Free Last Will and Testament Form for New York

Embarking on the journey of preparing a Last Will and Testament in New York represents a pivotal step in managing one's affairs, ensuring that wishes are respected, and providing for loved ones after one's departure. This legal document, crucial for residents of the Empire State, allows individuals to clearly articulate how they want their assets to be distributed among heirs, nominate a guardian for minor children, and appoint an executor to oversee the will's execution. It’s not just about material possessions; a will can also express funeral preferences, thereby relieving family members of the burden of making those decisions during a difficult time. Importantly, the New York Last Will and Testament form must adhere to state-specific legal requirements to be considered valid. These include stipulations about the signatory's age, mental state, and the presence of witnesses during the signing process. By taking control of these aspects, individuals can avoid potential disputes among survivors and prevent the state from determining the distribution of their assets, a process that might not align with their final wishes. Crafting a Last Will and Testament is, therefore, not merely a legal task but a profound act of care for oneself and one's family, ensuring that the legacy left behind is as intended.

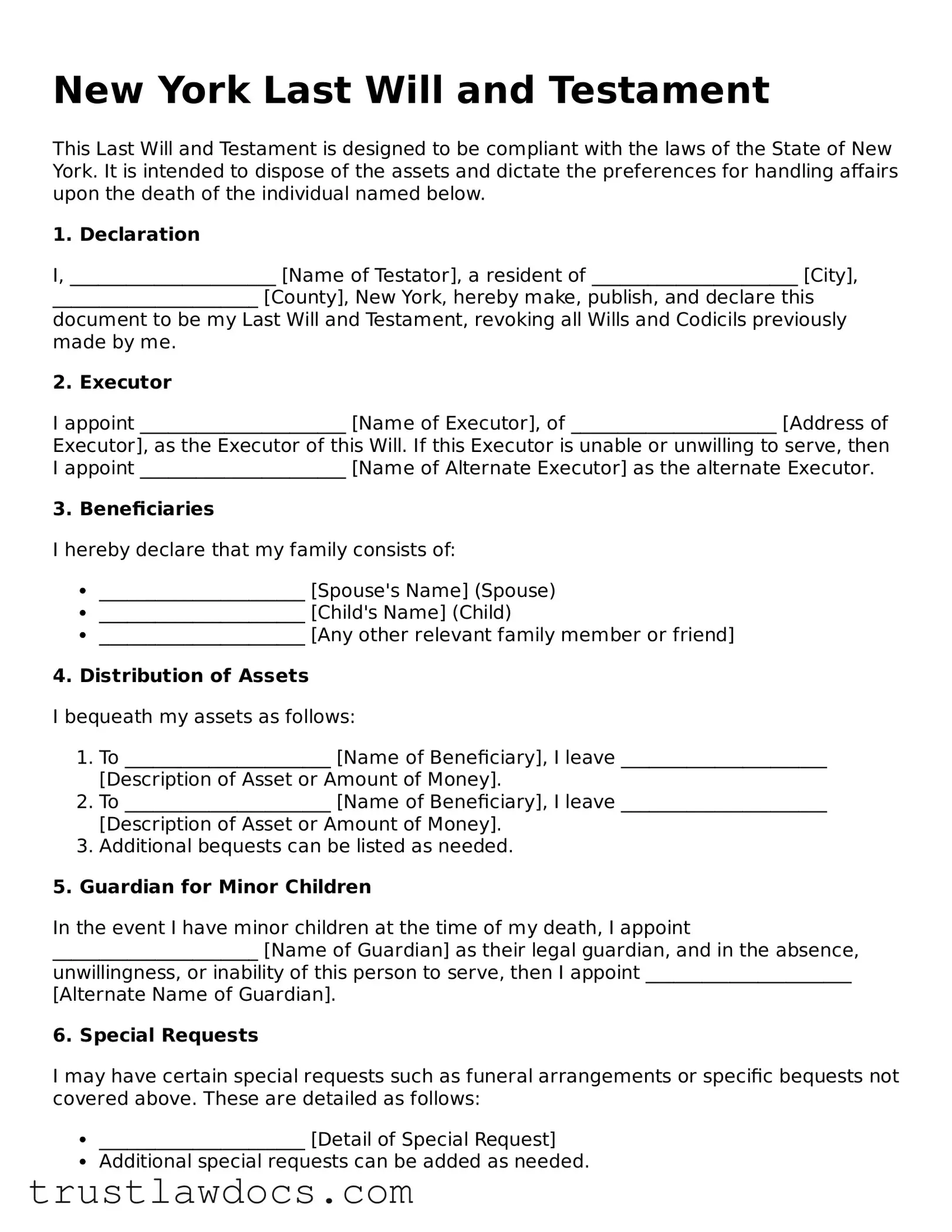

Form Example

New York Last Will and Testament

This Last Will and Testament is designed to be compliant with the laws of the State of New York. It is intended to dispose of the assets and dictate the preferences for handling affairs upon the death of the individual named below.

1. Declaration

I, ______________________ [Name of Testator], a resident of ______________________ [City], ______________________ [County], New York, hereby make, publish, and declare this document to be my Last Will and Testament, revoking all Wills and Codicils previously made by me.

2. Executor

I appoint ______________________ [Name of Executor], of ______________________ [Address of Executor], as the Executor of this Will. If this Executor is unable or unwilling to serve, then I appoint ______________________ [Name of Alternate Executor] as the alternate Executor.

3. Beneficiaries

I hereby declare that my family consists of:

- ______________________ [Spouse's Name] (Spouse)

- ______________________ [Child's Name] (Child)

- ______________________ [Any other relevant family member or friend]

4. Distribution of Assets

I bequeath my assets as follows:

- To ______________________ [Name of Beneficiary], I leave ______________________ [Description of Asset or Amount of Money].

- To ______________________ [Name of Beneficiary], I leave ______________________ [Description of Asset or Amount of Money].

- Additional bequests can be listed as needed.

5. Guardian for Minor Children

In the event I have minor children at the time of my death, I appoint ______________________ [Name of Guardian] as their legal guardian, and in the absence, unwillingness, or inability of this person to serve, then I appoint ______________________ [Alternate Name of Guardian].

6. Special Requests

I may have certain special requests such as funeral arrangements or specific bequests not covered above. These are detailed as follows:

- ______________________ [Detail of Special Request]

- Additional special requests can be added as needed.

7. Signing

This document, intended as my Last Will and Testament, will be signed on ______________________ [Date], at ______________________ [Location], in the presence of witnesses who will validate my wishes as stated herein.

______________________ [Signature of Testator]

______________________ [Printed Name of Testator]

Witnesses

We, the undersigned, declare that ______________________ [Testator's Name], the Testator, has signed this document in our presence. We believe the Testator to be of sound mind, not under any undue influence, and voluntarily signing this Will on the date and at the location listed above.

Witness 1: ______________________ [Signature]

Printed Name: ______________________ [Printed Name]

Address: ______________________ [Address]

Witness 2: ______________________ [Signature]

Printed Name: ______________________ [Printed Name]

Address: ______________________ [Address]

PDF Form Details

| Fact Name | Detail |

|---|---|

| Governing Law | The New York Last Will and Testament is governed by the Estates, Powers and Trusts Law of New York. |

| Age Requirement | The individual creating the Will (Testator) must be at least 18 years old. |

| Witness Requirement | The Will must be signed in the presence of at least two witnesses, who must also sign the Will in the presence of the Testator. |

| Self-Proving Affidavit | In New York, a Will can be made self-proving with a notarized affidavit by the witnesses, speeding up the probate process. |

| Writing Requirement | A New York Last Will and Testament must be in writing to be considered valid. |

How to Write New York Last Will and Testament

Filling out a Last Will and Testament form is a crucial step in planning for the future. It's about making sure your wishes are known and respected when you're no longer around to voice them yourself. This document allows you to designate who will receive your possessions and manage your estate, offering peace of mind to both you and your loved ones. The process might seem daunting at first, but with a clear set of instructions, you can complete your New York Last Will and Testament accurately and efficiently.

- Collect all necessary information: Before you start, gather all information regarding your assets, debts, and the individuals or organizations you wish to inherit your assets. This will make the process smoother.

- Choose an executor: Select a person you trust to carry out the instructions of your will. This individual will play a critical role in managing your estate and ensuring your wishes are followed.

- Decide on your beneficiaries: Clearly identify who will inherit your assets. These can be family members, friends, or charitable organizations. Be as specific as possible to avoid confusion.

- Appoint a guardian for minor children (if applicable): If you have children under the age of 18, choose a guardian you trust to take care of them in your absence.

- Detail your assets and how they are to be distributed: List all your assets, including real estate, bank accounts, investments, and personal possessions. Specify who gets what, ensuring your wishes are clearly documented.

- Review and abide by the witness requirements: New York law requires your will to be signed in the presence of two witnesses. Make sure these witnesses are not beneficiaries in your will to avoid any conflict of interest.

- Sign and date the form: Once you have completed the form and are satisfied that it accurately reflects your wishes, sign and date it in the presence of your witnesses.

- Store your will safely: Keep your will in a secure location and let your executor know where it is. It's important that your will can be easily accessed when needed.

After completing your New York Last Will and Testament, the next step is ensuring that all relevant parties are aware of the document and its contents. Inform your executor, beneficiaries, and any guardians named about their roles and your wishes. It's also beneficial to consult with an attorney who can review the document and ensure it meets all legal requirements. Taking these steps will help safeguard your will's validity and ensure your wishes are honored.

Get Answers on New York Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that allows you to express your wishes regarding the distribution of your property and the care of any minor children upon your death. It is a way to ensure that your personal and financial affairs are handled according to your desires.

Who can create a Last Will and Testament in New York?

In New York, any person over the age of 18 years and of sound mind can create a Last Will and Testament. Being of "sound mind" generally means you understand the nature of your assets, who your beneficiaries are, and the implications of creating a will.

Does my Last Will and Testament need to be notarized in New York?

While New York law does not require your Last Will and Testament to be notarized, it must be properly witnessed. Specifically, you need at least two individuals to witness you signing the will (or acknowledging your signature) and understand that the document is indeed your will. However, getting it notarized can add an extra layer of validation, often simplifying the probate process.

What happens if I die without a Last Will and Testament in New York?

If you die without a Last Will and Testament in New York, your assets will be distributed according to the state's intestacy laws. These laws prioritize relatives in a specific order, starting with your closest family members, such as your spouse and children, and can significantly differ from your personal wishes.

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your Last Will and Testament at any time as long as you are of sound mind. This can be done through creating a new will or by making a legal amendment called a codicil. However, the revocation must be done with the same formalities as creating a new will.

What should I include in my Last Will and Testament?

Your Last Will and Testament should clearly identify your assets, specify who will inherit these assets, appoint an executor to handle your estate, and, if applicable, appoint a guardian for any minor children. It's also wise to include any specific funeral arrangements or final wishes.

How can I ensure that my Last Will and Testament is valid in New York?

To ensure your Last Will and Testament is valid in New York, make sure it complies with state laws: it must be in writing, signed by you and by at least two witnesses who understand that the document is your will. Additionally, explicitly stating your intentions and having the document reviewed by a legal professional can also help safeguard its validity.

What is the role of the executor in my Last Will and Testament?

The executor, named in your Last Will and Testament, is responsible for managing your estate after your death. This includes paying any debts and taxes and distributing the remaining assets to your beneficiaries according to the wishes laid out in your will. It's important to choose someone trustworthy and capable, as it is a significant responsibility.

Common mistakes

One common mistake individuals make when filling out the New York Last Will and Testament form is failing to adhere to the state's requirement for witnesses. The form must be signed in the presence of two witnesses, who then also sign to verify the will-maker's signature. This oversight can render the will invalid, frustrating the intentions of the person making the will.

Another error people often make is not being specific enough about the distribution of their assets. Vague statements about who should inherit property, money, or personal items can lead to confusion and disputes among heirs. For clarity and to ensure that wishes are honored, it is critical to clearly identify recipients and their corresponding inheritances.

A further mistake is overlooking the appointment of an executor or naming an inexperienced individual for this role. The executor is responsible for executing the will's directives, making it essential to appoint someone who is both capable and willing to undertake this responsibility. Not choosing an executor, or choosing someone not suited for the task, can delay the handling of the estate.

Not considering the update requirements for a Last Will and Testament is also a common oversight. Life changes such as marriage, divorce, birth of a child, or acquisition of significant assets necessitate updates to the will. People often neglect this, leading to outdated wills that do not reflect their current wishes or circumstances.

Lastly, the attempt to include directives for medical care or funeral arrangements within the will is a frequent error. While these are important considerations, a Last Will and Testament is not the appropriate document for these types of instructions. Such preferences should be documented separately in a living will or health care proxy to ensure they are followed.

Documents used along the form

Preparing a Last Will and Testament in New York is a significant step in planning for the future. However, it's often just one part of a comprehensive estate planning strategy. Several other documents are commonly used in conjunction with a Last Will and Testament to ensure a person's wishes are fully understood and legally safeguarded. These documents encompass a range of directives and permissions, providing clarity and legal authority for various situations that may arise.

- Durable Power of Attorney: This legal document authorizes someone else to act on your behalf in legal and financial matters. It remains in effect even if you become unable to make decisions for yourself.

- Health Care Proxy: Similar to a Durable Power of Attorney, but specifically for medical decisions, this document allows you to designate someone to make health care decisions for you if you're incapacitated.

- Living Will: This document outlines your wishes regarding life-sustaining treatment if you're terminally ill or permanently unconscious and cannot communicate your desires. It works in conjunction with the Health Care Proxy.

- Revocable Living Trust: This enables you to manage your assets while you're alive and to pass them on to your beneficiaries without going through probate upon your death.

- Beneficiary Designations: Forms that designate beneficiaries for specific assets, such as retirement accounts and life insurance policies, which can supersede instructions in a will.

- Memorandum of Tangible Personal Property: A document that specifies who will receive certain items of tangible personal property that may not be addressed specifically in the will or trust documents.

Each of these documents serves a unique purpose and complements your Last Will and Testament. Including these documents in your estate plan allows you to create a detailed and effective plan for the future, addressing a wide range of potential issues and ensuring that your wishes are clearly communicated and legally enforceable. When prepared correctly and in accordance with New York law, these documents work together to create a comprehensive estate plan that reflects your wishes and protects your interests.

Similar forms

The Living Will is quite similar to the New York Last Will and Testament in that it also deals with personal wishes regarding the end of one's life. However, while the Last Will and Testament focuses on the distribution of assets after death, the Living Will specifies medical treatments you do or do not want in case you cannot make decisions for yourself due to illness or incapacity.

Trust documents, notably the Revocable Living Trust, share commonalities with the Last Will and Testament as well. Both allow for the management and distribution of one's assets. A Revocable Living Trust, however, enables this process to occur without the need for probate, offering a streamlined approach to managing one's affairs after death or during incapacity, unlike a Last Will which goes through probate court.

The Durable Power of Attorney for finances is another document that parallels the New York Last Will and Testament. This document appoints someone to handle your financial affairs if you're unable to do so yourself. While the Last Will becomes active after death, the Durable Power of Attorney operates during the individual's lifetime, ceasing to have effect upon their death.

Health Care Proxy forms bear resemblance to the Last Will and Testament too, in the sense that they plan for future incapacity. A Health Care Proxy allows you to designate someone to make health care decisions on your behalf if you're unable to do so. This ensures your health care wishes are respected, similarly to how a Last Will ensures your estate wishes are respected after death.

The Letter of Intent is a document that provides additional personal details and wishes that may not be explicitly outlined in a Last Will and Testament. It can include funeral arrangements or special instructions for the care of pets or personal items. Though not legally binding like a Last Will, it assists executors and beneficiaries in understanding the deceased's personal wishes.

Beneficiary Designations on accounts like IRAs, retirement plans, and insurance policies can bypass the directives in a Last Will and Testament, directly transferring assets to the named beneficiaries upon death. These designations are crucial to consider in estate planning as they can supersede the wishes laid out in one's Last Will if not aligned.

The Assignment of Business Interest is somewhat analogous to a Last Will, especially for business owners. This document outlines how a business owner's share of the business should be handled upon their death. While a Last Will can include instructions on business assets, an Assignment of Business Interest specifically deals with business succession.

The Digital Assets Will, although a modern iteration, parallels the Last Will and Testament by specifying what should happen to digital assets like social media accounts, digital files, and online accounts after one's death. This document ensures that digital assets are not forgotten and are properly managed according to the individual's wishes.

The Pet Trust is a specialized document for the care of pets after an owner's death, similar in intention to a Last Will that provides for human beneficiaries. By establishing a Pet Trust, an owner can allocate funds and give instructions for the care of their pets, ensuring they are well cared for in the owner's absence.

Lastly, the Pre- and Post-nuptial Agreements, although not typically part of estate planning documents, have similarities to a Last Will in that they specify how assets should be divided in the event of a divorce or death. These agreements can override the asset distribution terms in a Last Will if properly drafted and executed, making them an essential consideration in matrimonial and estate planning.

Dos and Don'ts

When preparing to fill out the New York Last Will and Testament form, it is essential to proceed with care. The decisions made in this document will have lasting impacts on your loved ones and how your assets are managed and distributed after your passing. Below are some important guidelines to help ensure your intentions are clearly documented and legally recognized.

Things You Should Do:

- Ensure that you fully understand each section of the form before you begin writing. If anything is unclear, seeking clarification from a legal professional is advisable.

- Be precise and clear in detailing your assets, beneficiaries, and any specific wishes you have regarding the distribution of your estate. Ambiguities can lead to disputes or complications later on.

- Sign and date the form in the presence of two witnesses, as required by New York state law. These witnesses should not be beneficiaries of the will to prevent any conflicts of interest.

- Keep the document in a safe, secure location and inform a trusted family member or friend of its whereabouts. It's also wise to provide your attorney with a copy for safekeeping.

Things You Shouldn't Do:

- Avoid using vague language or terms that could be open to interpretation. The clearer you are, the more likely your final wishes will be carried out as you intended.

- Refrain from making alterations or annotations in the margins after the document has been witnessed and signed. Such changes may not be legally binding and could invalidate the will or parts of it.

- Do not rely solely on a digital copy of your will. While keeping a digital copy for your records is advisable, the original signed document is what holds legal weight.

- Resist the temptation to create your Last Will and Testament without any professional advice. Even if your estate seems straightforward, a legal expert can offer valuable insights and ensure your will is valid and comprehensive.

Misconceptions

When it comes to preparing a Last Will and Testament in New York, there are several misconceptions that can lead to confusion and complications. Understanding these can help ensure that one's final wishes are executed as intended.

It's only for the wealthy: Many people believe that creating a Last Will and Testament is only necessary for those with substantial assets. In reality, it is crucial for anyone who wishes to have control over the distribution of their assets, regardless of their value, and to make arrangements for the care of minors.

Everything goes to the spouse automatically: It's a common misconception that in the absence of a Will, everything will automatically transfer to a surviving spouse. New York law provides a specific formula for distributing assets that may include parents, siblings, and children, not just the spouse.

A Will allows you to avoid probate: Another misconception is that having a Will means your estate will not go through probate. While a Will directs how your estate should be distributed, the document still requires probate to legally transfer assets to heirs.

Wills cover all types of assets: Some people think that once they have a Will, all their assets are covered. However, certain assets like life insurance policies, retirement accounts, and jointly held property may pass outside of the Will, depending on beneficiary designations and titling.

Oral Wills are valid: In New York, oral Wills, also known as nuncupative Wills, are typically not considered valid. A Will needs to be written and comply with specific legal standards to be enforceable.

A handwritten Will is enough: While handwritten Wills, or holographic Wills, can sometimes be valid, they must meet strict criteria. It's recommended to follow formal procedures to ensure the Will's validity and to reduce the risk of challenges.

Updating a Will is difficult: Many think that once a Will is made, changing it is a cumbersome process. In truth, Wills can be amended through a codicil or by creating a new Will, which can be done as often as necessary to reflect current wishes.

You can disinherit your spouse: In New York, it is very difficult to completely disinherit a spouse. Surviving spouses may be able to claim a portion of the estate under the right of election, regardless of the Will's contents.

A Will can include funeral instructions: Although you can include funeral instructions in your Will, it is often not the best place for them. Wills are usually read after funeral services have taken place, so it's better to communicate these wishes separately.

Lawyers are not necessary for creating Wills: While it's possible to create a Will without a lawyer's assistance, consulting with an attorney who understands New York estate laws can ensure that the Will complies with legal standards and truly reflects your wishes.

Key takeaways

Completing a Last Will and Testament in New York is a significant step toward ensuring your wishes are honored. Here are six key takeaways regarding this important document:

- Careful consideration is needed when choosing an executor. This individual will manage your estate, so select someone trustworthy and capable.

- Your Last Will and Testament must be witnessed by at least two people who are not beneficiaries of the will to be legally valid in New York.

- Be explicit about your wishes concerning the distribution of your assets. This includes specifying beneficiaries for specific items or monetary gifts to avoid potential conflicts or confusion.

- Include a provision for the care of minor children, such as naming a guardian to ensure their well-being and financial support.

- The document must be signed and dated by you in the presence of your witnesses to be considered valid under New York law.

- Regularly review and update your will as life changes occur (such as marriage, divorce, the birth of a child, or the acquisition of significant assets) to reflect your current wishes and circumstances.

Following these guidelines when completing your Last Will and Testament will help ensure that your estate is handled according to your wishes, providing peace of mind to you and your loved ones.

Popular Last Will and Testament State Forms

How to Make a Will in Indiana - Having this document can simplify the legal process for your heirs, potentially saving them time, money, and additional stress during the probate process.

Printable Last Will and Testament - Estate document that determines how personal and real property should be allocated.

Free Will Forms to Print - Requires witnesses to sign, making it valid and legally enforceable in a court of law.