Free Last Will and Testament Form for Michigan

The Michigan Last Will and Testament form is a crucial document for individuals residing in Michigan who wish to ensure their assets are distributed according to their desires after their passing. This legal instrument allows a person, known as the testator, to outline specifically how their personal and real property should be allocated to beneficiaries, which can include family members, friends, and even organizations. It also enables the appointing of an executor, who will be responsible for managing the estate according to the will's directives, and can make provisions for the care of minor children. The importance of this document lies not only in its capability to protect the testator's assets but also in its power to minimize disputes among surviving relatives. Understanding the legal requirements in Michigan, such as the need for the will to be in writing, signed by the testator, and witnessed by at least two individuals who are not beneficiaries, is essential for creating a valid Last Will and Testament. This preliminary step ensures that the intentions of the testator are upheld in a court of law, providing peace of mind to the testator and their loved ones. Michigan's specific stipulations for a Last Will and Testament underscore the significance of preparing for the future, reinforcing the notion that all adults should consider creating a will as part of their estate planning.

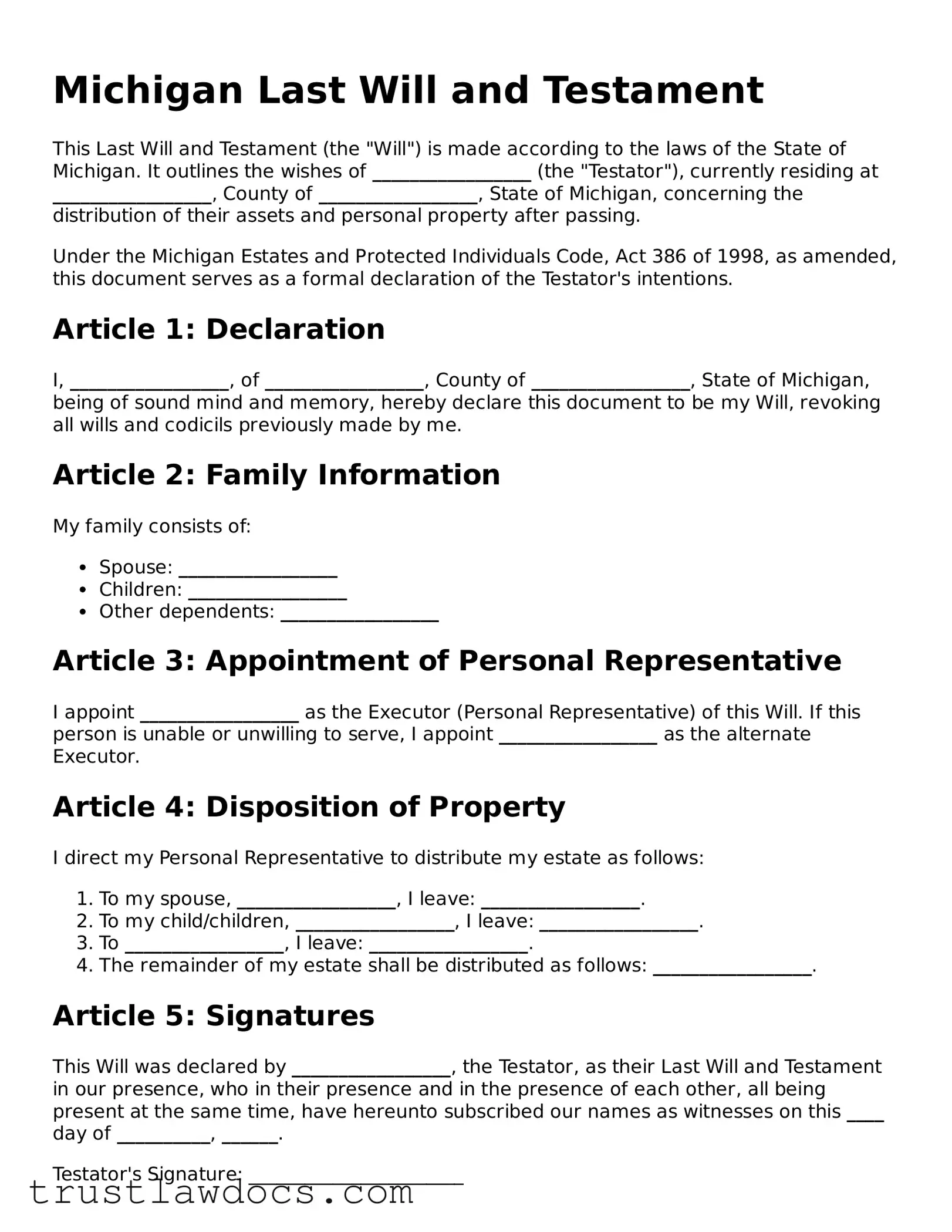

Form Example

Michigan Last Will and Testament

This Last Will and Testament (the "Will") is made according to the laws of the State of Michigan. It outlines the wishes of _________________ (the "Testator"), currently residing at _________________, County of _________________, State of Michigan, concerning the distribution of their assets and personal property after passing.

Under the Michigan Estates and Protected Individuals Code, Act 386 of 1998, as amended, this document serves as a formal declaration of the Testator's intentions.

Article 1: Declaration

I, _________________, of _________________, County of _________________, State of Michigan, being of sound mind and memory, hereby declare this document to be my Will, revoking all wills and codicils previously made by me.

Article 2: Family Information

My family consists of:

- Spouse: _________________

- Children: _________________

- Other dependents: _________________

Article 3: Appointment of Personal Representative

I appoint _________________ as the Executor (Personal Representative) of this Will. If this person is unable or unwilling to serve, I appoint _________________ as the alternate Executor.

Article 4: Disposition of Property

I direct my Personal Representative to distribute my estate as follows:

- To my spouse, _________________, I leave: _________________.

- To my child/children, _________________, I leave: _________________.

- To _________________, I leave: _________________.

- The remainder of my estate shall be distributed as follows: _________________.

Article 5: Signatures

This Will was declared by _________________, the Testator, as their Last Will and Testament in our presence, who in their presence and in the presence of each other, all being present at the same time, have hereunto subscribed our names as witnesses on this ____ day of __________, ______.

Testator's Signature: _______________________

Date: _______________________

Witness #1 Signature: _______________________

Print Name: _______________________

Date: _______________________

Witness #2 Signature: _______________________

Print Name: _______________________

Date: _______________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Legal Requirements | The Last Will and Testament in Michigan must be in writing, signed by the testator and by at least two witnesses. |

| Age Requirement | The testator must be at least 18 years old and of sound mind at the time of creating their Last Will and Testament. |

| Witness Requirement | Michigan law requires that at least two witnesses, who are not beneficiaries, must sign the Will in the presence of the testator. |

| Self-Proving Affidavit | A self-proving affidavit is not required in Michigan, but it is recommended because it can simplify the probate process. |

| Governing Law | The Michigan Estates and Protected Individuals Code (EPIC) governs the creation and interpretation of Last Wills and Testaments in Michigan. |

How to Write Michigan Last Will and Testament

Preparing a Last Will and Testament is a crucial step in planning for the future. It ensures that your wishes are clearly laid out, providing peace of mind for you and your loved ones. The process of completing a Michigan Last Will and Testament form can seem daunting at first, but by following these step-by-step instructions, the task becomes much more manageable. This guide is designed to help you accurately fill out your form, ensuring all necessary information is included and legally valid. Remember, once completed, this document will represent your final wishes, so it's important to take the time to fill it out carefully and thoughtfully.

- Gather all necessary information. Before you start filling out the form, make sure you have all relevant information handy. This includes your full legal name, address, a list of all assets (such as property, bank accounts, and personal treasured items), and the names and addresses of all beneficiaries.

- Identify the executor. The executor is the person you designate to carry out your wishes as outlined in your will. Write down the name, address, and contact information of your chosen executor. Make sure this person has agreed to take on this responsibility.

- Designate beneficiaries. Clearly indicate who will inherit your assets. Include the full names and addresses of each beneficiary, and specify what each person will receive. If you wish to leave specific items to certain individuals, describe these items in detail.

- Select a guardian for minor children. If you have minor children, choose a guardian to look after them in the event of your passing. Provide the name, address, and contact information of the guardian. It's critical to discuss this responsibility with the chosen guardian beforehand to ensure they are willing and able to take on this role.

- Be clear about any specific wishes. If you have particular directions you want to be followed regarding your burial or memorial service, include these instructions in your will. Be as specific as possible to ensure your wishes are understood and respected.

- Review and sign the document. After completing all sections of the will, review the document carefully. Ensure all information is accurate and reflects your wishes. Sign and date the will in the presence of at least two witnesses, who should also sign the document. In Michigan, these witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

- Store the will safely. Once signed, store your will in a safe place. Inform your executor and a trusted family member or friend of where the will is stored, so it can be easily accessed when needed.

By following these steps, you can confidently complete your Michigan Last Will and Testament. This document is a crucial part of your estate planning, ensuring your assets are distributed according to your wishes and providing important instructions for those you leave behind. While the process requires careful consideration and accuracy, the peace of mind it brings is invaluable. Remember, it's also advisable to consult with a legal professional to ensure your will meets all legal requirements and accurately reflects your intentions.

Get Answers on Michigan Last Will and Testament

What is a Last Will and Testament in Michigan?

A Last Will and Testament in Michigan is a legal document that allows a person, known as the testator, to specify how their possessions, including property and other assets, should be distributed upon their death. It can also appoint a guardian for minor children and an executor to manage the estate until its final distribution.

Who can make a Last Will and Testament in Michigan?

Any person who is at least 18 years old and of sound mind can make a Last Will and Testament in Michigan. This means the person must fully understand the extent of their assets, the act of making a will, and its effects.

What are the requirements for a Last Will and Testament to be valid in Michigan?

In Michigan, for a Last Will and Testament to be valid, it must be in writing, signed by the testator or by someone else in the testator's presence and at their direction, and witnessed by at least two individuals who are both present to witness the testator's signature or acknowledgment of the signature or the will itself.

Can I change or revoke my Last Will and Testament after creating it?

Yes, you can change or revoke your Last Will and Testament at any time as long as you are of sound mind. This can be done by creating a new will that states it revokes the previous ones or by performing a physical act such as burning, tearing, canceling, obliterating, or destroying the document with the intent to revoke it.

What happens if I die without a Last Will and Testament in Michigan?

If you die without a Last Will and Testament in Michigan, your assets will be distributed according to Michigan's intestacy laws. These laws dictate a hierarchy of beneficiaries, such as your spouse, children, or parents, who will receive your assets in a predetermined manner, which might not align with your personal wishes.

Do I need an attorney to create a Last Will and Testament in Michigan?

While it is not a legal requirement to have an attorney create your Last Will and Testament in Michigan, consulting with an experienced attorney can ensure that the will complies with Michigan law and truly reflects your wishes. An attorney can also offer advice on complex situations, such as providing for a blended family or setting up trusts.

How should I choose an executor for my estate?

Choosing an executor for your estate is a critical decision. This person will be responsible for managing your estate, paying any debts, and distributing assets according to your will. It should be someone you trust, who is organized and, preferably, lives in Michigan or nearby to handle duties more effectively. Consider discussing the responsibilities with them before making your choice.

Can I leave property to anyone I want?

Yes, in Michigan, you can leave your property to anyone you want through your Last Will and Testament. However, there are certain exceptions, such as provisions for your spouse under Michigan law that must be adhered to, unless they have agreed otherwise in a valid prenuptial or postnuptial agreement.

Is a handwritten Last Will and Testament valid in Michigan?

A handwritten, or "holographic," will can be valid in Michigan if it is dated, signed by the testator, and the material portions are in the testator's handwriting. A holographic will does not need to be witnessed, but it must be clear that the document is intended to serve as the testator's will. Despite this, having a will formally prepared and witnessed can help avoid complications during probate.

Common mistakes

Filling out a Last Will and Testament form is a crucial step in ensuring your wishes are respected after your passing. However, in Michigan, as elsewhere, individuals often make mistakes that can complicate or even invalidate their will. Understanding these common errors can help you avoid them.

One common mistake is not adhering to the specific witnessing requirements set forth by Michigan law. For a Last Will and Testament to be valid, it must be signed in the presence of two witnesses, who then must also sign the document themselves. These witnesses should not stand to inherit anything from the will to avoid potential conflicts of interest or challenges to the document’s validity.

Another mistake is neglecting to update the will regularly. Major life events such as marriage, divorce, the birth of a child, or the death of a named beneficiary can significantly alter your intentions for your estate. Failing to reflect these changes in your will can lead to unintended consequences, such as assets going to someone you no longer wish to inherit.

Some individuals mistakenly assume that their will covers all assets. However, certain types of property, like those jointly owned or with designated beneficiaries — such as life insurance policies or retirement accounts — bypass the will and go directly to the joint owner or named beneficiary. Not understanding which assets are covered by the will and which are not can lead to surprises and possibly disputes among survivors.

A lack of specificity in bequests is another frequent oversight. Vague language can lead to interpretations that might not align with your wishes. It is essential to be as clear and precise as possible about who receives what, especially when it comes to valuable or sentimental items.

Some individuals also erroneously believe that a will can dictate funeral instructions. While you can include your wishes for your funeral in your will, there’s a risk that your will may not be read until after your funeral. It's more effective to communicate these wishes separately to your family or executor.

Choosing the wrong executor can complicate the administration of your estate significantly. The executor should be someone you trust implicitly, but also someone who is capable of handling the responsibility. This choice is often overlooked or not given the serious consideration it requires.

Not having a contingency plan for the disposition of assets is a critical error. If the primary beneficiary is unable to inherit, without clear instructions on alternative arrangements, the state laws of intestacy will apply, possibly leading to outcomes that you might not have wanted.

Attempting to disinherit a spouse without understanding Michigan’s laws is another common pitfall. In Michigan, a spouse is entitled to a portion of your estate unless there is a prenuptial agreement in place or the spouse consents to being disinherited in a valid and enforceable manner. Ignoring these legal protections can lead to costly and time-consuming litigation.

Finally, the mistake of not seeking professional legal advice can be the most detrimental of all. Many believe they can navigate the complexities of creating a will on their own, but estate law is intricate. Professional guidance can ensure that the will is valid, reflects your wishes accurately, and takes into consideration all aspects of Michigan law.

Documents used along the form

In preparing a comprehensive estate plan, individuals often accompany the Michigan Last Will and Testament form with several other crucial documents. These documents work together to ensure clear communication of one’s wishes regarding their estate, healthcare, and financial matters. Here is a list of important forms and documents commonly used in conjunction with a Last Will and Testament in Michigan.

- Durable Power of Attorney for Finances: This allows an individual to appoint someone to manage their financial affairs if they become unable to do so. It can include paying bills, managing investments, and handling other financial responsibilities.

- Health Care Power of Attorney: Also known as a Patient Advocate Designation in Michigan, it enables one to designate a person to make healthcare decisions on their behalf if they are incapacitated. This document often includes wishes regarding treatment preferences.

- Living Will: This document outlines a person's wishes regarding life-sustaining treatments if they become terminally ill or permanently unconscious. It is a directive to physicians and can guide health care proxies in making decisions.

- Revocable Living Trust: A legal arrangement that allows one to maintain control over their assets during their lifetime and specifies how these assets are to be distributed upon their death, potentially avoiding probate.

- Funeral Directive: Specifies an individual’s preferences for their funeral arrangements and can include details on burial or cremation, type of ceremony, and disposition of their remains.

- Letter of Intent: A personal document providing additional guidance and instructions for the executor and beneficiaries. It can detail specific wishes not covered in the will regarding personal possessions, family heirlooms, or other non-monetary assets.

- Financial Records Document: A comprehensive list of accounts, insurance policies, real estate, and other assets, which helps the executor in identifying and managing the estate assets.

- Digital Assets Memorandum: Given the rise in digital assets and online presence, this document provides instructions for handling digital accounts, including social media profiles, digital currencies, and online financial accounts, after death.

Together, these documents form a robust estate plan that addresses a wide range of considerations from asset distribution and financial management to personal health care and digital legacy. Ensuring that these documents are completed in accordance with Michigan law and with the guidance of a legal professional can provide peace of mind and clarity for both the individual and their loved ones.

Similar forms

The Michigan Living Will is closely related to the Last Will and Testament, as it also deals with preparing for the future. While a Last Will and Testament dictates how a person's assets and responsibilities are handled after death, a Living Will focuses on a person's preferences for medical treatment and life support if they become unable to communicate these wishes themselves. Both documents serve to ensure a person's decisions are respected; the former concerning financial and property matters, and the latter regarding healthcare.

The Durable Power of Attorney (POA) for Healthcare is another document with similarities to the Last Will and Testament, primarily in its function of designating another person to make decisions on behalf of the individual. Where a Last Will and Testament takes effect after death, a Durable POA for Healthcare becomes relevant during the individual’s lifetime, particularly in situations where they cannot make medical decisions for themselves. It complements a Living Will but focuses on appointing a decision-maker rather than outlining specific medical wishes.

A Financial Power of Attorney document, much like a Last Will and Testament, involves assigning decision-making authority. However, in this case, the authority concerns financial affairs and is effective during the individual's lifetime, contrasting with a Will's posthumous effect. This document allows the designated person to handle financial transactions and decisions, revealing how both documents aim to manage one's affairs responsibly, yet at different stages of life and death.

The Trust Agreement shares a Last Will and Testament's goal of managing and bequeathing assets, albeit through a different legal mechanism. Trusts, established during a person's lifetime, can also continue after their death, offering a more flexible and often tax-efficient means of distributing property. While a Last Will undergoes probate, a Trust Agreement can bypass this process, making asset distribution quicker and more private.

Advanced Healthcare Directive, similar to a Living Will and part of the healthcare-related documents akin to a Last Will and Testament, outlines treatments a person wishes to receive or avoid in a medical crisis. This document combines the functions of a Living Will and a Healthcare POA, ensuring comprehensive coverage of one's healthcare preferences and the appointment of an advocate for those wishes.

The Guardianship Designation is integral for those with dependents, mirroring a Last Will's concern with appointing roles for after one's passing. This document specifies who will take care of the individual's minor children or dependent adults if they are no longer able to do so, ensuring that the appointed guardian aligns with their preferences and values.

The Funeral Directive is a document that, much like a Last Will and Testament, deals with posthumous wishes. However, instead of addressing asset distribution, it specifies a person's preferences for their funeral arrangements, such as the type of service or burial. This ensures that a person's final send-off reflects their wishes and relieves loved ones of the burden of making these decisions during a difficult time.

The Digital Asset Will, a contemporary counterpart to the traditional Last Will and Testament, addresses the management and inheritance of digital property, such as social media accounts, digital libraries, and online finances. In today's digital age, specifying what should happen with digital assets is key. This highlights an evolving landscape where estate planning encompasses not only physical and financial assets but digital legacies as well.

Dos and Don'ts

When it comes to filling out a Last Will and Testament form in Michigan, there are several important do's and don'ts to keep in mind. Ensuring your document is completed correctly is crucial for it to be considered valid and for your wishes to be followed after your passing. Here are some key points to help guide you through this important process.

Do's:

- Make sure all information is accurate and complete. This includes full names, addresses, and relationship descriptions of beneficiaries and the executor.

- Have the document witnessed as required by Michigan law. This typically means having two individuals present who will not benefit from the will to witness your signing.

- Consider having the will notarized, even though it’s not a requirement in Michigan, to add an extra layer of authenticity.

- Be clear and unambiguous when describing how your assets should be distributed. Specificity can help prevent potential disputes among beneficiaries.

- Sign and date the will in the presence of your witnesses. Their signatures also need to be included.

- Keep the will in a safe but accessible place. Inform a trusted individual, such as the executor, where it is stored.

- Review and update the will as necessary, particularly after major life events such as a marriage, divorce, the birth of a child, or the acquisition of significant assets.

Don'ts:

- Don't leave any sections blank. If a section doesn’t apply, write “N/A” to indicate this.

- Don't use ambiguous language that could lead to misinterpretation or disputes.

- Don't forget to name an alternate executor, in case your first choice is unable or unwilling to serve.

- Don't overlook the need to have the will witnessed; failing to do so can lead to questions about its validity.

- Don't attempt to make changes to the will after it has been signed and witnessed by writing on it or crossing items out. To make changes or additions, a new will or a codicil needs to be properly executed following the same formalities as the original will.

- Don't store your will in a safety deposit box that only you can access. This can create difficulties after your passing, as others may not be able to retrieve it easily.

- Don't assume that your will is a once-and-done task. Review it periodically and after any significant life changes.

Misconceptions

Misconceptions about legal documents, especially important ones like the Michigan Last Will and Testament, are common. They can lead to mistakes that significantly impact estate planning and the management of an individual's legacy. Let's clarify some of these misunderstandings to ensure that intentions and the law align accurately.

It has to be notarized to be valid: In Michigan, a Last Will and Testament does not need to be notarized to be legally valid. It must be written, signed by the person making the will (the testator), and witnessed by at least two people who are not beneficiaries. Notarization can help prove the authenticity of the will but is not a requirement for its validity.

Everything goes through probate: Not all assets are required to go through the probate process. In Michigan, certain assets that are jointly owned, or those with designated beneficiaries such as life insurance policies or retirement accounts, bypass probate and go directly to the named beneficiary.

If you die without a will, the state takes everything: If someone dies intestate (without a will), their assets are distributed according to Michigan's laws of succession. While the state does have a formula for distribution among relatives, it does not "take everything." The estate is divided among surviving family members according to the law, which typically favors spouses and children first.

Only the wealthy need a will: This is a dangerous misconception. Regardless of the size of an estate, having a will is crucial for ensuring that assets are distributed according to the individual's wishes. Without a will, the state’s intestacy laws determine who receives your assets, which may not align with personal preferences. Moreover, a will can designate a guardian for minor children, which is important regardless of wealth.

Oral wills are just as good as written ones: Michigan law strongly prefers written wills. While oral (nuncupative) wills might be recognized under very specific conditions, such as being made by a member of the armed forces during active duty, they are generally not advised. Written wills provide clarity, reduce the risk of misunderstandings, and are far easier to enforce.

Key takeaways

When planning for the future, a Michigan Last Will and Testament form serves as a critical tool to ensure your wishes are carried out with respect to the distribution of your assets and the care of minor children. The following key takeaways are designed to guide individuals through the process of filling out and using the form effectively:

- Legal Requirements: Michigan law requires the person creating the will (the testator) to be at least 18 years old and of sound mind. The document must be in writing, signed by the testator, and witnessed by at least two individuals who are not beneficiaries.

- Choosing an Executor: Appoint a trusted individual as the executor of your estate. This person will manage and distribute your assets according to the terms of your will.

- Identifying Beneficiaries: Clearly specify who will inherit your assets. Beneficiaries can include family members, friends, charitable organizations, or others.

- Designating Guardians: If you have minor children, nominate a guardian to care for them in the event of your and the other parent's death. Consider choosing an alternate guardian as well.

- Specific Gifts: You may wish to leave specific items or fixed sums of money to certain individuals. Clearly describe these items and the intended recipients to avoid confusion.

- Residual Estate: After specific bequests have been made, detail how the remainder of your assets (residual estate) should be distributed.

- Witness Requirements: Witnesses must be at least 18 years old and should not be beneficiaries of the will to avoid potential conflicts of interest.

- Regular Updates: Review and update your will regularly, especially after major life events such as marriage, divorce, birth of a child, or significant changes in your financial situation.

- Secure Storage: Keep your will in a safe but accessible place. Inform the executor, and possibly beneficiaries, of its location.

- Professional Advice: Consider consulting a legal professional to ensure that your will complies with Michigan law and accurately reflects your wishes.

Properly executing a Last Will and Testament is a straightforward but essential process for protecting your legacy and ensuring your wishes are honored. Taking these steps provides peace of mind and clarity to your loved ones during a difficult time.

Popular Last Will and Testament State Forms

Free Ny Will Template - Allows for the establishment of trusts to manage assets for beneficiaries over time, often used for minors.

California Last Will and Testament - The document can also address the care of pets, ensuring they are looked after by someone you trust.

How to Make a Will in Indiana - A clear and well-drafted Will removes any doubt about your intentions, reducing the likelihood of disputes among your heirs.