Official LLC Share Purchase Agreement Document

When embarking on the journey of purchasing shares in a limited liability company (LLC), understanding the LLC Share Purchase Agreement form is crucial. This document is the cornerstone of any transaction involving the sale and purchase of LLC shares, serving as the formal agreement between the buyer and the seller. It meticulously outlines all pertinent details such as the number of shares being bought, the price per share, payment methods, and any representations and warranties made by either party. Additionally, this form plays a pivotal role in protecting the interests of both the buyer and the seller by clearly defining the terms and conditions of the sale, ensuring a smooth transfer of ownership, and mitigating potential disputes. Whether you are dipping your toes into the world of LLCs or are a seasoned investor, having a comprehensive understanding of the LLC Share Purchase Agreement form is instrumental in navigating the complexities of share transactions confidently and effectively.

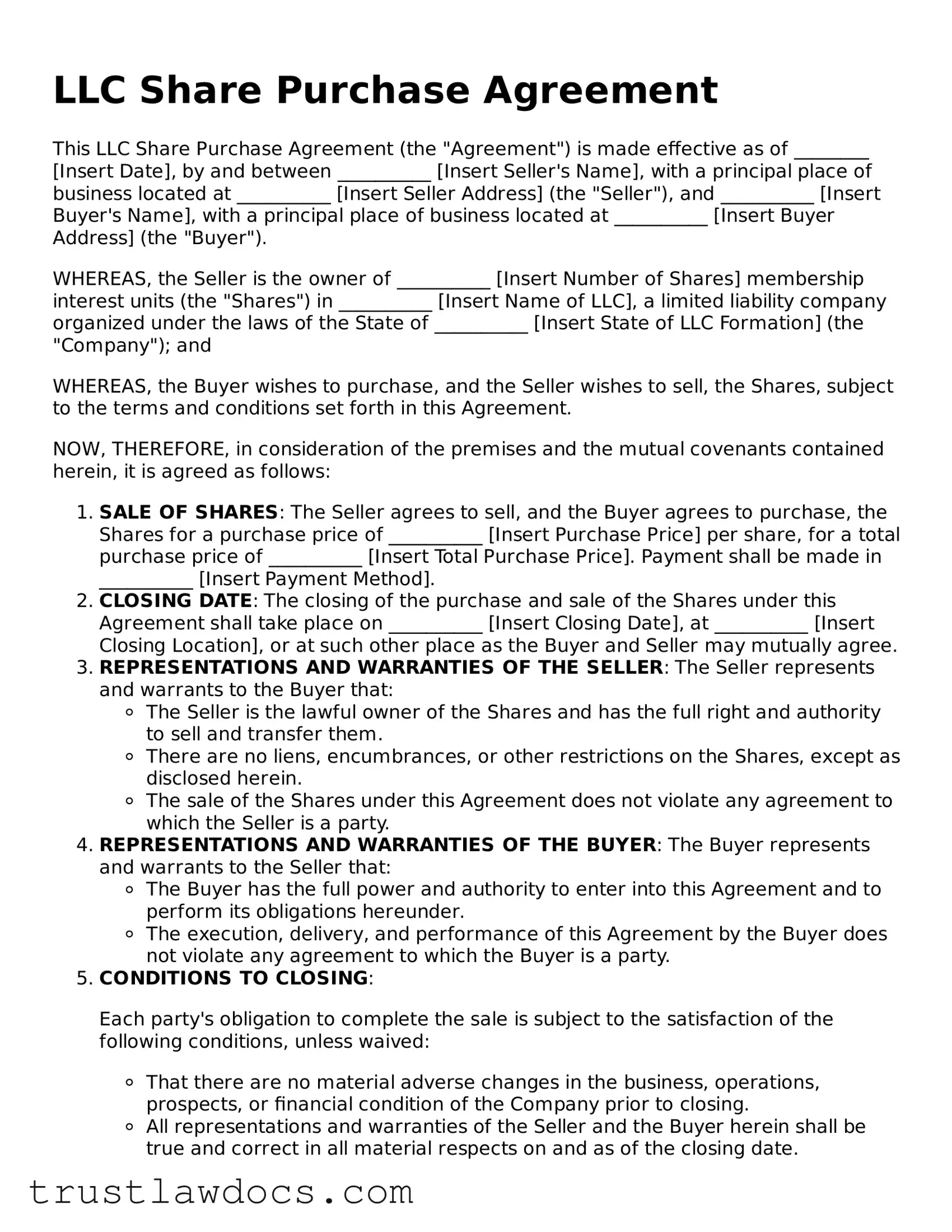

Form Example

LLC Share Purchase Agreement

This LLC Share Purchase Agreement (the "Agreement") is made effective as of ________ [Insert Date], by and between __________ [Insert Seller's Name], with a principal place of business located at __________ [Insert Seller Address] (the "Seller"), and __________ [Insert Buyer's Name], with a principal place of business located at __________ [Insert Buyer Address] (the "Buyer").

WHEREAS, the Seller is the owner of __________ [Insert Number of Shares] membership interest units (the "Shares") in __________ [Insert Name of LLC], a limited liability company organized under the laws of the State of __________ [Insert State of LLC Formation] (the "Company"); and

WHEREAS, the Buyer wishes to purchase, and the Seller wishes to sell, the Shares, subject to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, it is agreed as follows:

- SALE OF SHARES: The Seller agrees to sell, and the Buyer agrees to purchase, the Shares for a purchase price of __________ [Insert Purchase Price] per share, for a total purchase price of __________ [Insert Total Purchase Price]. Payment shall be made in __________ [Insert Payment Method].

- CLOSING DATE: The closing of the purchase and sale of the Shares under this Agreement shall take place on __________ [Insert Closing Date], at __________ [Insert Closing Location], or at such other place as the Buyer and Seller may mutually agree.

- REPRESENTATIONS AND WARRANTIES OF THE SELLER: The Seller represents and warrants to the Buyer that:

- The Seller is the lawful owner of the Shares and has the full right and authority to sell and transfer them.

- There are no liens, encumbrances, or other restrictions on the Shares, except as disclosed herein.

- The sale of the Shares under this Agreement does not violate any agreement to which the Seller is a party.

- REPRESENTATIONS AND WARRANTIES OF THE BUYER: The Buyer represents and warrants to the Seller that:

- The Buyer has the full power and authority to enter into this Agreement and to perform its obligations hereunder.

- The execution, delivery, and performance of this Agreement by the Buyer does not violate any agreement to which the Buyer is a party.

- CONDITIONS TO CLOSING:

Each party's obligation to complete the sale is subject to the satisfaction of the following conditions, unless waived:

- That there are no material adverse changes in the business, operations, prospects, or financial condition of the Company prior to closing.

- All representations and warranties of the Seller and the Buyer herein shall be true and correct in all material respects on and as of the closing date.

- GOVERNING LAW: This Agreement shall be governed by and construed in accordance with the laws of the State of __________ [Insert Governing Law State], without regard to its conflict of law principles.

- ENTIRE AGREEMENT: This Agreement constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral, concerning the sale and purchase of the Shares.

- AMENDMENTS: No amendment, modification, or waiver of any provision of this Agreement shall be effective unless in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

SELLER:

_________________________

[Insert Seller's Name]

BUYER:

_________________________

[Insert Buyer's Name]

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | An LLC Share Purchase Agreement is a document used when an individual or entity purchases ownership interest in a Limited Liability Company. |

| 2 | This document outlines the terms of the purchase, including the sale price, payment method, and any representations and warranties. |

| 3 | The agreement serves to protect both the seller and buyer, ensuring clarity and legal enforceability of the sale. |

| 4 | The document should include details about the LLC, such as its name, the state of incorporation, and information about the shares being sold. |

| 5 | State-specific laws often govern these agreements, so it's vital to refer to the laws of the state where the LLC was formed. |

| 6 | It may require the approval of other members of the LLC, depending on the company's operating agreement. |

| 7 | A thorough due diligence process is advised for the buyer to understand fully the financial and legal health of the LLC. |

| 8 | This agreement should be notarized and kept on file with the LLC’s official records for future reference. |

| 9 | Amendments to the agreement must be in writing and signed by both seller and buyer to be legally valid. |

How to Write LLC Share Purchase Agreement

Filling out an LLC Share Purchase Agreement is a vital step for anyone looking to buy or sell ownership shares in a limited liability company. This document outlines the terms of the sale, including the price and conditions of the share transfer. To ensure that the agreement is legally binding and reflects the intentions of both parties accurately, it's important to complete this form with careful attention to detail. The steps below guide you through this process, making it easy to navigate from start to finish.

- Gather all necessary information about the transaction, including the names and contact information of the buyer and seller, the LLC's details, and the specifics of the shares to be transferred (e.g., number of shares, price per share).

- Enter the date on which the agreement is being made at the top of the form.

- Fill in the full legal names and addresses of both the buyer and the seller in the designated sections.

- Describe the LLC whose shares are being purchased, including its legal name and principal place of business.

- Detail the share transaction, specifying the number of shares being bought, the total purchase price, and the price per share.

- Include any representations and warranties the seller is making about the LLC and its financial condition. This section might require additional information about the company's liabilities, assets, and legal standing.

- Outline any conditions precedent to the closing of the transaction, such as obtaining necessary approvals from other LLC members or fulfilling certain obligations before the transfer can be finalized.

- List the obligations of both parties regarding the closing of the transaction, including payment details and delivery of share certificates or other documentation.

- State the governing law which will be used to interpret the agreement. This is typically the law of the state where the LLC is registered.

- Provide a space for both parties to sign and date the agreement, making it legally binding. Ensure that the signatures are witnessed or notarized if required by state law.

After completing the LLC Share Purchase Agreement form, the next steps include reviewing the document thoroughly to ensure all entered information is accurate and reflects the agreed terms. Both parties should keep a copy of the signed agreement for their records. Following the signing, any necessary payments should be made, and the shares transferred according to the terms outlined in the agreement. It's important to update the LLC's operating agreement and membership records to reflect the new ownership structure. If needed, seek legal advice to navigate any complexities or to ensure compliance with state laws and regulations.

Get Answers on LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legally binding document used when an individual or entity agrees to buy ownership stakes in a Limited Liability Company (LLC) from an existing member (seller). This document outlines the terms and conditions of the sale, including the purchase price, payment method, and any warranties or representations.

Why do I need an LLC Share Purchase Agreement?

Having an LLC Share Purchase Agreement is important for providing a clear record of the sale, protecting both the buyer's and seller's interests. It ensures that both parties are clear about the terms of the transaction, reduces the potential for disputes, and offers legal protections if disagreements arise.

What information is typically included in an LLC Share Purchase Agreement?

This agreement usually includes details such as the identities of the buyer and seller, description of the shares being sold (including number of shares and class of membership interests), purchase price, payment terms, representations and warranties of both the buyer and seller, conditions to closing, confidentiality obligations, and dispute resolution mechanisms.

How does an LLC Share Purchase Agreement differ from an Asset Purchase Agreement?

An LLC Share Purchase Agreement involves buying the ownership stakes or membership interests in an LLC, meaning the buyer is stepping into the shoes of the existing member. An Asset Purchase Agreement, on the other hand, involves buying the company's assets (like equipment, inventory, intellectual property) rather than the ownership stakes. Each has different tax implications and legal considerations.

Do I need a lawyer to draft an LLC Share Purchase Agreement?

While it's possible to draft an LLC Share Purchase Agreement on your own, having a lawyer involved is highly advisable. Lawyers can ensure that all legal requirements are met, terms are clearly defined, and your interests are fully protected. This is especially important for complex transactions or when large sums are involved.

Can changes be made to an LLC Share Purchase Agreement after it's signed?

Yes, changes can be made after the agreement is signed, but only if all parties involved agree to the amendments. These changes must be documented in writing and signed by all parties, often in the form of an amendment to the original agreement.

What happens if someone breaches the LLC Share Purchase Agreement?

If a party breaches the agreement, the non-breaching party has the right to pursue legal remedies. These may include suing for damages, seeking specific performance (forcing the completion of the sale as per the agreement), or terminating the agreement and seeking a return of any deposit or payment made.

Are there any restrictions on who can buy shares in an LLC?

Yes, there can be restrictions based on the LLC's operating agreement, state laws, and sometimes federal regulations. For example, the LLC's operating agreement might require that existing members approve new members. It's important to review these documents and comply with any applicable requirements before proceeding with a share purchase.

How does the purchase of LLC shares affect taxes?

The purchase of LLC shares can have various tax implications for both the buyer and the seller. For example, the seller may be subject to capital gains tax on the sale. The specific effects depend on factors like the structure of the LLC and the individual tax circumstances of the buyer and seller. Consulting a tax professional is recommended for personalized advice.

What is the closing process like for an LLC Share Purchase Agreement?

The closing process involves finalizing the sale, usually including the payment of the purchase price, the transfer of membership interest certificates (if applicable), and the execution of any final legal documents. It's the point at which ownership officially changes hands. The specific steps can vary based on the terms of the agreement and any regulatory requirements.

Common mistakes

When filling out an LLC Share Purchase Agreement, individuals often encounter stumbling blocks that may hinder the process or jeopardize the agreement's validity. One common mistake is overlooking the need for a comprehensive understanding of the agreement. Parties sometimes fail to fully grasp the terms and conditions outlined in the document, leading to misinterpretations or misguided expectations about rights, responsibilities, and repercussions.

Another frequent error is the incorrect or incomplete filling of personal and business details. This might seem trivial, but inaccuracies in names, addresses, or identification numbers can delay the process or void the agreement. It's essential for all parties to double-check the information they provide, ensuring it matches legal documents and official records.

Often, individuals ignore the importance of specifying payment terms clearly. Without stating the purchase price, payment method, and schedule in unambiguous terms, disputes can easily arise. Such details should be explicitly agreed upon and recorded in the document to prevent misunderstandings or financial disputes down the line.

Failure to outline the representations and warranties of the seller and the buyer is another oversight. These clauses protect both parties by assuring that all the shared information is accurate and that neither side is withholding crucial data. Without these assurances, the purchaser risks acquiring shares under false pretenses, while the seller could face legal repercussions.

Many also neglect to include or properly detail the conditions precedent to closing. These conditions, which might include approvals, licenses, or other prerequisites, must be fulfilled before the transaction can be finalized. Ignoring this step could lead to a situation where parties are ready to proceed without having the legal or operational green light.

Not setting a clear timeline or failing to adhere to one is a mistake that can cause delays and increased costs. It's important for the agreement to specify when each phase of the transaction should be completed, offering a roadmap that can help manage expectations and coordinate efforts effectively.

Skipping the consultation of legal representation is surprisingly common. Individuals sometimes believe they can navigate the complexities of a Share Purchase Agreement without expert advice. However, legal professionals can offer invaluable insights, highlight potential pitfalls, and customize the agreement to fit specific needs, thereby safeguarding all parties involved.

Forgetting to address dispute resolution mechanisms within the agreement can lead to challenging situations down the road. It’s crucial to stipulate how disagreements will be handled, whether through mediation, arbitration, or court proceedings. This can save time, money, and preserve business relationships in the event of a conflict.

Lastly, not amending the operating agreement of the LLC to reflect the new ownership structure post-transaction is a common oversight. Ensuring that the operating agreement is updated to include the new member(s) and their rights and responsibilities is essential for the smooth continuation of the business.

The complexities of an LLC Share Purchase Agreement necessitate careful attention to detail and a robust understanding of the legal landscape. Avoiding these mistakes can lead to a smoother transaction process and help establish a solid foundation for future business relations.

Documents used along the form

When navigating the complexities of buying shares in a Limited Liability Company (LLC), the LLC Share Purchase Agreement form is a critical document. However, to ensure a comprehensive and legally sound transaction, several additional forms and documents often accompany this agreement. These documents help clarify the terms of the purchase, protect all parties involved, and comply with legal requirements.

- Operating Agreement: Details the operational aspects of the LLC, including the rights and responsibilities of the members. This document is essential to understand how the newly acquired shares will be governed.

- Bill of Sale: Provides proof of the transfer of ownership of the shares from the seller to the buyer. This document is crucial for the buyer’s records and future disputes or sales.

- Membership Interest Purchase Agreement: Similar to the Share Purchase Agreement, but specifically designed for LLCs, detailing the sale of membership interest rather than corporate shares.

- Due Diligence Checklist: A comprehensive list used to verify the financial health and compliance of the LLC before purchase. It helps the buyer assess the risk and value of their investment.

- Indemnity Agreement: Protects against future losses that may arise from unforeseen legal problems with the shares sold. This agreement is essential for the buyer's protection.

- Non-Disclosure Agreement (NDA): Ensures that sensitive information shared during the sale process remains confidential. Both parties commonly use this to protect their interests and information.

- Minutes of the Meeting: Documents the decision by the LLC members or board of directors to approve the sale of shares. This document provides legal proof that the transaction was approved according to the LLC’s operating rules.

- Stock Power: A brief document that accompanies the Share Purchase Agreement, formally authorizing the transfer of stock certificates to the buyer. It is often used to finalize the transfer process.

Together, these documents form a robust framework that supports the Share Purchase Agreement, ensuring that all parties are well-informed and protected throughout the transaction process. By understanding and properly utilizing these documents, buyers and sellers can navigate the complexities of LLC share transactions with greater confidence and legal security.

Similar forms

One document similar to the LLC Share Purchase Agreement is the Stock Purchase Agreement (SPA). Both serve as legally binding agreements that outline the terms and conditions under which shares of a company are sold and bought. The main difference is that the SPA is typically used for corporations, whereas the LLC Share Purchase Agreement is specific to Limited Liability Companies. These agreements contain critical details such as the number of shares sold, the selling price, and the closing date.

Another closely related document is the Asset Purchase Agreement (APA). Like the LLC Share Purchase Agreement, the APA outlines the sale of a business's assets. While the LLC Share Purchase Agreement focuses on the transfer of ownership interests in an LLC, the APA covers the sale of company assets, including real estate, intellectual property, and equipment. Both ensure that the terms of the sale are clearly defined and agreed upon by both parties.

The Membership Interest Purchase Agreement (MIPA) is also aligned with the LLC Share Purchase Agreement in purpose and structure. It specifically governs the sale and purchase of membership interests in an LLC, capturing the particulars of the transaction. These documents lay out the rights and obligations of the existing members and the incoming member or members, underlining the consent clause that might be required from other members for the transaction to proceed.

The Business Sale Agreement is akin to the LLC Share Purchase Agreement in that it facilitates the sale and transfer of a business entity. However, the Business Sale Agreement encompasses the entirety of a business, including its assets, liabilities, and operations, rather than just the ownership interests or shares. Both documents are vital for ensuring that both the buyer and the seller are clear on the terms of the business transfer.

A Shareholder Agreement can also bear resemblance to the LLC Share Purchase Agreement, as it involves the shareholders of a corporation. It often outlines the shareholders' rights and obligations, the management of the company, and the regulation of share sales and transfers. While the Shareholder Agreement governs ongoing relationships and operations, the LLC Share Purchase Agreement is transactional, focusing on the event of purchasing shares.

The Buy-Sell Agreement, often used in business partnerships, shares common ground with the LLC Share Purchase Agreement. This document outlines what happens to a partner's shares should they leave the company due to death, disability, or retirement. Although it's more about planning for future events rather than executing a current transaction, both agreements ensure the orderly transfer of business interests.

The Subscription Agreement is another document that parallels the LLC Share Purchase Agreement. Used when new shares of an LLC or corporation are issued, this agreement lists the price for the shares and the number being purchased. Unlike the LLC Share Purchase Agreement, which is used for buying existing shares from another member or shareholder, the Subscription Agreement is for the issuance of new shares directly from the company.

A Confidentiality Agreement might accompany an LLC Share Purchase Agreement. This document ensures that sensitive information disclosed during the sale process remains confidential. While the Confidentiality Agreement protects the information, the LLC Share Purchase Agreement finalizes the transaction, underscoring the cooperation needed between the seller and buyer to protect business secrets.

Lastly, the Non-compete Agreement can be related to the LLC Share Purchase Agreement. In cases where the seller is parting with their ownership shares, a Non-compete Agreement may restrict them from starting a competing business within a certain geographic area and timeframe. Though it addresses post-sale conduct rather than the sale itself, it is crucial for protecting the business's market position after the transaction is completed.

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it's crucial to pay attention to detail and follow specific guidelines to ensure the process goes smoothly. Below is a list of things you should and shouldn't do to help you navigate the form correctly.

- Do ensure all parties' names are spelled correctly. Accuracy in names ensures that the agreement is legally binding and avoids any confusion about the identities of the parties involved.

- Do review the number of shares being purchased and their price. Confirm these figures are correct to prevent any disputes or misunderstandings later on.

- Do check the payment terms. Understanding how and when the payment will be made helps in planning and avoids any future financial complications.

- Don't leave any blank spaces. If a section doesn't apply, consider writing "N/A" or "None" to indicate this clearly. Leaving blank spaces can raise questions about whether the document was completed with care.

- Do double-check the agreement for any restrictions or covenants. Be fully aware of any limitations or obligations being agreed upon to prevent unexpected legal complications.

- Don't rush through reading the agreement. Take your time to thoroughly understand every part of the document. This careful attention can prevent conflicts arising from misunderstandings.

- Do consult a legal professional. If anything is unclear, it's advisable to seek legal advice. A professional can provide clarity and ensure that your interests are adequately protected.

- Don't forget to verify the governing state laws. The agreement should align with the laws of the state where your LLC is registered, as legal requirements can vary significantly from state to state.

- Do ensure all parties sign the agreement. An unsigned agreement is typically not enforceable. Make sure everyone involved signs the document to make it legally binding.

By following these dos and don'ts, you'll be better prepared to complete the LLC Share Purchase Agreement form accurately and effectively.

Misconceptions

When navigating the complexities of acquiring shares in a Limited Liability Company (LLC), the LLC Share Purchase Agreement becomes a pivotal document. However, several misconceptions surround its utility and implications. Dispelling these myths ensures both buyers and sellers can approach such transactions with clearer understanding and better preparation.

Only Large Transactions Require an LLC Share Purchase Agreement: Whether it's a sizable acquisition or a small-scale share transfer, an LLC Share Purchase Agreement serves as a crucial document. It outlines the terms, conditions, and warranties that govern the sale, offering protection and clarity to all parties involved, irrespective of the transaction size.

The Process is Standardized and Unchanging: The belief that the structure and contents of an LLC Share Purchase Agreement are fixed and unalterable is misleading. In truth, these agreements are highly customizable. They need to be tailored to fit the specifics of each transaction, including any special conditions or terms pivotal to the parties involved.

It’s Just About Buying and Selling Shares: While the core function of an LLC Share Purchase Agreement is to facilitate the transfer of ownership, its scope extends much further. This document also addresses warranties, indemnities, and dispute resolution mechanisms, which are essential for protecting the interests of both buyers and sellers beyond the simple exchange of shares.

Legal Representation Isn’t Necessary: Some parties might underestimate the value of legal guidance, thinking they can navigate the agreement on their own. However, due to the potentially complex and customizable nature of these agreements, having legal professionals draft or review the document can prevent misunderstandings, ensure fairness, and protect against future legal issues.

Only the Purchase Price Matters: While the purchase price of the shares is undeniably important, focusing solely on this aspect overlooks other crucial elements. Terms related to payment schedules, methods of valuation, representations and warranties, and post-closure obligations also play a significant role in the agreement's overall balance and fairness.

Signing is the Final Step: The signing of the LLC Share Purchase Agreement might seem like the conclusion of a transaction, but this perception is inaccurate. Often, these agreements include provisions requiring certain actions to be completed post-closure, such as non-compete clauses and seller or buyer obligations, ensuring a smooth transition and fulfillment of all terms agreed upon.

It’s Identical to Stock Purchase Agreements in Corporations: Although LLC Share Purchase Agreements and Corporate Stock Purchase Agreements might appear similar at first glance, significant legal and structural differences exist between LLCs and corporations. These distinctions can affect governance, tax implications, and the rights of share purchasers, necessitating a document that specifically reflects the nature of an LLC.

Dispelling these misconceptions about LLC Share Purchase Agreements ensures that all parties enter transactions with a clear, informed understanding. This document is far more than a mere formality; it’s a safeguard and blueprint for the future relationship between buyers and sellers within the LLC structure.

Key takeaways

When dealing with an LLC Share Purchase Agreement form, understanding the essentials can help you navigate the process efficiently and effectively. This document plays a pivotal role when an individual or entity plans to buy shares in a Limited Liability Company (LLC). Here are key takeaways that should be kept in mind.

- Accuracy is key: The information provided in the LLC Share Purchase Agreement must be accurate and complete. This includes details of the parties involved, the number of shares being purchased, the price per share, and any representations or warranties. Inaccurate information can lead to disputes or legal challenges down the line.

- Diligence is crucial: Both the buyer and the seller should conduct thorough due diligence before finalizing the agreement. This includes reviewing the LLC’s operating agreement, financial statements, and any other relevant documents. Understanding the full scope of what is being purchased can prevent unexpected liabilities.

- Legal advice is invaluable: Even though many templates and guides are available, consulting with a legal professional can provide personalized advice tailored to your specific situation. A lawyer can help navigate complex legal language and ensure that the agreement protects your interests.

- Understand the tax implications: The sale and purchase of LLC shares can have significant tax consequences for both the buyer and the seller. It's important to understand these implications before completing the transaction. Seeking advice from a tax professional can help you anticipate and manage any financial impacts.

- Follow the LLC’s operating agreement: Most LLCs have an operating agreement that outlines procedures for transferring shares. It’s important to review this document and comply with any requirements it sets out, such as offering shares to existing members before selling them to an outside party. Ignoring these provisions can lead to legal complications.

By keeping these key takeaways in mind, individuals and entities can navigate the complexities of an LLC Share Purchase Agreement with greater confidence and security. Whether you are a seasoned investor or new to the world of LLCs, understanding these principles is crucial for executing a successful transaction.

Other Templates:

I9 - A reliable means to authenticate an employee’s tenure and role for promotion or transfer.

Child Travel Consent Form - It is a practical tool for facilitating family vacations where one parent cannot join due to various reasons.

Free Michigan Lady Bird Deed Pdf - Unlike traditional life estate deeds, the Lady Bird Deed provides a unique advantage by not locking the grantor into a decision; the property can still be disposed of if circumstances change.