Official Investment Letter of Intent Document

When embarking on the journey of investing, individuals and entities often take a significant step through the use of an Investment Letter of Intent. This document serves as a preliminary agreement between the investor and another party, detailing the general terms under which the investment will be made. It outlines the intentions of both parties, including the amount of the investment, the purpose of the investment, and the conditions under which it will be carried out. Crucially, it also addresses confidentiality and exclusivity agreements, serving to protect both the investor's and the recipient's interests. Although not a binding contract, the Investment Letter of Intent plays a critical role in facilitating negotiations and laying the groundwork for a formal agreement. It serves as an essential tool in the investment process, providing a foundation upon which a detailed and legally binding contract can be developed, ensuring clarity and commitment from all parties involved from the outset.

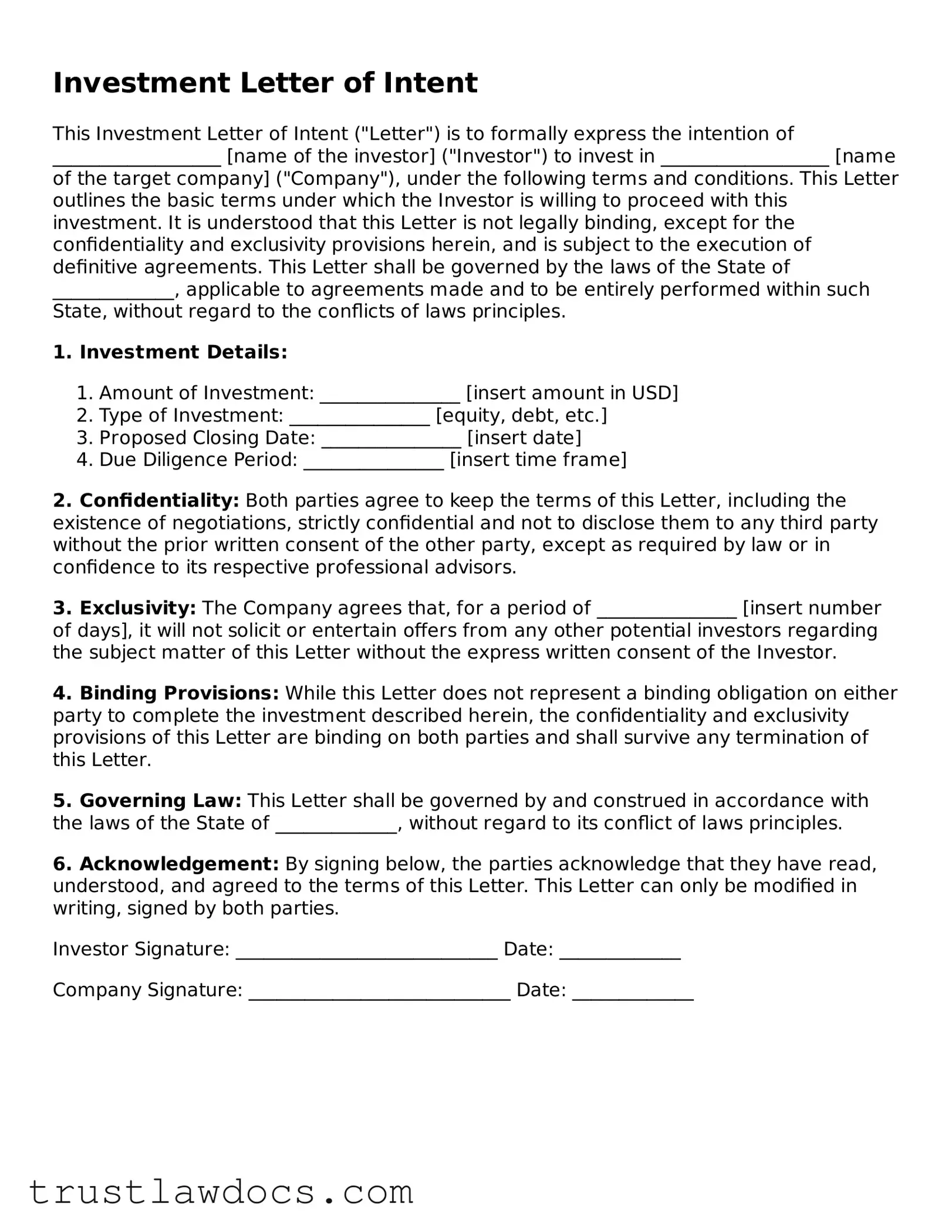

Form Example

Investment Letter of Intent

This Investment Letter of Intent ("Letter") is to formally express the intention of __________________ [name of the investor] ("Investor") to invest in __________________ [name of the target company] ("Company"), under the following terms and conditions. This Letter outlines the basic terms under which the Investor is willing to proceed with this investment. It is understood that this Letter is not legally binding, except for the confidentiality and exclusivity provisions herein, and is subject to the execution of definitive agreements. This Letter shall be governed by the laws of the State of _____________, applicable to agreements made and to be entirely performed within such State, without regard to the conflicts of laws principles.

1. Investment Details:

- Amount of Investment: _______________ [insert amount in USD]

- Type of Investment: _______________ [equity, debt, etc.]

- Proposed Closing Date: _______________ [insert date]

- Due Diligence Period: _______________ [insert time frame]

2. Confidentiality: Both parties agree to keep the terms of this Letter, including the existence of negotiations, strictly confidential and not to disclose them to any third party without the prior written consent of the other party, except as required by law or in confidence to its respective professional advisors.

3. Exclusivity: The Company agrees that, for a period of _______________ [insert number of days], it will not solicit or entertain offers from any other potential investors regarding the subject matter of this Letter without the express written consent of the Investor.

4. Binding Provisions: While this Letter does not represent a binding obligation on either party to complete the investment described herein, the confidentiality and exclusivity provisions of this Letter are binding on both parties and shall survive any termination of this Letter.

5. Governing Law: This Letter shall be governed by and construed in accordance with the laws of the State of _____________, without regard to its conflict of laws principles.

6. Acknowledgement: By signing below, the parties acknowledge that they have read, understood, and agreed to the terms of this Letter. This Letter can only be modified in writing, signed by both parties.

Investor Signature: ____________________________ Date: _____________

Company Signature: ____________________________ Date: _____________

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | An Investment Letter of Intent is a formal document that outlines the preliminary agreements between two parties before finalizing an investment deal. |

| 2 | This document serves as a foundation for further negotiations and is not legally binding in terms of the investment itself but may contain clauses that are, such as confidentiality. |

| 3 | The letter includes details such as the amount to be invested, the structure of the investment, and the roles and responsibilities of each party. |

| 4 | Due diligence is a critical component mentioned in the letter, indicating that the investment will proceed pending satisfactory completion of due diligence by the investor. |

| 5 | It may also specify any conditions precedent to the investment, such as approval by regulatory bodies or successful negotiation of final agreements. |

| 6 | State-specific forms must adhere to local laws governing securities and investments, which vary significantly from one jurisdiction to another. |

| 7 | The letter often includes a timeline, setting forth when the parties intend to complete negotiations and finalize the investment. |

| 8 | Exclusivity may be requested by either party, meaning that for a specified period, neither party will negotiate with anyone else regarding the same investment. |

| 9 | Governing law clauses specify which state's laws will apply to interpret the letter and resolve any disputes that might arise, providing predictability and legal framework. |

| 10 | The letter serves as a record of the initial agreement and intentions of the parties and can be a useful reference throughout the investment process. |

How to Write Investment Letter of Intent

After deciding to invest, the next step involves formalizing the intention through a Letter of Intent (LOI). This document outlines the preliminary agreement between the investor and the party seeking investment. It sets the stage for detailed negotiations and due diligence before finalizing the investment. Crafting this LOI carefully is crucial as it lays the groundwork for the investment process. Below are the steps to accurately fill out the Investment Letter of Intent form.

- Start by providing the date at the top of the form. This marks when the letter of intent is being issued.

- Enter the full legal name of the potential investor in the space provided.

- Fill in the complete legal name of the entity seeking investment.

- Specify the proposed investment amount in the designated space. Use numbers and write out the amount in words for clarity.

- Describe the purpose of the investment succinctly, indicating how the funds will be utilized by the entity receiving them.

- List any conditions that must be satisfied before the investment is finalized. This includes due diligence requirements and any other prerequisites.

- Include a timeline for when the investment is expected to proceed. Mention any specific dates for completing due diligence, signing the final agreement, and transferring funds.

- Outline the confidentiality agreement regarding the information shared during the negotiation and due diligence processes.

- State any exclusivity terms, specifying if the investor or the entity cannot engage in similar negotiations with others for a certain period.

- Provide a section for the potential investor to sign and date the document, verifying their intent to proceed under the outlined terms.

- Leave space for the entity seeking investment to sign and date the document, acknowledging the receipt of the letter of intent and agreeing to its terms provisionally.

Once the Investment Letter of Intent form is filled out and signed by both parties, it serves as a foundation for moving forward. The involved parties can then engage in more detailed discussions and due diligence, informed by the structure and expectations set forth in this initial document. Although the LOI itself does not typically bind the parties to a final agreement, it is a critical step in formalizing their intent to enter into an investment relationship.

Get Answers on Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent is a document that outlines the preliminary agreements between two parties regarding a potential investment. It specifies the basic terms and conditions under which the investment would be made, acting as a framework for further negotiations and agreements.

Why is an Investment Letter of Intent important?

This document is important because it signifies a serious commitment from both the investor and the company or individual receiving the investment. It helps in clearly laying out the intentions and expectations of both parties, thus minimizing misunderstandings and guiding the drafting of the final agreement.

What should be included in an Investment Letter of Intent?

An Investment Letter of Intent should include details such as the amount of investment, the ownership stake or interest the investor will receive, the purpose of the investment, any conditions precedent to the investment, and timelines for due diligence and finalizing the agreement. Confidentiality clauses and exclusivity terms are often also included.

Is an Investment Letter of Intent legally binding?

While the Investment Letter of Intent itself is generally not legally binding in terms of the obligation to invest, certain parts of it, such as confidentiality agreements and exclusivity clauses, can be binding. It's crucial for both parties to understand which components are enforceable.

How can I ensure that the Investment Letter of Intent is fair and balanced?

Both parties should thoroughly review the letter to ensure that their rights and interests are adequately protected. It's highly advisable to have legal counsel review the document before it is signed to avoid any unintended legal implications.

Can changes be made to the Investment Letter of Intent once it's signed?

Yes, changes can be made to the Letter of Intent after it's signed, provided both parties agree to the amendments. Any changes should be made in writing and signed by both parties, ensuring clarity and mutual agreement on the revisions.

What happens if the investment deal falls through after the Letter of Intent is signed?

If the investment deal does not proceed, the actions of the parties would depend on the terms detailed in the Letter of Intent. Typically, since the document is not fully binding regarding the investment commitment, either party can walk away. However, any binding provisions, like confidentiality agreements, remain in effect.

Common mistakes

Investors are often eager to secure their positions in promising ventures, but this eagerness can lead to oversights when filling out an Investment Letter of Intent (LOI). One common misstep is failing to specify the exact terms of the investment. This encompasses not only the amount of money being invested but also any conditions or milestones that need to be met. A LOI that lacks these details can result in misunderstandings between the investor and the recipient of the funds, potentially derailing the investment.

Another error involves neglecting to conduct due diligence before committing to the investment. An LOI, by its nature, signals a serious intention. However, it's crucial that the investor fully understands the enterprise they're investing in, including its financial health, market position, and potential risks. Skipping this step can lead to regrettable investment decisions based on incomplete information.

Moreover, many investors make the mistake of not clearly defining the timeline for their investment. Without setting clear deadlines for specific actions, such as due diligence periods or the final signing of formal agreements, projects can experience unnecessary delays. These delays not only frustrate all parties involved but can also adversely affect the venture's outcomes.

A lack of clarity regarding the exclusivity of the negotiation also poses a problem. If the LOI does not specify whether the discussions are exclusive, the party receiving the investment might engage in talks with other potential investors. This can complicate negotiations and even lead to lost opportunities, as exclusivity clauses protect the interests of both parties by ensuring a focused and dedicated negotiation period.

Ignoring the non-binding nature of most sections of the LOI is another oversight. While an LOI generally outlines the intent to proceed with an investment, most of its conditions are not legally binding. However, confidentiality and exclusivity terms typically are. Misunderstanding the binding nature of these terms can lead to legal challenges and disputes. Therefore, it's imperative to distinguish between what is enforceable by law and what is not.

Additionally, failing to include a dispute resolution mechanism is a notable omission. In the event of disagreements or misunderstandings, having a predefined method for resolving disputes can save both time and resources. Without such a mechanism, parties may find themselves mired in prolonged and costly legal battles that could have been avoided.

Another common mistake is not properly identifying the parties involved. An investment can involve multiple entities, such as individuals, corporations, or partnerships. Accurately detailing each party's legal name and structure is essential for enforcing the LOI and any subsequent agreements.

Furthermore, overlooking the need for a confidentiality agreement in conjunction with the LOI can result in the premature leakage of sensitive information. This oversight can compromise the competitive edge of the enterprise seeking investment or even the investment process itself. It's crucial to safeguard proprietary information from the outset of negotiations.

Last but certainly not least, investors sometimes neglect to seek legal advice when drafting or signing an LOI. Given the complexities and potential legal ramifications involved, consulting with a legal expert can prevent costly mistakes and ensure that the investment letter of intent accurately reflects the interests and intentions of all parties involved.

Documents used along the form

When engaging in investment transactions, an Investment Letter of Intent is often the first step, signaling the serious intent of the parties to come to an agreement. However, to navigate the complexities of these transactions efficiently and to provide a clear framework for the deal, several other documents are frequently used alongside it. Each of these documents plays a critical role in ensuring the investment process is transparent, legally sound, and aligns with the goals of all parties involved.

- Confidentiality Agreement: Often used in tandem with an Investment Letter of Intent, this agreement ensures that all proprietary information exchanged between the parties during negotiations remains confidential. It protects sensitive details about the business, its operations, and its financials from becoming public knowledge.

- Due Diligence Checklist: This document outlines all the information and documents the investor needs to review before finalizing the investment. It serves as a comprehensive guide to thoroughly evaluate the potential investment's viability, risks, and opportunities.

- Subscription Agreement: This legal document is used when purchasing shares of a company. It outlines the investor's commitment and the terms of the investment, including the number of shares and the price, providing a clear agreement on the investment's specifics.

- Shareholder Agreement: For investments that result in equity ownership, a Shareholder Agreement details the rights and obligations of each shareholder. It governs aspects like the distribution of profits, management decisions, and the process for selling shares, ensuring all parties are on the same page.

- Investment Agreement: More detailed than an Investment Letter of Intent, this comprehensive agreement finalizes the terms and conditions of the investment. It includes payment schedules, representations and warranties, conditions precedent, and other legal provisions to safeguard the interests of both parties.

- Compliance Documents: Depending on the nature of the investment and the regulatory environment, various compliance documents may be required. These can include filings with regulatory bodies, licenses, and permits, or compliance certifications, ensuring the investment adheres to all applicable laws and regulations.

Moreover, while the Investment Letter of Intent marks the commencement of a potentially fruitful partnership, it's the diligent completion and thorough review of these accompanying documents that ultimately secure a solid legal foundation for the investment. Gathering, understanding, and negotiating these documents meticulously can make a significant difference in the outcome of investment transactions, protecting the interests of all parties and paving the way for a successful partnership.

Similar forms

An Investment Letter of Intent (LOI) shares similarities with a Memorandum of Understanding (MOU). Both documents represent an agreement between two parties before the finalization of a deal, serving as a precursor to a more formal contract. They articulate the mutual expectations, outline the scope of the deal, and establish the main terms. While the Investment Letter of Intent is focused on the specifics of an investment transaction, the MOU can cover a broader range of agreements and is not exclusively used in investment contexts.

Comparable to the Investment Letter of Intent is the Term Sheet. This document, often used in venture capital transactions, outlines the key financial and functional terms of an investment. Both serve as preliminary agreements that precede final contracts and are negotiated and agreed upon before any funds are exchanged. However, a Term Sheet is typically more focused on detailing the financial aspects and investment conditions, rather than the broader intentions and principles captured in an Investment LOI.

The Purchase Agreement shows a resemblance to the Investment Letter of Intent by detailing the terms under which a transaction will occur, specifying price, conditions, and other critical information. Both documents are vital in the early stages of negotiation, setting the stage for a legally binding agreement. However, while the Purchase Agreement is a conclusive contract that legally binds the parties to its terms, the Investment LOI serves more as a statement of intent without necessarily being legally binding.

An Investment Proposal is another document similar to the Investment Letter of Intent, as both are tools used to kickstart negotiations between potential investors and those seeking investment. Each document outlines the framework of the proposed investment, including objectives, terms, and the value proposition. The primary difference lies in their application; the Investment Proposal is often a more detailed pitch used to attract and convince potential investors, whereas the LOI is a mutual acknowledgment of intent to proceed under defined terms.

The Confidentiality Agreement, or Non-Disclosure Agreement (NDA), bears similarity to the Investment LOI in that it often forms part of the preliminary steps in investment discussions. While the NDA specifically focuses on the protection of proprietary information shared between the parties during negotiations, an Investment LOI may also include confidentiality clauses to protect sensitive information while outlining the basic structure of the intended investment.

Finally, a Partnership Agreement can parallel the Investment Letter of Intent in its function to establish the terms of a business relationship between entities. Both documents outline the duties, expectations, and investment specifics of the parties involved. A Partnership Agreement, however, is typically more comprehensive, covering a wider array of operational, managerial, and financial details of a partnership, compared to the more narrowly focused investment details in an LOI.

Dos and Don'ts

Filling out an Investment Letter of Intent (LOI) is a critical step for potential investors indicating their intention to proceed with a financial commitment to a project or company. While the form may seem straightforward, ensuring that it's completed accurately and thoroughly is essential to avoid misunderstandings or legal complications down the line. Below are guidelines on what to do and what not to do when completing this important document.

Things You Should Do:

- Ensure that all information provided is accurate and up-to-date. This includes personal details, investment amounts, and any specific terms or conditions that are part of the agreement.

- Review the form with a legal professional before submission. Although it may appear to be a simple document, its implications are significant, and professional advice can prevent potential issues.

- Clearly outline any contingencies or conditions that are part of your investment decision. This can include due diligence requirements, approval from regulatory bodies, or other preconditions that must be met.

- Keep a signed copy of the Letter of Intent for your records. This document serves as proof of your intentions and can be crucial in the event of a dispute or misunderstanding.

Things You Shouldn't Do:

- Do not leave any sections blank. If a section does not apply, indicate this with "N/A" (not applicable) rather than leaving it empty, to prevent any assumptions or misinterpretations.

- Avoid using unclear or ambiguous language. The LOI should be clear and straightforward to prevent any confusion about the terms of the investment.

- Do not rush the process of filling out the LOI. Take the time to review all sections thoroughly to ensure that all information is complete and accurate.

- Refrain from making any verbal agreements or promises that are not captured in the letter. If something is important enough to agree upon, it should be included in the LOI to ensure it is legally recognized.

Misconceptions

When discussing an Investment Letter of Intent (LOI) form, it's crucial to navigate through common misconceptions. These misunderstandings can lead to skewed expectations and, in some cases, legal missteps. Let's clear the air on some of these misconceptions:

It's Legally Binding: Many believe that an LOI is entirely legally binding. The truth is, most LOIs are partially binding. While certain sections, like confidentiality agreements, are binding, the investment intentions are typically non-binding.

It's Just a Formality: Some investors and businesses treat the LOI as a mere formality. However, it sets the stage for negotiation and outlines key terms. Disregarding its importance can lead to misunderstandings and conflicts down the line.

It Requires Legal Representation to Draft: While having a lawyer can ensure clarity and legal soundness, it's not mandatory to hire one to draft an LOI. However, for high-stakes investments, professional legal advice is strongly recommended.

One Size Fits All: No two investments are identical, and neither are their LOIs. Customizing the LOI to fit the specific deal and negotiations is crucial for clarity and effectiveness.

It's Only About the Money: While financial terms are critical, an LOI covers more ground. It addresses the structure of the deal, expectations from both parties, and milestones, among other considerations.

It Guarantees Funding: An LOI does not guarantee that the investment will go through. It is a preliminary agreement, and either party can typically walk away. Due diligence and further negotiations can still alter the course of the deal.

It's the Same as a Memorandum of Understanding (MOU): Though similar, an LOI and an MOU serve different purposes. An MOU is broader and more partnership-oriented, while an LOI is more focused on the specifics of an investment deal.

It Must Disclose All Deal Terms: An LOI outlines the framework of the deal but doesn't need to detail every term. The final agreement will cover the specifics, following due diligence and negotiation.

It's a Public Document: An LOI is typically a private document shared between the investor and the company. Unless required by law or specific regulations, it doesn't have to be made public.

Signing Is Quick and Easy: Drafting and negotiating an LOI can be time-consuming. It requires careful consideration to ensure it aligns with both parties' expectations and legal requirements.

Understanding the nuances of Investment Letters of Intent can lead to better preparation and smoother negotiations. Clarity and due diligence at this early stage can pave the way for successful investment relationships.

Key takeaways

An Investment Letter of Intent (LOI) is a formal but non-binding document that outlines the preliminary commitments between two parties in a financial transaction, such as the investment in a company. When preparing and using an Investment Letter of Intent, it's crucial to keep in mind several key points to ensure clarity, legality, and the alignment of expectations. Here are seven key takeaways:

- Specify the Investment Details Clearly: The LOI should clearly outline the nature of the investment, including the amount, the structure (whether equity, debt, or a combination), and any specific conditions or milestones that must be met.

- Outline the Due Diligence Process: The document should specify the due diligence process, including timelines, what documents need to be reviewed, and any other requirements that the investor needs to fulfill before finalizing the investment.

- Include Confidentiality Clauses: Protecting sensitive information is crucial. Ensure the LOI includes clauses that bind both parties to confidentiality regarding the investment details and any proprietary information exchanged during due diligence.

- State the Exclusivity Period: If applicable, the LOI should mention an exclusivity period, during which the seller agrees not to engage in negotiations with other potential investors. This period should be clearly defined, with start and end dates.

- Detail the Terms of Termination: The conditions under which either party can walk away from the negotiations should be outlined. This includes the expiration date of the LOI, after which the agreement is no longer valid if not executed.

- Include a Non-binding Clause: It's essential that the LOI explicitly states that it is a non-binding document, except for specific clauses like confidentiality and exclusivity, which remain enforceable.

- Legal Consultation is Advised: Given the financial and legal implications of an Investment Letter of Intent, consulting with a legal professional before drafting or signing the document is highly recommended. Their expertise can help in ensuring that your interests are well-represented and protected.

While an Investment Letter of Intent signifies a serious commitment towards a transaction, it is fundamentally a tool for facilitating understanding and agreement before the final investment documents are prepared. Paying attention to these key areas when filling out and using the LOI can help in creating a smoother negotiation process and laying a strong foundation for the upcoming investment.

Consider More Types of Investment Letter of Intent Forms

Lease Proposal Letter of Intent - The letter helps both parties gauge their interest and compatibility before entering into a binding lease agreement.