Official Family (Friends) Personal Loan Agreement Document

When money exchanges hands between family members or friends, it often carries with it an underlying trust that doesn't typically require formal documentation. However, to safeguard relationships and ensure clarity in terms of repayment terms, interest (if any), and other key details, a Family (Friends) Personal Loan Agreement becomes an invaluable tool. This form essentially captures the essence of the loan's conditions, concisely putting down in writing what many assume to be understood and agreed upon verbally. The beauty of this document lies not just in its ability to prevent misunderstandings and potential conflicts down the line, but also in its flexibility to be tailored to the specific needs of the parties involved. Whether the loan is interest-free or carries a lower rate than those offered by traditional lenders, this form can help outline every pertinent detail, from the repayment schedule to the consequences of a default. It’s a simple way to ensure that both lender and borrower are on the same page and that the personal relationship continues smoothly alongside the financial agreement.

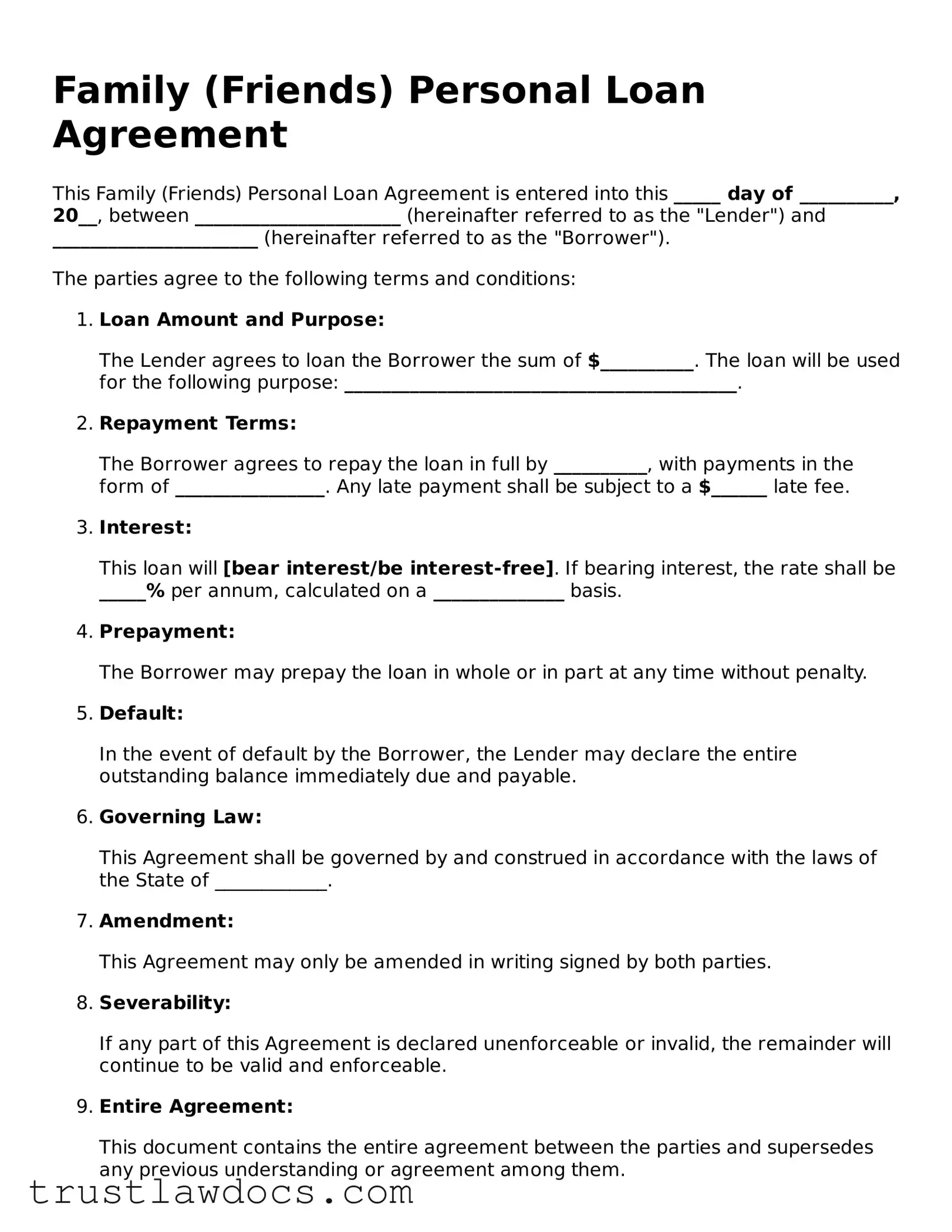

Form Example

Family (Friends) Personal Loan Agreement

This Family (Friends) Personal Loan Agreement is entered into this _____ day of __________, 20__, between ______________________ (hereinafter referred to as the "Lender") and ______________________ (hereinafter referred to as the "Borrower").

The parties agree to the following terms and conditions:

- Loan Amount and Purpose:

The Lender agrees to loan the Borrower the sum of $__________. The loan will be used for the following purpose: __________________________________________.

- Repayment Terms:

The Borrower agrees to repay the loan in full by __________, with payments in the form of ________________. Any late payment shall be subject to a $______ late fee.

- Interest:

This loan will [bear interest/be interest-free]. If bearing interest, the rate shall be _____% per annum, calculated on a ______________ basis.

- Prepayment:

The Borrower may prepay the loan in whole or in part at any time without penalty.

- Default:

In the event of default by the Borrower, the Lender may declare the entire outstanding balance immediately due and payable.

- Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of ____________.

- Amendment:

This Agreement may only be amended in writing signed by both parties.

- Severability:

If any part of this Agreement is declared unenforceable or invalid, the remainder will continue to be valid and enforceable.

- Entire Agreement:

This document contains the entire agreement between the parties and supersedes any previous understanding or agreement among them.

In witness whereof, the parties have executed this Agreement as of the first date above written.

Lender's Signature: __________________________________ Date: _______________

Borrower's Signature: ________________________________ Date: _______________

Witness Signature: __________________________________ Date: _______________

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | The Family (Friends) Personal Loan Agreement is a written document that records a loan's terms between individuals who have a personal relationship. |

| 2 | This agreement helps prevent misunderstandings or disputes by clearly outlining the loan amount, repayment terms, interest rates (if applicable), and any collateral. |

| 3 | Interest rates on a personal loan between friends or family should be reasonable and comply with the Internal Revenue Service (IRS) guidelines to avoid tax implications. |

| 4 | Collateral is not a requirement for these agreements, but including it can offer the lender security and influence the loan terms. |

| 5 | The agreement should specify the repayment schedule, such as monthly payments, a lump sum, or at the discretion of the lender. |

| 6 | In case of a dispute, the agreement should include how disputes will be resolved, whether through mediation, arbitration, or court action. |

| 7 | Each state may have specific laws regarding personal loans and interest rates; therefore, the agreement should comply with the governing laws of the state it's executed in. |

| 8 | The document should be signed by both the lender and borrower to be legally binding; witnesses or a notary public can add additional validity. |

| 9 | It's advisable for both parties to keep a copy of the agreement for their records and to track payments or modifications to the agreement. |

| 10 | A written agreement provides a clear record that the money exchanged was a loan and not a gift, which can be important for legal or tax purposes. |

How to Write Family (Friends) Personal Loan Agreement

A Family (Friends) Personal Loan Agreement is a document used when an individual decides to lend money to another person they have a personal relationship with, ensuring the terms of the loan are clear and legally documented. Filling out this form properly is essential for protecting both parties involved and providing a clear framework for the loan terms. The following steps will guide you through the process of completing the form accurately.

- Start by entering the date the loan agreement is being made at the top of the form.

- Fill in the full legal names of the lender and borrower in the respective spaces provided. Make sure to include any middle names or initials if they are commonly used.

- Specify the amount of money being loaned in both words and numbers to avoid any confusion.

- Detail the loan repayment terms. This includes the repayment schedule, whether it's in lump sum or installments, the amounts, due dates, and any interest rates applied.

- Address the policy on late payments. Include any fees or penalties for late payments and the conditions under which these would apply.

- If the loan is secured with collateral, describe the collateral item(s) in detail, including any identification numbers or documents if applicable.

- Include a section on the governing law, specifying which state laws will apply to the terms of the agreement and any disputes that may arise.

- Clearly outline any additional terms or conditions that are specific to the loan agreement. This may include clauses on early repayment, loan modification, or default terms.

- Both the lender and borrower must sign and date the agreement. If witnesses are required or desired, leave space for their signatures and printed names as well.

Once completed, it's advisable for both parties to keep a signed copy of the agreement. It provides a reference point should any questions or disputes arise regarding the terms of the loan. Remember, this legal document is designed to protect the interests of both the borrower and the lender, making clear the expectations and responsibilities of each party.

Get Answers on Family (Friends) Personal Loan Agreement

What is a Family (Friends) Personal Loan Agreement?

A Family (Friends) Personal Loan Agreement is a formal contract between two parties, often involving a borrower and a lender who are family members or friends. This agreement outlines the terms of the loan, including the amount borrowed, interest rate (if any), repayment schedule, and any other conditions or obligations. Its primary aim is to ensure clarity, prevent misunderstandings, and preserve the relationship between the parties involved.

Why is it important to have a Personal Loan Agreement even among family members or friends?

While lending money to family members or friends can be based on trust, having a written Personal Loan Agreement helps to avoid potential conflicts. It serves as a clear record of the loan's terms, preventing memory lapses or disagreements about the conditions agreed upon initially. Moreover, it can provide legal protection should the arrangement go awry, and help ensure that both parties are treated fairly and that the lender's investment is protected.

What should be included in a Family (Friends) Personal Loan Agreement?

A comprehensive Personal Loan Agreement should contain several key components: the full names and contact information of the lender and borrower, the loan amount, interest rate (if applicable), repayment schedule (including dates and amounts), and any collateral securing the loan. It may also include provisions for late payments, including potential penalties or interest rate adjustments, and conditions under which the loan must be repaid in full (e.g., upon the borrower's death or bankruptcy).

Can interest be charged on a personal loan between family or friends, and if so, how is it calculated?

Interest can be charged on a personal loan between family or friends, and it is often encouraged to prevent the loan from being considered a gift by tax authorities. The interest rate should be agreed upon by both parties and specified in the loan agreement. It's commonly set at a rate comparable to that of a market rate to make the loan fair and reasonable. However, it's important to check the applicable federal and state laws to ensure the chosen interest rate is legal and does not exceed usury limits.

What happens if the borrower cannot repay the loan as agreed?

If a borrower finds themselves unable to repay the loan according to the terms set out in the agreement, the first step should be communication between the borrower and lender to discuss the situation. It may be possible to negotiate a modified repayment plan that suits both parties. If such agreements cannot be reached, the lender may have legal ground to pursue repayment through the court system, depending on the specific terms of the agreement and local laws.

Is a witness or notarization required for a Personal Loan Agreement to be legally binding?

While not always required, having a witness or notarizing a Personal Loan Agreement can add a layer of validation and protection for both parties involved. The requirement for a witness or notarization varies by state, but even in cases where it is not mandatory, it may help in the enforcement of the agreement should disputes arise. Consultation with a legal professional can provide guidance specific to one's situation and jurisdiction.

Common mistakes

Lending money to friends or family can often lead to unforeseen complications and resentment if not handled properly, especially without a clear agreement. One common mistake people make when filling out a Family (Friends) Personal Loan Agreement form is not specifying the loan amount in clear terms. It's crucial to delineate the exact amount being loaned. Ambiguities or approximations can lead to disputes later on, as memories fade and interpretations vary over time.

Another area often overlooked is the failure to include the repayment schedule or terms. This schedule should detail when the repayment is expected to begin and the frequency of payments, whether monthly, quarterly, or on another agreed timeline. Without this schedule, the borrower might assume a more lenient repayment plan than the lender had in mind, which could strain the relationship. Moreover, specifying if the repayment will be in installments or a lump sum is equally important to avoid any confusion.

Interest rates are a tricky subject in personal loan agreements between friends and family. Many choose to forego interest to keep things simple or out of kindness. However, when interest is part of the agreement, failing to clearly define the rate and how it will be applied constitutes another prevalent mistake. Whether the interest is simple or compounded, clarity on this issue can prevent feelings of being taken advantage of or surprises when the total amount repayable grows unexpectedly.

Last but certainly not least, a glaring oversight often made is not delineating the consequences of a default. What happens if the borrower cannot, or does not, meet the agreed repayment terms? Not only should the agreement outline potential late fees, but it may also need to address more severe measures, such as recourse to legal action or collateral claims. Without these stipulations, the lender is left with few options for recourse, and the borrower may not feel the urgency or importance of adhering to the terms of the loan.

In summary, failure to address these critical components in a Family (Friends) Personal Loan Agreement can transform a gesture of goodwill into a source of tension and conflict. Thus, ensuring the loan amount, repayment terms, interest rates, and consequences of default are clearly stated is not just about protecting one's financial investment, but preserving important personal relationships as well.

Documents used along the form

When individuals decide to formalize a personal loan among friends or family, a Family (Friends) Personal Loan Agreement form often serves as the foundation document. This important agreement details the loan amount, repayment schedule, interest rate, and any other conditions relevant to the money exchanged. To further protect both the lender and borrower, and to comply with legal and financial requirements, several additional forms and documents are commonly used alongside this agreement. Understanding these documents can enhance the security and clarity of the transaction for all parties involved.

- Promissory Note: This document is a promise by the borrower to pay back the borrowed amount under specified conditions. It outlines the loan’s terms, including interest rate and repayment schedule, in a more formalized manner and serves as a legal record of the debt.

- Amortization Schedule: An amortization schedule offers a detailed breakdown of each payment over the course of the loan’s life. It shows how much of each payment goes toward the principal and how much goes toward interest. This document helps both parties understand how the loan balance decreases over time.

- Personal Financial Statement: Particularly necessary for larger loans, this document provides a snapshot of the borrower’s financial health. It lists assets, liabilities, income, and expenses, offering the lender insight into the borrower's ability to repay the loan.

- Lien Agreement: If the loan is secured with collateral, a lien agreement may be used to give the lender a legal right to the property until the loan is repaid in full. This document is crucial in ensuring the lender can recover their funds if the borrower fails to fulfill the repayment terms.

- Gift Letter: In situations where the lender does not expect repayment and the money is given as a gift, a gift letter may be necessary to clarify the nature of the transaction. This is particularly useful for tax purposes, to document that the transaction is not a loan but a gift.

- Loan Amendment Agreement: If both parties agree to changes in the loan terms after the initial agreement, a loan amendment agreement is essential. This document outlines any modifications to the original loan agreement, ensuring that all changes are mutually agreed upon and legally documented.

In conclusion, while a Family (Friends) Personal Loan Agreement outlines the basic elements of a personal loan between loved ones, the aforementioned documents can provide additional legal protections, clarity, and structure to the agreement. Ensuring that all these documents are correctly used and filled can prevent misunderstandings and disputes, making the lending process smoother and more secure for everyone involved.

Similar forms

The Family (Friends) Personal Loan Agreement form shares similarities with a Promissory Note. Both documents serve as written promises to pay back a sum of money borrowed. Where they align is in their core function: outlining the amount borrowed, interest rates if applicable, repayment schedule, and any other terms related to the loan. The key distinction is that a Promissory Note is often more formal and could be used in a broader range of lending situations, not limited to personal relationships.

Somewhat akin to this is the Personal Loan Contract. This contract is another variant that closely mirrors a Family (Friends) Personal Loan Agreement by specifying the loan details between individuals. It emphasizes the mutual understanding and agreement on how the borrowed funds will be repaid. The difference often lies in the level of detail and strictness in conditions, which could include collateral as a loan security, a feature less typical in informal lending agreements among family or friends.

A Loan Amendment Agreement is an additional document that shares its purpose with aspects of the Family (Friends) Personal Loan Agreement. When the original terms of a loan agreement need adjustments—be it due to changes in repayment terms, interest rates, or loan amounts—an Amendment Agreement is brought into play. It's a means to officially modify the existing contract's conditions, ensuring all parties are on the same page, much like updating terms in a more casual personal loan agreement.

Then, there's the IOU (I Owe You) document, which can be considered a less formal cousin of the Family (Friends) Personal Loan Agreement. An IOU straightforwardly acknowledges that a debt exists without delving into the specifics of repayment schedules, interest rates, or even collateral. It's a simpler form of acknowledgment between two parties that money has been borrowed and needs to be paid back, offering less protection and detail than a fully-fledged loan agreement.

A Debt Settlement Agreement shares a relationship with the Family (Friends) Personal Loan Agreement by dealing with the repayment of borrowed money. However, its focus is on settling debts under conditions that differ from the original terms, often involving a reduction of the owed amount. This type of agreement comes into play when the borrower faces difficulty in fulfilling the original repayment terms, requiring negotiations for a feasible settlement.

Similar in context is the Security Agreement, particularly when personal loans involve collateral. This document outlines the specifics about the asset(s) pledged as security for the loan, should the borrower fail to make repayments. It details the rights of the lender to seize the collateral, again emphasizing the legal framework within which loans are managed, albeit more commonly used in formal lending scenarios than in personal loans between family and friends.

Lastly, the Guarantee Agreement parallels the Family (Friends) Personal Loan Agreement when a third party is involved as a guarantor for the loan, ensuring the lender that the loan will be repaid. This agreement explicitly lays out the guarantor's obligations to fulfill the debt if the original borrower cannot. It serves as an added layer of security for the lender, introducing another dimension of formal assurance, likening itself to personal loans with a co-signer, strengthening trust in the transaction.

Dos and Don'ts

When filling out a Family (Friends) Personal Loan Agreement form, it's crucial to approach the process with careful consideration and clarity. This document not only formalizes the loan but also protects the relationship between the involved parties. Here are the things you should and shouldn't do to ensure a smooth, respectful, and legally sound agreement.

Do:

- Clearly state the loan amount and the repayment schedule. This includes the initial amount given and the dates or criteria under which repayments are expected.

- Include the interest rate, if any. Deciding whether to apply interest, and at what rate, can help in avoiding any misunderstandings or legal complications in the future.

- Document any collateral securing the loan. If the loan is secured against a piece of property or item, it should be described exactly.

- Have all parties involved sign the agreement. This formalizes the commitment and terms agreed upon by everyone.

- Get the document witnessed or notarized, depending on the legal requirements in your jurisdiction. This adds another layer of formality and protection.

Don't:

- Leave any terms vague or unspecified. Ambiguity can lead to disagreements and strain on personal relationships.

- Forget to specify what happens if the borrower defaults. Clear consequences help manage expectations and responsibilities.

- Exclude a provision for amending the agreement. Life is unpredictable; having a method to modify the agreement can be crucial.

- Let personal feelings or relationships interfere with the agreement's terms. Treat the loan with the same seriousness as a bank loan.

- Rely solely on verbal agreements or understandings. Without written documentation, it becomes challenging to enforce the terms or prove the existence of the loan.

Misconceptions

When families or friends decide to lend money amongst themselves, a Family (Friends) Personal Loan Agreement can help make things official. However, several misconceptions can cause hesitation or misuse of this important document. Let’s clear up some common misunderstandings:

It’s too formal for personal relationships. Many people believe that introducing a formal agreement into a personal relationship can signal distrust. However, having a written agreement helps clarify the terms and expectations, protecting the relationship in the long run.

Oral agreements are just as good. While oral agreements might hold some weight, they are challenging to enforce and prove in court. A written document provides a tangible record of the loan’s terms and conditions.

It’s only necessary for large loan amounts. Regardless of the loan size, misunderstandings can occur. A personal loan agreement is beneficial for any amount, as it lays out repayment schedules, interest rates, and consequences for non-repayment.

There’s no need to charge interest. People often skip including interest rates when lending money to friends or family. Yet, for tax purposes, the IRS may view a zero-interest loan as a gift, potentially triggering gift tax implications. To avoid this, it’s advisable to include a minimal interest rate.

All terms and conditions are set in stone. The flexibility of a personal loan agreement allows both parties to negotiate terms that work best for them. It’s a customizable tool, not a one-size-fits-all form.

Only the borrower needs to sign the agreement. For the agreement to be legally binding, both the lender and the borrower should sign. This confirmation documents the mutual understanding and agreement of the terms.

It's enough to have just the agreement for legal protection. While the agreement is a key part of documenting a loan, maintaining records of payments made or received and any communications about the loan can provide additional legal protection and clarity.

Using a Family (Friends) Personal Loan Agreement is a proactive step towards ensuring transparency and accountability in personal lending. By debunking these misconceptions, borrowers and lenders can foster healthier financial relationships within their personal networks.

Key takeaways

When considering a personal loan agreement among family or friends, it's vital to approach the process with care and formality. Here are key takeaways for effectively filling out and using the Family (Friends) Personal Loan Agreement form:

- Ensure that all parties involved clearly understand the loan's terms, including the loan amount, interest rate (if applicable), repayment schedule, and any other relevant conditions, before signing the agreement.

- Include the full legal names and contact information of both the lender and borrower in the agreement to avoid any ambiguity regarding the parties involved.

- Specify the exact loan amount in both words and numbers to prevent disputes or misunderstandings about the total money being borrowed.

- Decide if the loan will carry interest. If so, detail the interest rate and how it will be calculated. Always check state laws to ensure the rate is legal.

- Clearly outline the repayment plan, including start and end dates, frequency of payments (monthly, quarterly, etc.), and payment amounts, to ensure both parties are in agreement on expectations.

- Include a clause on late payment fees or penalties to encourage timely repayments and detail the consequences of failing to meet the agreed-upon terms.

- Add a provision for how disputes will be resolved should they arise, whether through mediation, arbitration, or court proceedings, to prepare for any disagreements that may occur.

- Both the lender and the borrower should sign the agreement in the presence of a witness or notary to add an extra layer of authenticity and commitment to the document.

- Keep a copy of the signed agreement in a safe place. Both parties should have a copy to refer back to during the repayment period, ensuring that all terms are being met and to resolve any disputes that may arise.

By carefully completing and using a Family (Friends) Personal Loan Agreement form, lenders and borrowers can protect their relationship and their finances, ensuring that both parties are clear on the expectations and fulfill their obligations.

Consider More Types of Family (Friends) Personal Loan Agreement Forms

Sample Employee Loan Agreement - It often includes provisions for payroll deductions as a repayment method, offering a convenient option for both parties involved.

Iou Date Meaning - Though enforceability can vary, having a signed IOU increases the seriousness of the agreement.