Official Employee Loan Agreement Document

In today's dynamic work environment, financial assistance in the form of employee loans has become a beneficial tool for both employers and employees. With the aim of fostering a supportive workplace, many organizations offer loans to their employees under conditions that are often more favorable than those available through traditional financial institutions. Such assistance can cover various needs, from emergency expenses to advancing educational goals. Enter the Employee Loan Agreement form, a crucial document meticulously crafted to ensure clarity, fairness, and legality in these transactions. This form outlines the loan's terms, including the loan amount, repayment schedule, interest rate (if applicable), and any collateral required. It serves as a binding contract that protects both the employer's interests and the employee's rights, ensuring that both parties are clear on their obligations. Addressing the complexities inherent in financial transactions within the workplace, the Employee Loan Agreement form provides a structured and legally sound framework that supports the financial wellbeing of employees while safeguarding the employer's assets.

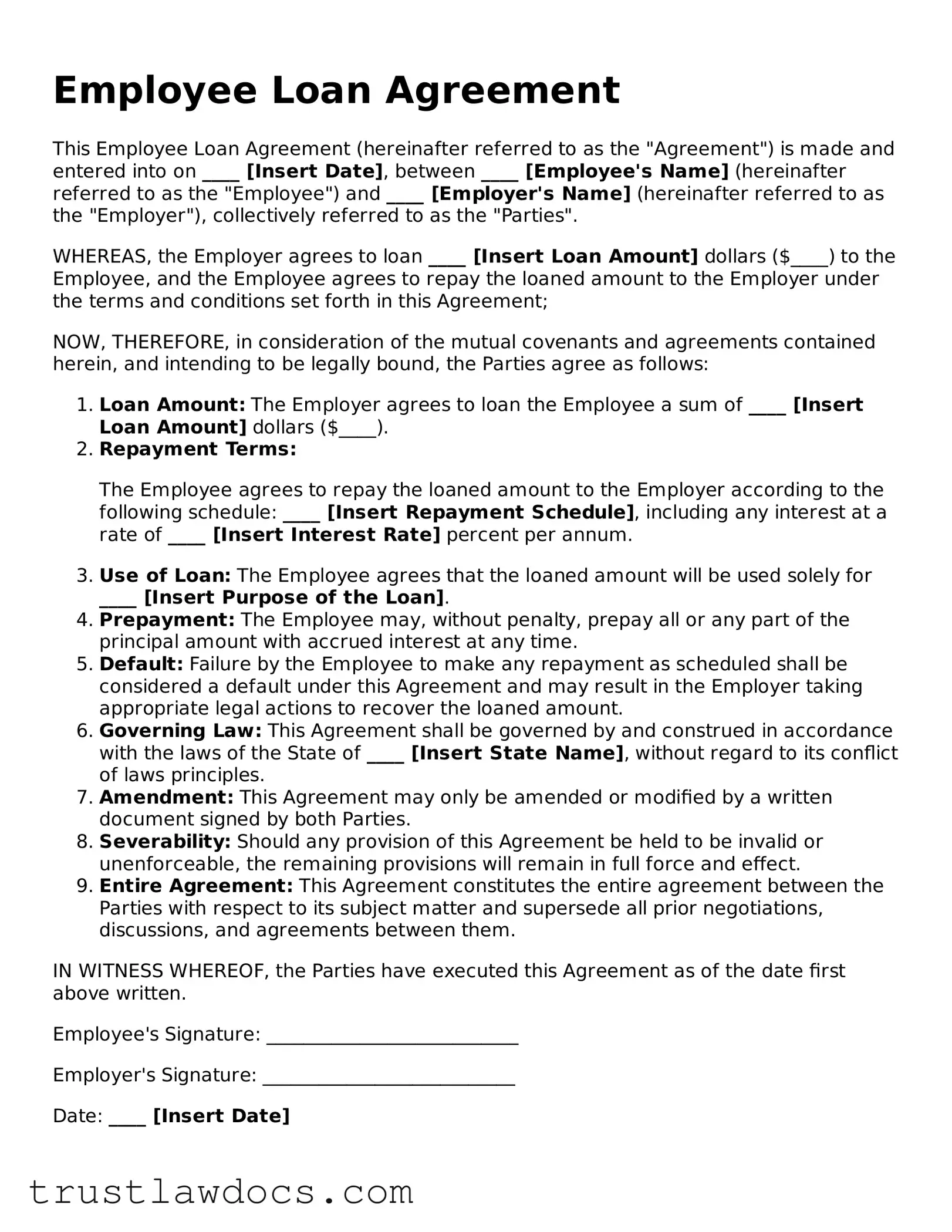

Form Example

Employee Loan Agreement

This Employee Loan Agreement (hereinafter referred to as the "Agreement") is made and entered into on ____ [Insert Date], between ____ [Employee's Name] (hereinafter referred to as the "Employee") and ____ [Employer's Name] (hereinafter referred to as the "Employer"), collectively referred to as the "Parties".

WHEREAS, the Employer agrees to loan ____ [Insert Loan Amount] dollars ($____) to the Employee, and the Employee agrees to repay the loaned amount to the Employer under the terms and conditions set forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, and intending to be legally bound, the Parties agree as follows:

- Loan Amount: The Employer agrees to loan the Employee a sum of ____ [Insert Loan Amount] dollars ($____).

- Repayment Terms:

The Employee agrees to repay the loaned amount to the Employer according to the following schedule: ____ [Insert Repayment Schedule], including any interest at a rate of ____ [Insert Interest Rate] percent per annum.

- Use of Loan: The Employee agrees that the loaned amount will be used solely for ____ [Insert Purpose of the Loan].

- Prepayment: The Employee may, without penalty, prepay all or any part of the principal amount with accrued interest at any time.

- Default: Failure by the Employee to make any repayment as scheduled shall be considered a default under this Agreement and may result in the Employer taking appropriate legal actions to recover the loaned amount.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of ____ [Insert State Name], without regard to its conflict of laws principles.

- Amendment: This Agreement may only be amended or modified by a written document signed by both Parties.

- Severability: Should any provision of this Agreement be held to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

- Entire Agreement: This Agreement constitutes the entire agreement between the Parties with respect to its subject matter and supersede all prior negotiations, discussions, and agreements between them.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

Employee's Signature: ___________________________

Employer's Signature: ___________________________

Date: ____ [Insert Date]

PDF Form Details

| Fact | Description |

|---|---|

| Purpose | Sets terms and conditions under which an employee receives a loan from their employer. |

| Governing Law | Varies by state, but typically includes interest rate caps and repayment terms as defined under state law. |

| Key Elements | Loan amount, interest rate, repayment schedule, and consequences of default. |

| Interest Rate | Must comply with state usury laws to avoid being considered predatory. |

| Repayment Schedule | Details how and when the loan must be repaid, often via payroll deductions. |

| Default Consequences | Includes potential for legal action, wage garnishment, or termination of employment in severe cases. |

| Benefits to Employee | Provides financial support without needing traditional credit checks or collateral. |

| Considerations | Employers must consider potential tax implications and ensure the agreement does not violate labor laws. |

How to Write Employee Loan Agreement

Filling out an Employee Loan Agreement is an essential step for both employers and employees when documenting a loan arrangement within the context of employment. This process ensures clarity, legality, and mutual understanding regarding the loan's terms and conditions. A well-completed form can prevent future misunderstandings and conflicts, offering peace of mind to both parties involved. Once you've completed the form, the next step involves both parties reviewing the filled-out document, signing it, and retaining copies for their records. This signed document then serves as a binding agreement, outlining the loan repayment schedule, interest rates if applicable, and consequences of non-repayment.

- Begin by filling out the date the agreement is being made at the top of the form.

- Enter the full legal names and addresses of both the employer and the employee in the designated sections.

- Specify the loan amount in words and figures to prevent any misunderstanding.

- Document the purpose of the loan to maintain transparency and ensure that both parties are aware of the loan's intended use.

- Detail the repayment schedule, including the start date, frequency of payments (e.g., monthly), and the total duration of the repayment period.

- If applicable, clearly state the interest rate per annum and calculate the total interest to be paid over the loan period.

- Include terms related to late payments, such as penalties or adjustments to the repayment schedule, to safeguard the agreement's terms.

- For security, if any assets are being used as collateral, describe them in full detail within the agreement.

- Both parties should read through the agreement carefully to ensure understanding and agreement on all points.

- Have the employer and employee sign and date the bottom of the form. Witnesses may also need to sign, depending on state laws or the preferences of the parties involved.

- Finally, distribute copies of the signed agreement to both the employer and the employee, ensuring each party retains a copy for their records.

Get Answers on Employee Loan Agreement

What is an Employee Loan Agreement form?

An Employee Loan Agreement form is a document used when an employer lends money to an employee. It outlines the terms and conditions of the loan, including the loan amount, repayment schedule, interest rates if applicable, and any other obligations. This formal agreement ensures both parties understand their rights and responsibilities, helping to prevent misunderstandings and disputes.

When should an Employee Loan Agreement form be used?

This form should be used anytime an employer agrees to loan money to an employee. It's important to have this agreement in place before any money changes hands, to protect both the employer's investment and the employee's interests. Whether the loan is for personal reasons, such as emergency expenses, or professional development, having a clear contract is essential.

What are the key components of an Employee Loan Agreement form?

The key components of this form include the loan amount, repayment schedule, interest rate, and any security or collateral for the loan. It should also specify the conditions under which the loan must be repaid in full, such as termination of employment, and detail any consequences for late or missed payments. Clarity on these points helps prevent future conflicts.

Can an Employee Loan Agreement form include an interest rate?

Yes, an Employer can charge interest on the loan provided to an employee. However, the interest rate must be clearly stated in the agreement and should comply with state usury laws to ensure it's not excessive. Both parties need to agree on the rate before finalizing the agreement.

What happens if an employee leaves the company before repaying the loan?

The terms under which an employee must repay the loan if they leave the company should be clearly outlined in the agreement. This might include a lump sum payment upon departure or continued installment payments as previously agreed. It’s essential for the agreement to detail the procedure for such circumstances to avoid misunderstandings or legal disputes.

Common mistakes

One common mistake individuals often make when filling out the Employee Loan Agreement form is neglecting to specify the exact terms of repayment. This oversight can lead to ambiguity regarding the timeframe for repayments, the amount of each installment, and whether interest will be applied to the borrowed sum. Clearly outlining these conditions is imperative to ensure both parties have a mutual understanding of the obligations involved. Without this clarity, the agreement can be difficult to enforce, leaving room for misunderstandings and potential disputes.

Another frequent error occurs when individuals fail to properly document the loan amount. Sometimes, the figures are either inaccurately represented or not specified in clear, numerical terms. This can lead to confusion over the exact amount of money lent, which complicates repayment. Ensuring the loan amount is explicitly stated in the document, in both numeric and written form, can prevent such issues and help maintain a transparent record of the transaction.

A critical oversight in many Employee Loan Agreements is the absence of signatures from both the lender and the borrower at the conclusion of the document. The signatures represent a concrete acknowledgment and agreement to the terms laid out in the document by both parties. A lack of signatures can invalidate the entire agreement, rendering it unenforceable in a legal context. Therefore, having all relevant parties sign the document is not just a formality but a crucial step in legitimizing the agreement.

Last but not least, failing to include a clause that addresses modifications or amendments to the agreement is a mistake that can hinder the flexibility of the arrangement. Circumstances may change, necessitating adjustments to the terms of the loan. Without a provision for making changes, any adjustments would require drafting a new agreement, which can be cumbersome and inefficient. Including a simple clause that allows for amendments, subject to agreement from both parties, ensures the document can easily be updated to reflect new terms without compromising its legal validity.

Documents used along the form

When engaging in an arrangement involving an employee loan, it's critical to have a clear and thorough understanding of all the documentation involved. Apart from the Employee Loan Agreement form, there are several key documents and forms that are commonly used to ensure the process is handled professionally and comprehensively. These documents play a pivotal role in clarifying the terms, safeguarding both the employer and the employee, and ensuring that the agreement complies with applicable laws and regulations.

- Promissory Note: This is a binding document where the employee promises to repay the borrowed amount under specified terms. It outlines the loan amount, interest rate, repayment schedule, and consequences of non-payment.

- Loan Repayment Schedule: Gives a detailed account of the payment deadlines, including the amounts due at each period. It helps both the employer and the employee keep track of payments and balances over time.

- Direct Debit Authorization Form: This form grants permission to the employer to deduct loan repayments directly from the employee's salary. It specifies the amounts and dates of deductions, providing a systematic way to manage repayment.

- Interest Rate and Fee Disclosure Form: Clearly communicates any interest or fees associated with the loan. Transparency about these costs helps prevent disputes and ensures the employee understands their obligations.

- Confidentiality Agreement: While not directly related to the financial aspects of the loan, this agreement is crucial for protecting sensitive information disclosed during the loan process. It outlines what information is confidential and the obligations of both parties to protect it.

- Default and Remedies Clause Document: Outlines the course of action in the event the employee fails to comply with the terms of the loan agreement. It details the remedies available to the employer, including acceleration of debt, penalties, and collection methods.

In conclusion, the Employee Loan Agreement form is just one piece of the puzzle in the employee loan process. By accompanying it with documents like promissory notes, repayment schedules, and authorization forms, both parties can ensure a transparent, fair, and enforceable agreement. These additional documents not only provide clarity and peace of mind but also help in maintaining a professional and amicable relationship between the employer and the employee throughout the duration of the loan.

Similar forms

The Promissory Note is closely related to an Employee Loan Agreement as both outline the terms under which money is borrowed and will be paid back. The key difference is that a Promissory Note is typically a more straightforward document, often used for more informal loans or personal loans between individuals. It sets out the repayment schedule, interest rate, and what happens in case of default, but may not include specific clauses related to employment as an Employee Loan Agreement does.

An Employment Agreement shares similarities with an Employee Loan Agreement in that both are formal contracts between an employer and an employee. However, an Employment Agreement focuses on the terms of employment, such as duties, salary, and duration, rather than loan details. The connection lies in the incorporation of clauses related to the loan directly into the Employment Agreement, thus binding the repayment terms to the tenure of employment.

A Personal Loan Agreement, much like an Employee Loan Agreement, is a formal contract between two parties regarding the borrowing and repayment of money. The main distinction is that Personal Loan Agreements are used between individuals who may or may not have an employer-employee relationship, making them more versatile for various personal lending situations. Both documents typically specify loan amounts, interest rates, repayment schedules, and consequences of non-repayment.

Debt Settlement Agreements share a common goal with Employee Loan Agreements: addressing and resolving the repayment of money owed. A Debt Settlement Agreement comes into play when the borrower is unable to meet the original repayment terms and seeks to negotiate a reduction or a new plan for repayment. While it also includes the amount owed and new terms of repayment, it is distinct because it signifies a modification to an existing repayment obligation, rather than setting out the terms of a new loan.

The Confidentiality Agreement, while not directly related to the financial components of an Employee Loan Agreement, often intersects in situations where sensitive information about the loan or the parties involved needs to be protected. Both agreements can include clauses that limit the disclosure of information related to the transaction and ensure that details of the loan, or any proprietary information shared as part of the employment relationship, remain confidential.

Last but not least, a Guarantor Agreement complements an Employee Loan Agreement by providing an additional layer of security to the lender. In cases where there's uncertainty about the employee's ability to repay, a guarantor commits to fulfilling the repayment obligations if the primary borrower fails to do so. This agreement is tied to the Employee Loan Agreement through the guarantor's promise, adding reassurance for the lender by involving a third party as a safety net.

Dos and Don'ts

When filling out an Employee Loan Agreement form, it is crucial to approach the task with care and attention to detail. This document is a formal contract that outlines the loan’s terms, including the repayment schedule, interest rate, and any other conditions agreed upon between the employer and employee. Below are essential do's and don'ts to ensure the process is handled correctly and efficiently.

Do's:

- Read the entire form carefully before writing anything. Understanding each section's requirements and implications is critical.

- Fill out the form neatly and legibly. If the document is hand-written, use black ink to ensure clarity and durability of the text.

- Ensure all the information provided is accurate and factual. This includes personal information, loan amount, repayment terms, and interest rates.

- Clarify any terms or sections that are unclear before signing the agreement. It might be necessary to consult with a legal advisor or HR representative.

- Keep a copy of the signed agreement for personal records. This copy can be crucial for future reference in case of any disputes or misunderstandings.

- Date the agreement correctly. The date is often important in legal documents and can affect the commencement of the loan term.

Don'ts:

- Do not leave any sections incomplete. Each section is important and requires attention. An incomplete form can lead to misunderstandings or legal issues.

- Avoid using pencil or erasable ink. These can be easily altered, which compromises the integrity of the agreement.

- Refrain from signing the document before all terms are clear and agreed upon. Signing indicates full agreement with the conditions set forth.

- Do not rely on verbal agreements to supplement the written contract. All agreements should be explicitly stated in the document.

- Do not ignore the repayment schedule. It is crucial to adhere to the agreed-upon schedule to avoid potential legal and financial repercussions.

- Avoid rushing through the process. Taking the time to fill out the form correctly is key to establishing a clear and enforceable agreement.

Misconceptions

When it comes to Employee Loan Agreements, both employers and employees often enter into these contracts with a mix of preconceived notions and misunderstandings. Clearing up these misconceptions is key to ensuring that both parties enter into these agreements with a clear understanding of their implications. Let's debunk some common myths:

It's not necessary to have it in writing: A verbal agreement might seem easier, but without a written agreement, the terms can be easily misunderstood or forgotten. A written agreement ensures that both parties have a clear understanding of the loan's terms and conditions.

Standard templates work for everyone: While templates can be a good starting point, every organization is different. Customizing the agreement to fit the specific arrangement between the employer and employee ensures that it covers all necessary details relevant to their situation.

Interest rates don't apply: It's a common myth that loans provided by an employer to an employee are interest-free. However, to avoid tax complications, it is often advisable to charge interest at or above the Applicable Federal Rate (AFR).

It's an informal agreement: Some think that an Employee Loan Agreement is more of a gentleman's handshake than a legally binding contract. This is not true. Once signed, it is enforceable in a court of law.

Only the employee benefits: While it's easy to see the immediate benefit to the employee, employers can also benefit. Offering loans can improve employee retention and loyalty.

All loan agreements are the same: Employee Loan Agreements can vary widely. They can be customized to include repayment schedules, interest rates, and consequences of non-payment that are unique to the agreement between an employee and employer.

There are no tax implications: Loans, especially those with little or no interest, can have tax implications for both parties. Both should consult with a tax advisor to understand these implications fully.

Employees can't negotiate terms: Employees often feel they must accept the terms as presented. However, there is room for negotiation to ensure the terms are fair and manageable for both parties.

Repayment terms are rigid: While the Employee Loan Agreement outlines repayment terms, there may be flexibility. Employers and employees can sometimes agree to modify terms based on circumstances.

Legal assistance isn't necessary: It might seem straightforward, but getting legal advice can ensure that the agreement complies with all relevant laws and protects both parties' interests.

Understanding these key points and dispelling myths surrounding Employee Loan Agreements can lead to more productive, clear, and mutually beneficial arrangements. It's always recommended that both employers and employees approach these agreements with due diligence and with a clear understanding of their implications.

Key takeaways

Filling out and using an Employee Loan Agreement form requires attention to detail and understanding the document's implications. This agreement serves as a binding contract between an employer and an employee, outlining the terms and conditions of a loan provided by the employer. Here are four key takeaways to keep in mind:

- Accuracy is key: When completing the Employee Loan Agreement form, it's crucial to provide precise information. This includes the full names of both parties involved, the loan amount, repayment schedule, interest rate (if any), and any other terms related to the loan. Mistakes or omissions can lead to misunderstandings or legal complications down the line.

- Clear repayment terms: The agreement should specify how and when the loan will be repaid. This includes setting a schedule for repayment, whether deductions will be taken directly from the employee’s paycheck, and what happens in case of early repayment or default. Clarity in this section helps prevent disputes over repayments.

- Interest and taxes: It's important to consider whether the loan will carry an interest rate and how this interest will be calculated. Moreover, loans to employees may have tax implications, both for the employer and the employee. Guidance from a financial advisor or accountant can ensure compliance with tax regulations.

- Signatures: For the Employee Loan Agreement to be legally binding, it must be signed by authorized representatives from both parties. Make sure the employee and a duly authorized company representative sign the document. The signatures validate the agreement, confirming that both parties understand and agree to the terms.

Employers and employees alike should treat the Employee Loan Agreement with the seriousness it deserves. Taking the time to fill out the form correctly and comprehensively can prevent future financial and legal headaches, ensuring a smooth and transparent lending process.

Consider More Types of Employee Loan Agreement Forms

Iou Date Meaning - An effectively drafted IOU can offer a simple method to settle minor debts or loans.