Free Deed Form for Texas

When navigating the complexities of property transactions in Texas, the Deed form plays a pivotal role, serving as the official document that transfers property ownership from one party to another. This essential legal instrument comes in various types, each tailored to specific circumstances and requirements of the transfer. Among these, the General Warranty Deed provides the highest level of buyer protection, guaranteeing the property is free from any liens or encumbrances. The Special Warranty Deed offers a more limited guarantee, applying only to the period the seller owned the property. For those seeking a no-frills transfer without warranty, the Quitclaim Deed is often the go-to document, primarily used between trusted parties, such as family members. Understanding the purpose, benefits, and limitations of each form is crucial for both the grantor and the grantee to ensure a smooth and legally sound property transaction. With the right knowledge and guidance, individuals can navigate the process efficiently, secure in the integrity and legality of the ownership transfer.

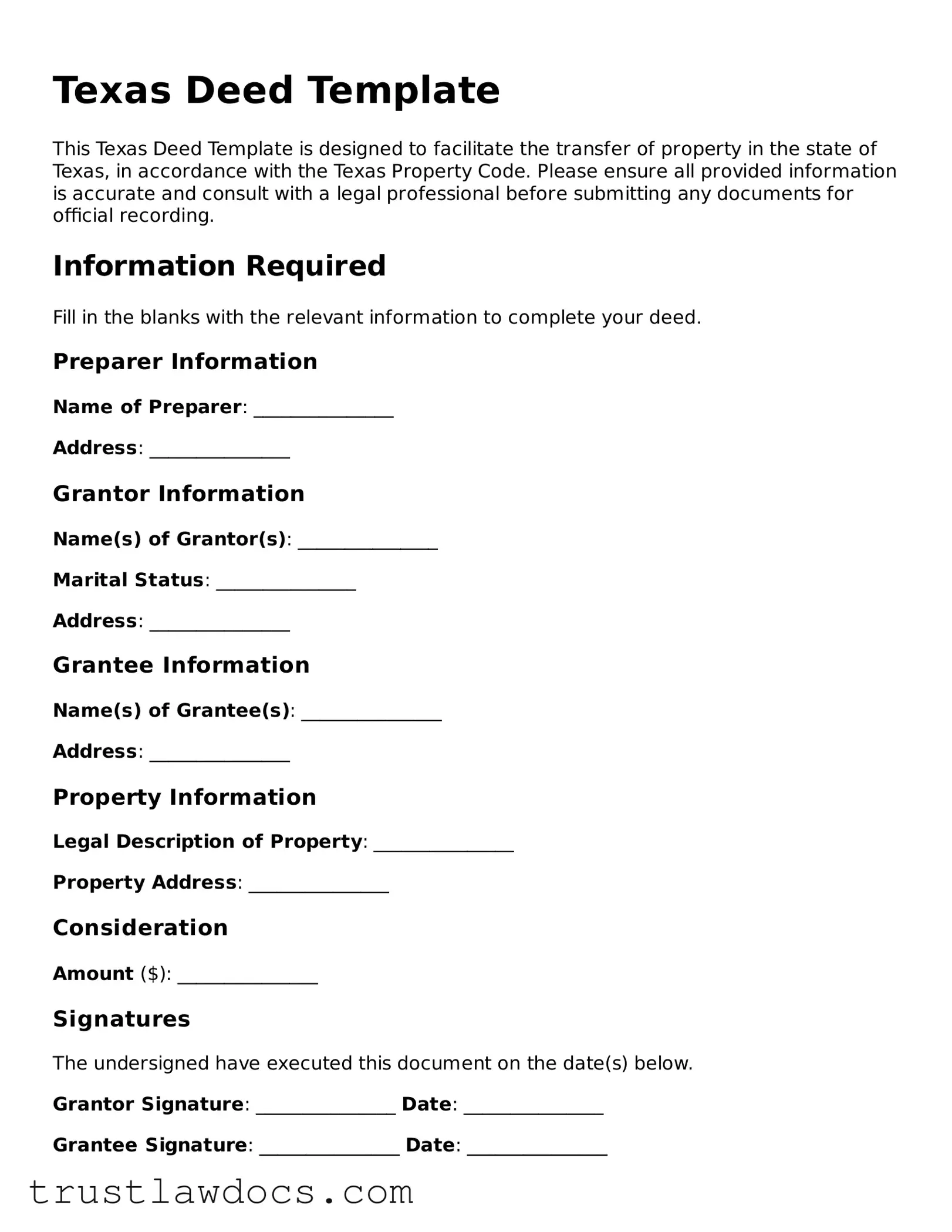

Form Example

Texas Deed Template

This Texas Deed Template is designed to facilitate the transfer of property in the state of Texas, in accordance with the Texas Property Code. Please ensure all provided information is accurate and consult with a legal professional before submitting any documents for official recording.

Information Required

Fill in the blanks with the relevant information to complete your deed.

Preparer Information

Name of Preparer: _______________

Address: _______________

Grantor Information

Name(s) of Grantor(s): _______________

Marital Status: _______________

Address: _______________

Grantee Information

Name(s) of Grantee(s): _______________

Address: _______________

Property Information

Legal Description of Property: _______________

Property Address: _______________

Consideration

Amount ($): _______________

Signatures

The undersigned have executed this document on the date(s) below.

Grantor Signature: _______________ Date: _______________

Grantee Signature: _______________ Date: _______________

Instructions for Completing the Deed

- Ensure that all the information provided in the deed is complete and accurate.

- Grantor(s) and Grantee(s) must sign the deed in the presence of a notary public.

- Record the completed deed in the County Clerk's office where the property is located.

- Pay any required recording fees as determined by the county.

Notary Acknowledgment

State of Texas

County of _______________

On this day, before me, the undersigned notary public, personally appeared _______________ known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public's Name: _______________

Commission Expiration: _______________

Seal:

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | A Texas Deed form is used to legally transfer property from one party to another in the state of Texas. |

| Type of Deeds | Common types include General Warranty Deed, Special Warranty Deed, Quitclaim Deed, and Grant Deed. |

| Governing Law | Property transfers via deed are governed by the Texas Property Code. |

| Recording | To be valid against third parties, the deed must be recorded with the county clerk in the county where the property is located. |

| Witness Requirements | While Texas law does not require a witness for the signing of the deed, it does require a notary public to acknowledge the signature of the grantor. |

| Consideration Statement | A statement of consideration is required, stating the actual transaction value, though it can sometimes simply affirm that "good and valuable consideration" has been exchanged. |

How to Write Texas Deed

When transferring property ownership in Texas, a deed form is a critical document that must be completed correctly. This document legally transfers the property from the current owner (grantor) to the new owner (grantee). Ensuring all details are accurately filled out on this form is crucial to prevent future legal complications. The steps to fill out the Texas Deed form may seem daunting at first, but breaking the process down can simplify the task. Here's how to do it systematically:

- Identify the type of deed required for the property transfer. In Texas, common types include general warranty, special warranty, and quitclaim deeds.

- Obtain a blank deed form. This can be sourced from a local county clerk's office or a reputable online resource.

- Fill in the date of the deed execution at the top of the form.

- Enter the full legal name and address of the grantor (the person selling or transferring the property) as well as the grantee (the recipient of the property).

- Provide the legal description of the property. This description can be found on the previous deed, property tax statement, or obtained from the county assessor's office. It typically includes lot number, subdivision name, and other details that delineate the property's boundaries.

- State the consideration amount, which is the value being exchanged for the property. This could be monetary or another form of compensation.

- Include any additional clauses or covenants that are part of the agreement. This may involve rights of access, restrictions on the property use, or other conditions of the sale.

- Have the grantor sign the deed in the presence of a notary public. The notary must then notarize the deed, adding their seal and signature, to validate the document.

- File the completed deed with the Texas county clerk's office where the property is located. There may be a filing fee, which varies by county.

The process of filling out and filing a deed in Texas is a key step in ensuring the legal transfer of property. Once the deed is filed, the property ownership transfer becomes part of the public record, affirming the grantee's rightful ownership. While this guide provides a step-by-step approach, it's always wise to seek legal advice or assistance to navigate any complexities or specific situations that may arise.

Get Answers on Texas Deed

What is a Texas Deed form and why is it important?

A Texas Deed form is a legal document that records the transfer of ownership for real property from one party to another in the state of Texas. This form is crucial because it legally formalizes the change of ownership and is necessary for the transaction to be recognized by state law. It ensures that the transfer is officially recorded and the rights to the property are clearly defined, protecting both the buyer and the seller.

What types of Deed forms are available in Texas?

In Texas, several types of Deed forms are used, each serving different purposes. The most common types include the General Warranty Deed, which offers the highest level of buyer protection, guaranteeing against any prior claims or liens; the Special Warranty Deed, providing limited protection and only covering the period during which the seller owned the property; and the Quitclaim Deed, transferring any ownership interest the seller has without any warranty. Choosing the right type depends on the level of protection desired and the specifics of the property transaction.

How does one obtain a Texas Deed form?

Securing a Texas Deed form can be done through several avenues. One can visit a local county recorder's office or a stationery store that carries legal forms. Additionally, online legal services and the Texas Department of Real Estate website offer downloads for various standardized Deed forms. It's essential to ensure that the form complies with Texas law and is specific to the type of Deed required for the transaction.

What information is needed to complete a Texas Deed form?

To properly fill out a Texas Deed form, several pieces of information are required, including the legal description of the property, the names and addresses of the seller (grantor) and the buyer (grantee), the sale price, and any related terms and conditions of the property transfer. Additionally, the form must be signed by the grantor in the presence of a notary public to be legally valid.

Are there legal requirements for filing a Texas Deed form?

Yes, Texas law specifies certain requirements for filing a Deed form. After being signed and notarized, the Deed must be recorded with the county clerk in the county where the property is located. There may be filing fees associated with this process. The timing of filing is also crucial, as delays can affect the enforceability of the Deed and potentially complicate future transactions involving the property.

Can a Texas Deed form be changed or revoked after it's been filed?

Once a Texas Deed form is completed, signed, notarized, and filed with the appropriate county clerk's office, it becomes a permanent record of the property transfer. Altering or revoking a filed Deed is complex and typically requires legal action such as filing a new Deed to correct or change the terms of the original transfer, or in some cases, going through court proceedings. Legal advice should be sought to navigate these processes.

What should one do if they encounter problems with a Texas Deed form?

If issues arise with a Texas Deed form, it's advisable to consult with a real estate lawyer who is knowledgeable about Texas property law. A lawyer can provide guidance on correcting errors in a filed Deed, disputing a transfer, or addressing any claims against the property that could affect ownership. Professional legal assistance ensures that any action taken complies with state laws and protects the individual's property rights.

Common mistakes

One common mistake that individuals often make when filling out the Texas Deed form is inaccurately describing the property. The legal description of the property, including boundaries and identification numbers, must be precise. Errors in this section can lead to significant complications, potentially invalidating the deed or causing issues with future property transactions. Ensuring accuracy in the property description protects both the grantor and grantee from future disputes and legal challenges.

Another error frequently encountered involves the incorrect identification of parties. It's crucial that the names of the grantor (the person selling or transferring the property) and the grantee (the person receiving the property) are spelled correctly and match their legal documents. Misidentifying parties can invalidate the deed or, at the very least, necessitate legal actions to correct the mistake. Such oversight complicates what should be a straightforward process, leading to unnecessary delay and expense.

Often, individuals neglect to have the deed properly signed and notarized, a critical step in the process. In Texas, the law requires that a deed be signed by the grantor in the presence of a notary public. The notary public then affirms that the correct party signed the deed. Skipping this step or executing it improperly can render the deed unenforceable. This oversight can be particularly problematic because it may not come to light until the grantee attempts to sell or otherwise transfer the property.

Finally, a mistake that can easily be avoided is failing to file the deed with the appropriate county clerk's office after it is executed. The deed officially transfers ownership only after it is filed and recorded. Unrecorded deeds may lead to disputes over property ownership and can complicate future sales. This step is vital for the protection of the grantee's interests and the legal recognition of their property rights.

Documents used along the form

In the realm of real estate transactions, the deed is a foundational document that signifies the transfer of ownership. However, this document does not stand alone. To ensure a smooth and legally secure transfer, several other forms and documents often accompany the Texas Deed form. Each plays a vital role in clarifying the terms, conditions, and responsibilities tied to the property transaction. Below is a curated list of these essential documents, each with a brief description of its purpose and importance.

- Promissory Note: A crucial document for transactions involving a mortgage, the promissory note outlines the borrower's promise to repay the loan amount under specified terms and conditions, including interest rates and payment schedules.

- Mortgage or Deed of Trust: This document secures the promissory note by tying it to the physical property, ensuring the loan's repayment by placing a lien on the property until the mortgage is fully paid off.

- Title Insurance Commitment: A preliminary report that details the conditions under which a title insurance company will issue a title insurance policy, including any existing liens, easements, or encumbrances on the property.

- Closing Disclosure: For transactions involving a mortgage, this form outlines the final details of the loan, including the interest rate, monthly payments, and closing costs, and must be provided to the borrower at least three days before closing.

- Bill of Sale: While often associated with the sale of personal property, a bill of sale can also accompany a deed to document the transfer of any personal property included in the sale of the real estate (e.g., appliances, furniture).

- Property Tax Statements: Recent statements provide evidence of current tax assessments and confirm whether property taxes are up to date or if any arrears need to be addressed before the transfer of ownership.

- Homeowners Association (HOA) Documents: For properties within an HOA, these documents provide details on the association's fees, rules, and regulations, which the new owner will be obliged to follow.

- Survey: A recent survey document can clarify the property's boundaries, easements, and any encroachments, providing both the buyer and the seller with a clear understanding of the property's physical limits.

- Home Warranty Documents: If a home warranty is being offered or transferred as part of the sale, these documents outline the coverage, terms, and conditions of the warranty service.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form discloses any known use of lead-based paint on the property, allowing buyers to understand potential risks.

The documents listed above, when used alongside the Texas Deed form, contribute to a transparent, secure, and efficient property transaction. Each document serves to protect the interests of all parties involved, providing a comprehensive legal framework that addresses the multiple facets of real estate transfers. Understanding these documents and their roles underscores the complexity of property transactions and the importance of thorough and careful preparation in navigating these waters successfully.

Similar forms

The Texas Deed form, an instrumental document in transferring property ownership from one party to another, shares similarities with various other documents used in real estate and legal transactions. These documents, while serving different purposes, incorporate elements of agreement, transfer, and declaration between parties.

One similar document is the Warranty Deed. This document also facilitates the transfer of property ownership but with added assurance that the seller holds a clear title to the property. Both documents ensure the legal transfer of ownership, though the Warranty Deed offers the buyer greater protection against claims on the property.

The Quitclaim Deed is another related document, used to transfer any interest in real property the grantor may have to the grantee without any guarantee of clear title. Like the Texas Deed form, it modifies ownership rights, although it offers less security to the recipient of the property rights.

A Grant Deed, much like the Texas Deed, transfers property ownership from one party to another. It guarantees that the property has not been sold to anyone else and is free of encumbrances, except those disclosed. This document-type balances between a Warranty Deed and a Quitclaim Deed in terms of the level of protection it offers to the buyer.

The Trust Deed, or Deed of Trust, is a document that implicates real property in securing a debt, designating a trustee who holds the property's title until the debt is paid off. While it serves a different purpose, involving a lending scenario, it resembles the Texas Deed form in its involvement in property title transfers, albeit conditionally.

The Deed of Surrender, which is primarily used in lease agreements, involves a tenant relinquishing rights to a property back to the landlord or lessor, effectively ending the lease. While focused on rental agreements, it shares with the Texas Deed form the concept of transferring rights over property, albeit without a sale.

Affidavits of Heirship document the transfer of property ownership in the absence of a will, identifying the rightful heirs to a deceased person's estate. Similar to the Texas Deed form, this document deals with the transfer of ownership, although it is utilized within the probate process and does not involve a traditional buying or selling transaction.

The Transfer on Death Deed allows property owners to name a beneficiary to whom the property will transfer upon the owner's death, without the need for probate. This document, while planning for future ownership transfer similar to the Texas Deed form, is uniquely designed to circumvent the probate process, making the transition smoother for the designated beneficiary.

Finally, a Real Estate Purchase Agreement is an agreement between a buyer and seller to transfer a property for a specified price after meeting certain conditions. Though it precedes the execution of a deed, including the Texas Deed form, by outlining the terms of the sale, it is integral to the process of transferring real estate ownership.

These documents, while serving unique roles within the legal and real estate arenas, intersect with the Texas Deed form in their collective aim to delineate, transfer, or clarify rights and responsibilities concerning property ownership. Each, in its way, establishes agreements that impact the status and disposition of real estate, reflecting the complexity and significance of property transactions.

Dos and Don'ts

Filling out a Texas Deed form can seem straightforward, but caution is advised to avoid errors that could delay or invalidate the document. Below are essential dos and don'ts to consider:

Do:

Provide accurate information about the grantor (seller) and grantee (buyer). Mistakes in names or addresses can lead to disputes about the deed's validity.

Ensure the legal description of the property is precise. This description is more detailed than just an address and usually references lot numbers, block numbers, and subdivisions as recorded in county records.

Sign in the presence of a notary public. Texas law requires deeds to be notarized to be considered valid for recording with the county.

Consider consulting with a real estate lawyer to determine the appropriate type of deed for your situation. Texas recognizes different types of deeds, including general warranty deeds, special warranty deeds, and quitclaim deeds, each offering different levels of protection.

File the completed deed with the appropriate county clerk’s office to make it official. Until it's recorded, the transfer of property isn't complete.

Don't:

Leave blanks on the deed. Unfilled sections can lead to misunderstandings or manipulation of the document, potentially invalidating it.

Forget to check the property tax status. Outstanding taxes can complicate the property transfer and may need to be addressed before finalizing the deed.

Underestimate the importance of the exact legal description. A mistake in this area can lead to significant issues, even invalidating the deed.

Ignore the need for witness signatures if required. While Texas doesn't mandate witnesses for all deeds, certain circumstances might necessitate them, such as when the grantor is unable to sign themselves.

Assume a recorded deed is the end of the responsibility. Ensure all relevant parties, including mortgage companies and tax authorities, are informed of the change in ownership.

Misconceptions

When dealing with property transactions in Texas, the deed form is an essential document. However, there are several misconceptions that can confuse or mislead people. Let’s clarify some of these misunderstandings to make the process smoother for everyone involved.

All Texas deed forms are the same: This is not true. Texas has several types of deed forms, such as General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds, each serving different purposes and offering varying levels of protection to the buyer.

A deed doesn’t need to be filed to be valid: While a deed is technically valid when signed and delivered, it's critical to file it with the county recorder's office to protect against claims from third parties.

Oral agreements can substitute for a deed in Texas: This is false. The Texas Statute of Frauds requires that transactions involving real estate must be in writing to be enforceable.

You don’t need a lawyer to draft a deed: While it's true that you can create a deed on your own, having a legal professional draft or review it ensures that the document complies with Texas law and accurately reflects your intentions.

A Quitclaim Deed transfers property with warranties: Actually, a Quitclaim Deed transfers only the interest the grantor has in the property, if any, without any warranties about clear title.

All parties must be present to sign the deed: Not necessarily. Parties can sign the deed at different times or locations. However, all signatures must be properly notarized.

Once signed, a deed transfer is irreversible: This isn't entirely accurate. While difficult, it's possible to reverse a deed transfer if both parties agree or if the deed was signed under duress, fraud, or mistake.

Deeds must be notarized to be valid: In Texas, notarization is a requirement for the deed to be filed and therefore fully effective in protecting the grantee’s interest. However, the lack of notarization does not inherently invalidate the deed between the parties involved.

Understanding these nuances is crucial when handling property transactions in Texas. Misconceptions can lead to mistakes, potentially affecting the rights and responsibilities of the parties involved. Therefore, it’s advisable to consult a professional to navigate the complexities of real estate transactions.

Key takeaways

Understanding the process and importance of properly filling out and using the Texas Deed form is crucial for the valid transfer of property ownership. Here are key takeaways to consider:

- Ensure all required information is complete and accurate. This includes the full legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property), a thorough description of the property, and the date of the transfer.

- It's important to determine the type of deed being used, as this impacts the warranty and level of protection the grantee receives. For example, a Warranty Deed provides a full warranty of clear title, while a Quitclaim Deed transfers any interest the grantor has without warranty.

- The deed must be signed by the grantor in the presence of a notary public to be legally effective. This notarization is a critical step that authenticates the identity of the grantor and validates the document.

- After completion, the deed must be filed with the county clerk in the county where the property is located. This public recording officially completes the process of transferring property and ensures the deed is recognized as valid.

Remember, while filling out the Texas Deed form may seem straightforward, each step is essential for the legal transfer of property. Overlooking details or skipping steps can lead to complications. For peace of mind and accuracy, consulting with a professional familiar with Texas property law may be beneficial.

Popular Deed State Forms

Indiana Quit Claim Deed Form - The integrity of the information within the deed form is essential for its legal standing and effectiveness.

How to Get a Copy of My House Deed - The language used in a deed form must be clear and follow legal standards to effectively convey property rights.

Broward County Property Search by Owner Name - Filling out a deed form requires attention to detail to accurately reflect the terms of the property transfer.