Free Last Will and Testament Form for Indiana

Preparing for the future is a task that comes with its complexities and responsibilities, with creating a Last Will and Testament being one of the most critical steps for residents in Indiana. This legal document allows individuals to express their wishes regarding how their assets should be managed and distributed after their passing, ensuring that their loved ones are cared for and their wishes are honored. In Indiana, like in other states, specific rules and requirements govern the creation of a Last Will and Testament, including the need for it to be written, the necessity of the testator's signature, and, often, signatures from witnesses. Beyond the simple allocation of assets, the Indiana Last Will and Testament form provides a platform for appointing an executor, who will manage the estate's affairs, and can also specify guardians for minor children, ensuring their wellbeing is safeguarded. Navigating through these legal requirements, understanding the implications of each section, and ensuring the form is filled out comprehensively and accurately, are key steps in securing one's legacy and providing peace of mind for both the individual and their loved ones.

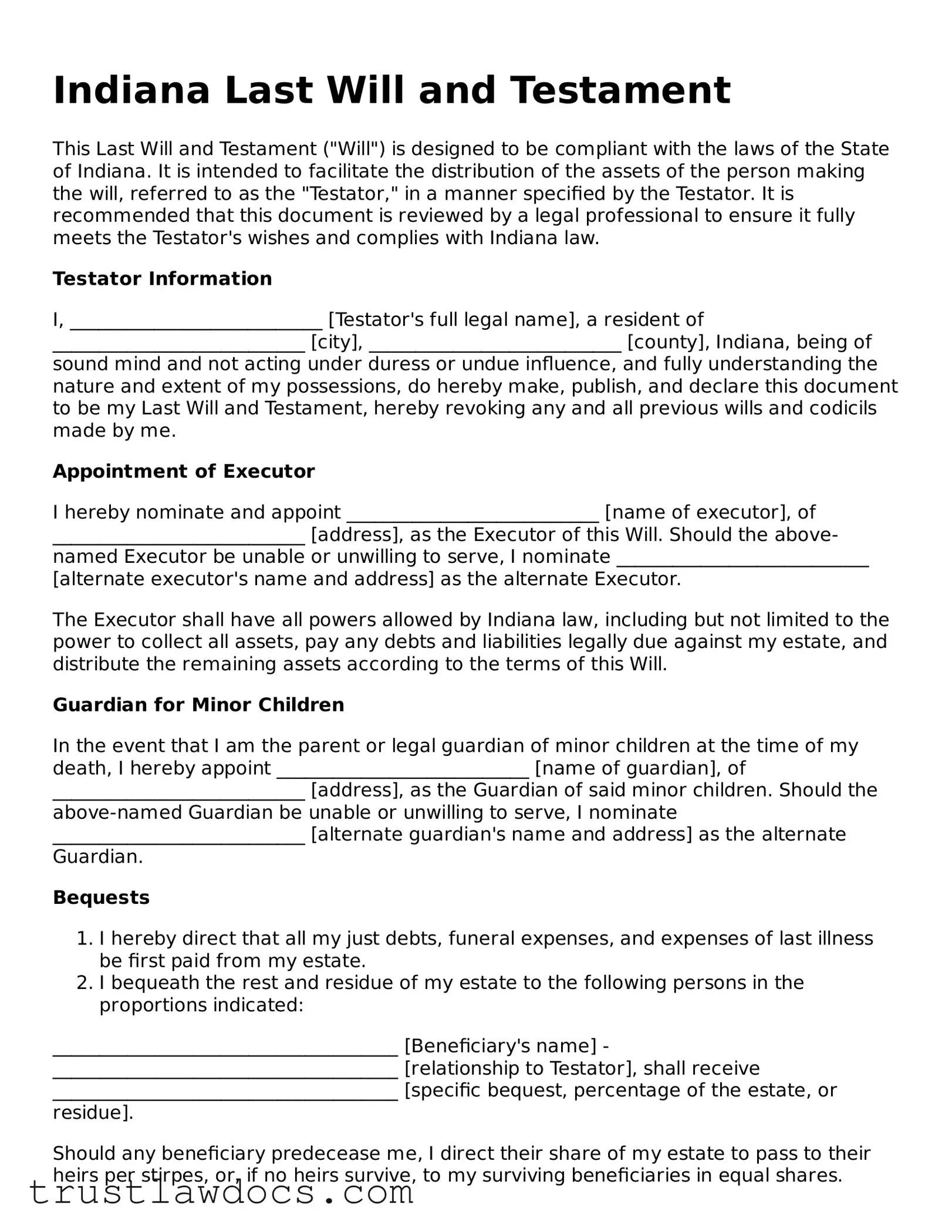

Form Example

Indiana Last Will and Testament

This Last Will and Testament ("Will") is designed to be compliant with the laws of the State of Indiana. It is intended to facilitate the distribution of the assets of the person making the will, referred to as the "Testator," in a manner specified by the Testator. It is recommended that this document is reviewed by a legal professional to ensure it fully meets the Testator's wishes and complies with Indiana law.

Testator Information

I, ___________________________ [Testator's full legal name], a resident of ___________________________ [city], ___________________________ [county], Indiana, being of sound mind and not acting under duress or undue influence, and fully understanding the nature and extent of my possessions, do hereby make, publish, and declare this document to be my Last Will and Testament, hereby revoking any and all previous wills and codicils made by me.

Appointment of Executor

I hereby nominate and appoint ___________________________ [name of executor], of ___________________________ [address], as the Executor of this Will. Should the above-named Executor be unable or unwilling to serve, I nominate ___________________________ [alternate executor's name and address] as the alternate Executor.

The Executor shall have all powers allowed by Indiana law, including but not limited to the power to collect all assets, pay any debts and liabilities legally due against my estate, and distribute the remaining assets according to the terms of this Will.

Guardian for Minor Children

In the event that I am the parent or legal guardian of minor children at the time of my death, I hereby appoint ___________________________ [name of guardian], of ___________________________ [address], as the Guardian of said minor children. Should the above-named Guardian be unable or unwilling to serve, I nominate ___________________________ [alternate guardian's name and address] as the alternate Guardian.

Bequests

- I hereby direct that all my just debts, funeral expenses, and expenses of last illness be first paid from my estate.

- I bequeath the rest and residue of my estate to the following persons in the proportions indicated:

_____________________________________ [Beneficiary's name] - _____________________________________ [relationship to Testator], shall receive _____________________________________ [specific bequest, percentage of the estate, or residue].

Should any beneficiary predecease me, I direct their share of my estate to pass to their heirs per stirpes, or, if no heirs survive, to my surviving beneficiaries in equal shares.

Signatures

This Will was signed in the presence of witnesses, who in my presence and in the presence of each other, have hereunto subscribed our names on this ______ day of ________________, 20____.

_______________________________ [Signature of Testator]

_______________________________ [Printed Name of Testator]

Witnesses:

- _______________________________ [Witness #1 Signature]

- _______________________________ [Printed Name of Witness #1]

- _______________________________ [Witness #2 Signature]

- _______________________________ [Printed Name of Witness #2]

Statement of Witnesses

We, the undersigned witnesses, certify that ___________________________ [Testator's full legal name], the Testator, signed this document as their Last Will and Testament in our presence. We further certify that the Testator appears to be of sound mind and not under duress, undue influence, or incapacity. We are at least eighteen years of age and not related to the Testator by blood or marriage and are not beneficiaries of this Will.

_____________________________________ [Signature of Witness #1]

_____________________________________ [Printed Name of Witness #1]

_____________________________________ [Signature of Witness #2]

_____________________________________ [Printed Name of Witness #2]

PDF Form Details

| Fact Name | Details |

|---|---|

| Legal Age Requirement | In Indiana, individuals must be at least 18 years old to create a Last Will and Testament. |

| Witness Requirement | The will must be signed by at least two witnesses who are not beneficiaries and are at least 18 years old. |

| Governing Law | Indiana Code Title 29 governs the Last Will and Testament forms and procedures in Indiana. |

| Self-Proving Affidavit | An optional, but recommended, notarized self-proving affidavit can accompany the will to expedite probate. |

How to Write Indiana Last Will and Testament

When deciding to draft your Last Will and Testament in Indiana, it's crucial to follow the necessary steps to ensure your document is legally binding and accurately reflects your wishes. This document serves as a critical tool for detailing how you want your estate to be handled after your passing. It encompasses decisions ranging from the distribution of your assets to the guardianship of minor children, if applicable. With a clear step-by-step guide, the process of filling out your Indiana Last Will and Testament can be straightforward and less daunting.

- Start by gathering all necessary information including your full legal name, address, and a comprehensive list of your assets. These assets include, but are not limited to, physical property, bank accounts, investments, and personal belongings of value.

- Identify your beneficiaries, the people or organizations to whom you wish to leave your assets. Carefully consider the full legal names and addresses of these individuals or entities.

- Choose an executor for your estate. This person will be responsible for managing your estate, following the instructions laid out in your will. Again, ensure you have the correct full legal name and address for your chosen executor.

- If you have minor children, decide on a guardian who will be responsible for their care. Obtain the full legal name and address of the person(s) you are appointing.

- Be clear and specific when assigning assets to your beneficiaries. Include detailed descriptions of the items and the beneficiary's full name to avoid any confusion.

- If desired, specify any conditions related to the distribution of your assets. This might include age restrictions or requirements for beneficiaries to meet certain conditions.

- Review your state's requirements for witnesses, as Indiana law may have specific stipulations regarding the number and qualifications of witnesses needed to legally validate your will.

- Once your document is completed, sign and date it in the presence of the required number of witnesses. Ensure the witnesses understand they are attesting to your sound mind and voluntary signing of the will.

- Finally, securely store your Last Will and Testament. Consider a safety deposit box, a lawyer’s office, or another secure location where your executor can easily access it after your passing.

Proper completion and storage of your Indiana Last Will and Testament are crucial steps in estate planning. They ensure that your wishes are known and can be legally upheld. This thoughtful preparation provides peace of mind to you and your loved ones, assuring that your legacy is carried out as you intended.

Get Answers on Indiana Last Will and Testament

What is a Last Will and Testament in Indiana?

A Last Will and Testament in Indiana is a legal document that allows an individual, referred to as the testator, to specify how their assets and property should be distributed upon their death. This document can also appoint a guardian for minor children and designate an executor who will manage the estate until its final distribution.

Who can create a Last Will and Testament in Indiana?

In Indiana, any individual who is at least 18 years old and of sound mind has the legal capacity to create a Last Will and Testament. Being of sound mind means that the individual understands the nature of their estate, the act of making a will, and the effects of their decisions.

Does a Last Will and Testament need to be notarized in Indiana?

No, a Last Will and Testament does not need to be notarized in Indiana to be considered legally valid. However, it must be signed by the testator in the presence of two witnesses, who must also sign the document. Having the will notarized can be beneficial as it can help authenticate the document and simplify the probate process.

What happens if someone dies without a Last Will and Testament in Indiana?

If someone dies without a valid Last Will and Testament in Indiana, their assets will be distributed according to the state's intestacy laws. These laws prioritize distributing assets to the closest living relatives, such as spouses, children, parents, and siblings. This may result in distributions that do not align with the deceased's wishes.

Can a Last Will and Testament be changed after it has been created?

Yes, a Last Will and Testament can be changed at any time by the testator as long as they remain legally competent. Changes can be made through a formal amendment called a codicil, which must be executed with the same formalities as the original will. Alternatively, the testator can create a new will that revokes and replaces the previous one.

Are digital or electronic wills valid in Indiana?

As of the last update, Indiana law requires wills to be in writing to be recognized as legally valid. Digital or electronic wills, therefore, may not meet the legal requirements. It is essential to create a physical document that complies with state laws governing wills to ensure it is considered valid in Indiana.

Common mistakes

Filling out the Indiana Last Will and Testament form incorrectly can have long-lasting implications on how one's estate is handled after their demise. One common mistake is neglecting to have the will properly witnessed. Indiana law requires that a will must be signed by at least two witnesses. These witnesses must be present when the testator (the person making the will) signs it, ensuring that it is a voluntary and deliberate act.

Another frequent error is assuming that all assets can be distributed through a will. Certain assets, such as jointly owned property or those with designated beneficiaries (like life insurance policies and retirement accounts), pass outside of a will. Failing to understand these distinctions can lead to confusion and unintended consequences for the distribution of one's estate.

Avoiding specificity when bequeathing assets is also a pitfall. Vague language can result in disputes among heirs and may necessitate court intervention to interpret the will's intentions. Being precise about who gets what can prevent a lot of headaches and heartaches in the future.

Not updating the will regularly is a mistake that can render it outdated. Life events like marriage, divorce, the birth of children, or the death of a named beneficiary necessitate changes in one's will. An outdated will might not reflect the current wishes of the testator or the realities of their estate, leading to potential disputes or complicated legal situations.

Overlooking digital assets is another common mistake. In today's digital age, many people have assets or accounts online that need to be considered in estate planning. Failing to provide instructions on how these digital assets should be managed or distributed can result in valuable or sentimental digital property being overlooked or lost.

Finally, attempting to execute complex estate planning strategies without professional help can lead to errors. Complex assets, tax considerations, or wishes that involve conditional bequests or trusts often require the guidance of an estate planning attorney. DIY estate planning might not adequately address these complexities, potentially leading to issues that could have been avoided with expert advice.

Documents used along the form

When preparing a Last Will and Testament in Indiana, it's not just about dictating who gets what after you're gone. It's also about making sure all aspects of your estate are covered, minimizing the burden on your loved ones during a difficult time. Here are seven other forms and documents commonly used alongside the Indiana Last Will and Testament to ensure a comprehensive estate plan.

- Durable Power of Attorney (POA): This document appoints someone to handle your financial affairs if you’re unable to do so yourself due to incapacitation.

- Health Care Proxy: Similar to the Durable Power of Attorney, but specifically for making medical decisions on your behalf if you're unable to make them yourself.

- Living Will: Also known as an advance directive, it outlines your wishes regarding medical treatment if you're terminally ill or permanently unconscious and cannot communicate.

- Revocable Living Trust: Allows you to manage your assets while you're alive and distribute them upon your death, often bypassing the potentially lengthy and costly probate process.

- Beneficiary Designations: Forms that specify who will receive assets that do not pass through the will, such as life insurance policies, retirement accounts, and some bank accounts.

- Funeral Instructions: Although not legally binding in some states, documenting your wishes for your funeral arrangements can relieve your loved ones of making those decisions during a time of grief.

- Inventory of Personal Property: A detailed list of your personal property, along with who you want to inherit each item, can help ensure nothing is overlooked and can simplify the process for your executor.

Each document plays a crucial role in a well-rounded estate plan, offering clarity, certainty, and peace of mind for both you and your loved ones. By understanding and utilizing these documents in concert with your Last Will and Testament, you can create a comprehensive plan that addresses all facets of your estate, ensuring your wishes are carried out and your loved ones are taken care of in the best way possible.

Similar forms

The Indiana Living Will Declaration is closely related to the Last Will and Testament form. Both documents allow individuals to outline their preferences and instructions for the future, but they serve different purposes. The Living Will Declaration specifically addresses wishes regarding medical treatment and life-prolonging measures when one is no longer able to communicate their preferences due to illness or incapacity. This ensures that an individual's healthcare preferences are respected, similar to how a Last Will ensures an individual’s estate is managed according to their wishes upon death.

A Power of Attorney (POA) is another document similar to a Last Will and Testament, focusing on the aspect of granting someone else the authority to make decisions on one's behalf. While a Last Will becomes effective after death, a POA is applicable during one's lifetime. It allows an individual to appoint an agent to manage personal, financial, or medical affairs if they are unable to do so themselves. This parallels the Last Will's function of entrusting an executor with the responsibility of managing and distributing one’s estate.

The Healthcare Proxy, akin to the Last Will and Testament, permits individuals to designate another person to make healthcare decisions for them when they are incapacitated. This document, similar to a Last Will, ensures an individual's specific desires are known and followed, particularly regarding medical treatment and end-of-life care. Both documents reflect the importance of appointing trusted individuals to uphold one's wishes during critical times.

The Trust Agreement shares some similarities with the Last Will and Testament, primarily in managing and passing on assets to beneficiaries. A Trust Agreement can come into effect during an individual's lifetime and continue after their death, providing a level of control and protection over how and when assets are distributed. This compares to a Last Will, which only takes effect upon death and provides a plan for distributing one's estate to named beneficiaries according to their instructions.

Beneficiary Designations on accounts such as retirement plans, life insurance policies, and bank accounts are documents that also function similarly to a Last Will and Testament. These designations specify who will receive the assets in these accounts upon the account holder's death, bypassing the probate process similarly to how specific bequests in a Last Will can expedite the distribution of assets to beneficiaries. However, beneficiary designations take precedence over wishes expressed in a Last Will, highlighting the importance of coordinating these documents.

The Transfer on Death (TOD) or Payable on Death (POD) designations, often used in securities and bank accounts, share a common purpose with the Last Will and Testament by allowing individuals to name beneficiaries to whom the assets will transfer directly upon death. These designations, like a Last Will, help avoid the probate process for these particular assets, ensuring a smoother and faster transfer to beneficiaries. It's a way to manage asset distribution outside of the broad scope of a Last Will, focusing on specific assets rather than the entire estate.

Dos and Don'ts

Filling out the Indiana Last Will and Testament form is a significant step in planning for the future. Here are important dos and don'ts to ensure the process is completed correctly and your wishes are honored.

Dos:

- Do read the instructions carefully before beginning to fill out the form. Understanding each section fully ensures your will is valid and comprehensive.

- Do choose an executor you trust implicitly. This person will be responsible for managing your estate and carrying out your final wishes.

- Do be specific about who receives what. Clearly identify property and beneficiaries to prevent any confusion or disputes later.

- Do sign and date the form in the presence of two witnesses. Witnessing is crucial as it validates the document.

- Do consult with a legal professional if you have complex assets, a blended family, or any other situation that might require expert advice.

- Do keep the document in a safe place, and inform your executor where it is stored. Accessibility is key in times of need.

- Do review and update your will periodically. Life changes such as marriage, divorce, births, and deaths can affect your final wishes.

- Do consider creating a living will or healthcare power of attorney to address medical decisions if you're unable to make them yourself.

- Do include a residuary clause to cover any property not specifically mentioned. This helps ensure all your assets are distributed according to your wishes.

- Do use clear and understandable language to avoid any potential ambiguity or misinterpretation.

Don'ts:

- Don't neglect to name a guardian if you have minor children. Failing to do so leaves their care up to the courts.

- Don't use informal language or nicknames. Always use full legal names to identify beneficiaries and executors clearly.

- Don't forget to sign the document, or it won’t be legally valid. This mistake is simple but critical.

- Don't leave any sections incomplete. An incomplete will could lead to parts of it being invalidated or disregarded.

- Don't witness your own will. Witnesses should be disinterested parties, meaning they do not stand to inherit anything.

- Don't violate state laws regarding disinheritance or other unique provisions without consulting with an attorney.

- Don't attempt to make amendments directly on the will after it's been signed and witnessed. Such changes might not be recognized legally.

- Don't rely solely on a will for items that can be transferred via other means, like life insurance or retirement accounts, which can be directed to beneficiaries outside of a will.

- Don't overlook digital assets. Include instructions for social media accounts, websites, and digital files.

- Don't procrastinate. The best time to prepare a will is now, as unexpected events can happen at any time.

Misconceptions

Creating a Last Will and Testament is an important step in planning for the future. However, when it comes to the Indiana Last Will and Testament form, there are several misconceptions that can lead to confusion and errors. Here are four common myths debunked to help clarify the process.

- You don't need a lawyer to create a valid Will in Indiana. While it's true that Indiana law does not require an attorney's involvement in drafting a Will, seeking legal advice can ensure that your Will meets all legal requirements and accurately reflects your wishes. A lawyer can also advise on complex situations, such as making provisions for a blended family or setting up a trust.

- If you die without a Will in Indiana, your assets automatically go to your spouse. This is a misunderstanding. In reality, if you die intestate (without a Will), Indiana law dictates how your assets are distributed. While your spouse may receive a portion of your estate, other relatives, like your children or parents, may also be entitled to a share. This distribution may not align with your wishes, highlighting the importance of having a Will.

- Oral Wills are just as valid as written ones in Indiana. This is not entirely accurate. Indiana recognizes oral Wills (nuncupative Wills) in very limited circumstances, mainly for those in imminent peril of death and who then die as a result of that peril. These Wills have strict requirements and are limited in what they can cover. Generally, a formally prepared, written Will is necessary to ensure your estate is handled according to your wishes.

- Once executed, you cannot change your Indiana Will. Many people mistakenly believe that once a Will is made, it is set in stone. However, Wills can be modified or completely rewritten at any time before the testator's (the person who made the Will) death, as long as they are of sound mind. This flexibility allows for adjustments following life changes such as marriage, divorce, the birth of children, or a significant change in assets.

Understanding these misconceptions can help ensure that your Indiana Last Will and Testament accurately reflects your final wishes and provides for your loved ones according to your desires. Remember, consulting with a legal professional can provide peace of mind and ensure that all aspects of your estate planning are properly addressed.

Key takeaways

Creating a Last Will and Testament is a significant step in managing your affairs and ensuring your wishes are respected after you're gone. When it comes to the Indiana Last Will and Testament form, here are some key takeaways to consider:

- Ensure the person creating the will, known as the testator, is at least 18 years old and of sound mind. This legal requirement is critical for the document to be valid.

- In Indiana, the Last Will and Testament must be in writing. Oral wills are not recognized by the state.

- The will must be signed by the testator in the presence of two witnesses, who are not beneficiaries in the will. This step is crucial for the document's validity.

- Choose an executor wisely. This person will manage your estate, so it's important they are trustworthy and capable of handling the responsibility.

- Include a self-proving affidavit. Although not mandatory, this step can speed up the probate process. The affidavit is a sworn statement by the witnesses, affirming the testator signed the will in their presence.

- Be specific about your beneficiaries and what you are leaving to them. Clearly identifying people and their inheritances can prevent disputes.

- Consider adding a guardian for minor children, if applicable. This can ensure they are cared for by someone you trust if you pass away before they reach adulthood.

- Regularly review and update your will. Life changes such as marriage, divorce, births, and deaths can affect your final wishes.

- Keep your will in a safe, accessible place. Inform your executor or a trusted family member of its location.

- Know that the Indiana Last Will and Testament does not cover everything. Certain assets, like those passed through joint tenancy or with designated beneficiaries, fall outside the will.

Following these guidelines can help ensure your Indiana Last Will and Testament is legally valid and fully expresses your final wishes. It's also advisable to consult with a legal professional to address any specific concerns or questions regarding your situation.

Popular Last Will and Testament State Forms

Free Ny Will Template - Often includes funeral and burial instructions, helping relieve the family of decision-making burdens during mourning.

Free Will Forms to Print - Helps avoid the state's default inheritance laws by explicitly stating the decedent's wishes.

Printable Last Will and Testament - A will that names executors responsible for managing estate settlement processes.

California Last Will and Testament - This legal form offers a way to reduce potential conflict among surviving family members by clearly documenting your decisions.