Free Quitclaim Deed Form for California

Among the various legal documents pivotal in the real estate sector, the California Quitclaim Deed form stands out for its simplicity and specific purpose. This form is extensively used to transfer property rights from one person to another with no guarantees about the title's status. Typically, it finds its utility within family members or close-knit relationships where trust is a given, such as between parents and children or between siblings. The process of utilizing a Quitclaim Deed in California doesn't involve the complex procedures akin to traditional property sales. There's no exhaustive search for liens or encumbrances against the property, making it a straightforward and swift method to relinquish or share rights over a piece of real estate. Despite its simplicity, understanding the implications and correctly filling out the form is crucial to avoid potential disputes or legal hurdles in the future. The document’s nature suggests that it's primarily intended for transactions where the parties have a shared confidence in the property's history and the absence of undisclosed encumbrances.

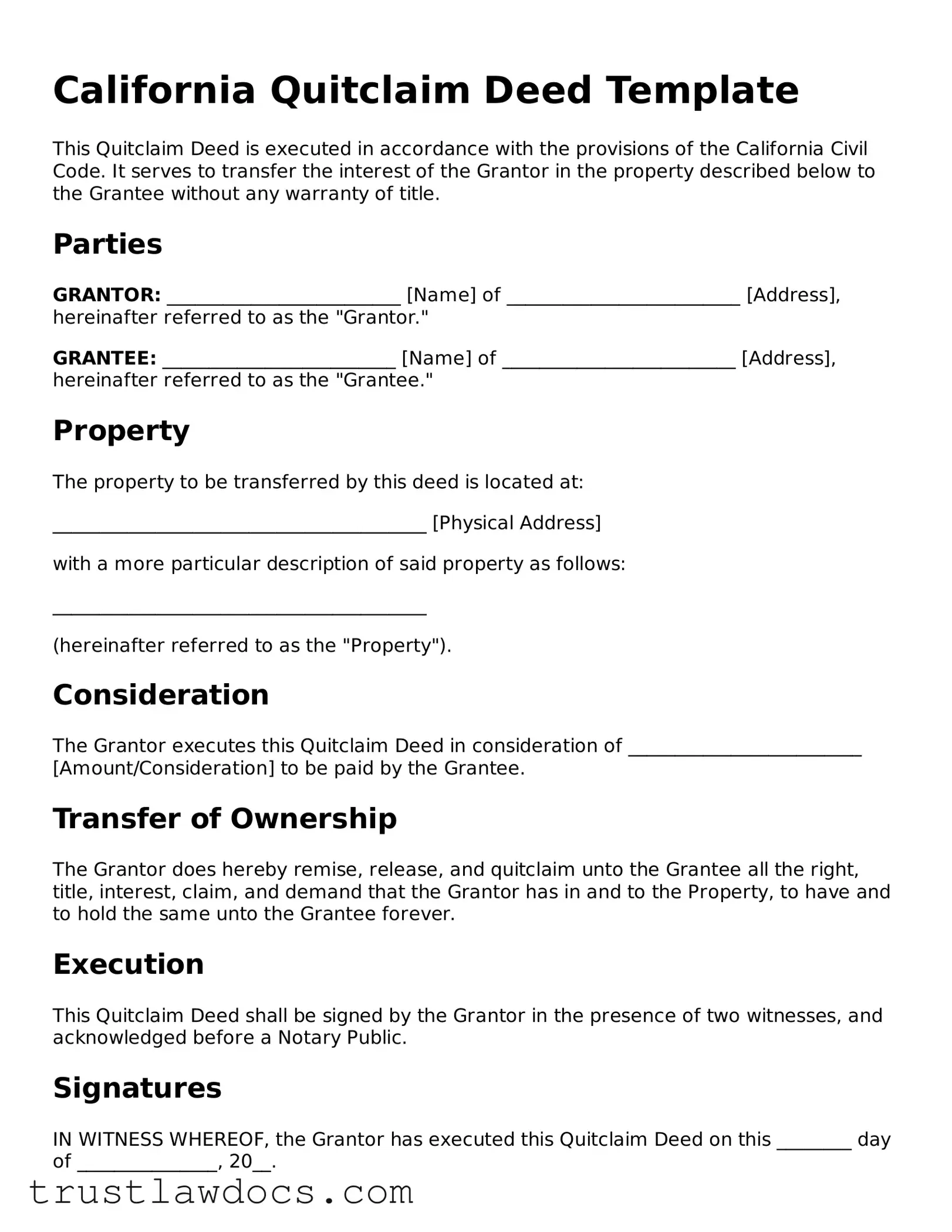

Form Example

California Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the provisions of the California Civil Code. It serves to transfer the interest of the Grantor in the property described below to the Grantee without any warranty of title.

Parties

GRANTOR: _________________________ [Name] of _________________________ [Address], hereinafter referred to as the "Grantor."

GRANTEE: _________________________ [Name] of _________________________ [Address], hereinafter referred to as the "Grantee."

Property

The property to be transferred by this deed is located at:

________________________________________ [Physical Address]

with a more particular description of said property as follows:

________________________________________

(hereinafter referred to as the "Property").

Consideration

The Grantor executes this Quitclaim Deed in consideration of _________________________ [Amount/Consideration] to be paid by the Grantee.

Transfer of Ownership

The Grantor does hereby remise, release, and quitclaim unto the Grantee all the right, title, interest, claim, and demand that the Grantor has in and to the Property, to have and to hold the same unto the Grantee forever.

Execution

This Quitclaim Deed shall be signed by the Grantor in the presence of two witnesses, and acknowledged before a Notary Public.

Signatures

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on this ________ day of _______________, 20__.

_________________________ [Grantor's Signature]

_________________________ [Printed Name]

STATE OF CALIFORNIA

COUNTY OF __________________

On __________________ before me, _________________________ [Notary's Name], Notary Public, personally appeared _________________________ [Grantor's Name], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

Signature _________________________ [Notary's Signature]

(Seal)

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The California Quitclaim Deed form is used to transfer property without a warranty. |

| 2 | It is typically used between family members or to clear up a title issue. |

| 3 | The form requires a complete legal description of the property. |

| 4 | Both the grantor (seller) and grantee (buyer) must sign the form. |

| 5 | The deed must be notarized to be considered valid. |

| 6 | It must be filed with the local county recorder's office where the property is located. |

| 7 | There is often a recording fee that must be paid at submission. |

| 8 | Californian law governing quitclaim deeds primarily falls under California Civil Code sections 1092, 1105, 1107, and 1113. |

| 9 | Transferring property with a quitclaim deed does not exempt the grantee from existing mortgages or liens on the property. |

How to Write California Quitclaim Deed

When you want to transfer property in California without the warranties that come with a standard deed, a Quitclaim Deed is often the tool of choice. This document is straightforward but requires attention to detail to fill out properly. It's commonly used between family members or to transfer property into a trust. Below are the steps to fill out a California Quitclaim Deed form correctly, ensuring a smoother process from one owner to the next.

- Start by obtaining the correct form. For California, ensure it's specifically for this state because real estate laws vary by location.

- Fill in the preparer's information. This is typically the details of the person who is filling out the form, which could be you or a legal professional assisting you.

- Include the name and mailing address of the person who will receive the recorded deed. This is often the new property owner.

- State the Assessor's Parcel Number (APN). You can find this number on the property tax statement or by contacting the local assessor's office.

- Identify the grantor(s) - this is the current owner(s) of the property who is transferring their rights with no guarantee or warranty to the grantee.

- Identify the grantee(s) - the individual(s), or legal entity, receiving the property interest.

- Write a legal description of the property. This is not just the address; it should include the property's boundaries and any legal descriptions used in official documents. If unsure, you can find this information on a previous deed or by contacting a local title company.

- Sign and date the document in the presence of a notary public. The grantor(s) must do this to have the deed be legally binding.

- Have the notary public complete their section, effectively notarizing the document. This typically includes their signature, seal, and the date.

- Record the deed with the County Recorder’s Office where the property is located. There may be a fee for this service, and the amount can vary by county.

Filling out a Quitclaim Deed in California is a critical but streamlined process. These steps ensure accuracy and compliance with state laws. Once recorded, the document becomes part of the public record, officially transferring property rights. Always consider consulting with a legal professional to navigate any complexities or specific situations related to your property transfer. This proactive approach can help avoid common pitfalls and ensure the process goes smoothly for all parties involved.

Get Answers on California Quitclaim Deed

What is a Quitclaim Deed in California?

A Quitclaim Deed in California is a legal document used to transfer ownership of real property from one person (the grantor) to another (the grantee) with no warranties regarding the title's quality. This means the grantor does not guarantee that they own the property free and clear of other claims. It's often used between family members or to clear up title issues.

How is a Quitclaim Deed different from a Warranty Deed?

The key difference between a Quitclaim Deed and a Warranty Deed lies in the level of protection offered to the buyer. A Warranty Deed guarantees that the property title is clear of any liens or claims, providing the grantee a legal recourse if issues arise. On the other hand, a Quitclaim Deed offers no such assurances or guarantees regarding the property's title.

What information is needed to complete a Quitclaim Deed in California?

To complete a Quitclaim Deed in California, you need the legal description of the property, the names and addresses of the grantor and grantee, and the amount of consideration, if any. This document must be signed by the grantor in front of a notary public to be valid.

Is a Quitclaim Deed in California revocable?

Once a Quitclaim Deed is executed and delivered to the grantee, it is irrevocable, meaning the grantor cannot cancel or withdraw the deed without the grantee's consent. The transfer of property rights is permanent, assuming the deed is legally valid.

Do I need a lawyer to prepare a Quitclaim Deed in California?

While it's not legally required to have a lawyer prepare a Quitclaim Deed in California, it's highly recommended. A lawyer can ensure that the deed is correctly prepared and addresses all legal aspects of the property transfer, providing peace of mind to all parties involved.

How do I file a Quitclaim Deed in California?

After the Quitclaim Deed is signed and notarized, it should be filed with the county recorder's office in the county where the property is located. This process, known as recording, makes the deed part of the public record. There may be filing fees associated with the recording, which vary by county.

Can a Quitclaim Deed in California be used to transfer property to a family member?

Yes, a Quitclaim Deed is commonly used to transfer property between family members. It's a straightforward way to transfer ownership without the warranties associated with other types of deeds. This can be for purposes such as adding a spouse to a property title or transferring property as a gift.

Common mistakes

Filling out a California Quitclaim Deed form can appear straightforward, yet it's easy for individuals to make errors that may impact the conveyance of property rights. One common mistake is incorrectly identifying the parties involved. Many individuals inadvertently provide incomplete names, misspellings, or fail to include essential legal designations, such as a trust or corporation, if applicable. This can lead to questions regarding the deed's validity and who exactly holds the property interest.

Another area where errors frequently occur is in not properly describing the property. The description of the property on a Quitclaim Deed must match the legal description used in previous deeds or title documents. A simple address is often not sufficient; the legal description includes lot numbers, tract name, and other details that uniquely identify the property. Using an inaccurate or incomplete description could result in disputes or confusion over what property is actually being transferred.

Additionally, a significant mistake is failing to execute the document properly. In California, the law requires quitclaim deeds to be signed by the grantor in the presence of a notary public. Sometimes, individuals overlook this requirement or believe that a witness's signature can substitute for notarization. This oversight can render the deed unenforceable, making it as though the property transfer never occurred.

Moreover, many do not realize the importance of filing the deed with the county recorder's office promptly. Once signed and notarized, the quitclaim deed must be recorded to put the public on notice of the new property ownership. Failure to record the deed does not invalidate the transfer but can create significant issues, especially if the grantor conveys interests to someone else or if disputes arise regarding property ownership.

Lastly, a common misstep is neglecting to consider tax implications and other legal consequences. Transferring property via quitclaim deed can have unexpected effects on property taxes, estate planning, and eligibility for public benefits. Without proper advice from a legal professional, individuals might find themselves facing unforeseen financial or legal challenges after the transaction.

Documents used along the form

When transferring property in California, the Quitclaim Deed form is commonly utilized. However, several other documents may also be required to efficiently complete the transfer or to comply with legal or financial requirements. These documents vary in purpose and necessity, from providing vital tax information to ensuring compliance with local regulations. Here is a list of forms and documents often used alongside the California Quitclaim Deed form.

- Preliminary Change of Ownership Report (PCOR): This document is required by the county assessor's office to document the change in ownership. It helps the office evaluate and adjust the property tax assessment.

- Transfer Tax Affidavit: This form is used to calculate and report the real estate transfer tax due to the county. The tax amount varies based on the property's sale price and specific county rates.

- Notice of Intended Transfer: Required in some cases, this notice informs the local tax assessor of the intent to transfer property, which may affect property tax assessments or exemptions.

- Statement of Information: Title companies often request this document. It provides detailed information on the parties involved in the transaction to clear any potential title issues and ensure the correct individuals are participating in the transaction.

- Grant Deed: Although not used together with a Quitclaim Deed for the same property transfer, individuals sometimes switch between a Grant Deed and a Quitclaim Deed depending on the guarantee provided about the title's status and any encumbrances.

- Property Tax Statement: While not directly related to the transfer process, the most recent property tax statement might be required by the buyer or involved parties to confirm the property's tax status. This statement provides a record of current and past tax payments.

These documents complement the Quitclaim Deed by ensuring all aspects of the property transfer are documented and legally compliant. Depending on the specific circumstances of the property transfer, additional forms may be required. Parties involved in the transfer are encouraged to consult with a real estate professional or legal advisor to ensure all necessary paperwork is completed accurately.

Similar forms

The California Quitclaim Deed form shares similarities with the Warranty Deed, primarily in their use to transfer property rights from one party to another. However, they differ significantly in the level of protection they offer the grantee (the person receiving the property). A Quitclaim Deed conveys only the grantor's (the person giving the property) rights and interests in the property, if any, without any guarantees that the title is clear of claims or liens. In contrast, a Warranty Deed provides the grantee with a full guarantee against any claims, offering a higher level of assurance about the property's title.

Another document similar to the California Quitclaim Deed is the Grant Deed. Both serve the function of transferring ownership rights in real estate. The crucial difference between them lies in the guarantees the grantor provides. A Grant Deed includes a promise that the grantor hasn't already transferred the title to someone else and that the property is not burdened with undisclosed encumbrances. This makes the Grant Deed somewhat more reassuring to the grantee than a Quitclaim Deed, which does not provide these guarantees.

Similar in concept to the Quitclaim Deed, the Trust Transfer Deed is used to move property into, or out of, a trust. Like a Quitclaim Deed, a Trust Transfer Deed does not provide any warranties regarding the property’s title. It is specific in its use for trusts, enabling a straightforward way to transfer property ownership without implicating warranty claims, making it a useful instrument for estate planning and asset management in California.

The Deed of Trust also finds itself in the circle of documents related to property transfer, acting not as a direct means to convey property rights but as a mechanism for securing a loan on real property. In this scenario, the property owner transfers the property title to a trustee, who holds it as security for the loan between the borrower and lender. While its purpose diverges from that of a Quitclaim Deed, the involvement of property titles links them. Upon fulfillment of the loan terms, the property can be released back to the borrower, similar to how rights are transferred in a quitclaim process.

An Affidavit of Title, while not a deed, plays a complementary role in the property transfer process. It is a sworn statement by the seller of a property affirming their ownership and disclosing any known liens, disputes, or encumbrances that may affect the title. This document supports the transaction process, much like a Quitclaim Deed, by clarifying the status of the property's title, but it does not itself transfer property rights.

The Interspousal Transfer Grant Deed is specifically designed for transferring property rights between spouses and can be used to make a property transfer exempt from reassessment under certain state laws. This deed operates similarly to a Quitclaim Deed in that it transfers whatever interest the grantor has in the property without extending warranties about the title. The focus on spousal property rights makes it distinct yet functionally similar regarding the transfer of property interests without guarantees.

Finally, the Transfer on Death Deed (TOD) shares the quitclaim feature of transferring property interests but with a unique twist—it allows property owners to name a beneficiary who will receive the property upon the owner's death, bypassing the probate process. Like a Quitclaim Deed, it offers no warranties about the property's title. However, its operational timing and the provision for post-mortem property transfer offer a planning tool for property owners wanting to streamline the inheritance process for their beneficiaries.

Dos and Don'ts

When filling out the California Quitclaim Deed form, it is essential to ensure accuracy and compliance with state laws. Here is a guide outlining what individuals should and shouldn't do to facilitate a smooth and legally sound process.

Things You Should Do

- Verify Property Information: Double-check the legal description of the property and its parcel number to ensure they are accurate. This can usually be found on a current deed or by contacting your local tax assessor's office.

- Include All Necessary Parties: Make sure to list all current owners (grantors) and the new owners (grantees) involved in the property transfer. Each party’s legal name should match the description on the official documents that identify them.

- Notarize the Document: Have the quitclaim deed notarized. This typically involves signing the document in front of a notary public. It’s a crucial step for the deed to be considered valid and enforceable.

- Record the Quitclaim Deed: File the completed and notarized quitclaim deed with the county recorder’s office. Recording the deed is not just a procedural step; it provides a public record of the property transfer and protects the interests of all parties involved.

Things You Shouldn't Do

- Forget to Specify Consideration: Failing to indicate the amount of money being exchanged, if any, or a statement of consideration can lead to complications. Even if the property is a gift, mention this fact to maintain transparency.

- Ignore Tax Implications: Overlooking the potential tax consequences of transferring property via a quitclaim deed is a mistake. It’s advisable to consult with a tax professional to understand any obligations that may arise.

- Leave Blanks on the Form: Do not leave any sections of the quitclaim deed form blank. If a particular section does not apply, it’s better to enter “N/A” (not applicable) than to leave it empty. Incomplete forms can be rejected or cause delays.

- Use Incorrect Names or Inaccurate Descriptions: Misidentifying parties or listing an incorrect property description can invalidate the deed or, at best, create significant legal headaches down the road. Precision in every detail is key.

Misconceptions

When it comes to transferring property rights in California, the Quitclaim Deed form is a common document. However, several misconceptions surround its use and implications. Clearing up these misunderstandings is crucial for parties involved in property transactions to make informed decisions.

Quitclaim Deeds guarantee a clear title: One common misconception is that Quitclaim Deeds ensure the property being transferred is free of liens or other encumbrances. In truth, Quitclaim Deeds transfer only the interest the grantor has in the property, if any, without any guarantees regarding the title’s validity or encumbrances.

Quitclaim Deeds are only for property sales: Many believe Quitclaim Deeds are strictly used for selling property. However, they are often used to transfer property between family members, to cure a title defect, or to change the way property is held, without the exchange of money.

Quitclaim Deeds remove the grantor from the mortgage: A common misunderstanding is that once a property has been transferred through a Quitclaim Deed, the grantor is absolved of any mortgage obligations. This is not the case; the deed transfers property rights, not financial responsibilities. Mortgage obligations remain unless specifically modified by the lender.

Quitclaim Deeds can force someone off a property title: It's wrongly presumed that a Quitclaim Deed can be used to remove an unwilling co-owner from a property title. All parties on the title must agree and sign the Quitclaim Deed for it to be effective; it cannot be executed unilaterally against another’s will.

Using a Quitclaim Deed is always the best option: While Quitclaim Deeds are useful in many circumstances, they are not always the most suitable choice for property transfer. Depending on the situation, a Warranty Deed, which provides guarantees about the title, may be a safer option for the grantee.

Quitclaim Deeds are complicated and require a lawyer: The perception that preparing a Quitclaim Deed is complex and necessitates legal assistance is widespread. However, these deeds are relatively straightforward to complete, and many individuals successfully do so without hiring a lawyer. Nonetheless, consulting a legal professional can provide valuable peace of mind and ensure the document meets all legal requirements.

Once signed, a Quitclaim Deed’s effects are immediate: While a Quitclaim Deed may be executed quickly, its impact is not recognized until the document is officially recorded with the county recorder’s office. Until such recording, the transfer of property rights is not considered complete or enforceable.

A Quitclaim Deed transfers property rights instantly: Although a Quitclaim Deed might transfer property rights, it does so according to the actual rights held by the grantor at the time of transfer. If the grantor acquires more rights later, those are not automatically passed to the grantee after the initial deed transfer.

Quitclaim Deeds are only for transferring to strangers: Some believe Quitclaim Deeds are meant for transactions involving individuals with no prior relationship. In reality, these deeds are more commonly and safely used between family members or close acquaintances, where there is a mutual trust regarding the property's title status.

Quitclaim Deeds are irrevocable: Another misunderstanding is that once a Quitclaim Deed is signed and recorded, it cannot be reversed. While it's difficult to revoke a deed, it's not impossible—especially if both parties agree to the revocation or if it was executed under duress, fraud, or mistake.

Key takeaways

When transferring property rights in California without warranties on the property's title, a Quitclaim Deed form is often employed. This document is essential for those wishing to change the ownership of property quickly and with minimal formalities. To make this process smoother and ensure the legal transfer of property rights, here are six key takeaways for filling out and using the California Quitclaim Deed form:

- Understand the purpose: The Quitclaim Deed transfers interest in real property from the grantor (the person transferring the property) to the grantee (the recipient) with no guarantee about the title's clearness. It's commonly used for property transfers between family members or to clear up title issues.

- Complete the form accurately: Ensure that all necessary fields on the form are filled out correctly. This includes the full names of the grantor and grantee, a legal description of the property, and any other information that identifies the property uniquely. Inaccurate or incomplete information can lead to complications.

- Notarize the document: For the Quitclaim Deed to be valid, it must be signed by the grantor in front of a Notary Public. The notarization process confirms the identity of the signer and their understanding of the document's contents and implications.

- File promptly: After the Quitclaim Deed is signed and notarized, it should be filed with the County Recorder's Office in the county where the property is located. This makes the document part of the public record and notifies third parties of the change in property ownership.

- Consider tax implications: Be aware that transferring property via a Quitclaim Deed may have tax consequences for both the grantor and grantee. It's advisable to consult a tax professional to understand these implications before proceeding with the transfer.

- Seek legal advice: Because Quitclaim Deeds affect legal rights and interests in real property, consulting with a legal professional before completing and using this form is crucial. They can provide valuable guidance tailored to your specific situation and help avoid potential legal issues.

Remember, the use of a Quitclaim Deed involves significant legal actions concerning property rights. Taking these key points into account can help ensure the process is conducted accurately, effectively, and with a clear understanding of all implications.

Popular Quitclaim Deed State Forms

Illegal Quit Claim Deed - Allows property owners to modify the interest held in a property without the complexities of a sale.

Quick Claim Deed Form Indiana - Great for property transfers where speed and simplicity are needed, a Quitclaim Deed skips the complexity of traditional warranties.