Official Purchase Letter of Intent Document

Embarking on the journey of purchasing property or business assets is a significant step that necessitates careful planning and detailed documentation to ensure clarity and seriousness of intent between the parties involved. At the heart of this preparatory phase lies the Purchase Letter of Intent (LOI), a foundational document that serves multiple critical functions. It outlines the basic terms between the seller and buyer, acting as a preliminary agreement before the final sale. This form not only signifies a buyer's genuine interest in proceeding with the purchase but also sets the stage for negotiations, allowing both parties to agree on key terms such as price, payment schedule, and other essential conditions before drafting the binding contract. Additionally, it provides a framework that helps in streamlining the due diligence process, ensuring that the buyer can verify the assets or property's stated value and condition. Moreover, the LOI helps in mitigating potential misunderstandings by clarifying the deal's specifics, thereby saving time and resources for both sides. By securing an initial agreement, it paves the way for a smoother transaction, reinforcing the trust and commitment necessary for any successful purchase agreement.

Form Example

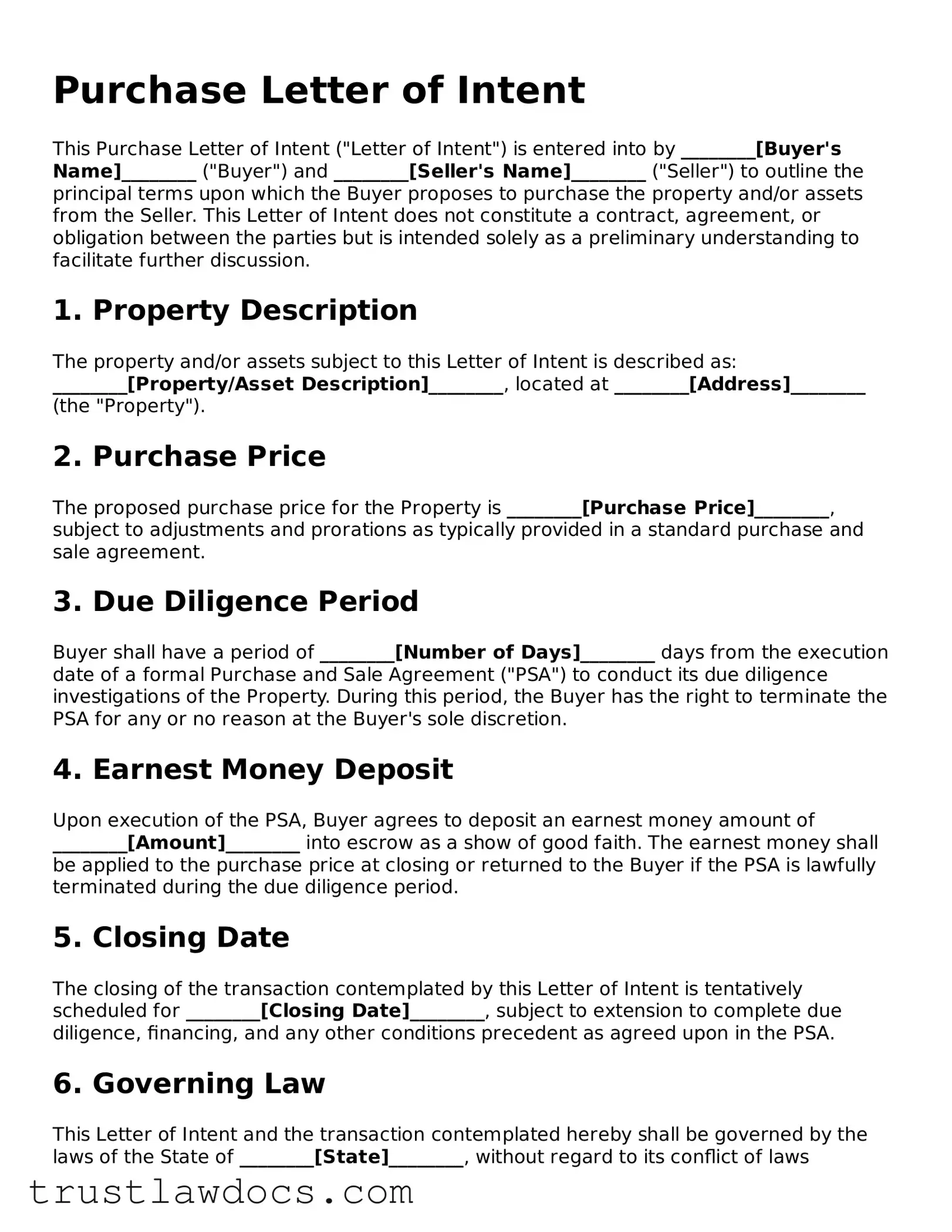

Purchase Letter of Intent

This Purchase Letter of Intent ("Letter of Intent") is entered into by ________[Buyer's Name]________ ("Buyer") and ________[Seller's Name]________ ("Seller") to outline the principal terms upon which the Buyer proposes to purchase the property and/or assets from the Seller. This Letter of Intent does not constitute a contract, agreement, or obligation between the parties but is intended solely as a preliminary understanding to facilitate further discussion.

1. Property Description

The property and/or assets subject to this Letter of Intent is described as: ________[Property/Asset Description]________, located at ________[Address]________ (the "Property").

2. Purchase Price

The proposed purchase price for the Property is ________[Purchase Price]________, subject to adjustments and prorations as typically provided in a standard purchase and sale agreement.

3. Due Diligence Period

Buyer shall have a period of ________[Number of Days]________ days from the execution date of a formal Purchase and Sale Agreement ("PSA") to conduct its due diligence investigations of the Property. During this period, the Buyer has the right to terminate the PSA for any or no reason at the Buyer's sole discretion.

4. Earnest Money Deposit

Upon execution of the PSA, Buyer agrees to deposit an earnest money amount of ________[Amount]________ into escrow as a show of good faith. The earnest money shall be applied to the purchase price at closing or returned to the Buyer if the PSA is lawfully terminated during the due diligence period.

5. Closing Date

The closing of the transaction contemplated by this Letter of Intent is tentatively scheduled for ________[Closing Date]________, subject to extension to complete due diligence, financing, and any other conditions precedent as agreed upon in the PSA.

6. Governing Law

This Letter of Intent and the transaction contemplated hereby shall be governed by the laws of the State of ________[State]________, without regard to its conflict of laws principles.

7. Confidentiality

Both parties agree to keep the terms of this Letter of Intent and all related negotiations confidential, except as required by law and to the extent necessary to facilitate the contemplated transaction.

8. Binding Effect

This Letter of Intent shall be binding upon the parties hereto and their respective heirs, executors, administrators, and assigns. However, it is understood that this Letter of Intent does not constitute a binding agreement to purchase or sell the Property until a formal PSA is entered into by both parties.

9. Acknowledgment

By their signatures below, the parties acknowledge that they have read, understood, and agree to the terms of this Letter of Intent as of ________[Date]________.

Buyer: ___________________________________ Date: __________

Seller: ___________________________________ Date: __________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Purchase Letter of Intent is a document that outlines the preliminary agreements between a buyer and a seller before a formal purchase agreement is finalized. |

| Purpose | It serves to clarify the key terms and conditions of the sale, ensuring both parties are aligned before entering a binding contract. |

| Components | Typically includes details such as purchase price, description of the property or item, payment terms, due diligence periods, and confidentiality clauses. |

| Legally Binding | While it outlines the intent to purchase, it is generally not legally binding except for certain provisions like confidentiality and exclusivity. |

| State-Specific Variations | Some states may have specific requirements or provisions that need to be included in the letter, leading to variations in the document's format and content. |

| Governing Law | The governing law clause specifies which state's laws will apply in interpreting the document. It's crucial for handling any disputes that may arise. |

How to Write Purchase Letter of Intent

Once a party has decided to express their intent to purchase a property, one of the preliminary steps involves filling out a Purchase Letter of Intent form. This document, while not legally binding, serves as a formal way to communicate a prospective buyer's desire to enter into negotiations for a property. It outlines the initial terms and conditions under which the buyer would be willing to proceed with the transaction. Following the completion of this form, the next steps typically involve negotiations between the parties, potentially leading to the drafting and signing of a legally binding purchase agreement based on the terms agreed upon in the letter of intent.

- Gather all necessary information about the property in question, including its full legal description, the proposed purchase price, and any specific terms or conditions that the buyer wishes to include.

- Begin with the date at the top of the form. This should be the date on which the letter is being prepared.

- Enter the full legal name of the seller, followed by the address of the property to be purchased.

- State the buyer's full legal name and contact information, ensuring accuracy to facilitate easy communication.

- Specify the proposed purchase price in the designated section. If the price is contingent on specific conditions being met, those conditions should be clearly outlined.

- Detail any earnest money deposit that the buyer proposes to make as a sign of good faith. Include the amount and the terms associated with the deposit.

- Outline the proposed timeline for the transaction, including dates for due diligence, the period for obtaining financing (if applicable), and the proposed closing date.

- If there are specific inspections or contingencies that need to be resolved before the transaction can proceed, list these in the appropriate section.

- Finally, both the buyer and the seller should sign and date the bottom of the form, signifying their acknowledgment of the letter's content and their intent to proceed as outlined.

Completing a Purchase Letter of Intent form is a crucial step in the property buying process, laying the foundation for further negotiations and clarifications. It is important to approach this task with diligence and attention to detail, ensuring all information is accurate and reflective of the buyer's intentions. Remember, this document can significantly impact the proceedings of the property transaction, setting the tone for what both parties can expect moving forward.

Get Answers on Purchase Letter of Intent

What is a Purchase Letter of Intent?

A Purchase Letter of Intent (LOI) is a document that indicates a buyer's intention to purchase a product or service from a seller. It outlines the basic terms and conditions of the sale, including price, delivery terms, and payment conditions. Although not always legally binding, it serves as a sign of a serious commitment from the buyer to proceed with the transaction.

Is a Purchase Letter of Intent legally binding?

In most cases, a Purchase Letter of Intent itself is not legally binding in terms of obligating both parties to complete the transaction. However, it can contain provisions that are binding, such as confidentiality agreements or a commitment to negotiate in good faith. It's important to read and understand these provisions carefully.

What should be included in a Purchase Letter of Intent?

A well-crafted Purchase Letter of Intent should include details such as the identification of both buyer and seller, a description of the product or service being purchased, the purchase price, terms of payment, any contingencies that must be met before the deal can close, and the proposed timeline for the transaction. It may also include conditions regarding due diligence processes and confidentiality requirements.

Why use a Purchase Letter of Intent?

Using a Purchase Letter of Intent can facilitate smoother negotiations by laying out the key terms of the deal upfront. It can help both parties to assess interest and commitment to the transaction before investing significant time and resources into due diligence and contract negotiations. It also acts as a framework for drafting the formal purchase agreement.

Can either party back out after signing a Purchase Letter of Intent?

Because a Purchase Letter of Intent is typically not fully binding, either party may generally back out of the agreement. However, if the LOI contains binding provisions (like those mentioned regarding confidentiality or good faith negotiations), backing out could have legal implications. Parties should consider the consequences outlined in the LOI before deciding to withdraw.

How formal does a Purchase Letter of Intent need to be?

A Purchase Letter of Intent should be drafted in a professional tone and follow a formal structure. While it may not require the same level of detail as a final purchase agreement, clarity and specificity are crucial to avoid misunderstandings. It's advisable to have legal counsel review the document before it is signed.

Does signing a Purchase Letter of Intent guarantee the transaction will close?

No, signing a Purchase Letter of Intent does not guarantee that the transaction will close. It is a preliminary step that expresses a buyer's intention to pursue the transaction and sets the stage for further negotiations. The deal is only finalized once all contingencies are met and a definitive purchase agreement is signed by both parties.

What happens after a Purchase Letter of Intent is signed?

After a Purchase Letter of Intent is signed, both parties typically move forward with due diligence, final negotiations, and drafting of the formal purchase agreement. The LOI serves as a guide for these next steps. Depending on the LOI’s terms, this phase may involve financial audits, inspections, and obtaining necessary approvals before the transaction can be finalized.

Common mistakes

One common mistake people make when filling out a Purchase Letter of Intent (LOI) form is not specifying the payment terms clearly. It is crucial to outline how and when payments will be made, whether in installments or a lump sum, to avoid future disputes. Leaving this information vague can lead to misunderstandings between parties and potentially derail the transaction.

Another error is failing to describe the property accurately. This includes the physical address, legal description, and any unique identifiers. Without these details, the LOI might be considered incomplete or invalid. It's like trying to send a package without a proper address; it simply won't reach its intended destination correctly.

People often neglect to include contingency clauses in their LOI, which are critical. These clauses can cover scenarios like the buyer obtaining financing, the results of a property inspection, or even zoning issues. Without them, a buyer could be legally bound to proceed with a purchase even if significant problems are discovered, or if financing falls through.

Overlooking the expiration date of the offer is another frequent oversight. An LOI should clearly state until when the offer is valid. This creates a sense of urgency and clarity for both parties. Without an expiration date, the seller might take their time considering the offer, potentially missing out on other opportunities.

Sometimes there is a failure to sign the document. An unsigned LOI is essentially worthless as it doesn’t legally bind anyone to anything. It's like writing down your intentions on a piece of paper and then not signing it; it lacks the necessary commitment to be taken seriously.

People also commonly forget to include a confidentiality clause, which protects sensitive information shared during the transaction process. If this clause is absent, there's nothing legally stopping parties from disclosing confidential information, which could hurt the interests of one or both parties involved.

Another mistake is not specifying which laws govern the document. In a situation where disputes arise, knowing which jurisdiction’s laws apply can be crucial. Without this clause, parties might find themselves in a legal gray area, complicating resolution processes.

Lastly, many fail to review the final details of the document before submission. This broad oversight can encompass any number of smaller errors, from typos in names or addresses to incorrect legal descriptions. These mistakes can invalidate the LOI or, at best, delay the process as corrections are made. A final review is akin to proofreading an important email before sending it; it's the step that ensures the message is clear, accurate, and effective.

Documents used along the form

When engaging in transactions, parties often utilize various forms and documents to ensure clear communication and legal compliance. One key document is the Purchase Letter of Intent (LOI), which signifies the initial agreement between parties before finalizing a transaction. Alongside this, several other documents are frequently used to complement the LOI, providing additional details, terms, or agreements between the involved parties.

- Due Diligence Checklists: These are comprehensive lists used by buyers to verify the assets, liabilities, and overall business health of a company they intend to purchase. The aim is to ensure there are no surprises after the transaction is completed.

- Non-Disclosure Agreements (NDAs): To protect sensitive information shared during negotiations, parties often sign NDAs. These agreements ensure that data pertaining to business operations, financials, and strategic plans are kept confidential.

- Terms Sheets: These documents outline the key financial and other terms of a deal. They serve as a foundation for more detailed agreements and help in aligning both parties' expectations early in the negotiation process.

- Memorandum of Understanding (MOU): An MOU is a formal agreement between two or more parties. It is used to establish official partnerships or agreements. It’s not as legally binding as a contract but indicates the intention to move forward towards a contract.

- Escrow Agreement: These agreements involve a third party holding funds or assets until the parties meet specific conditions or obligations. It is commonly used to provide security in transactions, ensuring that parties meet their commitments before assets change hands.

Together, these documents form a comprehensive framework that supports the Purchase Letter of Intent. They help clarify the terms and conditions of the agreement, safeguard confidential information, ensure due diligence, and secure the transaction process. By carefully preparing and reviewing these documents, parties can effectively manage risks and increase the likelihood of a successful transaction.

Similar forms

A Purchase Agreement is quite similar to a Purchase Letter of Intent as both documents serve the purpose of outlining the terms and conditions of a sale. However, where a Purchase Letter of Intent acts as an initial proposal or understanding between the parties, expressing an interest to proceed with the transaction, a Purchase Agreement is a legally binding contract that finalizes the sale and details the comprehensive terms of the transaction, including payment terms, delivery dates, legal and financial responsibilities of each party, and warranties.

An Expression of Interest (EOI) bears resemblance to a Purchase Letter of Intent in that both are preliminary documents declaring an intent to pursue further action regarding a transaction or project. However, an EOI is often more exploratory in nature and is used in various contexts, such as job applications or real estate inquiries. It broadly indicates a party's interest without detailing the specific terms of engagement, unlike the Purchase Letter of Intent which is more focused on the purchase specifics.

The Memorandum of Understanding (MOU) shares similarities with a Purchase Letter of Intent as both are preparatory documents that outline mutual intentions to engage in a deal or partnership. An MOU, however, tends to be used in more complex transactions, often involving multiple parties, and outlines a broader framework of understanding, cooperation, or partnership agreement rather than the specific details of a purchase transaction. It's a step towards a formal agreement, stressing shared goals without legally binding the parties to the transaction.

Heads of Terms, much like the Purchase Letter of Intent, function as a precursor to a formal agreement. They are typically used in the UK and outline key points of a deal or partnership that all parties agree to in principle, prior to the drafting of a detailed contract. While both documents serve to record a mutual preliminary agreement, the Heads of Terms are more commonly associated with real estate and large commercial deals, providing a basis for the contractual negotiations that follow.

A Non-Disclosure Agreement (NDA) can occasionally accompany a Purchase Letter of Intent, especially when proprietary information, trade secrets, or sensitive business information needs to be shared during the negotiation process. While the Purchase Letter of Intent outlines the intent to purchase or sell, an NDA specifically safeguards any confidential information exchanged between the parties. It creates a confidential relationship, protecting the assets that may be pivotal to the transaction or subsequent agreements.

The Term Sheet, often used in venture capital transactions, shares a purpose with the Purchase Letter of Intent, by indicating the basic terms and conditions under which an investment will be made. Though serving different sectors—purchase transactions versus investment deals—both documents serve as a foundation for drafting a more detailed agreement. Term Sheets are instrumental in negotiating the structures of a deal, focusing primarily on the financial aspects of investment transactions.

Lastly, a Letter of Agreement, while similar in function to a Purchase Letter of Intent, is typically a more formalized document that outlines the terms and conditions of a service rendered rather than a goods purchase transaction. It can be binding, depending on its wording and content, defining the scope of work, payment terms, timelines, and responsibilities of involved parties. Though both documents aim to clarify the intentions and preliminary terms between parties, a Letter of Agreement is more directly tied to the provision of services.

Dos and Don'ts

When preparing to fill out a Purchase Letter of Intent (LOI) form, attention to detail can make a significant difference in the negotiation process and outcomes. Here's a guide on what you should and shouldn't do to ensure your LOI accurately reflects your intentions and protects your interests:

DOs:

- Review the property's details thoroughly to ensure all relevant information is included, such as the property address, legal description, and any specific assets or fixtures involved in the purchase.

- Clarify the terms and conditions of the offer, including purchase price, deposit amount, financing arrangements, and any contingencies such as financing approval or property inspections.

- Include a clear timeline for each stage of the purchase process, specifying deadlines for acceptance of the offer, completion of due diligence, and the proposed closing date.

- Consult with a real estate attorney or legal advisor to review the LOI before submission, ensuring that it protects your rights and interests.

- Specify the confidentiality of the negotiation process, if applicable, to protect sensitive information shared between the parties during discussions.

- Maintain a professional and cordial tone throughout the document to foster a positive negotiating environment.

DON'Ts:

- Overlook the importance of specifying who is responsible for covering closing costs, inspection fees, or other transaction-related expenses.

- Forget to include an expiration date for the offer, leaving the LOI open indefinitely and potentially tying up your ability to make other offers.

- Omit any contingencies that are crucial to your decision to move forward with the purchase, as failing to include these can limit your options later.

- Provide vague or ambiguous terms that could lead to misunderstandings or disputes during the closing process.

- Assume everything is negotiable after submitting the LOI; make your intentions and requirements clear from the outset to avoid later complications.

- Sign the document without ensuring every piece of information is accurate and reflects your understanding of the agreement.

Taking the time to address these key points can pave the way for a smoother negotiation and transaction process, helping both parties move forward with confidence and clarity.

Misconceptions

When navigating the path of significant purchases, especially in the realm of real estate or business, a Purchase Letter of Intent (LOI) often serves as a preliminary agreement between the parties involved. However, there are several misconceptions surrounding the Purchase LOI, which can lead to misunderstandings or missteps. Let’s clarify some of these misconceptions.

It’s Legally Binding: A common misconception is that a Purchase LOI is fully legally binding like a formal contract. In reality, LOIs generally serve as a declaration of intent to enter negotiations in good faith. While certain sections, such as confidentiality clauses, may be binding, the document as a whole often does not compel either party to finalize the deal.

A Formal Contract Isn’t Necessary if an LOI Is Signed: This is incorrect. A Purchase LOI is typically a precursor to a detailed, formal contract. It outlines the terms and conditions in broad strokes, serving as a foundation for the binding agreement that follows. An LOI alone is not sufficient to finalize a transaction.

LOIs Are Just for Real Estate Transactions: While real estate deals frequently utilize LOIs due to their complex nature and the substantial sums involved, LOIs can be beneficial in various scenarios, including the sale of businesses, large equipment purchases, or any transaction where initial terms need to be agreed upon before a detailed contract is executed.

Every LOI Is the Same: There’s a wide belief that these letters are one-size-fits-all documents that simply get minor tweaks. However, the content of an LOI can vary significantly based on the transaction’s complexity, the specifics of the assets involved, and the parties’ requirements. Customization ensures that the LOI accurately reflects the preliminary agreement.

Terms Are Not Negotiable After an LOI Is Signed: Actually, the main purpose of an LOI is to provide a basis for further negotiation. Signing an LOI doesn’t mean the terms are set in stone; it signals the beginning of detailed negotiations with the intent to reach a mutual agreement reflected in a subsequent, binding contract.

LOIs Are Required for All Major Transactions: While LOIs can be incredibly useful for outlining the terms and facilitating negotiations in major transactions, they are not a universal requirement. Whether or not to use an LOI depends on the nature of the transaction, the preferences of the parties involved, and sometimes, the legal or financial advice they receive.

Understanding what a Purchase Letter of Intent is—and what it is not—can help parties navigate their negotiations more effectively, setting the stage for a smoother transaction process.

Key takeaways

Filling out and utilizing a Purchase Letter of Intent form is an important step in the purchasing process, serving as a preliminary agreement between a buyer and a seller. Below are five key takeaways to consider when navigating this process:

A Purchase Letter of Intent clearly outlines the terms of a deal before the official contract is drafted, including price, payment terms, and a description of the property or service being purchased. It acts as a foundation for the formal agreement.

Accuracy is paramount when filling out the form. Both parties need to ensure that all the information is detailed and accurate. This includes the legal names of both the buyer and seller, a comprehensive description of the purchase, and any contingencies that the purchase is subject to.

Timelines are crucial. The form should specify key dates, such as when the purchase is expected to close and any deadlines for due diligence or finalizing financing. This helps both parties manage their expectations and coordinate their plans accordingly.

Confidentiality can be addressed within the Letter of Intent. If either party requires certain information to remain confidential, this should be explicitly stated. This ensures both parties feel secure sharing information during the negotiation process.

Consulting with legal or professional advisors before submitting a Purchase Letter of Intent is always recommended. Professionals can provide valuable insight into the terms of the agreement, ensuring that the interests of both the buyer and seller are protected and that all legal requirements are met.

Remember, a Purchase Letter of Intent is not just a formality but a significant part of the negotiation process, setting the stage for a successful transaction. Careful attention to detail and consideration of the key points mentioned above can help streamline the purchase process, minimize misunderstanding, and pave the way for a smooth transition to a binding contract.

Consider More Types of Purchase Letter of Intent Forms

Letter of Intent Residency Example - Positions the candidate as a proactive, thoughtful individual keenly aware of how the residency aligns with personal and professional growth plans.