Free Commercial Lease Agreement Form for California

Embarking on a commercial lease journey in California can often feel akin to navigating a labyrinth, filled with legal terms and conditions that can perplex even the most astute business minds. Yet, at the heart of this journey lies the California Commercial Lease Agreement form, a pivotal document that sets the stage for the relationship between landlords and business tenants. This form encompasses everything from the length of the lease term to the specifics of rent payment schedules, not to mention detailed provisions regarding the use of the property, maintenance responsibilities, and criteria for lease renewal or termination. It's a comprehensive blueprint that outlines what is expected from each party, aiming to minimize disputes and ensure a harmonious landlord-tenant relationship. With the complexity and importance of such agreements, understanding the major aspects of this form is crucial for anyone looking to lease commercial property in California, providing a solid foundation for successful business operations.

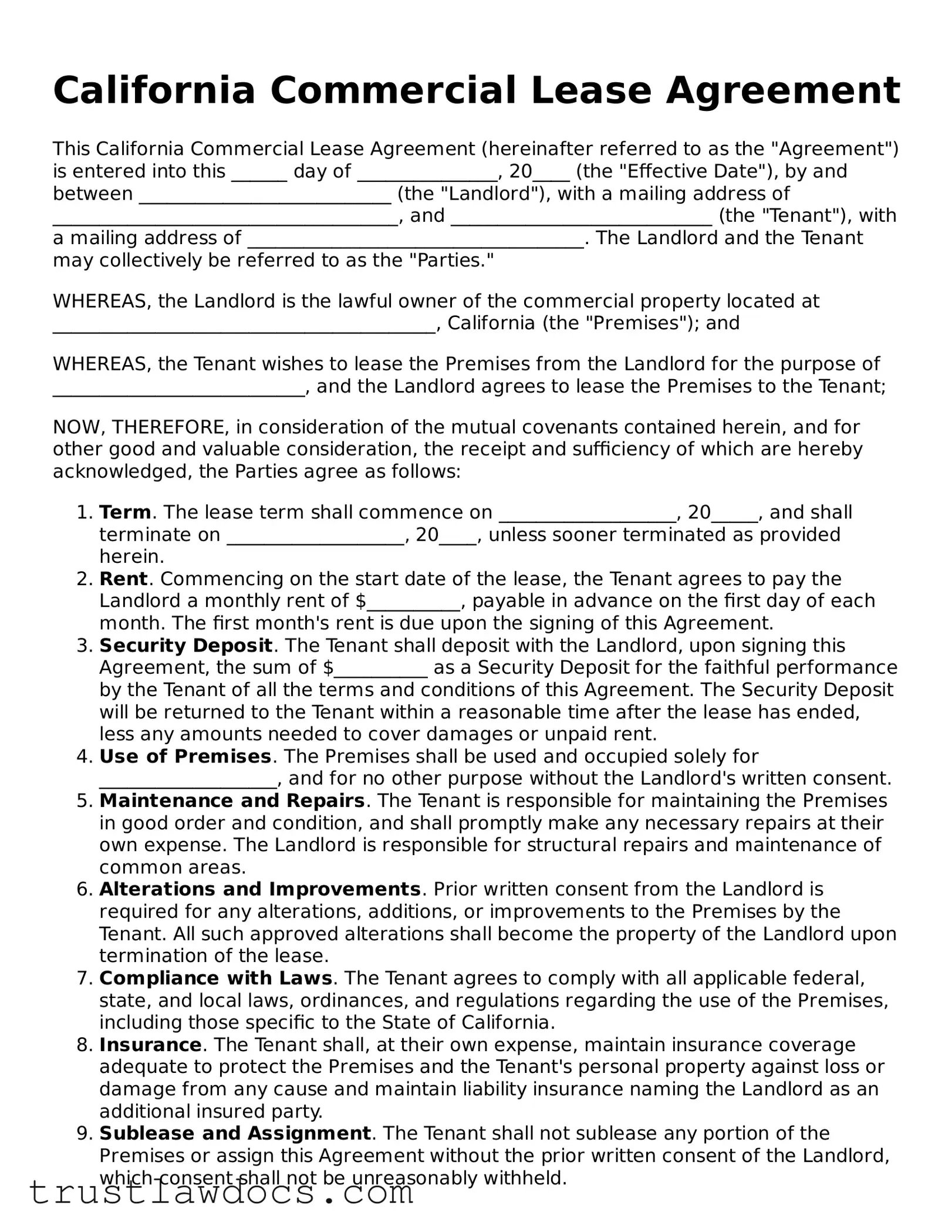

Form Example

California Commercial Lease Agreement

This California Commercial Lease Agreement (hereinafter referred to as the "Agreement") is entered into this ______ day of _______________, 20____ (the "Effective Date"), by and between ___________________________ (the "Landlord"), with a mailing address of _____________________________________, and ____________________________ (the "Tenant"), with a mailing address of ____________________________________. The Landlord and the Tenant may collectively be referred to as the "Parties."

WHEREAS, the Landlord is the lawful owner of the commercial property located at _________________________________________, California (the "Premises"); and

WHEREAS, the Tenant wishes to lease the Premises from the Landlord for the purpose of ___________________________, and the Landlord agrees to lease the Premises to the Tenant;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Term. The lease term shall commence on ___________________, 20_____, and shall terminate on ___________________, 20____, unless sooner terminated as provided herein.

- Rent. Commencing on the start date of the lease, the Tenant agrees to pay the Landlord a monthly rent of $__________, payable in advance on the first day of each month. The first month's rent is due upon the signing of this Agreement.

- Security Deposit. The Tenant shall deposit with the Landlord, upon signing this Agreement, the sum of $__________ as a Security Deposit for the faithful performance by the Tenant of all the terms and conditions of this Agreement. The Security Deposit will be returned to the Tenant within a reasonable time after the lease has ended, less any amounts needed to cover damages or unpaid rent.

- Use of Premises. The Premises shall be used and occupied solely for ___________________, and for no other purpose without the Landlord's written consent.

- Maintenance and Repairs. The Tenant is responsible for maintaining the Premises in good order and condition, and shall promptly make any necessary repairs at their own expense. The Landlord is responsible for structural repairs and maintenance of common areas.

- Alterations and Improvements. Prior written consent from the Landlord is required for any alterations, additions, or improvements to the Premises by the Tenant. All such approved alterations shall become the property of the Landlord upon termination of the lease.

- Compliance with Laws. The Tenant agrees to comply with all applicable federal, state, and local laws, ordinances, and regulations regarding the use of the Premises, including those specific to the State of California.

- Insurance. The Tenant shall, at their own expense, maintain insurance coverage adequate to protect the Premises and the Tenant's personal property against loss or damage from any cause and maintain liability insurance naming the Landlord as an additional insured party.

- Sublease and Assignment. The Tenant shall not sublease any portion of the Premises or assign this Agreement without the prior written consent of the Landlord, which consent shall not be unreasonably withheld.

- Termination. On the termination of the lease, the Tenant shall vacate the Premises and leave them in as good condition as they were at the commencement of the Agreement, reasonable wear and tear excepted.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of California.

IN WITNESS WHEREOF, the Parties have executed this California Commercial Lease Agreement as of the Effective Date first above written.

Landlord Signature: __________________________________

Tenant Signature: ___________________________________

PDF Form Details

| Fact | Detail |

|---|---|

| Governing Law | California Civil Code Sections 1940-1954.25 and Sections 1995.010 - 1995.340 |

| Type of Property | Can be used for commercial properties, including retail, office, and industrial spaces. |

| Accessibility Requirements | Must comply with the Americans with Disabilities Act and California Building Standards Code regarding accessibility. |

| Deposit Limits and Return | California law does not limit the amount; however, the return of the deposit is required within a specific period after the lease ends, usually 30 days. |

How to Write California Commercial Lease Agreement

Filling out a California Commercial Lease Agreement is a critical step for both landlords and tenants entering into a business property rental arrangement. This document outlines the terms, conditions, and obligations of both parties, ensuring a clear understanding and minimizing potential disputes. The process requires attention to detail and a thorough understanding of the lease terms to avoid common pitfalls. Here are the steps to properly fill out the form, aimed to guide you smoothly through the process.

- Begin with tenant and landlord information. Include full names, addresses, and contact details of both parties involved in the lease agreement.

- Describe the premises. Clearly define the leased property's address, including specific details about the space being rented.

- State the term of the lease. Specify the lease start and end dates, making it clear the duration of the agreement.

- Detail the rent obligations. Include the monthly rent amount, due dates, and acceptable payment methods. Don't forget to mention any security deposit that is required.

- Outline the permitted use of the premises. Clearly describe what the tenant is allowed to use the property for, to avoid any misunderstandings later on.

- Include lease renewal options. If applicable, detail any terms regarding the renewal of the lease, including how the renewal process should be initiated.

- Discuss modifications and improvements. State any terms regarding alterations the tenant may wish to make to the property.

- Address maintenance and repairs. Clearly assign responsibilities for both the landlord and tenant in maintaining and repairing the leased property.

- Explain insurance requirements. Specify the types and amounts of insurance each party must maintain.

- Include termination and default terms. Outline the circumstances under which the lease may be terminated early and the consequences for defaulting on lease terms.

- Signatures. Ensure both the landlord and tenant sign the agreement, making it legally binding. Don't forget to include the date next to the signatures.

After completing these steps, it's important for both parties to keep a signed copy of the lease agreement for their records. The document serves as a reference for the terms of the lease, helping to resolve any questions or disputes that may arise during the lease period. Filling out the form carefully and comprehensively can help prevent misunderstandings and ensure a smooth and amicable rental relationship.

Get Answers on California Commercial Lease Agreement

What is a California Commercial Lease Agreement?

A California Commercial Lease Agreement is a legal document that outlines the terms and conditions under which a commercial property is rented. Landlords and tenants use this agreement for leasing property for commercial purposes, such as offices, retail spaces, warehouses, and other business-related premises. This document specifies rent payments, lease duration, property use restrictions, and responsibilities for repairs and maintenance.

How long can a lease term be under a California Commercial Lease Agreement?

In California, a commercial lease can be set for any length of time agreed upon by both the landlord and the tenant. Lease terms are often negotiated based on business needs and can range from a short term of 1 year to longer terms of 10 years or more. It's essential to carefully consider the lease duration since it affects many other lease provisions.

Are there different types of Commercial Lease Agreements in California?

Yes, there are several types of Commercial Lease Agreements in California, including gross leases, modified gross leases, and triple net (NNN) leases. The type chosen affects how costs such as property taxes, insurance, and maintenance are divided between the landlord and tenant. Gross leases typically have the landlord covering most costs, while triple net leases shift most expenses to the tenant.

What are the responsibilities of the landlord in a California Commercial Lease Agreement?

The landlord's responsibilities include maintaining the property's structural integrity, complying with health and safety regulations, and ensuring any agreed-upon services are provided. Specific duties can vary based on the lease type and any modifications made to the standard agreement. It's crucial for landlords to clearly outline their responsibilities in the lease to prevent disputes.

Can a tenant modify the leased property?

Tenants can usually make modifications to the leased property, such as painting or installing fixtures, with the landlord's consent. The lease agreement should specify the types of alterations allowed and whether the tenant must restore the property to its original condition at the end of the lease. It's important for both parties to discuss and agree on any modifications in advance.

What happens if a lease is breached by either party?

If a lease is breached, the non-breaching party has the right to pursue legal remedies. These may include terminating the lease, seeking damages, or demanding specific performance. The specific consequences and remedies should be detailed in the lease agreement, including any notice requirements and opportunities to cure the breach.

How can a California Commercial Lease Agreement be terminated?

A lease can be terminated according to the terms outlined in the agreement, such as at the end of the lease term or through early termination provisions if agreed upon by both parties. Lease agreements may also include conditions under which either party may terminate prematurely, such as lease violations or business closure. Proper notice must typically be given, as specified in the lease.

Common mistakes

Filling out a California Commercial Lease Agreement form accurately is crucial for both landlords and tenants to ensure that their rights and responsibilities are clearly defined. However, mistakes can happen, which might lead to misunderstandings or legal issues down the line. Here are four common errors people tend to make when dealing with this document.

One common mistake is not specifying the details of the lease clearly. This includes the length of the lease, renewal options, and any provisions for rent increases. Details should be explicitly stated to prevent any ambiguity that could lead to disputes. For instance, failing to clearly outline the lease term can result in disagreements about when the tenant is supposed to vacate the premises, or under what conditions the lease can be renewed.

Another mistake is overlooking the description of the premises. It's essential to accurately describe the space being leased, including its address, square footage, and any specific use restrictions. This information should be detailed to avoid any confusion about what areas are included in the lease and how the tenant can use the space. Without a precise description, tenants might assume they have rights to areas not intended for their use, or landlords might find themselves unable to enforce use restrictions.

A third error involves failing to clarify maintenance and repair responsibilities. The lease should delineate who is responsible for maintaining and repairing different parts of the property, including common areas, the leased space, and structural elements. When this is not clearly defined, disputes can arise over who is responsible for handling and paying for necessary repairs, leading to potential legal battles or strained relationships between the landlord and tenant.

Lastly, not adequately addressing modifications and improvements is a significant oversight. Tenants may assume they have the freedom to modify or improve their leased space as they see fit, but landlords often have restrictions on what changes can be made. The agreement should specify what modifications are allowed, whether the landlord's approval is required, and how improvements should be handled at the end of the lease term. Failing to include this information can lead to misunderstandings or damage to the property that could have been avoided with clearer terms.

By paying close attention to these details when filling out a California Commercial Lease Agreement, both landlords and tenants can help ensure that their interests are protected, and their commercial relationship starts on a solid foundation.

Documents used along the form

When setting up a commercial lease agreement in California, several additional documents are typically used to ensure thoroughness, compliance, and clarity in the lease terms. These documents complement the lease agreement by providing detailed information, clarifications, safety measures, and legal assurances for both parties involved. They range from disclosures and addenda to acknowledgment forms, all playing a critical role in the leasing process. Here's an overview of some of the key forms and documents often accompanying a California Commercial Lease Agreement.

- Personal Guarantee Form: This document is used when the tenant is a business entity, ensuring that an individual (like an owner or major stakeholder) personally guarantees the payment of rent and other obligations.

- Lead-Based Paint Disclosure: For buildings constructed before 1978, this federal disclosure is required to inform tenants about the potential presence of lead-based paint, which can pose health risks.

- Asbestos Disclosure: Similar to the lead paint disclosure, this form is necessary if there's known asbestos in the building, alerting tenants to health hazards and related information.

- Property Condition Checklist: A checklist that documents the physical condition of the property at the time of lease commencement. It serves as a benchmark for assessing any damages or alterations during the tenancy.

- Rent Adjustment Addendum: This outlines the conditions under which rent may be increased, including the calculation method and notice requirements, providing clear expectations for future rent adjustments.

- Rules and Regulations Addendum: Specifies the rules tenants must follow regarding use of common areas, signage, noise levels, waste disposal, and other operational aspects of the premises.

- Subordination, Non-Disturbance, and Attornment Agreement (SNDA): This sets the rights of the tenant in relation to the landlord’s lender, ensuring the lease remains valid even if the property is foreclosed or the landlord’s interest is otherwise transferred.

- Estoppel Certificate: Requested by landlords or lenders, this document has the tenant confirm certain details of the lease (such as rent amounts, lease commencement and end dates, and option rights), ensuring accuracy and transparency.

- Parking Addendum: If parking is available, this addendum details terms regarding the number of spaces, location, cost, and any conditions or restrictions on parking.

- Option to Renew/Extend Lease Addendum: A clause or separate document that grants the tenant the right to extend the lease term under predefined conditions, offering stability and future occupancy rights.

Accompanying a California Commercial Lease Agreement with these forms and documents can significantly contribute to a smooth, transparent, and legally sound leasing process. By taking care of these additional steps, both landlords and tenants can safeguard their interests and build a strong foundation for their business relationship. Ensuring all pertinent documents are accurately completed and signed before the lease starts helps prevent conflicts and misunderstandings during the tenancy.

Similar forms

A California Commercial Lease Agreement form is closely related to a Residential Lease Agreement, albeit with a focus on commercial properties instead of residential ones. Both documents establish a legally binding relationship between a landlord and a tenant, outlining terms like lease duration, payment obligations, and maintenance responsibilities. However, a commercial lease might include clauses on commercial property use, renovations for business needs, and compliance with zoning laws, something not commonly found in residential agreements.

Another document similar to the California Commercial Lease Agreement is the Sublease Agreement. A sublease agreement comes into play when a tenant, holding a lease to a commercial property, decides to rent out part or all of the said property to another tenant. While the structures of these agreements are similar – specifying terms like rental payments, security deposits, and lease duration – a sublease agreement typically requires the original lessor’s consent and emphasizes the original tenant’s continued responsibility for lease obligations.

The Lease Amendment is an important document that shares similarities with a California Commercial Lease Agreement, primarily because it is used to make changes to an existing lease agreement. Whether commercial or residential, lease amendments adjust terms or conditions without needing to terminate the agreement and create a new one. Specific to commercial leases, amendments might include changes to rental space due to business expansion or reduction, adjustments in rent, or extensions of the lease term.

Property Management Agreements bear resemblance to California Commercial Lease Agreements in that both involve property use and maintenance, yet from different perspectives. While the commercial lease agreement delineates the relationship between landlord and tenant, a property management agreement is between a property owner and a management firm. This contract outlines the manager’s responsibilities, which may include leasing operations, property maintenance, and financial services, adhering to the owner’s goals and legal requirements.

A Triple Net Lease (NNN) Agreement is a specific type of commercial lease agreement, highlighting its similarity but with distinctive features concerning expense responsibilities. In a triple net lease, the tenant agrees to pay all real estate taxes, building insurance, and maintenance (the three "nets") on the property in addition to any normal fees expected under a standard lease agreement. This type of arrangement is typical in commercial leases for standalone buildings and is favored by investors for its predictability in expenses.

Lastly, an Offer to Lease is a precursor to a formal lease agreement, whether commercial or residential, setting the stage for negotiation. While not as in-depth as a California Commercial Lease Agreement, it serves a critical role in specifying the intent of both parties to enter into a lease under proposed terms. It generally includes proposed rental rates, lease term, and property description, facilitating the groundwork for a detailed lease agreement to follow.

Equipment Lease Agreements share the concept of leasing with commercial lease agreements but focus on personal property rather than real estate. These agreements allow businesses to lease equipment instead of purchasing it outright, detailing terms such as lease payments, duration, maintenance responsibilities, and return conditions. While different in terms of the leased asset, both arrangements outline use and financial responsibilities clearly to prevent conflicts.

Dos and Don'ts

Filling out a California Commercial Lease Agreement form is a significant step for both landlords and tenants. It's essential to approach this process with care and diligence. Below are some key dos and don'ts to keep in mind to ensure the agreement is completed effectively and protects the interests of both parties.

Do the following:

- Read the entire document before starting to fill it out. Understanding every section will help ensure that all the information is accurate and complete.

- Use clear and precise language. Ambiguities can lead to misunderstandings and legal complications down the line.

- Verify the accuracy of all names and addresses, including the legal names of the business entities involved.

- Describe the premises in detail, including the specific area being leased and any common areas the tenant will have access to.

- Specify the lease term, including the start and end dates, to avoid any confusion regarding the duration of the lease.

Avoid doing the following:

- Leaving blank spaces. If a section does not apply, write "N/A" (not applicable) instead of leaving it blank to prevent unauthorized alterations.

- Signing the agreement before all parties have reviewed the final draft. This ensures that any errors or omissions can be corrected before the lease is finalized.

- Forgetting to specify the tenant's and landlord's responsibilities, such as who is responsible for repairs, maintenance, and utilities. This can lead to disputes and unforeseen expenses.

Remember, a well-prepared lease agreement is foundational to a successful landlord-tenant relationship. Paying attention to these details can save time, money, and stress later on.

Misconceptions

When dealing with commercial lease agreements in California, it's crucial to navigate the complexities with accurate information. Several misconceptions often cloud the understanding of these contracts, leading to confusion and potentially costly mistakes. Here are five common misunderstandings, clarified to help inform your decisions about commercial leasing in California:

- All commercial leases are essentially the same. In reality, commercial leases vary greatly in structure, terms, and conditions. It's vital to thoroughly review and understand the specific obligations and rights granted by the lease document you are considering.

- The lease rate is non-negotiable. Contrary to what many believe, lease rates in commercial agreements can often be negotiated. Factors such as the location's desirability, the length of the lease, and the current market conditions can influence negotiations.

- A commercial lease doesn't offer flexibility. This is not always the case. Flexibility in a commercial lease can be achieved through negotiations. Clauses concerning subleasing, lease termination, and rent adjustments can provide flexibility for tenants depending on the lease terms agreed upon.

- Maintenance and repairs are always the landlord's responsibility. The responsibility for maintenance and repairs depends on the lease's specific terms. In some cases, tenants may be responsible for all or a portion of the property maintenance and repairs.

- Security deposits are optional in commercial leases. While residential leases in California have clear rules regarding security deposits, commercial leases often require them, and the terms can be significantly more variable. The amount and conditions for the return of the deposit should be explicitly stated in the lease agreement.

Understanding these misconceptions can help parties involved in a commercial lease in California make informed decisions and establish agreements that meet their needs more effectively.

Key takeaways

When entering into a commercial lease agreement in California, there are crucial aspects to consider to ensure that the lease meets the requirements of both the lessee and the lessor. Below are key takeaways that are instrumental in filling out and using the California Commercial Lease Agreement form effectively.

- Ensure all parties are identified accurately. This includes the full legal names of both the lessor (often referred to as the landlord) and the lessee (or tenant), as well as their legal entities if applicable. This clarity helps avoid any confusion about who holds the responsibilities and rights under the lease.

- Be precise with the description of the leased premises. The agreement should clearly define the space being leased, including its location, square footage, and any specific identifying details. This specificity helps prevent disputes regarding the scope of the lease.

- Understand the lease type being agreed upon. California commercial lease agreements can be gross, modified gross, or triple net (NNN). Each of these has different implications for what costs the tenant is responsible for beyond the rent, such as insurance, taxes, and maintenance expenses.

- Clarify the lease term. Specify the commencement and termination dates of the lease. This includes detailing any options for renewal and conditions related to ending the lease early.

- Detail the financial aspects comprehensively. Beyond just stating the rent amount, the agreement should include the payment schedule, any security deposit required, details regarding late payments, and potential rent adjustments.

- Outline the permitted use of the premises. Make sure the agreement specifies what activities the lessee is allowed to perform on the premises, which is vital for both zoning compliance and ensuring that the property meets the tenant's needs.

- Include provisions for alterations and improvements. The agreement should state what alterations or improvements the lessee can make to the premises, whether prior approval from the lessor is needed, and who bears the cost of such changes.

- Address maintenance and repairs. Clearly set out the responsibilities for maintenance and repairs of the premises, differentiating between the landlord's and tenant's obligations. This is crucial for avoiding disputes down the line.

- Consider compliance with laws and regulations. The lease should ensure compliance with all applicable laws, including zoning laws, health and safety regulations, and any specific requirements related to the business operation of the lessee.

By keeping these key takeaways in mind, parties can create a comprehensive and clear California Commercial Lease Agreement that safeguards the interests of both the tenant and the landlord, promotes a positive leasing relationship, and helps avoid potential legal issues.

Popular Commercial Lease Agreement State Forms

Michigan Commercial Lease Agreement - This document helps protect the interests of both the landlord and tenant by clearly defining responsibilities and expectations.

Simple Commercial Lease Agreement Ny - Encourages proactive communication and negotiation between the landlord and tenant to adapt to changing business needs.