Free Transfer-on-Death Deed Form for Texas

Passing on property to loved ones without the complications and expenses of going through probate is a concern for many property owners. In Texas, a valuable tool available for this purpose is the Transfer-on-Death (TOD) Deed form. This legal document allows property owners to designate a beneficiary who will inherit their real estate upon the owner's death, without the need for the property to go through the probate process. The TOD deed is straightforward to execute, requiring the property owner to simply fill out the form and then record it with the local county clerk’s office. What makes the TOD deed particularly attractive is its flexibility—property owners can change their mind and revoke the deed or change the beneficiary at any point during their lifetime, as long as they are mentally competent. This blend of simplicity, control, and efficiency in transferring real estate upon death makes the Transfer-on-Death Deed an important consideration for Texans planning their estate.

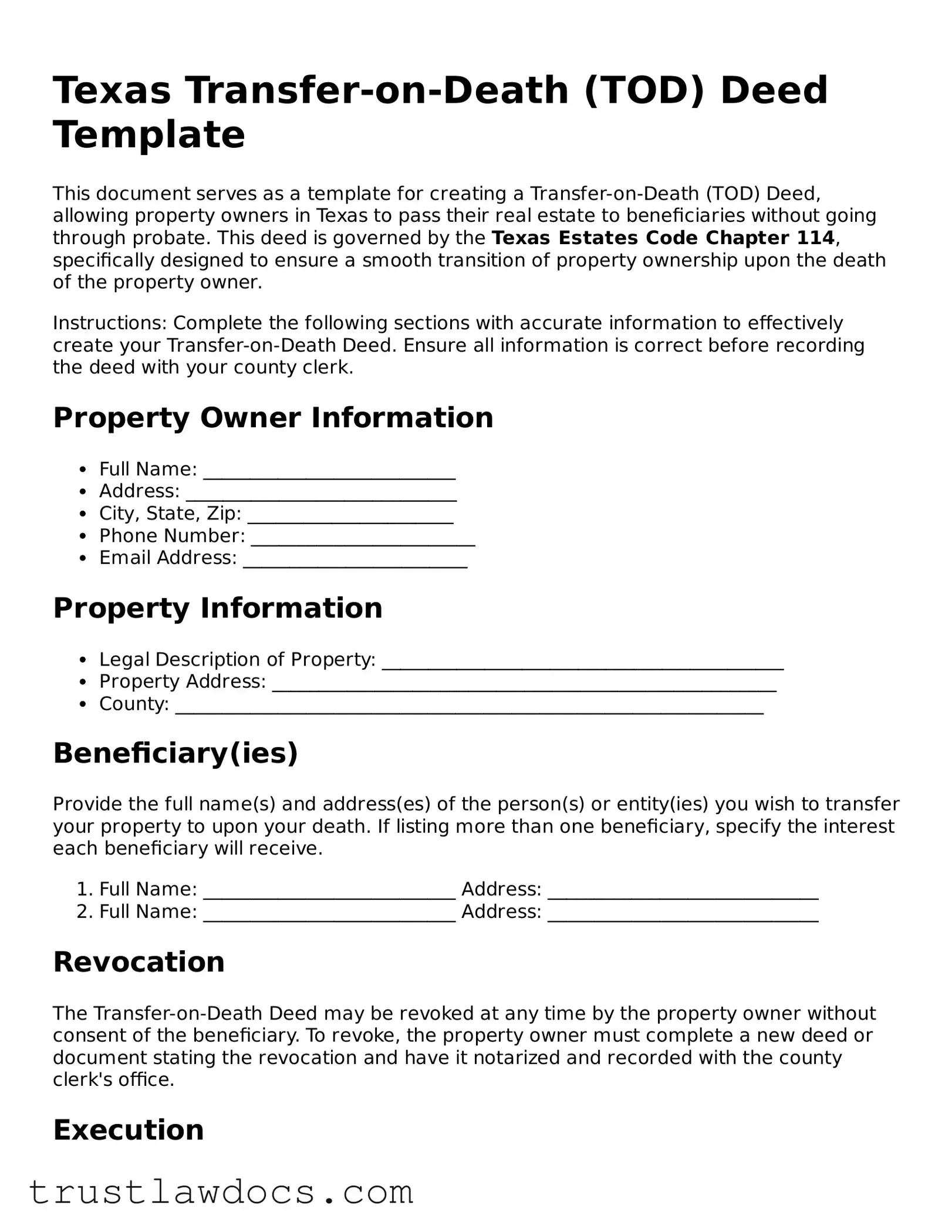

Form Example

Texas Transfer-on-Death (TOD) Deed Template

This document serves as a template for creating a Transfer-on-Death (TOD) Deed, allowing property owners in Texas to pass their real estate to beneficiaries without going through probate. This deed is governed by the Texas Estates Code Chapter 114, specifically designed to ensure a smooth transition of property ownership upon the death of the property owner.

Instructions: Complete the following sections with accurate information to effectively create your Transfer-on-Death Deed. Ensure all information is correct before recording the deed with your county clerk.

Property Owner Information

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ______________________

- Phone Number: ________________________

- Email Address: ________________________

Property Information

- Legal Description of Property: ___________________________________________

- Property Address: ______________________________________________________

- County: _______________________________________________________________

Beneficiary(ies)

Provide the full name(s) and address(es) of the person(s) or entity(ies) you wish to transfer your property to upon your death. If listing more than one beneficiary, specify the interest each beneficiary will receive.

- Full Name: ___________________________ Address: _____________________________

- Full Name: ___________________________ Address: _____________________________

Revocation

The Transfer-on-Death Deed may be revoked at any time by the property owner without consent of the beneficiary. To revoke, the property owner must complete a new deed or document stating the revocation and have it notarized and recorded with the county clerk's office.

Execution

This Transfer-on-Death Deed must be signed by the property owner in the presence of a notary public to be valid. Upon the property owner's death, the deed automatically transfers ownership to the named beneficiary(s) without requiring probate.

_____________________________ __________________

Property Owner's Signature Date

State of Texas

County of _______________

This document was acknowledged before me on this ___ day of ___________, 20___, by ________________________________, who is personally known to me or has presented ____________________________ as identification.

____________________________________

Notary Public's Signature

My commission expires: _______________

PDF Form Details

| Fact | Description |

|---|---|

| 1. Legal Basis | The Texas Transfer-on-Death (TOD) deed is governed by the Texas Estates Code, specifically Chapter 114, which details its creation, revocation, and effects after the death of the grantor. |

| 2. Purpose | The TOD deed allows property owners to transfer their real estate to a beneficiary upon their death without the need for probate. |

| 3. Eligibility | Any individual who has the legal capacity to own real property in Texas can execute a TOD deed. |

| 4. Property Types | This deed can be used for various types of real property but cannot transfer personal property, like money or vehicles. |

| 5. Revocability | The TOD deed is revocable, meaning the property owner can change or cancel it at any time before their death. |

| 6. Multiple Beneficiaries | It's possible to name more than one beneficiary, and the property will be distributed among them in equal shares unless specified otherwise. |

| 7. No Immediate Effect | The deed has no effect until the death of the owner, allowing them to retain full control and use of the property during their lifetime. |

| 8. Witness and Notarization | To be valid, the deed must be signed by the property owner in the presence of a notary public. Witness signatures are not specifically required by Texas law for this deed to be valid. |

| 9. Recording Requirements | For the TOD deed to be effective, it must be recorded with the county clerk's office in the county where the property is located, before the death of the grantor. |

How to Write Texas Transfer-on-Death Deed

Filling out the Texas Transfer-on-Death (TOD) Deed form is a straightforward process that allows property owners to designate beneficiaries to their real estate, avoiding the probate process upon their passing. It's essential for individuals looking to ensure a smooth transition of their property to loved ones. To successfully complete the form, certain steps must be followed carefully to ensure legal validity and to properly reflect the property owner's wishes. Remember, this document does not take effect until the property owner's death and can be revoked or changed at any time before then.

- Begin by obtaining the most current version of the Texas Transfer-on-Death Deed form. This can usually be found online on various legal services websites or through the local county recorder's office.

- Clearly print the full legal name of the property owner(s) as it appears on the current deed of the property. This ensures that the document correctly identifies the individual(s) making the transfer-on-death designation.

- Identify the primary beneficiary or beneficiaries who will receive the property after the owner's death. Include their full legal names, addresses, and their relationship to the property owner to avoid any confusion.

- If applicable, name alternate beneficiaries in the event that the primary beneficiary predeceases the property owner. The same information (full legal names, addresses, and relationship to the property owner) should also be provided for each alternate beneficiary.

- Provide a complete and accurate description of the property being transferred. This should include the property's legal description as found on the deed or property tax documents, not just the physical address. The legal description is necessary for correct and legal identification of the property in question.

- Sign the document in the presence of a notary public. The property owner's signature must be notarized to ensure the TOD deed's legal validity. In Texas, it is mandatory for the notarization process to include a seal or stamp from the notary.

- Finally, file the completed and notarized Transfer-on-Death Deed form with the county clerk's office in the county where the property is located. This step is crucial as it officially records and recognizes the deed, making the transfer-on-death arrangement legally binding. A filing fee may be required depending on the county's policies.

Following these steps carefully will facilitate the proper completion of the Texas Transfer-on-Death Deed form. It's important for property owners to understand that while this form provides a mechanism for avoiding probate for their real estate, it does not serve as a substitute for a comprehensive estate plan. Consulting with a legal professional knowledgeable in Texas estate law can provide additional guidance and ensure that all aspects of an individual's estate are appropriately addressed.

Get Answers on Texas Transfer-on-Death Deed

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death (TOD) Deed is a legal document that allows property owners to designate a beneficiary who will inherit their property upon the owner’s death. This type of deed bypasses the probate process, allowing for a more straightforward transfer of the property.

How does a Transfer-on-Death Deed differ from a traditional will?

While both a Transfer-on-Death Deed and a traditional will can specify beneficiaries for property, a TOD deed is specifically designed to transfer real estate upon death without the need for probate. A will, on the other hand, covers a broader range of property and must go through the probate process before assets are distributed to heirs.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the owner. To revoke a TOD deed, the owner must either (1) create and properly record a new deed that expressly revokes the TOD deed or changes the designated beneficiary, (2) sell or transfer the property to someone else, or (3) create and record a formal revocation document.

Who can be designated as a beneficiary in a Texas Transfer-on-Death Deed?

In Texas, almost anyone can be named as a beneficiary in a Transfer-on-Death Deed, including individuals, organizations, trusts, or other legal entities. You can designate multiple beneficiaries and specify the percentages of property each will receive. It's also possible to name contingent beneficiaries in case the primary beneficiary predeceases the property owner.

Are there any special requirements for executing a Texas Transfer-on-Death Deed?

To ensure that a Transfer-on-Death Deed is legally binding in Texas, certain requirements must be met. The deed must be completed with clear intentions, signed in front of a notary public, and recorded in the county records where the property is located. It's essential that the deed includes a legal description of the property and identifies the designated beneficiary with sufficient specificity.

What happens to a property with a Transfer-on-Death Deed if the beneficiary predeceases the owner?

If the beneficiary named in a Transfer-on-Death Deed predeceases the property owner, the property becomes part of the owner’s estate and will be distributed according to the owner’s will or, if there is no will, according to Texas intestate succession laws. This outcome underscores the importance of updating the TOD deed if circumstances change.

Common mistakes

When individuals attempt to fill out the Texas Transfer-on-Death (TOD) Deed form, there are common errors that can significantly impact the deed's validity and effectiveness. One such mistake is failing to provide the complete legal description of the property. Many people mistakenly believe that an address is sufficient to identify the property. However, the form requires the full legal description, which can typically be found on the property's existing deed or tax documents. Without this precise description, the TOD deed may not be enforceable.

Another error involves the designation of beneficiaries. Often, individuals do not clearly specify to whom the property should transfer upon their death. It is crucial to provide the full names of the beneficiaries and define their relationship to the grantor (the person creating the deed). Ambiguities in beneficiary designation can lead to disputes among potential heirs and might necessitate court intervention to resolve.

Incorrectly signing and notarizing the document is a further common mistake. The Texas TOD deed must be signed by the grantor in the presence of a notary public to be valid. Sometimes, individuals sign the document but neglect to have it notarized, or they do not follow the specific requirements for notarization set forth by Texas law. This oversight can render the deed ineffective, as proper execution is a legal necessity for the transfer of property upon the grantor's death.

Neglecting to file the deed with the county clerk's office is yet another error. After proper execution, the TOD deed must be filed with the county clerk in the county where the property is located, prior to the grantor's death. Failure to file the deed means it will not be recognized as valid, and the property could be subjected to probate, which the TOD deed is explicitly designed to avoid.

Some individuals mistakenly think they can use the TOD deed to transfer property to a beneficiary while still alive. The TOD deed only becomes effective upon the grantor's death. Any attempt to transfer property rights before death will not be recognized under the TOD deed provisions. This misunderstanding can lead to confusion and misconceptions about the ownership and rights to the property.

Lastly, there's often a failure to revoke or update the TOD deed when circumstances change. For example, if a beneficiary predeceases the grantor or if the grantor wishes to change the beneficiaries, the deed must be explicitly revoked or amended and the new deed filed. If these updates are not correctly documented and filed, the property could transfer contrary to the grantor's final wishes.

Documents used along the form

When planning for the future, individuals often rely on a variety of legal forms and documents to ensure their wishes are carried out efficiently. In Texas, one valuable tool for estate planning is the Transfer-on-Death (TOD) deed. This allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing probate court. However, to create a complete and effective estate plan, several other documents are typically utilized alongside the TOD deed. Each serves a unique purpose, contributing to a thorough approach to estate planning.

- Last Will and Testament: This foundational document outlines how a person’s assets and estate should be distributed after their death. It names an executor responsible for carrying out the decedent's wishes and can include specific legacies alongside the instructions for property not covered by the TOD deed.

- Power of Attorney: This legal document grants someone else the authority to act on your behalf in legal or financial matters. It can be especially crucial if you become unable to manage your affairs before your death.

- Advanced Healthcare Directive: Also known as a living will, this document specifies your wishes regarding medical treatment if you become incapacitated and cannot communicate your decisions about life support and other treatments.

- Declaration of Guardian: Should you become unable to make your own decisions, this document names the individual you wish to be appointed as your guardian rather than having the court decide without your input.

- Beneficiary Designations: Apart from the TOD deed, specifically for real estate, beneficiary designations are used to specify recipients for other assets, such as bank accounts, retirement accounts, and life insurance policies. These designations often bypass the will and probate, directly transferring assets to the named beneficiaries.

Together with the Transfer-on-Death Deed, these documents form a comprehensive estate plan that safeguards an individual’s wishes and provides clarity and ease for their loved ones during a difficult time. Estate planning can be complex, and each person’s situation is unique. Thus, it's advisable to consult with a legal professional to ensure that all documents are correctly executed and reflect the current state laws, thereby securing one's legacy according to their wishes.

Similar forms

The Texas Transfer-on-Death Deed shares similarities with a Last Will and Testament, both serving the crucial role of directing the distribution of assets upon one's passing. Like a Last Will, the Transfer-on-Death Deed allows individuals to specify beneficiaries for their property, ensuring that their wishes are respected without the need for probate court. However, while a Last Will covers a wide range of assets, the Transfer-on-Death Deed is specifically focused on real estate.

Another related document is the Living Trust, which also bypasses the probate process. Individuals can place assets, including real estate, into the trust to be managed by a trustee for the benefit of the designated beneficiaries. The Transfer-on-Death Deed, however, is more straightforward, directly transferring real estate ownership upon death without involving trustees or the ongoing management of a trust.

The Beneficiary Deed, used in some states, is nearly identical to the Texas Transfer-on-Death Deed, allowing property owners to designate beneficiaries for their real estate that will inherit the property automatically upon the owner's death. Both deeds are effective tools for avoiding probate and simplifying the transfer of property, but their availability and specific rules vary by state.

A Joint Tenancy Agreement allows multiple people to own property together with rights of survivorship. This means when one joint tenant dies, their share automatically passes to the surviving joint tenants, similar to the immediate transfer upon death ensured by a Transfer-on-Death Deed. However, joint tenancy involves ownership during the lifetime, unlike the posthumous effect of the Transfer-on-Death Deed.

The Lady Bird Deed, another real estate planning tool, allows property owners to maintain control over their property during their lifetime, including the ability to sell or mortgage, while automatically transferring to a designated beneficiary upon death. Similar to the Transfer-on-Death Deed, it avoids probate, yet it grants the owner more flexibility during their lifetime.

A Revocable Transfer on Death Account (TODA) is a designation used for financial accounts, allowing account holders to name beneficiaries who will receive the assets in the account upon the account holder's death. Just like the Transfer-on-Death Deed for real estate, TODAs avoid probate and allow for a smoother transition of assets, though they apply to financial rather than real property.

The Durable Power of Attorney for Asset Management allows an individual to appoint an agent to make financial decisions on their behalf, potentially including the sale or management of real estate, should they become incapacitated. Unlike the Transfer-on-Death Deed, which is activated by death, this power of attorney can be effective during the owner's lifetime under certain conditions.

The Medical Power of Attorney designates someone to make healthcare decisions on behalf of the individual if they are unable to do so themselves. While not directly related to the transfer of property, it is another important document for end-of-life planning, ensuring individuals' wishes are honored in both health and asset management.

A Life Estate Deed allows the property owner to transfer their property while retaining the right to use and live in the property for the rest of their life. Upon their death, the property automatically passes to the remainderman named in the deed, similar to the Transfer-on-Death Deed's bypassing of probate, though it comes with the limitation of the life tenant’s rights during their lifetime.

Finally, the Gift Deed is a document used to transfer property to another person without consideration or payment. While both the Gift Deed and Transfer-on-Death Deed involve transferring property, the Gift Deed takes effect immediately, unlike the Transfer-on-Death Deed, which only takes effect after the owner's death. Both allow property to change hands, but under different conditions and timings.

Dos and Don'ts

When it comes to securing the future of your assets, the Texas Transfer-on-Death Deed offers a simple way to pass real estate to your beneficiaries without the need for probate. However, it's important to approach this document with care to ensure that your wishes are clearly communicated and legally binding. Here are some essential do's and don'ts to consider:

Do:- Ensure that you meet all the requirements set by Texas law for creating a Transfer-on-Death Deed, including being of sound mind.

- Clearly identify the property being transferred, using the exact legal description found on your current deed or property tax statement.

- Name one or more beneficiaries precisely, including their full names and contact information, to avoid any confusion after your passing.

- Sign the deed in the presence of a notary public to validate its authenticity and your intention.

- Record the signed deed with the county clerk’s office in the county where the property is located, ideally shortly after signing it.

- Consider consulting with a legal professional to ensure the deed complements your overall estate plan and doesn't unintentionally conflict with other elements, such as your will.

- Keep a copy of the recorded deed in a safe place and inform your beneficiaries about the transfer-on-death arrangement.

- Forget to update your Transfer-on-Death Deed if your intended beneficiary's circumstances change, such as in the event of their death or a fallout.

- Assume that the deed overrides earlier wills or other documents without proper legal advice. The most recent valid document typically governs, but specific situations might differ.

- Overlook the potential impact of debts or taxes on the property. Beneficiaries inherit the property with any associated liabilities.

- Fill out the form too hastily without verifying all the details, especially the legal description of the property, which must be accurate.

- Attempt to use the deed to transfer property that is co-owned without understanding how your rights and the rights of the other owners are affected.

- Ignore the need for a new deed if you wish to change beneficiaries or revoke the transfer-on-death arrangement entirely.

- Forget to review and potentially update your estate plan regularly, especially after major life events such as marriage, divorce, or the birth of a child.

By following these guidelines, you can make the most of the Texas Transfer-on-Death Deed to ensure a smooth and clear transfer of your property, while also providing peace of mind for yourself and your loved ones.

Misconceptions

The Texas Transfer-on-Death (TOD) Deed form is an important tool for estate planning, allowing property owners to pass their real estate directly to beneficiaries without the need for probate. However, several misconceptions exist regarding its use and implications. Understanding these misconceptions can help individuals make more informed decisions about their estate planning needs.

- Misconception 1: The Transfer-on-Death Deed transfers property immediately upon signing. In reality, the transfer of property ownership only occurs after the death of the property owner, allowing them to retain full control over the property during their lifetime.

- Misconception 2: Creating a TOD Deed is a complex and expensive process. Contrary to this belief, the process of creating a TOD Deed in Texas can be straightforward and relatively inexpensive, especially when compared to the costs and complexities of probate.

- Misconception 3: A Transfer-on-Death Deed overrides a will. While a TOD Deed does allow property to pass outside of probate, it specifically concerns only the property described in the deed itself. Other assets and property will be distributed according to the terms of the will or state succession laws if there is no will.

- Misconception 4: All debts against the property are cancelled upon the owner's death. The truth is, any outstanding debts or encumbrances on the property at the time of the owner's death will transfer to the beneficiary. Beneficiaries inherit the property subject to these obligations.

- Misconception 5: The beneficiary has no right to the property before the owner’s death. While it is true that the beneficiary has no ownership rights before the death of the property owner, they do have a prospective interest in the property, which can impact decisions about the property during the owner's lifetime in some circumstances.

- Misconception 6: A Transfer-on-Death Deed is irrevocable. Property owners can indeed revoke a TOD Deed, or create a new one that overrides the previous document, provided they comply with the legal requirements for doing so. This flexibility allows property owners to adapt their estate plans as their wishes or circumstances change.

- Misconception 7: Only single-family homes can be transferred using a Transfer-on-Death Deed. In reality, various types of real property, including land, single-family homes, and certain types of multi-unit buildings, can be transferred via a TOD Deed, as long as the property meets the legal requirements outlined in Texas law.

Understanding these misconceptions is crucial for anyone considering a Transfer-on-Death Deed in Texas. By dispelling these myths, property owners can better appreciate the benefits and limitations of TOD Deeds and make more informed decisions in their estate planning endeavors.

Key takeaways

When filling out and using the Texas Transfer-on-Death (TOD) Deed form, it's important to be informed about its key aspects. Here's a summary of the essential takeaways to ensure the process is done correctly:

- Eligibility: The Texas Transfer-on-Death Deed allows property owners to pass their real estate to a beneficiary without going through probate.

- Property Types: This deed can be applied to various types of real property, including houses, land, and certain types of buildings located in Texas.

- Revocability: The deed is revocable, meaning the property owner can change their mind at any time before their death.

- Filling Out the Form: The form must be completed accurately, including the legal description of the property and the precise identification of the beneficiary.

- Signing Requirements: For the deed to be valid, it must be signed in the presence of a notary public.

- Recording the Deed: After signing, the deed must be filed with the county clerk's office in the county where the property is located, before the owner's death.

- Beneficiary Rights: Beneficiaries do not have any legal right to the property until the death of the owner, at which point the property transfers automatically without needing probate.

- No Impact on Mortgages or Liens: Executing a Transfer-on-Death Deed does not affect any mortgages or other liens on the property; these remain the responsibility of the estate.

Understanding these key points ensures that the Texas Transfer-on-Death Deed form is filled out and used correctly, making the property transfer process smooth and efficient for all parties involved.

Popular Transfer-on-Death Deed State Forms

Problems With Transfer on Death Deeds California - With this document, the tedious process of transferring property rights is streamlined for the beneficiary's benefit.

California Transfer on Death Deed - A Transfer-on-Death Deed form allows individuals to name beneficiaries to their property, ensuring it passes directly to them upon the owner's death, bypassing probate court.