Free Quitclaim Deed Form for New York

In the realm of real estate transactions, one document that often plays a pivotal role in the conveyance of property rights yet frequently goes misunderstood is the New York Quitclaim Deed form. This form, unlike the more commonly known warranty deeds, does not offer the grantee (the person receiving the property) any guarantee regarding the title's clarity or the existence of encumbrances such as liens or mortgages. Essentially, it transfers whatever interest the grantor (the person offering the property) has in the property, if any, at the time of the transfer. The use of a quitclaim deed is prevalent in specific scenarios such as property transfers between family members, in divorce proceedings where one spouse relinquishes their interest in the marital home, or in clearing title discrepancies. Due to its nature, ensuring accuracy and comprehensiveness in the completion of the New York Quitclaim Deed form is paramount, as is a robust understanding of its implications. While relatively simple at first glance, the nuances of how and when to use this form can greatly impact the involved parties’ rights and obligations.

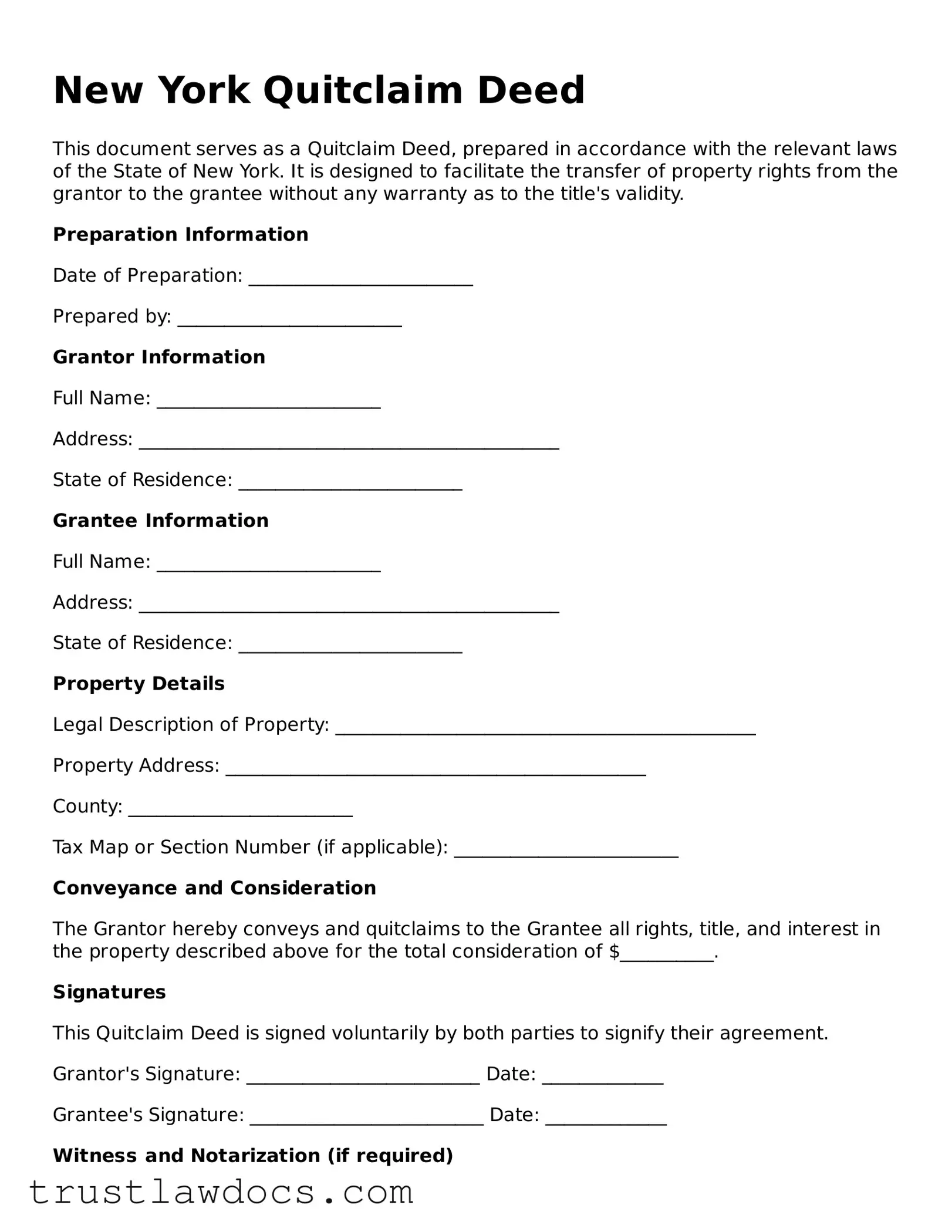

Form Example

New York Quitclaim Deed

This document serves as a Quitclaim Deed, prepared in accordance with the relevant laws of the State of New York. It is designed to facilitate the transfer of property rights from the grantor to the grantee without any warranty as to the title's validity.

Preparation Information

Date of Preparation: ________________________

Prepared by: ________________________

Grantor Information

Full Name: ________________________

Address: _____________________________________________

State of Residence: ________________________

Grantee Information

Full Name: ________________________

Address: _____________________________________________

State of Residence: ________________________

Property Details

Legal Description of Property: _____________________________________________

Property Address: _____________________________________________

County: ________________________

Tax Map or Section Number (if applicable): ________________________

Conveyance and Consideration

The Grantor hereby conveys and quitclaims to the Grantee all rights, title, and interest in the property described above for the total consideration of $__________.

Signatures

This Quitclaim Deed is signed voluntarily by both parties to signify their agreement.

Grantor's Signature: _________________________ Date: _____________

Grantee's Signature: _________________________ Date: _____________

Witness and Notarization (if required)

This section to be completed by a Notary Public, acknowledging the identities of the signatories and the voluntary nature of their signatures:

Notary Public Signature: _________________________ Date: _____________

My Commission Expires: _________________________

Recording

After signing, this Quitclaim Deed must be filed with the county clerk’s office in the county where the property is located to become a matter of public record.

Disclaimer

This template is provided as a general guide and does not constitute legal advice. Parties are advised to seek the services of a licensed attorney for any questions regarding the transfer of real property in New York.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Used to transfer property without any warranty regarding the clear title of the property. |

| Governing Law | New York Real Property Law |

| Recording Requirement | Must be filed with the County Clerk’s Office where the property is located. |

| Witness Requirement | Requires at least one witness to the signature of the grantor(s). |

| Consideration Statement | A statement of consideration is required to describe the value being exchanged for the property. |

| Acknowledgment Requirement | Must be acknowledged before a notary public or other official authorized to take acknowledgments. |

How to Write New York Quitclaim Deed

When transferring property ownership in New York without warranties regarding the quality of the title, a Quitclaim Deed is commonly used. This process requires precision and attention to detail. The form asks for specific information about the grantor (the person transferring the property), the grantee (the person receiving the property), and the property itself. Completing this form accurately is crucial to ensure the successful transfer of ownership. Here is a step-by-step guide to fill out the New York Quitclaim Deed form.

- Begin by identifying the preparer of the deed. This refers to the individual completing the form, whether it’s you or someone assisting you.

- Next, specify the return address. This is where the deed will be sent after recording.

- Indicate the county where the property is located at the top of the deed.

- Enter the consideration amount, which is the price paid for the property transfer. Even if no money is exchanged, a minimal amount must be stated to make the deed valid.

- List the name and address of the grantor(s) in the designated section. Ensure the name matches the title or previous deed for consistency.

- Provide the name and address of the grantee(s). Double-check the spelling and details to avoid any future complications.

- Include the legal description of the property. This information can be found on the current deed or by contacting the county recorder’s office. It must be precise as it delineates the property being transferred.

- For the grantor(s) to sign the deed in front of a Notary Public, there must be a designated section for this. Ensure that all grantors sign the deed as their names appear on the form.

- The presence of a Notary Public is crucial at this step. The notary will verify the identity of the grantor(s) and witness the signing, providing a seal or stamp to officialize the deed.

- Finally, file the completed deed with the county clerk’s office in the county where the property is located. There may be a filing fee associated with this process.

Filling out the Quitclaim Deed form with thoroughness and precision is essential for a smooth transfer of property. By following these steps carefully, grantors can help ensure that the process goes as planned, with minimal legal complications. Remember, consulting with a legal professional can provide additional guidance and help navigate any potential challenges.

Get Answers on New York Quitclaim Deed

What is a Quitclaim Deed in New York?

A Quitclaim Deed in New York is a legal document used to transfer a property's interest from a seller (grantor) to a buyer (grantee) without any guarantee that the property is free of debt or other encumbrances. This type of deed is commonly used between family members or to transfer property into a trust.

Does a Quitclaim Deed guarantee clear title in New York?

No, a Quitclaim Deed does not guarantee clear title. It only transfers whatever interest the grantor has in the property, if any, without any warranties or guarantees that the property is free from other claims or liens.

Are there any special requirements for a Quitclaim Deed to be valid in New York?

In New York, for a Quitclaim Deed to be valid, it must be in writing, contain the legal description of the property, be signed by the grantor, and notarized. It must also be recorded with the county clerk in the county where the property is located.

How do I record a Quitclaim Deed in New York?

To record a Quitclaim Deed in New York, you must bring the completed, signed, and notarized deed to the county clerk's office in the county where the property is located. Recording fees must be paid, and the clerk's office will officially record the document, making it part of the public record.

Can a Quitclaim Deed be used to transfer property to a family member in New York?

Yes, a Quitclaim Deed can be used to transfer property to a family member in New York. This is a common use for Quitclaim Deeds, as it is a simple way to transfer ownership without the warranties provided by other types of deeds.

What are the tax implications of using a Quitclaim Deed in New York?

When transferring property using a Quitclaim Deed, there may be tax implications for both the grantor and the grantee, such as capital gains tax or real estate transfer taxes. The exact implications depend on the specific circumstances of the transfer. It's advisable to consult with a tax professional to understand any potential tax consequences.

Can a Quitclaim Deed remove someone's name from a property title in New York?

Yes, a Quitclaim Deed can be used to remove someone's name from a property title in New York. For example, if one person wishes to relinquish their interest in a jointly held property, they can execute a Quitclaim Deed in favor of the other owner.

Is a Quitclaim Deed in New York suitable for real estate sales?

A Quitclaim Deed is generally not recommended for real estate sales in New York where the buyer expects a guarantee of clear title. In such cases, a Warranty Deed, which does provide such a guarantee, might be more appropriate.

Does a Quitclaim Deed need to be notarized in New York?

Yes, in New York, a Quitclaim Deed needs to be notarized to be valid. The notary public must witness the grantor signing the deed and then notarize the document to confirm the authenticity of the signature.

Common mistakes

Filling out a New York Quitclaim Deed form may seem straightforward, but it's easy to make mistakes. These mistakes can cause delays or even affect the legality of the transaction. Here are seven common errors to avoid:

First, a common mistake is not providing the correct legal description of the property. This isn't simply the address; it involves a detailed description that usually includes metes and bounds or a lot and block number, depending on the county's requirements. Without this precise description, the deed could be considered invalid, leading to significant issues down the line.

Second, people often mistakenly leave out or incorrectly fill in the grantor and grantee information. The grantor is the person selling or transferring the property, while the grantee is the receiver. It is crucial to use the correct legal names and ensure they match other legal documents. Errors here can cause confusion about the property’s rightful ownership.

Third, overlooking the signature requirements is a frequent mistake. In New York, the Quitclaim Deed must not only be signed by the grantor but also notarized. A notary public must witness the signing of the document. Failing to do so can render the deed unenforceable.

Fourth, neglecting to check for any required witness signatures is another common error. While not all states require a witness for the signing of a Quitclaim Deed, some areas in New York do. It’s important to comply with local regulations to ensure the deed's validity.

Fifth, failing to file the deed with the appropriate county clerk’s office is a mistake that can have serious repercussions. After the Quitclaim Deed is properly filled out, signed, and notarized, it must be officially recorded. This recording process is what legally transfers the ownership.

Sixth, not considering tax implications is often overlooked. Transferring property does not absolve the grantor of property tax obligations until the deed is correctly recorded. Additionally, there may be federal or state gift taxes to consider if the property is not sold at market value.

Lastly, many people mistakenly believe a Quitclaim Deed guarantees a clear title. However, this type of deed offers no warranties regarding the property’s title status. So, if there are any outstanding liens or claims, the grantee accepts these issues upon transfer.

Avoiding these common mistakes when filling out a New York Quitclaim Deed can make the process smoother and ensure the property transfer is legally binding.

Documents used along the form

When handling property transactions in New York, a Quitclaim Deed is a common document used to transfer property with no warranty as to the title. Essentially, it's a way to transfer property quickly, often between family members or into a trust. However, this deed is merely one piece of the puzzle. Several other documents are often used in conjunction with the Quitclaim Deed to ensure the process is thorough, legal, and meets all local and state requirements.

- Real Property Transfer Report (RP-5217): This form is necessary for documenting the transfer of real property and is required for all deed transfers unless exemptions apply. The information it contains helps local governments with assessments and real estate data management.

- Transfer Tax Returns: When property changes hands, state and sometimes local transfer taxes must often be paid. These forms calculate the amount of tax due based on the property's sale price or other criteria.

- Title Search Report: Before a Quitclaim Deed is executed, it's prudent to conduct a title search. This report outlines the property's ownership history, liens, encumbrances, and any other issues that could affect the transfer.

- Property Tax Forms: Completing this documentation ensures that property taxes are accurately assessed and recorded under the new owner's name. It's essential for the smooth transition of responsibilities.

- Affidavit of Consideration: In some cases, this affidavit might be required to detail the consideration (or the value exchanged) for the transfer. This is especially true if the Quitclaim Deed is filed without a sale price or as a gift.

- Notarization/Acknowledgment Forms: Finally, most Quitclaim Deeds and accompanying documents need to be notarized to verify the identity of the signatories and solidify the document's legality.

Each of these documents plays a vital role in the conveyance process, ensuring legal compliance and the smooth transition of property. Whether you're transferring property to a family member, adding or removing someone's name from the title, or putting property into a trust, these forms, along with the Quitclaim Deed, help to outline the responsibilities and rights of all parties involved. It's advisable to consult with a legal professional to ensure all necessary documentation is completed accurately and in accordance with the law.

Similar forms

The New York Quitclaim Deed form is similar to the Warranty Deed in that both are legal documents used for the transfer of real estate. However, the key difference lies in the level of protection offered to the buyer. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it, offering more protection by including warranties against any outstanding claims or liens. Conversely, a Quitclaim Deed offers no such guarantees or warranties, making it a quicker, simpler process primarily used between familiar parties.

Comparable to the Grant Deed, the Quitclaim Deed also involves the transfer of property ownership. Both serve to convey ownership rights from the grantor to the grantee, but how they handle defects in title differ markedly. A Grant Deed, unlike a Quitclaim Deed, includes assurances that the property has not been previously sold and is free of encumbrances, except those openly disclosed. This middle ground of assurance makes the Grant Deed a more secure option than a Quitclaim Deed but less secure than a Warranty Deed.

Similarities are seen between the Quitclaim Deed and the Trustee’s Deed in terms of their utility in specific situations. A Trustee's Deed is typically used when property is being transferred from a trust, with the trustee acting as the seller. Both documents are streamlined ways to transfer property without the warranties of clear title. However, a Trustee’s Deed, while also lacking guarantees, is often part of a more formal trust administration process and may offer some level of trust endorsement regarding the property’s status.

The Executor’s Deed is yet another document with a distinct purpose but conceptually similar to the Quitclaim Deed. Used when property is transferred as part of an estate settlement, the Executor's Deed is executed by the executor of the estate. Like a Quitclaim Deed, it primarily facilitates the transfer of property interest but differs because it is used in the context of settling an estate and may carry certain assurances based on the executor's authority. Despite these differences, both play a pivotal role in transferring property rights under specific circumstances.

Dos and Don'ts

When completing a New York Quitclaim Deed form, certain practices ensure the process is handled correctly, safeguarding the interests of all parties involved. Below are recommended actions to follow and pitfalls to avoid.

Do's:

- Verify that all parties' names are spelled correctly and match the identification documents. This includes double-checking the spelling of names and ensuring they are legally accurate.

- Ensure the property description is precise and detailed. The legal description of the property should include block and lot numbers, if applicable, and must match the description on the current deed to avoid disputes regarding the property boundaries.

- Sign the deed in the presence of a notary public. The State of New York requires the grantor(s) (the person or persons selling or transferring the property) to acknowledge the deed before a notary to validate the document.

- Review the quitclaim deed form for any specific filing requirements in the county where the property is located. Each county might have unique demands, such as particular margins, paper size, or additional forms that must accompany the quitclaim deed.

- Record the deed with the county clerk's office promptly after it's signed and notarized. This helps to protect the interests of the grantee (the person receiving the property) by providing public notice of the property transfer.

Don'ts:

- Avoid leaving blanks on the form. Incomplete information can lead to processing delays or even the rejection of the document by the county clerk.

- Resist the temptation to use generic or vague property descriptions. The absence of a precise legal property description can lead to legal challenges down the line.

- Do not skip having the deed notarized. A quitclaim deed that is not notarized may be considered invalid and could significantly disrupt the conveyance process.

- Do not disregard the need to report the transfer to the local tax assessor's office. This step is crucial to ensure property taxes are accurately assessed and billed to the new owner.

- Do not ignore the advice of a legal professional when unsure of the process. Consulting with someone knowledgeable about New York real estate laws can prevent costly mistakes and ensure the quitclaim deed is properly executed.

Misconceptions

Understanding the New York Quitclaim Deed form is crucial for anyone involved in property transactions within the state. However, there are several misconceptions about this document that can lead to confusion. Below are four common misunderstandings clarified for better comprehension.

Misconception #1: A Quitclaim Deed guarantees a clear title. Many people mistakenly believe that by accepting a Quitclaim Deed, they are guaranteed a clear and unencumbered title to the property. In reality, this form of deed transfers only the grantor's interest in the property, if any, without any guarantees about the title's validity or if there are any liens against it.

Misconception #2: Quitclaim Deeds are only for transactions without payment. It's a common belief that Quitclaim Deeds are exclusively used for transactions where no money exchanges hands, such as transferring property between family members. However, they can be used in a variety of transactions, including those where the property is sold.

Misconception #3: The process involves a complex legal procedure. Another misunderstanding is that using a Quitclaim Deed requires navigating a complicated legal process. In fact, the process is relatively straightforward. Once the deed is filled out correctly and signed, it simply needs to be notarized and recorded with the appropriate county office.

Misconception #4: A Quitclaim Deed removes the grantor's financial obligations. People often think that transferring property via a Quitclaim Deed relieves the grantor of any mortgage or financial obligations related to the property. This is not the case. The deed transfers property ownership rights but does not affect any existing financial responsibilities, such as mortgage payments, which remain with the grantor unless explicitly transferred and accepted by another party.

Key takeaways

When dealing with the transfer of property ownership in New York, understanding the role and requirements of the Quitclaim Deed form is essential. This document serves as a means to convey interest, title, or rights in a property from a seller (grantor) to a buyer (grantee) without any warranties. The following key takeaways provide a clearer view on completing and utilizing this form effectively.

- Accuracy is paramount: Information provided on the Quitclaim Deed form must be precise and correctly reflect the details of both the grantor and grantee, as well as the description of the property. Errors or inaccuracies may lead to complications in the transfer process and can result in legal disputes.

- Notarization is required: In New York, like in many other states, the Quitclaim Deed needs to be notarized to be considered valid. This step is crucial and involves signing the document in front of a notary public to confirm the identity of the parties involved.

- Filing with the county clerk: After the Quitclaim Deed has been properly completed and notarized, it must be filed with the county clerk's office in the county where the property is located. Filing the deed makes the document a part of the public record, which is important for establishing the transfer of ownership.

- Consideration of tax implications: While the Quitclaim Deed itself mainly deals with the transfer of property rights, it's important for both parties to be aware of potential tax responsibilities that may arise from the transaction. Consulting with a tax professional can help navigate any implications and ensure compliance with local, state, and federal tax laws.

Finalizing a property transfer with a Quitclaim Deed in New York is relatively straightforward, but it demands attention to detail and adherence to state-specific legal procedures. Keeping these key points in mind can help facilitate a smooth transfer process, minimizing risks and protecting the interests of both parties involved.

Popular Quitclaim Deed State Forms

Quit Claim Deed Florida Form - They are particularly useful in situations where property transfers are not straightforward, like clearing a title defect or errors in previous deeds.

Quit Deed Form Texas - It’s commonly used in real estate transactions where speed and simplicity are prioritized over guarantee of clear title.