Official Letter of Intent to Purchase Commercial Real Estate Document

Embarking on the journey to acquire commercial real estate is a significant step for any business or investor, one that requires careful consideration and meticulous planning. At the heart of this process, the Letter of Intent to Purchase Commercial Real Estate form emerges as a pivotal document, setting the foundation for negotiations between the buyer and seller. This form is a preliminary agreement, not binding in the same way a final purchase agreement is, but crucial in laying out the intentions, terms, and conditions proposed by the buyer. It serves multiple purposes: it clarifies the key points of the deal, provides a roadmap for future legal documentation, and acts as a safeguard to ensure that both parties are on the same page before substantial resources are allocated to due diligence and further contract negotiations. While it may seem like just another piece of paperwork, the Letter of Intent is a powerful tool in the commercial real estate acquisition process, setting the tone for what both parties can expect moving forward.

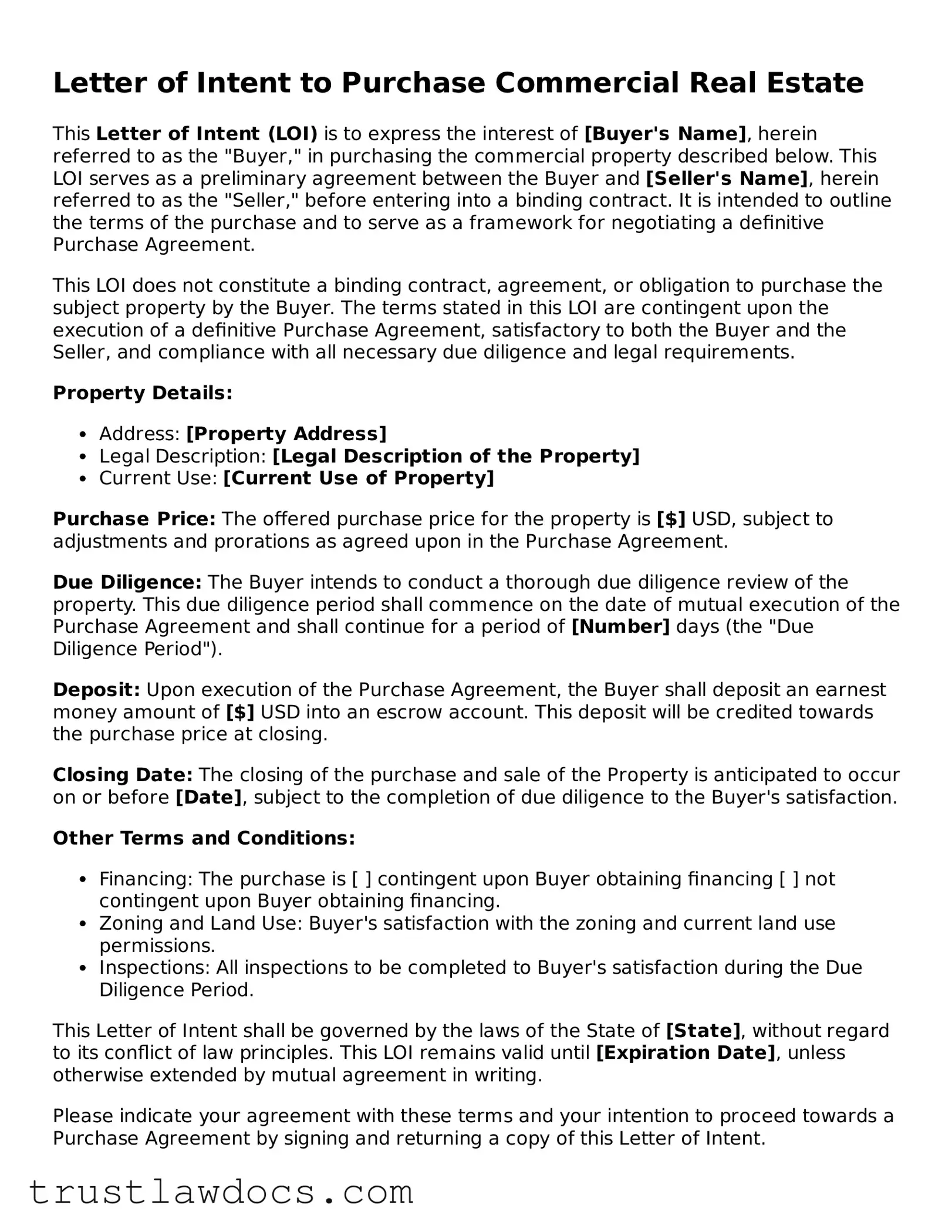

Form Example

Letter of Intent to Purchase Commercial Real Estate

This Letter of Intent (LOI) is to express the interest of [Buyer's Name], herein referred to as the "Buyer," in purchasing the commercial property described below. This LOI serves as a preliminary agreement between the Buyer and [Seller's Name], herein referred to as the "Seller," before entering into a binding contract. It is intended to outline the terms of the purchase and to serve as a framework for negotiating a definitive Purchase Agreement.

This LOI does not constitute a binding contract, agreement, or obligation to purchase the subject property by the Buyer. The terms stated in this LOI are contingent upon the execution of a definitive Purchase Agreement, satisfactory to both the Buyer and the Seller, and compliance with all necessary due diligence and legal requirements.

Property Details:

- Address: [Property Address]

- Legal Description: [Legal Description of the Property]

- Current Use: [Current Use of Property]

Purchase Price: The offered purchase price for the property is [$] USD, subject to adjustments and prorations as agreed upon in the Purchase Agreement.

Due Diligence: The Buyer intends to conduct a thorough due diligence review of the property. This due diligence period shall commence on the date of mutual execution of the Purchase Agreement and shall continue for a period of [Number] days (the "Due Diligence Period").

Deposit: Upon execution of the Purchase Agreement, the Buyer shall deposit an earnest money amount of [$] USD into an escrow account. This deposit will be credited towards the purchase price at closing.

Closing Date: The closing of the purchase and sale of the Property is anticipated to occur on or before [Date], subject to the completion of due diligence to the Buyer's satisfaction.

Other Terms and Conditions:

- Financing: The purchase is [ ] contingent upon Buyer obtaining financing [ ] not contingent upon Buyer obtaining financing.

- Zoning and Land Use: Buyer's satisfaction with the zoning and current land use permissions.

- Inspections: All inspections to be completed to Buyer's satisfaction during the Due Diligence Period.

This Letter of Intent shall be governed by the laws of the State of [State], without regard to its conflict of law principles. This LOI remains valid until [Expiration Date], unless otherwise extended by mutual agreement in writing.

Please indicate your agreement with these terms and your intention to proceed towards a Purchase Agreement by signing and returning a copy of this Letter of Intent.

Signed on [Date]:

For the Buyer:

___________________________

[Buyer's Name]

For the Seller:

___________________________

[Seller's Name]

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A Letter of Intent to Purchase Commercial Real Estate is a preliminary agreement indicating a buyer's interest in buying a commercial property before a formal, binding contract is drawn up. |

| Function | It outlines the terms of the purchase, including price, due diligence periods, and closing conditions, but is not legally binding. |

| Components | Typically includes details such as the offered purchase price, description of the property, payment terms, contingencies, and any conditions precedent to the final sale. |

| Legality | While the letter itself is not a legally binding document, it can include binding provisions related to confidentiality and negotiation exclusivity. |

| Governing Law | Real estate law governs these letters, and while they are generally consistent across jurisdictions, state-specific laws may further dictate their formulation and execution. |

How to Write Letter of Intent to Purchase Commercial Real Estate

Upon deciding to purchase commercial real estate, drafting a Letter of Intent (LOI) is a critical step. This document signifies a buyer's intention to enter into negotiations with the intention of purchasing the property. It outlines the preliminary terms between the parties, serving as a foundation for the formal purchase agreement. Creating a clear and precise LOI can streamline the negotiation process, ensuring both parties are aligned from the onset. The steps to complete this form are straightforward but require attention to detail to ensure all relevant information is accurately conveyed.

- Start by entering the date at the top of the document. This date marks when the LOI is being issued.

- Include the full legal names and addresses of both the buyer and the seller in the designated sections. This identifies the parties involved in the transaction.

- Describe the property in question, including its legal description and address. Detail is key to ensure there is no ambiguity regarding which property is being referred to.

- Specify the offered purchase price for the property. This should be a clear figure or a method of calculation if the price is contingent on certain appraisals or conditions.

- Outline the terms of the payment. Indicate whether the purchase will be made in cash, financed through a lender, or a combination of both. If installment payments or other financial arrangements are proposed, detail these terms.

- State the earnest money deposit amount, if applicable. This demonstrates the buyer's good faith and intention to purchase.

- Detail any contingencies that must be resolved before the sale can be finalized. These might include property inspections, approval of financing, or zoning verifications. Be explicit about what conditions must be met and the timeframe for their resolution.

- Specify the proposed closing date or how the date will be determined. This gives both parties a target timeline for completing the transaction.

- Include any additional terms or conditions that are important to the buyer or seller. This section allows for the inclusion of custom clauses specific to the transaction.

- Conclude by providing spaces for both the buyer’s and seller’s signatures, along with the date these were affixed. Signatures formally acknowledge the intent of both parties to proceed under the terms outlined in the document.

Completing a Letter of Intent is a step forward in the negotiation process for purchasing commercial real estate. It sets the tone for a professional and structured transaction, ensuring clarity and understanding right from the start. Though not legally binding in itself, it reflects the seriousness of the buyer's intent and lays the groundwork for the legal documentation that will follow.

Get Answers on Letter of Intent to Purchase Commercial Real Estate

What is a Letter of Intent to Purchase Commercial Real Estate?

A Letter of Intent (LOI) to Purchase Commercial Real Estate is a preliminary agreement between a buyer and a seller indicating the buyer's interest in purchasing the property. This document outlines the basic terms and conditions of the proposed transaction, including price, due diligence periods, and closing conditions, before entering into a binding contract. It serves to align both parties' expectations and acts as a foundation for negotiating a formal purchase agreement.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent itself is not legally binding in terms of the obligation to purchase or sell the property. However, certain provisions within, such as confidentiality, exclusivity, and governing law clauses, can be binding. It is crucial to clearly specify which parts are intended to be binding to avoid unintended legal obligations.

What key terms are included in a Letter of Intent?

A typical Letter of Intent to Purchase Commercial Real Estate includes terms such as the purchase price, deposit amount, due diligence period, anticipated closing date, description of the property, and any contingencies that the purchase is subject to. It may also address matters like title issues, financing terms, and the allocation of closing costs.

How can I ensure that my Letter of Intent is taken seriously?

To ensure that your Letter of Intent is taken seriously, present a clear, concise, and professionally formatted document. Include all relevant terms and show your commitment to the transaction through earnest money deposits or proof of funds. Demonstrating a willingness to move forward quickly on due diligence and closing processes can also convey seriousness.

Can either party back out after signing a Letter of Intent?

Yes, either party can typically back out after signing a Letter of Intent since it is not usually a binding agreement to purchase or sell. Nonetheless, if there are binding provisions within the LOI, such as exclusivity or confidentiality clauses, these must still be adhered to regardless of the decision to proceed with the purchase.

What happens after a Letter of Intent is signed?

After signing a Letter of Intent, both parties generally proceed with due diligence. This phase involves thorough examination of the property, reviewing legal, environmental, and structural aspects, among others. Concurrently, the formal Purchase and Sale Agreement (PSA) is negotiated. The findings from the due diligence process can impact the final terms of the PSA.

Can a Letter of Intent be negotiated?

Absolutely. A Letter of Intent serves as an initial proposal and starting point for negotiations. Both the buyer and seller have the opportunity to negotiate terms such as price, due diligence period, closing date, and other important conditions before committing to a formal agreement.

Do I need an attorney to draft a Letter of Intent?

While it's not mandatory, having an attorney draft or review your Letter of Intent is highly recommended. An experienced real estate attorney can ensure that the LOI accurately reflects your intentions, contains the necessary legal provisions, and doesn't inadvertently bind you to unfavorable terms. This step can prevent costly misunderstandings or disputes.

How does a Letter of Intent differ from a Purchase Agreement?

A Letter of Intent is an initial, often non-binding agreement that outlines the basic terms and conditions of a real estate transaction. A Purchase Agreement, on the other hand, is a legally binding contract that commits the buyer and seller to the sale under the terms and conditions agreed upon. The Purchase Agreement is more detailed and includes comprehensive legal protections for both parties.

Common mistakes

Filling out a Letter of Intent to Purchase Commercial Real Estate is a critical step in the property acquisition process. Often, individuals rush through this task without paying close attention to the details, leading to mistakes that can hinder the transaction. One common error is not properly identifying the parties involved. It is crucial to use full legal names and titles where applicable, to ensure there's no confusion about who is entering into the agreement.

Another area where errors frequently occur is in the description of the property. Some people might provide a general or vague description, but it's important to be as specific as possible. This includes not only the address but also any legal descriptions or parcel numbers associated with the property. Without this level of detail, the intent to purchase can be questioned or invalidated.

Often overlooked, the terms of the offer, including the purchase price, deposit amounts, and financing terms, must be clearly outlined. Leaving out these details or being ambiguous about them can lead to misunderstandings and disagreements down the road. It's not enough to simply agree on a price; how that price is reached and paid should be explicitly stated.

Conditions of the sale are another critical component that is sometimes underdeveloped. These might include due diligence periods, requirements for property inspections, and any contingencies upon which the sale is dependent. Failing to specify these conditions can leave the buyer unprotected if issues arise during the transaction process.

Deadlines play a significant role in real estate transactions, yet they are often not clearly set or are unrealistic. Whether it’s the deadline for the offer acceptance, closing date, or contingencies resolutions, precise dates need to be included. Inadequate attention to these timelines can derail the purchase process.

A frequent misstep is neglecting to detail who is responsible for closing costs and other fees. Without clear agreement in the letter of intent, disputes can emerge, potentially causing delays or even the collapse of the deal. Explicitly stating who bears these costs upfront can prevent such problems.

Another mistake is not specifying dispute resolution mechanisms in the event of a disagreement. A well-drafted letter of intent will outline whether disputes will be handled through mediation, arbitration, or court proceedings. This foresight can save time, money, and stress if tensions rise.

Signing the letter without the appropriate legal advice is a risk that some take, perhaps due to overconfidence or a desire to expedite the process. However, overlooking fine details or legal implications of the terms can lead to challenges later on. Consulting with a legal professional before finalizing the letter can avert these issues.

Also, sometimes parties fail to acknowledge the non-binding nature of the letter of intent. While it outlines the terms under which a deal would be considered, it’s crucial to understand that it is typically not a legally binding agreement to proceed with the purchase. Misunderstanding this can lead to premature commitments or expectations.

Last but not least, neglecting to include a confidentiality clause is a mistake that can lead to unwanted disclosure of the transaction details. This clause protects both parties’ interests and ensures that sensitive information is not shared indiscriminately. It's an essential inclusion for safeguarding the integrity of the deal.

Documents used along the form

When you're gearing up to purchase commercial real estate, the Letter of Intent (LOI) is just the beginning. This initial document outlines the preliminary terms between buyer and seller but comes hand in hand with several other crucial forms and documents. These additional documents ensure due diligence, legal compliance, and clarity for all parties involved throughout the transaction process. Let's go through some of these key documents that often accompany an LOI in a commercial real estate deal.

- Purchase Agreement: A more detailed and legally binding document than the LOI, this agreement outlines the specifics of the purchase terms, including price, deadlines, and conditions.

- Due Diligence Documents: These could include property inspections, environmental assessments, and title searches to ensure the property is as represented.

- Title Insurance Commitment: This document outlines the terms under which the title insurance company agrees to insure the buyer against any claims that may arise related to the property’s title.

- Escrow Agreement: An agreement that details the escrow process, which involves a third party holding funds in trust until all conditions of the purchase are met.

- Property Disclosure Statement: A document where the seller discloses known issues or defects with the property. This is crucial for the buyer's risk assessment.

- Financing Documents: If the purchase will be financed, these documents outline the terms of the loan, including interest rates, repayment schedule, and collateral.

- Lease Agreements: If the property is being purchased with existing tenants, copies of the current lease agreements will be necessary to review the terms and obligations.

Together, these documents form a comprehensive overview of the commercial real estate transaction process. Each plays a vital role in ensuring transparency and protecting the interests of both the buyer and the seller. Navigating these documents can be complex, but understanding their purpose and content can significantly smooth the path to a successful real estate acquisition.

Similar forms

The Purchase Agreement for Real Estate is strikingly similar to the Letter of Intent to Purchase Commercial Real Estate, primarily because both documents spell out the terms under which a piece of real estate will be purchased. However, the Purchase Agreement goes further by being legally binding once both parties sign, making it more than just an intent but a firm commitment to transfer ownership based on agreed conditions.

A Lease Agreement shares common ground with the Letter of Intent to Purchase Commercial Real Estate in that both are precursors to a more permanent arrangement concerning property. While a Letter of Intent signifies the beginning of the negotiation process for buying property, a Lease Agreement is typically the culmination of negotiation talks for renting a property, outlining the terms under which one party agrees to rent property from another.

The Memorandum of Understanding (MOU) is akin to a Letter of Intent as both signify a preliminary agreement between parties. Both are typically non-binding and used to outline the intentions of all parties before a formal, binding agreement is executed. MOUs are often used in various settings, from business deals to international agreements, much like Letters of Intent are used in real estate transactions.

An Offer to Purchase Real Estate is closely related to the Letter of Intent to Purchase Commercial Real Estate, for both signal an interest in buying property. Nonetheless, the Offer to Purchase usually contains more specific details about the offer, including price and terms, and can become binding if the seller accepts it, unlike the generally non-binding nature of the Letter of Intent.

The Non-Disclosure Agreement (NDA) echoes the Letter of Intent in its preliminary nature, safeguarding sensitive information ahead of any formal agreement. When entering into discussions about purchasing real estate, parties may share confidential information; thus, an NDA ensures that such information is protected before a purchase is finalized, similar to how a Letter of Intent sets the stage for detailed negotiations.

A Due Diligence Checklist bears similarity to a Letter of Intent by being an essential step in the process of purchasing real estate. Although it is more of a tool than an agreement, this checklist helps potential buyers identify what information and documents need to be reviewed before finalizing a purchase, setting the groundwork much like a Letter of Intent outlines the basic terms of a deal.

An Option Agreement gives a party the right, but not the obligation, to buy property within a specified timeframe, much like how a Letter of Intent indicates an interest in proceeding towards a purchase but doesn’t compel either party to finalize the deal. Option Agreements are specifically designed to hold a property for a buyer under agreed terms, contrasting with the more general preliminary agreement that a Letter of Intent represents.

The Joint Venture Agreement shares similarities with the Letter of Intent since both can pave the way for commercial real estate transactions involving multiple parties. A Joint Venture Agreement formalizes the partnership between two or more parties working together on a specific project, typically including provisions on how profits, losses, and managerial duties are shared, echoing the collaborative intentions outlined in a Letter of Intent.

Lastly, the Conditional Sale Agreement is similar to a Letter of Intent as it indicates the intention to buy property, but under certain conditions. This agreement goes a step further by being legally binding if conditions are met, similarly aiming to secure a path towards the purchase of real estate but with added security that the deal progresses only if specific terms are satisfied.

Dos and Don'ts

When dealing with a Letter of Intent (LOI) to Purchase Commercial Real Estate, it's essential to approach this initial step in the purchase process with care and diligence. This document sets the stage for negotiations and outlines the terms and conditions of the sale prior to the execution of a binding agreement. Below are key do’s and don’ts to consider:

Do’s:

- Include comprehensive details about the property, such as its address, legal description, and any identifiers. This ensures there is no ambiguity about which property is under consideration.

- State your proposed purchase price clearly along with the terms of payment. This can include whether the offer is contingent upon financing and the amount of earnest money to be deposited.

- Specify any contingencies clearly that need to be met before the deal can close, such as financing approval, property inspections, and appraisal values meeting or exceeding the purchase price.

- Indicate a clear timeline for each stage of the buying process, including dates for the submission of the initial deposit, completion of due diligence, and the final closing date. Timelines keep all parties on track.

- Require both parties to treat negotiations and shared information confidentially. This can protect your business strategies and property information during negotiations.

- Define the expiration date of the offer to ensure there's a sense of urgency and to facilitate timely decision-making.

- Have the document reviewed by a legal professional before submission. This can prevent misunderstandings and protect your interests.

Don’ts:

- Do not leave any verbal agreements out of the letter. If it's not written down, it's not enforceable.

- Avoid being vague about any of the terms and conditions of the offer. Ambiguity can lead to disputes or misunderstandings.

- Do not forget to include a clause that states the LOI is not legally binding. This is important to ensure flexibility until the final sale agreement is signed.

- Never ignore the need for due diligence. Failing to set terms for this process can result in overlooked details that could significantly impact the value or suitability of the property.

- Avoid rushing through the preparation of the LOI without carefully considering all aspects of the purchase. This document is crucial and sets the foundation for the purchase agreement.

- Do not neglect to specify who is responsible for closing costs, property taxes, and other fees. These details can significantly affect the final net cost to the buyer.

- Never submit the LOI without ensuring all involved parties, including partners or stakeholders, agree with its contents. Dissent within the buying party can cause delays or derail the purchase.

Misconceptions

When it comes to the Letter of Intent to Purchase Commercial Real Estate (LOI), there are several common misconceptions. Understanding these can help both buyers and sellers navigate the initial steps of a commercial property transaction more effectively.

A Letter of Intent is legally binding. Many people believe that an LOI, in itself, creates a binding agreement to purchase or sell real estate. However, the primary purpose of an LOI is to outline the basic terms of a deal before the official contract is drafted. While certain aspects, like confidentiality clauses, can be binding, the LOI as a whole does not usually obligate either party to complete the transaction.

Details in the LOI are merely suggestions. Although not legally binding as a contract, the terms laid out in an LOI can set significant expectations between the parties. Ignoring the agreed-upon terms when drafting the official purchase agreement can lead to disputes or a breakdown in negotiations.

Every LOI is pretty much the same. There's a misconception that there's a one-size-fits-all template for LOIs that works for every transaction. In reality, the content of an LOI should be tailored to the specific deal, covering terms that are crucial for the parties involved.

An LOI is unnecessary if you trust the other party. Trust between the buyer and seller is valuable, but an LOI serves as a critical step in clarifying the terms of a deal before entering into a binding contract. It helps prevent misunderstandings and provides a roadmap for the transaction.

Signing an LOI means you can't back out. Since most LOIs are not binding in terms of the transaction completion, both parties generally have the ability to walk away from the deal after the LOI is signed. However, this doesn't include any binding provisions within the LOI, such as confidentiality agreements, which remain enforceable.

LOIs are only about price. While the purchase price is a critical component, LOIs also cover other important terms such as the due diligence period, financing conditions, closing date, and any contingencies related to the sale.

You don't need an attorney to draft an LOI. While it's possible to draft an LOI without legal assistance, involving an attorney can ensure that the LOI accurately reflects the deal's terms without creating unintended obligations. Legal professionals can also advise on any binding clauses within the LOI.

An LOI will speed up the transaction. The goal of an LOI is to outline the main terms of a deal, potentially streamlining the drafting of the purchase agreement. However, drafting an LOI and negotiating its terms can also add time to the transaction process, especially if there are significant disagreements.

An LOI must be detailed. There's a balance to be struck in the level of detail in an LOI. While it should be comprehensive enough to outline the key terms of the deal, overly detailed LOIs can sometimes slow down negotiations or create confusion.

LOIs are a formality and can be rushed. Although not a contract, the LOI is an important step in the commercial real estate purchase process. Rushing through its preparation can lead to oversights or misaligned expectations, potentially derailing the transaction later on.

By dispelling these misconceptions, parties can approach the Letter of Intent to Purchase Commercial Real Estate with a clearer understanding, setting the stage for a smoother transaction process.

Key takeaways

When it comes to navigating the initial stages of a commercial real estate transaction, the Letter of Intent (LOI) to Purchase Commercial Real Estate plays a pivotal role. This document serves as a preliminary agreement between the buyer and seller, outlining the terms and conditions under which the buyer intends to purchase the property. Here are four key takeaways to consider when filling out and using this form:

- Clarify Terms Early On: The LOI allows both parties to agree on major terms before drafting a formal purchase agreement. This includes the sale price, deposit amounts, due diligence periods, and closing dates. By clarifying these terms early, both parties can proceed with a clear understanding of each other's expectations and requirements.

- Non-Binding Nature: Typically, a Letter of Intent is non-binding, meaning it doesn't legally compel either party to complete the transaction. Despite this, it's crucial to approach its preparation with seriousness, as it lays the groundwork for the binding purchase agreement. Certain sections, like confidentiality, may be binding, so it's essential to read and understand each part fully.

- Facilitates Negotiations: The LOI acts as a negotiation tool. By outlining the terms of the deal before entering into a binding contract, it provides a framework for discussing and refining the details. This process helps streamline negotiations and can save time and resources for both parties involved.

- Professional Assistance is Key: Given the implications and complexity of commercial real estate transactions, seeking professional legal and financial advice when drafting the LOI is advisable. Professionals can help ensure that the document accurately reflects the agreement's terms and that you are aware of all obligations and rights.

In conclusion, the Letter of Intent to Purchase Commercial Real Estate is a crucial document that facilitates the smoother negotiation and understanding of a commercial property transaction. Paying careful attention to its preparation and the terms it includes can set a positive tone for the entire purchase process.

Consider More Types of Letter of Intent to Purchase Commercial Real Estate Forms

Homeschool Letter of Intent - Important for meeting homeschooling regulations and ensuring a child's right to education is preserved.

Letter of Intent to Invest - Using an Investment Letter of Intent can facilitate a smoother transition to the later stages of investment, ensuring that foundational issues are addressed early on.

Letter of Intent Residency Example - A strategic tool to stand out in a competitive field, by marshalling personal narratives and professional achievements that resonate with the program's values.