Free Last Will and Testament Form for Florida

Planning for the future is an essential step that ensures one's wishes are respected and loved ones are cared for, even after passing. In Florida, as in other states, a Last Will and Testament form plays a critical role in this planning process. This legal document allows individuals to clearly express how they want their assets distributed, who will manage their estate, and even who should become guardians of their children. Florida has specific requirements for these forms to be considered valid, including the need for the will maker to be of sound mind, the document to be witnessed by at least two individuals, and for it to be written with clear intentions. While the process may seem daunting, understanding the significance of each section of the form and how it protects one's wishes and loved ones can alleviate much of the stress and uncertainty commonly associated with estate planning.

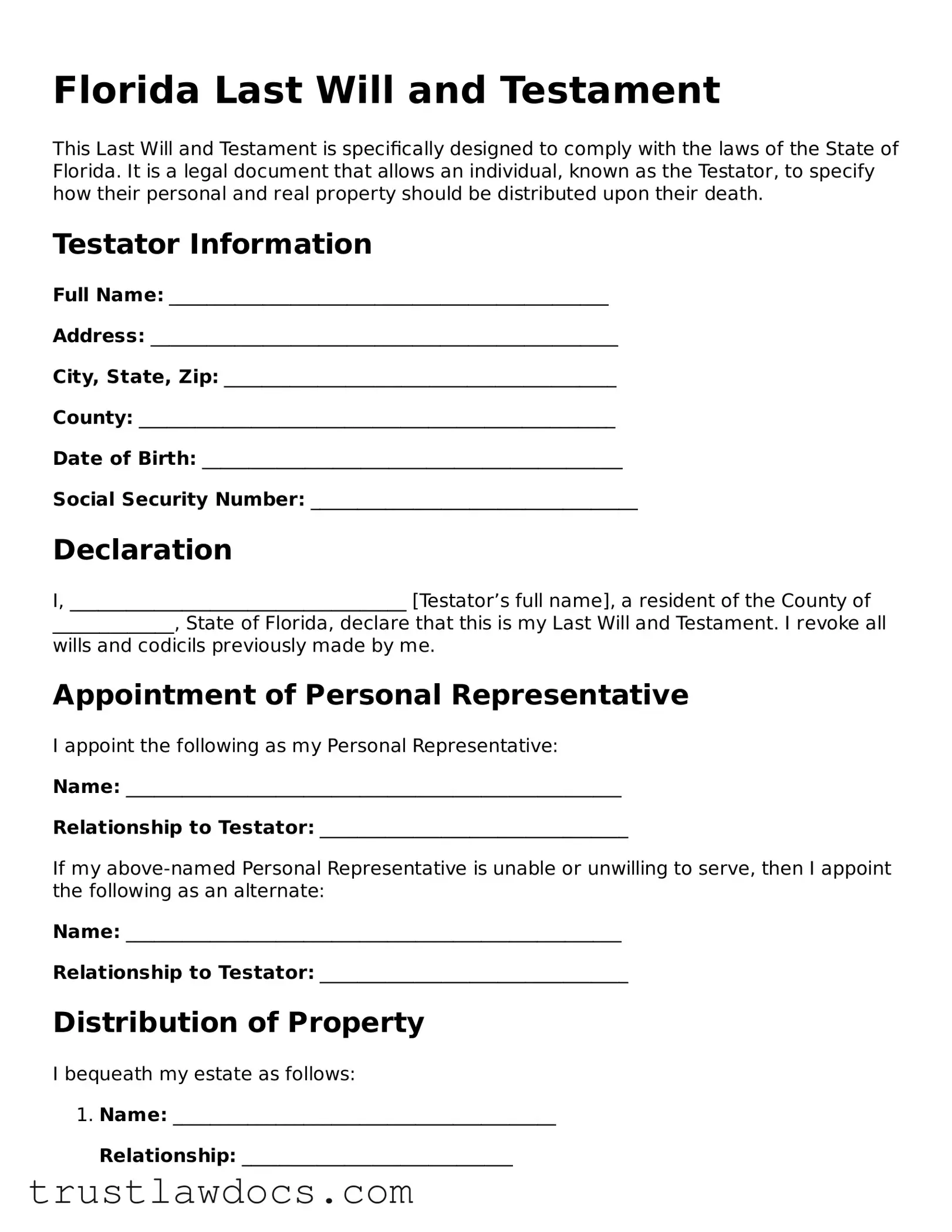

Form Example

Florida Last Will and Testament

This Last Will and Testament is specifically designed to comply with the laws of the State of Florida. It is a legal document that allows an individual, known as the Testator, to specify how their personal and real property should be distributed upon their death.

Testator Information

Full Name: _______________________________________________

Address: __________________________________________________

City, State, Zip: __________________________________________

County: ___________________________________________________

Date of Birth: _____________________________________________

Social Security Number: ___________________________________

Declaration

I, ____________________________________ [Testator’s full name], a resident of the County of _____________, State of Florida, declare that this is my Last Will and Testament. I revoke all wills and codicils previously made by me.

Appointment of Personal Representative

I appoint the following as my Personal Representative:

Name: _____________________________________________________

Relationship to Testator: _________________________________

If my above-named Personal Representative is unable or unwilling to serve, then I appoint the following as an alternate:

Name: _____________________________________________________

Relationship to Testator: _________________________________

Distribution of Property

I bequeath my estate as follows:

- Name: _________________________________________

Relationship: _____________________________

Property/Amount: __________________________

- Name: _________________________________________

Relationship: _____________________________

Property/Amount: __________________________

- Add more as necessary.

Guardianship

If I am the parent or legal guardian of minor children at the time of my death, I appoint the following guardian:

Name: _____________________________________________________

Relationship to Children: __________________________________

Signatures

This document, my Last Will and Testament, has been signed on the ____ day of ____________, 20__.

Testator’s Signature: _______________________________________

Printed Name: _____________________________________________

Witness #1 Signature: ______________________________________

Printed Name: _____________________________________________

Address: __________________________________________________

Witness #2 Signature: ______________________________________

Printed Name: _____________________________________________

Address: __________________________________________________

Notarization

This document was notarized on the ____ day of ____________, 20__, by a notary public of the State of Florida.

Notary Public Signature: ___________________________________

Printed Name: _____________________________________________

Commission Number: _______________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | Florida Statutes, Sections 732.501 to 732.522 (Florida Probate Code) |

| Age Requirement | The person making a will (testator) must be at least 18 years old. |

| Sound Mind Requirement | The testator must be of sound mind at the time of making the will. |

| Signature Requirement | The will must be signed by the testator or at the testator’s direction. |

| Witness Requirement | The will must be signed in the presence of at least two witnesses. |

| Witness Qualification | Witnesses must be at least 18 years old and of sound mind. |

| Self-Proving Affidavit | Florida allows for the will to be made self-proving with a notarized affidavit. |

| Handwritten Wills | Handwritten (holographic) wills are not recognized unless they meet standard requirements for wills in Florida. |

| Oral Wills | Oral (nuncupative) wills are not recognized in Florida. |

How to Write Florida Last Will and Testament

Creating a Last Will and Testament is an essential step in planning for the future. This document allows individuals to outline how they want their possessions to be distributed after they pass away. In Florida, the process has been made straightforward to encourage more people to prepare these vital instructions. Here's a step-by-step guide on how to fill out a Florida Last Will and Testament form, ensuring your wishes are honored and your loved ones are taken care of according to your wishes.

- Gather all necessary information, including the full names and addresses of all beneficiaries (people or organizations you wish to inherit your assets), details of your assets, and the name of the person you want to act as the executor of your will.

- Clearly identify yourself at the beginning of the document with your full legal name and address, confirming that you are creating the will in sound mental health and of your own free will.

- Appoint an executor who will manage the estate and carry out your wishes as outlined in the will. Include the executor’s full name and address.

- Specify beneficiaries for particular assets. Clearly describe the assets and the names of the beneficiaries. If you wish to leave specific items to particular individuals or organizations, list these items clearly along with the recipient’s name.

- For any remaining assets (often referred to as your "residuary estate"), state how these should be distributed. If there are multiple beneficiaries, specify the percentage or part of the estate each will receive.

- If you have minor children, nominate a guardian for them in the event both parents pass away before the children reach adulthood. Include the guardian’s full name and address.

- Include any additional instructions, such as donations to charities, conditions on bequests, or the creation of trusts, if applicable.

- Review the document thoroughly. Ensure all information is accurate and reflects your wishes. Look for any typographical errors or omissions.

- Sign the document in the presence of at least two witnesses. According to Florida law, these witnesses must be at least 18 years old and must not be beneficiaries in the will. All parties involved should sign the will in each other's presence.

- Consider having the will notarized to add an extra layer of authenticity. Although this step is not required by Florida law, it may help to prevent disputes over the validity of the document.

Once you've completed these steps, your Last Will and Testament will be legally binding in Florida. It's wise to keep the document in a safe place and inform the executor of where it is stored. Additionally, it's a good practice to review your will periodically and update it as necessary to reflect any changes in your life or financial situation. Properly planning today can save your loved ones a great deal of stress and confusion in the future.

Get Answers on Florida Last Will and Testament

What is a Last Will and Testament form in Florida?

A Last Will and Testament form in Florida is a legal document that allows individuals, referred to as testators, to specify how they want their property and affairs handled after their death. This document can outline the distribution of assets, name guardians for minor children, and designate executors who will manage the estate's affairs. It's essential for ensuring that one's wishes are respected and legally recognized within the state of Florida.

Who can create a Last Will and Testament in Florida?

In Florida, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. Being of "sound mind" generally means that the person understands the nature of the document they are creating, is aware of their property and the identity of those who are the natural beneficiaries of their estate, and can make decisions about how to distribute their assets. This ensures that the document reflects the testator's genuine intentions and is capable of being legally executed upon their death.

How does one execute a valid Will in Florida?

To execute a valid Will in Florida, the testator must sign the document in the presence of at least two witnesses, who must also sign the Will in the presence of the testator and each other. This process is designed to provide evidence that the Will's creation was voluntary and understood by the testator. It is recommended that the signing be done with a notary public to further affirm the validity of the signatures and the Will itself, although notarization is not a legal requirement in Florida.

Can a Last Will and Testament be changed or revoked in Florida?

Yes, a Last Will and Testament can be changed or revoked at any time by the testator as long as they remain legally competent. This can be done by creating a new Will that states it revokes previous Wills or by physically destroying the previous version with the intention of revoking it. Making changes or revoking a Will allows individuals to reflect changes in their personal circumstances, relationships, or financial situations throughout their lives.

What happens if one dies without a Last Will and Testament in Florida?

If a person dies without a Last Will and Testament in Florida, they are considered to have died "intestate." In such cases, Florida's intestacy laws determine how the deceased's assets will be distributed. These laws prioritize spouses, children, and other close relatives as beneficiaries. However, the distribution under intestacy laws may not always align with what the deceased might have wished, underscoring the importance of having a valid Will.

Are digital Wills legal in Florida?

As of the latest updates, Florida recognizes electronic Wills as legal documents, provided they meet specific requirements. This includes being signed with an electronic signature in the presence of a qualified custodian and observed by two witnesses through audio-video communication technology. However, it's advisable to consult with a legal professional to ensure an electronic Will meets all legal standards and fully captures the testator's intentions.

Common mistakes

Filling out a Last Will and Testament in Florida is a significant step in managing one's estate planning. However, people often make mistakes that can complicate the execution of their wishes. One common error is not adhering to the specific witness requirements of the state. Florida law mandates that a will must be signed in the presence of two witnesses, who must also sign the will in the presence of the testator and each other. This is crucial for the will to be considered valid under Florida law.

Another frequently encountered issue is the failure to update the will regularly. Life events such as marriages, divorces, the birth of children, or the acquisition of significant assets can significantly alter one's estate planning needs. A will that isn't updated to reflect these changes may not adequately express the current intentions of the testator, leading to potential disputes among beneficiaries or even causing the will to be challenged in court.

People often mistakenly believe that a will is the perfect tool for all types of asset distributions. However, certain assets, such as those held in joint tenancy or those with designated beneficiaries (like life insurance policies or retirement accounts), pass outside of a will. Not recognizing these distinctions can result in unintended consequences, where the assets do not go to the intended beneficiary under the will.

Attempting to include illegal or unenforceable provisions is another common error. For example, in Florida, you cannot completely disinherit your spouse without a legally binding agreement; they are entitled to a portion of the estate due to the elective share laws. Including such provisions can lead to portions of the will being invalidated or lead to increased legal costs and delays in the probate process.

Giving too much power to an executor without proper oversight can also be problematic. While it's crucial to appoint someone you trust as the executor of your will, providing unchecked authority can lead to abuses of power. It's advisable to include provisions that ensure accountability and transparency in the administration of the estate.

Failing to consider the tax implications of inheritance is yet another oversight. While Florida does not have a state estate or inheritance tax, the federal estate tax can affect larger estates. Not structuring a will to minimize tax liabilities can result in a significant portion of the estate being lost to taxes, rather than going to beneficiaries.

Lastly, trying to execute a Last Will and Testament without professional guidance is a significant misstep. Estate laws can be complex, and small errors in the drafting or execution of a will can invalidate the entire document. Seeking the advice of a legal professional ensures that the will is valid, reflects the testator's wishes accurately, and complies with Florida law.

Documents used along the form

When planning for the future, a Last Will and Testament is a crucial document that ensures your wishes are honored after you pass away. However, it often goes hand in hand with a variety of other forms and documents that help provide a comprehensive estate plan. Below is a list of additional documents that are commonly used in conjunction with the Florida Last Will and Testament form to ensure all aspects of your affairs are covered.

- Living Will: This document outlines your wishes regarding medical treatment in situations where you can no longer communicate your decisions due to illness or incapacity.

- Health Care Surrogate Designation: It allows you to appoint someone to make medical decisions on your behalf if you're unable to make them yourself.

- Durable Power of Attorney: This grants a trusted person the authority to handle your financial affairs, making decisions about your property and finances if you are unable to do so.

- Designation of Pre-Need Guardian: In the event you become incapacitated, this document specifies your choice for a guardian to oversee your personal and financial matters.

- Living Trust: A versatile tool for estate planning that allows you to place assets in a trust to be managed by a trustee for the benefit of your designated beneficiaries.

- HIPAA Release Form: This form is necessary to give designated individuals the right to access your medical records and make informed health care decisions on your behalf.

- Declaration of Preneed Guardian for Minor: This specifies your choice of guardian for your minor children in the event of your death or incapacity.

- Personal Property Memorandum: Often accompanying a will, it allows you to specify who should receive personal property items that may not be covered in the will itself.

- Funeral Planning Declaration: This document lets you outline your wishes for your funeral services, including the disposition of your remains, relieving your loved ones of these difficult decisions.

Together, these documents form a safety net, ensuring that both your personal and financial matters are taken care of according to your wishes. Properly executed, they provide peace of mind to you and your loved ones by making sure there's clarity in your intentions and legality in their execution. Remember, estate planning is a profound step in caring for your loved ones, even when you're not around to do it in person.

Similar forms

The Florida Last Will and Testament form shares similarities with a Living Will, primarily in how both documents allow individuals to outline their preferences for the future. While a Last Will and Testament focuses on the distribution of assets and guardianship of minors upon one's death, a Living Will deals with medical treatments and end-of-life care preferences while the individual is still alive but unable to communicate their wishes. Both documents serve to ensure an individual's wishes are respected, albeit in different circumstances.

Comparable to the Last Will and Testament is the Power of Attorney (POA) document, which also revolves around preparing for futures where the individual may not be able to make decisions for themselves. However, unlike a Last Will that activates upon death, a POA is effective during the individual's lifetime, allowing a designated agent to make financial, legal, or health decisions on their behalf. Both documents are proactive measures granting control over one's personal matters, but they operate within different timeframes and scopes of authority.

The Trust document, particularly a revocable living trust, shares a key similarity with a Last Will in the aspect of asset management and distribution. Both instruments allow for the delineation of what happens to an individual's assets upon their death. However, a trust has the added advantage of avoiding probate court, potentially saving time and money. While a Last Will activates after death and requires probate, a trust takes effect immediately upon creation and continues after the individual's death, providing a smoother transition of assets.

The Advance Directive is an umbrella term that encompasses several types of healthcare directives, including Living Wills and durable powers of attorney for healthcare. It is similar to a Last Will in its foresight and provision for future incapacitation. However, its focus is strictly on healthcare decisions, such as treatment preferences and the appointment of a healthcare proxy, contrasting with a Last Will’s emphasis on financial and guardianship matters after death. Both documents empower individuals to make preemptive decisions about their lives and care.

A Codicil to a Will bears direct relevance to a Last Will and Testament as it is essentially an amendment made to the will. It allows the will's author to make changes or additions without having to draft a new document entirely. Both a Codicil and the original Will aim to clearly communicate the individual's final wishes, but a Codicil is specifically for modifications post-creation of the initial will, reflecting changes in circumstances or desires.

Similarly, a “Transfer on Death” (TOD) designation is related to a Last Will in the way it handles the distribution of certain assets upon the owner’s death. It allows for assets like financial accounts and real estate to be directly transferred to a beneficiary without going through probate court, similar to how assets might be assigned in a Will. While a Last Will provides a broad reach over an individual’s estate, a TOD designation deals with specific assets, streamlining the process for those assets to bypass probate directly.

A Digital Assets Will, while a more modern adaptation, parallels the traditional Last Will in its intent to manage assets after death. It focuses specifically on digital property, such as social media accounts, digital currencies, and online accounts, ensuring they are handled according to the deceased's wishes. Like a Last Will, it eases the burden on family members by providing clear instructions for digital assets, though its scope is restricted to the digital realm, highlighting the evolution of asset management in the digital age.

Dos and Don'ts

When filling out the Florida Last Will and Testament form, certain practices should be followed to ensure the document is valid and reflects your wishes accurately. Below are lists of what you should and shouldn't do during this process.

Do's:

- Read the form carefully before you start filling it out. This ensures you understand each section and its requirements.

- Be specific in your wishes, especially when identifying beneficiaries and detailing the distribution of your assets.

- Use a blue or black ink pen if filling out the form by hand, as these colors are generally recognized for legal documents.

- Have the document reviewed by a legal professional to ensure it complies with Florida law and best practices.

- Ensure the form is signed in the presence of two witnesses, as required by Florida law for a last will and testament to be valid.

- Keep the document in a safe, secure place where your executor or personal representative can access it when necessary.

- Consider attaching a supplemental document that lists assets and important digital account passwords, providing a comprehensive overview of what you're leaving behind.

Don'ts:

- Don't leave any sections blank. If a section doesn't apply, write "N/A" (not applicable) to indicate you didn't overlook it.

- Don't use ambiguous language that could be open to interpretation. Be clear and precise in your wording.

- Don't forget to update your will after significant life events such as marriage, divorce, the birth of a child, or the death of a beneficiary.

- Don't attempt to disinherit your spouse without understanding Florida's laws regarding spousal rights to your estate.

- Don't sign without witnesses present, as their signatures are required to validate the will.

- Don't use a digital signature, since physical signatures are usually required for such legal documents in Florida.

- Don't keep your last will and testament a secret from your executor or the person you've chosen to handle your estate.

Misconceptions

When preparing a Florida Last Will and Testament, individuals often face misconceptions regarding its preparation and requirements. This document is crucial for outlining how one's assets and responsibilities are to be handled after their passing, ensuring clarity and easing the process for loved ones. Here, we address and clarify some common misconceptions to provide a better understanding.

Oral wills are just as valid as written ones in Florida: This is not accurate. Florida law requires that a Last Will and Testament be in writing. Oral wills, also known as nuncupative wills, are generally not recognized in Florida, emphasizing the importance of documenting your wishes in a written will.

Only the elderly or wealthy need a Last Will and Testament: This misconception fails to account for the universal benefit of having a will, regardless of age or wealth. A will is critical for anyone who wishes to make decisions about their estate, guardianship matters if they have minor children, and how their affairs should be handled after their death. It gives peace of mind and ensures that your wishes, not state laws, will guide the distribution of your assets.

A Last Will and Testament in Florida does not need to be witnessed: Florida law mandates that at least two witnesses must be present to observe the signing (execution) of the will. Moreover, these witnesses must also sign the will, attesting to the validity of the document and the sanity and free will of the testator (the person to whom the will belongs).

All assets can be distributed through a Will in Florida: Some assets, such as life insurance proceeds, retirement accounts, and certain jointly held properties, typically pass to the named beneficiaries or surviving co-owners outside of the provisions of a will. Therefore, it's important to understand that a Last Will and Testament does not cover the distribution of all types of property.

A self-prepared Will is always sufficient: While it's legally permissible to prepare your own Last Will and Testament, there can be complexities and specific state requirements that if not properly addressed, might invalidate your will. Seeking advice from a legal professional can help ensure your will meets all Florida legal standards and truly reflects your wishes.

Updating a Will is unnecessary after it’s made: Over time, personal circumstances and relationships change, which can affect your decisions on asset distribution and guardianship. Furthermore, changes in laws may affect the validity of your will or certain provisions within it. It’s prudent to review and possibly update your will periodically or after major life events to ensure it continues to accurately reflect your wishes and legal standards.

Key takeaways

Filling out and using the Florida Last Will and Testament form is an important step in planning one’s estate. It ensures one's wishes are honored after passing away. Here are key takeaways to consider when dealing with this form:

- Legal Requirements: Florida law specifies certain legal requirements for a Last Will and Testament to be valid. These include being 18 years of age or older, of sound mind, and having the Will signed in the presence of two witnesses who also sign the document.

- Witnesses: The two witnesses must be present at the same time to watch the signing of the document and then sign it themselves. Choosing witnesses who are not beneficiaries can help avoid potential conflicts of interest.

- Self-Proving Affidavit: Although not required, including a self-proving affidavit can simplify the probate process. This affidavit is a sworn statement by the witnesses, signed in front of a notary, confirming the validity of the Will and signatures.

- Be Specific: Clearly identify all assets and to whom they should be distributed. Ambiguities can lead to disputes and complicate the probate process.

- Appoint an Executor: Choose a reliable and trustworthy executor to manage your estate. This individual will be responsible for carrying out your wishes as stated in the Will.

- Guardianship: If you have minor children, specifying a guardian to care for them is crucial. This can prevent contentious court battles and ensure your children are cared for according to your wishes.

- Regular Updates: Life changes such as marriage, divorce, the birth of a child, or the acquisition of significant assets necessitate updates to your Will. Ensure it always reflects your current wishes.

- Secure Storage: Keep your Will in a safe place where your executor can access it when needed. A secure yet accessible location is important to ensure your Will can be executed without unnecessary delays.

- Legal Advice: Considering the complexities involved in estate planning, consulting with a legal professional can provide clarity and ensure that your Will is valid and effective in carrying out your wishes.

Popular Last Will and Testament State Forms

California Last Will and Testament - A well-prepared Will can also minimize taxes and other expenses, maximizing the inheritance for your beneficiaries.

How to Make a Will in Indiana - It's crucial for avoiding probate issues, speeding up the distribution process of your assets to your beneficiaries, and minimizing potential conflicts.