Free Last Will and Testament Form for California

In the state of California, preparing a Last Will and Testament is a critical step for individuals looking to ensure their wishes are honored regarding the distribution of their estate after their passing. This legal document serves as a personal declaration where one can specify beneficiaries for their possessions and assets, appoint guardians for minor children, and designate an executor who will oversee the estate's distribution as per the will's instructions. Tailored to comply with California state laws, the form must meet specific criteria, such as being signed by the testator (the person making the will) in the presence of at least two witnesses, to be considered valid. It provides a clear, legally-binding path for handling one’s affairs, helping to avoid potential disputes among heirs and ensuring that personal and financial matters are resolved according to the testator's wishes. Crafting a Last Will and Testament is a straightforward yet profound way to offer peace of mind to both the individual creating the document and their loved ones, delineating a clear plan for the future.

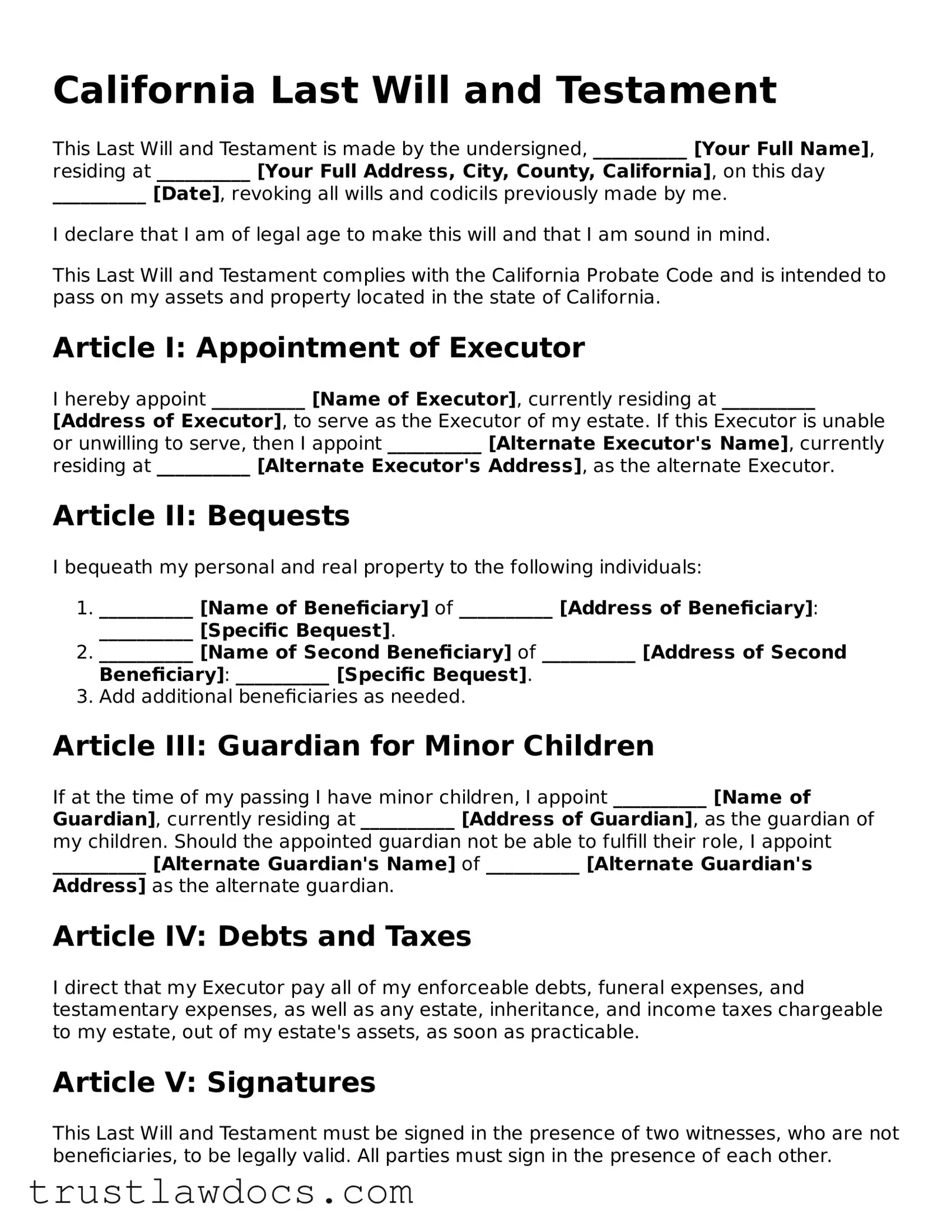

Form Example

California Last Will and Testament

This Last Will and Testament is made by the undersigned, __________ [Your Full Name], residing at __________ [Your Full Address, City, County, California], on this day __________ [Date], revoking all wills and codicils previously made by me.

I declare that I am of legal age to make this will and that I am sound in mind.

This Last Will and Testament complies with the California Probate Code and is intended to pass on my assets and property located in the state of California.

Article I: Appointment of Executor

I hereby appoint __________ [Name of Executor], currently residing at __________ [Address of Executor], to serve as the Executor of my estate. If this Executor is unable or unwilling to serve, then I appoint __________ [Alternate Executor's Name], currently residing at __________ [Alternate Executor's Address], as the alternate Executor.

Article II: Bequests

I bequeath my personal and real property to the following individuals:

- __________ [Name of Beneficiary] of __________ [Address of Beneficiary]: __________ [Specific Bequest].

- __________ [Name of Second Beneficiary] of __________ [Address of Second Beneficiary]: __________ [Specific Bequest].

- Add additional beneficiaries as needed.

Article III: Guardian for Minor Children

If at the time of my passing I have minor children, I appoint __________ [Name of Guardian], currently residing at __________ [Address of Guardian], as the guardian of my children. Should the appointed guardian not be able to fulfill their role, I appoint __________ [Alternate Guardian's Name] of __________ [Alternate Guardian's Address] as the alternate guardian.

Article IV: Debts and Taxes

I direct that my Executor pay all of my enforceable debts, funeral expenses, and testamentary expenses, as well as any estate, inheritance, and income taxes chargeable to my estate, out of my estate's assets, as soon as practicable.

Article V: Signatures

This Last Will and Testament must be signed in the presence of two witnesses, who are not beneficiaries, to be legally valid. All parties must sign in the presence of each other.

Witnessed by:

- Witness #1 Name: __________ [Witness #1 Name], Signature: __________ [Witness #1 Signature], Date: __________ [Date]

- Witness #2 Name: __________ [Witness #2 Name], Signature: __________ [Witness #2 Signature], Date: __________ [Date]

Executed by:

__________ [Your Signature]

__________ [Your Name Printed]

Date: __________ [Date]

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | The California Last Will and Testament must be in writing. |

| 2 | The person creating the Will (Testator) must be at least 18 years old. |

| 3 | The Testator must be of sound mind at the time of creating the Will. |

| 4 | The Will must be signed by the Testator or by another person under the Testator's direction and in the Testator's presence. |

| 5 | The signing of the Will must be witnessed by at least two individuals who are present at the same time and understand that the document is the Testator's Will. |

| 6 | Witnesses must be adults and should not be beneficiaries of the Will. |

| 7 | Governing Law: California Probate Code governs the Last Will and Testament in California. |

How to Write California Last Will and Testament

Filling out a Last Will and Testament in California is a crucial step in managing your estate and ensuring your wishes are followed after your passing. This document spells out how you'd like your assets distributed, who should care for any dependents, and even directions for your digital legacy. It's a poignant reminder of life's finite nature but also a powerful tool for guiding those you leave behind. While the thought of drafting a Will can seem daunting, breaking down the process into simple steps can make it manageable and less intimidating.

Here is how to fill out a California Last Will and Testament form:

- Determine your assets and debts. List everything you own and owe. This overview helps in deciding how to distribute your belongings.

- Choose an executor. This person will manage your estate according to your wishes. Consider someone trustworthy and capable of handling financial and legal matters.

- Select beneficiaries. Decide who will inherit your assets. These can be family members, friends, or charitable organizations.

- Appoint a guardian for minor children, if applicable. If you have minor children, choosing a guardian for them is crucial. Think about who would best respect your parenting wishes.

- Write out specific legacies. If you have particular items you want to go to certain individuals, like family heirlooms or personal effects, list these along with the names of the recipients.

- Sign the Will in front of witnesses. California law requires your Will to be signed in the presence of two witnesses. These witnesses must also sign, affirming they watched you sign the document and believe you to be of sound mind.

- Store your Will safely. Keep your Will in a safe place where your executor can access it when needed. Consider a fireproof safe or a safe deposit box.

Completing your Last Will and Testament is a significant accomplishment in planning for the future. It's advisable to consult with a legal professional, especially for complex estates or unique family situations, to ensure your Will complies with California laws and fully encapsulates your wishes. Remember, life's circumstances change, and so should your Will. Review and update your Will regularly or after major life events to keep it reflective of your current situation.

Get Answers on California Last Will and Testament

What is a California Last Will and Testament?

A California Last Will and Testament is a legal document that allows an individual, known as the testator, to specify how they would like their property and assets to be distributed upon their death. It also allows them to nominate an executor who will manage the estate and ensure that their wishes are carried out.

Who can create a Last Will and Testament in California?

In California, any individual who is 18 years of age or older and of sound mind can create a Last Will and Testament. This means the individual must be capable of making decisions and understanding the consequences of those decisions regarding the disposition of their property.

Does a California Last Will need to be notarized?

No, a California Last Will and Testament does not need to be notarized to be considered valid. However, it must be signed by the testator in the presence of two witnesses, who must also sign the document, acknowledging that they witnessed the testator's signature. These requirements are crucial for the document to be legally binding.

Can I include my children in the California Last Will and Testament?

Yes, you can include provisions for your children in your Last Will and Testament. You can specify guardians for minor children in the event of your death, and you can also outline how you wish your assets to be distributed to them, whether equally, in specific portions, or through a trust.

What happens if I die without a Last Will and Testament in California?

If you die without a Last Will and Testament in California, your assets will be distributed according to the state's intestacy laws. This means the state determines who inherits your property, which might not align with your wishes. Typically, assets are distributed to the closest relatives, such as spouses, children, parents, or siblings, in a predefined order.

Can I change my Last Will and Testament once it’s been created?

Yes, you can change your Last Will and Testament at any time as long as you are of sound mind. This is often done through a document called a codicil, which is an amendment to your will. The codicil must be executed with the same formalities as the original will. It's also possible to revoke a will entirely and create a new one.

Are digital assets included in the California Last Will and Testament?

Yes, digital assets can and should be included in your Last Will and Testament. This includes everything from social media accounts to digital currencies and online businesses. You should provide clear instructions on how these assets should be handled, including providing necessary access information while ensuring compliance with applicable privacy laws.

What is the role of an executor in a California Last Will?

The executor is the individual nominated by the testator in their Last Will and Testament to carry out the instructions contained within the will. This includes paying any debts or taxes on behalf of the estate and distributing assets to the beneficiaries as specified in the will. The executor has a legal responsibility to manage the estate in the best interests of the beneficiaries and according to the testator’s wishes.

Common mistakes

Filling out a California Last Will and Testament form is an important step in planning for the future. However, mistakes can be easily made, leading to potential complications. One common error is not adhering to the strict witness requirements. California law mandates the presence of two witnesses during the signing process. These witnesses cannot be beneficiaries of the will, a fact often overlooked. The oversight could invalidate the will or result in legal disputes among heirs.

Another critical mistake is assuming that all assets can be distributed through a will. Certain assets, such as those in a living trust, retirement accounts, and life insurance policies with named beneficiaries, are not governed by wills. Without understanding which assets are controlled by the will, individuals may inadvertently leave incomplete instructions or have unrealistic expectations about the distribution of their estate.

Failure to update the will is yet another common pitfall. Life changes such as marriage, divorce, the birth of children, or the death of a beneficiary can significantly alter one's intentions for estate distribution. Not updating the will to reflect these changes can result in assets being distributed in ways that no longer align with the person's wishes. This oversight underscores the importance of reviewing and possibly revising the will periodically.

Many people make the mistake of not being specific enough when detailing the distribution of personal items. Vague instructions can lead to disputes among heirs. Precise identification of items and their intended recipients minimizes the risk of misinterpretation and conflict.

Underestimating the importance of appointing an executor is another common error. Some individuals choose an executor without considering whether the person is willing, able, and knowledgeable enough to manage their estate after they're gone. This can result in mismanagement of the estate or even refusal by the chosen individual to serve, creating a need for court intervention.

Lastly, a frequent mistake is attempting to use the will to make arrangements that legally cannot be included, such as funeral instructions or the establishment of a trust. These elements should be communicated through separate legal documents to ensure they are respected and followed. Including them in a will, where they have no legal standing, can lead to confusion and unnecessary complications.

Documents used along the form

When preparing for the future, especially in terms of estate planning, a Last Will and Testament form is a critical document. However, in California, to ensure a comprehensive approach to estate planning, several other forms and documents are also commonly used along with the Last Will and Testament. These documents help cover a wide range of considerations from healthcare decisions to the management of one’s estate in the event of incapacitation.

- Advance Health Care Directive (AHCD): This document allows individuals to outline their preferences for medical care if they become unable to make decisions for themselves due to incapacitation. It also includes the appointment of a healthcare representative.

- Power of Attorney (POA): A legal document that grants another person the authority to make financial decisions and transactions on behalf of the individual, should they become unable to do so themselves.

- Durable Power of Attorney for Health Care: Similar to the AHCD, this specifies an individual's healthcare preferences in detail and appoints a healthcare agent to make decisions on their behalf.

- Living Trust: Often used alongside a Last Will and Testament, this document helps individuals manage their assets during their lifetime and distribute them after death, without the need for probate.

- Financial Inventory: While not a formal legal document, this inventory lists all significant financial assets and liabilities, providing a clear picture of the estate for executors and beneficiaries.

- Guardianship Designation: This document is essential for parents or guardians of minors, specifying their choice of guardian for their children in the event of the parents’ untimely demise.

- Letter of Intent: A supplementary document to a will that provides additional instructions and clarifications to the executor and beneficiaries about personal wishes regarding the estate.

- Property Deed Transfers Upon Death (TOD): Such deeds allow property owners in California to name beneficiaries who will receive the property upon the owner’s death, bypassing the probate process.

- Digital Asset Management Plan: With the rise of digital property, including online accounts and digital assets, this plan outlines how these should be handled after death.

While the Last Will and Testament serves as the foundation of a good estate plan, integrating it with other legal documents ensures a robust strategy that can address a wide array of personal and financial circumstances. Properly preparing these forms can significantly ease the transition for loved ones, ensuring that one's wishes are honored and reducing the potential for disputes among survivors.

Similar forms

The California Living Trust is a document that, like the Last Will and Testament, allows an individual to outline how they want their assets distributed after their death. However, a living trust has an added benefit of avoiding probate, the often lengthy and costly court process that a will must go through. The individual creating the trust, known as the trustor, can also control the assets during their lifetime, appointing themselves as the trustee.

A Power of Attorney is another document closely related to a Last Will and Testament, as it allows an individual to designate someone to manage their financial affairs. While a Last Will and Testament becomes effective only after death, a Power of Attorney is effective during the individual's lifetime, especially if they become incapacitated and unable to make decisions on their own.

The Advance Healthcare Directive, much like a Last Will, directs actions to be taken on an individual's behalf, but in this case, it concerns medical decisions rather than the distribution of assets. It lets individuals specify their healthcare wishes in the event that they are unable to communicate them directly, including treatments they do or do not want.

A Pour-Over Will works in conjunction with a Living Trust, capturing any assets that were not placed into the trust during the individual's lifetime. When the individual passes away, the Pour-Over Will directs these assets into the trust, ensuring they are distributed according to the trust's terms. It acts as a safety net, similar to a Last Will, but specifically for the benefit of a pre-existing trust.

The Financial Inventory Form, while not a directive document like a Last Will, complements it by providing a detailed account of an individual's assets and liabilities. This form aids in the estate planning process, offering a clear picture of what assets are available for distribution and helping to ensure that no significant assets are overlooked when drafting a Last Will and Testament.

A Guardianship Nomination is a document that allows an individual to designate a guardian for their minor children in the event of their death, which is a common provision included in a Last Will and Testament. The key difference is that a stand-alone Guardianship Nomination might be more readily accessible and can be acted upon immediately if needed, separate from the will's other provisions.

A Digital Assets Will is a modern supplement to a traditional Last Will and Testament, specifically designed to handle the management and distribution of an individual's digital assets, such as social media accounts, digital currencies, and online businesses, after death. While a Last Will encompasses all assets, a Digital Assets Will focuses on the intricacies of digital estate planning, emphasizing the unique aspects of digital asset management.

Last, the Estate Planning Letter of Instruction is an informal document that complements a Last Will by providing personalized guidance and information that doesn't fit into the formal will structure. It can include accounts and passwords, location of important documents, and personal wishes regarding funeral arrangements. While not legally binding, it helps executors and beneficiaries navigate the estate with the decedent's personal insights and directions.

Dos and Don'ts

Creating a Last Will and Testament is a crucial step in ensuring your estate is handled according to your wishes after you pass away. In California, the process involves completing a form with precision and care. Here are some essential dos and don'ts to keep in mind when filling out your California Last Will and Testament form:

Do:- Review estate laws in California: Understanding California's specific requirements will help ensure your will is valid.

- Provide clear information: Ensure all names, addresses, and other details are accurate and spelled correctly.

- Choose an executor you trust: This person will handle your estate, so select someone responsible and trustworthy.

- Be specific about your beneficiaries: Clearly indicate who should inherit your assets, including any organizations or charities.

- Sign in the presence of witnesses: California law requires your will to be signed in the presence of at least two witnesses who are not beneficiaries.

- Consider a self-proving affidavit: Although not required, this can speed up the probate process after your death.

- Store your will safely: Keep it in a secure location where your executor can easily access it when needed.

- Ignore state-specific forms: Using the wrong form can invalidate your will, so ensure you're filling out the correct one for California.

- Attempt to disinherit your spouse without understanding California law: California is a community property state, and spousal rights are protected.

- Forget to update your will: Life changes, such as marriage, divorce, or the birth of a child, require updates to your will.

- Use ambiguous language: Vague terms can lead to disputes among your heirs and potential litigation.

- Leave out digital assets: In today's world, digital assets like social media accounts and digital currencies should also be included.

- Rely solely on oral instructions: Verbal wishes are not legally binding in estate matters.

- Fail to consult with an attorney: Although not mandatory, getting legal advice can help avoid common pitfalls and ensure your will complies with state laws.

Misconceptions

When it comes to creating a Last Will and Testament in California, there are several misconceptions that can lead to confusion. Understanding the truth behind these common myths can ensure that individuals create a document that accurately reflects their wishes and complies with state law.

- Myth 1: A Last Will and Testament in California does not need to be notarized to be valid. While it's true that California law does not require a will to be notarized to be considered legally valid, it must be signed by two witnesses who do not stand to inherit anything from the will. Notarization, however, can be beneficial as it can help authenticate the document.

- Myth 2: All assets can be distributed through a Last Will and Testament. Certain types of assets, such as those held in joint tenancy, retirement accounts with designated beneficiaries, and life insurance policies, are not covered by a will. These assets pass directly to the named beneficiaries outside of the will's provisions.

- Myth 3: If you die without a Last Will and Testament in California, the state takes all your assets. This is not accurate. If someone dies intestate (without a will), their assets are distributed according to California's intestacy laws. The law outlines a hierarchy of heirs, starting with the deceased's spouse and children, followed by other relatives. The state only claims assets if there are no surviving relatives.

- Myth 4: You only need to make a Last Will and Testament once, and it applies forever. Circumstances and laws change, which may necessitate updates to a will. It is wise to review and possibly update a will after significant life events such as marriage, divorce, the birth of a child, or the acquisition of substantial assets.

- Myth 5: A handwritten (holographic) will is not valid in California. California law recognizes handwritten, or holographic, wills as long as the material provisions and the testator's signature are in the handwriting of the person making the will. Though valid, the lack of witnesses can sometimes complicate the probate process.

Dispelling these myths is crucial for creating a Last Will and Testament that effectively communicates an individual's wishes and operates as intended under California law. Everyone's situation is unique, so it may also be advisable to consult with a legal professional when drafting a will.

Key takeaways

When preparing a Last Will and Testament in California, individuals are taking a significant step in managing their affairs and leaving clear instructions for the distribution of their assets after they pass away. This process, although personal, is governed by specific state laws that ensure the wishes of the deceased are honored and conflicts among survivors are minimized. The following are key takeaways to keep in mind when filling out and using the California Last Will and Testament form:

- Understanding California laws is crucial before beginning. California has specific requirements that dictate how a Will must be executed to be considered valid.

- Complete all sections of the form to avoid any ambiguity that could lead to disputes among heirs or the Will being challenged in probate court.

- Be specific about who gets what. Clearly identify each beneficiary and specify the assets or portion of the estate they are to receive.

- Choosing an executor carefully is essential. This person will manage the estate and ensure your wishes are carried out as specified. They should be trustworthy and capable of handling the responsibilities involved.

- Signing requirements must be strictly followed. In California, a Last Will and Testament must be signed by the testator in the presence of two witnesses, who must also sign the document.

- Consider a self-proving affidavit. Although not required, this can speed up the probate process because it verifies the legitimacy of the Will without having to contact the witnesses later.

- Storing the Will in a safe and accessible location is important. Inform the executor and other critical parties of where it can be found when needed.

- Review and update the Will as necessary. Life changes, such as marriage, divorce, births, deaths, and significant changes in assets, should prompt a review and possible update of the document.

- Consider seeking professional guidance. Although one can fill out a Last Will and Testament independently, complex estates or special wishes might require the advice of legal and financial professionals.

By keeping these key points in mind, individuals can create a comprehensive and legally sound Last Will and Testament that ensures their wishes are respected and their loved ones are taken care of according to their desires.

Popular Last Will and Testament State Forms

Printable Last Will and Testament - Document articulating a person's wishes for the handling of their estate upon their death.

Online Will Michigan - Specifies the distribution of investment accounts and ensures that beneficiary designations are aligned with the will.