Official Letter of Intent to Lease Commercial Property Document

Embarking on the journey of securing a commercial property for business operations marks a significant milestone for any company. A crucial step in this process involves the Letter of Intent to Lease Commercial Property, a document that sets the foundation for negotiations between a potential tenant and the property owner. This document, while not legally binding, plays a pivotal role in outlining the terms and expectations of both parties before entering into a formal lease agreement. It covers a wide array of aspects including, but not limited to, the duration of the lease, the rental amount, maintenance responsibilities, and any conditions or allowances for modifications to the property. Serving as a precursor to a binding lease agreement, this letter acts as a safeguard, ensuring that the interests and intentions of both the lessee and lessor are clearly communicated and agreed upon, thus paving the way for a smoother transaction and relationship moving forward.

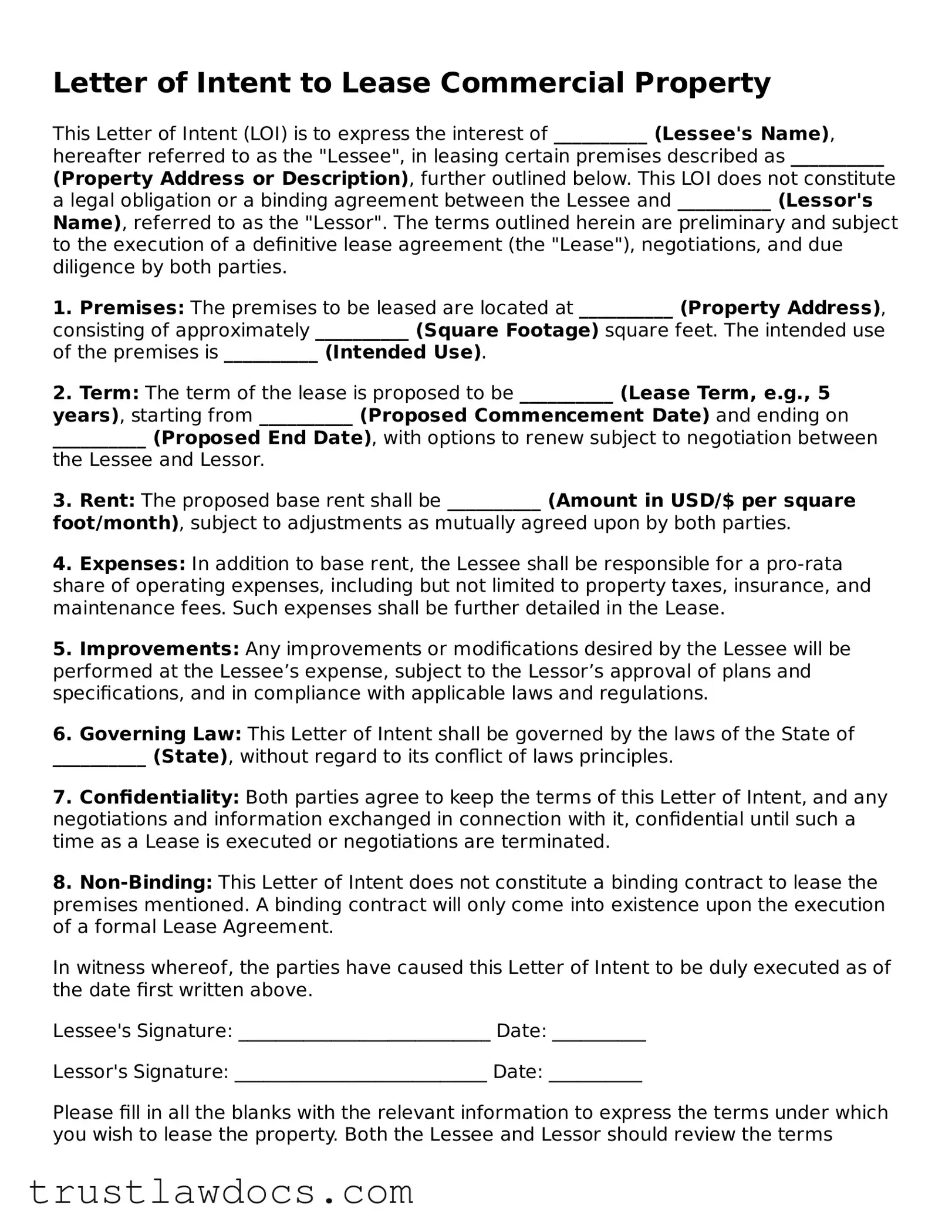

Form Example

Letter of Intent to Lease Commercial Property

This Letter of Intent (LOI) is to express the interest of __________ (Lessee's Name), hereafter referred to as the "Lessee", in leasing certain premises described as __________ (Property Address or Description), further outlined below. This LOI does not constitute a legal obligation or a binding agreement between the Lessee and __________ (Lessor's Name), referred to as the "Lessor". The terms outlined herein are preliminary and subject to the execution of a definitive lease agreement (the "Lease"), negotiations, and due diligence by both parties.

1. Premises: The premises to be leased are located at __________ (Property Address), consisting of approximately __________ (Square Footage) square feet. The intended use of the premises is __________ (Intended Use).

2. Term: The term of the lease is proposed to be __________ (Lease Term, e.g., 5 years), starting from __________ (Proposed Commencement Date) and ending on __________ (Proposed End Date), with options to renew subject to negotiation between the Lessee and Lessor.

3. Rent: The proposed base rent shall be __________ (Amount in USD/$ per square foot/month), subject to adjustments as mutually agreed upon by both parties.

4. Expenses: In addition to base rent, the Lessee shall be responsible for a pro-rata share of operating expenses, including but not limited to property taxes, insurance, and maintenance fees. Such expenses shall be further detailed in the Lease.

5. Improvements: Any improvements or modifications desired by the Lessee will be performed at the Lessee’s expense, subject to the Lessor’s approval of plans and specifications, and in compliance with applicable laws and regulations.

6. Governing Law: This Letter of Intent shall be governed by the laws of the State of __________ (State), without regard to its conflict of laws principles.

7. Confidentiality: Both parties agree to keep the terms of this Letter of Intent, and any negotiations and information exchanged in connection with it, confidential until such a time as a Lease is executed or negotiations are terminated.

8. Non-Binding: This Letter of Intent does not constitute a binding contract to lease the premises mentioned. A binding contract will only come into existence upon the execution of a formal Lease Agreement.

In witness whereof, the parties have caused this Letter of Intent to be duly executed as of the date first written above.

Lessee's Signature: ___________________________ Date: __________

Lessor's Signature: ___________________________ Date: __________

Please fill in all the blanks with the relevant information to express the terms under which you wish to lease the property. Both the Lessee and Lessor should review the terms outlined in this Letter of Intent carefully, making sure that they reflect the preliminary agreement before signing.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Letter of Intent to Lease Commercial Property form is used by potential tenants to express their intention to lease a specific commercial property from the landlord or property manager. |

| Content Included | This form typically includes information such as the proposed lease terms, rental amount, description of the property, length of lease, and any conditions or contingencies that must be met before finalizing the lease agreement. |

| Legal Status | While not a legally binding agreement, the letter of intent serves as a formal way to communicate the potential tenant's interest and terms before entering into a binding lease contract. |

| Negotiation Tool | It acts as a basis for negotiation between the tenant and the landlord, enabling both parties to agree on the lease terms before drafting the official lease agreement. |

| Governing Law(s) | Where applicable, the Letter of Intent to Lease Commercial Property must adhere to state-specific laws and regulations concerning commercial leasing. The relevant laws vary by state and govern aspects such as tenant and landlord rights, disclosures, and lease agreement stipulations. |

| Significance for Tenant | For the tenant, this document helps to lock in the agreed terms and prevent other potential tenants from leasing the property while negotiations are ongoing. It provides a form of assurance that they have the first right of refusal based on the negotiated terms. |

How to Write Letter of Intent to Lease Commercial Property

Before embarking on the process of leasing commercial property, a Letter of Intent (LOI) is typically drafted. This vital document serves as a preliminary agreement between the potential tenant and the landlord, laying out the main terms and the intention to enter into a lease. Crafting an LOI requires attention to detail, as it forms the foundation for the formal lease agreement. The steps outlined below guide you through filling out a Letter of Intent to Lease Commercial Property, ensuring clarity and precision in expressing your intent to lease.

- Identify the Parties: Clearly state the full legal names of both the potential tenant and the landlord at the beginning of the document.

- Describe the Property: Provide a detailed description of the commercial property to be leased, including its exact address and any identifying suite or lot numbers.

- List the Terms of the Lease: Outline the key terms of the lease, such as the lease duration (specify start and end dates), proposed rent amount, and any special conditions or responsibilities of each party.

- Specify Financial Details: Include the proposed financial arrangements, such as security deposit amounts, payment schedules, and any initial deposit required upon signing the formal lease agreement.

- Detail the Use of Property: Clearly mention the intended use of the leased property to ensure it aligns with zoning laws and the landlord's policies.

- Contingencies: State any conditions that must be met before finalizing the lease agreement, like obtaining financing or completing property improvements.

- Signature Section: Provide spaces for both the potential tenant and the landlord to sign and date the LOI, indicating their agreement to its terms. Remember, the LOI is not binding in terms of the lease but signifies intent to negotiate in good faith.

Once your Letter of Intent to Lease Commercial Property is completed following these steps, it serves as the blueprint for your lease negotiations. It's essential to review it carefully, ensuring that all the terms are correct and reflective of your discussions with the landlord. After both parties sign, the next stage involves moving towards drafting and signing the formal lease agreement, which will require due diligence, potentially legal consultation, and agreement on the comprehensive terms of the lease. Remember, a well-drafted LOI sets a positive tone for a successful leasing agreement, smoothing the path for both parties involved.

Get Answers on Letter of Intent to Lease Commercial Property

What is a Letter of Intent to Lease Commercial Property?

A Letter of Intent to Lease Commercial Property is a preliminary agreement between a prospective tenant and a landlord or property manager. It outlines the main terms and conditions under which the tenant intends to lease commercial property, such as lease duration, rental amount, and property use. Although not always legally binding in terms of the lease agreement itself, it sets the foundation for formal lease negotiations.

Why is a Letter of Intent important in commercial leasing?

The Letter of Intent plays a crucial role in the leasing process as it signifies a serious interest from the prospective tenant in leasing the property. It helps both parties to agree on major terms before spending time and resources on drafting a formal lease agreement. This can streamline negotiations, provide clarity, and potentially prevent misunderstandings or disputes later.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent itself is not legally binding in terms of obligating either party to finalize a lease. However, certain provisions within the letter, such as confidentiality requirements or exclusivity agreements, could be legally binding. It is crucial to specify in the Letter of Intent which parts, if any, are intended to be binding.

What should be included in a Letter of Intent to Lease Commercial Property?

A comprehensive Letter of Intent should include details such as the names and addresses of the landlord and prospective tenant, the proposed lease term, rent amount and payment terms, description of the leased premises, intended use of the property, and any fit-out allowances or improvements. Other terms might include options for renewal, early termination conditions, and maintenance responsibilities.

Can either party back out after signing a Letter of Intent?

Since most Letters of Intent are not binding with respect to the lease agreement, either party generally can back out of the deal without legal consequences unless it includes specific terms that are labelled as binding. However, doing so might breach trust and could impact future negotiations or dealings.

How does a Letter of Intent facilitate the negotiation process?

By laying out the key terms and conditions early on, a Letter of Intent helps both the landlord and the prospective tenant to identify and address any potential issues before drafting the formal lease agreement. This can save time and resources and helps ensure that both parties are aligned in their expectations and requirements, smoothing the path to a final agreement.

Should both parties seek legal advice before signing a Letter of Intent?

Yes, it is advisable for both the prospective tenant and the landlord to seek legal advice before signing a Letter of Intent. A lawyer can help clarify the terms, ensure that the Letter of Intent reflects the intentions of both parties accurately, and advise on any binding provisions that might inadvertently create legal obligations. This step can prevent future legal issues and misunderstandings.

Common mistakes

One common mistake people make when filling out a Letter of Intent to Lease Commercial Property is neglecting to provide detailed information about the property. This form is the foundation of what will become a binding lease agreement, and vagueness can lead to misunderstandings or legal disputes further down the line. It's crucial to clearly specify the address, square footage, and any relevant details about the space to ensure both parties are in agreement from the start.

Lack of clarity regarding lease terms is another pitfall. Potential tenants sometimes fail to state explicitly the duration of the lease they are seeking or the specific terms of renewal they desire. This omission can lead to conflicts or misaligned expectations. Clearly outlining the desired lease term, options for renewal, and conditions under those renewals can help prevent such issues.

Many people overlook the importance of specifying the intended use of the leased space. Each commercial property comes with its own set of zoning laws and restrictions. Failure to confirm that the intended business activity is permitted at the location can lead to serious complications, including the inability to operate the business legally in that space.

Another error involves not negotiating or clarifying maintenance responsibilities within the letter. Maintenance and repairs are significant aspects of a commercial lease, and the letter of intent should ideally outline who is responsible for what. Without this detail, tenants may find themselves unexpectedly responsible for major repairs or maintenance issues.

Errors in specifying financial terms, including rent, deposits, and any concessions, are surprisingly common. Sometimes potential tenants fail to include the amount of rent they're willing to pay or the terms for security deposits and any upfront concessions they're seeking, like free rent for the first month. This lack of specificity can lead to misunderstandings or lost opportunities to negotiate better terms.

A significant oversight is failing to address the subject of lease termination and penalties for early termination. It's crucial to understand and negotiate these terms upfront to avoid hefty fines or legal challenges if either party decides to terminate the lease early. An explicit discussion in the letter about these terms can save a lot of headache and financial strain.

Many also forget to include a confidentiality clause in their letter of intent. This oversight can lead to sensitive information about the business or individual being disclosed unintentionally. Inserting a clause that ensures the negotiations and terms remain confidential protects both parties.

Not setting a timeline for the negotiation process or lease commencement can stall the entire deal. Without a timeline, negotiations can drag on indefinitely, delaying business operations. It’s important to propose a reasonable timeline for negotiations to conclude and for the lease to officially begin.

Finally, a prevalent mistake is not having the Letter of Intent reviewed by a legal professional before submission. While it may seem like an extra step, getting legal advice ensures that the letter protects your interests and sets a solid foundation for the lease agreement. This review can catch oversights and suggest improvements that significantly benefit your business in the long run.

Documents used along the form

When negotiating a lease for commercial property, several key documents are often used in conjunction with the Letter of Intent to Lease. While the Letter of Intent serves as a preliminary agreement outlining the basic terms and intentions of both parties, it is typically followed by more detailed documents that further define the conditions and specifics of the lease. Such documents play crucial roles throughout the leasing process, ensuring clarity and legal compliance for both the landlord and the tenant.

- Lease Agreement: This is the formal contract between the landlord and tenant, detailing the terms of the lease including duration, rent, maintenance responsibilities, and other specific conditions agreed upon. It builds upon the foundation set by the Letter of Intent and provides legal protection for both parties.

- Personal Guarantee: Often required for businesses, especially startups or new enterprises, this document is a pledge by an individual (usually the business owner) to assume responsibility for the lease payments in case the business fails to make payments. It adds a layer of security for the landlord.

- Amendment to Lease: This document comes into play if both parties agree to alter any original conditions of the lease. It can modify, add, or remove terms within the original lease agreement, ensuring both parties are on the same page with any adjustments made during the lease term.

- Walk-Through Checklist: Before the official start of the lease, this form is used to document the condition of the commercial property. It is a detailed record of the property’s state prior to occupation, providing a baseline for any future disputes regarding maintenance or damage that may occur during the lease term.

Understanding how these documents interact with the Letter of Intent to Lease Commercial Property is essential for a smooth leasing process. They collectively provide a structured pathway from initial agreement to the commencement of the lease, ensuring all parties are informed and agreeable to the terms and conditions outlined throughout the leasing documents. Additionally, they play critical roles in safeguarding the rights and obligations of both the landlord and the tenant, setting clear expectations and legal standards for the lease duration.

Similar forms

A Letter of Intent to Purchase Real Estate is similar to the Letter of Intent to Lease Commercial Property as it also precedes a more formal and binding agreement. This document outlines the key terms and conditions under which a buyer intends to purchase property, showing a serious commitment to the transaction without fully committing to it. The Letter of Intent to Purchase Real Estate often lists the purchase price, deposit amount, due diligence period, and other terms, just as the lease version details rent, lease term, and other leasing conditions.

The Commercial Lease Agreement closely follows the Letter of Intent to Lease Commercial Property in the leasing process. It formalizes the terms discussed in the Letter of Intent into a binding contract that legally obligates both the lessee and the lessor. This agreement includes detailed provisions on lease duration, rental payments, property use restrictions, and maintenance responsibilities, solidifying the preliminary terms agreed upon in the Letter of Intent.

The Business Plan is another document that shares a goal-oriented nature with the Letter of Intent to Lease Commercial Property. While the Business Plan is broader, aiming to outline a company's strategy for success, it can impact and be impacted by the terms laid out in a Letter of Intent for leasing property. The proposed lease expenses, location, and terms can significantly affect a business's financial projections and operational plans included in a Business Plan.

Finally, the Non-Disclosure Agreement (NDA) can also be related to the process of negotiating a Letter of Intent to Lease Commercial Property. During negotiations, parties might share sensitive information about their businesses, financial standings, or strategic plans. An NDA ensures that this information remains confidential, preventing its misuse or unauthorized disclosure. While its purpose is primarily to safeguard information, it underscores the mutual trust and understanding between parties, similar to the intentions behind a Letter of Intent.

Dos and Don'ts

Filling out a Letter of Intent to Lease Commercial Property is a crucial step in the process of securing commercial space for your business. It serves as a preliminary agreement before the lease is officially signed and sets the stage for negotiations. Because of its importance, it's vital to approach this task with care. Here are some key dos and don’ts to consider:

Things You Should Do:

- Provide clear and concise information: Make sure that all the details you include in the letter, such as the property address, lease term, and rent, are accurate and to the point.

- Review the local laws: Understand and comply with your state and local regulations that might affect commercial leases. This knowledge can impact the contents of your letter.

- Cover all the essential terms: Besides the basic lease information, include any specific terms or conditions that are crucial for your business operations, such as options to renew, sublease, or exclusivity clauses.

- Seek professional advice: Before finalizing the letter, it’s wise to consult with a lawyer or a real estate professional. Their expertise can help you navigate complex terms and avoid potential pitfalls.

- Proofread the document: A letter without errors presents a professional image. Take the time to double-check your spelling, grammar, and the accuracy of all the information provided.

Things You Shouldn’t Do:

- Assume anything is standard: Avoid making assumptions about what is “usual” or “standard” in a commercial lease. Every deal is unique, and what’s common in one lease may not be in another.

- Overlook important clauses: It's crucial not to skim over or forget to include key clauses that might affect your business later on. This includes clauses about termination, rent increases, and maintenance responsibilities.

- Be too vague: Vagueness can lead to misunderstandings or disputes. Be as specific as possible regarding your expectations and the terms you’re agreeing to.

- Rush the process: Taking your time to thoroughly understand and accurately complete the letter is essential. A rushed document could lead to oversights that might complicate negotiations or the lease agreement.

- Ignore the importance of negotiation: The Letter of Intent is often the starting point for lease negotiations. Don’t view it as just a formality; instead, see it as an opportunity to express your interests and open the door to beneficial negotiations.

By adhering to these guidelines, you can create a Letter of Intent that clearly communicates your intentions, lays a solid foundation for your lease agreement, and addresses your business needs effectively.

Misconceptions

When it comes to leasing commercial property, the Letter of Intent (LOI) is a crucial step in the negotiation process. However, there are several misconceptions about its purpose and implications. Understanding these common misunderstandings can help both landlords and tenants navigate the leasing process more effectively.

- It's legally binding. A common misconception is that a Letter of Intent to Lease Commercial Property is a legally binding agreement committing the landlord or tenant to the lease. In reality, the LOI is typically a non-binding document that outlines the terms and conditions proposed for the lease. It serves as a precursor to the actual lease agreement, which, once signed by both parties, becomes legally binding.

- All terms are set in stone. Many people mistakenly believe that the terms stated in the LOI are final. However, the LOI serves as a starting point for negotiations. Both parties can negotiate terms until a mutual agreement is reached and the official lease agreement is drafted and signed.

- It's unnecessary if you trust the other party. Trust plays a vital role in any business transaction, but relying solely on trust without a written LOI can lead to misunderstandings and conflicts. The LOI helps ensure both parties clearly understand the proposed terms before entering into a binding lease agreement, regardless of their relationship.

- It covers every aspect of the lease agreement. While an LOI includes key terms and conditions of the lease, it does not cover every detail. Instead, it highlights important aspects such as rent, term, and use of the property. The actual lease agreement will provide a comprehensive account of the landlord-tenant relationship, covering a wide range of clauses and contingencies.

- There's a standard format that must be followed. While there are common elements typically included in an LOI, such as property description, lease term, and rent, there is no one-size-fits-all template that must be used. The format and content of the LOI can be adjusted to suit the specific needs and agreements of the parties involved.

Dispelling these misconceptions about the Letter of Intent to Lease Commercial Property can lead to a smoother leasing process, with clearer communications and better outcomes for both landlords and tenants. By understanding what an LOI is and what it isn't, parties can use it effectively as the negotiating tool it's meant to be.

Key takeaways

When embarking on the journey of leasing commercial property, a Letter of Intent (LOI) serves as the foundation upon which negotiations begin. Its use can streamline the process, ensuring clarity and mutual understanding from the onset. Here are four key takeaways regarding the drafting and utilization of a Letter of Intent to Lease Commercial Property.

- Clarifying Terms and Conditions: The LOI should meticulously outline the terms and conditions of the prospective lease. This encompasses the lease duration, rental amount, any escalations, maintenance responsibilities, and renewal options. By addressing these specifics upfront, both parties can avoid potential misunderstandings or disagreements in later stages of negotiation.

- Non-binding Agreement: It is paramount to recognize that the LOI is typically a non-binding document, serving principally as a means to express mutual interest in a proposed transaction and establish negotiation parameters. However, certain sections, such as confidentiality and exclusivity clauses, may hold binding force to protect the interests of both parties during the negotiation phase.

- Facilitating Negotiations: An effectively crafted LOI can significantly facilitate the negotiation process. By laying the groundwork for the lease agreement, it allows the parties to focus on material terms and resolve potential conflicts early. This focus can expedite the negotiation process, saving time and resources for both the lessee and the lessor.

- Legal Counsel Review: Given the potential implications and subtleties associated with commercial leases, it is advisable for both parties to have their legal representatives review the LOI before finalizing it. This ensures that the terms outlined are in their best interest and that they fully comprehend the legal ramifications of the proposed lease terms.

The Letter of Intent to Lease Commercial Property is not merely a procedural step in the leasing process but a significant document that shapes the entire negotiation landscape. Its importance cannot be understated, requiring careful consideration and, often, the guidance of experienced legal counsel to navigate its complexities successfully.

Consider More Types of Letter of Intent to Lease Commercial Property Forms

Commercial Real Estate Letter of Intent Template - Allows for a period of exclusivity in some cases, where the seller agrees not to negotiate with other buyers for a specified time frame.

Intent to Purchase Letter - A statement of intent that lays the groundwork for formalizing a purchase agreement, including the proposed transaction's scope and scale.