Official Land Purchase Agreement Document

Embarking on the journey of acquiring land is both an exciting and complex endeavor, requiring not just a vision for the future but also a keen attention to detail in the present. Central to this process is the Land Purchase Agreement form, a crucial document that outlines the terms and conditions of the property transaction. This form serves as the backbone of the negotiation, capturing everything from the purchase price to the obligations of both buyer and seller. It ensures clarity and understanding between parties, minimizing risks and creating a smooth path towards ownership. Beyond its basic function, the Land Purchase Agreement form also addresses contingencies, such as financing and inspections, safeguards to protect both parties if expectations are not met. Understanding this form, its function, and its elements is essential for anyone looking to navigate the complexities of land acquisition successfully. By doing so, buyers can approach this significant step with confidence, backed by the security of a well-structured agreement.

Land Purchase Agreement for Specific States

Form Example

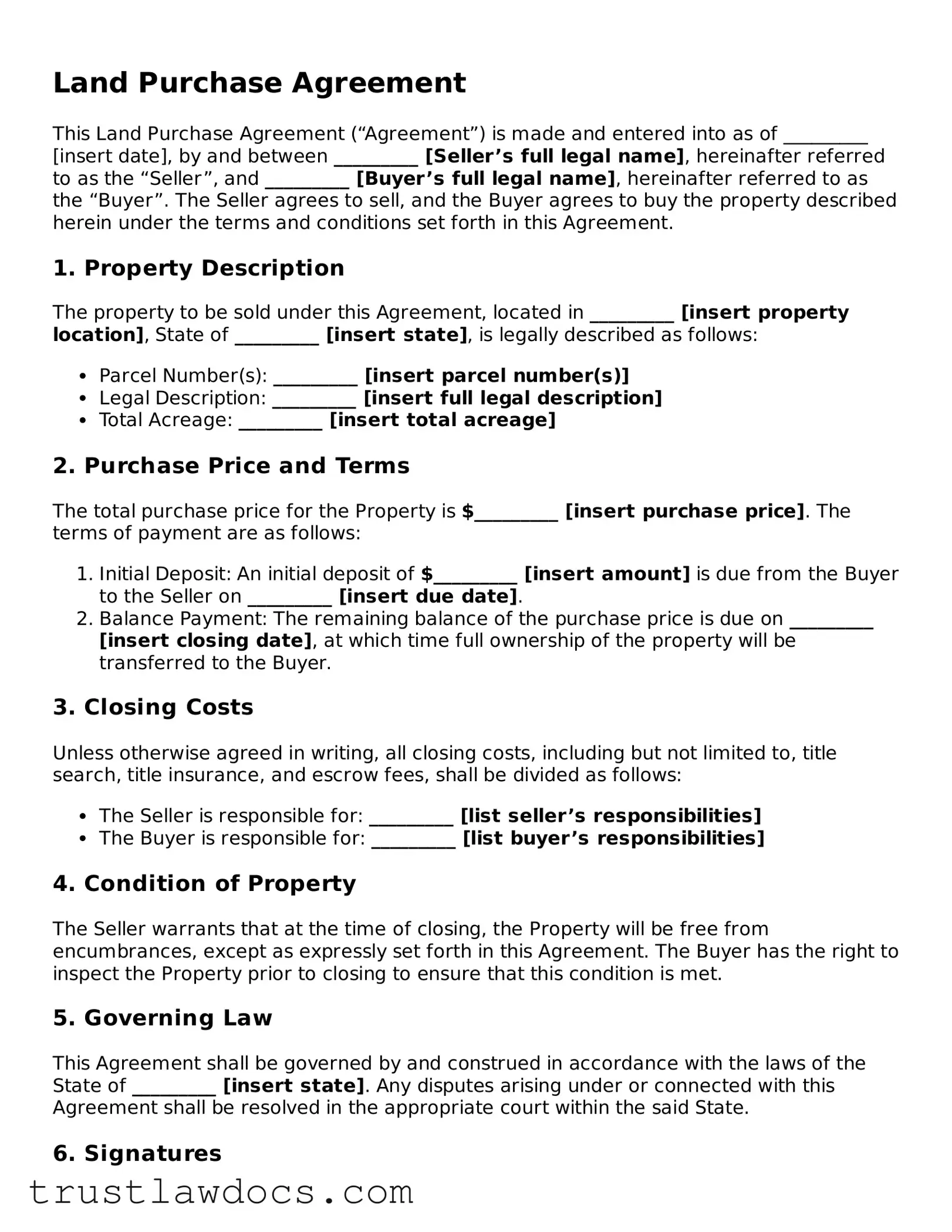

Land Purchase Agreement

This Land Purchase Agreement (“Agreement”) is made and entered into as of _________ [insert date], by and between _________ [Seller’s full legal name], hereinafter referred to as the “Seller”, and _________ [Buyer’s full legal name], hereinafter referred to as the “Buyer”. The Seller agrees to sell, and the Buyer agrees to buy the property described herein under the terms and conditions set forth in this Agreement.

1. Property Description

The property to be sold under this Agreement, located in _________ [insert property location], State of _________ [insert state], is legally described as follows:

- Parcel Number(s): _________ [insert parcel number(s)]

- Legal Description: _________ [insert full legal description]

- Total Acreage: _________ [insert total acreage]

2. Purchase Price and Terms

The total purchase price for the Property is $_________ [insert purchase price]. The terms of payment are as follows:

- Initial Deposit: An initial deposit of $_________ [insert amount] is due from the Buyer to the Seller on _________ [insert due date].

- Balance Payment: The remaining balance of the purchase price is due on _________ [insert closing date], at which time full ownership of the property will be transferred to the Buyer.

3. Closing Costs

Unless otherwise agreed in writing, all closing costs, including but not limited to, title search, title insurance, and escrow fees, shall be divided as follows:

- The Seller is responsible for: _________ [list seller’s responsibilities]

- The Buyer is responsible for: _________ [list buyer’s responsibilities]

4. Condition of Property

The Seller warrants that at the time of closing, the Property will be free from encumbrances, except as expressly set forth in this Agreement. The Buyer has the right to inspect the Property prior to closing to ensure that this condition is met.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of _________ [insert state]. Any disputes arising under or connected with this Agreement shall be resolved in the appropriate court within the said State.

6. Signatures

This Agreement shall be effective upon the signatures of both parties below:

Seller's Signature: ________________________ Date: _________

Buyer's Signature: _________________________ Date: _________

PDF Form Details

| Fact | Description |

|---|---|

| Necessity | A Land Purchase Agreement is essential to legally bind the seller and the buyer to the agreed terms of the land sale. |

| Governing Law | Land Purchase Agreements are governed by state laws, which can vary significantly from one state to another. |

| Components | These agreements typically include details such as price, property boundaries, earnest money deposits, closing dates, and any contingencies. |

| State-specific Forms | Some states require specific forms or disclosures to be included in the agreement to make it legally binding. |

How to Write Land Purchase Agreement

Entering into a Land Purchase Agreement is a significant step towards securing a piece of property. This written contract between the buyer and seller documents the sale's terms, ensuring clarity and mutual understanding throughout the process. The agreement lays down details such as the purchase price, property description, and conditions each party must meet before finalizing the sale. Filling out this form accurately is essential for a smooth transaction. Here's a step-by-step guide to help you navigate the process, ensuring all necessary details are appropriately documented.

- Identify the Parties: Start by providing the full legal names of both the buyer and the seller. If there are multiple buyers or sellers, include each person's information.

- Describe the Property: Enter a detailed description of the land being purchased. This should include the property's address, legal description (which can be found on the property deed), and any additional identifying details like parcel numbers.

- Agree on the Purchase Price: Clearly state the total purchase price that the buyer agrees to pay for the property. If applicable, also detail the earnest money deposit amount and the terms related to this payment.

- Outline Payment Terms: Specify the terms of payment for the property, including any financing details. This may involve a down payment followed by installment payments, or a one-time payment in full at a future date.

- Set the Closing Date: Indicate the agreed-upon date by which the sale should be finalized and the property officially transferred from the seller to the buyer.

- Discuss Contingencies: Document any conditions that must be met before the sale is finalized. Common contingencies include the buyer obtaining suitable financing, the sale of current property, or satisfactory results from a property inspection.

- Detail Closing Costs and Who Bears Them: Specify which closing costs each party is responsible for. Closing costs can include taxes, attorney fees, and title search fees, among others.

- Signatures: Ensure both the buyer and the seller sign the agreement. The signing should be done in the presence of a notary public or witnesses, depending on the requirements of the jurisdiction in which the transaction takes place.

Once the Land Purchase Agreement is fully completed and signed by both parties, it acts as a binding contract that outlines the transaction's terms. It's crucial for both the buyer and seller to review the agreement in detail before signing. This ensures that all the terms are understood and agreed upon, reducing the potential for conflict during the property transfer process. Remember, familiarity with the document and consulting with a real estate attorney if you have questions or concerns is always advisable.

Get Answers on Land Purchase Agreement

What is a Land Purchase Agreement?

A Land Purchase Agreement is a legally binding contract between a seller and a buyer for the purchase of real estate. This document outlines the terms and conditions of the sale, including price, property description, payment plans, and any contingencies that must be met before the sale can be finalized.

Why is a Land Purchase Agreement important?

This agreement provides a comprehensive framework that protects the interests of both the buyer and the seller. It ensures that both parties are clear about their obligations and the specifics of the property being sold. This document also serves as a legal record of the transaction, helping to prevent disputes in the future.

What should be included in a Land Purchase Agreement?

A Land Purchase Agreement should include the legal names of both the buyer and the seller, a detailed description of the property, the purchase price, payment terms, any contingencies like financing or inspections, closing date, and details of who will pay for taxes, insurance, and other fees related to the property transfer.

How does a Land Purchase Agreement differ from a Real Estate Purchase Agreement?

While a Land Purchase Agreement specifically relates to the sale of vacant land, a Real Estate Purchase Agreement can be used for the sale of land that has a house or other building on it. The terms and conditions may be similar, but the Real Estate Purchase Agreement includes details pertinent to the structures on the land, such as inspections and property condition.

Can a Land Purchase Agreement be customized?

Yes, a Land Purchase Agreement can be customized to suit the specific needs of the buyer and the seller. It is essential to ensure that any added clauses or modifications follow local real estate laws and regulations. Professional legal advice should be sought when customizing this agreement.

Is a down payment required in a Land Purchase Agreement?

While not always necessary, a down payment is commonly included in a Land Purchase Agreement. It acts as the buyer's initial investment towards the purchase price and demonstrates their commitment to the transaction. The specifics of the down payment, including the amount and terms, are negotiable between the buyer and the seller.

What happens if a party breaches a Land Purchase Agreement?

If a party fails to abide by the terms outlined in the agreement, it is considered a breach of contract. The non-breaching party may pursue legal remedies, which can include compensation for any financial loss or enforcing the terms of the agreement through legal action.

Can a buyer back out of a Land Purchase Agreement?

A buyer can back out of a Land Purchase Agreement if contingencies outlined in the agreement are not met. However, if the buyer withdraws without a contractual basis, they may lose their deposit or could be subject to legal action by the seller.

Who prepares the Land Purchase Agreement?

Typically, the seller or the seller’s real estate agent prepares the Land Purchase Agreement. However, it's advisable for both buyer and seller to review the agreement thoroughly and consult with legal counsel to ensure that their rights are adequately protected and the terms meet their needs.

Common mistakes

Filling out a Land Purchase Agreement is a significant step in the process of buying or selling property. It outlines the terms and conditions under which the land transaction will occur. However, several common mistakes can complicate this process, leading to potential misunderstandings or legal disputes. Recognizing these errors can help both parties ensure a smoother transaction.

One common mistake is not providing complete and accurate information about the parties involved. This includes full legal names, addresses, and contact information. Precision in this area is crucial because any inaccuracies can lead to questions about the agreement's validity. Ensuring the correct identification of both the buyer and the seller establishes a solid foundation for all subsequent steps.

Another error involves the description of the property. This section requires detailed information, including the property's legal description as found in public records, not just a street address. The legal description typically involves lot numbers, block numbers, and subdivision names, or it might describe the property’s boundaries. Overlooking these details can lead to disputes about what was actually meant to be purchased.

Many people also neglect to specify the terms of the sale clearly. This includes the purchase price, the deposit amount, and the financing details if not a cash transaction. Without an explicit agreement on the payment schedule, interest rates, and deadlines, the parties may have conflicting expectations. This oversight can result in financial misunderstandings or the collapse of the deal entirely.

Not including contingencies is another frequent oversight. Contingencies are conditions that must be met for the transaction to proceed, such as the buyer obtaining financing, the results of a property inspection, or other specific prerequisites. Failing to clearly define these terms can leave the buyer particularly vulnerable if unforeseen issues arise, potentially losing their deposit without recourse.

Similarly, failing to outline the obligations for both parties regarding due diligence can lead to complications. This encompasses the responsibility to examine the title for any issues, verify zoning and land use regulations, and conduct environmental assessments. Ignoring these responsibilities can result in legal and financial ramifications if problems are discovered after the sale.

Last but not least, many overlook the need for a clear closure and possession date. This is when the transaction is officially completed, and the buyer takes possession of the land. Without a clearly defined timeline, there may be confusion or disagreement about when the seller must vacate the property and when the buyer can assume control.

By paying attention to these details and avoiding these common mistakes, parties can help ensure their Land Purchase Agreement accurately reflects their intentions and protects their interests. This can lead to a smoother transaction and a more secure legal standing for both the buyer and seller.

Documents used along the form

Embarking on the journey of buying land is both exciting and intricate, involving more than just a Land Purchase Agreement. While this document serves as the cornerstone, securing the deal between buyer and seller, several other vital documents play pivotal roles in ensuring a smooth, transparent, and legally sound transaction. Understanding the purpose and importance of each is key to navigating the process effectively.

- Title Insurance Commitment: Before the final handshake, obtaining a Title Insurance Commitment is crucial. This document provides a comprehensive background check on the land, revealing any existing liens, easements, or other encumbrances that could affect your ownership rights. It essentially ensures that the seller rightfully owns the property and can transfer it without legal impediments.

- Property Survey: A Property Survey delineates the land's exact boundaries and dimensions, offering a bird's-eye view of what you're buying. It clarifies any discrepancies in the land's size as described in the purchase agreement and identifies any encroachments that might lead to disputes with neighbors in the future.

- Disclosure Statements: Sellers are often required to provide Disclosure Statements, where they must divulge any known issues with the land that could affect its value or your decision to buy. These include problems with soil contamination, water rights, or access issues, ensuring you go into the deal with your eyes wide open.

- Loan Documents: If you're not purchasing the land outright and are instead seeking financing, Loan Documents will play a crucial role in your land purchase journey. These documents outline the terms of your loan, including the interest rate, repayment schedule, and any other conditions imposed by the lender. They are essential for understanding and committing to your financial obligations in the land purchase process.

Each of these documents complements the Land Purchase Agreement, together weaving a protective net that safeguards your interests throughout the transaction. By familiarizing yourself with these documents, you're not just completing tasks on a checklist. You're taking informed steps towards making a land purchase that aligns with your dreams and legal requirements, ensuring a secure and satisfying investment in your future.

Similar forms

A Real Estate Purchase Agreement is quite similar to a Land Purchase Agreement as both lay out the terms and conditions for the sale of property. However, a Real Estate Purchase Agreement is broader, often encompassing not only land but also any structures on it, including homes or buildings. This document outlines specifics like purchase price, inspection rights, and closing conditions that both buyer and seller must meet. It serves the same purpose of defining the agreement between buyer and seller, ensuring both parties are clear on the conditions of the sale.

The Lease Agreement shares common ground with a Land Purchase Agreement by dictating terms between two parties regarding the use of property. While a Lease Agreement concerns the rental of property (rather than an outright sale), it similarly outlines terms such as payment amounts, duration of the lease, and responsibilities of each party. This agreement ensures that the landlord and tenant agree on how the property will be used and maintained during the rental period.

A Land Contract bears resemblance to a Land Purchase Agreement as it also deals with the sale of real property. However, a Land Contract typically involves the seller financing the purchase for the buyer, with the title remaining in the seller's name until the final payment is made. This document outlines the payment schedule, interest rates, and what happens in case of default. Like a Land Purchase Agreement, it specifies the terms under which property ownership will change hands.

Another similar document is the Deed of Trust, which is used in some real estate transactions to secure a loan on a property. While it serves a different function by involving a third party (the trustee) to hold the title until the loan is paid off, it's akin to a Land Purchase Agreement in facilitating the transfer of property. It outlines the borrower's obligations and what would happen if they fail to meet these obligations, similar to how a Land Purchase Agreement establishes conditions for the sale.

Option Agreements relate closely to Land Purchase Agreements as they give one party the option to buy property at a future date. These agreements specify a timeframe during which the buyer can decide to purchase the land at an agreed-upon price, securing the opportunity for a future sale. While it doesn't guarantee the sale like a Land Purchase Agreement, it creates a binding commitment regarding the terms under which a purchase could happen.

Last, the Right of First Refusal Agreement has similarities with a Land Purchase Agreement by providing a person or entity the first opportunity to buy a property before the owner can offer it to others. This agreement must outline specific conditions under which the right can be exercised and the timeframe in which the decision to purchase must be made. While it does not detail the sale's specifics like a Land Purchase Agreement, it ensures the right holder is offered the chance to buy under pre-defined conditions.

Dos and Don'ts

When filling out a Land Purchase Agreement form, attention to detail is key. This document is crucial in ensuring a smooth transaction between the buyer and seller. Here are seven things you should and shouldn't do:

Do's:

- Read the entire form carefully before starting to fill it out. Understanding every section will help you provide accurate information.

- Ensure all parties' names and contact information are spelled correctly and completely. Mistakes here can cause significant issues later.

- Include specific details about the land being purchased, such as its exact dimensions, location, and any applicable legal descriptions.

- Clearly state the purchase price and terms of payment. This should include any deposit amount and when the full payment is due.

- Specify any conditions or contingencies that must be met for the transaction to proceed. This could involve inspections, approvals, or financing arrangements.

- Review local and state regulations that might affect the sale. Compliance with these laws is crucial.

- Have the document reviewed by a legal professional before finalizing. A lawyer can catch errors or suggest changes to protect your interests.

Don'ts:

- Don't leave any blanks on the form. If a section does not apply, write "N/A" to indicate this.

- Avoid using vague language. Be as specific as possible to prevent misunderstandings.

- Don't forget to disclose any known issues with the land. Failure to do so could lead to legal problems after the sale.

- Don't sign the agreement without ensuring that all involved parties understand and agree to its terms.

- Don't ignore timelines and deadlines. Missing key dates can derail the entire transaction.

- Don't neglect to make copies of the signed agreement. Each party should have one for their records.

- Don't underestimate the importance of a professional review. Skipping this step can be costly in the long run.

Misconceptions

When it comes to buying or selling land, a Land Purchase Agreement form plays a critical role. However, there are several misconceptions surrounding this document that can lead to confusion and, sometimes, legal troubles. To clarify, let's dispel some common myths.

All Land Purchase Agreements are the same. This is not true. Though many agreements share common elements, specifics can vary greatly depending on local laws, the property in question, and the terms negotiated by the parties.

A verbal agreement is as good as a written one. While verbal agreements can be legally binding, proving the terms without written documentation is challenging. A Land Purchase Agreement should always be documented in writing to protect all parties involved.

Only the buyer needs to sign the agreement. In reality, the Land Purchase Agreement must be signed by all parties involved in the transaction to be legally binding. This includes both the buyer and the seller, and sometimes additional parties based on the agreement's complexity.

The price is the only important term. Though the purchase price is undoubtedly important, other terms, including the payment schedule, zoning restrictions, contingencies, and closing details, are equally crucial to a well-rounded agreement.

You don't need a lawyer to draft a Land Purchase Agreement. While it's possible to create an agreement without legal assistance, consulting with a lawyer is advisable to ensure the document meets all legal requirements and protects your interests.

If something isn't in the agreement, it's not enforceable. While the Land Purchase Agreement should cover all critical aspects of the transaction, verbal agreements or understandings made outside the written contract can be difficult to enforce. It's best to document every detail in the agreement.

Once signed, the agreement cannot be changed. This is a misconception. Parties can modify the agreement at any time before closing, provided all parties agree to the changes in writing. Flexibility exists to renegotiate terms if necessary.

Understanding these misconceptions about the Land Purchase Agreement can help parties navigate their real estate transactions more effectively, ensuring a smoother process for buying or selling land.

Key takeaways

Entering into a Land Purchase Agreement is a significant step in the process of buying or selling property. It outlines the terms of the sale, including price, property details, and the obligations of both parties. Understanding the key aspects of filling out and using a Land Purchase Agreement is crucial for a smooth transaction. Below are six key takeaways to consider:

- Accuracy is paramount: Ensure that all information in the agreement is accurate. This includes the legal names of the parties involved, the correct address, and legal description of the property, and the agreed-upon purchase price. Errors can lead to misunderstandings or legal disputes.

- Understand the terms: Both the buyer and the seller should thoroughly understand every term and condition outlined in the agreement. This includes payment terms, property boundaries, zoning restrictions, and any contingencies that allow either party to back out of the deal under specific conditions.

- Include all necessary details: The agreement should include detailed information about any easements, restrictions, or other rights and obligations associated with the property. These details are crucial for avoiding future disputes.

- Seek legal advice: It's highly recommended that both parties consult with a legal professional before signing the agreement. A legal professional can offer valuable insight, ensure that the agreement complies with state laws, and help understand complex legal terms.

- Observe deadlines and signatures: The agreement should clearly state any deadlines, such as for obtaining financing, inspections, and the closing date. Ensure that all parties sign the agreement, as unsigned agreements are typically not legally enforceable.

- Follow through with contingencies: If the agreement includes contingencies (such as the need for a satisfactory home inspection or securing financing), make sure these conditions are met by the specified deadlines. Failing to meet contingencies can void the agreement.

Adhering to these key points can help ensure that the process of buying or selling a piece of land is conducted fairly, legally, and with transparency for all parties involved.

Other Templates:

Unconditional Waiver and Release Upon Final Payment - Its implementation allows for a secure exchange of payment for services, with lien releases being conditionally held until both parties have fulfilled their respective commitments.

Real Estate Termination Agreement - Provides a mutual agreement to end a real estate deal, ensuring no further obligations exist between the buyer and seller.