Free Loan Agreement Form for California

In the realm of lending in California, the significance of a comprehensive and legally binding document cannot be understated. The California Loan Agreement form plays a pivotal role in this process, serving as a crucial tool for both lenders and borrowers. This essential document outlines the terms and conditions of the loan, including but not limited to the interest rate, repayment schedule, and the consequences of a breach. It is designed to protect the interests of both parties and ensure a clear understanding of the obligations and rights inherent in the lending process. Furthermore, the form addresses various legal requirements specific to California, making it a fundamental necessity for any loan transaction within the state. Its use is not only a best practice but, in many cases, a legal requirement to ensure compliance with state laws and regulations concerning financial transactions.

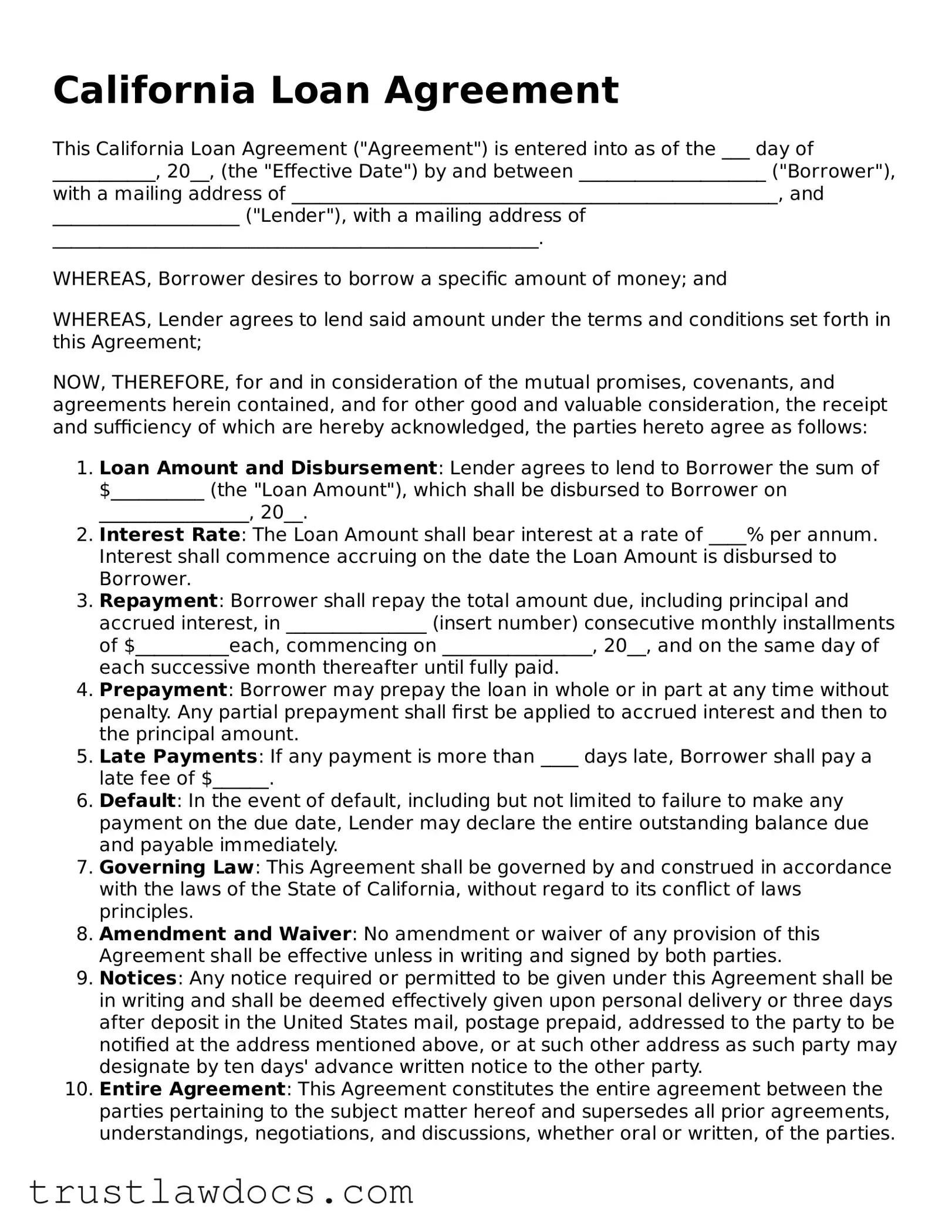

Form Example

California Loan Agreement

This California Loan Agreement ("Agreement") is entered into as of the ___ day of ___________, 20__, (the "Effective Date") by and between ____________________ ("Borrower"), with a mailing address of ____________________________________________________, and ____________________ ("Lender"), with a mailing address of ____________________________________________________.

WHEREAS, Borrower desires to borrow a specific amount of money; and

WHEREAS, Lender agrees to lend said amount under the terms and conditions set forth in this Agreement;

NOW, THEREFORE, for and in consideration of the mutual promises, covenants, and agreements herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

- Loan Amount and Disbursement: Lender agrees to lend to Borrower the sum of $__________ (the "Loan Amount"), which shall be disbursed to Borrower on ________________, 20__.

- Interest Rate: The Loan Amount shall bear interest at a rate of ____% per annum. Interest shall commence accruing on the date the Loan Amount is disbursed to Borrower.

- Repayment: Borrower shall repay the total amount due, including principal and accrued interest, in _______________ (insert number) consecutive monthly installments of $__________each, commencing on ________________, 20__, and on the same day of each successive month thereafter until fully paid.

- Prepayment: Borrower may prepay the loan in whole or in part at any time without penalty. Any partial prepayment shall first be applied to accrued interest and then to the principal amount.

- Late Payments: If any payment is more than ____ days late, Borrower shall pay a late fee of $______.

- Default: In the event of default, including but not limited to failure to make any payment on the due date, Lender may declare the entire outstanding balance due and payable immediately.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of California, without regard to its conflict of laws principles.

- Amendment and Waiver: No amendment or waiver of any provision of this Agreement shall be effective unless in writing and signed by both parties.

- Notices: Any notice required or permitted to be given under this Agreement shall be in writing and shall be deemed effectively given upon personal delivery or three days after deposit in the United States mail, postage prepaid, addressed to the party to be notified at the address mentioned above, or at such other address as such party may designate by ten days' advance written notice to the other party.

- Entire Agreement: This Agreement constitutes the entire agreement between the parties pertaining to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date first above written.

_______________________________ _______________________________

Borrower Signature Lender Signature

_______________________________ _______________________________

Borrower Printed Name Lender Printed Name

Date: ___________________________ Date: ____________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | The California Loan Agreement form is governed by the laws of the State of California, including but not limited to the California Finance Code, which regulates the terms and conditions under which loans may be made and enforced in the state. |

| Usage | This form is used to outline the details of a loan agreement between a borrower and a lender, specifying the loan amount, interest rate, repayment schedule, and other relevant terms. |

| Prepayment | In California, borrowers have the right to prepay the loan or any installment at any time without penalty unless specifically agreed otherwise in the loan agreement. |

| Interest Rate Cap | California law caps the interest rate that can be charged on personal loans, which varies based on the prime rate, but exceptions exist for certain financial institutions and circumstances. |

| Late Fees | Late fees for missed payments must be reasonable and are regulated by state law to ensure they are not punitive. |

| Required Disclosures | Lenders must provide borrowers with specific disclosures about the loan terms, borrower's rights, and the interest rate before finalizing the loan agreement, as mandated by the Truth in Lending Act (TILA) and other state regulations. |

How to Write California Loan Agreement

Filling out a California Loan Agreement form is a crucial step for both the borrower and the lender in setting the terms of a loan. This document is key to ensuring that the agreement between parties is legally binding and captures all necessary details such as loan amount, payment schedule, interest rate, and any collateral involved. Clear and accurate completion of this form is essential for protecting the rights and responsibilities of everyone involved. Below you'll find a step-by-step guide to assist you in filling out the form correctly.

- Gather all necessary information, including the full legal names and contact details of both the borrower and the lender, the principal amount of the loan, the interest rate, and the loan duration.

- Start by entering the date on which the loan agreement is being made at the top of the form.

- Write down the full legal names and addresses of both the borrower and the lender in their respective sections.

- Specify the principal amount of the loan. This is the amount of money being borrowed before any interest is added.

- Define the terms of the loan payment. Include how and when the loan will be repaid (e.g., in installments, a lump sum), the payment schedule, and any late payment fees.

- Detail the interest rate. Be clear whether the interest is fixed or variable and how it will be calculated and applied to the principal amount.

- If applicable, describe any collateral that the borrower is using to secure the loan. Provide a clear description of the collateral and state what will happen to it if the borrower fails to repay the loan as agreed.

- Include any additional clauses that are relevant to the loan agreement. These could involve the rights to prepay the loan or what happens in the event of a default.

- Review the agreement carefully, making sure all information is accurate and that both parties understand their obligations.

- Have both the borrower and lender sign and date the agreement. Consider having a witness or notary present at signing for additional legal validation.

Once the form is fully completed and signed by both parties, it becomes a binding agreement that outlines the loan's terms and conditions. Both the borrower and the lender should keep a copy of the agreement for their records. Remember, the importance of this document lies not only in its ability to enforce terms but also in its power to prevent misunderstandings and disputes down the line. Therefore, taking the time to accurately fill out a California Loan Agreement form is a prudent step towards a smooth and clear financial transaction.

Get Answers on California Loan Agreement

What is a California Loan Agreement form?

A California Loan Agreement form is a legally binding document between a borrower and a lender, detailing the specifics of the loan. It outlines the amount being borrowed, the interest rate, repayment schedule, and any other terms and conditions pertinent to the agreement. This form is essential for ensuring that all parties have a clear understanding of their obligations and rights.

Who needs to sign the California Loan Agreement form?

Both the borrower and the lender must sign the California Loan Agreement form. Additionally, if there are co-borrowers or guarantors involved, they also need to sign the agreement. This ensures that everyone involved is legally committed to adhering to the terms laid out in the document.

Is a witness or notary required for a California Loan Agreement form?

While not always legally required, having a witness or notarizing the California Loan Agreement form is highly recommended. This extra step can provide an additional layer of legal protection and authenticity, helping to enforce the terms of the agreement should any disputes arise.

Can modifications be made to the California Loan Agreement form after signing?

Yes, modifications can be made to the California Loan Agreement form after it has been signed, but any changes must be agreed upon by all parties involved. Any amendments should be documented in writing and appended to the original agreement, with all parties providing their signatures to validate the modifications.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender has the right to pursue legal action to recover the outstanding debt. The specific course of action may depend on the terms of the agreement and California state laws. This could include seizing collateral or garnishing wages, among other measures.

Are there any penalties for early repayment of the loan?

This depends on the terms outlined in the California Loan Agreement form. Some agreements may include prepayment penalties, discouraging the borrower from paying off the loan early. Others may not impose any penalties for early repayment. It's crucial to review the terms carefully before signing the agreement.

How can a California Loan Agreement form be enforced if there are disputes?

If disputes arise, the enforcement of a California Loan Agreement form typically begins with mediation or arbitration, as agreed upon by the parties. If these measures do not resolve the issue, legal action can be taken in court. The agreement itself and the evidence of compliance (or lack thereof) will be crucial in such proceedings.

Common mistakes

When individuals endeavor to complete the California Loan Agreement form, several common errors may occur, leading to potential misunderstandings or legal complications down the line. First and foremost, an oversight often seen is the incomplete filling of personal details. Ensuring every section is accurately completed with current information is paramount. This step sets the foundation for the entire agreement, thus any inaccuracies can significantly impact its enforceability.

Another mistake frequently encountered is the failure to specify the loan amount in clear terms. It is crucial that the figure is both written in numerals and spelled out in words to avoid any ambiguity. This dual method of stating financial figures helps to ensure that both parties have a mutual understanding of the loan's size.

Interest rates are often a complex area, and errors here are common. Some individuals neglect to detail whether the interest rate is fixed or variable. This omission can lead to confusion and conflict over time, especially if the market fluctuates significantly. Clarifying the nature of the interest rate from the outset is essential for a transparent agreement.

Terms regarding repayment are sometimes glossed over, but they should be defined with precision. Misunderstandings about the repayment schedule — whether monthly, quarterly, or on another basis — can disrupt the relationship between the lender and borrower. Equally, not clearly stating the loan's maturity date can lead to disagreements about when the total amount is due.

Collateral is another area where details are often insufficient. If the loan is secured, a clear description of the collateral, along with any conditions related to its seizure, should be provided. Without this, enforcing the agreement in case of default becomes more challenging.

Penalties for late payments or defaults are frequently not specified clearly enough. This vagueness can leave the lender without a clear recourse in such situations, and the borrower uncertain about the consequences of failing to meet the agreement's terms.

The omission of a clause regarding loan modification is a common oversight. Circumstances change, and having a provision for renegotiating the terms can save both parties considerable strain. Without it, adjusting the agreement to fit new situations becomes a legal quandary.

Signatures and dates are, surprisingly, areas where errors often occur. A loan agreement is not legally binding until all relevant parties have signed and dated the document. Sometimes, individuals forget to sign, only fill in one date where multiple are required, or neglect to have a witness where necessary, rendering the document potentially unenforceable.

Finally, not consulting a professional for advice is a mistake many make. Given the legal and financial implications of a loan agreement, professional guidance can help navigate the complexities and ensure the agreement is solid, fair, and free of errors. Ignoring this step may lead to a document that does not fully protect one's interests or anticipate potential issues.

Documents used along the form

When you're navigating the world of lending and borrowing in California, a Loan Agreement form is a critical tool in ensuring that both parties understand the terms of their financial arrangement. However, this document does not stand alone. To form a complete picture of the rights and responsibilities of each party, and to meet legal requirements, several other forms and documents are often used in tandem with the California Loan Agreement form. Let’s take a look at some of these essential documents.

- Promissory Note: This document complements the Loan Agreement by detailing the borrower's promise to repay the loan. It includes the amount borrowed, interest rate, repayment schedule, and the consequences of failing to make payments as agreed.

- Deed of Trust: In transactions involving real estate, this document is used alongside a Loan Agreement. It places a property as collateral against the loan, providing the lender a means of recourse should the borrower default on their payments.

- Security Agreement: Similar to a Deed of Trust but more commonly used with personal property, a Security Agreement details the collateral offered by the borrower to secure the loan. This could include equipment, vehicles, or inventory.

- Guaranty: This is an agreement in which a third party (the guarantor) agrees to take on the debt obligations of the borrower if they default on their loan. It's often used when the borrower’s creditworthiness is in question.

- Amendment Agreement: Over the life of a loan, things can change. An Amendment Agreement is used to document any changes made to the original Loan Agreement, ensuring that both parties are on the same page.

- Release of Liability: Upon full repayment of the loan, this document is used to officially release the borrower from their obligation. It provides proof that the debt has been satisfied completely.

Together with the California Loan Agreement form, these documents function as a comprehensive framework, safeguarding the interests of both lender and borrower. They ensure clarity, reduce the potential for disputes, and provide legal protection. Whether you’re stepping into the role of a borrower or a lender, understanding these documents and how they interact with your Loan Agreement will equip you for a smoother financial transaction.

Similar forms

A Promissory Note is quite similar to a California Loan Agreement in that it is a written promise to pay a specified amount of money to another party under specified conditions. However, a Promissory Note is simpler, often involving fewer parties (just the borrower and the lender) and less detailed terms of repayment. It typically doesn't include the extensive clauses on default and remedies that a loan agreement would contain. Both serve as legally binding agreements for the repayment of debt but differ in complexity and detail.

A Mortgage Agreement shares similarities with a California Loan Agreement as well, especially when it comes to loans related to real estate. In a Mortgage Agreement, the borrower agrees to put up a real estate property as collateral to secure a loan, which is not necessarily a feature of all loan agreements. Both documents outline the loan's terms, repayment schedule, and interest rates. Yet, the Mortgage Agreement specifically ties the loan to a physical property, and default can lead to foreclosure on that property.

The Line of Credit Agreement is another document with similarities to a California Loan Agreement. This document establishes a maximum loan balance that the borrower can access, not unlike some loan agreements that might set a maximum draw limit. Both detail interest rates, repayment terms, and what constitutes default. However, the key difference lies in the flexibility of fund access. A Line of Credit Agreement offers ongoing access to funds up to the set limit, whereas a loan agreement typically involves a one-time lump sum disbursement.

A Business Loan Agreement and a California Loan Agreement are similar in that both are used to borrow money. However, a Business Loan Agreement specifically relates to business loans, detailing the loan's use in a business context, which might include acquisition, expansion, or operational costs. It shares common features with general loan agreements such as outlining repayment terms, security interests, and borrower and lender responsibilities, but it's tailored for business purposes with clauses that address the business's unique needs.

Debt Settlement Agreements bear similarities to a California Loan Agreement because they both involve terms of repayment. A Debt Settlement Agreement is used when a debtor is unable to pay back their loan as originally agreed and the parties agree on a reduced amount to be paid. It outlines the new terms for settling the debt, often less than the original amount. While both documents outline payment obligations, a debt settlement agreement specifically alters the terms of the original agreement due to financial hardship or negotiation.

A Co-Signer Agreement is akin to a California Loan Agreement in that it involves a loan but introduces a third party, the cosigner, who agrees to pay back the loan if the original borrower fails to make payments. This agreement adds an extra layer of security for the lender. It aligns with loan agreements in dictating repayment terms, but specifically details the cosigner's obligations and circumstances under which the cosigner would be called upon to fulfill the loan obligations.

Dos and Don'ts

When filling out a California Loan Agreement form, it's essential to proceed with caution and attention to detail. This document is a legally binding contract between the lender and borrower, dictating the terms under which money is lent and will be repaid. Here are some guidelines to help ensure the process is done accurately and efficiently.

Do:

- Review the entire form before starting: Ensure you understand each section and what is required. This understanding will prevent mistakes and reduce the need for corrections later.

- Provide accurate information: From the full names of the parties involved to the loan amount and repayment terms, every detail must be accurate. Errors can lead to legal issues or disputes down the line.

- Specify the interest rate: Clearly state the interest rate being charged on the loan. In California, the interest rate should not exceed the legal maximum, and it's vital for both parties to agree on this term.

- Document the repayment schedule: Detail the payment plan, including due dates and amounts for each installment. This clarity prevents misunderstandings regarding payment expectations.

- Sign and date the form: A loan agreement isn't enforceable unless it's signed by both parties. Ensure the document is signed and dated, solidifying the agreement's validity.

Don't:

- Leave blanks: Do not leave any fields empty. If a section does not apply, mark it with "N/A" or "None" to indicate that it has been considered and deemed not applicable.

- Use unclear language: Avoid using jargon or overly complex language. The goal is to make the agreement as clear as possible to all parties involved.

- Forget to include contingencies: Life is unpredictable. Therefore, include terms that cover potential scenarios such as late payments or early repayment.

- Overlook the need for a witness or notary: Depending on the nature of the loan and the amounts involved, having the document witnessed or notarized can add an extra layer of legal protection.

- Ignore legal advice: If anything is unclear or if the stakes are high, consulting with a legal professional can prevent future complications. It’s better to be safe and ensure that the agreement adheres to California law and protects both parties' interests.

Misconceptions

When it comes to understanding the California Loan Agreement form, various misconceptions can complicate the process for both lenders and borrowers. Clarifying these misunderstandings ensures that everyone involved can navigate loan agreements with confidence and fairness. Here are eight common misconceptions:

It must be drafted by a lawyer. While having a lawyer can ensure the agreement complies with all legal requirements, parties can draft a loan agreement without a lawyer's direct involvement. Many use standardized forms or guidelines provided by reputable sources to create their document.

A verbal agreement is just as binding. Although verbal contracts can be enforceable, proving the terms without written documentation is challenging. In California, loan agreements over a certain amount need to be in writing due to the Statute of Frauds.

Only interest rates are negotiable. Many terms within a loan agreement can be negotiated besides interest rates, including repayment schedules, collateral requirements, and consequences of default.

All loan agreements are basically the same. Loan agreements can vary greatly depending on the amount, term, purpose of the loan, and the parties involved. Customizing the document to reflect the specific agreement's terms is crucial.

There's no need to update the agreement. Changes in circumstances or regulations may necessitate updates to the agreement. Both parties should regularly review and, if necessary, modify the document to ensure its relevance and legality.

Signing without reading is fine if you trust the lender. Always thoroughly read and understand any legal document before signing, even if the other party is a trusted friend or family member. This protects both the borrower and the lender from future disputes.

The borrower is the only party who needs to uphold terms. Loan agreements are binding on both the lender and the borrower. Lenders also have obligations, such as following agreed-upon terms for providing the funds and adhering to agreed repayment terms.

Prepayment penalties are required. Not all loan agreements include prepayment penalties. Whether to include such penalties is a negotiable term, and their absence or presence should be clearly stated in the agreement.

Understanding these misconceptions allows both lenders and borrowers to approach California Loan Agreements with a clearer perspective and to ensure that the terms are fair and clearly understood by all involved.

Key takeaways

When navigating the process of using the California Loan Agreement form, certain key takeaways are essential for ensuring that the agreement is legally compliant, clear, and enforceable. Here are eight critical points to consider:

- Ensure all parties are correctly identified with their full legal names and addresses to avoid any ambiguity about who is obligated or entitled under the agreement.

- Clearly specify the loan amount and terms, including the exact amount lent and the repayment schedule. Precise figures and dates will prevent misunderstandings.

- Interest rates should be explicitly stated, and they must comply with California's usury laws to avoid imposing illegal or excessive interest.

- Include a clause detailing the use of collateral, if any, to secure the loan. This must clearly describe the collateral and conditions under which it can be taken if the loan is not repaid.

- Outline the consequences of late payments or default by the borrower. Specify any fees, increased interest rates, or other penalties to ensure clarity on repercussions.

- Consider adding a provision for prepayment, stating whether the borrower can pay off the loan early and if any penalties apply for doing so to avoid future disputes.

- The governing law clause is vital. Stipulate that the agreement is governed by the laws of California. This ensures any legal disputes will be resolved under California law.

- Both parties should review the entire agreement before signing. This final step is crucial to confirm that all terms are understood and agreed upon. Having witnesses or a notary public witness the signing can add an extra layer of legal protection.

Following these guidelines will help create a solid, legally binding loan agreement that protects both the lender and the borrower's interests, ensuring a straightforward repayment process.

Popular Loan Agreement State Forms

Texas Promissory Note Template - It often includes a severability clause, ensuring that if one part of the agreement is invalid, the rest remains enforceable.