Free Quitclaim Deed Form for Michigan

The intricacies of property transfer in Michigan encompass various legal documents, among which the Quitclaim Deed form stands out due to its specific use and implications. This document, instrumental in the process of transferring property rights with no guarantees about the title's status, offers a streamlined method for property conveyance between parties who trust each other, such as family members or close acquaintances. The Michigan Quitclaim Deed form, characterized by its simplicity and lack of warranty, contrasts sharply with more comprehensive deeds that assure the buyer of the property’s clear title. Its application ranges from changing names on a title post-marriage or divorce to transferring property to a trust or rectifying a previously recorded title. Understanding its nuances ensures that individuals navigating the realms of property transfer in Michigan do so with an informed perspective, recognizing the form's limitations and the specific scenarios under which its use is most beneficial. Whether utilized to simplify intrafamily property transfers or adjust ownership structures for estate planning purposes, the Michigan Quitclaim Deed form is a pivotal tool in the state's legal landscape. As such, potential users must grasp its role within the broader context of property law to utilize it effectively and prevent unintended consequences.

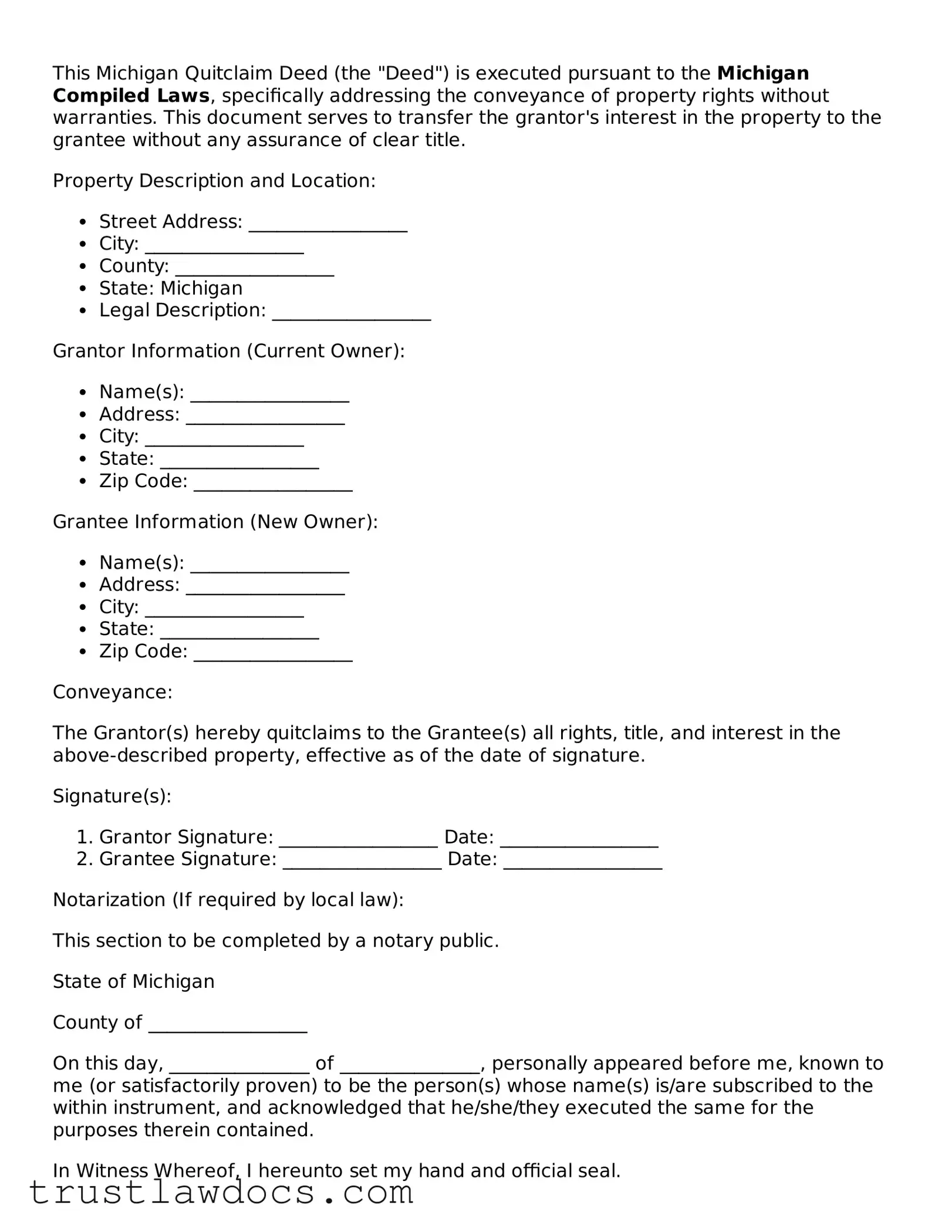

Form Example

This Michigan Quitclaim Deed (the "Deed") is executed pursuant to the Michigan Compiled Laws, specifically addressing the conveyance of property rights without warranties. This document serves to transfer the grantor's interest in the property to the grantee without any assurance of clear title.

Property Description and Location:

- Street Address: _________________

- City: _________________

- County: _________________

- State: Michigan

- Legal Description: _________________

Grantor Information (Current Owner):

- Name(s): _________________

- Address: _________________

- City: _________________

- State: _________________

- Zip Code: _________________

Grantee Information (New Owner):

- Name(s): _________________

- Address: _________________

- City: _________________

- State: _________________

- Zip Code: _________________

Conveyance:

The Grantor(s) hereby quitclaims to the Grantee(s) all rights, title, and interest in the above-described property, effective as of the date of signature.

Signature(s):

- Grantor Signature: _________________ Date: _________________

- Grantee Signature: _________________ Date: _________________

Notarization (If required by local law):

This section to be completed by a notary public.

State of Michigan

County of _________________

On this day, _______________ of _______________, personally appeared before me, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal.

- Notary Public Signature: _________________

- Printed Name: _________________

- Commission Expires: _________________

PDF Form Details

| Fact | Detail |

|---|---|

| Purpose | Transfers property ownership without warranty |

| Governing Law | Michigan Compiled Laws (MCL 565.152) |

| Warranty Level | None |

| Popularity | Commonly used in family or informal transactions |

| Recording Requirement | Must be recorded with the county clerk's office |

| Witness Requirement | Requires signature(s) of witness(es) for validity |

| Notarization Requirement | Must be notarized to be valid |

| Consideration Statement | Must include a statement of consideration or value exchanged |

| Preparation Statement | Must indicate who prepared the document |

How to Write Michigan Quitclaim Deed

Filling out the Michigan Quitclaim Deed form is a necessary step in the process of transferring property rights from one person to another without any warranties about the property's title. This process might seem daunting at first, but understanding each step can simplify the procedure and provide clarity. Ensuring the form is completed accurately is crucial for a smooth transfer, and remembering to file the deed with the local county record's office after it's filled out and signed is essential. Here's a guide to help you through the process:

- Prepare the Document: Begin by obtaining the official Michigan Quitclaim Deed form. This can typically be found online at the official website of the county where the property is located or at a local office supply store that sells legal forms.

- Fill in the Preparer's Information: At the top of the deed, there's a section for the name and address of the individual preparing the deed. Enter your name and address as the preparer.

- Enter the Return Address: Below the preparer's information, specify the name and address where the recorded deed should be returned after processing.

- List the Consideration: A specific section on the deed requires listing the amount of money being exchanged for the property, if any. Even if no money is exchanged, a nominal amount (like $1.00) is typically listed to satisfy legal requirements.

- Input the Grantor(s) Information: The grantor is the person(s) transferring the property. Write the name(s) and address(es) of the grantor(s) in the designated section.

- Detail the Grantee(s) Information: The grantee is the individual(s) receiving the property rights. Like with the grantor(s), fill in the name(s) and address(es) of the grantee(s) in the corresponding section.

- Describe the Property: The legal description of the property must be accurately entered on the deed. This description can be obtained from a previous deed for the property, from the county recorder's office, or from a property tax bill. It is more detailed than just the address and may include lot numbers, subdivision name, and other legal identifiers.

- Signatures: The deed must be signed by the grantor(s) in the presence of a notary public. Ensure that all parties required to sign the deed do so according to state requirements and that the notary stamps and signs the document as well.

- Recording the Deed: After the deed is fully executed, it needs to be filed with the county clerk or register of deeds in the county where the property is located. A recording fee will likely be required at this time.

By following these steps, you can confidently prepare and submit a Michigan Quitclaim Deed. This document is vital in legally transferring property rights and ensuring the correct parties are recognized as the new owners. Completing this process with attention to detail is key to protecting the interests of all involved parties. After submission, keeping a copy of the recorded deed for personal records is advisable, as it serves as proof of ownership and the transfer.

Get Answers on Michigan Quitclaim Deed

What is a Quitclaim Deed in Michigan?

A Quitclaim Deed in Michigan is a legal document used to transfer an interest in real property from one person (the grantor) to another (the grantee) without any warranties of title. It is often used among family members or close associates, where trust is not an issue, to quickly transfer property. This deed merely transfers whatever interest the grantor has in the property, if any, without guaranteeing that the property is free of claims or liens.

When should a Quitclaim Deed be used in Michigan?

A Quitclaim Deed is appropriate in situations where the property is being transferred without a traditional sale. Examples include adding or removing a spouse's name from the title, transferring property to a trust, or changing the name on the title due to marriage or divorce. It is crucial to consult with a professional to ensure this is the right document for your circumstances, as it offers no protection for the buyer (grantee).

What information is required to complete a Michigan Quitclaim Deed?

To complete a Quitclaim Deed in Michigan, specific information is needed: the names and addresses of the grantor and grantee, a legal description of the property, the parcel number (if available), the date of the transfer, and the amount of consideration (if any). The deed must be signed by the grantor in front of a notary public and then filed with the county register of deeds where the property is located.

Is a Quitclaim Deed in Michigan subject to any taxes or fees?

Yes, the transfer of property using a Quitclaim Deed in Michigan may be subject to state and county transfer taxes, depending on the circumstances of the transfer. Additionally, there will be a fee to record the deed with the county register of deeds. These costs can vary, so it's advisable to check with the local register of deeds or a legal professional to understand the specific fees and taxes that may apply to your situation.

Can a Quitclaim Deed in Michigan be revoked?

Once a Quitclaim Deed has been executed (signed, notarized, and recorded), it cannot be revoked unilaterally by the grantor. Any change or revocation would require the grantee's consent and a new deed to reflect the change. It is essential to be certain of the decision to transfer property using a Quitclaim Deed, as reversing the process can be complex.

Do both parties need to agree for a Quitclaim Deed to be valid in Michigan?

For a Quitclaim Deed to be valid in Michigan, the grantor must agree to the transfer, as they are relinquishing their rights to the property. The grantee is not required to sign the deed. However, the deed must be delivered to and accepted by the grantee for the property transfer to be effective. Ensuring clear communication and agreement between both parties before proceeding with a Quitclaim Deed is beneficial to avoid any misunderstandings.

Common mistakes

Filling out a Michigan Quitclaim Deed form is a common step for transferring property rights, but it's also easy to make mistakes if you're not careful. These errors can range from simple typos to significant legal oversights, potentially complicating the transfer or invalidating the deed. Being aware of these common mistakes can help ensure a smoother property transfer process.

One common mistake is not using the correct legal names for both the grantor (the person transferring the property) and the grantee (the person receiving the property). It's crucial to use full legal names, exactly as they appear on official IDs and documents. Nicknames or short forms can lead to confusion or disputes about the deed’s validity.

Another issue arises when people inaccurately describe the property. The legal description of the property, which includes details like its boundary lines, lot number, and any applicable survey information, must be precise. Relying solely on a street address can lead to misunderstandings, as addresses can change or may not be specific enough.

Often overlooked is the requirement to have the Quitclaim Deed signed in the presence of a notary public. The deed must be notarized to be considered valid. Skipping this step is a common error that can entirely nullify the document's legal standing.

Failing to file the deed with the Michigan county where the property is located is another critical misstep. Once signed and notarized, the Quitclaim Deed must be recorded with the county to become part of the public record. Unrecorded deeds might not be recognized in future legal situations, affecting the grantee's ability to prove ownership.

People often overlook the importance of including all necessary signatures. Depending on the property’s ownership structure, there might be a need for multiple parties to sign the deed. For instance, if the property is owned jointly, both owners must sign the Quitclaim Deed. Similarly, if the grantee is accepting the property on behalf of a business entity, the appropriate business representative must sign.

Misunderstanding the tax implications is another area where mistakes are common. Transferring property using a Quitclaim Deed can have tax consequences for both the grantor and grantee. It's advisable to consult with a tax professional before completing the deed to understand any potential tax liability or benefits.

Incorrectly assuming that a Quitclaim Deed guarantees a clear title is a significant mistake. Quitclaim Deeds transfer only whatever interest the grantor has in the property without any guarantee of clear title. Confusion about this can lead to unexpected legal challenges down the road.

Last but not least, neglecting to seek legal advice when needed can lead to misunderstandings or errors in the Quitclaim Deed process. While filling out the form may seem straightforward, complex situations or questions about the property’s legal standing should be addressed with the help of an experienced attorney.

By avoiding these common errors, individuals can ensure their Quitclaim Deed accurately reflects their intentions and meets all legal requirements, facilitating a smoother property transfer process in Michigan.

Documents used along the form

When engaging in property transactions in Michigan, particularly those involving a Quitclaim Deed, various other forms and documents are frequently required to ensure the transaction complies with state laws and regulations. A Quitclaim Deed is commonly used to transfer property interest from one party to another with no warranty on the title's validity. The following list outlines additional documents that are often used alongside the Michigan Quitclaim Deed to facilitate a smooth and legally sound property transfer.

- Property Transfer Affidavit: This document is necessary for the new property owner to submit to the local assessing officer to report the change of ownership. It ensures that the property is assessed correctly and receives the appropriate tax exemptions.

- Title Search Report: A title search report provides a comprehensive history of the property, including its previous owners, and reveals any encumbrances, liens, or easements on the property. This report is vital to ensure the buyer is aware of any potential issues with the property’s title.

- Property Disclosure Statement: Though not always mandatory in transactions involving a Quitclaim Deed, a property disclosure statement gives details about the property’s condition, including any known defects or problems. This document is typically required in traditional sale transactions.

- Real Estate Transfer Tax Declaration: This declaration is necessary for calculating the state and county transfer taxes owed on the property transaction. The amount varies depending on the property’s value and its location within Michigan.

- Mortgage Payoff Statement: If there is an existing mortgage on the property, a mortgage payoff statement will be required. It outlines the remaining balance on the mortgage to be paid off upon the transfer of the property.

- Homeowners' Association (HOA) Documents: For properties within an HOA, it is crucial to obtain the covenants, conditions, and restrictions (CC&Rs) documents, along with any other HOA documents outlining rules, regulations, and fees associated with the property.

- Warranty Deed: In some cases, parties might opt for a Warranty Deed in addition to or as an alternative to a Quitclaim Deed, depending on the level of guarantee the seller is willing to provide about the title’s validity.

- Loan Documents: If the buyer is financing the purchase, loan documents, including the mortgage agreement and Truth in Lending Statements, will be necessary. These documents detail the loan terms, interest rates, and repayment schedule.

- Property Insurance Documents: Proof of property insurance is required to protect against future liabilities. Lenders often require insurance documents before financing a property transfer to ensure the property is adequately covered.

In preparation for a property transfer in Michigan, especially those executed with a Quitclaim Deed, it's important for all parties involved to understand and prepare the appropriate accompanying documents. Each document plays a significant role in ensuring the legality and success of the property transfer, safeguarding against future disputes and financial burdens. Therefore, stakeholders should consult with real estate professionals or legal advisors to ensure they meet all legal requirements and thoroughly complete each needed form and document.

Similar forms

The General Warranty Deed is closely related to the Quitclaim Deed, primarily focusing on the transfer of property rights from one individual to another. However, unlike the Quitclaim Deed which doesn't guarantee the grantor holds clear title to the property, the General Warranty Deed provides the grantee (buyer) guarantees against any past ownership claims or liens. This broader protection ensures the buyer acquires a title free from any encumbrances not listed in the deed, making it a more secure option for property transfers.

Another document akin to the Quitclaim Deed is the Special Warranty Deed. This document also conveys property from a grantor to a grantee but differs in its scope of protection. The Special Warranty Deed guarantees that the grantor owns the property and there are no title issues during their period of ownership. This means it does not cover any title problems that may have existed before the grantor acquired the property, offering an intermediate level of security between the Quitclaim and General Warranty Deeds.

The Grant Deed shares similarities with the Quitclaim Deed in that it is used in real estate transactions to transfer property. However, the Grant Deed comes with an implied promise that the property hasn't been sold to someone else, and there are no undisclosed encumbrances. This slightly elevates the level of assurance provided to the grantee, as compared to the Quitclaim Deed which offers no such promises or warranties.

The Trustee’s Deed is another document similar to the Quitclaim Deed, principally used when property held in a trust is being conveyed. While similar in function—to transfer title—the Trustee’s Deed typically includes warranties that the trustee has the authority to sell the property and that the property is not encumbered, except as specifically stated in the deed. This is a key difference from the non-warranty nature of a Quitclaim Deed.

The Executor’s Deed and the Quitclaim Deed both serve to transfer property, but the context and the assurances provided differ. The Executor’s Deed is used when a property is being sold from an estate, where the executor of the estate transfers property to a buyer. It may provide warranties depending on the authority granted in the will and local laws, contrasting with the Quitclaim's lack of warranties regarding the property title.

A Deed of Trust is somewhat parallel to the Quitclaim Deed with a significant difference in purpose. While a Quitclaim Deed transfers property ownership rights, a Deed of Trust involves three parties (borrower, lender, and trustee) and is used to secure a loan on real property. In this arrangement, the borrower transfers the real property interest to a trustee, which holds it as security for the loan provided by the lender.

The Life Estate Deed, while utilized for transferring property rights like the Quitclaim Deed, significantly differs by allocating those rights between the life tenant and the remainderman. The life tenant has the right to use the property for their lifetime, after which the property automatically passes to the remainderman. The Quitclaim Deed does not inherently set up such a structured future interest in the property.

Last but not least, the Transfer on Death Deed (TODD) bears similarity to the Quitclaim Deed by facilitating property transfer without the need for probate. However, the Transfer on Death Deed allows an owner to name a beneficiary to whom the property will transfer upon their death, without giving up ownership or control during their lifetime. The Quitclaim Deed does not provide this post-death transfer mechanism, making TODD unique in planning for the future disposition of property.

Dos and Don'ts

When filling out the Michigan Quitclaim Deed form, attention to detail and adherence to legal norms are paramount. This document facilitates the transfer of property rights without warranties, making accuracy and clarity crucial. Below is a list of recommended actions to undertake and avoid during this process, ensuring the transaction is conducted smoothly and lawfully.

- Do ensure all parties’ names are accurately spelled. The names of the grantor (seller) and grantee (buyer) must match official identification documents to avoid disputes or procedural hiccups.

- Don't overlook the property description. A comprehensive and detailed description of the property is crucial. This should include the legal description as found in previous deeds or tax documents, not just the address.

- Do verify the correct document formatting. Michigan may have specific requirements regarding the formatting of Quitclaim Deeds, including margin size, font size, and paper size. Non-compliance could lead to filing rejection.

- Don't forget to include the consideration. Although quitclaim deeds often transfer property between family members for a nominal value, stating this amount ("consideration") is necessary to delineate the transaction’s nature.

- Do sign in the presence of a notary public. For a Quitclaim Deed to be legally binding in Michigan, it must be signed by the grantor in the presence of a notary public who also signs the document.

- Don't disregard tax implications. Transferring property can have tax consequences for both the grantor and grantee. It's advisable to consult with a tax professional before completing the transaction.

- Do review local recording requirements. Each Michigan county might have its own set of rules and fees associated with recording a Quitclaim Deed. Familiarize yourself with these to ensure the document is properly recorded.

- Don't skip the transfer tax declarations. If applicable, completing the transfer tax declaration form is necessary when filing the deed. This form details the transaction for tax purposes and is required by many counties.

- Do keep copies of the completed deed. After the Quitclaim Deed is notarized and recorded, both the grantor and grantee should keep copies for their records. This is essential for future reference or potential legal needs.

Adherence to these guidelines will help in executing a Quitclaim Deed in Michigan effectively, protecting the interests of all parties involved and ensuring compliance with state legal requirements.

Misconceptions

In exploring the realm of property transactions within Michigan, the topic of quitclaim deeds often emerges, accompanied by a host of misconceptions. Below, several of these misconceptions are clarified to provide a clearer understanding of what a quitclaim deed entails.

Guarantees property ownership: A common misconception is that a quitclaim deed guarantees that the grantor (the person transferring the property) has legal ownership of the property. However, this type of deed merely transfers whatever interest the grantor may have in the property, without any warranty regarding the quality of that interest.

Includes warranties on the property: Unlike warranty deeds, quitclaim deeds do not contain any warranties about the condition of the property or clear title. This means that the recipient (grantee) receives no guarantees against potential title issues or claims from others.

Eradicates existing liens or claims: The belief that executing a quitclaim deed removes any existing liens or claims against the property is incorrect. Any such encumbrances remain attached to the property despite the transfer.

Only used between family members: While often used to transfer property rights among family members, such as during estate planning or divorce settlements, quitclaim deeds can be utilized in a variety of contexts beyond familial transactions.

Transfers property immediately: Some might think that a quitclaim deed results in an immediate transfer of property. The reality is that the transfer becomes official only upon the deed's execution, delivery to the grantee, and, in many cases, recording with a local government office.

Provides a form of protection for the buyer: Because quitclaim deeds offer no warranties about the property, they offer less protection to buyers compared to warranty deeds. Buyers receive only the rights that the grantors themselves had, with no recourse against seller defects.

Irrelevant in the title search process: Despite misconceptions, quitclaim deeds play a role in the title search process. They appear in the chain of title and must be accounted for when researching a property's history to ensure a clear title.

Eliminates the need for title insurance: Some assume that receiving property via a quitclaim deed negates the need for title insurance. This is misleading; since quitclaim deeds do not guarantee clear title, title insurance can provide additional security against potential claims.

Equates to a public declaration that property is debt-free: The action of transferring property through a quitclaim deed does not in any way declare that the property is free from debt or other financial encumbrances. All existing debts or claims on the property remain in effect.

Simple and always advisable: While quitclaim deeds are simpler than other types of deeds due to the lack of warranties, suggesting they are always the advisable option is inaccurate. The decision to use a quitclaim deed should be based on careful consideration of the circumstances and legal advice.

Understanding these misconceptions about the Michigan Quitclaim Deed is essential for anyone involved in property transactions within this jurisdiction. Proper knowledge ensures that individuals can make informed decisions regarding the transfer of property rights.

Key takeaways

When dealing with the Michigan Quitclaim Deed form, it's important to understand its purpose and the process for correctly completing and using the document. Here are five key points to remember:

- The form is used to transfer property ownership from the grantor (the current owner) to the grantee (the new owner) without warranties. This means the grantor does not guarantee the clear title to the property.

- It is crucial to provide accurate information about the grantor, grantee, and the property description. Mistakes in this information can lead to disputes or legal complications.

- The document must be signed by the grantor in front of a notary public. This official acknowledgment is necessary for the deed to be considered valid.

- Once the quitclaim deed is completed and notarized, it needs to be filed with the county clerk’s office in the county where the property is located. Filing the deed is a critical step to make the transfer public record.

- It's strongly recommended to consult with a legal professional before proceeding, especially for complex situations. They can offer guidance specific to the circumstances, ensuring that rights are protected and the process is handled correctly.

Popular Quitclaim Deed State Forms

Quick Claim Deed Form Indiana - Ideal for transactions among family members, gifting property, or divorcing couples dividing assets, simplifying the transfer process.

Illegal Quit Claim Deed - Appropriate for property transactions where the buyer is confident in the property’s history.