Free Quitclaim Deed Form for Florida

In the state of Florida, property transactions are a common occurrence, ranging from the buying and selling of real estate to the transfer of ownership between family members. Among the various legal instruments available to facilitate these transactions, the Florida Quitclaim Deed form stands out for its simplicity and specific use cases. Unlike other more complex forms of property deeds, which provide warranties about the property's title status, the Quitclaim Deed is characterized by the absence of any guarantees. This means that the grantor transfers whatever interest they may have in the property to the grantee without promising that the title is clear or that they even own the property outright. Given its straightforward nature, this deed is often used in transactions between trusted parties, such as family members, or in situations where a quick transfer of interest is desirable and the parties are willing to accept the risks involved. Understanding the specifics of this form, including its benefits and limitations, is crucial for anyone involved in property transactions within Florida, as it can significantly impact the legal and financial outcomes of a transfer.

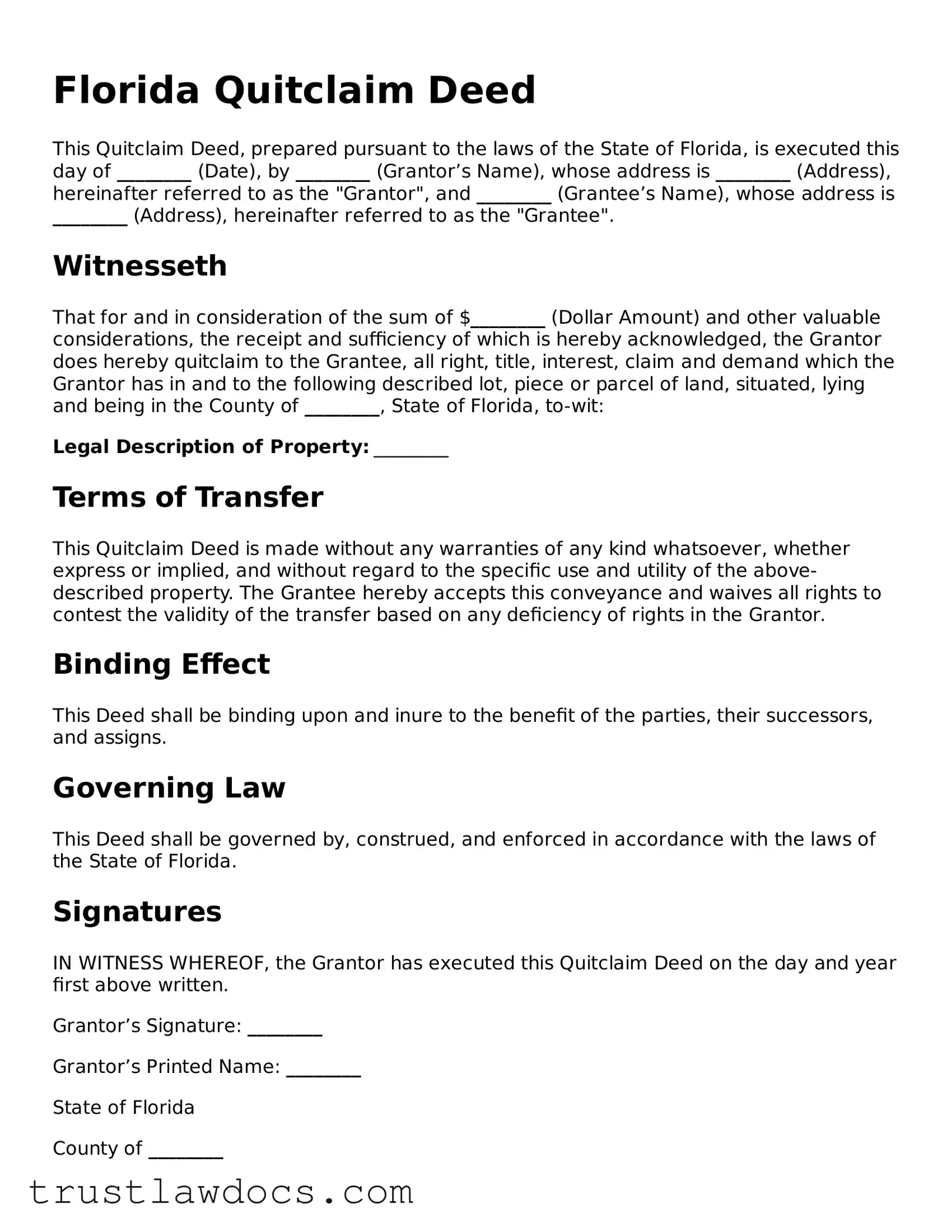

Form Example

Florida Quitclaim Deed

This Quitclaim Deed, prepared pursuant to the laws of the State of Florida, is executed this day of ________ (Date), by ________ (Grantor’s Name), whose address is ________ (Address), hereinafter referred to as the "Grantor", and ________ (Grantee’s Name), whose address is ________ (Address), hereinafter referred to as the "Grantee".

Witnesseth

That for and in consideration of the sum of $________ (Dollar Amount) and other valuable considerations, the receipt and sufficiency of which is hereby acknowledged, the Grantor does hereby quitclaim to the Grantee, all right, title, interest, claim and demand which the Grantor has in and to the following described lot, piece or parcel of land, situated, lying and being in the County of ________, State of Florida, to-wit:

Legal Description of Property: ________

Terms of Transfer

This Quitclaim Deed is made without any warranties of any kind whatsoever, whether express or implied, and without regard to the specific use and utility of the above-described property. The Grantee hereby accepts this conveyance and waives all rights to contest the validity of the transfer based on any deficiency of rights in the Grantor.

Binding Effect

This Deed shall be binding upon and inure to the benefit of the parties, their successors, and assigns.

Governing Law

This Deed shall be governed by, construed, and enforced in accordance with the laws of the State of Florida.

Signatures

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor’s Signature: ________

Grantor’s Printed Name: ________

State of Florida

County of ________

On this day, before me, an officer duly authorized in the state and county aforesaid to take acknowledgments, personally appeared ________ (Name of the Grantor), known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public’s Signature: ________

Notary Public’s Printed Name: ________

My Commission Expires: ________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Florida Quitclaim Deed form transfers property without making any guarantee about the clear title of the property. |

| Primary Use | Used primarily to transfer property between family members or to transfer real estate into a trust. |

| Governing Law | Florida Statutes, Section 695.01 governs the execution of quitclaim deeds in Florida. |

| Recording Requirement | Must be recorded with the Clerk of the Circuit Court in the county where the property is located to be effective against third parties. |

| Witness Requirement | Florida law requires the presence of two witnesses to the signing of the quitclaim deed for it to be valid. |

| Notarization Requirement | The quitclaim deed must be notarized to be considered legally valid and recordable. |

How to Write Florida Quitclaim Deed

Filling out a Florida Quitclaim Deed form is a straightforward process, although it might seem complex at first glance. This document is used to transfer property from one person to another without any warranty regarding the title of the property. The process does not guarantee that the property title is clear; it simply transfers whatever interest the granting party has in the property, if any. Knowing the part each section of the form plays is crucial for a successful property transfer.

- Start by entering the preparer's name and address in the designated section at the top of the form. This identifies who filled out the document.

- Fill in the "Return to" information with the name and address of the individual who should receive the document after recording.

- Enter the County in Florida where the property is located in the space provided.

- For the consideration amount, input the dollar value being exchanged for the property. If there is no monetary exchange, a nominal amount like $10 is commonly used to fulfill legal requirements.

- In the section allocated for the grantor(s) (the person(s) transferring the property), input their full legal name(s), marital status, and address(es).

- List the name(s) and address(es) of the grantee(s) – the recipient(s) of the property. Be sure to clarify how the grantees will hold the property, whether jointly, as tenants in common, or in some other manner.

- Write a complete legal description of the property being transferred. This information can be found on the current deed or by contacting a local property records office.

- If the property is in a special taxing district, that information must be included on the form as well.

- Both the grantor(s) and grantee(s) should sign the form in the presence of a notary public. The signing must adhere to Florida law, which typically requires the presence of two witnesses.

- Once signed, the form should be filed with the local county recorder's office, accompanied by any necessary filing fees. This final step legally completes the property transfer.

It's important to note that while the Quitclaim Deed process itself might seem simple, understanding the implications of transferring property without warranties can be complex. Individuals considering this form of property transfer should ideally consult with a legal specialist to ensure their rights and interests are fully protected. Moreover, each county in Florida may have specific requirements or fees, so checking with the local recorder's office beforehand can provide helpful guidance and prevent any delays.

Get Answers on Florida Quitclaim Deed

What is a Florida Quitclaim Deed?

A Florida Quitclaim Deed is a legal document used to transfer a property owner's interest in a piece of real estate to another person without providing any warranty or guarantee about the property's title. Essentially, the seller, also known as the grantor, quits any claim to the property, passing whatever ownership they may have to the buyer, known as the grantee, without asserting that the title is clear of issues.

When is a Quitclaim Deed typically used in Florida?

quitclaim Deeds are most often used among family members, in divorce settlements where one spouse grants the property to the other, or in other informal transactions where the parties know each other and the property well. They're helpful for transferring property quickly without the formalities of a title search or warranty of title. However, because they offer less protection to the buyer, they're not recommended for transactions where the parties do not have a trusting relationship.

What are the essential elements of a Florida Quitclaim Deed?

For a Florida Quitclaim Deed to be legally effective, it must contain certain key elements. These include the full names of the grantor and grantee, a complete legal description of the property being transferred, the granting clause, and the date of the transfer. Additionally, the grantor must sign the deed, and the signature usually needs to be notarized. In some counties, witness signatures may also be required for the document to be recorded properly.

How does one record a Quitclaim Deed in Florida?

After the Quitclaim Deed is completed and signed, it should be filed with the Clerk of the Circuit Court in the county where the property is located. Recording the deed makes it part of the public record, providing notice of the transfer to future purchasers and interested parties. There may be a filing fee, which varies by county. It's advisable to check with the specific county's clerk’s office for their requirements and fees.

Are there any specific filing fees for a Quitclaim Deed in Florida?

Yes, there are filing fees associated with recording a Quitclaim Deed in Florida, and these fees can vary from county to county. Typically, the filing fee is based on the number of pages the deed contains plus any additional fees that may apply for indexing, documentary stamp taxes, or other county-specific charges. It’s important for individuals to contact the county clerk’s office where the property is located to get accurate information on the current fees.

Can a Quitclaim Deed in Florida be revoked or changed once it's filed?

Once a Quitclaim Deed has been executed and recorded, it cannot be revoked or changed unilaterally. If the grantor wishes to change the terms of the deed or revoke it after filing, they would need to obtain a new deed, signed by the grantee, to transfer the property interest back or to another party. This highlights the importance of being certain about the decision to transfer property using a Quitclaim Deed before proceeding.

Common mistakes

Filling out the Florida Quitclaim Deed form can seem straightforward, but several common mistakes can lead to issues down the line. One of the most frequent errors involves not accurately identifying the grantor and grantee. It's essential that the full legal names of both parties are used and spelled correctly. Nicknames or omissions of middle names can cause confusion or disputes in the property's ownership history.

Another mistake is not providing a complete legal description of the property. The legal description is more detailed than just the address. It includes lot numbers, subdivision names, and other details found in the property's deed of record. Failing to include this level of detail might result in an invalid deed or challenges in identifying the property in future transactions.

Often, individuals forget to check whether the form complies with Florida's specific requirements. Each state has unique mandates for quitclaim deeds, including witness and notarization requirements. In Florida, the deed must be signed in the presence of two witnesses and a notary to be valid. Overlooking these requirements can result in an unenforceable deed.

Incorrectly assuming that a quitclaim deed removes one's obligations related to a mortgage is another significant misunderstanding. People often believe that transferring ownership interest via a quitclaim deed absolves them of any mortgage responsibility. However, unless the grantee agrees to take over the mortgage and the lender releases the grantor from the obligation, the original mortgagee remains responsible for the debt.

There's also a tendency to neglect recording the deed with the county clerk's office after completion. For a quitclaim deed to be effective and to put the public on notice of the change in property ownership, it must be recorded. Failure to do so can lead to legal complications and disputes over the property's title.

Sometimes, people mistakenly fill out a quitclaim deed when another type of deed may be more appropriate for their situation. Quitclaim deeds do not provide any warranties about the property title's quality. If the grantor is looking to provide guarantees about the title or if the transaction is more complex, a different type of deed may be preferable.

The omission of necessary attachments or supporting documents is another error. The Florida Quitclaim Deed form may need to be accompanied by additional paperwork, such as proof of current property taxes paid or a death certificate if the property is being transferred due to the owner's death. Not attaching these documents can delay the process and complicate the transfer.

Finally, a common mistake is not seeking legal advice when unsure about the process. Quitclaim deeds can seem deceptively simple, but they carry significant legal implications. Consulting with a professional can help to avoid errors and ensure that the deed meets all legal requirements and the parties' needs.

Documents used along the form

In the process of transferring property in Florida, using a Quitclaim Deed form is a common step. However, this form is often not the only document needed to complete a transaction or ensure its legality and compliance with local regulations. When parties are involved in a property transfer, several additional forms and documents might be required to support or complement the Quitclaim Deed. Understanding these documents can make the process smoother and help prevent future complications.

- Warranty Deed – A Warranty Deed is used to guarantee that the seller holds clear title to a piece of real estate and has the right to sell it. Unlike the Quitclaim Deed, this document provides the buyer with greater legal protection.

- Property Appraisal Report – This document evaluates the property's market value and is often required by lenders before approving a mortgage loan. It helps in determining if the property's value is adequate concerning the loan amount.

- Title Search Report – A Title Search Report reveals the legal owner of the property and any liens, mortgages, or other encumbrances on it. This report is crucial for ensuring that the property can be transferred without legal issues.

- Loan Estimate and Closing Disclosure – Required for real estate transactions involving mortgages, these documents provide details about the loan terms, closing costs, and other financial aspects of the purchase. They are essential for transparency between the lender and the borrower.

- Flood Zone Statement – In Florida, properties in certain areas may be within flood zones, requiring specific insurance. A Flood Zone Statement identifies whether the property is in such a zone and affects insurance needs and costs.

- Closing Statement – Also known as a HUD-1 Settlement Statement, this document itemizes all costs associated with the transaction. Both buyers and sellers receive this document for review prior to closing, ensuring that all financial aspects of the deal are explicitly agreed upon.

A comprehensive approach to property transfer involves not only executing a Quitclaim Deed but also preparing and understanding several other important documents. Facilitating a smooth property transfer, or any related transaction, entails dealing with these documents correctly. By doing so, all parties can ensure that the legal and financial aspects of the transfer are clear, reducing the risk of future disputes or complications.

Similar forms

The Florida Quitclaim Deed form shares similarities with a Warranty Deed, primarily in its function of transferring property rights. Unlike a Quitclaim Deed, which does not guarantee the grantor holds clear title to the property, a Warranty Deed provides the buyer with guarantees that the title is clear of liens or claims, offering greater protection to the buyer.

Comparable to the Quitclaim Deed is the Grant Deed, used for transferring property ownership with certain guarantees. While a Quitclaim Deed offers no assurances about the property title's status, a Grant Deed assures the recipient that the property has not been sold to someone else and is free from undisclosed encumbrances.

The Special Warranty Deed, similar to a Quitclaim Deed, involves property transfer but with limited guarantees. It ensures the grantor has not encumbered the property during their ownership but does not cover potential issues from before they owned it, unlike the broader protections of a General Warranty Deed.

Deed of Trust documents also bear resemblance in their involvement in property transactions. However, rather than directly transferring property rights between two parties, a Deed of Trust involves a third-party trustee, holding the property's legal title as security for a loan.

A Transfer-on-Death (TOD) Deed, like a Quitclaim Deed, changes property ownership, though it specifies that the transfer occurs upon the grantor's death. This allows property to bypass probate, directly transferring to the beneficiary, contrasting with the immediate effect of a Quitclaim Deed.

The Corrective Deed serves a purpose akin to that of a Quitclaim Deed by modifying a previously recorded deed to correct errors. However, its use is specialized for corrections, such as misspellings or incorrect property descriptions, without the broader application of transferring title.

The Gift Deed, like a Quitclaim Deed, is used for transferring property without monetary compensation. However, a Gift Deed typically includes a statement that the transfer is a gift, potentially offering tax benefits or implications distinct from the Quitclaim process.

A Life Estate Deed allows a property owner to transfer a future interest in real property while retaining rights to use and occupy the property during their lifetime. This contrasts with a Quitclaim Deed’s immediate transfer of the owner’s complete interest in the property.

The Partition Deed is related in its use for handling property interests among co-owners, typically dividing property that was jointly inherited or owned. Unlike the Quitclaim Deed, which transfers one person’s interest to another, a Partition Deed separates the property into distinct parts for individual ownership.

Finally, a Trust Deed is somewhat similar to a Quitclaim Deed in that it involves property transfer, but it places the property into a trust rather than transferring it directly between individuals. This method is often used for estate planning purposes, enabling management of the grantor's property according to the terms of the trust.

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, it's important to follow specific guidelines to ensure the process is completed correctly. Below are lists of things you should and shouldn't do when handling this document.

Things You Should Do

- Ensure all parties' names are spelled correctly and match their identification and other legal documents.

- Include a complete legal description of the property being transferred, which can be found on the previous deed or at the county recorder's office.

- Specify the county in Florida where the property is located, as this dictates where the document should be recorded.

- Have the grantor(s) sign the deed in front of a notary public to validate the document.

- Check if witness signatures are required, as Florida law may necessitate their presence during the signing.

- Record the quitclaim deed with the appropriate county office to make the transfer public record, ensuring legal recognition of the transaction.

- Verify any specific recording fees or stamp taxes required by the local county office and include payment upon submitting the deed for recording.

Things You Shouldn't Do

- Leave blanks in any of the fields that require a response, as this could invalidate the deed or cause delays.

- Forget to obtain a legal description of the property, since a street address alone may not suffice for the deed’s requirements.

- Overlook the necessity of notarization, as a deed without notarization will not be recorded by the county clerk.

- Assume the quitclaim deed transfers any title warranties to the grantee; it only transfers the grantor's interests in the property without any guarantee of clear title.

- Ignore the need to provide the grantee’s mailing address, which is necessary for tax purposes and future correspondence.

- Attempt to use the quitclaim deed to evade creditors or legal responsibilities, as such actions could lead to legal repercussions.

- Fail to research whether there are any outstanding taxes or liens on the property, as these will remain after the transfer and could affect the grantee's use of the property.

Misconceptions

When it comes to transferring property rights in Florida, many people consider using a Quitclaim Deed form. However, there are several misconceptions about this document that need to be cleared up for property owners and potential buyers to make informed decisions. Here are ten common misunderstandings:

- Quitclaim Deeds guarantee a clear title: One of the most significant misconceptions is that a Quitclaim Deed ensures the seller has a good title to the property. In truth, this form of deed makes no promises about the title's status, merely transferring whatever interest the grantor has, which could be none.

- They are only for real estate transactions: While Quitclaim Deeds are often used to transfer real estate between family members or into a trust, they can also be used to relinquish rights to any type of property, not solely land or buildings.

- They offer buyer protection: A Quitclaim Deed offers the least amount of protection to the buyer since it does not warrant the quality of the property title being transferred. Buyers receive only the interest the grantor possesses, which may be subject to claims or liens.

- A Quitclaim Deed transfers property ownership immediately: Although the deed can transfer the grantor's interest to the grantee quickly, the actual transfer is not completed until the deed is delivered and accepted by the grantee, and properly recorded in the county where the property is located.

- Property transferred by Quitclaim is exempt from taxes: This is false. The transfer of property via a Quitclaim Deed may still be subject to federal and state tax implications, including transfer taxes and capital gains taxes.

- They can clear up title issues: Sometimes, Quitclaim Deeds are thought to be a tool for clearing title issues. However, they do not affect third-party claims against the property. Professionals, such as attorneys and title companies, usually address title problems.

- Quitclaim Deeds can be reversed: Once a Quitclaim Deed has been executed and recorded, it cannot be easily "undone" without the grantee's consent. The grantee must agree to quitclaim their interest back to the grantor or to another party.

- They are only for transferring property to family members: Although Quitclaim Deeds are commonly used in transfers between family members, they can be used to transfer property to any individual or legal entity, as long as both parties agree to the terms.

- Recording a Quitclaim Deed is optional: Some believe that it's not necessary to record the deed. However, for the transfer to be fully effective against third parties and to provide public notice of the change in property ownership, the deed must be recorded in the appropriate county recorder's office.

- All states have the same Quitclaim Deed requirements: This isn't true. Each state has specific requirements for executing and recording a Quitclaim Deed. In Florida, for example, the deed must be signed in the presence of two witnesses and notarized to be valid.

Understanding these misconceptions can help individuals navigate the complexities of real estate transactions more efficiently and avoid potential pitfalls associated with Quitclaim Deeds in Florida. It's always wise to consult with a real estate attorney to ensure that any deed executed complies with Florida law and accurately reflects the intentions of the parties involved.

Key takeaways

Filing a Florida Quitclaim Deed form is an important process that transfers property without making any guarantees about the title. This simplified transaction can expedite the transfer of property ownership, but it is crucial to understand the implications and requirements. Here are key takeaways to guide you through filling out and using a Florida Quitclaim Deed form:

- Ensure accuracy in recording the names of the grantor (the person transferring the property) and grantee (the recipient of the property), as mistakes can lead to legal complications.

- Thoroughly describe the property being transferred, including the legal description found in previous deed documents, to avoid any confusion regarding the boundaries and specifics of the property.

- The Quitclaim Deed must be signed by the grantor in the presence of two witnesses and a notary public to be valid under Florida law.

- The form requires the grantor's signature, not the grantee's, contrary to some misconceptions about the process.

- While the Quitclaim Deed transfers property ownership, it does not affect any mortgage or loan attached to the property; the original borrower remains responsible for the debt unless otherwise negotiated.

- Recording the deed with the local county clerk’s office is crucial for making the transaction public record, which provides protection against subsequent claims.

- The state of Florida mandates the payment of documentary stamp taxes upon recording the deed unless an exemption applies, which is based on the consideration paid for the property transfer.

- It is essential to understand that this form offers no warranties on the title, meaning the grantee receives the property as-is, with all the risks associated with any defects in the title.

- Consider a title search before the transfer to uncover any potential issues with the property’s title that could affect future ownership.

- Professional legal advice is invaluable when completing a Quitclaim Deed to ensure that it meets all legal requirements and accurately reflects the intentions of the parties involved.

Approaching the completion and filing of a Florida Quitclaim Deed with due diligence and an understanding of these key aspects will help facilitate a smoother property transfer process.

Popular Quitclaim Deed State Forms

Quick Claim Deed Form Indiana - Use a Quitclaim Deed when you need to release ownership of a property, often used between family members or to clear up title issues.

Filled Out Quit Claim Deed Michigan - Despite its limits, a Quitclaim Deed can be an effective means to transfer ownership rights in a property quickly.