Free Quitclaim Deed Form for Indiana

In the realm of property transactions, the Indiana Quitclaim Deed form serves as a critical instrument for the conveyance of property rights without warranties. This particular form is tailor-made for scenarios where property is transferred between individuals with a pre-existing relationship, such as family members or close acquaintances. Unlike a warranty deed, which guarantees the buyer's title against all defects, the quitclaim deed transfers ownership as is, making no assurances about the condition of the title. Its simplicity and the speed with which transactions can be completed make it a favored option for those looking to efficiently transfer property. However, due to the lack of guarantees concerning the title's status, it's imperative for potential buyers to conduct thorough due diligence before proceeding with a quitclaim deed. This document, integral to the legal framework in Indiana, encapsulates the complex interplay between ease of transfer, relationship trust, and the inherent risks tied to the absence of warranties.

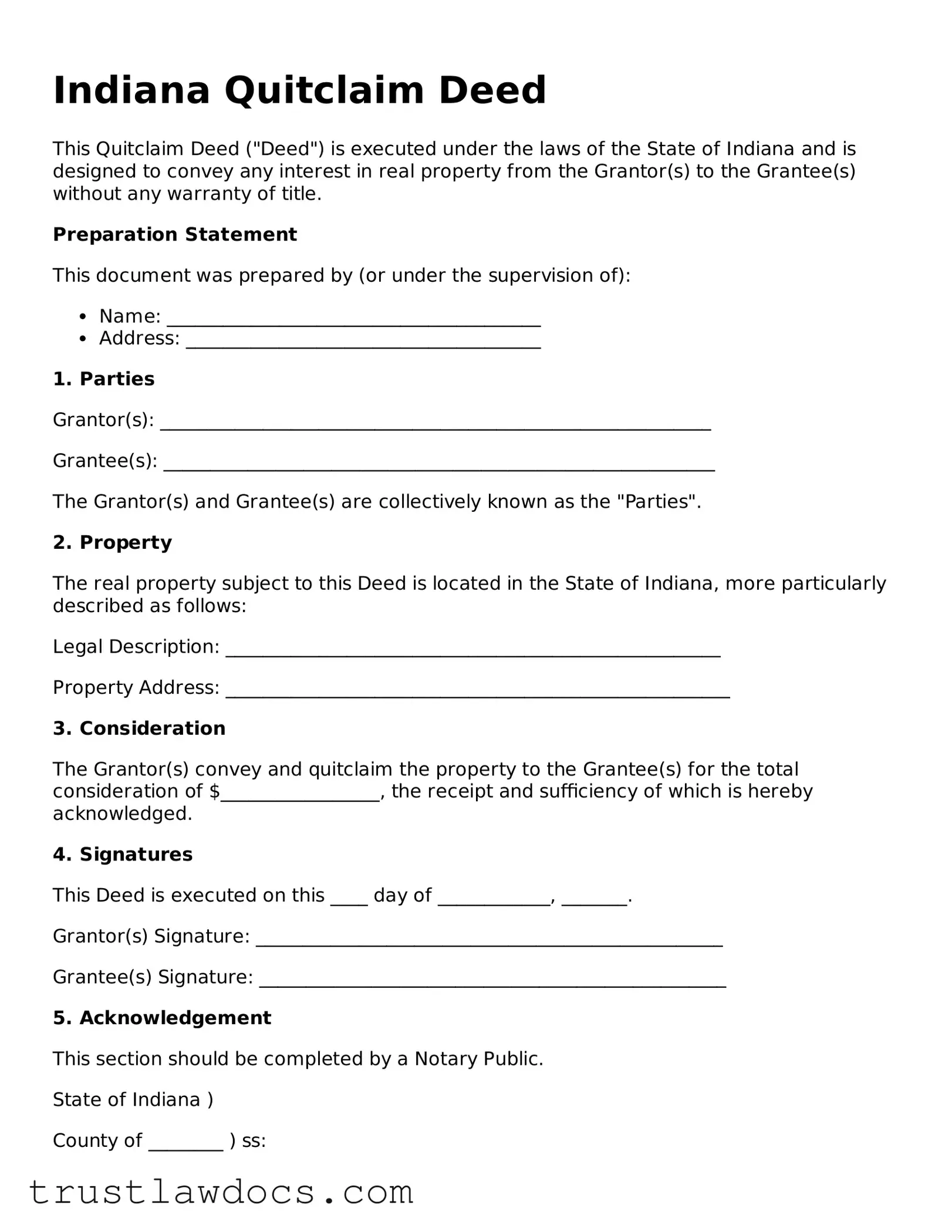

Form Example

Indiana Quitclaim Deed

This Quitclaim Deed ("Deed") is executed under the laws of the State of Indiana and is designed to convey any interest in real property from the Grantor(s) to the Grantee(s) without any warranty of title.

Preparation Statement

This document was prepared by (or under the supervision of):

- Name: ________________________________________

- Address: ______________________________________

1. Parties

Grantor(s): ___________________________________________________________

Grantee(s): ___________________________________________________________

The Grantor(s) and Grantee(s) are collectively known as the "Parties".

2. Property

The real property subject to this Deed is located in the State of Indiana, more particularly described as follows:

Legal Description: _____________________________________________________

Property Address: ______________________________________________________

3. Consideration

The Grantor(s) convey and quitclaim the property to the Grantee(s) for the total consideration of $_________________, the receipt and sufficiency of which is hereby acknowledged.

4. Signatures

This Deed is executed on this ____ day of ____________, _______.

Grantor(s) Signature: __________________________________________________

Grantee(s) Signature: __________________________________________________

5. Acknowledgement

This section should be completed by a Notary Public.

State of Indiana )

County of ________ ) ss:

On this ____ day of ____________, _______ before me, a notary public, personally appeared ____________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

__________________________

Notary Public

My commission expires: ___________

PDF Form Details

| Fact | Detail |

|---|---|

| Purpose | Transfers property rights without any warranty. |

| Governing Law | Indiana Code Title 32. Property |

| Warranty | Does not guarantee clear title. |

| Form Requirement | Must be in writing and include a legal description of the property. |

| Signatory Requirement | Must be signed by the grantor. |

| Notarization | Signature must be notarized. |

| Recording | Must be recorded with the county recorder’s office. |

| Filing Fee | Varies by county. |

| Common Use | Often used between family members or to clear up title issues. |

How to Write Indiana Quitclaim Deed

When transferring property ownership in Indiana without the warranties that come with a traditional warranty deed, a Quitclaim Deed form is used. This document is vital for efficiently and effectively making changes to property titles, be it for settling estates, divorcing, or transferring property between family members. The process of filling out the Indiana Quitclaim Deed form requires attention to detail and a clear understanding of the information required. Below are the steps to guide you through completing the form with precision.

- Begin by gathering all necessary information about the property, including its legal description, parcel number, and current ownership details. This information can typically be found on a previous deed for the property or by contacting the county recorder's office.

- Complete the top section of the form by entering the date of the document creation.

- Write the full name and address of the individual(s) transferring the property (referred to as the grantor(s)) in the designated space. Ensure the spelling matches the way the grantor's name appears in the public record.

- Provide the full name and address of the recipient of the property (referred to as the grantee(s)) in the relevant section. Like with the grantor's details, confirm that the name is spelled correctly and matches public records.

- Enter the legal description of the property being transferred. This part must be accurate; copy the language from a current deed to avoid errors.

- State the amount paid for the property transfer, if applicable. Even if no money is exchanged, a nominal amount is typically mentioned here to satisfy legal requirements.

- Have the grantor(s) sign the Quitclaim Deed form in the presence of a notary public. The notary will then fill out their section, confirming the grantor's identity and the signing date.

- Document the preparer's information (name and address) at the designated spot on the form. This indicates who completed the document.

- Review the completed form for any mistakes or omissions. Everything should be complete and accurate, reflecting both parties' agreement to the property transfer.

- File the signed and notarized Quitclaim Deed with the local county recorder's office where the property is located to make the transfer official. A filing fee will likely be required.

Following these steps ensures the Quitclaim Deed is filled out correctly, providing a smooth process for altering property ownership. Should any questions or concerns arise during this process, consulting with a professional familiar with Indiana’s real estate laws may provide additional guidance and assurance.

Get Answers on Indiana Quitclaim Deed

What is a Quitclaim Deed in Indiana?

In Indiana, a Quitclaim Deed is a legal document used to transfer property from one person (the grantor) to another (the grantee) without any warranty regarding the title's quality. Essentially, the person transferring the property does not guarantee that they own the property free and clear of other claims. It's often used among family members or to clear up title issues.

When should someone use a Quitclaim Deed in Indiana?

Quitclaim Deeds are typically used in situations where property is transferred without a sale, such as adding or removing someone's name on the title during a divorce, transferring property to a trust, or changing ownership between family members. It's useful when both parties know each other and the property's history well.

Does a Quitclaim Deed mean you own the property in Indiana?

Yes and no. While a Quitclaim Deed transfers whatever interest the grantor has in the property to the grantee, it doesn't guarantee that the grantor actually owns the property or that there are no other claims or liens against it. So, if the grantor does not have a clear title, the grantee may not get full ownership.

What are the requirements for a Quitclaim Deed to be valid in Indiana?

To be valid, an Indiana Quitclaim Deed must include the legal description of the property, the names of the grantor and grantee, and must be signed by the grantor. It must also be notarized and recorded with the county recorder's office in the county where the property is located.

How can someone record a Quitclaim Deed in Indiana?

After the Quitclaim Deed is signed and notarized, it should be taken or mailed to the county recorder's office in the county where the property is located. A recording fee will be required. Recording the deed provides public notice of the property transfer and is necessary for the deed to be fully effective.

Is a lawyer required to create a Quitclaim Deed in Indiana?

While a lawyer is not strictly required to create a Quitclaim Deed in Indiana, consulting with one can help ensure the deed is correctly prepared and meets all legal requirements. A lawyer can also provide advice on whether a Quitclaim Deed is the best option for transferring property in your specific situation.

How does a Quitclaim Deed affect property taxes in Indiana?

Transferring property via a Quitclaim Deed may affect property taxes. Property assessments could change, leading to higher or lower taxes. The grantee should check with the local tax assessor's office to understand any potential changes in property taxes after the transfer.

Can a Quitclaim Deed be revoked in Indiana?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unless the grantee agrees to quitclaim the property back to the grantor. If there are disputes about the deed or if it was signed under fraud or duress, legal action might be necessary to address those issues.

Common mistakes

Filling out the Indiana Quitclaim Deed form is a significant step in transferring property ownership. However, mistakes during this process can lead to unexpected complications. One of the first errors people make is not providing the correct legal description of the property. This description is more detailed than just an address and must match the description used in previous deeds to ensure continuity of records.

Another common mistake is failing to include the grantor's complete and correct legal name. This might seem like a simple oversight, but it can create discrepancies in public records, making future transactions involving the property more complicated. Similarly, neglecting to list the grantee's full legal name and how they will hold the title (e.g., solely, jointly with rights of survivorship, tenants in common) can also lead to issues down the line.

Often, individuals mistakenly believe they do not need a witness or notary public to formalize the document. Indiana law requires that a quitclaim deed be notarized to be valid. Without proper notarization, the deed might not be legally enforceable. Furthermore, an error often made is not checking local county recording requirements, which can vary. Some counties might have specific forms, fees, or submission processes, and overlooking these can delay the recording of the deed.

Completing the form without consulting a professional is another frequent error. Legal or real estate professionals can offer valuable advice on the ramifications of transferring property via a quitclaim deed, help avoid mistakes, and ensure that the deed accomplishes the grantor's goals.

Moreover, people often forget to file the quitclaim deed with the appropriate county recorder's office after completion. Simply signing the document does not finalize the transfer; it must be recorded to establish the change in ownership publicly.

Lastly, a significant mistake is not considering the tax implications and fees associated with filing a quitclaim deed. While the form itself might seem straightforward, there may be taxes or fees due based on the property's value or the transfer itself. Failing to account for these can lead to financial surprises.

By avoiding these common mistakes, individuals can ensure a smoother property transfer process, safeguarding their interests and those of the grantee.

Documents used along the form

When handling property transactions in Indiana, particularly those involving a Quitclaim Deed, various other forms and documents are often required to ensure the process complies with state laws and regulations. A Quitclaim Deed is typically utilized to transfer property rights from one person to another without the seller guaranteeing the title's clearness. To support this transaction and address the surrounding needs, several additional forms might be customarily used alongside the Quitclaim Deed.

- Real Estate Sales Disclosure Form: This document is necessary in many situations involving the sale of real estate in Indiana. It requires the seller to disclose information about the condition of the property, including any known defects or issues that could affect the property’s value. This disclosure protects buyers and ensures transparency in real estate transactions.

- Title Search Report: Often accompanying a quitclaim deed, a title search report outlines the history of the property’s ownership and notifies of any encumbrances, such as liens or easements, that might affect the property. This document is crucial for the buyer to understand what rights are being transferred and any potential limitations.

- Indiana Sales Disclosure Form: Specific to Indiana, this form is typically required for any real estate transaction, including those with quitclaim deeds, if the property meets certain criteria. It involves disclosing the property's physical condition and other critical information to ensure the buyer is fully informed.

- Homestead Exemption Forms: When a property serves as a primary residence, the owner might qualify for a homestead exemption, which can provide tax benefits. Filing this form with the local county assessor may reduce the taxable value of the home, thereby lowering property tax obligations.

Utilizing these documents in conjunction with a Quitclaim Deed in Indiana can streamline the transfer process, safeguard the interests of all parties involved, and ensure compliance with state law. Property transactions often involve multiple steps and require a thorough understanding of the paperwork to guarantee a successful and legal transfer of property rights.

Similar forms

The Indiana Quitclaim Deed form shares similarities with the Warranty Deed in that both serve the primary function of transferring property rights between parties. However, where they diverge is in the level of protection offered to the buyer. The Quitclaim Deed transfers ownership without any guarantees regarding the title's cleanliness or freedom from third-party claims. In contrast, the Warranty Deed comes with a guarantee that the seller holds a clear title to the property, offering more security to the purchaser against future claims to the title.

Comparable to the Quitclaim Deed is the Grant Deed, utilized for the conveyance of property rights as well. The Grant Deed, like the Quitclaim, facilitates property transfers but with a slight assurance — it implies that the property hasn't been sold to someone else. Unlike the Quitclaim Deed, which offers no affirmations about the property's title, the Grant Deed suggests that the title is free from encumbrances made by the seller, albeit without the comprehensive guarantees provided by a Warranty Deed.

The Trustee’s Deed is another document sharing common ground with the Quitclaim Deed, typically used in the context of trusts. When a Trustee’s Deed is employed, it involves transferring property held in a trust, either to a beneficiary or upon the sale of the property. Like Quitclaim Deeds, Trustee’s Deeds may not always offer a guarantee about the property’s title status, depending on the trust's terms. The key similarity lies in their capacity to transfer interest in real property, though their specific applications and the level of title assurance diverge.

Finally, the Deed of Trust draws parallels with the Quitclaim Deed through its involvement in property transactions, yet its purpose and function significantly differ. The Deed of Trust is part of securing a real estate transaction through a neutral third party, holding the property title until a loan against the property is paid. While it resembles a Quitclaim Deed in its role in transferring interests, the Deed of Trust primarily serves to secure an obligation, contrasting with the Quitclaim’s purpose of relinquishing a claim or interest in a property without assurance on liens or encumbrances.

Dos and Don'ts

When it comes to filling out the Indiana Quitclaim Deed form, it's crucial to approach the task with care and attention. A quitclaim deed can transfer ownership of property quickly and efficiently, but accuracy is key to preventing any legal issues down the line. Here are some essential dos and don'ts to keep in mind:

Do:

- Verify the correct form. Make sure you have the current version of the Indiana Quitclaim Deed form specific to your county, as requirements may vary.

- Include complete legal descriptions. The deed must have a precise legal description of the property. This information can be found on your original deed or by contacting your local county recorder's office.

- Print clearly and legibly. All information entered on the form should be easy to read to avoid any misunderstanding or misinterpretation.

- Review for errors. Double-check the form for any mistakes or inaccuracies before finalizing it. Errors can lead to complications in the transfer of property rights.

- Sign in the presence of a notary public. Indiana law requires that quitclaim deeds be notarized. Ensure all parties sign the deed in front of a notary.

Don't:

- Leave blanks. Do not leave any fields blank. If a section doesn't apply, enter "N/A" (not applicable) to indicate that you did not overlook it.

- Forget to check county-specific requirements. Some counties have unique filing requirements or fees. Verify these with your local county recorder's office.

- Delay the recording of the deed. Once the deed is signed and notarized, file it promptly with the county recorder's office. This recording formalizes the transfer and protects the grantee's interests.

Following these guidelines can help ensure that your Indiana Quitclaim Deed is filled out correctly and effectively, simplifying the property transfer process and helping to avoid potential legal complications.

Misconceptions

When discussing the topic of transferring property rights in Indiana, many people mention the quitclaim deed form. However, there are several misconceptions about this legal document. Clearing up these misunderstandings can help individuals make more informed decisions regarding property transactions.

A quitclaim deed guarantees a clear title. Contrary to popular belief, a quitclaim deed does not guarantee that the grantor (the person transferring the property) has a valid title or even owns the property. It simply transfers any interest the grantor might have at the time of the transfer, without any promises about property rights or encumbrances.

Quitclaim deeds are only for transactions without payment. While it's often used in transfers that don't involve a traditional sale, such as adding or removing someone's name from the property title, a quitclaim deed can also be used in sales where money is exchanged. However, because it does not guarantee a clear title, it’s less common in outright sales.

All property transfers can be done with a quitclaim deed. While quitclaim deeds are useful for certain types of property transfers, they might not be appropriate for all situations. For instance, if a buyer wants assurance of a clear title, a warranty deed, which guarantees the seller owns the property free and clear, would be more suitable.

A quitclaim deed means you no longer have any rights to the property. This is true to the extent that the grantor gives up their rights to the property. However, if the deed was made under coercion or with incomplete understanding, the grantor might be able to challenge it.

Filing a quitclaim deed is complicated. The process to file a quitclaim deed can vary, but in Indiana, it is relatively straightforward. The grantor needs to sign the deed in front of a notary and then file it with the county recorder's office where the property is located. The complexity arises in ensuring the deed is filled out correctly and understanding the implications of the transfer.

Quitclaim deeds are immediate and irreversible. While quitclaim deeds are effective upon filing with the appropriate county recorder's office, there are instances where the deed can be contested or revoked, such as if it was filed under fraudulent circumstances or by someone who lacks the legal capacity.

Using a quitclaim deed avoids inheritance taxes. The use of a quitclaim deed has no bearing on inheritance taxes. Tax implications of transferring property are determined by state and federal tax laws, not by the type of deed used to convey the property.

Quitclaim deeds offer the same protections as warranty deeds. This is a common misconception. Unlike warranty deeds, quitclaim deeds do not provide the grantee (the person receiving the property) with any warranty as to the title's status. A warranty deed guarantees the grantor holds a clear title and has the right to sell the property.

A quitclaim deed will remove your name from the mortgage. It’s important to understand that a quitclaim deed transfers property rights but does not affect any mortgage or loan obligations tied to the property. If your name is on the mortgage, you remain responsible for the debt, even if you no longer own the property.

Quitclaim deeds are only for transfers between family members. Although quitclaim deeds are commonly used for transfers between family members due to their simplicity and the trust factor, they can be used between any parties for various purposes, including transfer of ownership rights into a trust, changing the names on a title, or correcting a title mistake.

Understanding these misconceptions about the Indiana quitclaim deed form can help individuals navigate property transfers more effectively. It's always advisable to consult with a legal professional to ensure you fully understand the documents you are handling and the implications of such transfers.

Key takeaways

When handling the Indiana Quitclaim Deed form, individuals transferring property should pay careful attention to the following key takeaways:

- Proper completion of the form is essential to its validity; any errors can result in delays or legal complications.

- The form must include the full names of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- The legal description of the property being transferred must be precise; this includes its address and any identifiers used in public records.

- Indiana laws require the Quitclaim Deed to be notarized, meaning the signatures of the grantor and, if required, the grantee must be witnessed by a Notary Public.

- Consideration should be clearly stated on the deed, even if the property is being transferred for a nominal amount such as $1.

- The form needs to be filed with the County Recorder's Office in the county where the property is located to be considered valid and to effect the transfer officially.

- All parties involved should keep copies of the notarized deed for their records and future reference.

- It's crucial to check with local county requirements as additional forms or submissions may be necessary for the recording of the deed.

- Seeking legal advice is advisable to ensure the deed complies with Indiana laws and to understand the tax implications of transferring property.

- Remember, a Quitclaim Deed transfers ownership without any guarantees on the title; conducting a title search beforehand is prudent to understand any potential encumbrances or issues.

By meticulously following these steps and being aware of the nuances surrounding the Quitclaim Deed, parties can effectively navigate the transfer process and ensure their legal and financial interests are protected.

Popular Quitclaim Deed State Forms

Quit Claim Deed Real Estate - Requires fewer disclosures than other deeds, streamlining the conveyance process.

Illegal Quit Claim Deed - It offers a straightforward way for a property owner to renounce ownership rights.

Quit Deed Form Texas - Recording a Quitclaim Deed with the local county office is essential for making the transfer public record.

Filled Out Quit Claim Deed Michigan - Quitclaim Deeds may also be used in tax-related or gift transactions, transferring property without a traditional sale.