Official Transfer-on-Death Deed Document

In considering the management and distribution of one's estate, the Transfer-on-Death (TOD) Deed emerges as a noteworthy instrument that allows individuals to bypass the often lengthy and complex probate process. With this form, property owners can designate beneficiaries to whom their real estate will automatically transfer upon their demise, without the need for judicial intervention. This method not only simplifies the transition of assets but also ensures that the property reaches the intended heirs swiftly and efficiently. Recognized in several states across the country, the TOD Deed stands out for its ability to provide peace of mind to property owners by securing the future of their real estate holdings, making it an essential consideration in estate planning strategies. Its major aspects include the requirement for the deed to be properly executed and recorded before the owner's death, and its revocable nature, allowing owners to make changes as their circumstances or wishes evolve. The TOD Deed, thus, represents a powerful tool for estate management, combining simplicity, flexibility, and effectiveness in a single legal document.

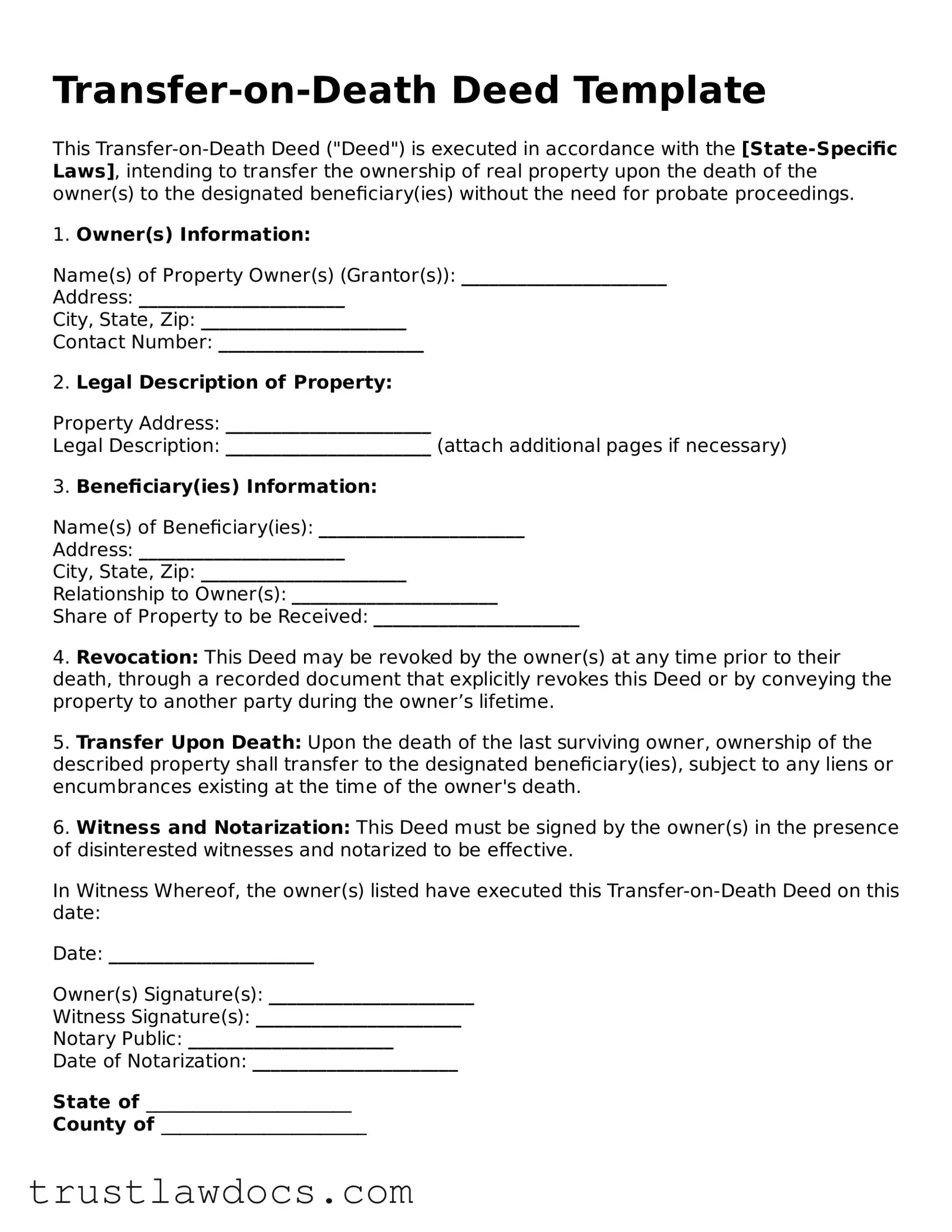

Form Example

Transfer-on-Death Deed Template

This Transfer-on-Death Deed ("Deed") is executed in accordance with the [State-Specific Laws], intending to transfer the ownership of real property upon the death of the owner(s) to the designated beneficiary(ies) without the need for probate proceedings.

1. Owner(s) Information:

Name(s) of Property Owner(s) (Grantor(s)): ______________________

Address: ______________________

City, State, Zip: ______________________

Contact Number: ______________________

2. Legal Description of Property:

Property Address: ______________________

Legal Description: ______________________ (attach additional pages if necessary)

3. Beneficiary(ies) Information:

Name(s) of Beneficiary(ies): ______________________

Address: ______________________

City, State, Zip: ______________________

Relationship to Owner(s): ______________________

Share of Property to be Received: ______________________

4. Revocation: This Deed may be revoked by the owner(s) at any time prior to their death, through a recorded document that explicitly revokes this Deed or by conveying the property to another party during the owner’s lifetime.

5. Transfer Upon Death: Upon the death of the last surviving owner, ownership of the described property shall transfer to the designated beneficiary(ies), subject to any liens or encumbrances existing at the time of the owner's death.

6. Witness and Notarization: This Deed must be signed by the owner(s) in the presence of disinterested witnesses and notarized to be effective.

In Witness Whereof, the owner(s) listed have executed this Transfer-on-Death Deed on this date:

Date: ______________________

Owner(s) Signature(s): ______________________

Witness Signature(s): ______________________

Notary Public: ______________________

Date of Notarization: ______________________

State of ______________________

County of ______________________

This document was acknowledged before me on ______________________ (date) by ______________________ (name of principal).

Notary Seal: ______________________

Notary Signature: ______________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | A Transfer-on-Death (TOD) deed allows property owners to pass real estate directly to a beneficiary upon their death, bypassing the probate process. |

| Revocability | The owner can revoke a TOD deed at any time before their death, making it a flexible estate planning tool. |

| Beneficiary Designation | The property owner can name one or more beneficiaries, including individuals, trusts, or organizations, to inherit the property. |

| Governing Law Variety | TOD deed laws vary by state, with some states not recognizing TOD deeds at all, so it's essential to consult state-specific laws. |

| Impact on Probate | A TOD deed allows the property to transfer to the beneficiary without going through probate, potentially saving time and legal fees. |

How to Write Transfer-on-Death Deed

When planning for the future, ensuring that your assets are seamlessly transferred to your designated beneficiaries without the need for probate can be a crucial step. A Transfer-on-Death (TOD) deed is a simple and effective tool to achieve this. By filling out the TOD deed properly, the property owner can directly name whom they wish the property to pass to upon their death. It is important that the form is filled out accurately to ensure that your wishes are legally documented. Follow these steps carefully to complete the Transfer-on-Death Deed form.

- Identify the current owner(s) of the property as the grantor(s). Include all legal names in full.

- Specify the legal description of the property. This information can be found on your property deed or by contacting your local assessor's office.

- Name the designated beneficiary(ies) clearly. Ensure to spell their names correctly and include their full legal names.

- State the relationship between the grantor(s) and the beneficiary(ies), if any exists. This information is not mandatory but can clarify the intention behind the deed.

- Include any specific conditions or restrictions on the transfer, if desired. Be clear and precise to avoid any possible ambiguity in the future.

- Have the document notarized. This step usually requires the grantor(s) to sign the deed in the presence of a notary public to authenticate the signature(s).

- File the completed deed with the county recorder's office in the county where the property is located. Note that a recording fee may apply.

After the TOD deed is properly filed, the documentation will stand as a testament to your wishes for the property after your passing. It is a straightforward document, but getting it right is crucial. Should there be any changes in your decisions or the designated beneficiaries, it would be necessary to either amend the existing deed or create a new one altogether. For such legal documents, consulting with a professional is always recommended to ensure compliance with state laws and regulations.

Get Answers on Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed?

A Transfer-on-Death Deed is a legal document that allows property owners to name a beneficiary who will inherit their property upon the owner's death, without the need for probate court proceedings. The property is transferred directly to the beneficiary after the owner's death, simplifying the process and avoiding the time and expense of probate.

How does a Transfer-on-Death Deed differ from a will?

While both a Transfer-on-Death Deed and a will can dictate who inherits property, a Transfer-on-Death Deed takes effect immediately upon the death of the property owner and bypasses probate court. A will, on the other hand, is subject to probate, which can be a lengthy and costly process.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Almost anyone can be named as a beneficiary in a Transfer-on-Death Deed. This includes family members, friends, or organizations. However, the beneficiary must be specifically named; generic designations like "my children" are not sufficient.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the death of the property owner, as long as the owner is mentally competent. This is usually done by filing a new deed or a revocation of the TOD deed with the county recorder's office.

What happens if the beneficiary named in the Transfer-on-Death Deed dies before the owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the owner, the deed typically becomes void unless an alternate beneficiary is named. The property would then be handled according to the owner's will or, if there is no will, through the state's laws of intestate succession.

Are there any costs associated with a Transfer-on-Death Deed?

There may be minimal costs associated with preparing and recording a Transfer-on-Death Deed, such as fees for legal assistance and recording fees at the county recorder's office. However, these costs are generally much lower than the expenses incurred during probate.

Does the beneficiary have any rights to the property before the owner's death?

No, the beneficiary has no legal rights to the property before the death of the owner. The owner retains full control over the property and can use, sell, or even change the beneficiary designation at any point during their lifetime.

Is a Transfer-on-Death Deed valid in all states?

No, Transfer-on-Death Deeds are not available in all states. It's important to check the laws in your specific state or consult with a legal professional to determine if this option is available and appropriate for your situation.

What happens if there is a conflict between the Transfer-on-Death Deed and the owner's will?

In most cases, the Transfer-on-Death Deed would take precedence over the will for the specific property designated in the deed. This is because the deed transfers ownership directly upon death, outside of the probate process that would enforce the will's terms.

Common mistakes

One common mistake when filling out a Transfer-on-Death (TOD) Deed form is not checking the legal requirements that vary by state. Each state has specific laws regarding TOD deeds, including who can be named as a beneficiary and how the form must be witnessed or notarized. Failing to adhere to these legal prerequisites can render the deed invalid, complicating the transfer process after the owner's death.

Another issue often encountered is incorrectly listing the property description. A precise legal description of the property is crucial for a TOD deed's validity. This description typically includes lot numbers, subdivision names, and other details that might not be top of mind for the property owner. An inaccurate or incomplete description can lead to disputes or confusion about which property is being transferred, potentially requiring legal intervention to resolve.

Many individuals also neglect to name an alternate beneficiary. If the primary beneficiary predeceases the property owner and no alternate is named, the property may end up going through probate, which the TOD deed aims to avoid. Naming an alternate ensures that the property transfer aligns with the owner's wishes, even if the initial beneficiary is unavailable to inherit.

Some property owners make the mistake of not properly recording the deed with the county recorder’s office. For a TOD deed to be effective, it usually must be recorded before the owner's death in the county where the property is located. Failure to do so might invalidate the deed, forcing the property to go through probate.

Another common error is failing to consider how a TOD deed affects the overall estate plan. A TOD deed transfers property outside of the probate process, but it should be harmonized with wills, trusts, and other estate planning tools to ensure a cohesive distribution of assets. Conflicting instructions between these documents can lead to legal challenges from potential heirs.

Not consulting with a legal professional is a significant oversight. While a TOD deed can seem straightforward, its implications on estate planning and potential tax consequences can be complex. Professional advice can help navigate these waters, ensuring that the deed aligns with the broader estate plan and complies with relevant laws.

Finally, overlooking the need for updating the TOD deed is a common misstep. Life changes, such as marriage, divorce, the birth of children, or the death of a named beneficiary, necessitate revisiting and potentially revising the TOD deed. Keeping the deed current is vital for ensuring that the property transfer reflects the owner's intentions.

Documents used along the form

When planning for the future, particularly in regards to estate planning, the Transfer-on-Death (TOD) Deed form is a powerful tool that allows property owners to designate beneficiaries to receive their property upon their passing, without the property having to go through probate. Alongside the TOD Deed, there are other essential documents that complement and enhance the estate planning process. These documents ensure a comprehensive approach to asset management and transfer, offering peace of mind to the property owner and their loved ones. Here are four key documents commonly used in conjunction with a Transfer-on-Death Deed form.

- Last Will and Testament: This document is a foundational element of any estate plan. It outlines the individual's wishes regarding the distribution of their assets and care of minor children, if any, after their death. While a TOD deed can transfer real estate, a Last Will and Testament covers the distribution of other personal assets.

- Durable Power of Attorney: This legal document grants an individual the authority to make decisions on behalf of another person, typically in financial or healthcare matters, should they become incapacitated. It's an essential part of planning for future incapacity.

- Healthcare Directive or Living Will: A healthcare directive, often referred to as a living will, specifies an individual's preferences for medical treatment if they become unable to communicate or make decisions for themselves due to illness or incapacity. This document complements the TOD deed by addressing non-financial aspects of planning for the future.

- Revocable Living Trust: This legal instrument allows an individual to manage their assets during their lifetime, with provisions to transfer them to beneficiaries upon death, bypassing the probate process, similar to a TOD deed but applicable to a broader range of assets. It offers flexibility and control, allowing changes to be made as circumstances evolve.

In summary, while a Transfer-on-Death Deed form is an effective tool for avoiding probate for real estate, incorporating other documents like a Last Will and Testament, Durable Power of Attorney, Healthcare Directive, and Revocable Living Trust into your estate planning ensures a more comprehensive strategy. Each document serves a distinctive role, working together to cover all aspects of your life and assets, thereby providing a well-rounded approach to future planning and peace of mind for you and your loved ones.

Similar forms

The Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament, in that both allow the transfer of assets upon the death of the individual. A Last Will and Testament is a comprehensive document that outlines how a person's assets will be distributed after their death, often involving various types of property and possessions. Similarly, a TOD Deed focuses on the transfer of real estate upon the owner's death directly to the named beneficiary, bypassing the probate process. This direct transfer mechanism is common to both documents, though the TOD Deed is specifically designed to streamline the transfer of real estate.

Comparable to a Living Trust, the Transfer-on-Death Deed provides a mechanism for managing assets after the owner's death. A Living Trust is created during a person's lifetime and can include various types of assets, with the trust owning the assets and the individual serving as the trustee. Upon the individual's death, the assets are transferred to designated beneficiaries according to the terms of the trust, avoiding probate. Similarly, a TOD Deed avoids probate by allowing real estate to pass directly to a beneficiary, yet it only applies to real estate and does not require the management of a trust during the owner's lifetime.

A Beneficiary Deed, particularly prevalent in some states, functions almost identically to a TOD Deed. It allows property owners to name beneficiaries who will inherit the property upon the owner's death, seamlessly and without going through probate. Both documents are revocable, allowing property owners to change their named beneficiaries if their intentions or circumstances change. The primary difference lies in terminology and the specific legal requirements that might vary from one state to another.

The Joint Tenancy Agreement shares a key feature with the Transfer-on-Death Deed: the ability to pass real estate to another individual upon death without the need for probate. In a Joint Tenancy, two or more individuals own property together with rights of survivorship. Upon the death of one joint tenant, the property automatically passes to the surviving joint tenant(s), similar to how a TOD Deed transfers property to a named beneficiary. However, while TOD Deeds and Joint Tenancies both avoid probate, TOD Deeds do not involve shared ownership or control of the property prior to the owner's death.

Dos and Don'ts

When preparing a Transfer-on-Death (TOD) Deed form, it's important to proceed with caution and precision to ensure that your assets are transferred smoothly to your designated beneficiaries after your passing. Following the right steps can protect your interests and the interests of those you care about. Here are some essential dos and don'ts to consider:

What you should do:

- Review your state's laws: Confirm that your state acknowledges TOD deeds, as not all do. Each state that permits TOD deeds has its own guidelines and requirements that must be met for the deed to be valid.

- Clearly identify the property: Provide a precise legal description of the property you are transferring. This typically involves more detail than just the address and may include the lot number, subdivision, and any other information that legally identifies the property.

- Select your beneficiaries carefully: Think about who you wish to inherit your property. You can name more than one beneficiary, but you should specify how they will own the property, whether equally, in shares, or in some other designation.

- Sign and notarize the document: For a TOD deed to be effective, it must be signed in the presence of a notary public. Only then does the document become legally binding. This also helps to prevent any challenges to the deed after your death.

What you shouldn't do:

- Delay recording the deed: After the deed is notarized, don't procrastinate in recording it with the local county records office. An unrecorded TOD deed might not be effective, depending on your state's laws.

- Overlook the impact on estate planning: A TOD deed can significantly impact your overall estate plan. Ensure it aligns with your will and other estate documents to prevent any unintended consequences.

- Forget to review and update as needed: Life changes such as marriage, divorce, the birth of a child, or the death of a beneficiary can impact your TOD deed. Review and, if necessary, update it to reflect your current wishes.

- Assume it overrides other agreements: A TOD deed does not necessarily supersede other legal agreements you might have in place, like a prenuptial agreement. Always consider how all your documents work together.

Misconceptions

Transfer-on-Death (TOD) deeds are an important tool for estate planning, allowing homeowners to pass on property directly to a beneficiary without the need for probate court proceedings upon their death. However, several misconceptions surround the understanding and use of TOD deeds. Let's clear up some of the most common ones.

Misconception 1: A TOD Deed Overrides a Will - Many believe that a TOD deed will automatically override the provisions of a will regarding the distribution of property. However, the TOD deed specifically transfers property to a designated beneficiary upon death, independent of what a will might state about the property. It's a direct transfer mechanism that bypasses the will entirely.

Misconception 2: TOD Deeds Can Transfer Any Type of Property - It's commonly misunderstood that TOD deeds can be used to transfer any asset. In reality, TOD deeds are designed specifically for real estate. Other assets, such as cars or financial accounts, might have their own transfer-on-death or payable-on-death designations.

Misconception 3: Once Executed, a TOD Deed Cannot Be Revoked - Some think that once a TOD deed is signed and recorded, it cannot be changed. This isn't true. As long as the property owner is alive, they have the right to revoke or modify the TOD deed.

Misconception 4: TOD Deeds Remove the Property From the Estate for Tax Purposes - A frequent misunderstanding is that property transferred via a TOD deed will not be considered part of the estate for tax purposes. The reality is that even though the property bypasses probate, it's still counted as part of the estate for determining federal estate taxes.

Misconception 5: A TOD Deed Guarantees the Beneficiary Will Inherit the Property Free of Issues - Many believe that a TOD deed means the beneficiary will receive the property without any complications. However, the property could still have claims against it, such as mortgages, liens, or other encumbrances, which the beneficiary would inherit along with the property.

Understanding the realities of Transfer-on-Death deeds helps property owners make informed decisions about estate planning and ensures their assets are distributed according to their wishes.

Key takeaways

A Transfer-on-Death (TOD) Deed is a vital document that allows property owners to pass on their real estate to a beneficiary without the need for the property to go through probate after their death. Understanding how to accurately complete and effectively use this form is crucial for ensuring a smooth transfer of property to the intended recipient. Here are key takeaways about filling out and using the Transfer-on-Death Deed form:

- Eligibility Requirements: Not all states recognize Transfer-on-Death Deeds, so it's paramount to first verify that the property is located in a jurisdiction where such deeds are valid.

- Accurate Information is Crucial: When completing the form, the property owner must provide exact details, including the legal description of the property and the full legal name of the beneficiary.

- Revocability: One of the standout features of a TOD deed is that it can be revoked or changed at any time before the owner’s death, provided the property owner has the legal capacity to do so.

- Witness and Notarization Requirements: The deed must be signed in the presence of a notary public and, depending on the state's requirements, may also need to be witnessed by one or more impartial parties.

- Recording the Deed: For a TOD deed to be effective, it must be properly recorded in the county where the property is located, usually before the owner's death.

- No Immediate Effect: The TOD deed only takes effect upon the death of the property owner, allowing them to retain full control and use of the property during their lifetime.

- Impact on Estate Planning: Incorporating a TOD deed into one’s estate plan can simplify the distribution of assets, potentially avoiding the time-consuming and costly probate process.

It's important for individuals considering a Transfer-on-Death Deed to consult with a legal professional to ensure that this form aligns with their overall estate planning goals and complies with applicable state laws. This ensures that the real estate asset passes to the beneficiary as intended, with minimal legal hurdles.

Consider More Types of Transfer-on-Death Deed Forms

Free Deed of Trust Template - It serves as a crucial instrument for risk management in real estate finance, protecting the interests of both the lender and the trustee.

Quick Title Deed - Real estate transactions that involve a quitclaim deed are often expedited due to its simplicity.