Free Transfer-on-Death Deed Form for Michigan

Planning for the future, especially when it involves the matters of estate transition, demands careful consideration and understanding of the legal instruments available. Among these, the Michigan Transfer-on-Death (TOD) Deed form stands out as a vital resource for property owners seeking a straightforward method of passing on real estate to their beneficiaries upon their passing, without the need for probate. This legal document allows individuals to retain full control over their property during their lifetime, including the ability to sell or modify the property, with the added confidence that their estate will be transferred directly to the designated beneficiaries when the time comes. Unique in its structure, the TOD Deed in Michigan underscores the importance of proactive estate planning, ensuring that the transfer process aligns with the owner’s wishes, simplifying the complex legal landscape surrounding estate management. By unlocking a more direct path to inheritance, this tool not only provides peace of mind for property owners but also offers a semblance of security for future generations, underscoring the significance of understanding and utilizing such forms in one's estate planning endeavors.

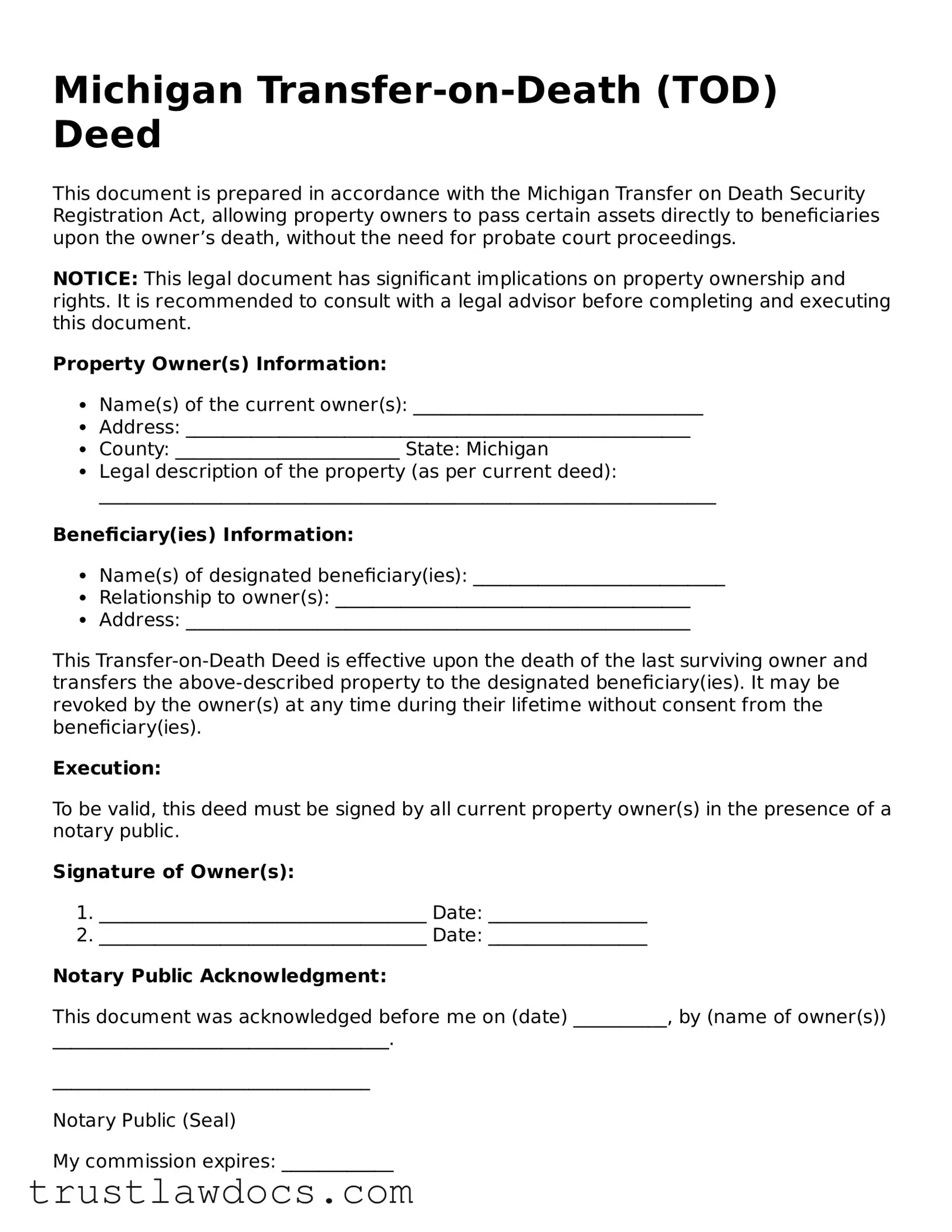

Form Example

Michigan Transfer-on-Death (TOD) Deed

This document is prepared in accordance with the Michigan Transfer on Death Security Registration Act, allowing property owners to pass certain assets directly to beneficiaries upon the owner’s death, without the need for probate court proceedings.

NOTICE: This legal document has significant implications on property ownership and rights. It is recommended to consult with a legal advisor before completing and executing this document.

Property Owner(s) Information:

- Name(s) of the current owner(s): _______________________________

- Address: ______________________________________________________

- County: ________________________ State: Michigan

- Legal description of the property (as per current deed): __________________________________________________________________

Beneficiary(ies) Information:

- Name(s) of designated beneficiary(ies): ___________________________

- Relationship to owner(s): ______________________________________

- Address: ______________________________________________________

This Transfer-on-Death Deed is effective upon the death of the last surviving owner and transfers the above-described property to the designated beneficiary(ies). It may be revoked by the owner(s) at any time during their lifetime without consent from the beneficiary(ies).

Execution:

To be valid, this deed must be signed by all current property owner(s) in the presence of a notary public.

Signature of Owner(s):

- ___________________________________ Date: _________________

- ___________________________________ Date: _________________

Notary Public Acknowledgment:

This document was acknowledged before me on (date) __________, by (name of owner(s)) ____________________________________.

__________________________________

Notary Public (Seal)

My commission expires: ____________

Instructions for Recording:

To be legally effective, this Transfer-on-Death Deed must be recorded with the county recorder’s office where the property is located before the owner's death. Please contact the local recorder's office for specific filing requirements and fees.

Revocation:

A Transfer-on-Death Deed can be revoked by completing a new deed or by executing a formal revocation document. The revocation must be recorded in the same manner as this deed to be effective.

It is crucial to keep this document in a safe but accessible place and inform beneficiaries or executors of its location.

This document is prepared to provide peace of mind and clarity on the succession of ownership of the property described. It allows for a smoother transition and can help avoid lengthy and potentially costly probate proceedings.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Michigan Transfer-on-Death (TOD) Deed form allows property owners to pass their real estate to a beneficiary upon their death without the property going through probate. |

| Governing Law | Michigan Compiled Laws Section 700.3801 to 700.3840, which is part of the Estates and Protected Individuals Code. |

| Property Types Allowed | Only applies to real property, such as homes, buildings, and land. |

| Probate Avoidance | Upon the owner's death, the property immediately transfers to the beneficiary, avoiding probate. |

| Revocability | The Transfer-on-Death Deed can be revoked or changed at any time by the owner before death. |

| Beneficiary Restrictions | No restrictions on who can be named a beneficiary; individuals, organizations, and trusts can be beneficiaries. |

| Recording Requirements | The deed must be recorded with the county register of deeds before the owner's death to be effective. |

| Signature and Witnessing | The owner must sign the deed in the presence of a notary public to be legally binding. |

How to Write Michigan Transfer-on-Death Deed

When it's time to manage how your real estate property will pass on after you're gone, Michigan's Transfer-on-Death (TOD) deed can be a straightforward solution. This deed allows you to name a beneficiary who will inherit the property without the need for probate court. Filling out the TOD deed requires attention to detail to ensure your wishes are accurately recorded. The steps below will guide you through the process, helping to make sure that your property is transferred smoothly and according to your plans.

- Start by locating the correct form. Transfer-on-Death Deeds may be available from local law offices, online legal services, or potentially from the Michigan state government's website.

- Fill in your full name and address at the top of the form. This section identifies you as the current property owner.

- Enter the legal description of the property. This information can be found on your property's current deed or by contacting your local property records office. Make sure to copy this information accurately; mistakes here could lead to big problems later.

- Next, designate your beneficiary(s). Write their full legal names and addresses. If you're naming more than one beneficiary, specify the interest each person will have in the property (for example, equal shares).

- Review the remainder of the deed carefully. Some TOD deeds have additional sections or acknowledgments that need to be read and understood before proceeding.

- Sign the deed in front of a notary public. Many banks offer notary services, or you might find a notary public at local government offices or shipping centers.

- Finally, file the completed deed with your county’s Register of Deeds office. There may be a filing fee, so it's wise to check in advance what the cost will be and acceptable forms of payment.

After these steps are complete, you will have successfully set up a Transfer-on-Death Deed, ensuring your property bypasses probate and goes directly to your chosen benefactor(s). Remember, life circumstances and relationships may change, so it's a good idea to review and possibly update your TOD deed periodically or after significant life events.

Get Answers on Michigan Transfer-on-Death Deed

What is a Michigan Transfer-on-Death (TOD) Deed?

A Michigan Transfer-on-Death (TOD) Deed is a legal document that allows property owners to pass their real estate to a named beneficiary without the need for a will or going through probate court. Upon the death of the property owner, the property is transferred to the beneficiary directly.

Who can use a TOD Deed in Michigan?

Any individual who owns real estate in Michigan and wishes to transfer their property upon death without the complexities of probate can use a TOD Deed. It's crucial that the individual is of sound mind and legal capacity to execute this document.

How does one create a TOD Deed in Michigan?

To create a TOD Deed in Michigan, the property owner must complete a deed form that complies with state laws, including the legal description of the property, and must designate a beneficiary. The deed then needs to be signed in the presence of a notary and recorded with the county recorder's office where the property is located before the owner's death.

Can a TOD Deed be revoked?

Yes, a TOD Deed in Michigan can be revoked at any time by the property owner before their death. This can be done by preparing a new TOD Deed that revokes the previous one, transferring the property to someone else, or creating and recording a document that specifically revokes the TOD Deed.

Are there any limitations to what can be transferred with a TOD Deed?

In Michigan, a TOD Deed can only be used to transfer real estate. This includes houses, condos, and land. It does not apply to personal property such as vehicles, bank accounts, or other types of assets.

What happens if the beneficiary predeceases the owner?

If the beneficiary named in the TOD Deed predeceases the owner, the deed becomes ineffective. The property owner should then execute a new TOD Deed naming a different beneficiary to ensure the property is transferred according to their wishes upon death.

Do beneficiaries need to accept the property?

Yes, beneficiaries named in a TOD Deed must formally accept the property after the owner's death. This process typically involves filing a document, such as an affidavit, with the local county recorder's office. If the beneficiary chooses not to accept the property, it may be distributed according to the deceased owner's will or state succession laws if no will exists.

How does a TOD Deed affect estate taxes?

The transfer of property through a TOD Deed is subject to estate taxes just like any other asset transfer upon death. However, estate taxes at the federal and state level are subject to thresholds, and many estates fall below these thresholds and are not subject to taxes. Property owners should consult with a tax professional to understand potential tax implications.

Can a TOD Deed be contested?

Like any legal document, a TOD Deed can be contested, typically on grounds such as the property owner's lack of mental capacity at the time of signing, undue influence, or fraud. Contesting a TOD Deed requires legal proceedings, and any interested party considering such action should seek advice from a qualified attorney.

Common mistakes

When filling out the Michigan Transfer-on-Death (TOD) Deed form, people often make a handful of mistakes that could potentially complicate what is meant to simplify the transfer of property upon their death. Understanding these common pitfalls can ensure that the process goes smoothly and that the property is transferred according to the owner’s wishes.

Firstly, a common mistake is not properly identifying the beneficiaries. The names of the beneficiaries should be clearly stated, including middle names or initials if that is how their legal identification is formatted. This specificity helps to avoid any confusion regarding the identity of the beneficiaries, ensuring that the property is transferred to the right person.

Another error is not providing a clear legal description of the property. Simply using an address is often not enough. The legal description of the property as found in your property deed should be used on a TOD Deed form. This description includes lot numbers, subdivision names, and other details that precisely identify the property in legal terms. Neglecting to provide this can lead to disputes about exactly what land is being transferred.

Not acknowledging the potential for simultaneous death is also a mistake. Including a provision for what should happen if the beneficiary dies at the same time as the property owner—or within a short period thereafter—can avoid complications. This could involve naming alternate beneficiaries to ensure the property still passes outside of probate, in line with the original intent.

Incorrectly signing or notarizing the document is another common issue. The TOD Deed must be signed in the presence of a notary to be legally binding. Sometimes, individuals overlook this step or assume a standard signature is enough. Without proper notarization, the transfer could be deemed invalid, derailing the entire intent of avoiding probate for the property.

Failing to file the TOD Deed with the appropriate county register of deeds before the death of the property owner is a critical oversight. The document only becomes effective upon filing with the county where the property is located. If this step is missed, the TOD Deed could be considered ineffective, leaving the property to be dealt with as part of the estate, which typically involves going through probate.

Lastly, some property owners forget to update the TOD Deed after major life changes, such as the death of a beneficiary or a change in marital status. Keeping the TOD Deed current ensures that the property will transfer according to the owner's most recent wishes. Changes in relationships or the addition of family members might necessitate updates to the deed to prevent unintended outcomes.

By being mindful of these common mistakes, property owners can ensure that their Michigan TOD Deed accurately reflects their intentions, paving the way for a smoother transition of their assets upon their passing.

Documents used along the form

In the state of Michigan, the Transfer-on-Death (TOD) deed form is a valuable document for individuals looking to pass on real estate to a beneficiary without the need for probate court proceedings. Alongside the TOD deed, several other forms and documents are commonly used to ensure a smooth transfer process and comprehensive estate planning. These documents play crucial roles in designating the transfer of assets, specifying wishes, and ensuring legal compliance. Below is a list of up to six forms and documents often utilized in conjunction with the Michigan Transfer-on-Death deed form.

- Last Will and Testament: This legal document complements the TOD deed by specifying the decedent’s wishes regarding the distribution of personal belongings and assets not covered by the TOD deed. It appoints an executor to manage the estate affairs.

- Revocable Living Trust: A trust allows individuals to manage their assets during their lifetime and specify how these assets are distributed upon death, avoiding probate for the assets held in the trust. It can work alongside the TOD deed for a comprehensive estate plan.

- Financial Power of Attorney: This form designates someone to manage financial affairs on behalf of the individual if they become unable to do so themselves. It’s essential for comprehensive estate planning.

- Medical Power of Attorney: Also known as a healthcare proxy, this document appoints someone to make medical decisions on the individual’s behalf if they are incapacitated, ensuring their health care wishes are honored.

- Beneficiary Designations: Often used for retirement accounts, life insurance policies, and other financial accounts, these designations specify who will receive the assets upon the account holder's death, bypassing the probate process.

- Property Deed: For real estate not covered by a TOD deed, a property deed transfers ownership of real estate. It is necessary to have a clear record of all real estate owned and how it is titled to understand what happens upon the owner's death.

Utilizing these documents in conjunction with the Michigan Transfer-on-Death deed can offer a comprehensive approach to estate planning, addressing various assets and ensuring that an individual’s wishes are honored without the lengthy and often costly probate process. Proper consultation with a legal professional can offer guidance tailored to an individual’s unique situation, ensuring that all legal requirements are met and assets are protected for future generations.

Similar forms

The Michigan Transfer-on-Death (TOD) Deed form shares similarities with a will, specifically in its function of designating beneficiaries for the transfer of property upon the owner's death. Like a will, the TOD deed allows individuals to outline their wishes regarding who inherits their real estate without the property having to go through probate. However, unlike a will, a TOD deed only applies to real estate and becomes effective immediately upon the owner's death without requiring probate court proceedings.

Comparable to a living trust, the Michigan TOD deed provides a mechanism for the management and transfer of assets upon death. Both living trusts and TOD deeds enable the direct transfer of assets to beneficiaries, bypassing the probate process. The crucial difference is in the control mechanism; a living trust can encompass various types of assets and involves managing them during the grantor's lifetime, whereas a TOD deed specifically pertains to real estate and only transfers ownership after death.

A life estate deed is another document that bears resemblance to the Michigan TOD Deed. In both cases, control over the property is divided by time: a life estate deed grants someone use of the property for their lifetime before it passes to a remainderman, while a TOD deed allows the owner to retain control until death, after which the property transfers to a named beneficiary. The key distinction lies in the TOD deed providing full control to the owner without involving a remainderman during their lifetime.

Joint tenancy with right of survivorship agreements also share common ground with Michigan's TOD deeds, as they both provide for the transfer of property upon death outside of probate. Under joint tenancy, the property automatically passes to the surviving owner(s) upon the death of one owner. However, a TOD deed names a beneficiary who is not necessarily an owner, allowing a more flexible approach to planning for the single owner's death.

Beneficiary deeds, similar to the Michigan TOD deed, are used to transfer property to a beneficiary upon the death of the property owner. They are virtually synonymous but might be more common or legally recognized in different states under the beneficiary deed terminology. The purpose and function remain consistent, focusing on avoiding the probate process and simplifying the transfer of real estate assets upon death.

A Payable on Death (POD) account is akin to the transfer-on-death deed concept, applied to financial accounts. Like the TOD deed, a POD designation allows the account holder to name a beneficiary who will receive the funds in the account upon the holder's death, without going through probate. While a TOD deed applies to real property, POD designations apply to financial assets, offering a streamlined means of transferring wealth.

The Lady Bird deed, exclusive to some states and not specifically Michigan, resembles the TOD deed in its core goal of bypassing the probate process for real estate. It allows the property owner to retain control over the property during their lifetime, including the right to sell or mortgage, with the property automatically transferring to the named beneficiary upon the owner’s demise. The difference is mainly in the legal framework and specific control elements during the owner's lifetime.

Lastly, the General Warranty Deed, while used for different purposes, intertwines with the mechanism of a TOD deed in the realm of real estate transactions. A General Warranty Deed is used to guarantee the buyer's clear title to the property, providing protection against future claims. In contrast, a TOD deed makes no promises regarding the title's condition, solely focusing on naming a beneficiary to receive the property upon the owner's death without any warranty of clear title.

Dos and Don'ts

When planning for the future of your estate, a Transfer-on-Death (TOD) Deed can be a valuable tool, particularly in Michigan where it allows property to be passed on without the need for a probate court process. However, completing this form requires attention to detail and a clear understanding of your intentions. Below are essential dos and don'ts that should guide you when filling out the Michigan Transfer-on-Death Deed form.

Do:

- Review the form thoroughly before starting to ensure you understand all requirements.

- Use clear and precise language to describe the property and the beneficiaries to prevent any potential confusion.

- Consult with an estate planning attorney if you have questions or need advice specific to your situation. Legal guidance can help avoid common pitfalls.

- Make sure all the information provided matches the official records, especially details like the legal description of the property and the full legal names of the beneficiaries.

- Sign the deed in front of a notary public to ensure it is legally binding. The notarization process is a crucial step for the document to be effective.

- Record the deed with the Michigan County Register of Deeds where the property is located. Filing the deed is essential for the transfer to be recognized legally upon your death.

- Inform your beneficiaries about the TOD deed. This ensures they are aware of the property they will inherit and understand any responsibilities they may have.

- Review and update the deed as necessary, especially if your circumstances or intentions change. Life events such as marriage, divorce, or the death of a beneficiary may require adjustments to the deed.

- Keep a copy of the recorded deed in a safe place, but make sure it is accessible to your beneficiaries or executor.

- Consider the impact on your overall estate plan and how the TOD deed fits with your other estate planning documents and strategies.

Don't:

- Postpone completing the deed if you’ve decided it’s the right step for your estate plan. Procrastination can lead to unnecessary complications later.

- Forget to designate an alternate beneficiary in case your primary beneficiary predeceases you. This foresight can prevent the property from going through probate.

- Use vague language when identifying the property or beneficiaries. Clarity is key to enforceability and effectiveness.

- Fail to adhere to state-specific requirements. Each state has its own laws regarding TOD deeds, and neglecting these can invalidate your document.

- Leave parts of the form blank or incomplete. This could lead to misinterpretation or invalidation of your deed.

- Overlook the need for notarization. This step is not just a formality; it's a legal necessity for the deed’s validity.

- Rely solely on the TOD deed for your estate planning. It should be part of a comprehensive plan that addresses all your assets and wishes.

- Neglect to consider potential conflicts among beneficiaries. Clear communication can help mitigate disputes before they arise.

- Forget to record the deed. An unrecorded deed is ineffective for the transfer of property upon death.

- Assume the deed absolves you from mortgage obligations or other responsibilities tied to the property. The beneficiary inherits the property along with any associated liabilities.

Misconceptions

Misconceptions about legal documents are common, especially when it comes to something as crucial as the management and transfer of property after one's death. In Michigan, the Transfer-on-Death (TOD) deed is a useful tool, but it is often misunderstood. Here, we're clearing up some of the most common misconceptions about the Transfer-on-Death Deed form in Michigan.

- It overrides a will: A frequent misunderstanding is that a TOD deed can override the provisions of a will regarding the same piece of property. However, the truth is that a TOD deed takes precedence over a will. If a property is designated to a beneficiary in a TOD deed, that designation stands, regardless of what the will says about the property.

- It avoids all forms of estate administration: Many people think that by having a TOD deed, they can skip the estate administration process altogether. While it's true that a TOD deed can help avoid the probate process for the property in question, it does not eliminate the necessity for estate administration if there are other assets that do not have a designated beneficiary.

- It’s only for real estate: Although the TOD deed is primarily used for the transfer of real estate, it’s important to understand that similar mechanisms exist for other types of assets, such as vehicles and financial accounts. Each asset type has its own form of transfer-on-death designation available in Michigan.

- The beneficiary has immediate rights to the property: Some believe that once a TOD deed is executed, the beneficiary has immediate rights to the property. This is not the case. The beneficiary's rights to the property only come into effect upon the death of the property owner.

- It’s irrevocable: Another common misconception is that once a TOD deed is created, it cannot be changed. In fact, a TOD deed is fully revocable. The property owner can change the beneficiary or revoke the deed entirely at any time prior to their death, as long as it is done so in a legally acceptable manner.

- No taxes are due on transfer: Finally, it’s often assumed that the transfer of property using a TOD deed is free from taxes. While a TOD deed can avoid probate, it does not automatically exempt the transfer from estate taxes, inheritance taxes, or other forms of taxation that may apply upon the owner's death.

Understanding the true nature of Transfer-on-Death deeds in Michigan is important for effective estate planning. It allows property owners to make informed decisions, ensuring their assets are distributed according to their wishes with minimal complications. As with any legal process, seeking the advice of a qualified professional is recommended to navigate the specifics of your situation.

Key takeaways

When contemplating the facilitation of property transfer upon passing, the Michigan Transfer-on-Death (TOD) Deed form emerges as a pivotal document. It enables property owners to designate beneficiaries for their real estate, ensuring a smooth transition without the necessity of probate court proceedings. Understanding its provisions can significantly empower property owners, providing clarity and ensuring their wishes are faithfully executed. The following key takeaways outline essential aspects of filling out and utilizing the Michigan Transfer-on-Death Deed form:

- Eligibility and Requirements: To be eligible to create a TOD deed in Michigan, one must hold the title to the property individually or as joint tenants. The form requires complete and accurate details about the property, the current owner(s), and the designated beneficiary(ies). This document must be notarized to ensure its legality and enforceability.

- Revocability: A distinguishing feature of the TOD deed is its revocability. At any point during the owner’s lifetime, the deed can be amended or revoked. This flexibility allows property owners to adapt their estate plan to changing circumstances without impacting the current ownership or possession of the property.

- Witnessing and Notarization: Proper execution of the TOD deed demands it be signed in the presence of a notary public. Some states may also require witnesses; however, the primary emphasis is on the notarization process, confirming the identity of the signer and their understanding and willingness to sign the document.

- Recording the Deed: After notarization, the TOD deed must be recorded with the local county’s Register of Deeds to be effective. This recording process places the deed into the public record, providing notice of the intended transfer of ownership upon the death of the property owner. Failure to record the deed may invalidate the transfer, compelling the estate to pass through probate court.

Overall, the Michigan Transfer-on-Death Deed provides a valuable tool for estate planning, offering a streamlined mechanism to transfer property posthumously. It preserves the owner's control over the property during their lifetime while ensuring the property bypasses the potentially lengthy and costly probate process. By adhering to these key practices and legal requirements, property owners can ensure their assets are distributed according to their wishes, providing peace of mind and security for both themselves and their beneficiaries.

Popular Transfer-on-Death Deed State Forms

What Are the Disadvantages of a Transfer on Death Deed? - The document is effective only upon the death of the property owner, offering a straightforward approach to estate planning.

Where Can I Get a Tod Form - Streamlines the process of transferring property, making it an essential tool for effective estate planning.