Free Transfer-on-Death Deed Form for Florida

In the realm of estate planning and property disposition, the concept of transferring real estate upon death without the complexities of probate court is increasingly appealing. The Florida Transfer-on-Death (TOD) Deed form stands as a critical document enabling this smooth transition of property ownership. This legal instrument allows property owners in Florida to name beneficiaries who will inherit their property automatically upon the owner’s death, thereby bypassing the often lengthy and costly probate process. Although this sounds straightforward, the execution and validity of a TOD deed require adherence to specific legal formalities, including proper signing, witnessing, and recording procedures. While the form simplifies the transfer of real estate upon death, property owners must also consider the implications of such a transfer on their overall estate plan and tax obligations. Furthermore, the TOD deed’s impact on potential beneficiaries, including their rights and responsibilities, merits careful consideration to ensure that the transition aligns with the property owner's intentions and legal requirements.

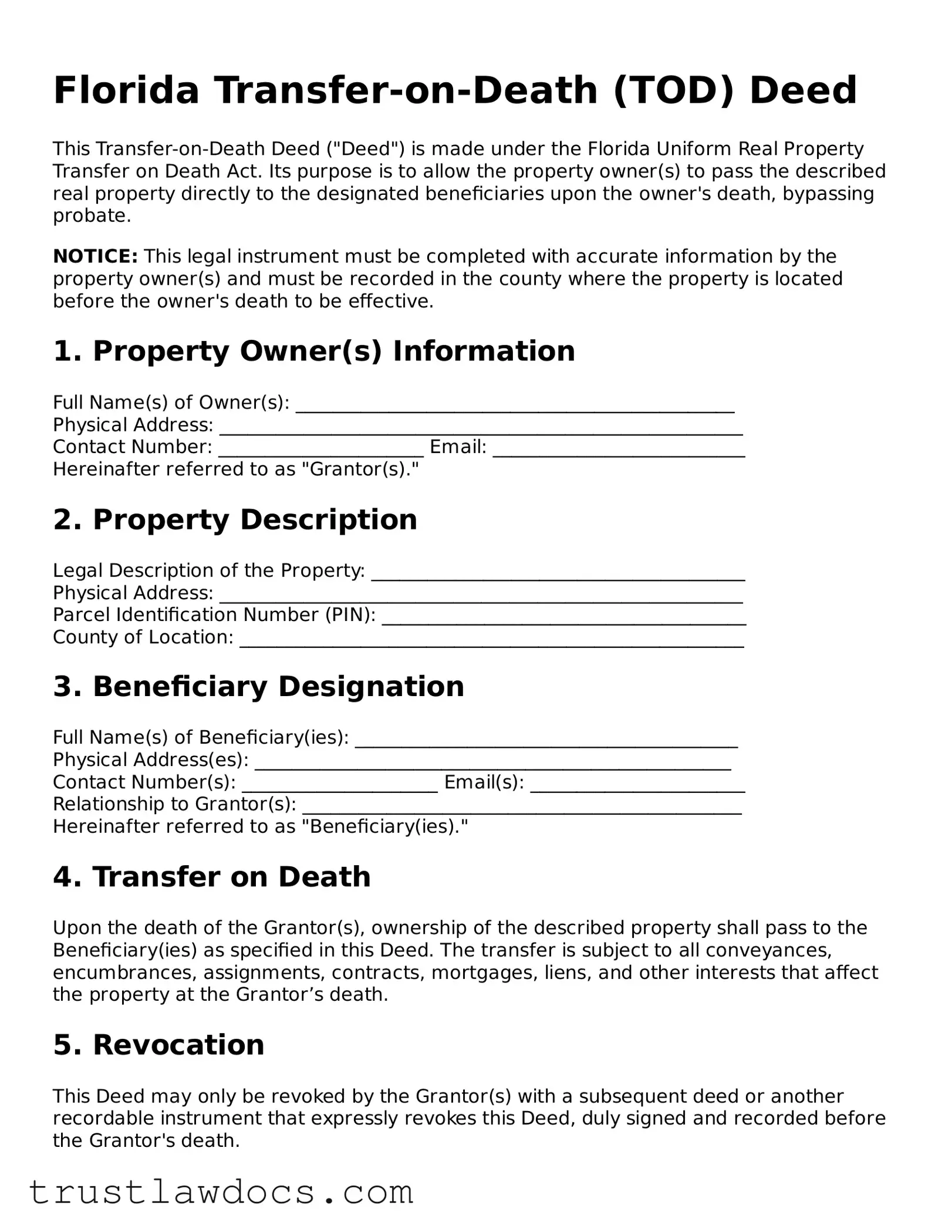

Form Example

Florida Transfer-on-Death (TOD) Deed

This Transfer-on-Death Deed ("Deed") is made under the Florida Uniform Real Property Transfer on Death Act. Its purpose is to allow the property owner(s) to pass the described real property directly to the designated beneficiaries upon the owner's death, bypassing probate.

NOTICE: This legal instrument must be completed with accurate information by the property owner(s) and must be recorded in the county where the property is located before the owner's death to be effective.

1. Property Owner(s) Information

Full Name(s) of Owner(s): _______________________________________________

Physical Address: ________________________________________________________

Contact Number: ______________________ Email: ___________________________

Hereinafter referred to as "Grantor(s)."

2. Property Description

Legal Description of the Property: ________________________________________

Physical Address: ________________________________________________________

Parcel Identification Number (PIN): _______________________________________

County of Location: ______________________________________________________

3. Beneficiary Designation

Full Name(s) of Beneficiary(ies): _________________________________________

Physical Address(es): ___________________________________________________

Contact Number(s): _____________________ Email(s): _______________________

Relationship to Grantor(s): _______________________________________________

Hereinafter referred to as "Beneficiary(ies)."

4. Transfer on Death

Upon the death of the Grantor(s), ownership of the described property shall pass to the Beneficiary(ies) as specified in this Deed. The transfer is subject to all conveyances, encumbrances, assignments, contracts, mortgages, liens, and other interests that affect the property at the Grantor’s death.

5. Revocation

This Deed may only be revoked by the Grantor(s) with a subsequent deed or another recordable instrument that expressly revokes this Deed, duly signed and recorded before the Grantor's death.

6. Execution

In witness whereof, the Grantor(s) has/have executed this Transfer-on-Death Deed on this ______ day of _______________, 20___.

Signature of Grantor(s): _________________________________________________

Printed Name(s): ________________________________________________________

7. Acknowledgment

This document was acknowledged before me on (date) ___________ by (name of Grantor) _______________________________________.

Signature of Notary Public: ______________________________________________

Printed Name of Notary: __________________________________________________

Commission Number: ______________________________________________________

My Commission Expires: ___________________________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | Florida Statutes, Section 689.15 governs the Transfer-on-Death (TOD) Deed form, allowing property owners to pass their real estate to a beneficiary upon the owner's death without the need for probate. |

| Beneficiary Designation | The owner can designate one or more beneficiaries to receive the property upon their death, which includes individuals, trusts, or organizations. |

| Revocability | The deed is revocable, meaning the property owner can change their mind at any time before their death, allowing for modifications or complete revocation of the beneficiary designations. |

| Probate Avoidance | Upon the death of the property owner, the property passes directly to the named beneficiary(ies), bypassing the often lengthy and costly probate process. |

How to Write Florida Transfer-on-Death Deed

Transferring property upon death without the complexity of going through probate is a significant advantage provided by a Transfer-on-Death (TOD) deed in Florida. This document allows property owners to name beneficiaries who will receive the property directly upon the death of the owner, simplifying the process and avoiding lengthy legal procedures. While the advantages are clear, successfully navigating the completion of a TOD deed requires attention to detail and understanding of each step involved.

To correctly fill out the Florida Transfer-on-Death Deed form, follow these steps:

- Begin by downloading the latest version of the Florida Transfer-on-Death Deed form from the official state website or a reliable legal forms provider.

- Read through the form thoroughly before starting to fill it out. This will help you understand the information required and how to accurately provide it.

- Enter the full legal name and current address of the property owner(s) in the designated section at the top of the form.

- Describe the property in detail, including its legal description as found on the deed or property tax statement. This should be highly detailed and match official records.

- Identify the beneficiary(ies) by providing their full legal names, addresses, and relationship to the property owner. If there are multiple beneficiaries, specify the share each person will receive clearly to avoid confusion later.

- Review the form to ensure there are no errors or omissions. Mistakes can invalidate the deed or cause problems with property transfer later.

- Have the form notarized. This involves signing the form in front of a notary public. The notary will verify your identity and witness your signature before applying their seal, making the document legally binding.

- Finally, file the completed and notarized form with the appropriate local government office that handles property records in the county where the property is located. There may be a filing fee, so it's wise to inquire about this in advance.

Filling out the Transfer-on-Death Deed form accurately is crucial for ensuring that the property is transferred smoothly and according to the wishes of the property owner upon their death. It is a straightforward process but requires careful attention to detail. Individuals are encouraged to seek legal advice if they have questions or if their situation involves complex issues not directly addressed by the form. This proactive step can safeguard against potential issues and provide peace of mind to all parties involved.

Get Answers on Florida Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in Florida?

A Transfer-on-Death Deed in Florida allows property owners to pass on their real estate to a beneficiary directly upon their death, without the need for the property to go through the probate process. This legal document must be properly filled out, signed, and recorded before the owner's death to be effective.

Who can create a TOD Deed in Florida?

Any property owner in Florida who holds a clear title to the property and is of sound mind has the ability to create a TOD Deed. This means the individual must fully understand the nature and consequences of the document they are signing.

How does one file a TOD Deed in Florida?

To file a TOD Deed in Florida, the property owner must complete the deed form, ensuring all information is accurate and follows state laws. After completion, the deed must be signed in the presence of two witnesses and a notary public. Finally, it is recorded with the county recorder’s office where the property is located, usually for a nominal fee.

Can a TOD Deed be revoked or changed in Florida?

Yes, a TOD Deed can be revoked or changed at any time before the property owner's death, as long as the owner is competent. This is typically done by filing a new deed that explicitly revokes the old one or creating a new TOD Deed that designates a different beneficiary.

Are there any restrictions on who can be named as a beneficiary in a TOD Deed in Florida?

In Florida, almost anyone can be named as a beneficiary in a TOD Deed, including individuals, trusts, or organizations. However, the beneficiary must be clearly identifiable in the deed. It's crucial to provide accurate details to avoid any confusion or disputes after the property owner's death.

What happens to a property with a TOD Deed if the beneficiary predeceases the owner?

If the beneficiary named in a TOD Deed dies before the property owner, the deed becomes ineffective unless an alternate beneficiary is named. Property owners are encouraged to consider naming a secondary beneficiary to address this possibility.

Does a TOD Deed in Florida bypass the probate process?

Yes, one of the primary benefits of a TOD Deed in Florida is that it allows the property to bypass the often lengthy and costly probate process. Upon the owner's death, the property is transferred directly to the beneficiary, subject only to any outstanding debts or liens against the property.

How does a TOD Deed affect estate taxes in Florida?

The impact of a TOD Deed on estate taxes in Florida will depend on the specific circumstances of the estate and the overall value of the property being transferred. It's recommended to consult with a tax professional to understand how a TOD Deed might affect an estate's tax obligations.

Can a beneficiary refuse to accept property transferred via a TOD Deed in Florida?

Yes, a beneficiary has the right to refuse property transferred to them via a TOD Deed in Florida. This process, known as disclaiming the property, requires the beneficiary to formally reject the inheritance according to state laws.

Is a Transfer-on-Death Deed right for everyone?

A Transfer-on-Death Deed can be a valuable estate planning tool, but it may not be the best option for everyone. Factors such as the property owner’s overall estate plan, the need for probate avoidance, and the specifics of the beneficiary situation should be carefully considered. Consulting with an estate planning attorney can help individuals decide if a TOD Deed aligns with their goals.

Common mistakes

One common mistake people make when filling out the Florida Transfer-on-Death (TOD) Deed form is not fully understanding the form's terminologies. Many individuals might be uncertain about legal terms such as "grantor," "grantee," or "beneficiary." This confusion can lead to inaccuracies in naming the right parties or properly detailing the property to be transferred, which might result in the TOD deed being invalid.

Another error is failing to accurately describe the property. The description of the property on a TOD deed needs to be precise and must match the legal description used in the property’s current deed or title. Any discrepancy in this area can cause significant issues, possibly preventing the intended transfer of the property upon the grantor's death.

Some people forget to sign the deed in the presence of a notary public. In Florida, a TOD deed must be notarized to be valid. That means the grantor must sign the document in front of a notary. Skipping this step or not completing it correctly (such as not having the proper identification) can invalidate the entire document.

It’s also common for individuals to neglect to add a contingent beneficiary. While it's not mandatory, including a secondary beneficiary can safeguard against the possibility that the primary beneficiary predeceases the grantor. Without a contingent beneficiary, the property could end up in probate, thereby defeating one of the major advantages of a TOD deed.

Many fail to properly witness the deed. Beyond notarization, Florida law requires the presence of witnesses when the grantor signs the TOD deed. This requirement aids in verifying the authenticity of the document. Witnesses' absence can lead to questions about the deed's validity.

Last but not least, a significant mistake is not filing the deed before the grantor's death. A TOD deed must be filed with the county recorder’s office to be effective. If this step is overlooked, the deed will not transfer the property upon the grantor’s death, despite the grantor's wishes. Timely filing ensures that the property transitions smoothly to the beneficiary, avoiding potential legal complications.

Documents used along the form

In estate planning, the Transfer-on-Death (TOD) Deed is a valuable document for property owners in Florida looking to bypass the lengthy and often costly probate process, by directly transferring property to a beneficiary upon the owner's death. While it may stand alone as a powerful tool in estate management, there are other documents frequently used in conjunction to ensure a comprehensive and effective estate plan. From designating decision-making authorities to detailing final wishes, incorporating these documents alongside a TOD Deed can offer peace of mind and a well-rounded approach to estate planning.

- Last Will and Testament: This pivotal legal document facilitates the distribution of personal property, delineates guardianship for minor children, and can appoint an executor to manage the estate. Though a TOD Deed transfers real estate to a beneficiary upon death, the will covers any property not included in the TOD, ensuring no asset is left without direction.

- Power of Attorney (POA): A POA grants another individual the authority to make decisions on behalf of the person creating the document, should they become unable to do so themselves. This can cover a range of decisions from financial matters to healthcare, offering a safety net during life's unpredictable moments.

- Living Will: A Living Will, or an advance healthcare directive, specifies wishes regarding medical treatment and life-sustaining measures in situations where recovery is not expected. This document complements a TOD Deed by addressing personal care and medical treatment decisions ahead of time.

- Designation of Health Care Surrogate: This document names a trusted individual to make healthcare decisions on behalf of the person creating it, in the event they cannot make decisions themselves. It's a crucial component for comprehensive estate planning, ensuring decisions are made according to predetermined wishes.

- Revocable Living Trust: Although not necessary for everyone, a revocable living trust can be a strategic document for managing both during life and after death. It holds assets for the benefit of a third party, the beneficiary, and can be altered or revoked during the grantor's lifetime. When used with a TOD Deed, it can further avoid probate for assets not covered by the deed.

Each of these forms and documents plays a crucial role in a well-structured estate plan, ensuring that all aspects of an individual's life and legacy are addressed thoughtfully and thoroughly. When used together with a Florida Transfer-on-Death Deed, they provide a comprehensive solution to managing one's estate, protecting assets, and ensuring that an individual's wishes are honored, both in life and death.

Similar forms

The Florida Transfer-on-Death (TOD) Deed form is similar to a Last Will and Testament in that both documents allow you to specify how your property will be distributed after your death. While the Last Will and Testament applies to all of your assets, the TOD Deed is specifically for real estate. Both need to be executed according to state laws to be valid but serve to ensure your property goes to your chosen beneficiaries.

Just like a Living Trust, the TOD Deed helps in bypassing the probate process for the property it covers. However, whereas a Living Trust can apply to various types of assets and offers more control over the distribution, the TOD Deed solely affects real property that is explicitly described in the deed. Both instruments allow for the direct transfer of assets outside of probate, streamlining the transfer process upon death.

Similar to a Joint Tenancy with Right of Survivorship deed, the TOD Deed allows property to pass to the surviving owner(s) without going through probate. However, the TOD Deed differs because it does not take effect until the death of the owner, allowing them to retain full control over the property during their lifetime, whereas Joint Tenancy involves shared ownership from the start.

A Durable Power of Attorney for Finances allows someone you choose to manage your financial affairs if you're unable to do so, including potentially managing your real estate assets. While it offers no post-mortem property transfer mechanism like the TOD Deed, it's another estate planning tool focusing on the management of your assets during your lifetime.

The Beneficiary Designation form, commonly used for retirement accounts and life insurance policies, similarly allows assets to bypass probate and go directly to the named beneficiaries upon death. The TOD Deed acts much like these designations but is used for real estate, highlighting the flexibility in planning for different types of assets.

Comparable to a Lady Bird Deed, another estate planning tool used in some states, the TOD Deed provides a way to transfer property upon death without probate. Both allow the original owner to maintain control over the property during their lifetime, but the Lady Bird Deed includes the additional power to sell or mortgage the property without the beneficiary’s consent.

A Healthcare Power of Attorney designates someone to make medical decisions on your behalf if you're incapacitated. Though it doesn't deal with property transfer, its purpose of planning for future incapacity complements the TOD Deed's focus on property transfer after death, highlighting the broad scope of estate planning.

The Revocable Transfer on Death Deed, available in some states, closely resembles the Florida TOD Deed by allowing real estate to transfer to a beneficiary upon the owner’s death, bypassing probate. The main difference lies in the legal specifics and requirements varying by state, but the intent and functionality are largely congruent.

The General Warranty Deed guarantees the property title against past claims or liens, assuring the buyer of clear ownership. While it's a vehicle for property transfer during the owner's lifetime, unlike the TOD Deed, it emphasizes the importance of clear title for smooth property transfer, whether now or after death.

Dos and Don'ts

Filling out the Florida Transfer-on-Death (TOD) Deed form requires careful attention to detail and a clear understanding of your intentions for your property after your passing. To ensure the process is completed correctly and your real estate is transferred smoothly, here are some dos and don'ts to consider.

- Do verify that the property described in the deed matches exactly with your real estate’s legal description as on your current deed or property tax documents.

- Do clearly list the beneficiary's full legal name to avoid any future confusion or disputes.

- Do consult with a legal professional before filling out the form to ensure it aligns with your estate planning goals and adheres to Florida law.

- Do remember that the deed must be notarized and recorded in the public records in the county where the property is located to be valid.

- Do inform the beneficiary about the TOD deed so they are aware of their future interest in your property.

- Don’t forget to sign the deed in the presence of two witnesses, as required by Florida law for the deed to be legally binding.

- Don’t use a TOD deed to attempt to transfer property you do not solely own or if there are complications with the title that have not been resolved.

- Don’t leave any sections incomplete or provide inaccurate information, as this could invalidate the deed or create legal challenges after your death.

- Don’t assume that the TOD deed overrides other legal documents like your will or trust, without professional legal advice on how these documents interact.

Misconceptions

One common misconception is that the Florida Transfer-on-Death (TOD) Deed allows the transferor to bypass probate for all assets. In reality, this form specifically applies to real estate only. Other assets the decedent owns at the time of death will likely still need to go through probate.

Another misconception is that creating a TOD deed automatically takes care of all the details and requirements for transferring property upon death. However, for the deed to be valid, it must be properly executed, which includes being signed in the presence of two witnesses and notarized. Additionally, it must be recorded with the county recorder’s office before the transferor’s death.

Some people believe that once a TOD deed is filed, it cannot be revoked or changed. This is not true. The owner can revoke the deed or file a new deed that changes the designated beneficiary at any time before death, as long as the change is done with the same formalities as creating the original TOD deed.

There is also a misconception that the beneficiary named in the TOD deed will become responsible for the decedent's debts and taxes on the property. Although the property transferred through a TOD deed will not go through probate, the beneficiary may still be responsible for settling any debts or taxes that the estate owes, specifically those associated with the property, but this is based on overall estate planning and not solely on the TOD deed.

Key takeaways

The Florida Transfer-on-Death (TOD) deed form provides a mechanism for property owners to pass their real estate to a beneficiary without the need for probate proceedings. Here are ten key takeaways to consider when filling out and using this form:

Eligibility: To use the TOD deed, ensure the property is eligible under Florida law, which typically includes real estate such as houses and land.

Form Requirements: The Florida TOD deed must comply with state laws for real estate deeds, including being in written form, containing the legal description of the property, and meeting specific signing and notarization requirements.

Beneficiary Designation: Clearly identify the beneficiary or beneficiaries who will receive the property. Include full names and relationship to you to avoid ambiguity.

Joint Ownership: If the property is owned jointly, understand how Florida laws affect the transfer, especially if it involves tenants by the entirety or joint tenants with rights of survivorship.

Revocability: The TOD deed is revocable. You can change your mind at any time before death by executing a new deed or a formal revocation.

Not A Will Substitute: Although useful, the TOD deed does not replace a will. Consider how it fits into your broader estate plan, especially regarding residuary estate and other assets.

Witness Requirements: As with traditional deeds, the TOD deed requires witnesses. Know the number of witnesses required by Florida law to ensure the document's validity.

Recording the Deed: For the TOD deed to be effective, it must be properly recorded with the county recorder's office in the county where the property is located before your death.

Impact on Medicaid Eligibility: Be aware of how owning property and transferring it via a TOD deed might affect your eligibility for Medicaid and other benefits, both now and in the future.

Legal and Tax Advice: Seek advice from a legal or tax professional familiar with Florida law to ensure the TOD deed is properly executed and does not have unintended consequences on your estate plan.

Whether planning for the future of your real estate or administering a loved one's estate, understanding the nuances of the Florida Transfer-on-Death Deed can help streamline the process, ensuring property is transferred according to the owner's wishes, efficiently, and with minimal legal complication.

Popular Transfer-on-Death Deed State Forms

Where Can I Get a Tod Form - A convenient tool for estate planning, enabling property owners to maintain control over their property until their passing.

Texas Transfer on Death Deed Form 2023 - The deed must be signed and notarized, then recorded with the local county recorder's office to be legally effective.