Official Loan Agreement Document

Entering into a loan agreement is a significant financial decision, one that formalizes the act of lending money between two parties: the borrower and the lender. This essential financial document outlines the terms of the loan, including the amount of money being loaned, the interest rate, repayment schedule, and any collateral involved. It serves not only as a legal record of the loan but also as a clear set of expectations for both parties involved. Additionally, the form addresses conditions under which the agreement might be modified or terminated, and the consequences of a default by the borrower. Designed to protect both the lender's interests by ensuring repayment and the borrower's interests by detailing the loan's cost, a loan agreement is a key tool in personal and professional finance management. Its comprehensive nature makes it equally important in informal transactions between individuals and in more formal lending arrangements between businesses and financial institutions.

Loan Agreement for Specific States

Loan Agreement Document Types

Form Example

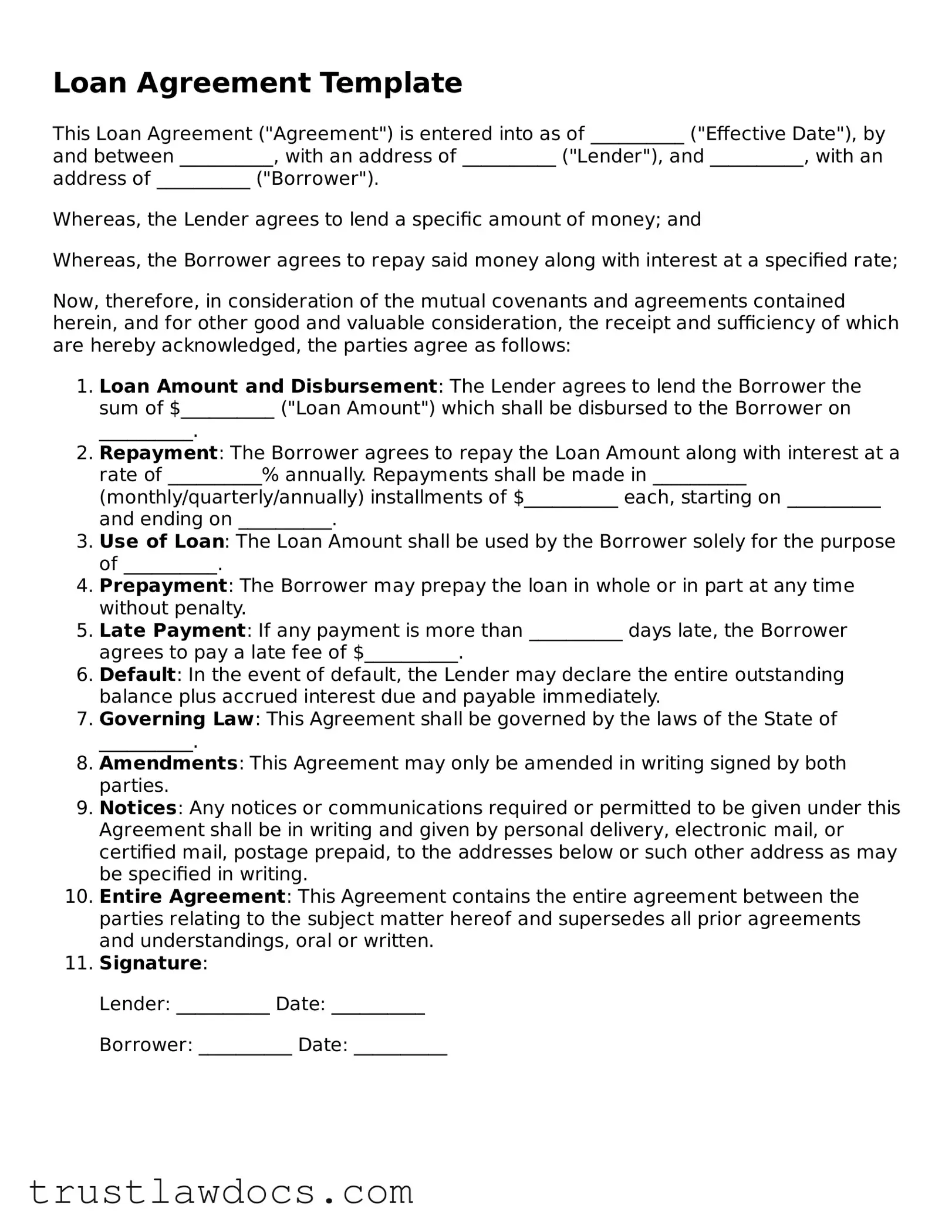

Loan Agreement Template

This Loan Agreement ("Agreement") is entered into as of __________ ("Effective Date"), by and between __________, with an address of __________ ("Lender"), and __________, with an address of __________ ("Borrower").

Whereas, the Lender agrees to lend a specific amount of money; and

Whereas, the Borrower agrees to repay said money along with interest at a specified rate;

Now, therefore, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Loan Amount and Disbursement: The Lender agrees to lend the Borrower the sum of $__________ ("Loan Amount") which shall be disbursed to the Borrower on __________.

- Repayment: The Borrower agrees to repay the Loan Amount along with interest at a rate of __________% annually. Repayments shall be made in __________ (monthly/quarterly/annually) installments of $__________ each, starting on __________ and ending on __________.

- Use of Loan: The Loan Amount shall be used by the Borrower solely for the purpose of __________.

- Prepayment: The Borrower may prepay the loan in whole or in part at any time without penalty.

- Late Payment: If any payment is more than __________ days late, the Borrower agrees to pay a late fee of $__________.

- Default: In the event of default, the Lender may declare the entire outstanding balance plus accrued interest due and payable immediately.

- Governing Law: This Agreement shall be governed by the laws of the State of __________.

- Amendments: This Agreement may only be amended in writing signed by both parties.

- Notices: Any notices or communications required or permitted to be given under this Agreement shall be in writing and given by personal delivery, electronic mail, or certified mail, postage prepaid, to the addresses below or such other address as may be specified in writing.

- Entire Agreement: This Agreement contains the entire agreement between the parties relating to the subject matter hereof and supersedes all prior agreements and understandings, oral or written.

- Signature:

Lender: __________ Date: __________

Borrower: __________ Date: __________

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | A loan agreement form is a legally binding contract between a borrower and a lender that outlines the terms of a loan. |

| 2 | The form specifies the loan amount, interest rate, repayment schedule, and any collateral securing the loan. |

| 3 | Interest rates can be either fixed or variable, with terms specified within the agreement. |

| 4 | Repayment terms detail the frequency of payments (monthly, quarterly, etc.) and may include an end date for when the loan must be paid off. |

| 5 | Collateral is an asset pledged by the borrower to secure the loan, which the lender can seize if the loan is not repaid. |

| 6 | The document often includes clauses about late fees, prepayment penalties, and the steps to be taken in case of default. |

| 7 | State-specific laws may govern the agreement, affecting how interest is calculated, the legality of certain terms, and the remedies available upon default. |

| 8 | Loan agreements are used for both personal and business loans, and the specificity of terms can vary greatly based on the purpose of the loan. |

| 9 | Before signing, both parties should thoroughly review the agreement to ensure understanding and agreement on all terms. |

| 10 | Having a well-drafted loan agreement helps to protect both the lender's and borrower's interests and reduces the potential for future legal disputes. |

How to Write Loan Agreement

Completing a Loan Agreement form is an essential step in the borrowing process, as it outlines the terms and conditions between the borrower and lender. This agreement plays a critical role in ensuring both parties understand their responsibilities and the requirements of the loan. The process might seem daunting at first, but by following some straightforward steps, you can fill out the form accurately and efficiently. Here’s what you need to do:

- Start by reading through the entire form carefully to understand all the sections and information required.

- Enter the full names and contact details of the borrower and the lender in the designated sections at the beginning of the form.

- Specify the loan amount in the section labeled "Loan Amount". Ensure this number is accurate and matches any verbal agreements you have had.

- Fill in the "Loan Purpose" section by describing the reason for the loan. Be as specific as possible.

- In the "Repayment Terms" section, detail the repayment schedule, including the due dates and amounts for each payment. If the loan includes interest, specify the rate and how it will be calculated here as well.

- Look for any clauses related to late payments or defaults and understand the implications. Fill in any information required in these sections, such as late fees or actions taken in case of default.

- Review the section on collateral, if applicable. If the loan will be secured with collateral, describe the asset(s) being used and their condition.

- Both parties should review the "Governing Law" section, which indicates the state laws that will govern the agreement. This is particularly important for understanding how disputes will be resolved.

- Check for any additional clauses or special conditions that might be included towards the end of the form. These could relate to early repayment options, amendment processes, or other specific agreements you’ve made.

- Once the form is filled out, both the borrower and the lender should review it thoroughly to ensure all the information is accurate and complete. This is a good time to clarify any questions or concerns.

- Sign and date the form in the designated areas. Depending on the amount of the loan and the requirements in your state, you may also need to have the signatures notarized for additional legal validity.

- Make sure both the borrower and the lender retain copies of the signed agreement for their records.

After completing these steps, you have successfully filled out your Loan Agreement form. This document now serves as a binding contract between the borrower and lender, outlining the terms of the loan and the obligations of each party. Remember, the clarity and thoroughness of this agreement can prevent misunderstandings and conflicts during the repayment period. It’s important for both parties to adhere to the terms set forth in the agreement and to communicate openly should any issues arise.

Get Answers on Loan Agreement

What is a Loan Agreement form?

A Loan Agreement form is a legally binding document between two parties, the lender and the borrower. It outlines the terms and conditions of a loan, including the loan amount, interest rate, repayment schedule, and any collateral involved. The form serves as a formal record of the loan and protects both parties by clarifying their obligations and expectations.

Why do I need a Loan Agreement?

Creating a Loan Agreement is essential whenever money is being lent to ensure that both lender and borrower are aware of and agree to the terms. It helps prevent misunderstandings or disagreements in the future by detailing the loan's specifics. For the lender, it provides legal recourse if the borrower fails to repay the loan. For the borrower, it ensures that the lender cannot change the terms arbitrarily.

What should be included in a Loan Agreement?

A comprehensive Loan Agreement should include the following key components: the names and contact information of the lender and borrower, the amount of money being lent, the interest rate, repayment terms, late fees, collateral (if any), and any other terms specific to the agreement. It should also outline what happens in the case of default by the borrower, and it should be signed and dated by all parties involved.

Can I write a Loan Agreement on my own?

Yes, it is possible to write a Loan Agreement on your own, especially for straightforward loans. There are templates and software available that can help guide you through the process. However, for more complex agreements or large sums of money, it’s advisable to consult with a legal professional. This ensures that the agreement complies with state laws and fully protects your interests.

Is a notarized Loan Agreement legally binding?

While notarization is not always required for a Loan Agreement to be legally binding, it can add a layer of authenticity and may help in the enforcement of the document. A notarized Loan Agreement verifies that the signatures are genuine and that the parties entered into the agreement willingly and without duress. It is a good idea to check local laws to see if notarization is recommended or required for loan agreements in your jurisdiction.

Common mistakes

Filling out a Loan Agreement form can often seem straightforward, but errors can easily occur without careful attention. One common mistake people make is neglecting to provide complete details for both the borrower and the lender. These details include legal names, addresses, and contact information. It's crucial because these elements legally identify the parties involved. A Loan Agreement with incomplete or incorrect information may not be enforceable in a court of law, should a dispute arise.

Another area where errors frequently occur is in the description of the loan terms. This includes the loan amount, interest rate, repayment schedule, and any collateral involved. Some people might enter vague terms or leave out critical details, such as the loan's due dates or the conditions under which the loan must be repaid. Specifying clear, detailed loan terms ensures both parties fully understand their obligations, which can prevent conflicts in the future.

Failure to include the consequences of a default is also a common oversight. It's crucial to outline what will happen if the borrower fails to meet the terms of the loan, such as late fees, collection processes, or legal actions. Without this information, enforcing consequences in case of non-payment can become complicated and might require additional legal proceedings.

Last but certainly not least, many people overlook the necessity of getting the Loan Agreement witnessed or notarized. While not always legally required, having a third party witness or a notarization can add a level of formality and credibility to the document. It can also help in the verification of signatures if the agreement is ever disputed. Skipping this step might make it harder to prove the validity of the agreement if issues arise later on.

Documents used along the form

When entering into a loan agreement, it's rare that a simple handshake will suffice. Throughout the borrowing process, several key documents work in tandem with the loan agreement to ensure all aspects of the loan are covered comprehensively. These documents not only provide legal protection for both lender and borrower but also outline the responsibilities and expectations of each party. Below is a list of items commonly used alongside a Loan Agreement form to ensure a smooth financial transaction and to mitigate any potential disputes that may arise during the loan term.

- Promissory Note: This is a crucial document that outlines the borrower's promise to repay the loan. It includes the amount borrowed, interest rate, repayment schedule, and consequences of non-payment.

- Personal Guarantee: Often required for business loans, a personal guarantee holds an individual (usually the business owner) personally responsible for the loan if the business fails to pay it back.

- Security Agreement: When a loan is secured with collateral, a security agreement details the asset(s) pledged as security. It grants the lender a legal right to seize the collateral if the borrower defaults.

- Amortization Schedule: This document breaks down each payment over the course of the loan into principal and interest, showing how the loan will be paid off over time.

- Prepayment Agreement: This outlines the terms under which a borrower can pay off the loan early, including any penalties or fees for early repayment.

- Disclosure Statement: Required by federal law for most loans, this statement details the loan’s terms, including the annual percentage rate (APR), total costs, and payment schedule.

- Insurance Documents: For loans requiring insurance (such as auto or homeowners insurance), these documents prove that the collateral is adequately insured against loss or damage.

- Covenant Agreement: This includes any additional promises made by the borrower, such as maintaining a certain credit score or financial ratio, important for maintaining loan terms.

- Subordination Agreement: If the borrower has other loans, this agreement establishes the new loan's priority over existing debts in the event of a default.

- Default Notice: A formal document sent to a borrower indicating they have failed to meet the terms of the loan, highlighting the nature of the default and any potential actions to rectify the situation.

The careful preparation and use of these documents can significantly reduce risks for both parties in a loan agreement. Ensuring clear understanding and agreement on these terms is essential for a transparent and successful lending relationship. It is advisable to seek professional advice when preparing or signing these documents to fully understand their implications and to ensure that your interests are well-protected.

Similar forms

A Promissory Note is closely akin to a Loan Agreement, as it is a written and legally binding document in which one party promises to pay another a specified sum of money by a certain date or upon demand. Both outline the loan amount, interest rate, repayment schedule, and the consequences of defaulting on the loan. However, a Promissory Note is generally simpler and more concise, typically used for more straightforward loans without the need for detailed terms and conditions that a Loan Agreement often includes.

Mortgage Agreements share similarities with Loan Agreements, as they are both used to secure a loan through collateral. In a Mortgage Agreement, the collateral is real estate property. It details the loan specifics, including repayment terms and the lender's rights to foreclose on the property if the borrower fails to comply with the repayment terms. Unlike a general Loan Agreement, which can cover any type of loan, a Mortgage Agreement is specifically designed for real estate transactions.

A Line of Credit Agreement is another document similar to a Loan Agreement, offering a flexible borrowing option where the lender provides access to funds up to a specified limit for a certain period. Both documents regulate the terms under which money is borrowed, including interest rates and repayment schedules. However, the Line of Credit Agreement allows the borrower to draw upon the available funds as needed, unlike a Loan Agreement, which typically disburses a lump sum at the outset.

The Deed of Trust is used in some states instead of a Mortgage Agreement but serves a similar purpose to secure a real estate loan through a property. It involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee, who holds the property title until the loan is repaid. Like a Loan Agreement, it contains detailed terms of the loan, but it uniquely involves the trustee, who has the authority to foreclose on the property if the borrower defaults, without requiring court action.

An Installment Sale Agreement is related to a Loan Agreement when a purchase is made, and the buyer agrees to pay the seller the purchase price over time in installments. Although it incorporates aspects of a sales contract, its structure to outline payment amounts, dates, and interest rates bears resemblance to that of a Loan Agreement. The key difference lies in its primary function as an agreement for the sale of goods or property, with the deferred payments resembling a loan from the seller to the buyer.

Dos and Don'ts

When it comes to filling out a Loan Agreement form, being diligent and attentive to detail is key. A Loan Agreement is a legally binding document between a borrower and a lender that outlines the terms of the loan, including repayment schedule, interest rates, and any security or collateral. Making sure you complete it correctly can save both parties from any misunderstandings or legal issues down the line. Below are some important dos and don'ts to consider:

Do:- Review the entire form before starting: Make sure you understand all the sections and what information is required in each.

- Use clear, precise language: Ambiguities can lead to misunderstandings or legal challenges. Specify the loan amount, repayment schedule, interest rate, and any collateral clearly.

- Double-check all figures: Whether it's the loan amount, interest rates, or repayment terms, ensuring accuracy is crucial.

- Include all parties' full legal names and contact information: This should include anyone who is a party to the agreement, such as co-signers.

- Keep a signed copy of the agreement: Both the borrower and the lender should keep a fully executed (signed by all parties) copy of the agreement for their records.

- Rush through the process: Taking your time to fill out each section carefully will prevent mistakes and potential conflicts later.

- Leave any sections blank: If a section doesn't apply, write “N/A” (not applicable) rather than leaving it empty. This indicates that you didn't mistakenly skip over it.

- Sign without reading: Both parties should thoroughly read the entire agreement before signing to ensure they fully understand the terms.

- Forget to specify a governing law: Mention which state's laws will govern the agreement. This is crucial for resolving any disputes that might arise.

- Use vague terms: Avoid any ambiguity by clearly defining the loan terms, including the repayment schedule, interest rate, penalties for late payment, and any clauses related to prepayment or default.

Filling out a Loan Agreement form with attention to detail and clarity can help establish a smooth partnership between the borrower and lender, preventing misunderstandings and future disputes. By following these dos and don'ts, you'll be on your way to creating a solid, enforceable agreement.

Misconceptions

Loan agreements serve as formal documents outlining the terms and conditions under which one party lends money to another. These documents are fundamental to the lending process, yet several misconceptions persist about their content and significance. It is crucial to dispel these myths to ensure that both lenders and borrowers enter into these agreements with clear expectations and understanding. Here are nine common misconceptions about loan agreement forms:

All loan agreements are basically the same. This is not true; loan agreements can significantly vary depending on the lender, the borrower, and the purpose of the loan. Each agreement is tailored to the specific terms of the loan it covers, including interest rates, repayment schedules, and collateral requirements.

Loan agreements are only necessary for large loans. Any amount of money lent, regardless of size, should be accompanied by a loan agreement. This document protects both the lender and the borrower, even in transactions that may seem too small to warrant formal documentation.

The terms of the loan agreement cannot be changed once signed. While it's true that a loan agreement is legally binding, amendments can be made if both parties agree to them. Any changes should be documented in writing and added to the original agreement to avoid future disputes.

Verbal agreements are just as binding as written agreements. While verbal agreements can be legally enforceable, proving the terms of the agreement in the absence of written documentation can be challenging. Written loan agreements provide clear evidence of the terms agreed upon by the parties.

Loan agreements are only beneficial for the lender. A loan agreement provides clarity and legal protection for both the lender and the borrower. It ensures that the borrower understands their repayment obligations and protects them from potential unfair practices by the lender.

There's no need for a loan agreement among friends or family. Even when lending to friends or family, a loan agreement is vital. It helps prevent misunderstandings and protects personal relationships by setting out clear expectations for the loan.

Signing a loan agreement means you will automatically lose your collateral if you miss a payment. Not necessarily. Many loan agreements include terms that allow for renegotiation or forbearance in the event of financial hardship. Lenders often prefer to work out a revised payment plan rather than take collateral.

Loan agreements are designed to confuse borrowers. The intention behind drafting loan agreements is not to confuse but to clarify. They outline the rights and responsibilities of each party in detail to prevent any misunderstanding.

Only physical copies of loan agreements are legally valid. Digital or electronic versions of loan agreements are just as legally binding as their physical counterparts, provided they meet the necessary legal requirements, such as being signed by both parties.

Understanding these misconceptions about loan agreements can lead to more informed decisions when entering into such arrangements. It is always advisable for both lenders and borrowers to thoroughly review and comprehend any loan agreement before signing. Furthermore, consulting with legal counsel can help interpret and ensure the fairness of the agreement's terms.

Key takeaways

When it comes to drawing up a Loan Agreement form, several key elements need your attention. This document outlines and formalizes the terms of a loan, binding both borrower and lender to specific conditions. Understanding these crucial takeaways ensures both parties are knowledgeable and agreeable to the terms, making for a smoother transaction.

- Be clear and specific about the amount being loaned. This is the very foundation of your Loan Agreement. The total amount must be accurately stated to avoid any confusion or disputes down the line.

- Interest rates should be defined clearly. It's essential to explicitly state if the loan carries an interest rate, what that rate is, and how it will be calculated. This helps prevent misunderstands and ensures fairness for both parties.

- Repayment terms are a critical aspect of the agreement. Outline how repayments will be made, including frequency, amounts, and the total duration of the repayment period. Clarity in this area ensures both parties are on the same page regarding expectations.

- Include detailed information about the parties involved. Full legal names, addresses, and contact details of both the lender and borrower should be accurately included in the document. This information adds legitimacy and aids in enforceability.

- Late fees and consequences for non-payment must be clearly stated. Setting out the financial penalties for late payments or detailing the actions that can be taken in the event of non-payment protects the lender and informs the borrower of the seriousness of their commitments.

- Collateral should be described if applicable. In agreements where the loan is secured against an asset, it’s vital to detail the collateral involved, including a clear description and its value. This ensures both parties understand what is at stake.

- A section on amendments and how they can be made should be included. Life is unpredictable, and sometimes terms need adjusting. Defining the process for making changes to the agreement ensures it can evolve in a way that's agreed upon by both parties.

- Governing law is an important addition. Specifying which state's law will govern the agreement adds another layer of legality and clarity. This is particularly relevant in the event of a dispute or litigation.

- Both parties should sign the agreement. The document isn't legally binding until it has been signed by both the borrower and the lender. Ensure this step is not overlooked, as it finalizes the agreement and its terms.

Meticulously preparing and understanding a Loan Agreement can help minimize risks and disputes, making sure that both parties are protected and aware of their rights and obligations. Paying attention to these key takeaways can save a lot of headaches and legal challenges down the road.

Other Templates:

Intent to Marry - Often a prerequisite for various immigration or legal proceedings, it establishes a couple’s plan to marry as genuine and planned.

Simple Rental Agreement Between Family Members - By covering all bases from lease start to end, it provides a comprehensive guideline for family member landlords and tenants alike.