Free Transfer-on-Death Deed Form for Indiana

Preparing for the future, especially when it involves making plans for one's assets post-mortem, requires careful consideration and understanding of available legal instruments. Among these, the Indiana Transfer-on-Death (TOD) Deed form stands out as a critical document for individuals wishing to bypass the often lengthy and expensive probate process for real estate assets. This form allows property owners in Indiana to designate beneficiaries to whom their property will automatically transfer upon their death, without the need for probate. It is a powerful tool that ensures a smoother transition of property ownership, but it also necessitates adherence to specific legal requirements and considerations to ensure its validity. Understanding its implications, the conditions under which it can be revoked, and how it fits into one's broader estate planning strategy is essential for anyone considering its use. This introduction aims to shed light on the major aspects of the Indiana TOD Deed form, offering a foundation on which to build a comprehensive estate planning approach.

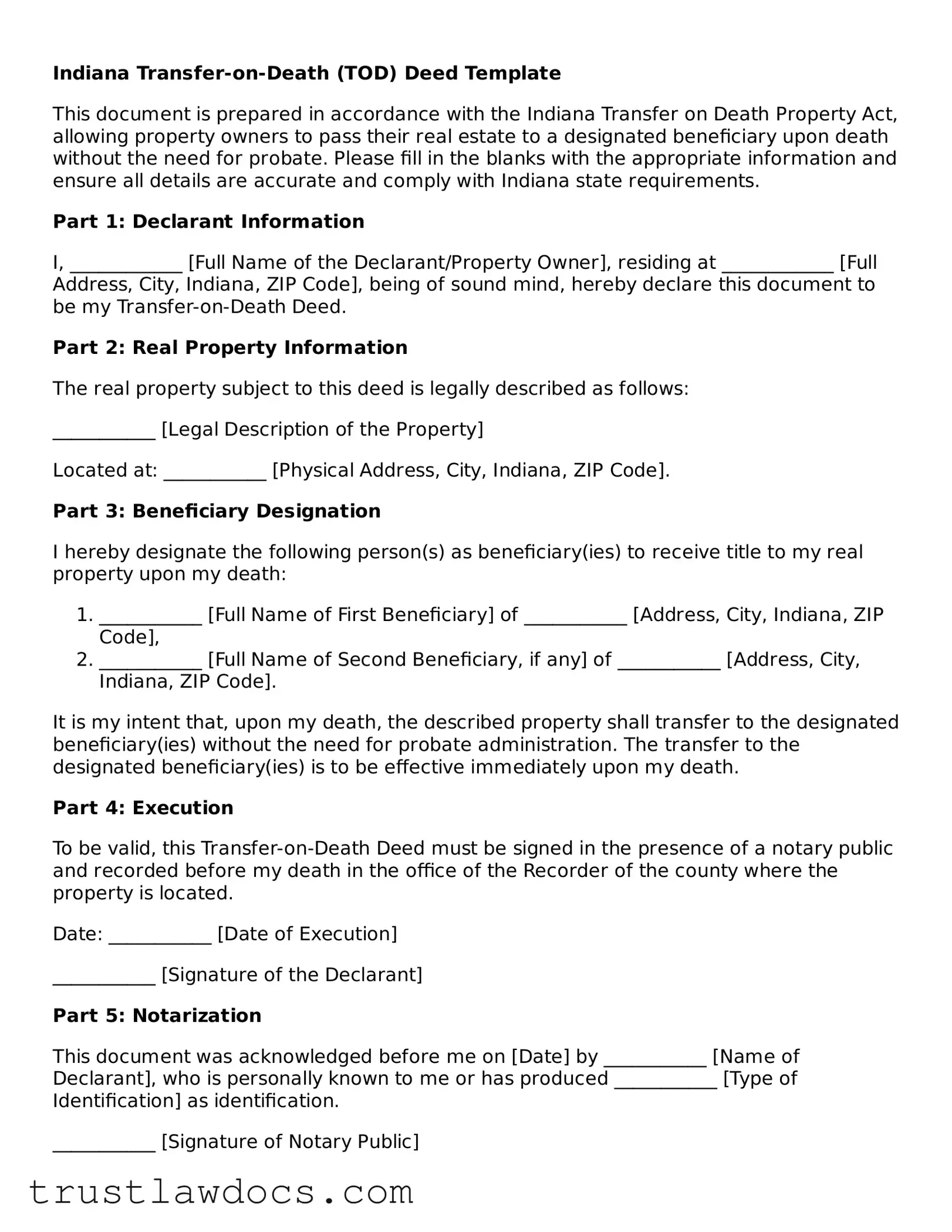

Form Example

Indiana Transfer-on-Death (TOD) Deed Template

This document is prepared in accordance with the Indiana Transfer on Death Property Act, allowing property owners to pass their real estate to a designated beneficiary upon death without the need for probate. Please fill in the blanks with the appropriate information and ensure all details are accurate and comply with Indiana state requirements.

Part 1: Declarant Information

I, ____________ [Full Name of the Declarant/Property Owner], residing at ____________ [Full Address, City, Indiana, ZIP Code], being of sound mind, hereby declare this document to be my Transfer-on-Death Deed.

Part 2: Real Property Information

The real property subject to this deed is legally described as follows:

___________ [Legal Description of the Property]

Located at: ___________ [Physical Address, City, Indiana, ZIP Code].

Part 3: Beneficiary Designation

I hereby designate the following person(s) as beneficiary(ies) to receive title to my real property upon my death:

- ___________ [Full Name of First Beneficiary] of ___________ [Address, City, Indiana, ZIP Code],

- ___________ [Full Name of Second Beneficiary, if any] of ___________ [Address, City, Indiana, ZIP Code].

It is my intent that, upon my death, the described property shall transfer to the designated beneficiary(ies) without the need for probate administration. The transfer to the designated beneficiary(ies) is to be effective immediately upon my death.

Part 4: Execution

To be valid, this Transfer-on-Death Deed must be signed in the presence of a notary public and recorded before my death in the office of the Recorder of the county where the property is located.

Date: ___________ [Date of Execution]

___________ [Signature of the Declarant]

Part 5: Notarization

This document was acknowledged before me on [Date] by ___________ [Name of Declarant], who is personally known to me or has produced ___________ [Type of Identification] as identification.

___________ [Signature of Notary Public]

___________ [Printed Name of Notary Public]

Notary Public for the State of Indiana.

My commission expires: ___________

PDF Form Details

| Fact | Detail |

|---|---|

| Governing Law | Indiana Code Title 32, Article 17, Chapter 2.5 - Transfer on Death Property Act. |

| Purpose | Allows property owners in Indiana to pass their real estate to a designated beneficiary upon the owner's death without the need for probate court. |

| Eligibility | Any individual who is competent and owns real estate in Indiana can execute a Transfer-on-Death (TOD) deed. |

| Requirements | Must be signed by the property owner in the presence of a notary public and recorded before the owner's death in the county where the property is located. |

| Revocability | The deed is revocable at any time before the death of the owner, without the consent of the beneficiary. |

How to Write Indiana Transfer-on-Death Deed

When planning for the future, one important tool at your disposal is the Transfer-on-Death (TOD) deed. This form allows property owners in Indiana to pass on their real estate to a beneficiary without the need for the property to go through probate court after their death. It's a straightforward process that can save time, reduce paperwork, and alleviate stress for loved ones during a difficult time. However, it is crucial to fill out this form carefully and accurately to ensure that your wishes are honored.

The steps to fill out the Indiana Transfer-on-Death Deed form are as follows:

- Identify the Grantee Beneficiary: Begin by specifying the name or names of the person, or people, you intend to transfer the property to upon your death. Ensure names are spelled correctly and match the beneficiaries' legal identification.

- Describe the Property: Provide a legal description of the property you're transferring. This information can be found on your property deed or with the county recorder's office. It's crucial to include detailed information to avoid any ambiguity about what property is being transferred.

- Declare Ownership Status: State your current ownership status of the property. Indicate whether you own the property alone or jointly with others, and specify the nature of that ownership.

- Sign and Date the Form: Once all other sections are completed, sign and date the form. Your signature must be witnessed by a notary public to be valid. In Indiana, the notarization process confirms your identity and willingness to execute the deed under your own free will.

- Record the Deed: After the form is notarized, it must be filed with the county recorder’s office where the property is located. There may be a filing fee, which varies by county. The deed becomes effective upon your death and does not impact your ownership rights as long as you live.

Filling out the Indiana Transfer-on-Death Deed correctly is a proactive step towards ensuring your property is passed on according to your wishes without unnecessary legal complications. Once the form is properly completed and filed, you can have peace of mind knowing that an important part of your estate planning is in place. Remember, it’s advisable to consult with a legal professional if there are any questions during this process to ensure your intentions are fully understood and legally sound.

Get Answers on Indiana Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Indiana?

A Transfer-on-Death (TOD) Deed in Indiana allows property owners to name a beneficiary who will inherit their real estate after they pass away. This type of deed enables the property to transfer to the beneficiary without going through the probate process. It's a simple, effective way to ensure that your property goes directly to someone you choose without the need for a lengthy legal process.

How can I create a Transfer-on-Death Deed in Indiana?

To create a TOD Deed in Indiana, you must complete a form that includes specific details about the property, the current owner's name, and the beneficiary's name. The deed must be signed by the owner in the presence of a notary public to be valid. After notarization, it is crucial to record the deed with the county recorder's office where the property is located. This recording makes the deed a matter of public record and legally effective.

Can I change my mind after recording a Transfer-on-Death Deed?

Yes, you can change your mind after recording a TOD Deed. In Indiana, property owners have the flexibility to revoke or change the beneficiary named in a TOD Deed. This can be done by recording a new TOD Deed that either names a different beneficiary or revokes the previous deed altogether. It’s important to note that the most recently recorded TOD Deed is the one that takes effect upon the owner’s death.

What happens to the property if the beneficiary predeceases the owner?

If the named beneficiary in a Transfer-on-Death Deed predeceases the owner, the deed becomes ineffective. In such cases, the property will be included in the estate of the deceased owner and will pass according to their will or, if there is no will, by Indiana's intestate succession laws. This means the property could end up going through the probate process, which the TOD Deed aims to avoid. To prevent such situations, property owners may consider naming an alternate beneficiary in the TOD Deed.

Common mistakes

One common mistake when filling out the Indiana Transfer-on-Death (TOD) Deed form is not properly identifying the beneficiary. The beneficiary’s full legal name, address, and relationship to the grantor should be clearly provided. Without precise details, it might be difficult to ensure the property is transferred to the intended person upon the grantor's death.

Another error involves not providing a complete legal description of the property. Many people mistakenly provide only the address or a brief description of the property. However, the legal description, which can be found on the deed or at the county recorder’s office, is necessary to accurately identify the property in legal terms. This description often includes lot numbers, subdivision names, and other details critical to distinguishing the property clearly in legal documents.

Some individuals fail to execute the document correctly by not following Indiana’s specific requirements. The TOD deed must be signed by the grantor in the presence of a notary public. The absence of proper notarization renders the document invalid, failing to legally transfer the property upon the grantor's death.

Others overlook the importance of recording the deed with the county recorder’s office. Simply filling out and signing the form does not complete the process. For the deed to be effective, it must be recorded in the county where the property is located before the grantor's death. Failing to do so may result in the deed not being recognized legally, complicating the transfer process after the grantor’s demise.

Mistakenly believing the deed overrides a will is another issue. Some people assume that the TOD deed takes precedence over the terms of a will. It is crucial to understand that while the TOD deed does directly transfer property to beneficiaries, any conflicting instructions in a will do not alter the TOD deed's effectiveness. This misunderstanding can lead to unexpected outcomes if not properly considered.

Incorrectly assuming all debts and liens against the property will automatically be cleared upon transfer is also a pitfall. Beneficiaries receive property subject to existing debts or liens. Grantors should clearly communicate about any encumbrances on the property to avoid surprising beneficiaries with unexpected financial responsibilities.

Not consulting with an attorney or legal advisor experienced in estate planning and Indiana-specific laws is a significant mistake. The TOD deed has legal implications that might not be wholly understood without professional guidance. This oversight can result in improperly filled forms or missed steps in the process, leading to the deed being contested or deemed invalid.

Lastly, failing to update the TOD deed when circumstances change, such as the death of a beneficiary or a change in the grantor’s intentions, is a critical error. Keeping the deed current ensures that the property will be transferred according to the grantor’s most recent wishes, avoiding confusion or disputes among potential heirs.

Documents used along the form

When preparing for future estate planning, particularly in Indiana, utilizing a Transfer-on-Death (TOD) Deed form can significantly streamline the process of transferring property upon death. Alongside a TOD Deed, a set of additional documents often play a crucial role in ensuring a comprehensive estate plan. These documents help to clarify intentions, provide instructions, and secure the legal transfer of assets with minimal complications. Below is a list of forms and documents commonly used alongside the Indiana Transfer-on-Death Deed form to ensure a thorough approach to estate planning.

- Last Will and Testament: This document complements a TOD deed by outlining the individual's wishes regarding the distribution of assets and property that are not included in the TOD deed. It serves as a comprehensive guide for managing and distributing one's estate.

- Power of Attorney: A Power of Attorney (POA) grants someone the authority to act on your behalf in legal and financial matters, potentially including those related to the TOD deed, should you become incapacitated. This ensures that one's affairs remain in trusted hands.

- Revocation of Transfer on Death Deed Form: This allows the individual to revoke a previously recorded TOD deed, providing flexibility to change beneficiaries or transfer methods as life circumstances change. It's vital for maintaining control over one's estate plan.

- Living Trust: A Living Trust can be used in coordination with a TOD deed to manage assets during the individual's lifetime and then transfer the remaining assets upon their death. It offers privacy and avoids probate for the assets placed within the trust.

Together with the Indiana Transfer-on-Death Deed, these documents form a robust framework for estate planning. They enable individuals to articulate their wishes clearly, manage their affairs efficiently, and ensure that their assets are distributed according to their desires. It is advisable to consult with a legal professional when preparing these documents to ensure accuracy and compliance with Indiana law.

Similar forms

The Indiana Transfer-on-Death (TOD) Deed form is similar to a traditional Will in that both allow individuals to specify how their property should be distributed after their death. Like a Will, a TOD Deed enables property owners to dictate the future ownership of their property, ensuring that it passes to the designated beneficiary without going through probate court. However, unlike a Will, a TOD Deed is specifically focused on real estate property and takes effect immediately upon the death of the property owner, without needing inclusion in the probate process.

A TOD Deed also shares similarities with a Life Estate Deed, where the property owner transfers the rights to use the property during their lifetime and specifies a remainderman to inherit the property upon their death. Both documents allow the original owner to retain control over the property during their lifetime. However, a TOD Deed gives the owner more flexibility, as it can be revoked or changed at any time before death, whereas a Life Estate Deed typically cannot be altered once executed.

The TOD Deed has resemblances to a Living Trust in that both arrangements can bypass the probate process for property transfer after death. Property placed in a Living Trust can be managed by the trust owner until their death, after which it passes to the trust beneficiaries directly. Similar to a TOD Deed, this setup avoids the time and expense associated with probate court. However, a Living Trust can encompass a broader range of properties and assets, not just real estate.

Joint Tenancy with Right of Survivorship is another form of property ownership that parallels the intent behind the TOD Deed. In a Joint Tenancy, when one owner dies, the surviving owner(s) automatically inherit the deceased owner’s share of the property. This process, like the TOD Deed, avoids probate. The key difference is that Joint Tenancy involves immediate shared ownership, while a TOD Deed does not affect property ownership until the death of the deed holder.

A Beneficiary Designation, commonly used for retirement accounts and insurance policies, is in many ways similar to a TOD Deed. It allows an account or policy owner to name who will receive the assets upon their death. Both mechanisms bypass probate and enable a direct transfer to the named beneficiaries, streamlining the transfer process. However, a Beneficiary Designation is specific to financial accounts and policies, not real estate property.

The Durable Power of Attorney for Finances is somewhat analogous to a TOD Deed because it allows an individual to designate someone to manage their financial affairs. While it operates during the individual’s lifetime, not after their death, it reflects the concept of appointing another to handle one’s assets. Unlike a TOD Deed, which takes effect upon death, a Durable Power of Attorney ceases to be valid when the individual dies.

Health Care Proxy forms bear a resemblance to the TOD Deed conceptually, in that they allow individuals to appoint someone to make decisions on their behalf. In the case of a Health Care Proxy, the focus is on health care decisions in the event the individual becomes incapable of making those decisions themselves. While dealing with different aspects of a person’s affairs—health rather than property—the underlying principle of appointing a representative aligns with the intent behind the TOD Deed.

Lastly, the Revocable Transfer on Death Deed, available in some other states, closely matches the Indiana TOD Deed. Both allow property owners to name beneficiaries for their real estate so that the property can transfer to them upon the owner’s death, without probate. These deeds can be revoked or amended at any time before the owner passes away, offering flexibility and control over the future disposition of the property. The main difference lies in the specific state laws governing each type of deed, as real estate law can vary significantly from state to state.

Dos and Don'ts

When preparing the Indiana Transfer-on-Death Deed form, it’s crucial to approach the task with care and precision. Below are seven key dos and don'ts to assist you in accurately completing the form and ensuring your intentions are clearly communicated.

Do:

- Read all instructions provided with the form carefully to ensure you understand the requirements.

- Use black ink for clarity and legibility, ensuring the information is permanent and readable.

- Include all necessary details, such as full legal names, addresses, and a clear description of the property to avoid any confusion.

- Consult with a legal professional if you have any questions or uncertainties about how to complete the form or its effects.

- Ensure the form is signed in the presence of a notary public to validate its authenticity.

- Keep a copy of the completed form for your records and peace of mind.

- File the completed form with the appropriate county recorder’s office to make the deed legally effective.

Don’t:

- Attempt to fill out the form without thoroughly understanding every section; incorrect information can lead to unintended consequences.

- Use erasable ink or pencil, as these can be altered, leading to questions about the document's integrity.

- Leave sections of the form blank; incomplete forms may not be processed, or worse, misinterpreted.

- Sign the form without a notary present; unnotarized forms will not be considered valid.

- Forget to notify the designated beneficiaries about the deed, as they should be aware of their future interests.

- Overlook the importance of checking with the county recorder’s office about any specific filing requirements or fees.

- Assume the form is a substitute for a will or other estate planning instruments; it only covers the specific property described.

Misconceptions

In discussing the Indiana Transfer-on-Death (TOD) Deed, several misconceptions frequently arise. Addressing these inaccuracies is crucial for individuals planning their estate to avoid future complications. Here are seven common misunderstandings and the clarifications for each.

- It allows immediate transfer of property upon death. A common misconception is that the Transfer-on-Death Deed allows the beneficiary to immediately take control of the property upon the death of the owner. In reality, the beneficiary must file a TOD deed acceptance with the county recorder and may need to clear other legal requirements before assuming control of the property.

- The form is universally compatible with all types of real estate. Some individuals mistakenly believe that the TOD deed can be used for transferring any type of real estate in Indiana. However, certain types of property, such as jointly owned property, may have restrictions or may not be eligible for transfer using a TOD deed.

- Creating a TOD deed overrides a will. Another incorrect assumption is that a TOD deed supersedes a will. While a TOD deed does transfer property outside of probate, it does not inherently override the provisions of a will if there are conflicting bequests. It's essential to ensure that all estate planning documents are consistent.

- There are no tax implications. Often, people are under the impression that transferring property through a TOD deed has no tax implications. However, the beneficiary may be responsible for inheritance tax, depending on their relationship to the deceased and the value of the estate. Consulting with a tax professional is advisable to understand potential tax liabilities.

- A TOD deed cannot be revoked. Some believe once a TOD deed is created, it cannot be revoked. This is incorrect. The property owner can revoke a TOD deed at any time before death, provided they follow the legal process for revocation as specified under Indiana law.

- Setting up a TOD deed is complicated and expensive. There's a misconception that establishing a TOD deed involves a complex and costly process. While it does require legal documentation and adherence to Indiana statutes, it is generally less complicated and costly than setting up a living trust or navigating probate.

- It automatically clears the title. Individuals often assume that the TOD deed automatically clears any encumbrances on the title after the owner's death. In reality, the beneficiary takes the property subject to any existing mortgages, liens, or other encumbrances. It is crucial for the current owner and beneficiary to clearly understand the implications of these encumbrances.

Understanding the intricacies of the Indiana Transfer-on-Death Deed is essential for effectively managing estate planning and avoiding potential legal challenges. It’s always advisable to consult with a legal expert to fully understand the implications of setting up a TOD deed and ensuring it aligns with your overall estate plan.

Key takeaways

The Indiana Transfer-on-Death (TOD) Deed form is a legal document that allows property owners to pass on their real estate to a beneficiary upon their death, bypassing the probate process. Understanding how to fill out and use this form properly is crucial for executing a smooth transfer. Here are six key takeaways to keep in mind:

- Eligibility: Not all properties may be eligible for transfer using a TOD deed. Ensure the property in question qualifies under Indiana law.

- Clear Identification of Beneficiary: The form requires you to clearly identify the beneficiary or beneficiaries. Include their full names and relationship to you to prevent any confusion or disputes after your death.

- Witnesses and Notarization: For the TOD deed to be legally binding, it must be signed in the presence of a notary public. Additionally, having witnesses can further support the validity of the document, even if not strictly required by Indiana law.

- Filing the Deed: Simply completing and notarizing the TOD deed is not enough. It must be filed with the appropriate county recorder’s office before the property owner's death to be effective.

- Revocation: If circumstances change, the property owner has the right to revoke the TOD deed. This process requires either creating a new deed or formally documenting the revocation, following similar formalities as when creating the deed.

- No Impact on Current Ownership: Filling out and filing a TOD deed does not affect the property owner's current rights to use, sell, or mortgage the property. The deed only takes effect upon the owner's death.

Preparing a Transfer-on-Death Deed with careful attention to detail can ensure that property transfers to the intended beneficiary smoothly and without the need for probate. This legal tool offers a straightforward approach to estate planning for real estate assets in Indiana.

Popular Transfer-on-Death Deed State Forms

California Transfer on Death Deed - With a Transfer-on-Death Deed, property owners can maintain control over their real estate until their demise, able to alter or revoke the deed if their circumstances change.

Texas Transfer on Death Deed Form 2023 - Homeowners must properly complete and record the Transfer-on-Death Deed according to state laws for it to be valid.