step process, individuals can ensure they properly complete the form, reducing the risk of disputes or misunderstandings throughout the loan's duration.

- Begin by entering the date the agreement is made at the top of the form.

- Fill in the full names and addresses of the borrower and the lender in the designated sections.

- Specify the loan amount in words and numbers to eliminate any discrepancies.

- Detail the loan's purpose, allowing for transparency and understanding of how the borrowed funds will be used.

- Enter the interest rate, adhering to Florida's legal limits, and specify whether it is fixed or variable.

- List the repayment terms, including the installment amounts, payment due dates, and the final payment date.

- Specify any collateral that will secure the loan, if applicable, to ensure both parties are aware of the security interests.

- Include clauses on late payment penalties and default consequences to protect the lender's interests.

- Outline the conditions under which the loan can be prepaid or if there are any penalties for early repayment.

- Have both parties read the agreement carefully to confirm that all information is accurate and comprehensive.

- Ensure that the borrower and lender sign and date the agreement in the presence of a witness or notary for added legal reinforcement.

Once the Florida Loan Agreement form is properly completed and signed, it becomes a legally binding document. Both parties should keep a copy for their records. This careful attention to detail will help to ensure that the lender and borrower adhere to their agreed-upon terms, reducing the potential for financial and legal complications down the road. Additionally, should any disputes arise, the completed agreement will serve as a critical resource for resolution. Filling out the form accurately and thoroughly is thus not just a matter of procedural necessity but of mutual benefit and safeguarding.

Get Answers on Florida Loan Agreement

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legally binding document between a lender and a borrower, outlining the specifics of a loan. It details the terms under which money is lent, including the loan amount, interest rate, repayment schedule, and any other conditions agreed upon by both parties. This form serves as proof of the transaction and ensures that both parties understand their obligations.

Who needs to sign the Florida Loan Agreement form?

Both the lender and the borrower must sign the Florida Loan Agreement form. These signatures formally acknowledge their agreement to the terms laid out in the document. It is also advisable for witnesses or a notary public to sign, to add an extra layer of legal protection.

Is a notary required for a Florida Loan Agreement form?

While not always legally required, having a notary public notarize the Florida Loan Agreement form is highly recommended. Notarization provides a level of authenticity to the document and helps protect against claims of forgery or coercion in the future.

Can I modify a Florida Loan Agreement form after signing it?

Yes, modifications to a Florida Loan Agreement form are possible but they must be agreed upon by both the lender and the borrower. Any changes should be made in writing, and an amendment to the original agreement should be signed by both parties.

What happens if the borrower violates the terms of the Florida Loan Agreement form?

If the borrower violates any terms of the Agreement, such as failing to make payments on time, the lender has the right to enforce the agreement. This could include pursuing legal action to recover the borrowed money or seizing collateral if it was part of the agreement. The specific consequences should be clearly outlined in the agreement itself.

Is collateral required for a Florida Loan Agreement form?

Collateral is not required for every Florida Loan Agreement, but it can be requested by the lender to secure the loan. If collateral is part of the agreement, it should be clearly described in the document, along with terms regarding its seizure in the event of default.

How long is a Florida Loan Agreement form valid?

The validity of the Florida Loan Agreement form spans until the loan is fully repaid according to the terms specified in the agreement. Upon full repayment, the agreement is considered fulfilled and is no longer in effect.

Can a Florida Loan Agreement form be used for both personal and business loans?

Yes, a Florida Loan Agreement form is versatile and can be utilized for either personal or business loans. The key is to ensure that the agreement clearly specifies the details relevant to the type of loan, including the purpose of the loan if necessary.

What should I do if I don't understand part of the Florida Loan Agreement form?

If there’s any part of the Florida Loan Agreement form you do not understand, it's crucial to seek clarification before signing. Consulting with a legal professional can help ensure that you fully comprehend the agreement and your obligations under it.

Common mistakes

Filling out a Florida Loan Agreement form can be a critical step in securing a loan, but errors during this process can lead to significant issues down the line. One common mistake is not providing complete information. Borrowers sometimes leave sections blank, thinking they are not applicable or overlooking them entirely. This incomplete information can delay the processing of the agreement, alter the terms, or even lead to a denial of the loan application.

Another prevalent error is misunderstanding the terms. Borrowers often rush through filling out the form without fully understanding the terms and conditions of the loan. This misunderstanding can lead to agreeing to unfavorable terms, such as higher interest rates or less time to repay the loan than anticipated. It's crucial to read and comprehend every part of the agreement before signing.

Incorrect financial information is equally problematic. When borrowers inaccurately report their income or debt, this can affect the loan terms or approval process. Whether unintentional or deliberate, providing incorrect information can be construed as fraud, leading to severe consequences beyond the immediate loan concerns.

Neglecting to consider the co-signer's obligations is a mistake that can have lasting repercussions. If the agreement involves a co-signer, both the primary borrower and the co-signer must fully understand their responsibilities. Failing to do so can strain personal relationships and negatively impact both parties' credit scores if issues arise with the loan repayment.

A common oversight is not verifying personal details. Errors in personal information, such as misspelling a name or providing an outdated address, can complicate or delay the loan process. Such inaccuracies might seem minor, but they can require additional documentation or corrections, slowing down the loan's disbursement.

Lastly, skipping the fine print is a critical mistake. The fine print may contain essential details about the loan, including prepayment penalties, late fees, and the rights of the borrower and lender. By not carefully reviewing these details, borrowers risk agreeing to terms that can make the loan more costly or restrictive than anticipated.

Avoiding these mistakes requires attention to detail, a clear understanding of the loan terms, and asking questions when in doubt. Ensuring accuracy and completeness when filling out the Florida Loan Agreement form is essential for a smooth lending process and to avoid potential legal and financial difficulties.

Documents used along the form

In addition to the Florida Loan Agreement form, which outlines the terms and conditions under which money is lent, several accompanying documents are often necessary to ensure the agreement is legally binding and comprehensive. These supplementary documents serve to provide additional details, secure the loan, and clarify the responsibilities of all parties involved. Below is a description of up to five other forms and documents commonly used alongside the Florida Loan Agreement form.

- Promissory Note: This document complements the loan agreement by recording the borrower's promise to repay the loan amount under the terms agreed upon. Unlike the broader loan agreement, the promissory note typically focuses on the repayment obligations, including the interest rate, repayment schedule, and consequences for default.

- Mortgage or Deed of Trust: To secure the loan, a Mortgage or Deed of Trust can be used when the loan is for real estate purposes. This document places a lien on the property being financed, allowing the lender to foreclose on the property if the borrower fails to comply with the terms of the loan agreement and promissory note.

- Guaranty: A Guaranty is often required to provide additional security to the lender. It is a legal commitment by a third party (the guarantor) to pay back the loan if the borrower does not. This document is crucial in situations where the borrower's ability to repay the loan is uncertain.

- Security Agreement: When the loan involves personal property instead of real estate, a Security Agreement might be used to outline the terms under which personal property is pledged as collateral. This document gives the lender a security interest in the specified assets, ensuring they have a claim to the collateral if the loan is not repaid.

- UCC-1 Financing Statement: This document is filed with the state to perfect a lender's security interest in the collateral specified in a Security Agreement. It serves as a public record that the lender has a claim on the borrower's assets, protecting the lender's rights against third parties that might claim an interest in the same collateral.

Utilizing these documents in conjunction with the Florida Loan Agreement form ensures a thorough and enforceable financial arrangement. Each document plays a specific role in detailing the obligations of all parties, securing the loan with collateral, and providing a clear pathway for recourse should disagreements or defaults arise. This comprehensive approach to documenting loan agreements safeguards both borrower and lender interests, promoting trust and clarity in financial transactions.

Similar forms

The Florida Loan Agreement form shares similarities with a variety of other contractual documents, each serving specific purposes yet closely related by their legal nature and the obligation agreements they entail. One such document is the Promissory Note. Like the Loan Agreement, a Promissory Note is a written promise to pay a sum of money to a particular person or entity. The difference primarily lies in the level of detail; while a Loan Agreement covers terms, conditions, interest rates, and repayment schedules, a Promissory Note tends to be more straightforward and concise.

Mortgage Agreements are also closely related to the Florida Loan Agreement form. These agreements are secured with the borrower's property as collateral in case the borrower defaults on the loan. The concept of securing an asset for a loan plays a critical role in both documents, although Mortgage Agreements specifically deal with real estate properties, and the terms and protections can vary significantly.

Another similar document is the Personal Guarantee. This type of agreement adds an additional layer of security for the lender by holding a third party (the guarantor) liable if the initial borrower fails to repay the loan. While fundamentally different in their main actors, both the Personal Guarantee and the Loan Agreement share the underlying principle of ensuring the loan is repaid.

The Line of Credit Agreement is another document sharing core principles with the Florida Loan Agreement form. It allows the borrower to access funds up to a specified limit rather than receiving a fixed amount upfront. The flexibility in borrowing and repayment underlines the similarity, with both documents detailing the terms under which money is borrowed.

Business Loan Agreements, tailored specifically for business financing, resemble the broader Loan Agreement form in structure and purpose. They outline the terms under which a business borrows money, including the repayment schedule, interest rates, and any collateral involved. The principal difference lies in the focus on business borrowers and the inclusion of clauses relevant to commercial operations.

Debt Settlement Agreements offer a comparison from the perspective of resolving existing debts. They typically involve the borrower agreeing to pay a reduced amount of the owed debt, differing in intent but similar to loan agreements in that they outline specific financial obligations and the conditions under which they are settled.

A Lease Agreement, while primarily used for renting property, shares the contractual essence with a Loan Agreement. Both establish a relationship between two parties regarding the use of an asset—money in one, property in the other—under agreed-upon terms. The repayment or compensation structure, terms of use, and duration of agreement link them closely.

Lastly, the Student Loan Agreement form, specifically designed for educational purposes, mirrors the general Loan Agreement in its setup of lending terms, repayment conditions, and sometimes, the provision of a guarantor. The focus on funding education marks its unique purpose, yet the foundational agreement between lender and borrower to repay borrowed funds connects them.

In sum, while the Florida Loan Agreement form is uniquely tailored to suit the needs of those entering into a loan within the state, its core components echo through various other legal documents. Each serves its purpose by outlining the specifics of a financial agreement or the use of assets, underpinning the importance of clear, legally binding agreements in a multitude of financial interactions.

Dos and Don'ts

When filling out the Florida Loan Agreement form, it's important to complete it correctly to ensure that all parties understand their obligations and rights under the agreement. Following these guidelines can help make the process smoother and protect your interests.

Do:- Read carefully: Before filling out the form, thoroughly read through the entire document to understand all the terms and conditions.

- Use Black Ink: Fill out the form using black ink to ensure that the document is legible and can be photocopied or scanned without issues.

- Be Precise: Provide accurate and precise information for every section. Mistakes or inaccuracies can lead to disputes or legal complications down the road.

- Include All Parties: Ensure that all parties involved in the loan agreement are clearly listed, including full legal names and contact information.

- Detail the Loan Terms: Clearly specify the loan amount, interest rate, repayment schedule, and any other relevant terms to avoid ambiguity.

- Sign and Date: Make sure that all parties sign and date the form. A signature is necessary to validate the agreement and acknowledge the terms.

- Leave Blanks: Do not leave any sections blank. If a section does not apply, write “N/A” (not applicable) to indicate this.

- Use Pencil: Avoid using pencil or any erasable writing tools, as alterations can raise questions about the document's integrity.

- Rush Through: Take your time filling out the form to ensure that all information is correct and that you understand every part of the agreement.

- Skip Legal Advice: If there's any confusion or concern about the terms, seek legal advice before signing. It's better to understand all aspects fully.

- Forget to Make Copies: Always keep a copy of the signed agreement for your records and provide one to all other parties involved.

- Overlook Specific State Laws: Be aware that Florida may have specific laws regarding loans and agreements. Ensure that your loan agreement abides by these regulations.

Misconceptions

When it comes to financial transactions such as loans, the importance of clearly understanding the agreement cannot be overstated. In Florida, like elsewhere, misconceptions about loan agreement forms can lead to problematic assumptions and outcomes for both lenders and borrowers. Here's a breakdown of common misconceptions about the Florida Loan Agreement form.

All loan agreements are essentially the same. This misunderstanding could lead one to overlook Florida-specific legal requirements or provisions that uniquely apply to their situation. Loan agreements vary significantly in their terms, conditions, and legal obligations.

The terms of loan agreements are non-negotiable. Contrary to this belief, many terms of a loan can be negotiated before signing. Both parties have the opportunity to discuss interest rates, repayment schedules, and other terms to reach a mutually beneficial agreement.

A verbal agreement is just as binding as a written one. While verbal agreements can be enforceable under specific conditions, a written loan agreement provides a clear, tangible record of the terms consented to by all parties involved and is considerably easier to enforce in court.

Non-payment consequences don’t need to be explicitly stated. Failing to outline the consequences of non-payment in the loan agreement can lead to misunderstandings and limited recourse for the lender. Clearly stating the repercussions helps manage expectations and protect both parties’ interests.

Loan agreements are only for banks and large financial institutions. This is a common misconception. Individual lenders and small businesses also use loan agreements to formalize lending terms and protect themselves legally. A proper agreement is prudent, regardless of the loan's size or the relationship between the borrower and lender.

Interest rates are fixed and unchangeable once set. Interest rates can be designed to be fixed or variable. The conditions under which they can change should be specifically stated within the agreement to avoid future disputes.

A loan agreement does not need to be filed or registered with any Florida state agency. While not all loan agreements need to be registered, certain types, such as mortgages, do need to be recorded with the appropriate Florida state agency. Failing to do so could affect the enforceability of the agreement.

Adding a co-signer is always an option to secure a loan. The decision to add a co-signer depends on the agreement of all parties involved, including the lender. It’s not a given right but a negotiable term that should be discussed before finalizing the loan agreement.

A default clause is automatically included in every loan agreement. Default provisions, including what constitutes a default and the steps that will be taken if it occurs, must be clearly articulated in the loan agreement. Assuming they are included could leave the lender at a disadvantage if repayment issues arise.

Only the borrower needs to comply with the agreement. Loan agreement forms are binding contracts for both the borrower and the lender. Both parties have obligations that must be met to ensure compliance with the terms of the agreement. Overlooking the responsibilities of either party can lead to legal challenges.

Understanding these misconceptions can help individuals and businesses navigate the complexities of loan agreements more effectively. It highlights the importance of thorough review and possibly seeking legal advice before finalizing any loan arrangement, especially in the unique legal environment of Florida.

Key takeaways

When dealing with the Florida Loan Agreement form, it is crucial to handle the document with precision and care. This agreement is a legally binding contract between the lender and the borrower. It outlines the loan's terms and conditions, protecting both parties involved. Here are key takeaways to ensure the process is completed smoothly and effectively.

- Personal Information: Ensure all personal information for both the lender and borrower, such as names, addresses, and contact details, are accurately provided. This ensures there are no ambiguities regarding the parties' identities.

- Loan Amount and Interest Rate: Precisely specify the loan amount and the interest rate. This clarity prevents future disputes. Ensure that the interest rate complies with Florida's usury laws to avoid illegal terms.

- Repayment Schedule: Clearly outline how and when the loan will be repaid. This includes the frequency of payments, the amount of each payment, and the due date for the final payment, providing a clear roadmap for repayment.

- Collateral: If the loan is secured against collateral, thoroughly describe the asset. Detailed identification helps in avoiding confusion about what is being used as security.

- Late Fees and Penalties: Define any applicable late fees or penalties for missed payments. It's crucial for both parties to understand the consequences of late payments.

- Governing Law: The agreement should state that it will be governed by the laws of the State of Florida. This ensures that any legal disputes will be resolved under Florida law.

- Signatures: A Florida Loan Agreement must be signed by both the lender and borrower. Signatures legally bind both parties to the agreement's terms. Consider witnessing or notarizing the signatures to add another layer of authenticity.

- Prepayment: Address whether the borrower can pay off the loan early and if any prepayment penalties apply. Providing this option could be mutually beneficial if the borrower can reduce interest costs without penalizing the lender significantly.

Using the Florida Loan Agreement form correctly is essential for documenting a loan's terms and protecting both the lender and borrower. It's recommended to review the form carefully and possibly consult with a professional if there are any doubts or complex issues. Legal guidance can ensure that the agreement complies with all relevant laws and regulations, reducing potential legal hurdles down the line.

Popular Loan Agreement State Forms

Promissory Note Template New York - It features a section on dispute resolution, outlining steps to be taken in case of disagreements.