Official Commercial Lease Agreement Document

Envision stepping into a new phase for your business, a journey that begins with the excitement of expansion or the launch of your very first storefront. This pivotal moment is often marked by signing a Commercial Lease Agreement, a form that acts as the cornerstone of your relationship with the landlord of your business space. This document, more than just a piece of paper, outlines the rights and responsibilities of both the tenant and the landlord, ensuring that both parties have a clear understanding of what is expected during the lease term. It includes essential details such as the duration of the lease, the amount of rent, payment schedules, and any terms regarding the modification of the property to suit the needs of the business. Additionally, it addresses the intricate issues of renewals, terminations, and what happens in the event of default, providing a safety net for both parties. Understanding the major aspects of the Commercial Lease Agreement form is crucial before embarking on this exciting business venture, as it not only safeguards your investment but also lays down the foundation for a successful and harmonious landlord-tenant relationship.

Commercial Lease Agreement for Specific States

Form Example

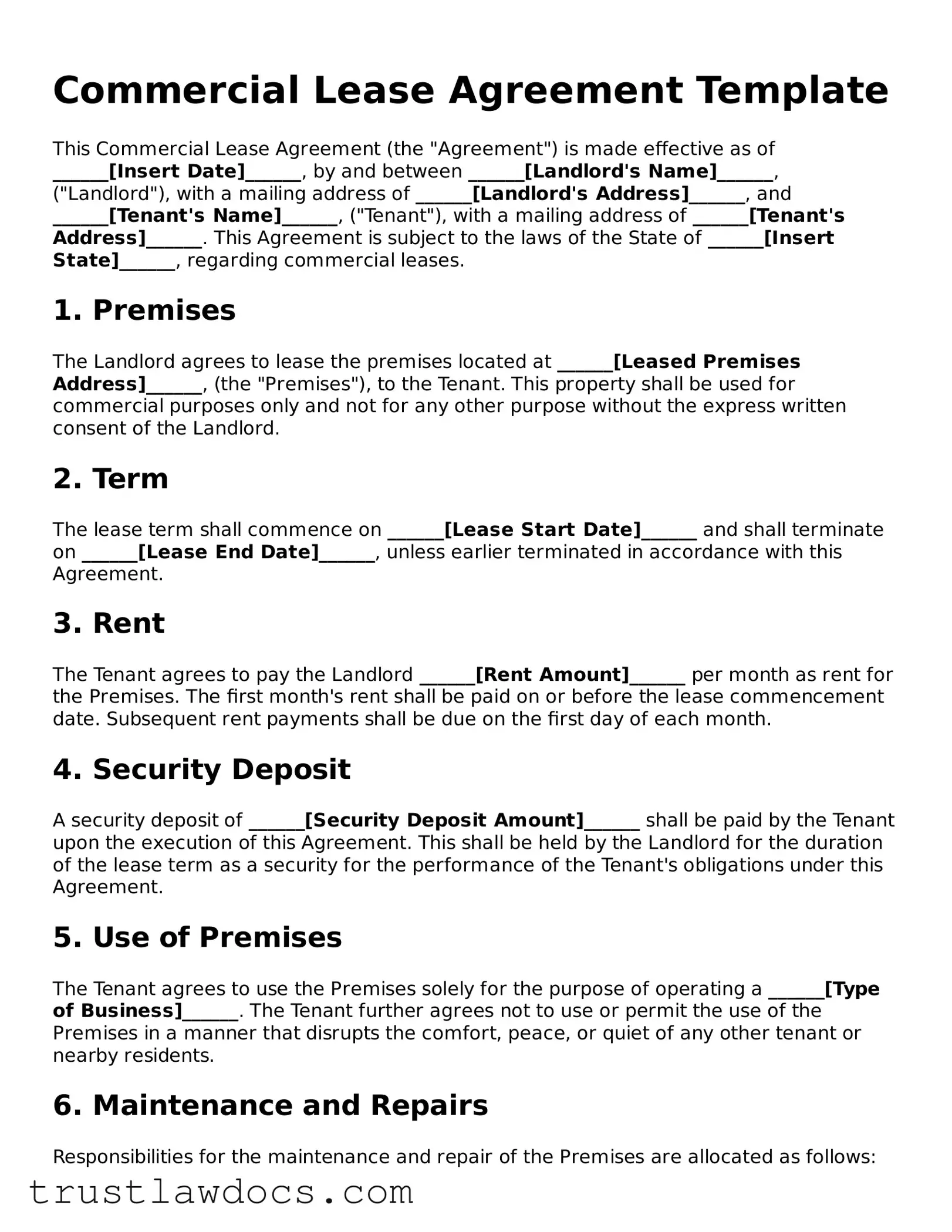

Commercial Lease Agreement Template

This Commercial Lease Agreement (the "Agreement") is made effective as of ______[Insert Date]______, by and between ______[Landlord's Name]______, ("Landlord"), with a mailing address of ______[Landlord's Address]______, and ______[Tenant's Name]______, ("Tenant"), with a mailing address of ______[Tenant's Address]______. This Agreement is subject to the laws of the State of ______[Insert State]______, regarding commercial leases.

1. Premises

The Landlord agrees to lease the premises located at ______[Leased Premises Address]______, (the "Premises"), to the Tenant. This property shall be used for commercial purposes only and not for any other purpose without the express written consent of the Landlord.

2. Term

The lease term shall commence on ______[Lease Start Date]______ and shall terminate on ______[Lease End Date]______, unless earlier terminated in accordance with this Agreement.

3. Rent

The Tenant agrees to pay the Landlord ______[Rent Amount]______ per month as rent for the Premises. The first month's rent shall be paid on or before the lease commencement date. Subsequent rent payments shall be due on the first day of each month.

4. Security Deposit

A security deposit of ______[Security Deposit Amount]______ shall be paid by the Tenant upon the execution of this Agreement. This shall be held by the Landlord for the duration of the lease term as a security for the performance of the Tenant's obligations under this Agreement.

5. Use of Premises

The Tenant agrees to use the Premises solely for the purpose of operating a ______[Type of Business]______. The Tenant further agrees not to use or permit the use of the Premises in a manner that disrupts the comfort, peace, or quiet of any other tenant or nearby residents.

6. Maintenance and Repairs

Responsibilities for the maintenance and repair of the Premises are allocated as follows:

- The Landlord is responsible for repairs to the structure of the building, including but not limited to the roof, exterior walls, and foundation.

- The Tenant is responsible for the day-to-day maintenance and repairs of the Premises, including keeping the interior of the Premises clean and in good repair.

7. Alterations

Any alterations, additions, or improvements to the Premises by the Tenant must receive the prior written consent of the Landlord. Upon the termination of this lease, the Tenant shall remove such alterations, additions, or improvements, unless the Landlord requests in writing that they remain in place.

8. Termination

This Lease may be terminated before the end of the term under the following conditions:

- By mutual agreement of both parties in writing.

- If one party breaches any term of this Agreement and fails to correct the breach within a reasonable period following written notice from the other party.

9. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ______[Applicable State]______.

10. Signatures

IN WITNESS WHEREOF, the parties have executed this Commercial Lease Agreement as of the date first above written.

Landlord: ___________________________________ Date: ______

Tenant: _____________________________________ Date: ______

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | A Commercial Lease Agreement is a legally binding contract between a landlord and a tenant for the rental of business property. |

| 2 | This agreement outlines the terms and conditions of a tenancy, including rent, lease duration, and usage of the property. |

| 3 | Commercial leases are generally more complex than residential leases and offer less protection under the law. |

| 4 | They can be categorized into different types: gross leases, net leases, and modified gross leases, each defining how costs are allocated between the landlord and tenant. |

| 5 | Before signing, it is crucial for both parties to understand the specific terms, as they can significantly impact a business's operations and finances. |

| 6 | Rent escalation clauses, maintenance responsibilities, sublease conditions, and termination rights are critical factors often negotiated in a commercial lease. |

| 7 | The governing law of a commercial lease agreement is typically the state law where the property is located. |

| 8 | Due diligence, including a review by a legal professional, is recommended to ensure the agreement meets all legal requirements and protects the interests of both the landlord and the tenant. |

How to Write Commercial Lease Agreement

Filling out a Commercial Lease Agreement is a critical process that solidifies the terms under which a tenant is allowed to use a property for business purposes. This document outlines important details such as the duration of the lease, payment amounts, and the responsibilities of each party. Getting it right ensures a clear understanding between the landlord and the tenant, which can help prevent disputes in the future. Below are step-by-step instructions designed to guide you through completing this form effectively.

- Begin by entering the full names and contact information of both the landlord and the tenant at the top of the form. This establishes who is agreeing to the lease terms.

- Specify the address and a detailed description of the commercial property being leased. Include any important features or restrictions related to its use.

- Enter the start date and end date of the lease term. Be clear about the exact duration to avoid any ambiguity.

- Detail the financial aspects of the lease, including monthly rent, security deposit, and any additional fees or expenses for which the tenant is responsible. Ensure the amounts are accurate and agreed upon by both parties.

- Outline how and when payments should be made. This includes the preferred payment method and any late fees for overdue payments.

- Describe the permitted uses of the property, specifically what type of business the tenant is allowed to conduct. This helps prevent activities that the landlord may find undesirable.

- Include clauses on maintenance and repairs, clearly stating which party is responsible for various types of maintenance work on the property.

- Detail the conditions under which the lease may be renewed or terminated early, including any penalties or procedures that must be followed.

- Add any additional terms and conditions that are specific to your lease agreement. This can include insurance requirements, dispute resolution methods, or subletting policies.

- Review the entire document carefully with both the landlord and the tenant present to ensure all information is correct and agreed upon. Make any necessary corrections.

- Both parties should sign and date the lease agreement. Witnesses or notarization might be required, depending on the laws of your state.

- Finally, distribute copies of the signed document to both the landlord and the tenant for their records.

Completing a Commercial Lease Agreement is not just a formality; it's a foundational step in establishing a successful landlord-tenant relationship. With the right attention to detail and a comprehensive approach to outlining the lease's terms, both parties can enter into the agreement with confidence and a clear understanding of their respective obligations.

Get Answers on Commercial Lease Agreement

What is a Commercial Lease Agreement?

A Commercial Lease Agreement is a legally binding contract made between a landlord and a tenant. This agreement outlines the terms and conditions under which the tenant can rent commercial property from the landlord. It typically includes details on rent, lease duration, use of property, and responsibilities of each party. Commercial properties could range from office spaces to retail locations, among others.

How long can a Commercial Lease Agreement last?

The duration of a Commercial Lease Agreement can vary widely depending on the agreement between the landlord and the tenant. Terms can range from a single year to over ten years, often with options to renew. Short-term leases might offer more flexibility, while longer leases can provide stability for businesses planning to establish themselves in a location.

What should be included in a Commercial Lease Agreement?

Key elements to include are the rental amount, payment terms, security deposit details, property description, permitted use of the property, maintenance and repair obligations, modifications and improvements policies, insurance requirements, and clauses on breach of lease and termination. The agreement should also clearly state the lease term and any options for renewal.

Can I negotiate the terms of a Commercial Lease Agreement?

Yes, the terms of a Commercial Lease Agreement are negotiable. Tenants can negotiate factors such as rent, lease length, renewal options, and tenant improvements. It's recommended to review the lease terms carefully and consider negotiation to ensure they meet your business needs and expectations.

What happens if a tenant breaks a Commercial Lease Agreement?

If a tenant breaks a Commercial Lease Agreement, they may be held liable for the remaining rent due under the lease, along with other potential damages specified in the agreement. Landlords can also enforce specific clauses within the lease to mitigate their losses, such as retaining the security deposit or pursuing legal action.

Is insurance required for a Commercial Lease?

Most Commercial Lease Agreements require the tenant to obtain insurance. The type and amount of insurance might vary, commonly including general liability and property insurance. This protects both the tenant and landlord from potential liabilities and losses related to the property use.

How is rent for a Commercial Lease typically calculated?

Rent for commercial properties can be calculated in several ways, including a fixed amount, a percentage of business sales, or based on the square footage of the leased space. The specific terms regarding how rent is calculated should be clearly defined in the Commercial Lease Agreement.

What are common types of Commercial Leases?

Common types include net leases, where tenants pay some or all of the property expenses; gross leases, where tenants pay a fixed rent while the landlord covers expenses; and modified gross leases, which split certain expenses between the tenant and landlord. Each type has its advantages and is chosen based on the needs of both parties.

What’s the process for renewing a Commercial Lease?

The process for renewing a Commercial Lease typically involves reviewing the terms of the current lease, negotiating any changes, and signing a new lease agreement or amendment. Renewal terms may already be included in the original lease, specifying the conditions under which renewal can occur and any changes to rent or other terms.

Common mistakes

Filling out a Commercial Lease Agreement form is a crucial step in securing a property for your business. However, mistakes in this process can lead to complications down the line. One common error is not fully identifying both parties involved. It's imperative to use the legal names of the business and the property owner or management company. Without precise identification, you could face challenges in enforcing the agreement.

Another mistake often made is not specifying the terms of the lease clearly. This includes the lease duration, renewal options, and any stipulations regarding early termination. A lease that lacks this clarity can lead to disputes between the landlord and tenant regarding their rights and obligations. It's essential to outline these details explicitly to ensure that both parties have a clear understanding.

Many also overlook the importance of detailing the permitted use of the property. This section of the agreement should state exactly what activities the business can carry out on the premises. Without this specificity, you may inadvertently violate the lease by engaging in unauthorized business operations, risking penalties or even eviction.

Neglecting to include or incorrect statement on maintenance and repair obligations is another common pitfall. The agreement should clearly delineate which party is responsible for various types of maintenance and repairs to prevent any misunderstandings or neglect. A well-defined section on this matter helps in maintaining the property's condition throughout the lease term.

Failing to specify the security deposit amount and conditions for its return is a mistake that can lead to financial disputes. The lease agreement should clearly mention how much needs to be paid upfront and under what circumstances the deposit will be returned at the end of the lease. This clarity helps in protecting both the tenant's and landlord's interests.

Last but not least, underestimating the importance of a detailed inventory of fixtures and fittings included with the lease can cause issues. An exhaustive list helps in avoiding disputes over what was originally provided and what condition it should be returned in. This list serves as a valuable reference for both parties throughout the tenancy and upon its conclusion.

Documents used along the form

When entering into a commercial lease, various additional documents are often required to ensure a comprehensive and clear agreement between the landlord and tenant. These documents help to clarify terms, provide legal protections, and set expectations for both parties involved, ultimately supporting a smoother business relationship. Below is a list of forms and documents frequently used alongside the Commercial Lease Agreement form.

- Personal Guarantee – This document is used when the business does not have sufficient credit history and requires a business owner or a third party to guarantee the lease payments.

- Amendment to Lease – Employed to make any changes to the original lease agreement, ensuring both parties agree to and document any new terms legally.

- Sublease Agreement – Allows the original tenant to rent out the commercial property or a portion of it to another tenant, with the terms defined separately from the original lease.

- Lease Renewal Agreement – Used to extend the term of the existing lease, avoiding the need to draft a new lease while potentially revising terms such as rent.

- Security Deposit Receipt – Provides proof of payment for the security deposit, detailing the amount paid and the conditions under which it is refundable.

- Estoppel Certificate – Requested by landlords or lenders, this document verifies the current status of the lease and the tenant’s acknowledgment of no claims against the landlord.

- Letter of Intent (LOI) – Typically used before the lease agreement, outlining the preliminary terms of the lease as agreed upon by both parties.

- Property Inspection Checklist – Completed at the time of moving in and moving out, documenting the condition of the property to determine if there are damages that affect the security deposit.

Together with the Commercial Lease Agreement, these documents form a framework that addresses many of the complexities and specifics of commercial leasing. Ensuring these documents are filled out accurately and kept up-to-date can help protect the interests of both the landlord and the tenant, setting the stage for a successful business endeavor at the chosen location.

Similar forms

The Commercial Lease Agreement shares similarities with a Residential Lease Agreement, primarily in structure and purpose. Both documents are contracts that legally bind the landlord and tenant to the agreed-upon terms concerning the rental of property. However, the key difference lies in their application: one targets commercial spaces like offices, retail, or warehouses, while the other is for residential use. They both detail terms such as lease duration, payment schedules, and rules regarding the use of the property, ensuring both parties are aware of their rights and obligations.

Another document similar to the Commercial Lease Agreement is the Sublease Agreement. A Sublease Agreement is used when an existing tenant wishes to rent out the leased premises (or a portion thereof) to a third party. Like the Commercial Lease Agreement, it outlines terms concerning rent, utility payments, and other crucial details pertaining to the use of the premises. However, it operates under the umbrella of an existing lease, requiring adherence to the primary lease’s terms while introducing additional conditions specific to the sublease.

A Lease Amendment Agreement is akin to the Commercial Lease Agreement in that it modifies the terms of an existing lease contract. Both documents ensure that any alterations to the lease are clearly documented and legally binding. A Lease Amendment might address changes such as extensions of the lease term, adjustments in rent, or permissions for modifications to the leased property. It’s a tailored document that adapts an existing agreement to new circumstances, reflecting changes agreed upon by the landlord and tenant.

The Property Management Agreement closely relates to the Commercial Lease Agreement, with a focus on the delegation of property management responsibilities. This agreement is between a property owner and a property manager or management company, detailing responsibilities such as collecting rent, handling maintenance, and addressing tenant issues. While the Commercial Lease Agreement focuses on the tenant-landlord relationship, the Property Management Agreement concerns the operation and oversight of the property itself, ensuring it's well-maintained and profitable.

Similar in function to the Commercial Lease Agreement, the Real Estate Purchase Agreement is utilized during the buying and selling of property. Instead of arranging rental terms, this document outlines the conditions under which a property will be sold, including the purchase price, closing details, and any contingencies that must be met before the sale is finalized. Both agreements are crucial in real estate transactions, ensuring clarity and legal compliance in either leasing or purchasing scenarios.

An Equipment Lease Agreement shares the concept of leasing found in a Commercial Lease Agreement but applies it to equipment rather than real estate. This document sets forth the terms under which one party agrees to rent equipment from another. It includes specifics on rental payments, maintenance obligations, and the duration of the lease term. While the content and focus differ—equipment versus property—the fundamental structure and intent to define a temporary, mutually beneficial arrangement remain consistent.

Last but not least, the Exclusive Agency Agreement bears resemblance to the Commercial Lease Agreement, in the aspect of exclusive rights and specific terms laid out within a contract. Particularly used in real estate to grant an agent the exclusive right to sell or lease a property, it specifies the conditions under which the agent operates, including commission rates and listing periods. Like the Commercial Lease Agreement, it delineates a detailed relationship between parties, but with a focus on sales or leasing representation rather than the direct landlord-tenant dynamic.

Dos and Don'ts

When filling out a Commercial Lease Agreement form, it's crucial to understand both what you should do and what you should avoid to ensure the process goes smoothly and your interests are protected. Here's a guide to help you navigate through the process:

Do's:

- Read the entire lease agreement thoroughly before signing. Understanding every clause can help prevent future disputes.

- Clarify the terms regarding the use of the leased property to ensure it aligns with your business's needs.

- Check and confirm the lease duration, including any options for renewal, to align with your business plans.

- Understand all costs involved, not just the rent. This includes maintenance fees, taxes, insurance, and any other additional expenses.

- Ensure that the agreement specifies who is responsible for repairs and maintenance. Knowing these responsibilities can prevent future disagreements.

- Confirm the rules around modifications or improvements to the property. Being clear on what changes you can make helps in planning your business setup.

- Inspect the property thoroughly before signing the lease. Identifying any existing damages or issues can prevent them from being attributed to you later.

- Consider negotiating the terms. If something in the lease does not suit your business needs, it's often possible to negotiate with the landlord.

- Document everything. Ensure all agreed-upon terms and conditions are written in the lease to avoid any misunderstandings.

- Seek professional advice if required. Sometimes, consulting with a legal expert can help clarify complex terms and protect your interests.

Don'ts:

- Rush into signing the lease without understanding every aspect of the agreement. Taking your time can prevent future problems.

- Overlook the fine print. Important details are often found in the fine print, so it's essential to read it carefully.

- Assume anything. If something is not explicitly stated in the lease, do not assume it will be allowed.

- Forget to check zoning laws. Ensure that your business activities are permitted on the property under local zoning laws to avoid legal issues.

- Fail to consider the future of your business. Make sure the lease is flexible enough to accommodate potential growth or changes in your business.

- Ignore the termination clause. Understanding the conditions under which the lease can be terminated helps you prepare for any situation.

- Skimp on documenting the property's condition. Photographs and detailed notes can be invaluable if disputes arise about the property condition later.

- Miss asking about subleasing. Knowing your options for subleasing can provide flexibility as your business needs change.

- Neglect to inquire about signage and branding possibilities. Your ability to display signs or logos can significantly impact your business visibility.

- Sign without a clear exit strategy. Knowing how you can exit the lease, if necessary, can save a lot of trouble and financial loss.

Misconceptions

When it comes to navigating the complexities of commercial lease agreements, misunderstandings can lead businesses into challenging situations. By addressing some common misconceptions, tenants and landlords can better prepare themselves for successful lease negotiations and relationships. Here are seven common misconceptions about the Commercial Lease Agreement form:

- All Commercial Lease Agreements Are Essentially the Same: A prevailing misconception is that commercial lease agreements are standardized documents. In reality, lease agreements can vary widely depending on the landlord, the type of property being leased, and the specific needs of the business. These documents are highly customizable to accommodate varying terms such as lease duration, rent increases, and responsibilities for repairs and maintenance.

- Rent is the Only Cost: Many tenants enter into lease agreements mistakenly believing that rent is their only financial obligation. However, commercial leases often include additional costs such as maintenance fees, utility charges, property taxes, and insurance premiums. These extra charges can significantly impact the overall cost of leasing the space.

- Commercial Leases Favor Landlords: While it may seem that lease agreements inherently favor landlords, this is not always the case. Tenants have the opportunity to negotiate terms that can provide them significant benefits and protections. Effective negotiation can lead to favorable lease terms, such as caps on rent increases or restrictions on neighboring tenants that could negatively affect your business.

- Termination Clauses Are Non-Negotiable: Some tenants believe that the terms for ending a lease early are set in stone. However, termination clauses, like many aspects of a commercial lease, are negotiable. Tenants can often negotiate terms that provide more flexibility for ending the lease early under certain conditions.

- A Personal Guarantee is Always Required: A personal guarantee requires the business owner to be personally responsible for the lease payments if the business fails to make them. While many landlords request a personal guarantee, especially from small businesses or startups, it's not a universal requirement. In some cases, tenants can negotiate to remove or limit the scope of personal guarantees.

- Lease Agreements Don’t Allow Subletting: Contrary to popular belief, commercial leases can permit subletting or assignment of the lease to another business. This flexibility can be crucial for businesses that may need to relocate or close. These provisions, however, need to be explicitly included in the lease agreement and are subject to the landlord’s approval.

- Verbal Agreements Are Binding: While verbal agreements can be enforceable under certain circumstances, relying on them, especially for commercial leases, is risky. Commercial lease agreements should always be documented in writing to ensure that all parties' rights and obligations are clearly defined and legally enforceable.

Understanding these misconceptions can empower tenants and landlords to navigate commercial lease agreements more effectively. By doing so, they can establish lease terms that support their business objectives and foster a beneficial relationship for both parties.

Key takeaways

Navigating the complexities of a Commercial Lease Agreement can be challenging, but understanding the foundational elements can significantly impact the success of your business operations. Here are seven key takeaways to keep in mind when filling out and using this form:

- Read Every Clause Carefully: Make sure to read and understand each clause thoroughly. This agreement will govern your use of the commercial space, and it's crucial to know exactly what you're agreeing to. Pay close attention to clauses related to rent increases, maintenance responsibilities, and lease termination conditions.

- Understand the Type of Lease: Commercial leases can vary widely, including net leases, where the tenant is responsible for certain additional costs, and gross leases, where the tenant pays a flat rate. Knowing the type of lease you're signing can help you budget accordingly.

- Lease Duration is Critical: The length of your lease can affect your business flexibility. Short-term leases offer more flexibility to move or expand your business but might come with higher rental rates. Long-term leases lock in rates and conditions but can restrict your business if it grows faster than expected.

- Negotiate Terms: Many aspects of a commercial lease are negotiable. Don't hesitate to negotiate terms that could benefit your business, such as tenant improvements, exclusivity clauses, or caps on rent increases.

- Clarity on Maintenance and Repairs: The agreement should clearly outline who is responsible for maintenance and repairs. Understand whether these obligations fall on the landlord or tenant, and to what extent.

- Consider the Impact of Zoning Laws: Before signing, ensure that the property's zoning allows for your intended use. Zoning laws can be strict, and you don't want to sign a lease only to find out your business operations are not permitted in that location.

- Securing the Option to Renew: Having an option to renew your lease can provide security for your business’s future. It can protect you from the uncertainty of finding a new location if your business becomes well-established in its current place.

Approaching a Commercial Lease Agreement with a well-informed perspective can safeguard your interests and promote your business's long-term growth. Make sure to consider these points carefully before committing to any legal agreement.

Consider More Types of Commercial Lease Agreement Forms

Notice of Lease Termination - An essential tool for tenants looking to vacate their rental unit ahead of the lease's scheduled end.