Official Quitclaim Deed Document

When navigating the complexities of property transfers, one might encounter various legal forms, each designed for specific scenarios. Among these, the Quitclaim Deed form stands out as a valuable tool for a straightforward property transfer without the seller guaranteeing the title's status. This form is typically used among family members, in divorce settlements, or in other informal transactions where the parties know each other and the property's history. It's an efficient way to convey interest in a property, though its simplicity also means it lacks the protections found in more comprehensive forms like Warranty Deeds. As such, understanding the nuances of how and when to use a Quitclaim Deed, including any potential risks and limitations, is essential for anyone looking to either convey or receive property interest through this method.

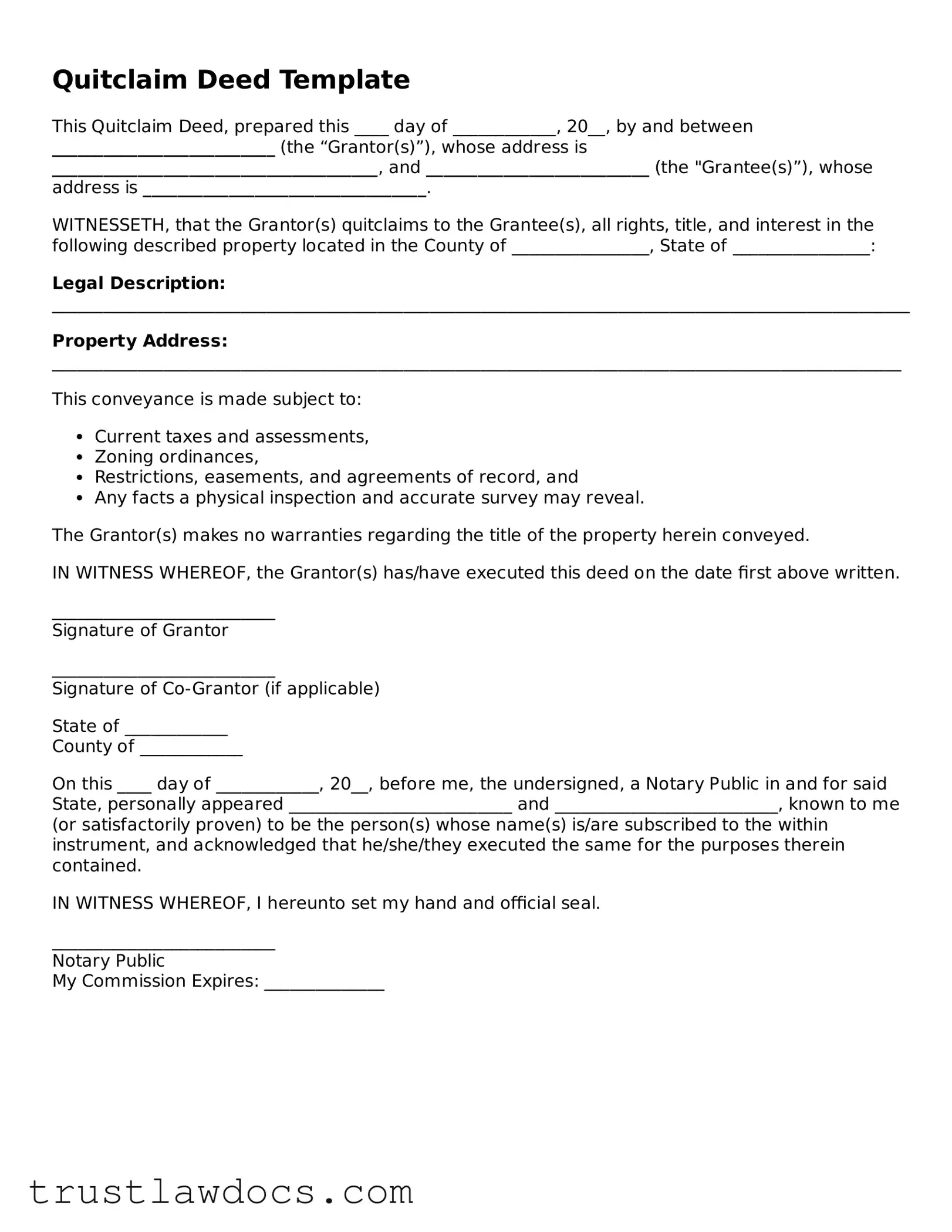

Form Example

Quitclaim Deed Template

This Quitclaim Deed, prepared this ____ day of ____________, 20__, by and between __________________________ (the “Grantor(s)”), whose address is ______________________________________, and __________________________ (the "Grantee(s)”), whose address is _________________________________.

WITNESSETH, that the Grantor(s) quitclaims to the Grantee(s), all rights, title, and interest in the following described property located in the County of ________________, State of ________________:

Legal Description: ____________________________________________________________________________________________________

Property Address: ___________________________________________________________________________________________________

This conveyance is made subject to:

- Current taxes and assessments,

- Zoning ordinances,

- Restrictions, easements, and agreements of record, and

- Any facts a physical inspection and accurate survey may reveal.

The Grantor(s) makes no warranties regarding the title of the property herein conveyed.

IN WITNESS WHEREOF, the Grantor(s) has/have executed this deed on the date first above written.

__________________________

Signature of Grantor

__________________________

Signature of Co-Grantor (if applicable)

State of ____________

County of ____________

On this ____ day of ____________, 20__, before me, the undersigned, a Notary Public in and for said State, personally appeared __________________________ and __________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

__________________________

Notary Public

My Commission Expires: ______________

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A Quitclaim Deed transfers interest in real property from one person to another without any warranties of title. |

| Warranties | It comes with no guarantees about the title's status, meaning the grantee is not protected against any title issues. |

| Common Use | Often used between family members, or in divorce settlements, to transfer property quickly and without a title search. |

| Execution Requirements | Must be signed by the grantor, notarized, and in some states, witnessed to be legally valid. |

| State-Specific Laws | Governing laws vary by state, affecting how the deed must be executed and recorded. |

How to Write Quitclaim Deed

Filling out a Quitclaim Deed form might seem daunting, but it's a straightforward process once you understand what's required. This document is used to transfer property ownership without making any warranties about the property title. Whether you're adding a family member to the deed, transferring property into a trust, or handling property transactions after a divorce, the steps below will guide you through the process. It's important to complete the form accurately to ensure the transfer is valid and meets all legal requirements. After completing the form, the next step will be to have it signed, notarized, and then filed with the county recorder's office.

- Identify the preparer of the document. This is usually the person completing the form or the legal representative handling the property transaction.

- Fill in the return address. This is where the county recorder will send the official documents after recording.

- Specify the county and state. This indicates where the property is located and ensures that the deed is processed in the correct jurisdiction.

- Enter the date of the transfer. This is the date when the property ownership transfer officially takes place.

- List the grantor(s) details. The grantor is the current owner transferring the property. Include full names and addresses.

- Include the grantee(s) details. The grantee is the new owner receiving the property. Similar to the grantor(s), provide full names and addresses.

- Describe the property being transferred. This typically requires the legal description of the property, not just the address. You might find this description on the current deed or property tax documents.

- State the amount being exchanged for the property, if applicable. Sometimes, the form may simply require stating “for valuable consideration” without specifying an amount.

- Have the grantor(s) sign the deed. The signature(s) must be done in the presence of a notary public to validate the document.

- Notarize the document. The notary public will fill out their section, confirming the identity of the grantor(s) and the signing of the document.

Once all steps are complete, the Quitclaim Deed form is ready for the final and crucial step of being filed or recorded with the local county recorder or land registry office. This ensures the change in ownership is officially recognized and the public records are updated. Remember, the filing requirements and fees can vary by county, so it's essential to check with the local office where the property is located to ensure compliance with all local regulations and to confirm any associated filing fees.

Get Answers on Quitclaim Deed

What is a Quitclaim Deed form?

A Quitclaim Deed form is a legal document used to transfer interest, ownership, or rights in real property from one party to another without any guarantee about the extent of the grantor's interest, if any, in the property. This means the person receiving the property, known as the grantee, accepts the transfer as-is, potentially with all its faults or claims against it.

How does a Quitclaim Deed differ from a Warranty Deed?

Unlike a Warranty Deed, which guarantees that the grantor holds clear title to the property, a Quitclaim Deed offers no warranties or assurances about the property's title status. It merely transfers whatever interest the grantor has at the time of the transfer, which could be none at all. Therefore, Quitclaim Deeds are often used between family members or close parties where there is a high level of trust.

When should a Quitclaim Deed be used?

Quitclaim Deeds are commonly used in non-commercial property transactions, such as transferring property within a family (e.g., from parents to children), between divorcing spouses, or to clear up a title issue. They are chosen for their simplicity and speed but are not suitable for all property transactions, especially where the property's clear title is in question.

What information needs to be included in a Quitclaim Deed?

A Quitclaim Deed must include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and the date of the transfer. It must be signed by the grantor and, depending on the state, may also require a notary's acknowledgement to be officially recorded.

Is a Quitclaim Deed revocable?

Once executed, a Quitclaim Deed is generally not revocable without the grantee's consent. It permanently transfers any ownership rights the grantor has in the property to the grantee. Therefore, before using a Quitclaim Deed, the grantor should be certain they wish to renounce their rights to the property.

What are the tax implications of transferring property using a Quitclaim Deed?

The transfer of property using a Quitclaim Deed may have tax implications for both the grantor and grantee, including potential capital gains taxes for the grantor and property tax reassessment for the grantee. The specifics can vary widely based on local laws and the situation of the parties involved. It is advisable to consult a tax professional to understand the impact fully.

Common mistakes

Filling out a Quitclaim Deed form is a task that necessitates attention to detail, a clear understanding of the implications, and an appreciation for the legal nuances involved. One common mistake is incomplete or incorrect information. Every field on the form requires accurate information, from the names of the grantor and grantee to the legal description of the property. An error as simple as a misspelled name or a missing digit in the property's parcel number can invalidate the entire document.

Another pitfall is failing to use the correct legal description of the property. The legal description is not the same as the street address; it refers to the detailed description used in public records that identifies the parcel's boundaries and location. Using an inaccurate or incomplete legal description can lead to disputes over the property's boundaries or, in the worst-case scenario, render the deed void.

Many people underestimate the importance of notarizing the document. A Quitclaim Deed, like many legal documents, often requires notarization to be valid. Ignoring this step can lead to the rejection of the document by the county recorder's office, delaying the transfer process or even putting it into legal jeopardy.

It’s also crucial not to overlook the requirement for the grantor's signature. The signing party must be the grantor, as they are the individual transferring their interest in the property. If the signature is missing or if someone else signs on behalf of the grantor without proper legal authority, the quitclaim deed could be challenged or considered invalid.

Another common error involves misunderstanding the form’s purpose. Some individuals may believe that a Quitclaim Deed guarantees that the grantor holds a clear title to the property. However, this deed only transfers whatever interest the grantor has in the property, if any, without any guarantees. This misunderstanding can lead to unexpected legal complications down the road.

Failing to file the Quitclaim Deed with the appropriate county office is another mistake that can have significant repercussions. Once completed and notarized, the quitclaim deed must be recorded with the county recorder's or land registry's office to make the transfer of interest official and public record. Failure to do so can result in disputes about property ownership and create a cloud on the title, complicating future transactions.

People often neglect the necessity of consulting legal counsel before proceeding with a Quitclaim Deed. Legal counsel can provide crucial advice tailored to the specific situation, helping to avoid common pitfalls and ensuring that the deed aligns with the individual's intentions and legal requirements.

A subtle yet impactful mistake is the incorrect formatting or use of an outdated form. Requirements for Quitclaim Deeds can vary significantly by jurisdiction, and using a format that doesn't meet current local standards can lead to the document being rejected.

Assuming that a Quitclaim Deed negates financial responsibilities related to the property is a critical misunderstanding. For instance, if the grantor has an outstanding mortgage on the property, the Quitclaim Deed does not relieve them of this obligation, unless specifically agreed upon by the lender.

Lastly, individuals often fail to provide copies of the recorded deed to all parties involved, including the grantee and any lenders. This oversight can lead to confusion and a lack of documentation for necessary legal or financial proceedings related to the property in the future.

Documents used along the form

When handling property transfers, a Quitclaim Deed is one form among many necessary documents needed to ensure a smooth and legally binding transaction. This document is often best understood in the context of other forms that either accompany it or are required in the process of property transfer. The following list outlines and describes additional documents that are frequently used alongside the Quitclaim Deed form to facilitate a complete and secure transfer of property.

- Warranty Deed - Similar to a Quitclaim Deed, a Warranty Deed also transfers property ownership but provides the buyer with guarantees that the seller holds clear title to the property.

- Title Search Report - This document provides a history of the property, including its previous owners and any claims, liens, or encumbrances on the property, ensuring the buyer is aware of potential issues.

- Property Disclosure Statement - Sellers provide this form to disclose any known issues or defects with the property that could affect its value or desirability.

- Loan Documents - If the transfer involves a new mortgage or assumes an existing one, the relevant loan documents outline the terms and conditions of the financing.

- Escrow Instructions - When an escrow company is involved, this document specifies the terms and conditions under which the escrow agent is authorized to distribute funds.

- Property Deed of Trust - In some states, instead of a mortgage, a Deed of Trust is used. This document places the property as security for a loan.

- Real Estate Transfer Disclosure Statement - Required in certain states, this form is similar to the Property Disclosure Statement but focuses on state-specific disclosures.

- Closing Statement - A comprehensive outline of the transaction details, including the purchase price, financing arrangements, closing costs, and the distribution of funds at closing.

Understanding and completing these documents can be a complex process, but their completion is vital to ensuring that property transfers are legally sound and protect the interests of all parties involved. Together with a Quitclaim Deed, these forms contribute to the integrity and efficiency of real estate transactions, offering peace of mind to buyers, sellers, and legal professionals alike.

Similar forms

The Quitclaim Deed form shares similarities with the Warranty Deed in that both are legal instruments used to transfer property rights from one party to another. However, whereas a Quitclaim Deed offers no warranties about the quality of the property title being transferred, a Warranty Deed includes guarantees that the seller holds clear title to the property and has the right to sell it, providing greater protection to the buyer.

Another document akin to the Quitclaim Deed is the Grant Deed. Like the Quitclaim, a Grant Deed is used to transfer an interest in real property. The key difference lies in the level of protection offered to the buyer; while a Grant Deed guarantees that the property has not been sold to someone else, it provides less assurance than a Warranty Deed but more than a Quitclaim Deed, as it assures the grantee against prior conveyances or encumbrances made by the grantor.

The Trust Deed, or Deed of Trust, also relates to the Quitclaim Deed, serving as a means to secure a real estate transaction. A Trust Deed involves three parties — the borrower, lender, and a neutral third party (trustee) — and places the property in trust with the trustee as security for the loan. Quitclaim Deeds may be used in tandem with Trust Deeds when transferring property held in trust or when changing the beneficiary of a trust-held property.

Similar to the Quitclaim Deed is the Life Estate Deed, which is used to transfer property while reserving rights for the grantor during their lifetime. It allows the grantor to retain use and possession of the property until death, at which point ownership passes directly to the remainderman named in the deed. The key similarity lies in the mechanism of transferring interest in real property, though their legal implications and purposes differ significantly.

A Deed of Reconveyance is another related document, serving as evidence that a borrower has fulfilled the terms of a Deed of Trust and the trustee is transferring title back to the borrower. This document comes into play after a Trust Deed arrangement is concluded, effectively clearing the property title. Although it operates differently than a Quitclaim Deed, both deal with the transfer and clarification of property titles.

The Correction Deed closely resembles the Quitclaim Deed as it is frequently used to rectify errors in a previously recorded deed, including a Quitclaim Deed. Such errors may include misspellings, incorrect property descriptions, or other clerical mistakes. The Correction Deed serves to clear any ambiguities or errors without fundamentally altering the original intentions of the property transfer.

Last but not least, the Transfer-on-Death Deed (TODD) parallels the Quitclaim Deed in its purpose to transfer property rights, yet it uniquely activates upon the death of the owner. This allows property owners to name beneficiaries who will receive the property directly upon the owner’s death, bypassing probate. While a Quitclaim Deed is effective immediately upon execution and delivery, a TODD is contingent on a future event. Both documents, however, facilitate the transfer of property interests without the guarantees associated with traditional sale deeds.

Dos and Don'ts

When dealing with the Quitclaim Deed form, it's important to approach the process with diligence and care. This document, which is used to transfer interest in real property from one person to another without a warranty of title, has its own set of guidelines for completion. Below are seven dos and don'ts you should consider to ensure a smooth and error-free transaction.

Dos:

- Ensure that all parties' full names are written exactly as they appear in public records. This includes middle names or initials if they are used on the property's title.

- Verify the legal description of the property. This is not the street address but the description used in legal documents. You can usually find this on a previous deed for the property.

- Double-check that the grantor (the person transferring the property) signs the deed in the presence of a notary public. The notarization process is crucial for the document's legality.

- Make sure the form complies with local and state laws, which can vary widely. This might involve specific wording or additional forms.

- Record the deed with the local county clerk or land records office after it's completed. This public recording is necessary for the document to be effective.

- Consider consulting with a real estate lawyer if you have questions about the process or your specific situation.

- Keep copies of the recorded deed for both the grantor and grantee's records.

Don'ts:

- Don't leave any blanks on the form. If a section doesn't apply, mark it N/A (not applicable). An incomplete form might be considered invalid.

- Don't rely on verbal agreements to supplement the quitclaim deed. The deed should fully and accurately reflect the agreement between parties.

- Don't forget to check for any specific filing requirements like additional forms or attachments that your county might require.

- Don't use informal property descriptions. The deed needs the legal description to accurately identify the property.

- Don't neglect to review the deed for errors before filing. Typos or incorrect information can lead to legal complications.

- Don't assume the quitclaim deed transfers liability for any existing mortgages or liens on the property. The grantee should be aware of taking over the property subject to these encumbrances.

- Don't hesitate to seek professional advice. Real estate transactions can be complex, and the consequences of mistakes can be significant.

Misconceptions

When it comes to transferring property, quitclaim deeds are a common tool, but they're often misunderstood. Let’s clear up some common misconceptions:

- Quitclaim deeds guarantee a clear title. This is a common misconception. In reality, quitclaim deeds do not guarantee that the grantor (the person transferring the property) has a clear title to the property or even owns it. They simply transfer whatever interest the grantor has in the property—if any—to the grantee (the person receiving the property). It's a case of 'what you see is what you get.'

- Quitclaim deeds can only be used between family members. While it's true that quitclaim deeds are frequently used in transfers between family members, such as adding or removing a spouse from the title, this is not their only use. Quitclaim deeds can be used between any parties when the property is being transferred without a sale, such as in gifting property or transferring it into a trust.

- Quitclaim deeds can resolve boundary disputes. Some people believe that you can resolve boundary disputes with a neighbor by simply having them sign a quitclaim deed. However, quitclaim deeds transfer property ownership without addressing the specifics of the property boundaries. Boundary disputes often require a survey and sometimes a court judgment to be legally resolved.

- Quitclaim deeds transfer property rights immediately. While it's true that a quitclaim deed can be a quick way to transfer property rights, the transfer isn’t complete until the deed is properly signed, dated, notarized, and in some cases, recorded with the appropriate local government office. Failing to complete these steps can invalidate the transfer or cause legal issues down the line.

Key takeaways

When navigating the process of transferring property rights without the warranties of a traditional sale, quitclaim deeds become a central document. Here are key takeaways for filling out and using a Quitclaim Deed form:

- Understand the purpose: A Quitclaim Deed is used to transfer any interest in real property from the grantor to the grantee without any guarantee that the title is clear and free of claims.

- Know the parties involved: The "grantor" is the person who is transferring the property interest, while the "grantee" receives this interest. Correctly identifying and naming these parties is crucial.

- Ensure accuracy in the property description: The legal description of the property being transferred must be meticulously accurate. This information can be found on the current deed, property tax documents, or by consulting a land surveyor.

- Notarization is necessary: For a Quitclaim Deed to be valid, it typically must be signed by the grantor in the presence of a notary public.

- Witness requirements may vary by state: Some states require witnesses in addition to notarization. Check local laws to ensure compliance.

- Consideration should be stated: Although often nominal, stating the consideration or value being exchanged for the property interest is important and legally required in some jurisdictions.

- Recording the deed: Once signed and notarized, the Quitclaim Deed must be filed with the local county recorder's office or appropriate land registry to be effective and to put the public on notice of the new property interest.

- Understand the lack of warranties: Unlike a warranty deed, a Quitclaim Deed comes with no guarantees regarding the title’s status, meaning it transfers property as-is. This is a critical factor when considering a quitclaim for property transactions.

Transferring property rights using a Quitclaim Deed can be straightforward, but the importance of diligence in completing the form and understanding the legal implications cannot be overstated. Whether moving property between family members or adjusting co-ownership rights, getting the specifics right helps ensure that the transfer achieves the intended result without unexpected complications.

Consider More Types of Quitclaim Deed Forms

Correction Deed Form California - Helps maintain the integrity of real estate transactions by allowing for corrections to be officially acknowledged.

Does California Have a Transfer on Death Deed - This form facilitates a worry-free transfer of property, allowing owners and beneficiaries alike to focus on honoring the decedent's memory.

Free Michigan Lady Bird Deed Pdf - While it offers many advantages, individuals should carefully consider their estate planning goals and whether this instrument aligns with their needs before proceeding.