Official Lease-to-Own Agreement Document

The concept of a Lease-to-Own Agreement is a pivotal option for many individuals and families who dream of owning a home but may not initially qualify for traditional mortgage financing due to various reasons, such as inadequate savings for a down payment or insufficient credit history. This unique form of agreement bridges the gap between renting and owning, providing a structured path for tenants to eventually purchase the home they are living in. Under such agreements, a portion of the monthly rent payments is often credited toward the purchase price of the property, enabling tenants to build equity over time. Additionally, these agreements outline specific terms and conditions related to the lease duration, purchase price, and responsibilities of each party regarding property maintenance and repairs. Understanding the intricacies and legal obligations entailed within a Lease-to-Own Agreement is crucial for both landlords and tenants to ensure that the arrangement is fair and beneficial to both sides.

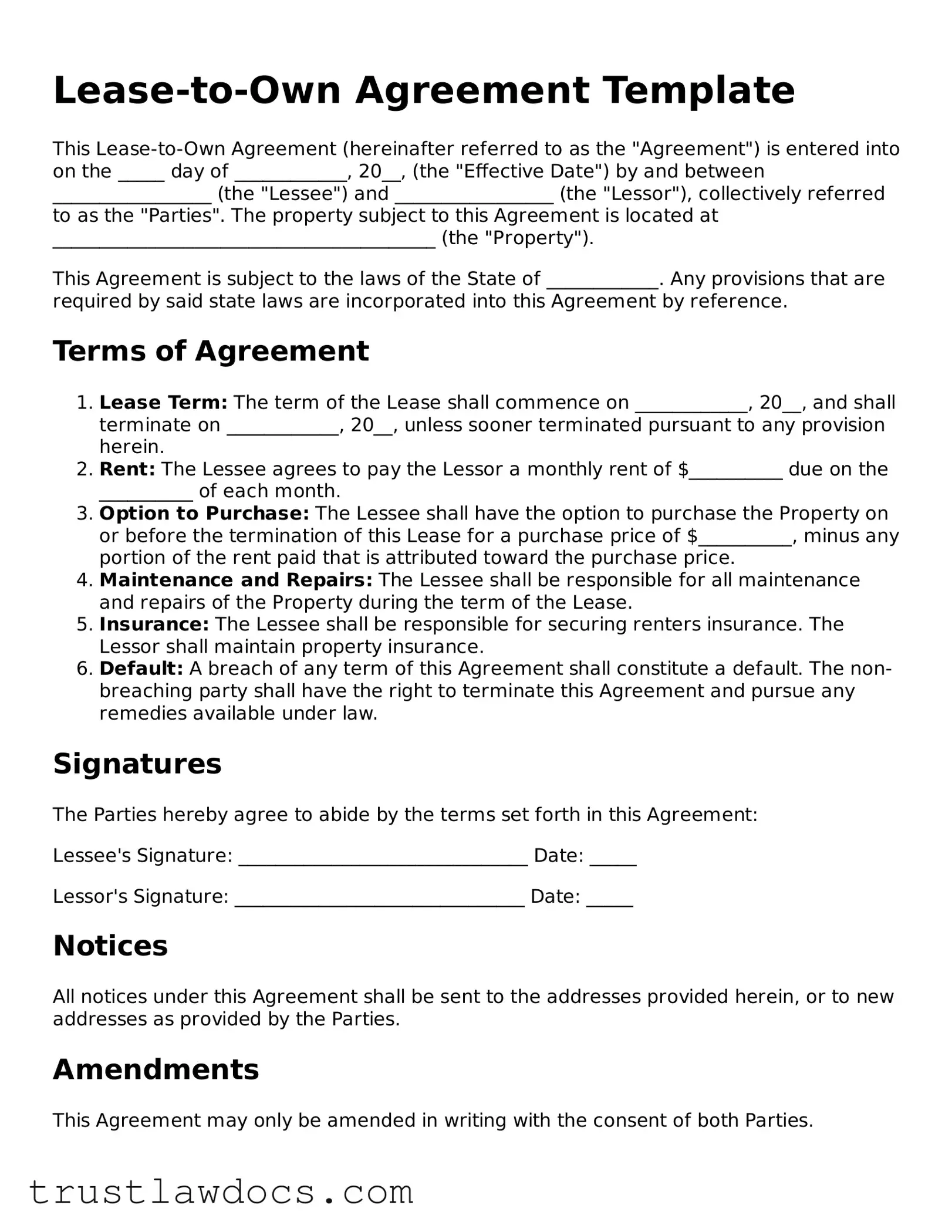

Form Example

Lease-to-Own Agreement Template

This Lease-to-Own Agreement (hereinafter referred to as the "Agreement") is entered into on the _____ day of ____________, 20__, (the "Effective Date") by and between _________________ (the "Lessee") and _________________ (the "Lessor"), collectively referred to as the "Parties". The property subject to this Agreement is located at _________________________________________ (the "Property").

This Agreement is subject to the laws of the State of ____________. Any provisions that are required by said state laws are incorporated into this Agreement by reference.

Terms of Agreement

- Lease Term: The term of the Lease shall commence on ____________, 20__, and shall terminate on ____________, 20__, unless sooner terminated pursuant to any provision herein.

- Rent: The Lessee agrees to pay the Lessor a monthly rent of $__________ due on the __________ of each month.

- Option to Purchase: The Lessee shall have the option to purchase the Property on or before the termination of this Lease for a purchase price of $__________, minus any portion of the rent paid that is attributed toward the purchase price.

- Maintenance and Repairs: The Lessee shall be responsible for all maintenance and repairs of the Property during the term of the Lease.

- Insurance: The Lessee shall be responsible for securing renters insurance. The Lessor shall maintain property insurance.

- Default: A breach of any term of this Agreement shall constitute a default. The non-breaching party shall have the right to terminate this Agreement and pursue any remedies available under law.

Signatures

The Parties hereby agree to abide by the terms set forth in this Agreement:

Lessee's Signature: _______________________________ Date: _____

Lessor's Signature: _______________________________ Date: _____

Notices

All notices under this Agreement shall be sent to the addresses provided herein, or to new addresses as provided by the Parties.

Amendments

This Agreement may only be amended in writing with the consent of both Parties.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Lease-to-Own Agreement is a contract for leasing property with an option or requirement to buy at the end of the leasing period. |

| Purpose | The agreement offers tenants an opportunity to purchase the rented property they live in before or by the end of the lease term. |

| Components | Typically includes lease terms, purchase price, option fee, and maintenance responsibilities, among other stipulations. |

| Option Fee | A non-refundable fee paid by the tenant for the option to purchase the property. It's often credited towards the purchase price if the option is exercised. |

| Purchase Price | The price at which the tenant can buy the property, often agreed upon at the start of the lease. |

| Benefits for Tenants | Allows tenants to build equity and test a property before committing to purchase. |

| Benefits for Landlords | Provides landlords with steady income and a potential buyer, reducing the hassle of finding new tenants or selling the property. |

| State-Specific Laws | The agreement is governed by state laws, which can vary significantly in terms of enforcement and the rights and responsibilities of both parties. |

| Risks | Tenants risk losing the option fee and additional rent paid towards the purchase if they decide not to buy or cannot secure financing. |

How to Write Lease-to-Own Agreement

Entering into a Lease-to-Own Agreement is a significant step for both parties involved, marking the beginning of a journey towards homeownership for the lessee and a sales transaction for the lessor. The completion of this agreement form is integral to ensure the clarity of terms, protection of rights, and the laying down of responsibilities for both the lessees and lessors. To ensure this process is executed smoothly and efficiently, a comprehensive guide on how to fill out the Lease-to-Own Agreement form is provided below. By carefully following these steps, parties can confidently move forward, knowing their interests are safeguarded and the path towards concluding the arrangement is clearly laid out.

- Start by entering the date the agreement is being filled out at the top of the form.

- Fill in the full names and contact details of both the lessor and the lessee. Ensure accuracy to avoid any potential confusion or legal issues in the future.

- Describe the property in question with precise detail, including its address, legal description, and any unique identifiers. This ensures both parties are in agreement about the property being transacted.

- Specify the term of the lease, explicitly stating the start and end dates. This term should cover the agreement's duration until the potential transfer of property ownership.

- Determine the total purchase price of the property and note it in the allocated section. Also, describe the terms under which the purchase price may be adjusted.

- Detail the payment schedule, including the amount of initial payment, subsequent payments, and any deposits required. Clearly state the due dates for each payment to avoid misunderstandings.

- Outline the responsibilities of the lessee and lessor, particularly concerning property maintenance, repairs, and modifications. Be clear about who is responsible for what to prevent disputes.

- Include clauses regarding defaults and remedies. Clearly articulate the consequences if either party fails to uphold their agreement terms and the steps towards resolution.

- Insert any contingencies that might affect the completion of the purchase, such as financing approval or property inspections. This helps prepare both parties for potential obstacles.

- Both parties should review the agreement thoroughly to ensure all information is accurate and all terms are understood.

- Sign and date the agreement. It's recommended to have a witness or notary present to validate the signatures.

Following the completion of these steps, it's essential to keep a copy of the agreement for personal records and to execute the following steps in adherence to the agreement's terms. Performing these actions with diligence and attention to detail can prevent legal complications and foster a mutually beneficial relationship throughout the term of the lease and the process of ownership transfer.

Get Answers on Lease-to-Own Agreement

What is a Lease-to-Own Agreement?

A Lease-to-Own Agreement is a document that outlines the arrangement between a property owner and a tenant to lease a property for a specified period, with the option for the tenant to purchase the property at the end of the lease term. This agreement includes terms regarding rent payments, the purchase price, and conditions for the sale and purchase of the property.

Who can benefit from a Lease-to-Own Agreement?

Both property owners and tenants can benefit from a Lease-to-Own Agreement. Property owners receive regular rental income while securing a potential future sale, whereas tenants can lock in a purchase price and test the property before committing to buy it.

How is the purchase price determined in a Lease-to-Own Agreement?

The purchase price is usually agreed upon at the beginning of the Lease-to-Own Agreement. This can be based on the current market value of the property or an estimated value at the end of the lease term. It is crucial for both parties to agree on a fair price considering potential market changes.

What happens if the tenant decides not to buy the property?

If the tenant chooses not to purchase the property at the end of the lease term, the agreement typically concludes like any standard lease agreement. The tenant may move out, and the option to buy lapses. Any upfront option fee or portion of rent paid towards the purchase price may be non-refundable, depending on the terms of the agreement.

Can the purchase price change during the lease term?

In most cases, the purchase price agreed upon at the start of the agreement remains fixed throughout the lease term. This is beneficial for tenants, as it protects them from price increases in a rising market. Any change to the purchase price typically requires a renegotiation and amendment of the agreement, agreed upon by both parties.

Is a Lease-to-Own Agreement legally binding?

Yes, a Lease-to-Own Agreement is a legally binding contract as long as it is executed in accordance with state laws and contains all necessary legal elements. Both parties are obligated to adhere to the terms as outlined in the agreement.

What are the risks involved in a Lease-to-Own Agreement?

There are risks for both parties in a Lease-to-Own Agreement. Tenants risk losing the option fee and additional rent paid towards the purchase, should they decide not to buy or fail to qualify for a mortgage at the end of the lease. Property owners risk being locked into a sale price in a rising market and potential legal disputes if the tenant breaches the agreement terms.

How can one terminate a Lease-to-Own Agreement?

Termination clauses vary by agreement but typically include breach of contract, failure to secure financing, or mutual consent. It is important to clearly define termination conditions in the agreement to protect both parties.

Are there any tax benefits with a Lease-to-Own Agreement?

While not outright tax benefits, tenants can benefit from locking in a purchase price without upfront property taxes, and owners receive rental income which is taxable. Specific tax implications for both parties should always be reviewed with a tax professional.

How does a Lease-to-Own Agreement impact the tenant’s ability to secure a mortgage?

Successfully making timely payments under a Lease-to-Own Agreement can positively impact a tenant's credit history, potentially facilitating the process of securing a mortgage. However, tenants should ensure they understand the requirements they must meet to qualify for a mortgage once the lease term ends.

Common mistakes

When filling out a Lease-to-Own Agreement form, many people make mistakes that can affect the validity of the agreement or lead to misunderstandings down the line. One common mistake is not specifying the exact details of the property being leased. This includes not only the address but also a detailed description of the property to ensure there is no ambiguity about what is being leased and eventually sold.

Another error often encountered is failure to outline the payment structure clearly. This includes the lease payments, the portion of each payment (if any) that will contribute towards the purchase price, the duration of the lease, and any other financial details. It's essential that these terms are spelled out concretely to prevent disputes over payments.

People also frequently omit critical terms regarding the purchase option. This includes the price at which the tenant can buy the property, when they can choose to do so, and what happens to their initial investment if they decide not to buy. Failing to include these details can lead to confusion and potential legal issues.

A significant misstep is not addressing maintenance responsibilities and costs. In a Lease-to-Own Agreement, it's crucial to outline who is responsible for the property's upkeep during the leasing period. Without clear terms, disputes over who pays for repairs or maintenance can arise, potentially derailing the agreement.

Another oversight is neglecting to include terms for breach of contract. What happens if either party fails to uphold their end of the agreement? Without clear consequences outlined in the agreement, enforcing the terms becomes much more challenging. This lack of clarity can lead to legal battles and failed agreements.

Lastly, many people fail to get the agreement reviewed by a legal professional. While it may seem like a straightforward process to fill out a Lease-to-Own Agreement form, the legalities involved are complex. Professional review can protect all parties involved and ensure the agreement is legally sound and fair.

Documents used along the form

When individuals enter into a lease-to-own agreement, which allows tenants to buy the property they're renting after a certain period, additional forms and documents often play crucial roles in ensuring all legal and financial aspects are properly managed. These documents not only provide clarity and security for both parties involved but also help adhere to applicable laws and regulations. Below is a summary of other important forms and documents that are typically used alongside a lease-to-own agreement.

- Application Form: This form is filled out by the prospective tenant before entering the lease-to-own agreement. It collects the applicant’s personal and financial information to assess their eligibility.

- Property Inspection Report: Documents the condition of the property before the tenant moves in, ensuring any existing damages are recorded to prevent future disputes.

- Rent Receipts: Serve as proof of the tenant's rental payments. These are crucial for maintaining a record of payments applied toward the purchase price.

- Lease Agreement: Outlines the terms of the lease, separate from the option to purchase. It covers rent, maintenance, and other responsibilities of each party.

- Option to Purchase Agreement: Specifies the conditions under which the tenant can buy the property, including the price and the time frame for making the decision.

- Home Warranty: Offers protection for the tenant-buyer against the cost of repair and replacement of appliances and major home systems.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide the rules and regulations the tenant must follow.

- Disclosures: Required by law in many areas, disclosures inform the tenant of any known issues with the property, such as lead paint or flood risks.

- Closing Documents: When the tenant proceeds with purchasing the property, these documents formalize the transfer of ownership. They include title deeds, mortgage papers, and settlement statements.

In summary, a lease-to-own agreement is enveloped in a suite of legal documents aimed at protecting all parties involved and ensuring the process runs smoothly. Each document serves a specific purpose, from validating the agreement's terms to safeguarding the interests of both the property owner and the tenant-become-homeowner. Careful consideration and completion of these documents is crucial for a successful lease-to-own arrangement.

Similar forms

A Lease Agreement is inherently similar to a Lease-to-Own Agreement, with both setting forth the terms under which one party agrees to rent property owned by another party. However, the crucial distinction lies in the end goal; a Lease Agreement is purely rental with no option to buy, whereas a Lease-to-Own Agreement includes provisions for the renter to purchase the property after a specified period.

A Purchase Agreement shares similarities with a Lease-to-Own Agreement in that both are pathways to homeownership and detail the conditions of the sale. The key difference is timing; a Purchase Agreement is used when the buyer is ready to acquire the property immediately, while a Lease-to-Own Agreement spreads the purchase process over a longer period, often allowing the renter to accumulate funds or improve creditworthiness.

A Real Estate Assignment Contract is akin to a Lease-to-Own Agreement because both involve the transfer of interest in a property. The major difference is that an Assignment Contract is used when an investor transfers their contract rights to another buyer before the original contract with the seller closes, whereas a Lease-to-Own Agreement directly involves the eventual transfer of property ownership from the seller to the lessee/buyer.

Rent-to-Own Agreements are very much like Lease-to-Own Agreements with a focus on the renter's option to purchase at the end of the lease. However, Rent-to-Own Agreements often cater more to personal property, like appliances or vehicles, unlike Lease-to-Own Agreements which are predominantly used for real estate transactions.

A Mortgage Agreement is related to a Lease-to-Own Agreement by its ultimate goal of transferring property ownership. While a Mortgage Agreement involves a borrower taking a loan to purchase a property directly, with the property acting as collateral for the loan, a Lease-to-Own Agreement allows the tenant to rent the property with the option to buy it later, usually financing the purchase without a traditional mortgage loan during the rental period.

An Option to Purchase Agreement parallels a Lease-to-Own Agreement in providing a right to buy under specified conditions. While the Option to Purchase can be a standalone document that gives one party the exclusive right to buy property within a set timeframe, it's often embedded within Lease-to-Own Agreements as the ‘option’ mechanism, which is triggered after certain terms are met, such as lease duration or rental payments contributing towards the purchase price.

A Land Contract is somewhat related to a Lease-to-Own Agreement as an alternative financing option for buying property. In a Land Contract, the buyer makes payments directly to the seller over time until the agreed upon purchase price is paid in full, at which point the deed is transferred. Unlike a Lease-to-Own Agreement, the buyer typically assumes immediate possession as if they were the owner, despite the title remaining with the seller until the contract's terms are fulfilled.

Last but not least, a Residential Lease Agreement, though primarily focusing on the rental aspect without concluding in a sale, shares the setup of terms for living in a property owned by another party. It lays down rules regarding rent, maintenance, and other conditions like a Lease-to-Own Agreement but lacks the component for eventual property ownership. These agreements are essential for establishing a clear landlord-tenant relationship during the period preceding the potential purchase in a Lease-to-Own Agreement.

Dos and Don'ts

When engaging in a Lease-to-Own Agreement, clarity, transparency, and due diligence are paramount for protecting all parties involved. Below are essential dos and don’ts to observe.

Do:Read the entire agreement carefully to understand all the terms and conditions before signing. Ensuring that you comprehend every aspect can prevent future conflicts.

Verify accuracy in all the personal details and property information included in the form. Inaccuracies can lead to legal complications down the line.

Consult with a legal professional to evaluate the agreement. Legal advice can help navigate complex clauses and ensure the contract serves your best interest.

Clarify the terms regarding the lease duration, purchase price, and payment schedules. These are critical components of the agreement that need to be explicitly agreed upon.

Inspect the property thoroughly. Since the intention is to eventually own it, ensure that it meets your expectations and is in the condition as described in the agreement.

Document all communications and agreements made during negotiations. Keeping records can be invaluable if disputes arise later.

Sign the agreement without full understanding or under pressure. Take your time to digest the terms and seek clarification where necessary.

Overlook the fine print. Details such as maintenance responsibilities, penalties for late payments, and conditions for terminating the agreement can have significant repercussions.

Assume standard terms. Lease-to-Own agreements can vary greatly, so it’s crucial to know exactly what you’re agreeing to.

Neglect to plan for financing the purchase. Ensure that you will qualify for a mortgage or have means to complete the purchase when the lease term ends.

Underestimate the importance of a property inspection. Unidentified issues can lead to unexpected expenses that may affect your ability to purchase.

Forget to check zoning laws and property restrictions. It’s important to know what you can and cannot do with the property before committing to buy it.

Misconceptions

Lease-to-own agreements offer potential homeowners a path to purchase that blends renting with the option to buy. However, misunderstandings about this process are common. Here, we explore and debunk eight misconceptions that people frequently hold about the lease-to-own agreement form.

The buyer is guaranteed to secure financing at the end of the lease. This is a common misconception. In reality, lease-to-own agreements do not guarantee that the buyer will be approved for a mortgage at the end of the lease period. Tenants must still meet the lender's requirements to secure a loan.

The terms are standardized like traditional leases. Contrary to this belief, lease-to-own agreements are highly customizable and can vary greatly in terms of lease duration, purchase price, and who covers maintenance and repairs. These details are negotiated between the seller and the potential buyer.

It’s a less expensive route to homeownership. While it can be, it is not always the case. Lease-to-own agreements often require a higher rent than standard leases to accumulate a portion as credit toward the purchase price. These terms can make it more costly in the short term compared to traditional renting.

All money paid goes toward the purchase of the home. This is not always true. Only a part of the lease payments (often termed as rent credit) and the initial option fee may be applied to the purchase price. Regular rent payments, in excess of the rent credit, do not count towards the home purchase.

If the tenant decides not to buy, they can get their money back. Typically, money invested in the lease-to-own process, such as the option fee and any rent credits, are non-refundable if the tenant chooses not to purchase the home or is unable to secure financing.

The purchase price is set in stone from the beginning. While the purchase price is often agreed upon in advance, some agreements allow for the price to be renegotiated or set at the future appraised value of the home. This depends entirely on the terms negotiated at the start of the lease.

Lease-to-own benefits only the seller. While sellers do benefit by having a potential buyer and receiving regular income, buyers also benefit by locking in a purchase price, experiencing homeownership before buying, and potentially building equity. Both parties can find advantages in a well-negotiated agreement.

Entering a lease-to-own agreement means you must buy the home. A critical misunderstanding is the belief that tenants are obligated to buy the home at the end of the lease term. Most agreements offer the option, not the obligation, to buy. Tenants can choose not to proceed with the purchase for any reason.

Understanding the specifics of lease-to-own agreements is crucial for both parties involved. By clarifying these misconceptions, individuals can make more informed decisions that align with their financial realities and homeownership goals.

Key takeaways

A Lease-to-Own Agreement form is a crucial document that serves as a bridge for renters aspiring to become homeowners, providing a structured path toward owning the home they lease. Understanding how to efficiently fill out and utilize this form can significantly impact the process, making it smoother for both the renter (lessee) and the property owner (lessor). Below are six key takeaways that everyone should keep in mind when dealing with a Lease-to-Own Agreement:

- Read and Understand All Terms: This agreement is more complex than a standard lease, combining elements of both renting and buying. Ensure you understand every term, condition, and responsibility detailed in the agreement to avoid unexpected obligations.

- Identify Specific Property Details: The agreement should meticulously describe the property being leased, including its address, description, and any inclusions or exclusions. Accuracy in this section prevents potential disputes about what is being purchased.

- Determine the Purchase Price: Often, the purchase price or a method for determining the price is outlined within the agreement. This could be a fixed amount known at the beginning of the lease or a formula based on future appraisals. Clarity in this area ensures both parties are aware of the financial commitments involved.

- Understand the Rent Credit: A unique feature of lease-to-own agreements is the rent credit, which is a portion of the monthly payment that goes toward the purchase price of the property. Recognizing how much of your rent is contributing to your future ownership is essential for financial planning.

- Maintenance and Modifications: Who is responsible for property maintenance and allowable modifications during the lease term should be clearly defined. Since the lessee might eventually own the property, there might be more leeway in terms of modifications compared to standard leases.

- Secure Financing: In most cases, the lessee will need to secure financing to purchase the property at the end of the lease term. It’s crucial to understand the conditions under which you must qualify for a mortgage or other financing to buy the home, including any stipulations that might affect this ability.

Engaging with a Lease-to-Own Agreement requires a careful balance of the lessee's aspirations towards homeownership and the lessor's interests. By keeping these key takeaways in mind, parties on both sides of the agreement can navigate the complexities of lease-to-own arrangements more effectively, leading towards a successful and mutually beneficial conclusion.

Consider More Types of Lease-to-Own Agreement Forms

360 Photo Booth Contract - Availability of on-site reprints or additional prints post-event is clarified, including the process and any associated costs.

Free Roommate Agreement - Aids in preventing disputes by detailing the procedure for handling breaches of agreement, damages, and eviction notices.

Simple Rental Agreement Between Family Members - An essential tool for avoiding family disputes over property usage, making sure that relationship ties do not overshadow formal agreements.