Free Last Will and Testament Form for Texas

The Texas Last Will and Testament form stands as a critical legal document, designed to outline the final wishes of an individual regarding the distribution of their property and assets upon their passing. This essential document not only ensures that one's belongings are allocated according to their wishes but also aims to simplify and streamline the probate process for surviving family members. It requires careful consideration and adherence to specific legal standards set forth by Texas law to be considered valid. Contemplation of one's eventual passing may be challenging, but the importance of a well-prepared Last Will and Testament cannot be overstated. It provides peace of mind to the individual creating it and significantly eases the emotional and financial burden on loved ones left behind. Furthermore, it allows for the appointment of an executor, who will manage the estate, and guardians for any minor children, ensuring that each aspect of one's legacy is handled as desired.

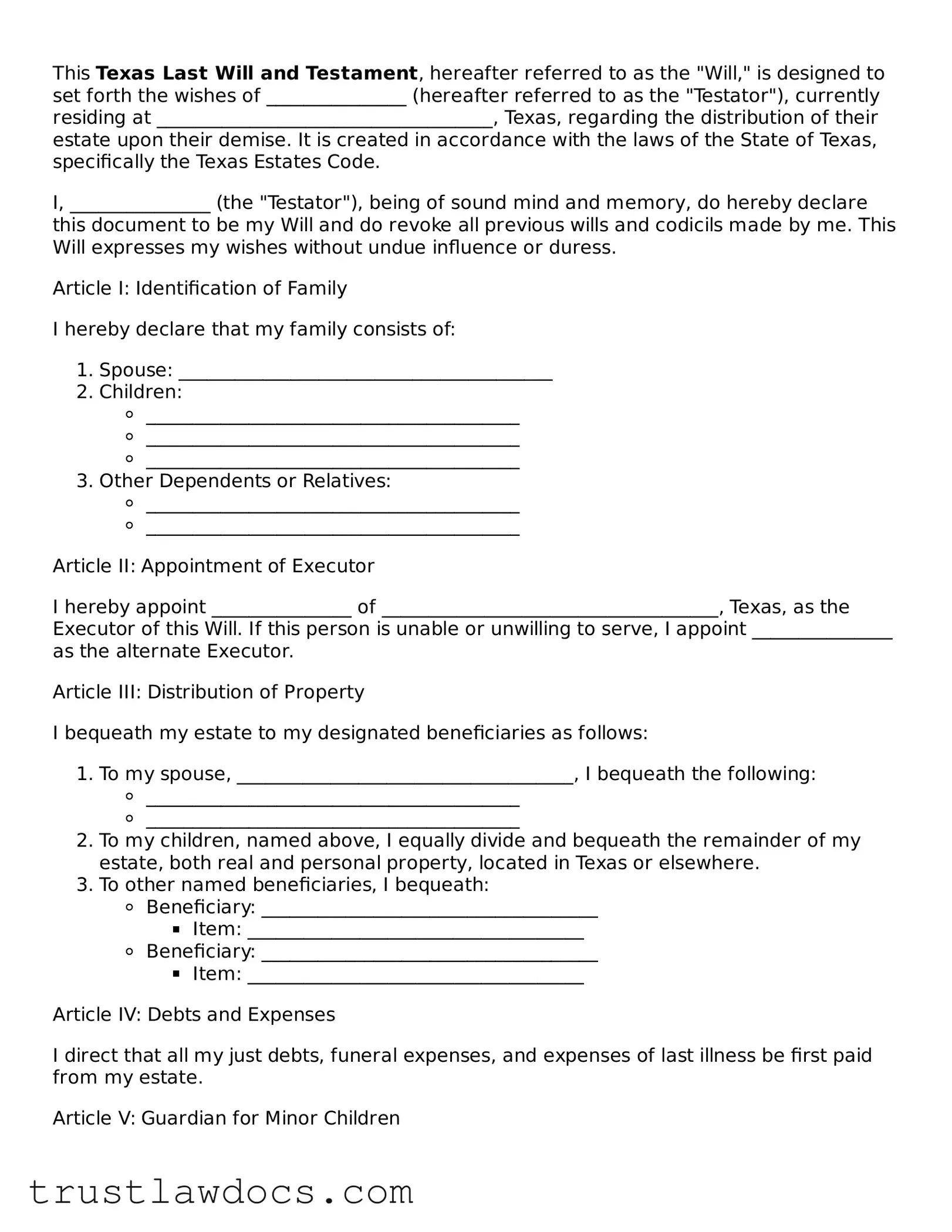

Form Example

This Texas Last Will and Testament, hereafter referred to as the "Will," is designed to set forth the wishes of _______________ (hereafter referred to as the "Testator"), currently residing at ____________________________________, Texas, regarding the distribution of their estate upon their demise. It is created in accordance with the laws of the State of Texas, specifically the Texas Estates Code.

I, _______________ (the "Testator"), being of sound mind and memory, do hereby declare this document to be my Will and do revoke all previous wills and codicils made by me. This Will expresses my wishes without undue influence or duress.

Article I: Identification of Family

I hereby declare that my family consists of:

- Spouse: ________________________________________

- Children:

- ________________________________________

- ________________________________________

- ________________________________________

- Other Dependents or Relatives:

- ________________________________________

- ________________________________________

Article II: Appointment of Executor

I hereby appoint _______________ of ____________________________________, Texas, as the Executor of this Will. If this person is unable or unwilling to serve, I appoint _______________ as the alternate Executor.

Article III: Distribution of Property

I bequeath my estate to my designated beneficiaries as follows:

- To my spouse, ____________________________________, I bequeath the following:

- ________________________________________

- ________________________________________

- To my children, named above, I equally divide and bequeath the remainder of my estate, both real and personal property, located in Texas or elsewhere.

- To other named beneficiaries, I bequeath:

- Beneficiary: ____________________________________

- Item: ____________________________________

- Beneficiary: ____________________________________

- Item: ____________________________________

Article IV: Debts and Expenses

I direct that all my just debts, funeral expenses, and expenses of last illness be first paid from my estate.

Article V: Guardian for Minor Children

In the event that I am the parent or legal guardian of minor children at the time of my demise, I appoint _______________ of ____________________________________, Texas, as guardian of said minor children. Should this person be unable or unwilling to serve, I appoint _______________ as the alternate guardian.

Article VI: Signatures

This Will was executed on the ______ day of _______________, 20____, at ____________________________________, Texas, by the Testator, who in our presence and in the presence of each other, all being present at the same time, have hereunto subscribed our names as witnesses.

Witness #1: _____________________________ Witness #2: _______________________________

Testator: ___________________________________

Article VII: Notarization

Subscribed, sworn to, and acknowledged before me by _______________, the Testator, and subscribed and sworn to before me by ______________________ and ______________________, witnesses, this ______ day of _______________, 20____.

Notary Public: ___________________________________

My Commission Expires: ___________________________

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | The Texas Last Will and Testament must be in writing to be legally valid. |

| 2 | The person creating the Will (Testator) must be at least 18 years old, or be or have been married, or be a member of the armed forces. |

| 3 | The Testator must be of sound mind when making the Will. |

| 4 | The Will must be signed by the Testator or by another person under the Testator’s direction and in their presence. |

| 5 | It is required to have at least two credible witnesses, who are at least 14 years old, to sign the Will in the presence of the Testator. |

| 6 | A self-proved Will, facilitated by a notary public, expedites the probate process. |

| 7 | Oral (nuncupative) Wills are only valid in specific, limited situations. |

| 8 | Holographic (handwritten) Wills are considered valid if they are entirely in the Testator's handwriting and signed. |

| 9 | The Will can appoint an executor to manage the estate’s affairs. |

| 10 | Governing law: Texas Estates Code governs the creation, validity, and probate of Wills in Texas. |

How to Write Texas Last Will and Testament

When preparing a Texas Last Will and Testament, it's crucial to ensure all details are addressed accurately. This will not only express your wishes regarding your estate but also help your loved ones follow through with those wishes efficiently. To assist you in this process, below are step-by-step instructions on how to fill out the form correctly. Please note that while these steps aim to guide you, consulting with an estate planning attorney can provide personalized advice and peace of mind that your will is prepared correctly.

- Begin by gathering all necessary information, including your full legal name, date of birth, and an inventory of your assets and debts.

- At the top of the form, write your full legal name and address, indicating that you are creating the document voluntarily and are of sound mind.

- Designate an executor, the person who will carry out the provisions of your will. Include their full name and relationship to you.

- If you have minor children, choose a guardian for them should you pass away before they reach legal adulthood. State the guardian’s full name and relationship to the children.

- List all your assets, including real estate, bank accounts, investments, and personal property. Specify who will inherit each asset.

- If there are specific items you wish to leave to certain individuals, detail these bequests clearly, specifying the item and the beneficiary’s full name.

- For the remaining estate, outline how it should be divided among your heirs. If you wish to leave portions to friends, family, or charities, specify the percentages or amounts.

- Appoint a trustee for any property left to minor heirs, providing guidance on how the property should be managed until they are of age.

- Review your will to ensure all information is correct and reflects your wishes accurately. Pay special attention to names and addresses to avoid any confusion.

- Sign the will in the presence of at least two witnesses, who are not beneficiaries, and have them sign as well. Their contact information should be included to verify their signatures later if necessary.

- Consider having the will notarized, though it is not a requirement in Texas, to add an extra layer of validation to the document.

After completing your Texas Last Will and Testament, keep it in a safe place and inform your executor or a trusted family member of its location. Regularly review and update your will as needed to reflect changes in your life and preferences.

Get Answers on Texas Last Will and Testament

What is a Texas Last Will and Testament?

A Texas Last Will and Testament is a legal document where a person, known as the testator, can define how they want their property and assets distributed after their death. It outlines to whom their property should go, specifies executors to manage the estate, and can include guardians for any minor children.

Who can create a Last Will and Testament in Texas?

In Texas, any individual who is 18 years of age or older, or a minor who is either married or a member of the armed forces, and who is of sound mind, can create a Last Will and Testament.

Does a Texas Last Will and Testament need to be notarized?

No, a Texas Last Will and Testament does not need to be notarized to be legally valid. However, it must be signed in the presence of at least two credible witnesses, who must also sign the document attesting they witnessed the testator’s signature.

Can I write my own Last Will and Testament in Texas?

Yes, you can write your own Last Will and Testament in Texas. This is known as a holographic will, and it must be entirely in the testator's handwriting, signed, and dated. However, it's often advisable to seek legal advice or use a standard form to avoid any potential issues with the will’s validity.

What happens if someone dies without a Last Will and Testament in Texas?

If someone dies without a Last Will and Testament in Texas, their property is distributed according to the state’s intestacy laws. This usually means the deceased’s assets will go to their closest relatives, such as a spouse, children, parents, or siblings, in a predefined order set by the law.

Can a Last Will and Testament in Texas be changed?

Yes, a Last Will and Testament in Texas can be changed at any time before the testator's death, as long as the testator is of sound mind. This can be done by creating a new will or by making a codicil, which is an amendment to the existing will.

How should a Last Will and Testament be stored?

A Last Will and Testament should be stored in a safe and secure place, such as a safe deposit box at a bank or in a fireproof safe at home. It's also advisable to inform the executor of the will or a trusted family member of its location.

Is a handwritten Last Will and Testament legal in Texas?

Yes, a handwritten, or "holographic," Last Will and Testament is legal in Texas, provided it is entirely in the handwriting of the testator, and signed and dated by them. Unlike other wills, it does not need to be witnessed, though verifying its validity later may be more complicated.

What can I include in my Texas Last Will and Testament?

In your Texas Last Will and Testament, you can include instructions on how to distribute your real and personal property, name an executor, appoint guardians for any minor children, and even make specific bequests to charities or individuals outside of your immediate family.

What makes a Texas Last Will and Testament invalid?

A Texas Last Will and Testament may be considered invalid if it's found that the testator was not of sound mind at the time of its creation, if it was executed under duress or undue influence, if the necessary signatures are missing, or if it does not comply with Texas law. Additionally, a newer will that contradicts the terms of an older will can invalidate the older document.

Common mistakes

In the process of completing a Texas Last Will and Testament, individuals often encounter various complexities. This can lead to a range of mistakes that might affect the document's validity or the clear expression of the individual's final wishes. By highlighting the common errors made during this process, one can take steps to avoid them, ensuring their intentions are honored.

One of the most prevalent mistakes is neglecting to adhere to the formal witnessing requirements. Texas law mandates that a Last Will and Testament must be signed in the presence of at least two impartial witnesses. These witnesses must be over the age of 14 and have no interest in the will. Failure to meet this essential criterion can lead to disputes or the will being invalidated.

Another common error is the lack of specificity when bequeathing assets. When individuals do not clearly describe the property or to whom it should go, it can result in confusion and potentially lengthy legal battles among heirs. It is crucial to be as precise as possible, identifying beneficiaries and assets with enough detail to avoid any ambiguity.

An oversight often seen is neglecting to name an executor or naming one without considering their willingness or capability to serve. The executor plays a critical role in the management and distribution of the estate. Therefore, it's vital to choose someone who is not only trustworthy but also able to carry out these responsibilities. It’s wise to discuss this role with them ahead of time to ensure they’re prepared for the task.

Ignoring the need to update the will is another misstep. Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, necessitate updates to your Last Will and Testament. An outdated will may not reflect current wishes or relationships, potentially leading to unintended outcomes.

Failing to consider the impact of taxes and debts is a mistake that can significantly affect the value of the estate left to heirs. Without proper planning, your beneficiaries might inherit less than you intended after taxes and debts are settled. It's helpful to consult with financial advisors or attorneys to minimize these burdens on your estate.

Some individuals mistakenly believe that a Last Will and Testament is the only necessary document for estate planning. However, relying solely on a will can overlook the benefits of trusts, medical directives, or powers of attorney, which can offer additional protections and directives for different scenarios.

Lastly, attempting to execute or prepare a Last Will and Testament without professional guidance is a risk. While templates and DIY forms are available, they may not account for individual circumstances or comply with all Texas legal requirements. Seeking advice from a legal professional can ensure that the will is both valid and fully represents one’s intentions.

Documents used along the form

When creating a Last Will and Testament in Texas, individuals often need additional forms and documents to ensure that all aspects of their estate planning are thoroughly covered. These additional documents complement the will by specifying wishes in scenarios not typically detailed within the will itself, helping to create a comprehensive estate plan. Four key documents often used alongside the Texas Last Will and Testament include:

- Medical Power of Attorney: This document allows an individual to appoint someone they trust to make healthcare decisions on their behalf if they are unable to do so. It’s critical for specifying who can make medical decisions and what those decisions should be, especially in cases where the individual becomes incapacitated.

- Directive to Physicians (Living Will): Often used in conjunction with a Medical Power of Attorney, this document outlines an individual's wishes regarding life-sustaining treatment if they are terminally ill or irreversibly incapacitated. It’s instrumental in guiding healthcare providers and family members during difficult times.

- Durable Power of Attorney: This legal document grants another person the authority to act on an individual's behalf in financial matters if they become unable to do so themselves. It can cover a wide range of activities, from managing bank accounts to selling property, ensuring that the individual's financial affairs are handled according to their wishes.

- Designation of Guardian in Advance: Should there ever be a need for a court to appoint a guardian, this document allows individuals to express their preference for who that guardian should be. It’s particularly important for parents of minor children or those who care for adults with special needs to have in place to influence decisions regarding guardianship.

Together, these documents form the cornerstone of a well-rounded estate plan that addresses not only the distribution of assets but also personal care and financial management in case of incapacity. Each plays a vital role in safeguarding an individual’s wishes and ensuring they are honored, providing peace of mind to both the person creating the estate plan and their loved ones.

Similar forms

A Texas Last Will and Testament form shares similarities with a Living Will, although they serve different purposes. Both documents are vital for end-of-life planning, but while a Last Will and Testament outlines how a person’s estate should be distributed after their death, a Living Will specifies an individual's preferences regarding medical treatment and life support if they become incapacitated. This ensures that the individual’s health care wishes are known and can be followed if they are unable to communicate them themselves.

Comparable to a Last Will and Testament, a Trust, specifically a Revocable Living Trust, is another estate planning tool. Like a Last Will, it details how assets should be managed and distributed upon the grantor's death. However, a Trust goes into effect once it's created and funded, not after the person's death. One significant advantage is the avoidance of probate, the legal process through which a Last Will is verified. This makes a Trust a desirable option for those looking to streamline the transfer of their assets to heirs.

Another document related to a Last Will and Testament is a Durable Power of Attorney. This document grants someone else the authority to handle personal affairs, such as finances or real estate transactions, on behalf of the person creating it if they become incapacitated. While a Last Will and Testament is effective posthumously, a Durable Power of Attorney is effective during the individual’s lifetime, ensuring that their affairs can be managed without court intervention if they're unable to do so themselves.

A Health Care Proxy, sometimes known as a Medical Power of Attorney, is akin to a Last Will and Testament in that it allows an individual to appoint someone to make health-related decisions on their behalf if they're unable to make those decisions themselves. This document complements a Living Will, ensuring decisions align with the incapacitated person’s wishes. Like a Last Will, it is crucial for making one’s preferences known and legally enforceable, although it operates during the person's lifetime concerning healthcare decisions.

Finally, the Advance Directive, or Medical Directive, bears resemblance to a Last Will and Testament because it is a document that outlines an individual’s preferences for end-of-life care. Though it focuses specifically on medical and health care decisions, like the use or non-use of life-sustaining treatment, it shares the Last Will's goal of ensuring an individual's wishes are honored and followed. Both documents are integral to comprehensive estate and health care planning, providing guidance and directions to loved ones and healthcare providers alike.

Dos and Don'ts

When preparing a Texas Last Will and Testament, it's crucial to approach the process with careful attention to detail and respect for legal requirements. Whether you're drafting a new will or updating an existing one, following essential dos and don'ts will assist in ensuring your final wishes are respected and legally enforceable.

Here are essential points to consider:

Do:- Clearly identify yourself in the document, including full name and residency, to affirm that the will belongs to you.

- Be of sound mind and understanding that you are creating a will, which involves distributing your property upon death.

- Appoint a trustworthy executor, someone you believe will carry out the instructions in your will as intended.

- Sign the will in the presence of at least two impartial witnesses, who are not beneficiaries, to validate your will under Texas law.

- Be specific about who receives what portions of your estate to prevent potential disputes among heirs.

- Consult with a legal professional if you have a complex estate or need advice on state laws regarding wills.

- Keep the will in a safe but accessible place, and inform the executor or a trusted family member of its location.

- Regularly review and update your will, especially after significant life events such as marriage, divorce, the birth of a child, or the acquisition of significant assets.

- Forget to date the will, as the most recent document is typically considered the valid version if multiple wills exist.

- Include funeral wishes in your will, as it's often not read until after the funeral. Instead, leave separate written instructions.

- Assign an executor who lives out of state without checking Texas laws, as some states have special requirements for out-of-state executors.

- Use vague language that might be open to interpretation; clarity is your ally in estate planning.

- Assume joint-owned property will be part of your estate unless it's owned as "tenants in common."

- Fail to consider digital assets, such as social media accounts, online bank accounts, and digital currencies.

- Sign or amend your will without witnesses, as witness signatures are required for the document to be legally binding.

- Rely solely on a will for healthcare decisions or financial matters in case of incapacitation; look into healthcare directives or powers of attorney for these purposes.

Fulfilling a Last Will and Testament correctly is not just about legal compliance; it’s an act of consideration for those you love. By following these guidelines, Texans can help ensure their final wishes are respected and their loved ones are cared for, minimizing potential conflicts and confusion during difficult times.

Misconceptions

When discussing the Texas Last Will and Testament, misconceptions commonly arise due to a mixture of outdated information, popular culture portrayals, and a general misunderstanding of the law. Clarifying these misunderstandings is crucial for individuals as they make important decisions about their futures and legacies.

“A will needs to be notarized to be valid in Texas.” — Texas law does not require a Last Will and Testament to be notarized to be considered valid. What is necessary, however, is that it be signed in the presence of two witnesses, who are over the age of 14 and who also sign the will.

“If I die without a will, the state takes everything.” — This is not accurate. In Texas, if someone dies without a will, their estate is distributed according to the state’s intestacy laws, which typically allocate assets to the closest surviving relatives.

“My spouse will automatically inherit everything.” — While surviving spouses do inherit a significant portion of the estate under Texas law, they do not automatically inherit everything. The distribution depends on whether there are surviving children, parents, or other relatives, and whether assets are separate or community property.

“Handwritten (holographic) wills are not legal in Texas.” — This is incorrect. Texas recognizes handwritten (or holographic) wills as long as they are written entirely in the testator’s handwriting and signed by the testator, even if they are not witnessed.

“A will covers all my assets.” — Some assets are not covered by a Last Will and Testament, including jointly owned property, retirement accounts, and life insurance policies with designated beneficiaries. These assets typically pass directly to the named beneficiary or surviving owner.

“I can disinherit my spouse entirely.” — In Texas, a spouse has certain rights that can make it difficult to completely disinherit them, such as the right to claim a portion of the estate under the state’s elective share laws or community property laws.

“I only need to write a will once.” — Life changes, such as marriage, divorce, and the birth of children, can necessitate updates to your will. Additionally, changes in laws may affect the validity or effectiveness of your will’s provisions.

“Wills can avoid probate in Texas.” — This is a misunderstanding. While certain measures, like designating beneficiaries for financial accounts or establishing a living trust, can help avoid probate, simply having a will does not avoid the probate process. The will must still be probated to be legally effective, but it does guide the probate court on how to distribute the estate.

“A Last Will and Testament can dictate funeral arrangements.” — While you can include funeral wishes in your will, it is not the best place for such instructions. Wills are often read after funeral arrangements need to be made. It is more effective to communicate these wishes to loved ones in advance or include them in a separate document specifically intended for that purpose.

Understanding the complexities and nuances of estate planning, specifically within the context of Texas law, is essential. Dispelling these common misconceptions helps individuals make more informed decisions regarding their Last Will and Testament, ensuring their wishes are respected and their loved ones are provided for according to their desires.

Key takeaways

The Texas Last Will and Testament form is a critical legal document that outlines how an individual, known as the testator, wishes their estate to be distributed upon their death. Given the importance of this document, it is essential to approach its creation with care and due diligence. Here are five key takeaways to keep in mind when dealing with such a significant piece of one's estate planning in Texas.

Understanding the requirements: The state of Texas has specific legal requirements that must be met for a Last Will and Testament to be considered valid. These include the need for the testator to be of sound mind, the presence of at least two credible witnesses over the age of 14 who are not beneficiaries, and for the document to be written (typed or handwritten).

Choosing an executor wisely: The executor of your will is responsible for managing your estate and ensuring that your wishes are carried out as specified. Thus, it’s imperative to select someone who is not only trustworthy but also capable of handling the responsibilities that come with the role.

Being comprehensive: While it might be tempting to focus solely on the distribution of major assets, such as real estate or significant bank accounts, it’s important to consider all possessions. This includes personal items, such as jewelry or family heirlooms, which can hold sentimental value and might lead to disputes if not clearly addressed.

Signing in accordance with the law: For a Texas Last Will and Testament to be legally binding, it must be signed by the testator in the presence of the witnesses. All parties should sign the document voluntarily and under no duress, ensuring that the signing process adheres to Texas legal standards.

Seeking legal advice: Given the complexities and legal nuances involved in preparing a Last Will and Testament, consulting with a legal professional is highly advisable. This can help ensure that the document accurately reflects your wishes and meets all necessary legal requirements, thereby safeguarding your legacy and providing peace of mind for both you and your loved ones.

In conclusion, preparing a Last Will and Testament in Texas involves more than simply filling out a form. It requires thoughtful consideration, meticulous attention to detail, and, often, professional legal counsel. By keeping these key takeaways in mind, individuals can better navigate the process, ensuring their final wishes are honored, and minimizing potential disputes among survivors.

Popular Last Will and Testament State Forms

How to Make a Will in Indiana - This document can also include detailed instructions for your funeral, helping relieve your loved ones of the burden of guessing your last wishes during a difficult time.

Free Will Forms to Print - May contain funeral and burial wishes, although not legally binding, can guide the family.

California Last Will and Testament - It plays a critical role in blended families, ensuring that children from previous relationships are included according to your wishes.