Official Last Will and Testament Document

Planning for the future, especially in the context of ensuring that one's wishes are respected after they pass away, is a crucial consideration for individuals of all ages and backgrounds. A Last Will and Testament form serves as a cornerstone in this planning process, offering a legally binding means to distribute a person's assets, specify guardianship for minor children, and articulate any final wishes regarding the disposition of their estate. The importance of this document cannot be overstated; it provides peace of mind to both the person creating it and their loved ones, by clearly outlining how assets should be handled and ensuring that personal wishes are followed. Furthermore, by having a Last Will and Testament in place, individuals can minimize the potential for disputes among family members, streamline the legal process, and potentially reduce estate taxes, making the aftermath of their passing as smooth and conflict-free as possible.

Last Will and Testament Document Types

Form Example

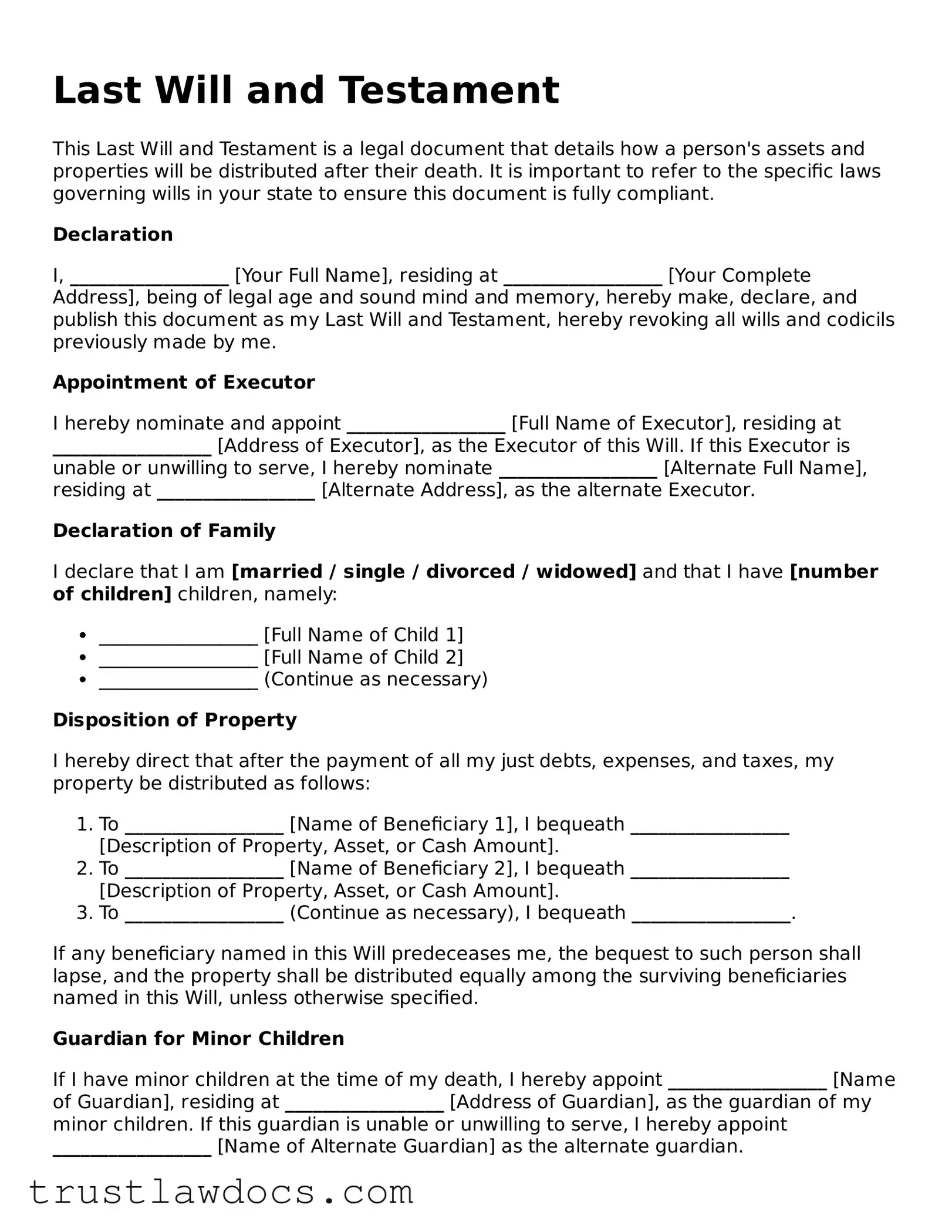

Last Will and Testament

This Last Will and Testament is a legal document that details how a person's assets and properties will be distributed after their death. It is important to refer to the specific laws governing wills in your state to ensure this document is fully compliant.

Declaration

I, _________________ [Your Full Name], residing at _________________ [Your Complete Address], being of legal age and sound mind and memory, hereby make, declare, and publish this document as my Last Will and Testament, hereby revoking all wills and codicils previously made by me.

Appointment of Executor

I hereby nominate and appoint _________________ [Full Name of Executor], residing at _________________ [Address of Executor], as the Executor of this Will. If this Executor is unable or unwilling to serve, I hereby nominate _________________ [Alternate Full Name], residing at _________________ [Alternate Address], as the alternate Executor.

Declaration of Family

I declare that I am [married / single / divorced / widowed] and that I have [number of children] children, namely:

- _________________ [Full Name of Child 1]

- _________________ [Full Name of Child 2]

- _________________ (Continue as necessary)

Disposition of Property

I hereby direct that after the payment of all my just debts, expenses, and taxes, my property be distributed as follows:

- To _________________ [Name of Beneficiary 1], I bequeath _________________ [Description of Property, Asset, or Cash Amount].

- To _________________ [Name of Beneficiary 2], I bequeath _________________ [Description of Property, Asset, or Cash Amount].

- To _________________ (Continue as necessary), I bequeath _________________.

If any beneficiary named in this Will predeceases me, the bequest to such person shall lapse, and the property shall be distributed equally among the surviving beneficiaries named in this Will, unless otherwise specified.

Guardian for Minor Children

If I have minor children at the time of my death, I hereby appoint _________________ [Name of Guardian], residing at _________________ [Address of Guardian], as the guardian of my minor children. If this guardian is unable or unwilling to serve, I hereby appoint _________________ [Name of Alternate Guardian] as the alternate guardian.

Signatures

This Will shall be effective only upon my death and after it is signed in the presence of witnesses. To validate this Will, it must be signed by me or at my direction and acknowledged by me in the presence of two witnesses, who must also sign this Will in my presence.

In witness whereof, I have hereunto set my hand and seal this ____ day of ____, 20____.

__________________________________

[Your Signature]

__________________________________

[Witness 1 Name and Signature]

__________________________________

[Witness 2 Name and Signature]

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets and properties will be distributed after their death. |

| Components | Typically includes the identification of the testator, appointment of an executor, details on asset distribution, and beneficiaries. |

| Witness Requirement | Most states require the will to be witnessed by at least two individuals who are not beneficiaries of the will. |

| Executor | An executor is named to manage the estate, ensuring that the will's instructions are carried out as written. |

| Revocation | A will can be revoked or amended by the testator at any time before their death, through a codicil or by creating a new will. |

| State-Specific Laws | Each state has its own laws governing the creation and execution of wills, including witness requirements and what constitutes a valid will. |

| Probate Process | After death, the will is typically submitted to probate court to verify its validity and oversee the estate's distribution. |

| Intestacy | If a person dies without a will, state intestacy laws determine the distribution of their assets, which may not align with their wishes. |

| Legal Advice | It's advisable to consult with a legal professional when creating a will to ensure it complies with state laws and fully captures the testator's intentions. |

How to Write Last Will and Testament

Creating a Last Will and Testament is a vital step in planning for the future. It ensures your wishes regarding the distribution of your property and the care of any minor children are respected. Although the process may seem daunting at first, by following a simple step-by-step guide, you can complete your Last Will and Testament efficiently and accurately. Remember, it's important to review your will periodically and make necessary updates to reflect changes in your circumstances or preferences.

- Gather all necessary information, including the full names and addresses of beneficiaries, details of your assets, and information on any significant debts.

- Decide on an executor for your will. This person will manage the estate according to your wishes as outlined in the will. Make sure to obtain their consent and have their full name and address at hand.

- If you have minor children, choose a guardian for them in the unfortunate event both parents pass away. Again, consent is key, along with their full contact information.

- Start filling out the form by entering your full legal name and address at the top.

- Specify how you wish to distribute your assets. Include specific details such as account numbers, property addresses, and specific items of personal property to avoid any confusion.

- For any assets not specifically listed, describe how the remainder of your estate should be distributed. You can divide it among several people or donate it to a charity, for example.

- Name the guardian(s) for your minor children, if applicable. Provide their full legal names and addresses.

- Appoint your executor by including their full name and address. You may also wish to appoint a secondary executor as a backup.

- Review the will carefully, ensuring all information is accurate and reflects your wishes.

- Sign the will in the presence of at least two witnesses, who are not beneficiaries. These witnesses must also sign the will, attesting they saw you sign it and are aware it's your will.

- Store your Last Will and Testament in a safe location and inform your executor where it can be found.

Completing a Last Will and Testament is a profound act of responsibility towards your loved ones. By taking the time to put your wishes on paper, you're not only ensuring that your assets are distributed according to your wishes, but also that you're making a difficult time a little easier for your family and friends. Remember to consult with a legal professional if you have any questions or need advice specific to your situation.

Get Answers on Last Will and Testament

What exactly is a Last Will and Testament?

A Last Will and Testament is a legal document that spells out an individual's wishes regarding the distribution of their assets and the care of any minor children after their death. It is a way for people to ensure their wishes are fulfilled and can help prevent disputes among surviving family members.

Who needs a Last Will and Testament?

Essentially, anyone with assets, regardless of their value, or those with minor children should consider creating a Last Will and Testament. It's a crucial step in planning for the eventualities of life and ensuring that your wishes are honored.

Can I write a Last Will and Testament myself?

Yes, it is possible to write your own Last Will and Testament, and there are templates available for this purpose. However, consulting with a legal professional can help ensure that the will complies with state laws and that your wishes are clearly articulated and legally enforceable.

What happens if someone dies without a Last Will and Testament?

If a person dies without a Last Will and Testament, they are considered to have died "intestate." This means the distribution of their assets will be carried out according to the intestacy laws of the state where they lived. These laws may not reflect the deceased's wishes, which can lead to unintended consequences for the survivors.

Is a Last Will and Testament the same as a Living Will?

No, a Last Will and Testament is not the same as a Living Will. A Last Will and Testament details how a person’s assets should be distributed after their death, while a Living Will addresses health care decisions, such as life support, in the event that the person is unable to communicate their wishes due to incapacity.

Can a Last Will and Testament be changed?

Yes, a Last Will and Testament can be changed as long as the person who created it is alive and legally competent. This is typically done by making a new will that revokes the previous one or by creating a codicil, which is an amendment to the existing will.

Are there any assets that cannot be included in a Last Will and Testament?

Yes, there are certain types of assets that typically cannot be included in a Last Will and Testament because they are governed by separate legal mechanisms. These include life insurance proceeds, retirement accounts, and jointly held property, among others, which usually pass directly to a named beneficiary or surviving co-owner.

What is required for a Last Will and Testament to be valid?

The requirements for a Last Will and Testament to be considered valid vary by state but generally include being of legal age and mental capacity, the document being written and signed, and having it witnessed according to state laws. It’s advisable to check specific state requirements to ensure validity.

What should be done with a Last Will and Testament after it's created?

After a Last Will and Testament is created, it should be stored in a safe, accessible place. Importantly, a trusted individual or the executor named in the will should know its location. Some choose to keep it in a safe deposit box, with a lawyer, or in a secure home safe to ensure it can be found after their passing.

Common mistakes

One common mistake people make when filling out their Last Will and Testament form is neglecting to list all their assets. It's crucial to be thorough and include everything you own, from real estate and bank accounts to personal possessions. Failing to account for all your assets can lead to confusion and potential disputes among your heirs, as not everything you own may be covered under the terms of your will.

Another error is not clearly designating the beneficiaries for specific assets. When you leave room for interpretation about who gets what, you open the door to conflict among your loved ones. Being explicit about your wishes helps ensure that your assets are distributed according to your desires, minimizing the chances of misunderstandings or legal challenges.

A further oversight involves not updating the will regularly. Life changes such as marriage, divorce, the birth of children, or the death of a named beneficiary can drastically alter your intentions for your estate. Without regular updates to reflect these life events, your Last Will and Testament might not accurately reflect your current wishes, potentially leading to unintended consequences for the distribution of your estate.

Additionally, many individuals mistakenly believe that a will covers all aspects of their estate planning, neglecting to consider other important documents like a living will or a durable power of attorney. These documents are crucial for outlining your wishes in situations where you might be unable to make decisions for yourself, and not having them can leave important decisions about your health care and finances in limbo.

Lastly, trying to create a will without professional guidance is a risky move. While do-it-yourself legal forms are readily available, estate laws vary significantly from one state to another, and a generic form may not address all the legal intricacies of your locale. This mistake can result in a will that's not legally enforceable, ultimately defeating the purpose of making one in the first place. Consulting with a legal professional ensures that your Last Will and Testament is valid, properly executed, and tailored to your specific situation.

Documents used along the form

When preparing for the future, a Last Will and Testament is a critical document that outlines how you want your assets distributed after your death. However, to ensure a comprehensive estate plan, several other documents are often used alongside it. These documents can offer additional instructions, clarity, and protection for both you and your loved ones. Here's a look at five key documents that are commonly utilized in conjunction with a Last Will and Testament.

- Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you're unable to do so yourself. It can be effective immediately or activated under specific circumstances, such as incapacitation.

- Healthcare Proxy (also known as a Medical Power of Attorney): Similar to the Power of Attorney, this document appoints someone to make medical decisions on your behalf if you become unable to make them yourself. It ensures that your healthcare preferences are followed.

- Living Will: This document provides instructions for your medical care if you become terminally ill or permanently unconscious. It guides your healthcare proxy's decisions and informs doctors of your wishes concerning life-sustaining treatments.

- Trust: A trust is a legal arrangement where one party holds assets on behalf of another. It can be used to manage your property during your lifetime and distribute it after your death, often bypassing the lengthy and costly probate process.

- Beneficiary Designations: These forms allow you to specify who will receive assets from certain accounts, such as retirement accounts, life insurance policies, and annuities, upon your death. It's essential to ensure these designations are up to date and do not conflict with your will.

Together, these documents form a robust estate plan that can address a wide range of legal and personal concerns. It's important to consult with a legal professional to understand how each of these documents fits into your overall estate planning strategy and to ensure that your wishes are clearly documented and legally binding. By taking these steps, you can provide peace of mind for yourself and your loved ones.

Similar forms

A Living Will is closely related to the Last Will and Testament, essentially serving as its healthcare counterpart. While a Last Will outlines what happens to your property after you pass away, a Living Will specifies your wishes regarding medical treatment if you become unable to communicate them yourself. This document is vital for providing clear instructions on how you want your health care to be managed, especially in terms of life-sustaining measures.

A Trust is another document that shares similarities with a Last Will and Testament, primarily in how it deals with the management and distribution of your assets. While a Last Will becomes effective only after death, a Trust can be operative during your lifetime and afterwards, depending on its type. Trusts also offer more control over when and how your assets are distributed, potentially bypassing the often lengthy and costly probate process that wills are subjected to.

A Power of Attorney is a legal document that, like a Last Will, involves designating someone to handle your affairs. However, instead of dealing with the distribution of your assets after death, a Power of Attorney allows someone to make decisions on your behalf while you are still alive. This can cover a broad range of duties, from financial decisions to healthcare directives, depending on the type of Power of Attorney established.

Beneficiary Designations often accompany or stand in place of directions given in a Last Will, especially for certain types of property like retirement accounts, life insurance policies, and some bank accounts. These designations specify who will receive these assets upon your death, bypassing the will entirely. This means that even if your Last Will states something contrary, the beneficiary designation on these accounts takes precedence.

A Health Care Proxy is somewhat of a subset of both a Living Will and a Power of Attorney, focusing specifically on healthcare decisions. Like a Last Will that designates an executor for your estate, a Health Care Proxy names someone as your agent to make medical decisions for you if you're unable to do so. This document is crucial for ensuring that your healthcare is in trusted hands, reflective of your wishes, if you become incapacitated.

The HIPAA Release Form, while not directly related to the distribution of your assets, complements a Last Will and Testament in the realm of preparing for the unexpected. This form allows designated individuals to access your medical records, which can be crucial for making informed decisions about your health care or for settling estate matters after your departure. It’s an essential component of a comprehensive estate plan, ensuring your privacy preferences are respected while allowing necessary access to your medical history.

Finally, a Letter of Intent is an informal document that often accompanies a Last Will, providing additional context and wishes that aren't legally binding. This letter can outline your desires concerning your funeral arrangements, explain the reasoning behind your will's provisions, or share personal messages with loved ones. While not a legal document itself, it can serve as a valuable guide for your executor and beneficiaries, personalizing the more formal nature of estate planning with your voice and intentions.

Dos and Don'ts

Preparing a Last Will and Testament is a vital step in ensuring your assets are distributed according to your wishes after you pass away. However, it's a process that demands careful consideration to avoid common pitfalls. Here are some dos and don'ts to keep in mind when filling out your Last Will and Testament form.

Do:Be clear and precise in naming your beneficiaries to prevent any misunderstandings about who gets what.

Choose an executor you trust to manage your estate efficiently and in accordance with your final wishes.

Update your will as significant life events happen (e.g., marriage, divorce, birth of a child) to reflect your current intentions and circumstances.

Include a residuary clause to handle any assets that you haven't specifically mentioned elsewhere in the will.

Sign your will in the presence of witnesses, as required by state law, to ensure it's legally binding.

Store your will in a safe but accessible place and inform your executor or a trusted family member of its location.

Consult with a legal professional if you have any doubts or complicated assets to make sure your will is valid and all-encompassing.

Attempt to dispose of property in your will that is subject to other agreements (such as life insurance or jointly owned property).

Forget to name a guardian for your minor children, leaving their care decision to the courts.

Overlook the importance of naming an alternate executor in case your first choice is unable or unwilling to serve.

Leave out detailed information about how debts, taxes, and funeral expenses should be paid.

Assume state laws don't apply to you — each state has its own set of laws governing wills.

Use ambiguous language that could be open to interpretation and lead to disputes among beneficiaries.

Rely solely on a handwritten (holographic) will, which may not be recognized as valid in all states.

Thoughtfully preparing your Last Will and Testament is an act of kindness to your loved ones, sparing them unnecessary stress during a difficult time. By following these guidelines, you can help ensure your final wishes are honored and your estate is handled in an orderly manner.

Misconceptions

When it comes to planning for the future, creating a Last Will and Testament is a critical step. However, there are several misconceptions that people often have about this process. Understanding the facts can help ensure that your wishes are properly documented and carried out.

A Last Will and Testament allows one to distribute all types of assets. Some people believe that a Last Will and Testament can be used to distribute any kind of asset they own upon their death. However, certain assets, such as those held in joint tenancy, retirement accounts with named beneficiaries, and life insurance policies, typically pass outside of a will directly to the named beneficiary.

Creating a Last Will and Testament avoids probate. Another common misconception is that having a Last Will and Testament means your estate will not have to go through probate. In reality, the will is a document that must be submitted to probate court in order for its instructions to be carried out. The probate process is necessary to validate the will, settle debts, and distribute assets according to the will’s provisions.

A Last Will and Testament takes effect immediately upon signing. Some may believe that a Last Will and Testament takes effect as soon as it is signed. However, it only becomes effective upon the person's death. Until then, the individual has the right to change or revoke their will at any time, as long as they are mentally competent.

Only the elderly or those with significant assets need a Last Will and Testament. This misconception can lead people to postpone creating a will, thinking it isn’t necessary until later in life or unless they have considerable assets. In reality, anyone who wants to control how their assets are distributed, nominate guardians for minor children, or specify final wishes should have a will, regardless of their age or wealth.

Handwritten (holographic) wills are not legally binding. While formal requirements can vary by state, many states do recognize handwritten wills as valid, provided they meet specific criteria, such as being entirely in the handwriting of the person making the will. However, because they may not address all legal intricacies and could be more easily contested, it’s often advised to create a formally prepared will.

Dispelling these misconceptions about Last Wills and Testaments can help individuals take the necessary steps to ensure their wishes are honored and their loved ones are provided for in the manner they intend.

Key takeaways

Filling out and using a Last Will and Testament form is a crucial step in managing your estate and ensuring your wishes are honored after you pass away. It's vital to approach this document with care and understanding to make it legally binding and reflective of your intentions. Here are key takeaways to consider:

- Understand your state's requirements: The legality of a Last Will and Testament is governed by state law, which can vary significantly. Ensure you understand the specific requirements for wills in your state, such as the number of witnesses needed or the necessity of notarization.

- Be clear and specific: Clarity in your Last Will and Testament prevents potential disputes among beneficiaries. Be as specific as possible when designating heirs and allocating your assets.

- Choose an executor wisely: The executor of your will is responsible for managing your estate according to your wishes after your death. Select someone who is responsible, trustworthy, and capable of handling financial matters and the probate process.

- Keep it updated: Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets should prompt a review and update of your Last Will and Testament to ensure it reflects your current wishes.

- Include a residuary clause: A residuary clause covers any assets that are not explicitly mentioned in the will. This catch-all provision ensures that all your property is distributed according to your wishes, even items acquired after the will was written.

- Consider a guardian for minor children: If you have minor children, your Last Will and Testament should specify a guardian for them in the event of your death. This decision should not be taken lightly, as it determines who will be responsible for your children's care and upbringing.

- Sign in the presence of witnesses: To be legally valid, most states require that you sign your will in the presence of at least two witnesses. These witnesses must also sign the document, affirming that you declared the document to be your will and that you signed it willingly.

- Store it safely: Keep your Last Will and Testament in a secure location where your executor can easily access it upon your death. Safe deposit boxes, with the executor having access, or a fireproof safe in your home are common choices.

- Consult professionals if needed: While many individuals successfully use do-it-yourself will forms, consulting with an attorney can provide valuable peace of mind. This is especially true if your estate is large or complex, if you have concerns about someone contesting your will, or if you need advice on tax implications.

Other Templates:

Rent Contract - Includes information on insurance requirements, protecting both the landlord’s property and the tenant’s possessions.

Employee Release Form Template - Establishes the employer's ownership of photographs taken during employment.

Hunting Lease Agreement - The agreement specifies the types of game that can be hunted, ensuring both parties understand what is permissible.