Official Letter of Intent to Purchase Business Document

In the often intricate world of buying and selling businesses, clarity and intent play crucial roles long before any formal agreements are made. A pivotal document, the Letter of Intent to Purchase Business, serves as a lynchpin in this process, marking the transition from preliminary discussions to serious negotiation. This document, while not typically binding in its entirety, outlines the basic terms of the deal, including, but not limited to, the proposed purchase price, payment structure, and time frames for due diligence and closing. It acts as a foundation upon which the definitive purchase agreement will later be built, allowing both parties to align their expectations and negotiate in good faith with a clear understanding of the other's position. Furthermore, it can include provisions that serve to protect both the buyer and seller during the negotiation phase, such as exclusivity clauses that restrict the seller from courting other purchasers for a specified period. Understanding the nuances of this document is vital for anyone navigating the complex waters of business acquisitions, as it not only signifies serious intention but also lays the groundwork for the intricate negotiation process that follows.

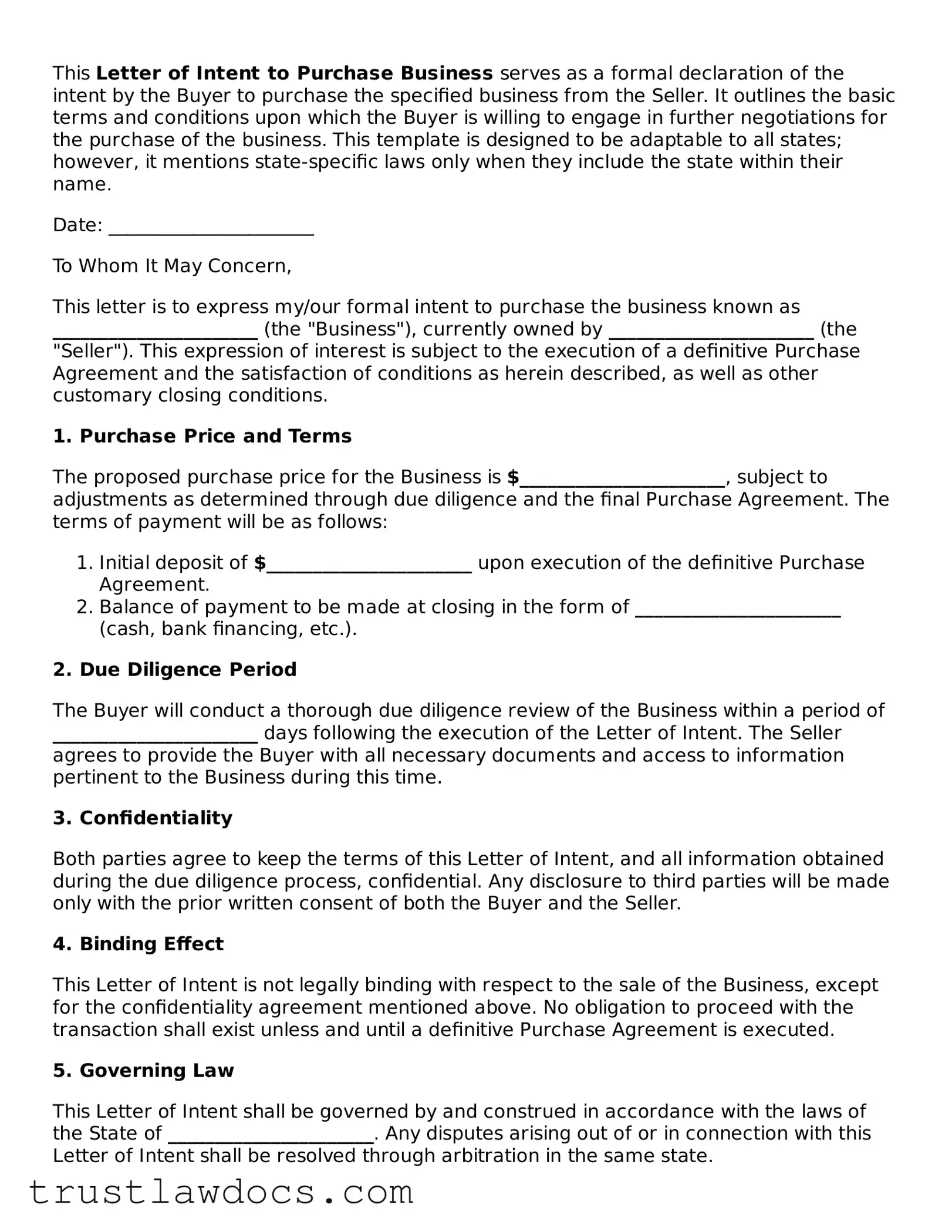

Form Example

This Letter of Intent to Purchase Business serves as a formal declaration of the intent by the Buyer to purchase the specified business from the Seller. It outlines the basic terms and conditions upon which the Buyer is willing to engage in further negotiations for the purchase of the business. This template is designed to be adaptable to all states; however, it mentions state-specific laws only when they include the state within their name.

Date: ______________________

To Whom It May Concern,

This letter is to express my/our formal intent to purchase the business known as ______________________ (the "Business"), currently owned by ______________________ (the "Seller"). This expression of interest is subject to the execution of a definitive Purchase Agreement and the satisfaction of conditions as herein described, as well as other customary closing conditions.

1. Purchase Price and Terms

The proposed purchase price for the Business is $______________________, subject to adjustments as determined through due diligence and the final Purchase Agreement. The terms of payment will be as follows:

- Initial deposit of $______________________ upon execution of the definitive Purchase Agreement.

- Balance of payment to be made at closing in the form of ______________________ (cash, bank financing, etc.).

2. Due Diligence Period

The Buyer will conduct a thorough due diligence review of the Business within a period of ______________________ days following the execution of the Letter of Intent. The Seller agrees to provide the Buyer with all necessary documents and access to information pertinent to the Business during this time.

3. Confidentiality

Both parties agree to keep the terms of this Letter of Intent, and all information obtained during the due diligence process, confidential. Any disclosure to third parties will be made only with the prior written consent of both the Buyer and the Seller.

4. Binding Effect

This Letter of Intent is not legally binding with respect to the sale of the Business, except for the confidentiality agreement mentioned above. No obligation to proceed with the transaction shall exist unless and until a definitive Purchase Agreement is executed.

5. Governing Law

This Letter of Intent shall be governed by and construed in accordance with the laws of the State of ______________________. Any disputes arising out of or in connection with this Letter of Intent shall be resolved through arbitration in the same state.

We look forward to moving ahead with the proposed transaction and anticipate prompt and mutually beneficial agreements. Please indicate your acceptance of this Letter of Intent by signing and returning a copy to us.

Sincerely,

____________________________________

(Buyer's Name)

Buyer's Contact Information:

Address: ____________________________________

Phone: ____________________________________

Email: ____________________________________

Acknowledged and Agreed:

____________________________________

(Seller's Name)

Seller's Contact Information:

Address: ____________________________________

Phone: ____________________________________

Email: ____________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Serves as a formal proposal to indicate the buyer's intention to purchase a business. |

| Non-Binding Nature | Generally, it is non-binding except for specific provisions such as confidentiality and exclusivity. |

| Main Components | Includes details like purchase price, payment terms, due diligence period, and conditions for the sale. |

| Due Diligence | Allows the buyer to assess the business’s financials, legal standing, and operational viability. |

| Confidentiality Clause | Protects sensitive information shared during negotiations from being disclosed. |

| Exclusivity Agreement | Restricts the seller from negotiating with other potential buyers for a specified period. |

| Governing Law | Varies by state; state-specific forms should conform to the local laws governing business sales. |

| Importance of Legal Review | Advisable to have the document reviewed by a legal professional to safeguard interests and ensure the terms are clear and enforceable. |

| Final Agreement | The letter precedes a more detailed purchase agreement that finalizes the sale. |

How to Write Letter of Intent to Purchase Business

Once the decision to move forward with acquiring a business has been made, the Letter of Intent to Purchase Business form becomes an essential step in the process. This document serves to express a buyer's intention to purchase a business and outlines the terms and conditions under which the buyer intends to make the purchase. Creating a strong and clear Letter of Intent helps both parties understand and agree upon the framework of the deal before delving into the more involved phases of due diligence and contract negotiation. The steps outlined below aim to guide you through filling out the form effectively, ensuring that all necessary details are accurately captured.

- Begin by filling in the date at the top of the form. This signifies when the letter is being issued.

- Enter the full name and address of the seller in the space provided. Be sure it matches the legal documents of the business being purchased.

- Enter the full name and address of the buyer or purchasing entity in the corresponding section. Accuracy here is crucial for legal purposes.

- Provide a detailed description of the business to be acquired. Include the legal name, any operating names (DBAs), the location, and a brief description of what the business does.

- State the proposed purchase price and the terms of payment. This includes any deposits, financing arrangements, or other conditions affecting the price.

- Detail any assets or inventory included in the purchase. Specify any exclusions or conditions that apply to these assets.

- Outline any liabilities or obligations that will be assumed by the buyer. Clarify the scope and limitations of what will be transferred as part of the deal.

- Include the proposed timeline for due diligence and the expected closing date. Providing clear dates helps manage expectations and planning for both parties.

- Specify any contingencies that must be met before the deal can be finalized. These might include financing approvals, satisfactory due diligence findings, or regulatory clearances.

- List any additional terms and conditions that are important to the buyer or seller. This can include non-compete clauses, consulting agreements for transitioning the business, or any other special arrangements.

- Conclude by providing a space for both the buyer and seller to sign and date the letter. This formalizes the intent to proceed under the specified terms.

After completing and signing the Letter of Intent to Purchase Business form, the next step involves both parties engaging in their respective duties—due diligence for the buyer and preparing the necessary documents and information for the seller. This phase is critical and often requires careful examination of financial records, legal contracts, and other business aspects by the buyer. Meanwhile, the seller must ensure all requested documentation and responses are provided promptly. Successful navigation through this phase sets a solid foundation for finalizing the purchase agreement and concluding the transaction smoothly.

Get Answers on Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent to Purchase Business, often abbreviated as LOI, is a document that a potential buyer sends to a seller to express interest in buying their business. This form outlines the preliminary terms between the two parties, including the proposed purchase price, the structure of the transaction (e.g., assets or stock purchase), and other key conditions. Although not a binding agreement to buy or sell, it sets the framework for negotiations and due diligence processes that precede a final sale agreement.

What should be included in a Letter of Intent to Purchase Business?

Typically, a Letter of Intent to Purchase Business should include several essential components: the identification of the buyer and seller, a description of the business to be purchased, the proposed purchase price, the structure of the proposed transaction, any contingencies that the deal is subject to (such as financing or satisfactory completion of due diligence), terms concerning confidentiality and exclusivity during the negotiation period, and the anticipated timeline for completing the transaction. It might also outline responsibilities like who will bear certain costs and provide for a period during which the offer will remain valid.

Is a Letter of Intent to Purchase Business legally binding?

In general, a Letter of Intent itself is not legally binding in terms of the obligation to complete the purchase. However, certain sections within the letter, like confidentiality, non-solicitation, and exclusivity clauses, can be binding. The LOI serves more as a good faith agreement between the parties to work together under specified terms toward a final sale. It's critical for both parties to carefully review these sections with their legal advisers to understand which parts of the letter, if any, have legal obligations attached.

How does the Letter of Intent to Purchase Business fit into the overall business purchase process?

The Letter of Intent is typically an initial step in the business purchase process. After it is issued and if the seller accepts the outlined terms, both parties enter into a period of due diligence. During this time, the buyer investigates the business more thoroughly to confirm the accuracy of its understanding and assesses the business's true value. Concurrently, legal teams often start drafting the definitive purchase agreement, taking into account the findings during due diligence. Following successful due diligence, and once negotiations conclude satisfactorily for both parties, the transaction moves forward to closing, where the final sale documents are signed, and ownership of the business changes hands. The LOI plays a critical role in ensuring both parties are initially on the same page regarding the deal's main terms before investing significant time and resources into the transaction.

Common mistakes

One common mistake when completing a Letter of Intent to Purchase Business form is failing to adequately describe the terms of the deal. In specific, people often under-specify the purchase price, payment method, and terms of the payment schedule. This lack of detail can lead to ambiguity and potential disputes during the negotiation process. It is crucial to outline these elements clearly to ensure both parties have a mutual understanding of the agreement's financial aspects.

Another error is neglecting to include necessary contingencies that protect the buyer's interests. These provisions allow the buyer to withdraw from the deal under certain conditions, such as failing to secure financing or discovering significant issues during the due diligence process. Without these contingencies, the buyer might be legally obligated to proceed with the purchase even if substantial problems are uncovered, or if financing falls through.

A third mistake often seen is not having a confidentiality clause within the letter. This omission can lead to sensitive information about the deal or the business itself becoming public knowledge, potentially harming the business's value or reputation. A confidentiality clause ensures that details of the negotiation remain private between the involved parties, protecting the interests of both buyer and seller.

Last, parties sometimes mistakenly treat the letter as a binding agreement rather than a statement of intent. Although some parts of the letter can be legally binding, such as confidentiality and exclusivity agreements, the document primarily serves to outline the terms of a potential agreement. It is important to specify which parts of the letter are intended to be binding to avoid legal complications that might force one party into an unintended commitment.

Documents used along the form

When initiating the purchase of a business, a Letter of Intent (LOI) serves as a pivotal document, setting the stage for negotiation and outlining the preliminary terms between the buyer and the seller. However, this form does not stand alone in the process of acquiring a business. Several other essential documents and forms often accompany or follow the LOI to ensure a thorough and legal transfer of ownership. These documents play critical roles in due diligence, financing, and the legal mechanics of the transition. Below is a list of up to 10 key documents often used in conjunction with the Letter of Intent to Purchase Business, each briefly described to shed light on their significance in the business acquisition process.

- Confidentiality Agreement: This form protects sensitive information shared during the negotiation process. It obligates all parties to keep the details of the business and the potential sale private.

- Due Diligence Checklist: A comprehensive list detailing records, documents, and other information for the buyer to review before finalizing the purchase. This checklist ensures the buyer fully understands what they are acquiring.

- Non-Compete Agreement: Often required from the seller to prevent them from starting a new, competing business within a certain geographical area and timeframe after the sale.

- Asset Purchase Agreement: A detailed agreement that outlines the exact assets being purchased, including tangible and intangible assets, and the terms of the purchase.

- Stock Purchase Agreement: Used when the transaction involves buying the company’s stock, this document outlines the sale of shares from the seller to the buyer, including price and number of shares.

- Bill of Sale: This document officially transfers ownership of the assets or stock to the buyer, serving as a receipt for the transaction.

- Employment Agreement: Should the buyer intend to retain any of the current employees, including management, this agreement outlines the terms of their continued employment.

- Lease Assignment: If the business occupies leased property, this document transfers the lease agreement from the seller to the buyer.

- Closing Statement: Prepared at the culmination of the deal, this document summarizes all the financial transactions that occurred, including the final sale price, adjustments, and any fees.

- Non-Disclosure Agreement (NDA): Similar to the Confidentiality Agreement, this ensures that proprietary information shared during negotiations remains confidential, often signed by parties involved in the assessment and finalization of the deal.

Together with the Letter of Intent, these documents facilitate a smooth and legally sound transfer of business ownership. Whether it's for due diligence, legal compliance, or operational transition, each form plays a vital role in paving the way for a successful business acquisition. Understanding the purpose and details of these documents can significantly enhance the efficiency and security of the transaction process.

Similar forms

A Letter of Intent to Purchase Business form is closely related to a Memorandum of Understanding (MOU). Both serve as preliminary agreements between two parties before a final agreement is reached. An MOU, like a letter of intent, outlines the basic terms and conditions of a partnership or deal. The critical similarity lies in their non-binding nature, designed to express a mutual agreement to proceed, without constituting a legally enforceable contract. These documents are preparatory steps used in various negotiations, capturing intentions and understandings before detailed contracts are drawn up.

Another similar document is a Term Sheet, which, like a Letter of Intent, is often used in the early stages of business transactions, especially in financing or acquiring businesses. Term Sheets outline the primary terms and conditions under which an investment or acquisition will proceed. They focus heavily on financial details, such as valuation and investment structure, clearly paralleling the financial and structural outlines seen in a Letter of Intent. Both are negotiating tools that lay the groundwork for more formal agreements, yet do not typically bind the parties to the transaction.

The Letter of Intent to Purchase Business form also shares similarities with a Purchase Agreement. Though a Purchase Agreement is a binding contract and the Letter of Intent is not, both documents are crucial in the process of buying and selling businesses. They detail the terms of the sale, including payment terms, due diligence periods, and confidentiality clauses. The main difference is that the Purchase Agreement finalizes these terms, making them legally enforceable, whereas the Letter of Intent simply indicates a serious intention to engage in these terms pending further negotiation and due diligence.

Lastly, a Preliminary Agreement stands in close relation to a Letter of Intent. This document is used after initial negotiations to outline the structure of a deal and the steps both parties will take towards closing. Like a Letter of Intent, a Preliminary Agreement helps to establish a clear path forward for the transaction, but it may carry a bit more weight in terms of commitment without being as binding as a final contract. Both documents serve to orchestrate the progression of negotiations and streamline the transition to binding agreements, ensuring that both parties are aligned in their understanding and expectations.

Dos and Don'ts

When you're ready to take the significant step of expressing your intention to purchase a business, filling out the Letter of Intent to Purchase Business form is crucial. Approaching this document with diligence ensures you communicate your intentions clearly and professionally. Below are essential dos and don'ts to consider:

What You Should Do:

- Provide accurate details of both the buyer and seller, including full names and addresses, to avoid any confusion.

- Clearly outline the terms and conditions of the purchase, including the purchase price, payment methods, and any contingencies like financing approval or satisfactory inspection results.

- Include a confidentiality clause to protect sensitive information shared during the negotiation and purchase process.

- Seek professional advice from a lawyer or a professional experienced in business acquisitions to ensure the letter covers all the necessary legal aspects and to gain insight into best practices.

What You Shouldn't Do:

- Leave out any essential details that could lead to misunderstandings or disputes in the future, such as specific assets and liabilities included in the sale.

- Sign the letter without reviewing all the information for accuracy and completeness. Mistakes or omissions can lead to legal complications down the line.

- Ignore state and federal laws that might affect the business purchase. Compliance with these laws is crucial for a smooth transition.

- Rush the process without considering all aspects of the purchase. Taking your time to thoroughly evaluate the business and negotiate terms can prevent regrettable decisions.

Misconceptions

When considering the purchase of a business, one key document that often comes into play is the Letter of Intent (LOI) to Purchase Business. This document can serve as a preliminary agreement between a buyer and a seller, outlining the terms and conditions of the business sale. However, there are several misconceptions about the LOI that need to be clarified to ensure both parties fully understand its significance and limitations.

- Misconception 1: A Letter of Intent is Legally Binding. Many people believe that an LOI, once signed, is a legally binding agreement that obligates both parties to conclude the transaction as specified. In reality, an LOI is generally a non-binding document, intended to serve as a framework for further negotiation and due diligence. It typically outlines the proposed terms, but does not compel either party to finalize the deal.

- Misconception 2: It Covers Every Detail of the Transaction. While an LOI outlines key elements of the sale, including purchase price, payment terms, and closing conditions, it does not cover every detail of the transaction. Comprehensive agreements and contracts drafted later in the process will address more specific terms, protections, and obligations.

- Misconception 3: An LOI Is Not Necessary. Some parties may skip the LOI, believing it to be an unnecessary step. However, creating an LOI can provide a clear structure for the deal, facilitate financing approval, and set expectations for both parties. It's a valuable tool in clarifying the major terms and can save time and resources in the long run.

- Misconception 4: Signing an LOI Limits Negotiation Flexibility. A common misconception is that once an LOI is signed, the terms are set in stone, limiting negotiation on finer points later. In fact, because an LOI is typically non-binding regarding the final purchase agreement, it leaves room for further discussion and adjustment of terms as due diligence is conducted.

- Misconception 5: An LOI Is Only Beneficial to the Buyer. Both buyers and sellers can benefit from an LOI. For the buyer, it can secure a period of exclusivity to conduct due diligence without the fear of another party swooping in. For the seller, it demonstrates a serious buyer, which can be reassuring and potentially reduce the time the business is on the market.

- Misconception 6: There's No Risk in Signing an LOI. Although generally non-binding, certain sections of an LOI, such as confidentiality agreements and exclusive negotiation rights, may carry legal obligations. It is crucial to understand these aspects and consider potential implications before signing.

- Misconception 7: Any Attorney Can Draft an LOI. The drafting of an LOI requires knowledge of business transactions and the specific industry involved. It's advisable to engage attorneys experienced in corporate law and, ideally, familiar with the industry of the business being acquired, to ensure that the document accurately reflects the intentions of the parties and addresses potential issues specific to the transaction.

Understanding these misconceptions is vital for any party involved in the acquisition of a business. By approaching the Letter of Intent with clear knowledge of its purpose and limitations, both buyers and sellers can better navigate the initial stages of a business transaction and lay a solid foundation for a successful deal.

Key takeaways

When considering the acquisition of a business, a Letter of Intent to Purchase Business is a vital step in the negotiation process. It serves as a formal proposal to express your interest in buying a company before the final agreement is drawn up. Here are key takeaways to remember while filling out and using the form:

- Clarify the Basic Information: Start by ensuring all basic information is accurately filled out. This includes the full names and addresses of both the buyer and the seller, along with the legal name of the business in question.

- Determine the Offer: The letter should clearly state your offer for purchasing the business. This includes the purchase price and the terms of payment. Be as specific as possible to avoid any misunderstanding.

- Due Diligence is Critical: The letter often stipulates a period for due diligence, allowing the buyer to examine the business's financials, operations, and legal standings thoroughly. Specify the time frame and conditions for this process.

- Confidentiality Agreement: It's common to include a confidentiality clause in the letter. This ensures that both sides agree to not disclose any sensitive information about the deal to outsiders.

- Exclusivity Clause: An exclusivity clause may be included to prevent the seller from negotiating with other potential buyers for a specified period. This gives you a clear path to finalize the acquisition.

- Specify Contingencies: Clearly outline any conditions that must be met before the purchase can be completed. These could relate to financing, approval from regulatory bodies, or satisfactory completion of due diligence.

- Legal Review is Essential: Before you sign the letter, have it reviewed by a legal professional. This ensures that your interests are protected and that the letter complies with local and federal laws.

Remember, while a Letter of Intent to Purchase Business is not a binding contract to buy or sell a business, it lays the foundation for more detailed negotiations and agreements. Handling it with diligence and attention to detail can significantly influence the transaction's outcome in your favor.

Consider More Types of Letter of Intent to Purchase Business Forms

Sample of Intent Letter for Transfer - Employees can use this form to detail their request for a job transfer, making a compelling case based on their skills and the company’s needs.

Commercial Real Estate Letter of Intent Template - Helps streamline the purchase process by identifying any potential issues early on, allowing for smoother negotiations and agreements.