Free Quitclaim Deed Form for Texas

In the realm of real estate transactions in Texas, the Quitclaim Deed form plays a unique and specific role. Unlike other forms of property transfer documents, this form is often used to transfer ownership of property quickly without the guarantees typically associated with a warranty deed. It is particularly common among family members or close acquaintances, where there is a high level of trust. The form requires minimal information: the name of the grantor (person giving the property), the grantee (person receiving the property), and a legal description of the property being transferred. Once signed, the deed must be filed with the local county recorder to be considered valid. While the simplicity and speed of a Quitclaim Deed might be appealing, it's important for both parties to understand that it does not guarantee the grantor's ownership of the property or that the title is free of liens or other encumbrances. This aspect makes it critical for potential users of the form to carefully consider their situation and, if necessary, consult with a professional to ensure their interests are adequately protected.

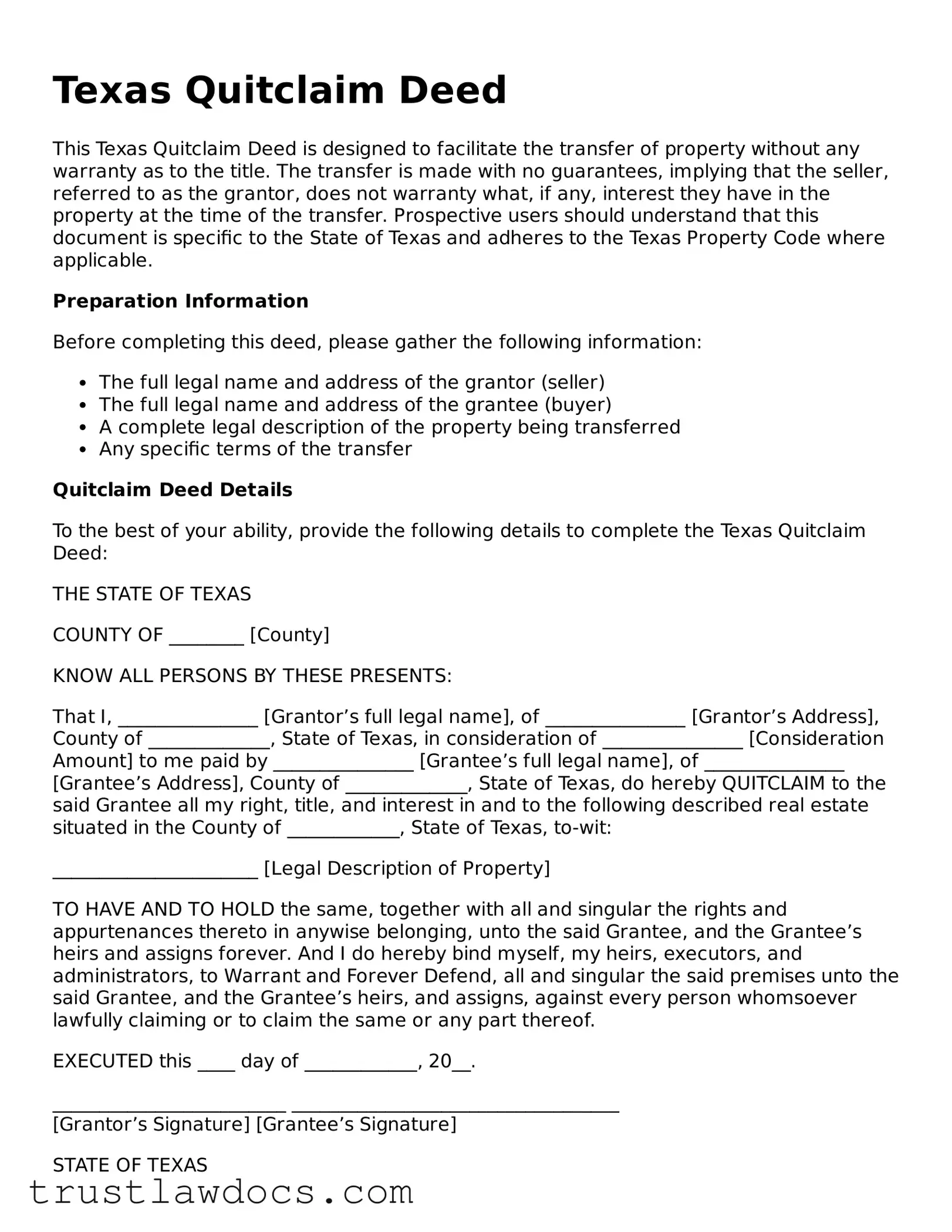

Form Example

Texas Quitclaim Deed

This Texas Quitclaim Deed is designed to facilitate the transfer of property without any warranty as to the title. The transfer is made with no guarantees, implying that the seller, referred to as the grantor, does not warranty what, if any, interest they have in the property at the time of the transfer. Prospective users should understand that this document is specific to the State of Texas and adheres to the Texas Property Code where applicable.

Preparation Information

Before completing this deed, please gather the following information:

- The full legal name and address of the grantor (seller)

- The full legal name and address of the grantee (buyer)

- A complete legal description of the property being transferred

- Any specific terms of the transfer

Quitclaim Deed Details

To the best of your ability, provide the following details to complete the Texas Quitclaim Deed:

THE STATE OF TEXAS

COUNTY OF ________ [County]

KNOW ALL PERSONS BY THESE PRESENTS:

That I, _______________ [Grantor’s full legal name], of _______________ [Grantor’s Address], County of _____________, State of Texas, in consideration of _______________ [Consideration Amount] to me paid by _______________ [Grantee’s full legal name], of _______________ [Grantee’s Address], County of _____________, State of Texas, do hereby QUITCLAIM to the said Grantee all my right, title, and interest in and to the following described real estate situated in the County of ____________, State of Texas, to-wit:

______________________ [Legal Description of Property]

TO HAVE AND TO HOLD the same, together with all and singular the rights and appurtenances thereto in anywise belonging, unto the said Grantee, and the Grantee’s heirs and assigns forever. And I do hereby bind myself, my heirs, executors, and administrators, to Warrant and Forever Defend, all and singular the said premises unto the said Grantee, and the Grantee’s heirs, and assigns, against every person whomsoever lawfully claiming or to claim the same or any part thereof.

EXECUTED this ____ day of ____________, 20__.

_________________________ ___________________________________ [Grantor’s Signature] [Grantee’s Signature]

STATE OF TEXAS

COUNTY OF ________ [County]

On this day, personally appeared before me, _______________ [Name of Notary], a Notary Public in and for said County and State, _______________ [Name of Grantor], known to me (or proved to me on the oath of _______________) to be the person whose name is subscribed to the foregoing instrument and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ____ day of ____________, 20__.

_________________________ (Notary Public) My Commission Expires: ____________

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A Texas Quitclaim Deed is a legal document used to transfer interest in real estate from one person (the grantor) to another (the grantee) without any warranty of title. |

| Warranty of Title | Unlike a warranty deed, the quitclaim deed does not guarantee that the grantor holds clear title to the property; it only transfers whatever interest the grantor may have at the time of the transfer. |

| Common Uses | Often used in non-sale situations such as transferring property between family members or to clear up title issues. |

| Governing Law | Governed by the Texas Property Code, specifically sections related to conveyances of real property. |

| Recording Requirements | Must be filed with the county clerk in the county where the property is located to be effective against third parties. |

| Execution Requirements | Must be signed by the grantor in the presence of a notary public to be valid for recording in Texas. |

How to Write Texas Quitclaim Deed

When you're ready to transfer property in Texas without making any warranties about the title, a Quitclaim Deed form is the tool you need. This document is commonly used between family members or close friends, where trust is high and the risk of future title disputes is low. Filling out the Quitclaim Deed form is straightforward, but it requires attention to detail to ensure the transfer proceeds smoothly. Follow these steps to complete the form accurately.

- Begin by entering the Preparer's information at the top of the form. This includes the name and address of the person who is completing the document.

- Next, fill in the Return To section. This should have the name and address of the individual who will receive the deed after it's recorded.

- On the "After Recording Return to" line, specify where the county clerk should send the deed once it’s recorded – include the name, address, city, state, and zip code.

- In the Consideration section, state the amount of money being exchanged for the property, if any. Even if no money is exchanged, a nominal amount (like $10) is often stated to fulfill legal requirements.

- List the Grantor’s (the current property owner’s) full name and address. Make sure to get the legal spelling of names correct and include the state and zip code for the address.

- Enter the Grantee’s (the new property owner’s) full name and address, following the same guidelines for accuracy.

- Fill in the Legal Description of the property. This might include the lot number, subdivision, and any other details that appear on the property’s current deed or tax documents. Precise details are crucial here for a lawful transfer.

- Specify if any money is exchanged and how it's distributed, under "The State of Texas". Although the Quitclaim Deed does not guarantee clear title, it's important to clarify the transaction.

- Have the Grantor(s) sign the deed in front of a notary public. The form must be notarized to be valid.

- Lastly, file the completed form with the county clerk’s office in the county where the property is located. Filing fees may apply, and they vary by county.

Completing the Quitclaim Deed form is a crucial step in transferring property rights, but it's only part of the process. Keep in mind that each county in Texas might have specific requirements or additional forms to fill out. Always check with the local county clerk’s office to ensure compliance with local regulations. With careful attention to these steps, you can effectively complete your property transfer.

Get Answers on Texas Quitclaim Deed

What is a Texas Quitclaim Deed form?

A Texas Quitclaim Deed form is a legal document used to transfer interest in real property from one person (the grantor) to another (the grantee) without any warranty regarding the title. It is often used between family members or in situations where the parties know each other and want a simple transfer.

When should you use a Quitclaim Deed in Texas?

Use a Quitclaim Deed when transferring property between family members, clearing up a title issue, transferring property into a trust, or in situations where the property is gifted. It's important to use this deed when both parties understand the property's title status and agree on the transfer without warranties.

Does a Quitclaim Deed guarantee a clear title in Texas?

No, a Quitclaim Deed does not guarantee a clear title. It transfers whatever interest the grantor has in the property, if any, without any promise that the title is clear or free of liens.

How is a Quitclaim Deed different from a Warranty Deed in Texas?

A Quitclaim Deed transfers interest with no guarantees about the title's status, while a Warranty Deed includes promises from the grantor to the grantee that the title is clear and the grantor has the right to sell the property. A Warranty Deed offers more protection to the buyer.

What are the necessary steps to file a Quitclaim Deed in Texas?

To file a Quitclaim Deed, complete the deed form with accurate information, have the grantor sign it in front of a notary public, and then record the deed with the county clerk in the county where the property is located. Recording the deed makes it a matter of public record.

Are there any fees associated with filing a Quitclaim Deed in Texas?

Yes, there are fees associated with filing a Quitclaim Deed. These fees vary by county but are typically required for recording the deed. Check with the local county clerk's office for the exact fees.

Can a Quitclaim Deed be reversed or canceled in Texas?

A Quitclaim Deed can be reversed or canceled if both parties agree to the revocation and execute another deed or legal document that nullifies the original transfer. Legal advice might be necessary to ensure any revocation is properly conducted.

What are some potential risks of using a Quitclaim Deed?

The main risk is the lack of warranty on the title. The grantee receives no assurances about the title's status and assumes any liabilities, such as liens or claims against the property. It's advisable to conduct a thorough title search before accepting a quitclaim transfer.

Common mistakes

Filling out the Texas Quitclaim Deed form can sometimes be tricky. One common mistake people make is not correctly identifying the Grantor and Grantee. It's crucial to use the complete legal names of both parties involved to ensure the deed is legally binding. Besides, every person whose name goes on the deed must sign it, so it's important to get this right.

Another error often encountered is failing to provide a complete legal description of the property. This isn't just the street address; it includes the lot or parcel number and any other information that's used to record the property officially. Without this, the deed might not be valid or could lead to confusion about what land is being transferred.

People sometimes overlook the necessity of getting the deed notarized. A notary public must witness the signing of the deed for it to be considered valid. This step verifies that the people signing the deed are who they say they are and that they are signing under their own free will.

There is also a misunderstanding about the filing of the deed. Once the deed is signed and notarized, it should be filed with the county clerk in the county where the property is located. Failing to file the deed means the transfer is not complete and could lead to legal complications down the road.

Incorrectly assuming that a Quitclaim Deed guarantees clear title is another pitfall. This type of deed makes no promises about whether the Grantor has a clear title to the property. It simply transfers whatever interest the Grantor might have at the time of the transfer. Potential buyers often require additional title searches or insurance to protect their interests.

Avoiding these mistakes requires attention to detail and an understanding of the legal requirements. By ensuring the deed is correctly filled out, notarized, and filed, and by having a clear understanding of what a Quitclaim Deed does and does not do, parties can make the property transfer process much smoother.

Documents used along the form

In real estate transactions, particularly those involving the transfer of property rights without guarantees, such as through a Texas Quitclaim Deed, various supplementary documents are often necessary. These documents support, validate, and safeguard the transfer process, ensuring that it complies with legal standards and requirements. Here's a look at some commonly used forms and documents alongside the Texas Quitclaim Deed.

- Warranty Deed - This form is used when the seller guarantees that they hold clear title to the property. It offers more protection to the buyer than a quitclaim deed.

- Title Search Report - A document that details the history of ownership of the property, revealing any liens, encumbrances, or claims against it. It’s crucial for confirming the clear title.

- Property Disclosure Statement - Sellers use this form to disclose known problems or defects with the property. Although not always required with a quitclaim deed, it promotes transparency.

- Loan Payoff Statement - If there's an existing mortgage on the property, this document outlines the amount required to pay off the loan in full at the time of the sale.

- Homeowners Association (HOA) Documents - For properties in HOA-managed areas, these documents detail any HOA fees, rules, or restrictions that apply to the property.

- Insurance Policies - Evidence of current homeowner's and title insurance policies may be required to ensure all risks are covered throughout the transfer process.

- Power of Attorney - If one of the parties cannot be present to sign the documents, a power of attorney may be used to grant authority to another individual to sign on their behalf.

- Real Estate Transfer Tax Declarations - Some states or localities require a tax declaration form to be filed alongside the deed for the transfer of real property.

- Closing Statement - A detailed account of all the transactions and fees paid or required to be paid by the buyer and seller during the closing of the property transfer.

When preparing to use a Texas Quitclaim Deed, gathering these additional documents in advance can significantly streamline the process. Each plays a critical role in ensuring the legality and smooth execution of property transfers, protecting the interests of all parties involved. Consulting with a legal professional can also help navigate the specific requirements and nuances of these documents.

Similar forms

The Texas Quitclaim Deed form shares similarities with the Warranty Deed. Both serve to transfer property ownership, but they differ significantly in the level of protection they offer to the buyer. While the Quitclaim Deed provides no warranties about the property's title, meaning it transfers only the ownership interest the grantor has at the time of the deed's execution, the Warranty Deed goes further by guaranteeing the buyer that the property title is free of any claims, such as liens or encumbrances.

Comparable to a Grant Deed, the Quitclaim Deed also facilitates property transfers. The key distinction lies in the guarantees provided about the property's title. A Grant Deed guarantees that the property has not been sold to someone else and is free from encumbrances made by the seller, unlike the Quitclaim Deed, which makes no such assurances, transferring only the seller's rights, if any, to the property.

The Deed of Trust is another document related to real estate transactions but serves a different purpose than the Quitclaim Deed. In the context of financing, the Deed of Trust involves three parties - the borrower, lender, and trustee, and acts as a lien on the property being purchased. This contrasts with the Quitclaim Deed, which is primarily used for the simple transfer of property rights without any guarantees or implications of financial obligations.

Alike in their function to change property titles, the Special Warranty Deed and the Quitclaim Deed transfer ownership. However, the Special Warranty Deed offers a more moderate level of assurance compared to a Warranty Deed but more than a Quitclaim Deed. It assures the buyer that the seller only guarantees against title defects that occurred during their period of ownership, not for any time before that period, unlike the Quitclaim Deed, which offers no such assurances.

The Transfer on Death Deed (TODD) also parallels the Quitclaim Deed, as both are mechanisms for transferring property. However, the TODD is unique because it allows property to be passed directly to beneficiaries upon the property owner’s death, bypassing probate court. This contrasts with the Quitclaim Deed, which is effective immediately upon execution and does not necessarily contemplate the owner's death.

Last but not least, the Executor’s Deed, often used in the context of settling an estate, bears resemblance to the Quitclaim Deed in terms of transferring property rights. The difference lies in the Executor’s Deed being executed by the executor of an estate based on the powers vested by a will or court order, transferring property from the estate to a beneficiary. On the other hand, a Quitclaim Deed can be executed by anyone holding property rights, without necessarily involving an estate or the probate process.

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it's crucial to approach the process with diligence and attention to detail. Below is a list of practices to follow and to avoid, ensuring that the procedure is handled correctly and efficiently.

- Do verify all property details, such as the legal description and parcel number, to ensure accuracy. Errors in this information can invalidate the document.

- Do confirm the grantor (the person transferring the property) and the grantee (the person receiving the property) are correctly identified by their full legal names and contact information.

- Do make sure that the grantor signs the deed in the presence of a notary public. The notarization is essential for the document's validity.

- Do review the form thoroughly before submitting it to the county clerk's office for recording. A complete and error-free document speeds up the recording process.

- Don't leave any sections of the form blank. Incomplete documents may be rejected or could lead to future complications.

- Don't use informal names or nicknames for the grantor or grantee. The deed should reflect legal names as they appear on government-issued IDs.

- Don't overlook the necessity of having the document recorded with the county clerk in the county where the property is located. Failure to record can affect the transfer of title.

- Don't neglect to seek legal advice if there are any uncertainties or questions about how to fill out the form correctly. A professional can help clarify the process and prevent legal issues.

Misconceptions

When it comes to understanding the quitclaim deed in Texas, several misconceptions commonly arise. It's crucial to dispel these myths to navigate the complexities of property transactions accurately. Below is a list of misconceptions and explanations to clear up any misunderstandings.

- A quitclaim deed guarantees a clean title. Unlike a warranty deed, a quitclaim deed does not guarantee that the property's title is free and clear of liens or other encumbrances. It only transfers whatever interest the grantor has in the property, if any, at the time of transfer.

- Quitclaim deeds are only for transferring property between strangers. Actually, quitclaim deeds are most often used between family members, close friends, or within a trust to transfer property without a formal sale.

- A quitclaim deed transfers property ownership immediately. While the deed does transfer whatever interest the grantor has in the property, the actual change in ownership is only legally complete once the deed is properly filed with the county clerk's office.

- Signing a quitclaim deed means you no longer have financial responsibility for the property. If the grantor has an existing mortgage on the property, signing a quitclaim deed does not relieve them of the obligation to pay the mortgage. The financial responsibilities remain until the debt is fully paid or legally reassigned.

- You don't need a lawyer to execute a quitclaim deed. While it's true that you can complete a quitclaim deed without legal representation, consulting with a lawyer can ensure that the deed is properly executed and that you understand the legal implications of the transfer.

- Quitclaim deeds are best for commercial property transactions. Due to the lack of warranty, quitclaim deeds are typically not the best choice for commercial property transactions where the buyer expects a guarantee regarding the title's status.

- A quitclaim deed can clear up any title defects. Quitclaim deeds do not address or clear title defects. They simply transfer the interest of the grantor with no warranties regarding the title's validity or status.

- All states recognize quitclaim deeds in the same way. While quitclaim deeds are used in many states, the specific laws and implications can vary significantly from one jurisdiction to another. It's important to understand Texas-specific laws when dealing with a quitclaim deed in Texas.

Dispelling these myths is essential for anyone involved in a property transfer in Texas to ensure that they have a clear understanding of their rights and obligations. Misunderstandings can lead to unnecessary risks and complications in what could otherwise be a straightforward process.

Key takeaways

When filling out and using the Texas Quitclaim Deed form, it's crucial to adhere to specific guidelines and practices to ensure the process is conducted correctly. Below are several key takeaways to consider:

- Understand the Purpose: The Quitclaim Deed is a legal document used to transfer interest in real property from the grantor to the grantee without any warranty. It's commonly used among family members or to clear up titles.

- Accurate Information is Key: Ensure all information on the form is accurate, including the legal description of the property, names of the grantor(s) and grantee(s), and the date of transfer.

- Notarization is Required: For the Quitclaim Deed to be valid, it must be signed by the grantor in front of a Notary Public. The Notary Public must then notarize the document.

- Witnesses May Be Needed: While Texas law does not require witnesses for the execution of a Quitclaim Deed, some counties might have their own requirements. Verify with local regulations to ensure compliance.

- Recording is Essential: After obtaining the necessary signatures, the Quitclaim Deed must be filed with the County Clerk's Office in the county where the property is located. This officiates the transfer and protects the grantee's interest.

- Understand the Limitations: It's important to recognize that a Quitclaim Deed offers no guarantees regarding the grantor's ownership or rights in the property. The grantee receives only what interest the grantor had, if any.

By familiarizing yourself with these essentials, you can navigate the complex process of handling a Texas Quitclaim Deed with greater confidence and precision.

Popular Quitclaim Deed State Forms

Quit Claim Deed Real Estate - An expedient way to handle property transactions without the guarantees typical of sale situations.

Quick Claim Deed Form Indiana - Use this form for transferring property when you're not concerned about underlying claims, focusing on a straightforward process.

Filled Out Quit Claim Deed Michigan - The document, once completed, should include a legal description of the property to avoid any confusion about what is being transferred.

Quit Claim Deed Florida Form - Quitclaim Deeds can assist in clearing lien claims against a property by transferring ownership to a lien holder.