Free Transfer-on-Death Deed Form for New York

When planning for the future, particularly in regard to the assets one has amassed over a lifetime, the New York Transfer-on-Death (TOD) Deed form presents a straightforward yet powerful tool. This legal instrument allows property owners to designate a beneficiary who will inherit their property upon their passing, bypassing the often lengthy and complex probate process. The beauty of the TOD Deed lies in its simplicity and the control it offers property owners over their estate, ensuring that their wishes are honored without undue burden on the heirs. Furthermore, it's revocable, meaning that the property owner retains the flexibility to make changes as life circumstances evolve. The process involves specific criteria and procedures to ensure its legal validity, including proper completion and timely recording with the appropriate county office, underscoring the importance of understanding the form inside and out. By leveraging this mechanism, individuals can secure peace of mind, knowing their legacy will be protected and passed on according to their desires.

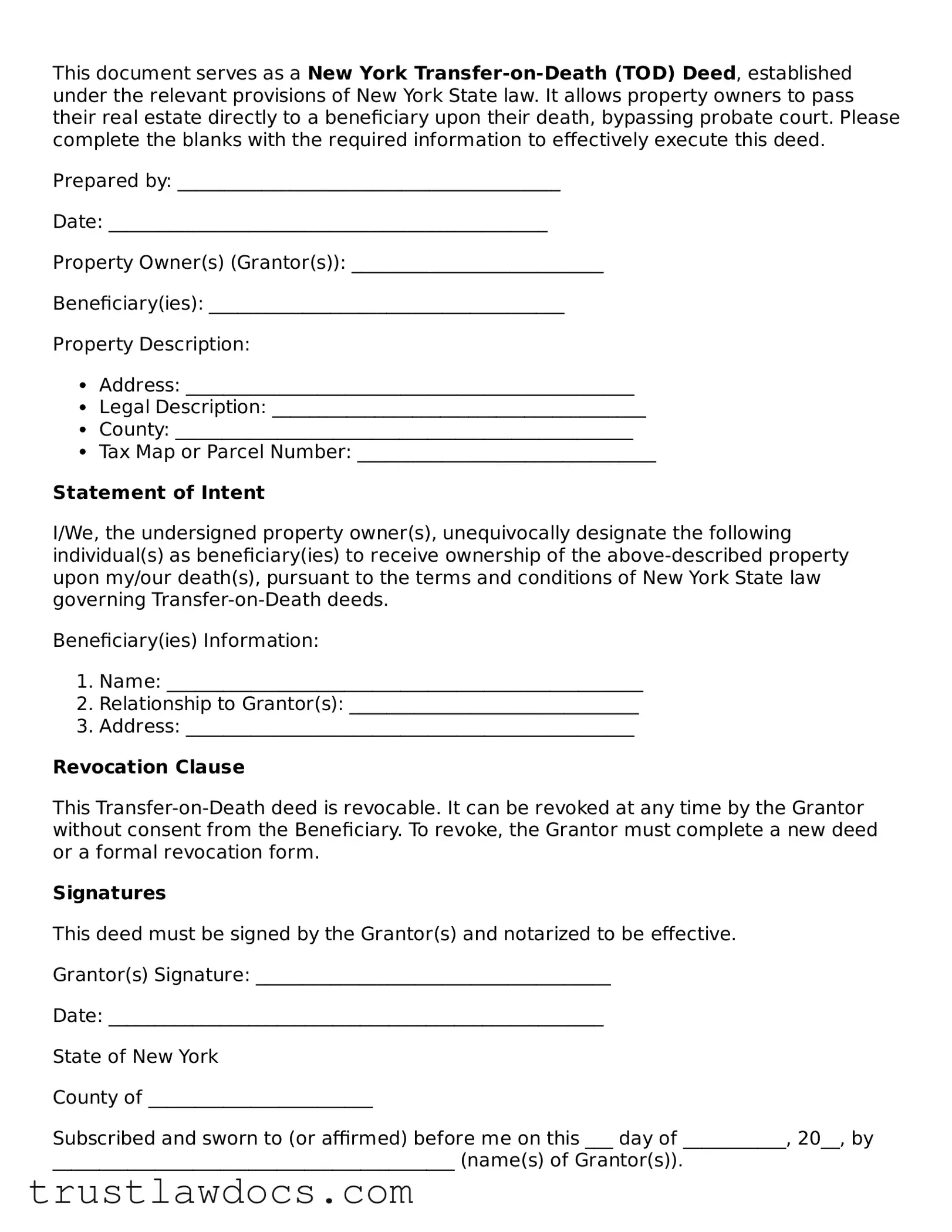

Form Example

This document serves as a New York Transfer-on-Death (TOD) Deed, established under the relevant provisions of New York State law. It allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing probate court. Please complete the blanks with the required information to effectively execute this deed.

Prepared by: _________________________________________

Date: _______________________________________________

Property Owner(s) (Grantor(s)): ___________________________

Beneficiary(ies): ______________________________________

Property Description:

- Address: ________________________________________________

- Legal Description: ________________________________________

- County: _________________________________________________

- Tax Map or Parcel Number: ________________________________

Statement of Intent

I/We, the undersigned property owner(s), unequivocally designate the following individual(s) as beneficiary(ies) to receive ownership of the above-described property upon my/our death(s), pursuant to the terms and conditions of New York State law governing Transfer-on-Death deeds.

Beneficiary(ies) Information:

- Name: ___________________________________________________

- Relationship to Grantor(s): _______________________________

- Address: ________________________________________________

Revocation Clause

This Transfer-on-Death deed is revocable. It can be revoked at any time by the Grantor without consent from the Beneficiary. To revoke, the Grantor must complete a new deed or a formal revocation form.

Signatures

This deed must be signed by the Grantor(s) and notarized to be effective.

Grantor(s) Signature: ______________________________________

Date: _____________________________________________________

State of New York

County of ________________________

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20__, by ___________________________________________ (name(s) of Grantor(s)).

Notary Public: ________________________________

My Commission Expires: ________________________

Instructions for Recording

After completing and notarizing this deed, you must file it with the county recorder's office where the property is located. Ensure all information is accurate and legible to avoid any delays in the recording process.

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | New York does not formally recognize Transfer-on-Death (TOD) deeds under its state laws. |

| 2 | Instead, New York allows for the transfer of real estate upon death through mechanisms such as joint tenancy and trusts. |

| 3 | The absence of a TOD deed statute means real estate owners cannot directly pass property to a beneficiary without the property going through probate. |

| 4 | Probate is the legal process through which a deceased person's estate is properly distributed to heirs and designated beneficiaries, and any debt owed to creditors is paid off. |

| 5 | Creating a living trust is a common alternative in New York for avoiding probate for real estate assets. |

| 6 | A living trust allows property owners to transfer the title of their home into a trust, choosing beneficiaries who will inherit the property upon their death. |

| 7 | In New York, real estate owned as joint tenants with the right of survivorship automatically passes to the surviving owner(s) without going through probate. |

| 8 | The New York Estates, Powers, and Trusts Law (EPTL) governs estate distribution, including assets not covered by a TOD deed or similar instrument. |

| 9 | The lack of a TOD deed option in New York emphasizes the need for comprehensive estate planning to ensure smooth transfer of real estate upon death. |

| 10 | Consulting with an estate planning attorney knowledgeable about New York State law can provide guidance on using trusts, joint tenancy, or other methods to achieve similar outcomes to a TOD deed. |

How to Write New York Transfer-on-Death Deed

A Transfer-on-Death (TOD) Deed can be a powerful estate planning tool, allowing individuals to transfer their real estate to a beneficiary upon their death without the property having to go through probate. This simplifies the process and ensures a smoother transition of the property to the designated beneficiary. In New York, filling out a TOD Deed requires careful attention to detail to ensure that the deed is valid and accurately reflects the grantor's intentions. Follow these steps to fill out the New York Transfer-on-Death Deed form effectively.

- Start by identifying the current owner(s) of the property as the grantor(s). Write the full legal name and address of each grantor exactly as it appears on the current deed.

- Specify the legal description of the property. This information can be found on the current deed or the property's tax bill. It must be accurate and include block and lot numbers, if applicable.

- Designate the beneficiary(ies) who will receive the property upon the grantor’s death. Include the full legal name and address of each beneficiary. If there are multiple beneficiaries, specify the interest each one will have (e.g., equal shares).

- Review the terms of the Transfer-on-Death aspect of the deed, which should specify that the transfer of property will occur upon the grantor's death. This section may be pre-printed on the form.

- Ensure all grantors sign the deed in the presence of a notary public. The notary will need to notarize the deed, confirming the identity of the signers and that they signed the document voluntarily.

- Lastly, file the completed and notarized deed with the New York County Clerk’s Office in the county where the property is located. This may require a filing fee, which varies by county.

Once these steps are completed, the TOD deed will be effective. It's important to note that the deed can be revoked or changed at any time before the grantor's death, as long as the changes are made in accordance with New York law. Ensuring that the form is filled out correctly and filed properly is crucial for the smooth transfer of property to the intended beneficiary without the need for probate proceedings.

Get Answers on New York Transfer-on-Death Deed

What is a Transfer-on-Death Deed (TODD) in New York?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in New York to pass their real estate directly to a beneficiary upon their death, without the need for the property to go through probate. This document only takes effect upon the death of the property owner and allows the owner to maintain control over the property during their lifetime.

Who can use a Transfer-on-Death Deed in New York?

Any individual who owns real estate in New York and wishes to transfer their property upon death without the complexities of probate can use a Transfer-on-Death Deed. The property owner must be of sound mind and legally competent to create this document.

How do I create a Transfer-on-Death Deed in New York?

To create a Transfer-on-Death Deed in New York, the property owner must fill out the TODD form, stating the beneficiary's name clearly. The deed must be signed in the presence of a notary public and then filed with the county clerk in the county where the property is located before the owner's death.

Can I name multiple beneficiaries on a Transfer-on-Death Deed?

Yes, a property owner can name multiple beneficiaries on a Transfer-on-Death Deed. The property owner can specify the percentage of the property each beneficiary is to receive or simply divide it equally among them.

Can a beneficiary be changed after a Transfer-on-Death Deed is recorded?

Yes, the property owner has the right to change the beneficiary(ies) of a Transfer-on-Death Deed at any time before their death. To change a beneficiary, the property owner must complete a new TODD form and record it with the county clerk, nullifying the previous deed.

What happens to the property if the beneficiary predeceases the property owner?

If the beneficiary predeceases the property owner, the Transfer-on-Death Deed becomes ineffective. The property owner should then create a new TODD naming a different beneficiary or the property will become part of the estate and go through probate.

Does a Transfer-on-Death Deed affect my rights to the property during my lifetime?

No, creating a Transfer-on-Death Deed does not affect your rights to the property. You retain full control, including the right to sell or mortgage the property, and may revoke or change the deed at any time during your lifetime.

Are there any costs associated with creating a Transfer-on-Death Deed in New York?

While creating a Transfer-on-Death Deed itself may only involve minimal costs, such as notary fees, there might be recording fees charged by the county clerk's office when the deed is filed. These fees can vary by county.

Is a Transfer-on-Death Deed right for everyone?

A Transfer-on-Death Deed can be a valuable estate planning tool, but it might not be suitable for everyone. For instance, individuals with complex estate issues, multiple properties, or specific wishes regarding their estate's distribution might require a more comprehensive estate plan. Consulting with an estate planning attorney is recommended to explore all available options and to ensure a Transfer-on-Death Deed aligns with your overall estate planning goals.

Common mistakes

Filling out a New York Transfer-on-Death (TOD) Deed form requires attention to detail and an understanding of the legal requirements. A common mistake is not clearly identifying the property. It is crucial to include the full legal description of the property, not just its address, to ensure the deed accurately refers to the correct piece of real estate.

Another oversight is failing to name a beneficiary correctly. It's essential to provide the full legal name of the beneficiary and to specify their relationship to the transferor if possible. Ambiguities in naming beneficiaries can lead to confusion and legal challenges after the transferor's death.

Many people also omit alternate beneficiaries. Including an alternate recipient in case the primary beneficiary predeceases the transferor can prevent the property from falling into unintended hands or becoming part of the transferor's estate, which would be subject to probate.

Ignoring the need for notarization is a critical error. A TOD deed must be notarized to be valid. This means the transferor must sign the document in the presence of a notary public who then verifies the transferor’s identity and affixes an official seal.

Forgetting to file the deed with the county recorder's office renders the TOD deed ineffective. Once notarized, the document must be filed with the appropriate county office to be legally binding. Failure to do so means the property will not automatically transfer upon the transferor’s death.

Some individuals mistakenly alter the deed without legal advice. Modifying a legal document without understanding the implications can void its legality. For changes or revocations, consult a legal professional to ensure the deed remains valid and reflects the transferor's wishes.

A significant blunder is failing to inform beneficiaries about the TOD deed. While not a legal requirement, informing beneficiaries of their designation and the whereabouts of the deed can facilitate a smoother transfer process upon the transferor's death.

Overlooking tax implications is another issue. Although a TOD deed can help avoid probate, it does not exempt the beneficiary from potential estate or inheritance taxes. Understanding the tax consequences tied to receiving property through a TOD deed is important for both the transferor and the beneficiary.

Last but not least, assuming a TOD deed substitutes for a will or estate plan is a misconception. While useful, a TOD deed is just one piece of a comprehensive estate plan. It does not replace the need for a will or address non-titled assets, personal preferences for end-of-life care, or the appointment of guardians for minors.

Documents used along the form

When planning for the future, especially in terms of real estate, a Transfer-on-Death (TOD) deed allows property owners in New York to pass their real estate directly to a beneficiary without the need for probate. However, completing this process typically requires more than just a TOD deed. Several other forms and documents often accompany the TOD deed to ensure a smooth transfer of property and to address all legal and financial aspects involved. The following are some of the most commonly used documents alongside a TOD deed.

- Last Will and Testament: This document complements a TOD deed by specifying the distribution of other assets not covered by the TOD deed. It outlines the decedent's wishes regarding their estate and appoints an executor.

- Revocable Living Trust: Property owners often use this document to manage their assets while they're alive and to transfer property upon death, which can include real estate, thus bypassing probate.

- Power of Attorney: This legal document grants someone else the authority to act on your behalf in legal and financial matters, which can include managing real estate transactions.

- Advance Healthcare Directive: While not directly related to property transfer, this document is crucial for a comprehensive estate plan. It outlines your preferences for medical care if you become unable to make decisions for yourself.

- Beneficiary Designations: Often used for retirement accounts and life insurance policies, these designations ensure that assets are transferred directly to the named beneficiaries, complementing the TOD deed for non-real estate assets.

- Joint Tenancy Agreement: This form of property ownership includes a right of survivorship, which may be considered instead of or in conjunction with a TOD deed for co-owned property.

- Life Estate Deed: Similar in purpose to a TOD deed, this document allows a property owner to transfer their home while retaining the right to live in it for the remainder of their life.

- Probate Avoidance Letter: This document provides a detailed explanation and instructions on how to transfer assets without going through probate, helpful for beneficiaries and executors.

- Property Insurance Policy: Ensuring that there is a current policy is essential. It protects the property's value for the beneficiary who will receive the property upon the owner's death.

Utilizing these documents in conjunction with a Transfer-on-Death deed can create a thorough and comprehensive estate plan. Each document serves a unique purpose, ensuring that all aspects of an individual's estate are addressed, from real estate transfer without probate to the management and distribution of other assets. It's always advisable to consult with a legal professional to create an estate plan that best suits your needs and complies with New York laws.

Similar forms

A Last Will and Testament shares similarities with a New York Transfer-on-Death (TOD) Deed, as both are critical documents for estate planning, allowing individuals to specify beneficiaries for their assets. While a Last Will covers a broad range of assets and requires probate to be legally effective, the TOD Deed is more specific, designed for real estate transactions. It enables a straightforward transfer of property to a beneficiary upon the owner's death, bypassing the often time-consuming and expensive probate process. This swift transfer is a key advantage, making the TOD Deed a valuable tool for estate planning.

Living Trusts are another type of document resembling the New York TOD Deed, albeit with broader implications for asset management and distribution. Both tools help in avoiding probate by directly transferring assets to beneficiaries upon death. However, a Living Trust offers more control over how and when the assets are distributed, catering to more complex situations, such as staggered distributions or provisions for minors. The TOD Deed, conversely, is more straightforward, mainly focusing on real estate transfers without the detailed conditions applicable to various assets managed by a trust.

The Beneficiary Designation, commonly used for retirement accounts, insurance policies, and certain bank accounts, also parallels the New York TOD Deed in function and objective. Each document names beneficiaries to receive assets directly upon the account holder's or property owner's death, bypassing the probate process. However, while beneficiary designations apply to specific financial products or accounts, the TOD Deed is exclusive to real estate property, serving a similar purpose in a different legal and financial context.

Joint Tenancy Agreements share a resemblance to the Transfer-on-Death Deed, as both involve the transfer of property rights upon death. In a Joint Tenancy, the property is owned by two or more individuals with equal rights. Upon the death of one owner, the property automatically passes to the surviving owner(s) without the need for probate, similar to how a TOD Deed transfers property to a designated beneficiary. The main difference lies in the joint owners' rights during their lifetimes under a Joint Tenancy, which is not a feature of the TOD Deed, emphasizing post-death transfer without affecting ownership rights or the property control during the owner's lifetime.

Dos and Don'ts

When addressing the task of filling out a New York Transfer-on-Death (TOD) Deed form, it’s essential to navigate the process with precision and foresight. This document enables individuals to transfer property to a beneficiary upon their death, bypassing the complexities of probate. Here are key do’s and don’ts to guide you through this critical legal document.

Do's:- Review the Entire Form Before Starting: Understand all sections of the form to ensure you provide complete and accurate information. This will minimize the risk of errors that could potentially render the deed invalid.

- Consult with a Real Estate Lawyer: Legal advice is invaluable in interpreting the form’s requirements and implications. A lawyer can offer personalized guidance on tailoring your TOD deed to suit your estate planning goals.

- Use Precise Legal Descriptions for the Property: The description of the property in the deed must match the one on your current property deed. Accuracy is crucial for the legal transfer of the property.

- Sign in the Presence of a Notary Public: Your signature must be notarized to validate the deed. This formalizes your intent and the document’s authenticity.

- Don’t Leave Any Sections Blank: Incomplete forms may lead to misunderstandings or legal challenges. If a section does not apply, consider marking it as “N/A” (not applicable) instead of leaving it blank.

- Don’t Forget to Plan for Contingencies: Life is unpredictable. Designate alternate beneficiaries in case your primary beneficiary predeceases you or is unable to inherit for any reason.

- Don’t Neglect to Review the Beneficiary Designation: Ensure that the names of beneficiaries are spelled correctly and clearly identify each person or entity you intend to inherit the property.

- Don’t Fail to Record the Deed: After proper completion and notarization, the deed must be recorded with the county clerk’s office where the property is located. An unrecorded TOD deed may not be effective.

This list is not exhaustive, but it covers fundamental aspects of completing a TOD deed accurately and legally. Always remember, the smallest details can have significant legal implications, making thoroughness and precision paramount.

Misconceptions

When it comes to planning for the future, understanding the specifics of legal documents is crucial. In New York, Transfer-on-Death (TOD) Deeds can be an effective tool for estate planning but are surrounded by common misconceptions. Let's clear up some of these misunderstandings to ensure you have the accurate information you need.

- Misconception 1: A Transfer-on-Death Deed automatically overrides a will.

This is not accurate. While a TOD Deed does transfer property to a beneficiary without going through probate, it doesn't override a will if there are inconsistencies regarding the property in question. Both instruments must be coordinated to reflect your current wishes.

- Misconception 2: You cannot change your mind after recording a Transfer-on-Death Deed.

Actually, one of the benefits of a TOD Deed is its flexibility. The owner can revoke the deed or change the beneficiary at any time before their death, as long as the modifications are properly executed and recorded.

- Misconception 3: The beneficiary takes on the property's debts and taxes upon the owner's death.

This is a myth. The property transferred through a TOD Deed does indeed pass to the beneficiary free from probate, but the beneficiary is not personally responsible for the decedent’s debts unless they agree to assume them. The estate is still liable for any debts and taxes owed.

- Misconception 4: Transfer-on-Death Deeds are recognized and can be used in all 50 states.

Not all states recognize the use of TOD Deeds. It’s important to consult with a legal professional in your state to understand if and how you can use a TOD Deed as part of your estate planning.

- Misconception 5: Creating a Transfer-on-Death Deed is complicated and expensive.

In reality, preparing a TOD Deed can be relatively straightforward and cost-effective, especially compared to the potential costs and time involved with probate. However, to ensure it is executed correctly and reflects your wishes, professional guidance is recommended.

- Misconception 6: A Transfer-on-Death Deed allows the beneficiary to take immediate control of the property before the owner's death.

This isn't true. The TOD Deed only takes effect upon the owner’s death. Until then, the owner retains full control over the property, including the right to sell or mortgage it.

- Misconception 7: Transfer-on-Death Deeds are only for those with no heirs or close family.

People with a wide range of family circumstances use TOD Deeds. They can be a useful estate planning tool for anyone looking to streamline the process of transferring property upon their death, not just for those without heirs.

- Misconception 8: A Transfer-on-Death Deed must be notarized and witnessed by two non-family members.

While a TOD Deed does need to be notarized to be valid, the requirement for witnesses can vary by state. It's crucial to follow the specific legal requirements of your state to ensure the deed is correctly executed.

- Misconception 9: The beneficiary needs to accept the deed before the owner's death to make it valid.

Actually, the beneficiary does not need to accept the TOD Deed or even be aware of it for the deed to be valid. Acceptance is only required after the owner's death for the transfer of the property to be completed.

Understanding these misconceptions about Transfer-on-Death Deeds in New York can empower you to make informed decisions in your estate planning. Remember, laws can vary by state, and it’s always recommended to seek professional advice specific to your situation. Being well-informed will help ensure that your estate is handled according to your wishes with as little stress for your loved ones as possible.

Key takeaways

The New York Transfer-on-Death (TOD) deed form allows property owners to pass their real estate to a beneficiary without the need for probate court proceedings after their death. Utilizing this form effectively requires understanding some key aspects:

- Ensure Accurate Completion: To be valid, all sections of the Transfer-on-Death deed form must be accurately filled out. It's imperative that the property owner correctly identifies the property, themselves, and the designated beneficiary(ies). Any error can make the deed invalid, potentially leading to complicated legal disputes.

- Witness and Notarization Requirements: For a TOD deed to be legally binding in New York, it must be signed in the presence of two witnesses. Furthermore, the deed requires notarization. These steps are crucial for the document to be considered valid and enforceable. Skipping or improperly completing these steps could render the document void, leaving the estate subject to the traditional probate process.

- Revocability: The Transfer-on-Death deed form is revocable. This means that the property owner can change their mind at any time before their death. Modifications or revocations must also follow specific legal procedures to be effective. This flexibility allows the property owner to adapt to changes in circumstances or relationships.

- Filing the Deed: Simply completing and notarizing a TOD deed is not the final step; the deed must be properly filed with the appropriate local office (typically the county recorder's office) before the property owner’s death. Failure to file the deed correctly can result in the TOD deed being considered invalid, forcing the estate into probate.

By understanding these key takeaways, individuals can ensure their Transfer-on-Death deed accurately reflects their wishes and that their property will be transferred smoothly and efficiently to their chosen beneficiary(ies) upon their passing.

Popular Transfer-on-Death Deed State Forms

What Are the Disadvantages of a Transfer on Death Deed? - The Transfer-on-Death Deed stands as a testament to the owner's foresight in planning for the seamless transition of their property.

Problems With Transfer on Death Deeds California - This straightforward document dictates clear terms for property succession, making it an effective estate planning instrument.