Free Transfer-on-Death Deed Form for California

In the realm of estate planning, individuals often seek straightforward methods to transfer their assets to heirs without the need for probate, which can be both time-consuming and costly. The California Transfer-on-Death (TOD) Deed form emerges as a key tool in this effort, offering property owners the opportunity to name beneficiaries for their real estate, ensuring that the property passes directly to them upon the owner's death. Unique in its simplicity, the TOD Deed enables a seamless transition of home ownership, bypassing the probate process entirely. Residents of California have the added advantage of making these designations without necessitating the creation of a living trust or undergoing complex legal procedures. However, it's vital to be aware of the form’s stipulated criteria, such as eligibility of properties, restrictions on beneficiaries, and the necessity for the deed to be properly signed, dated, and notarized to be valid. Additionally, considering the irreversible nature of this action once the property owner passes away, reflecting on the decision carefully and understanding all its implications becomes paramount. This deed, while beneficial in many cases, underscores the importance of thoughtful estate planning and legal guidance to navigate its use effectively.

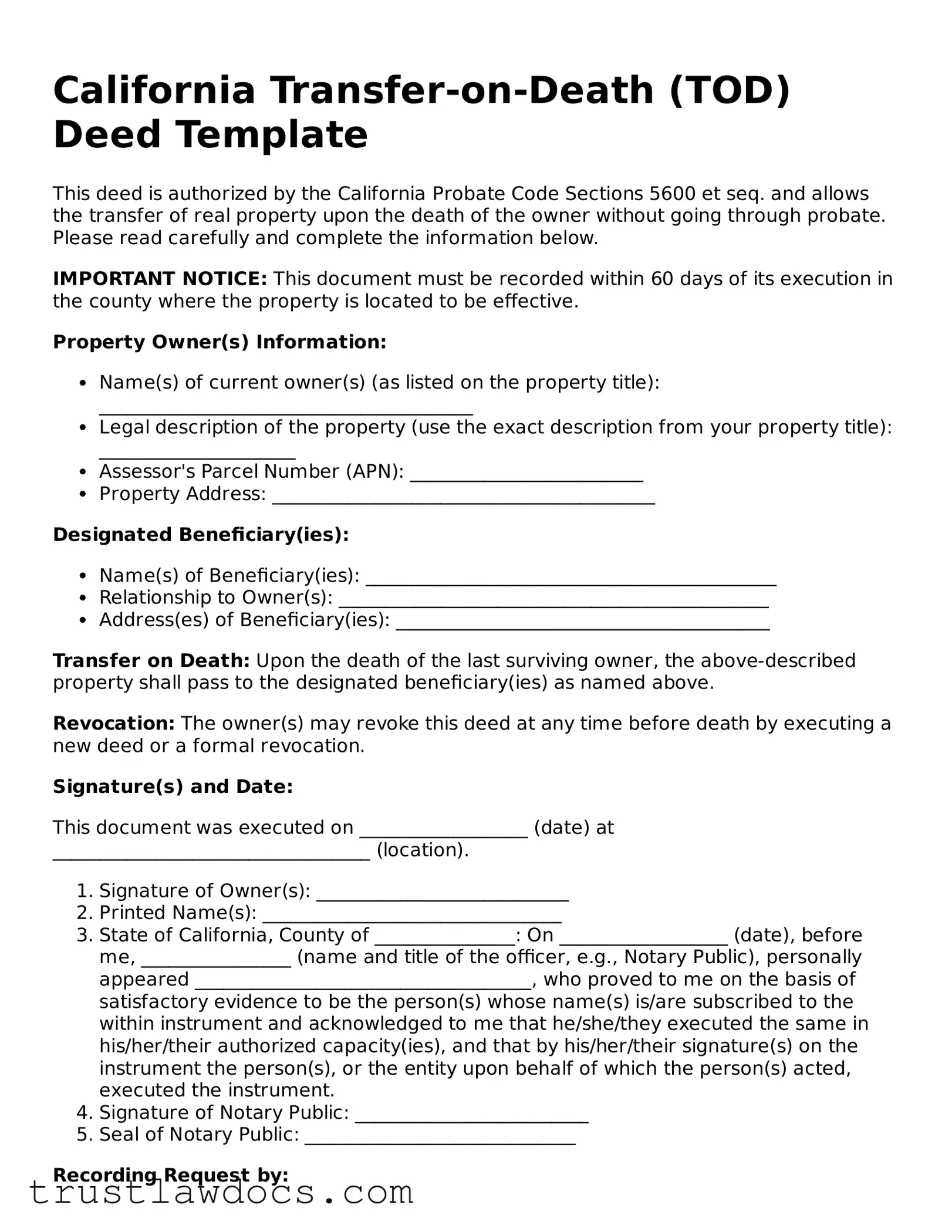

Form Example

California Transfer-on-Death (TOD) Deed Template

This deed is authorized by the California Probate Code Sections 5600 et seq. and allows the transfer of real property upon the death of the owner without going through probate. Please read carefully and complete the information below.

IMPORTANT NOTICE: This document must be recorded within 60 days of its execution in the county where the property is located to be effective.

Property Owner(s) Information:

- Name(s) of current owner(s) (as listed on the property title): ________________________________________

- Legal description of the property (use the exact description from your property title): _____________________

- Assessor's Parcel Number (APN): _________________________

- Property Address: _________________________________________

Designated Beneficiary(ies):

- Name(s) of Beneficiary(ies): ____________________________________________

- Relationship to Owner(s): ______________________________________________

- Address(es) of Beneficiary(ies): ________________________________________

Transfer on Death: Upon the death of the last surviving owner, the above-described property shall pass to the designated beneficiary(ies) as named above.

Revocation: The owner(s) may revoke this deed at any time before death by executing a new deed or a formal revocation.

Signature(s) and Date:

This document was executed on __________________ (date) at __________________________________ (location).

- Signature of Owner(s): ___________________________

- Printed Name(s): ________________________________

- State of California, County of _______________: On __________________ (date), before me, ________________ (name and title of the officer, e.g., Notary Public), personally appeared ____________________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

- Signature of Notary Public: _________________________

- Seal of Notary Public: _____________________________

Recording Request by:

- Name: _____________________________________________

- Mailing Address: ____________________________________

- City, State, Zip Code: ______________________________

This template provides a general framework for creating a California Transfer-on-Death Deed. Individuals are encouraged to consult with a legal professional to ensure that all legal requirements are met and that their rights are protected.

PDF Form Details

| Fact | Detail |

|---|---|

| 1. Legal Basis | The California Transfer-on-Death (TOD) Deed form is governed by sections 5600-5696 of the California Probate Code. |

| 2. Purpose | This legal instrument allows property owners in California to pass on their real estate to a designated beneficiary upon their death, bypassing the probate process. |

| 3. Eligible Property | The form applies to residential real properties that are 1-4 units, a condominium unit, or agricultural land up to 40 acres with a single-family residence. |

| 4. Beneficiary Designation | Property owners can name one or more beneficiaries, including individuals, trusts, or legal entities, to inherit their property. |

| 5. Revocability | The TOD Deed is revocable at any time before the property owner's death, enabling adjustments as personal circumstances change. |

| 6. No Immediate Effect | Recording a TOD Deed does not affect the property owner’s rights to use, sell, or mortgage the property during their lifetime. |

| 7. Witnesses and Notarization | The TOD Deed must be signed by the property owner in the presence of a notary to be valid. |

| 8. Avoidance of Probate | Upon the property owner's death, the property transfers directly to the named beneficiary, avoiding the lengthy and costly probate process. |

| 9. Recordation | For the TOD Deed to be effective, it must be recorded with the county recorder’s office where the property is located prior to the owner's death. |

| 10. Effect on Mortgages or Liens | The transfer of property does not eliminate any mortgages or liens on the property; these obligations pass to the beneficiary. |

How to Write California Transfer-on-Death Deed

When preparing for the future, a California Transfer-on-Death (TOD) Deed can be a straightforward way to pass real estate to a beneficiary without the complexity of going through probate. This legal document allows property owners to name someone to inherit their property when they pass away, ensuring a smoother transition. The following steps will guide you through filling out the California TOD Deed form correctly and efficiently.

- Begin by locating the most current version of the California Transfer-on-Death Deed form. This can often be found on government or legal websites dedicated to state-specific forms.

- Fill in your full legal name as the current property owner. Use the name on the property's current deed to avoid any discrepancies.

- Specify the assessor’s parcel number (APN) and the legal description of the property. This information can be copied from your current deed to ensure accuracy.

- Add the full legal name(s) of the beneficiary(ies) who will inherit the property. If naming more than one, clarify how they will own the property together, such as joint tenants or as tenants in common.

- Next, sign and date the TOD deed in front of a notary public. This step is crucial, as the form must be notarized to be valid.

- Lastly, record the deed with the county recorder’s office where the property is located. There may be a recording fee, which varies by county.

Once completed and recorded, the Transfer-on-Death Deed is effective immediately but does not affect your ownership rights until your passing. It's a simple yet powerful tool to manage your estate planning. Ensure all information is accurate and reflects your wishes accurately to make this transition as smooth as possible for your chosen beneficiary.

Get Answers on California Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in California?

A Transfer-on-Death (TOD) Deed in California allows homeowners to pass on their real property directly to a beneficiary upon their death, bypassing the often lengthy and costly probate process. This deed is a simple way to ensure property is transferred according to the homeowner's wishes without the need for a will or living trust to be involved in the exchange.

Who can use a TOD Deed in California?

Any individual who owns and has the legal right to the property in California can utilize a TOD Deed. This means the person must be mentally competent and not under undue influence at the time of signing the document. However, it's critical to note that the property must be residential and can include a single-family home, condominium, or a 1-4 unit residential building.

How can someone create a TOD Deed?

To create a TOD Deed, the property owner must complete a form that meets California's legal requirements. This includes providing a legal description of the property, naming the beneficiary clearly, and having the deed signed and notarized. After these steps, the deed must be recorded with the county recorder's office where the property is located, preferably before the owner's death.

Can a TOD Deed be revoked or changed?

Yes, a TOD Deed can be revoked or changed at any time before the owner's death, as long as the owner is mentally competent. To revoke a deed, the owner can either create and record a new deed that explicitly revokes the previous one, sign and record a form of revocation, or sell the property to someone else. Changing a beneficiary involves creating and recording a new TOD Deed.

What happens to the mortgage on the property?

If the property has a mortgage on it at the time of the owner’s death, the beneficiary inherits the property along with the mortgage. The beneficiary is then responsible for continuing the mortgage payments if they wish to retain ownership of the property. It's important to communicate with the lender to ensure a smooth transition.

Are there any tax implications for using a TOD Deed?

Using a TOD Deed may have tax implications for the beneficiary, particularly in regards to property and inheritance taxes. However, in many cases, the property's transfer through a TOD Deed allows for a step-up in basis, potentially reducing capital gains tax if the property is sold by the beneficiary. Consulting a tax professional is recommended to understand the specific implications.

Does a TOD Deed offer protection from the owner's creditors?

Upon the owner's death, the property may still be subject to claims by the owner's creditors. This means that if there are outstanding debts, creditors might seek repayment through the estate, potentially affecting the property transferred via a TOD Deed. Beneficiaries should be aware of the owner's financial situation and possible claims against the estate.

How does a TOD Deed differ from a will or living trust?

Unlike a will or living trust, a TOD Deed is a straightforward document that only applies to the specified property and does not require probate. A will, while it can dictate the distribution of various assets upon death, must go through probate. A living trust can avoid probate but requires a more comprehensive process of transferring all assets into the trust. A TOD Deed offers a simpler alternative for transferring real estate without affecting other estate planning strategies.

Common mistakes

Failing to properly identify the property is one of the most common mistakes people make when filling out the California Transfer-on-Death (TOD) Deed form. This document requires a precise legal description of the property, not just an address. An incorrect or imprecise description can lead to confusion and potential disputes over what property is actually being transferred upon the owner’s death.

Another error involves not adequately identifying the beneficiary. The TOD deed must clearly state the full legal name of the beneficiary or beneficiaries who will receive the property. Sometimes, people use nicknames or incomplete names, which can lead to ambiguity about the deed's intent. Legally, the recipient's identity must be beyond doubt for the transfer to proceed smoothly.

Skipping the acknowledgment section is a critical oversight that can invalidate the deed. California law requires that a TOD deed be acknowledged before a notary public. This acknowledgment validates the signer’s identity and their understanding of the document's content. Without this, the deed may not be legally binding.

People often forget to record the TOD deed with the county recorder’s office. For the deed to be effective and to put the public on notice, it must be recorded before the owner’s death in the county where the property is located. Failing to do so may result in the deed not being honored, and the property could pass through the probate process instead.

Incorrectly signing the document is another mistake. The TOD deed requires the property owner’s signature to comply with state laws. Mistakenly signing in the wrong place or failing to sign as required can render the document void. Additionally, the signature must be witnessed as specified by law, which is another step that individuals sometimes overlook.

Not updating the TOD deed when circumstances change is a misstep. Life events such as marriage, divorce, or the death of a beneficiary can affect the intended transfer of property. Property owners should review and, if necessary, update their TOD deed to reflect their current wishes; otherwise, the property may not end up with the intended recipient.

Finally, attempting to use a TOD deed to transfer property that is co-owned without understanding the rights of survivorship is problematic. If the property is owned as joint tenants, the survivorship rights typically override the provisions of a TOD deed. Thus, if one co-owner tries to transfer their interest upon death without the co-tenants’ consent or without proper legal structuring, it may lead to legal complications or the TOD deed being ineffective.

Documents used along the form

Effectively managing and transferring your assets after your passing is a crucial aspect of estate planning. In California, the Transfer-on-Death (TOD) deed form is a valuable tool for this purpose, allowing property to be passed directly to a beneficiary without the need for probate. However, this form often works hand in hand with other legal documents to ensure a comprehensive estate plan. Here is a list of ten other forms and documents that are frequently used alongside the California Transfer-on-Death Deed form to secure a well-rounded estate planning strategy.

- Will - A legal document that outlines how your assets should be distributed after your death. It appoints an executor to carry out your wishes and manage estate affairs.

- Revocable Living Trust - Allows you to control your assets during your lifetime and specifies how they should be handled after your death, potentially avoiding probate.

- Durable Power of Attorney - Authorizes someone you trust to manage your affairs if you become incapacitated.

- Advanced Healthcare Directive - Specifies your wishes regarding medical treatment if you're unable to communicate them yourself and appoints a healthcare proxy.

- Pour-Over Will - Works in conjunction with a living trust to ensure any assets not included in the trust at the time of death are transferred into it.

- Beneficiary Designations - Forms provided by financial institutions that allow you to designate beneficiaries for assets like retirement accounts and life insurance policies, bypassing the will and probate.

- Property Agreement for Married Persons - A document for married couples in community property states that specifies how property should be treated upon the death of a spouse.

- Financial Inventory - A comprehensive list of your financial assets, debts, accounts, and insurance policies, which helps your executor or trustee manage your estate.

- Letter of Intent - A non-binding document that provides additional instructions and wishes not covered in the will, such as funeral arrangements or a personal message to beneficiaries.

- Guardianship Designation - A legal document that names a guardian for minor children or dependents in the event of your incapacitation or death.

Utilizing the Transfer-on-Death Deed form in conjunction with these key documents can provide a solid foundation for your estate plan, ensuring that your assets are managed and distributed according to your wishes while minimizing the burden on your loved ones. It's advisable to consult with an estate planning attorney to tailor your estate plan to your specific needs and circumstances, ensuring all legal requirements are met and your future intentions are clearly documented.

Similar forms

The California Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament, primarily in its purpose to direct the distribution of assets after death. Like a Last Will, a TOD Deed allows an individual to specify beneficiaries for their property, ensuring that it goes to the chosen individuals without the need for probate. However, unlike a Will, which covers a broad range of assets, the TOD Deed is specific to real estate properties.

Comparable to a Life Insurance Policy, the TOD Deed provides a direct means of transferring assets upon the owner's death, bypassing probate court. Both instruments allow for the designation of beneficiaries and come into effect only after the death of the owner. The critical difference lies in the nature of the assets; life insurance proceeds are cash benefits, while a TOD Deed concerns real property.

A Payable-on-Death (POD) Bank Account also mirrors aspects of the TOD Deed, focusing on the seamless transfer of financial assets without the need for probate. Both enable an individual to designate beneficiaries who will receive the assets directly upon the account holder or property owner's demise. The main difference is that a TOD Deed is used for real estate, whereas a POD arrangement applies to bank and financial accounts.

A Living Trust is another estate planning tool that parallels the TOD Deed in its goal to avoid probate. By placing assets into a Trust, individuals can manage their property during their lifetime and dictate its distribution upon their death. While a Living Trust can encompass a variety of assets, including real estate, and offers more control and flexibility over the management of those assets, a TOD Deed is strictly for the transfer of real property upon death.

Finally, a Joint Tenancy with Right of Survivorship arrangement shares the bypass of probate court with the TOD Deed, enabling real estate to pass automatically to the surviving owner(s) upon a co-owner's death. Both approaches facilitate a transfer of property without probate, but while a Joint Tenancy requires all owners to take title at the same time and in equal shares, a TOD Deed allows a property owner to designate anyone they choose as the beneficiary.

Dos and Don'ts

When dealing with the California Transfer-on-Death (TOD) Deed form, it is important to approach the process with care to ensure your property is transferred according to your wishes without unwanted complications. Below are key dos and don'ts to consider:

Do:Review the form thoroughly to understand all requirements. It's essential to have a clear understanding of each section to fill it out correctly.

Confirm eligibility of the property. Not all property types may qualify for a Transfer-on-Death Deed, so it's important to verify that yours does.

Print legibly or type the information. This ensures that there's no ambiguity about your intentions and the details of the property and beneficiaries.

Be precise in the designation of beneficiaries. Clearly identify each beneficiary by their full legal name to avoid any potential disputes or confusion after your passing.

Sign the deed in the presence of a notary public. The State of California requires notarization for the document to be legally binding.

Record the deed with the county recorder's office. Until this step is completed, the deed does not take effect.

Rush through the process without fully understanding each part of the form. Mistakes or oversights can lead to legal complexities later.

Forget to consider how this deed fits into your broader estate plan. It should complement other estate planning documents and strategies you have in place.

Overlook the implications of joint ownership. Understand how the deed affects your property if it's co-owned, as the TOD deed may not be effective until all owners have passed.

Assume the deed is revocable by destroying the document. Proper revocation requires creating and recording a new document or taking other formal steps as outlined by state law.

Leave blank spaces. If a section does not apply, mark it accordingly rather than leaving it empty, to avoid potential tampering or questions of intent.

Fail to keep the deed in a safe, accessible place and inform your beneficiaries or executor about its location and contents. This can prevent confusion and ensure that your wishes are fulfilled.

Misconceptions

When it comes to planning for the future, the California Transfer-on-Death (TOD) Deed is an essential tool many choose for its simplicity. However, misconceptions abound, leading some to either misuse or shy away from it entirely. Here are seven common misunderstandings:

It replaces a will. One common belief is that having a TOD Deed means you don't need a will. While a TOD Deed can transfer real estate to a beneficiary without going through probate, it doesn't cover other assets or specify wishes for them like a will does. Both can be integral parts of a comprehensive estate plan.

It's irrevocable. Many think once a TOD Deed is signed, it cannot be changed. However, the reality is that the property owner can revoke it at any time prior to their death. Flexibility is one of the TOD Deed's advantages, allowing adjustments as circumstances change.

It avoids all taxes. While a TOD Deed simplifies the transfer of property, reducing the likelihood of it being a part of a probate estate, this does not inherently mean all taxes are avoided. Beneficiaries may still be subject to estate or inheritance taxes, depending on overall estate values and specific tax laws.

It takes effect immediately. It's often misunderstood that the TOD Deed transfers property rights as soon as it's signed. However, the deed only takes effect upon the death of the owner, leaving full control and ownership with them until that point.

It's complicated to create. The process to establish a TOD Deed might seem daunting, but California has made it relatively straightforward. The deed requires basic information about the property and beneficiary, a notary's acknowledgment of the owner's signature, and then recording the document with the county recorder's office.

It conflicts with joint tenancy. There's a belief that if property is owned in joint tenancy, a TOD Deed is not applicable or creates a conflict. On the contrary, a TOD Deed can still be executed by a joint tenant, but it only affects their share and comes into play when they are the last surviving joint tenant.

It covers all types of property. A common mistake is assuming a TOD Deed applies to all property types, including personal property. In reality, it's specific to real estate and cannot be used to transfer vehicles, bank accounts, or other non-real estate assets.

Understanding these misconceptions about the California Transfer-on-Death Deed can empower property owners to make informed decisions, ensuring their wishes are respected and their loved ones are cared for according to their intentions.

Key takeaways

In California, a Transfer-on-Death (TOD) deed is a simple, effective way to pass on real estate to a beneficiary without the need for a will or going through probate. When filling out and using the TOD deed form, here are nine key takeaways to keep in mind:

A Transfer-on-Death deed allows you to name a beneficiary who will receive the property upon your death without the need for probate.

The form must be completed correctly and include the legal description of the property, as well as the name of the designated beneficiary.

To be valid, the TOD deed must be signed before a notary public.

After it is notarized, the deed must be recorded with the county recorder’s office in the county where the property is located, usually within 60 days of signing.

You can revoke the TOD deed at any time before death by completing a new TOD deed, a revocation form, or through the sale of the property without issuing a new TOD deed.

The presence of a TOD deed does not affect your rights to use and control the property during your lifetime; you can still sell or mortgage the property.

Debt or other encumbrances on the property at the time of death will pass to the beneficiary along with the property.

If the designated beneficiary predeceases you, the TOD deed becomes ineffective unless you have named an alternate beneficiary.

It's strongly recommended to consult with a legal professional when considering a TOD deed to ensure it aligns with your overall estate planning goals and to understand the tax implications for the beneficiary.

Filling out and properly recording a Transfer-on-Death Deed can significantly simplify the transfer of real property upon death, but it's important to fully understand the implications and ensure that it fits into a comprehensive estate planning strategy. Paying attention to the details and requirements will ensure that your property seamlessly transfers to your intended beneficiary.

Popular Transfer-on-Death Deed State Forms

Problems With Transfer on Death Deeds California - An ideal solution for those seeking a direct, uncomplicated way to bequeath their home or land.

Texas Transfer on Death Deed Form 2023 - Beneficiaries will receive the property without assuming any responsibility for the owner’s debts, other than the property's encumbrances.

Transfer on Death Deed Florida Form - A Transfer-on-Death Deed is not suitable for all estate plans or properties and should be considered as part of a broader estate planning strategy.