Free Deed Form for Michigan

Embarking on the journey of buying or selling property in Michigan, one encounters a pivotal document that lays the groundwork for this significant transaction: the Michigan Deed form. This essential piece of paper serves as the formal instrument by which ownership of property is transferred from one party to another. It embodies the agreement, capturing details about the seller, the buyer, and the property itself in precise language to ensure clear communication and understanding between all parties involved. Notably, the Michigan Deed form is not a mere transactional artifact; it carries legal weight, stipulating the rights, responsibilities, and protections for both the seller and the buyer. Various types of deeds can be utilized, each offering different levels of warranty and assurance regarding the property’s title, directly influencing the security of the investment. Therefore, understanding the nuances and implications of the form is not only beneficial but essential for anyone navigating the landscape of real estate in Michigan. This document acts as a cornerstone in property transactions, meticulously crafted to safeguard interests and foster trust among parties, marking a key milestone in the journey of property ownership.

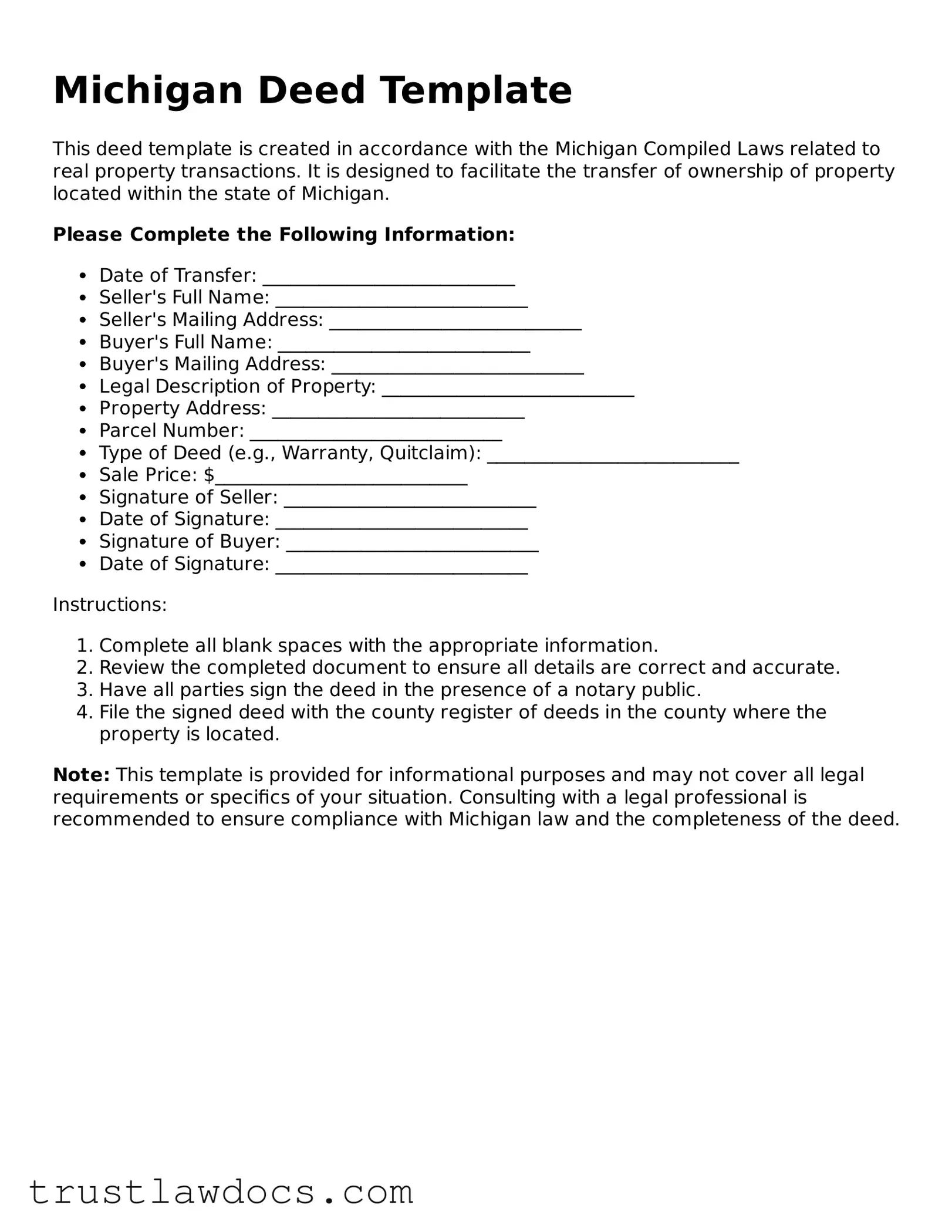

Form Example

Michigan Deed Template

This deed template is created in accordance with the Michigan Compiled Laws related to real property transactions. It is designed to facilitate the transfer of ownership of property located within the state of Michigan.

Please Complete the Following Information:

- Date of Transfer: ___________________________

- Seller's Full Name: ___________________________

- Seller's Mailing Address: ___________________________

- Buyer's Full Name: ___________________________

- Buyer's Mailing Address: ___________________________

- Legal Description of Property: ___________________________

- Property Address: ___________________________

- Parcel Number: ___________________________

- Type of Deed (e.g., Warranty, Quitclaim): ___________________________

- Sale Price: $___________________________

- Signature of Seller: ___________________________

- Date of Signature: ___________________________

- Signature of Buyer: ___________________________

- Date of Signature: ___________________________

Instructions:

- Complete all blank spaces with the appropriate information.

- Review the completed document to ensure all details are correct and accurate.

- Have all parties sign the deed in the presence of a notary public.

- File the signed deed with the county register of deeds in the county where the property is located.

Note: This template is provided for informational purposes and may not cover all legal requirements or specifics of your situation. Consulting with a legal professional is recommended to ensure compliance with Michigan law and the completeness of the deed.

PDF Form Details

| Fact | Description |

|---|---|

| 1. Definition | In Michigan, a deed form is used to transfer property ownership from one person to another. |

| 2. Types | Michigan recognizes several types of deeds, including Warranty Deeds, Quitclaim Deeds, and Lady Bird Deeds, each serving different purposes. |

| 3. Governing Law | The Michigan Compiled Laws (MCL) govern the creation, execution, and recording of deeds within the state. |

| 4. Signature Requirements | A deed must be signed by the grantor (the person selling or transferring the property) in the presence of a notary public. |

| 5. Recording | After signing, the deed must be recorded with the Register of Deeds in the county where the property is located to be effective against third parties. |

| 6. Consideration Statement | The deed must include a statement of consideration, specifying the amount paid for the property, to be valid. |

| 7. Transfer Tax | Transfer of real property in Michigan may be subject to a state transfer tax, which is based on the consideration paid for the property. |

How to Write Michigan Deed

Filling out a deed form in Michigan is a crucial step in the process of transferring property ownership. A deed is a legal document that enables the transfer of property from one owner (the grantor) to another (the grantee). The form requires careful attention to detail to ensure the transfer is valid and recognized by law. Following these steps will guide you through completing a Michigan deed form accurately.

- Begin by obtaining the correct deed form for the type of property transfer you intend to make. Michigan has several deed forms, including warranty deeds, quitclaim deeds, and others, each serving different purposes.

- Identify the grantor(s) and grantee(s) by legal name, ensuring they are spelled correctly. The grantor is the current property owner, while the grantee is the new owner receiving the property.

- Provide a complete and accurate description of the property being transferred. This description should include the property's physical address, legal description, and parcel number, which can be found on property tax statements or previous deed documents.

- Decide on any warranties or guarantees the grantor will provide to the grantee. This may vary based on the type of deed chosen. For instance, a warranty deed provides guarantees about the property’s title, while a quitclaim deed does not.

- The consideration should be stated. This is the amount of money or the value of property being exchanged for the deed transfer. Even if the property is a gift, it is necessary to state a nominal consideration.

- Have the grantor(s) sign the deed in front of a notary public. The notary must witness the signing and provide an official stamp or seal, verifying the identity of the signer(s).

- Check if any additional forms or declarations are required by Michigan law or local practice for the deed to be recorded. This may include tax forms or statements about the sale price.

- File the completed deed with the appropriate county Register of Deeds office. This step officially records the property transfer and may require a recording fee.

After the deed is filed, the property ownership transfer is legally recognized in Michigan. The new deed will be a permanent record of the ownership change, accessible through the county’s Register of Deeds office. Completing this form correctly and ensuring its proper recording solidifies the grantee's rights as the new property owner.

Get Answers on Michigan Deed

What is a Michigan Deed form?

A Michigan Deed form is a legal document used to transfer ownership of real estate from one party (the seller or "grantor") to another (the buyer or "grantee") in the state of Michigan. It must include specific information like the legal description of the property, the names of both parties involved, and the signature of the seller, witnessed and notarized as per Michigan law.

How do I know which type of deed to use in Michigan?

The type of deed you need depends on your situation. In Michigan, the most common types are warranty deeds, quitclaim deeds, and covenant deeds. Warranty deeds provide the highest level of protection for the buyer, guaranteeing against any title issues. Quitclaim deeds transfer only the seller's interest in the property without any guarantees. Covenant deeds offer a middle ground, providing some assurances about the property's title. Consulting with a real estate attorney can help you decide which is right for your transaction.

Are there any specific requirements for a Michigan Deed to be valid?

Yes, Michigan law requires certain elements for a deed to be valid: the deed must be in writing, contain a legal description of the property, include the grantor's signature, and that signature must be notarized. The deed should also clearly state the grantee's name and be delivered to and accepted by the grantee.

Do I need a lawyer to prepare a Michigan Deed?

While it's not legally required to have a lawyer prepare a Michigan Deed, it's highly recommended. Real estate transactions can be complex, and an experienced attorney can ensure that the deed complies with all state laws, accurately reflects the agreement, and protects your interests.

Can I write my own Michigan Deed?

You can write your own Michigan Deed, but it's important to ensure that it meets all legal requirements for it to be valid and enforceable. Mistakes in the deed could lead to significant issues, including disputes over property ownership. It's usually better to have a professional draft the document or at least review it.

How is a Michigan Deed filed?

After a Michigan Deed is executed (signed, witnessed, and notarized), it must be filed with the Register of Deeds in the county where the property is located. This process, known as recording, provides public notice of the property transfer and is essential for the deed to be considered valid against third parties.

What are the fees for recording a Michigan Deed?

The fees for recording a Michigan Deed vary by county. Typically, there's a base fee for the first page of the deed and an additional smaller fee for each subsequent page. There may also be other charges, such as a transfer tax depending on the property's sale price. It's best to contact the local Register of Deeds for the exact fees.

Is a Michigan Deed publicly accessible?

Yes, once a Michigan Deed is recorded, it becomes a public document. Anyone can request to view or obtain copies of the deed from the county's Register of Deeds office. There may be a small fee for obtaining copies.

What happens if a mistake is made on a Michigan Deed?

If a mistake is made on a Michigan Deed, it may be corrected by preparing and recording a corrected deed or, in some cases, a document known as a "scrivener's affidavit" that explains the error and states the correction. It's crucial to address any errors promptly to ensure clear and undisputed ownership of the property.

Can I change my mind after signing a Michigan Deed?

Once a Michigan Deed is signed, notarized, and especially after it's recorded, changing your mind and reversing the transaction can be difficult. The grantee would need to agree to transfer the property back to you by signing another deed. If you have concerns or doubts before finalizing the transaction, it's important to address them as soon as possible.

Common mistakes

Filling out a Michigan Deed form might seem straightforward, but a surprising number of people make mistakes that can complicate the transfer of property. One common error is not checking the type of deed required for the transaction. Michigan law recognizes several types of deeds — warranty, quitclaim, covenant, and others — each serving different purposes and providing varying levels of protection for the buyer and seller.

Another slip-up involves incorrect or incomplete names and addresses of the parties involved. This detail is crucial for any legal document. Every name must match the official identifications of the parties, and addresses must be complete and accurate. This ensures that the deed correctly identifies who is transferring property and to whom.

Leaving out the legal description of the property is yet another error that can render a deed ineffective. The legal description is more detailed than just an address; it includes lot numbers, subdivisions, and it may reference plat books or surveys. Without this precise description, identifying the exact property being transferred can be ambiguous.

Forgetting to have the deed notarized is a mistake that can invalidate the entire document. In Michigan, a notary public must witness the signing of the deed to verify the identity of the signees and their understanding and willingness to sign the document. This step is crucial for the deed to be recognized as legally binding.

Some also neglect to check for spelling and typographical errors in the document. Even minor mistakes can lead to significant issues, such as incorrect legal descriptions or party names, leading to disputes or challenges in recognizing the deed's legality.

Failing to record the deed with the local county clerk’s office is another oversight. In Michigan, recording the deed is necessary for it to be acknowledged as legal. This process provides a public record of the property transfer and protects the new owner's interests.

Apart from these errors, not understanding the transfer tax implications can also be problematic. Depending on the nature of the property transfer, there might be state or county taxes required at the time of recording. Misunderstanding or ignoring these taxes can lead to financial penalties or issues with the deed's recording.

Finally, overlooking the need for legal advice is a common misstep. The nuances of real estate law and the specifics of Michigan's statutes can be complex. Without professional guidance, parties might not fully understand the implications of their deed, potentially leading to future legal challenges.

Addressing these common mistakes requires attention to detail and, often, professional legal advice. Ensuring the deed is completed correctly the first time can save a lot of time, money, and legal headaches down the road.

Documents used along the form

When transferring property in Michigan, several documents may accompany the Deed form to ensure a smooth and legally compliant process. These documents support the transfer, clarify the property's legal standing, and protect all parties involved. Understanding these forms can make the real estate transaction process more transparent and less daunting.

- Property Transfer Affidavit: This document is crucial whenever there is a change in ownership or if there is a transfer of property. It notifies the local assessor's office of the change, ensuring that property taxes are assessed accurately and billed to the rightful owner.

- Real Estate Transfer Tax Declaration (Form 2766): Used to calculate the state transfer tax on the conveyance of real property, this form provides details on the price and terms of the property's sale. It's a critical step in making sure that all taxes due are paid appropriately.

- Homestead Exemption (Principal Residence Exemption) Affidavit: This affidavit allows homeowners to claim a reduction in property taxes for their primary residence. Filing this form can offer significant savings, ensuring that the property is taxed at a lower rate than non-exempt real estate.

- Title Insurance Policy: Though not a form, per se, obtaining a title insurance policy is a common practice alongside property transfer. This policy protects both the buyer and lender from future legal claims against the property's title, such as outstanding liens or discrepancies in past ownership records.

To navigate the complexities of property transactions, it's essential to familiarize oneself with these forms and understand their role in the process. Whether you're a buyer, a seller, or a real estate professional, being well-prepared with the right documents can pave the way for a seamless transition of property ownership.

Similar forms

The Michigan Deed form, pivotal in transferring property ownership, bears resemblance to the Warranty Deed. A Warranty Deed guarantees that the property title is clear, offering protection to the buyer against future claims to the property. This document, like the Michigan Deed, is an essential tool in real estate transactions, ensuring the buyer receives a clear and undisputed title.

Similarly, the Quitclaim Deed shares the purpose of transferring real estate interests, although it does not assure the quality of the title like the Warranty Deed or the Michigan Deed. It is typically used between familiar parties, such as family members, to clear up title issues or transfer property without a traditional sale. Its simplicity and the lack of guarantees make it a rapid but less secure option for transferring property rights.

The Grant Deed, another document closely related to the Michigan Deed, serves to transfer property ownership while implying certain guarantees. It suggests that the property has not been sold to someone else and that it is free from undisclosed encumbrances. This document strikes a balance, offering more security than a Quitclaim Deed but fewer assurances than a Warranty Deed.

The Trust Deed, or Deed of Trust, parallels the Michigan Deed in its involvement in real estate transactions but functions differently. This document places the property title in the hands of a trustee until a loan is fully paid. Like the Michigan Deed, it is instrumental in property transactions but is used specifically for securing a debt with real property.

Comparable in purpose, the Transfer-on-Death (TOD) Deed allows homeowners to name a beneficiary to their property, effective upon the owner's death. This document, akin to the Michigan Deed, facilitates the transfer of real estate, yet distinguishes itself by bypassing the probate process, offering a streamlined method of transferring property post-mortem.

The Easement Agreement, while distinct, shares the concept of granting rights related to property use. Unlike the Michigan Deed, which transfers ownership, an Easement Agreement allows a non-owner to use the property for a specified purpose. It’s a crucial document for situations requiring shared access or utility maintenance, reflecting the diverse ways property rights can be allocated.

The Land Contract is another critical real estate document, similar to the Michigan Deed, in that it outlines terms for buying property. However, it allows the buyer to pay the seller directly in installments before receiving the deed upon full payment. This document underscores the flexibility in property transactions, providing an alternative financing route to traditional mortgage lending.

The Mortgage Agreement parallels the Michigan Deed through its role in property transactions, specifically by securing a loan with real estate as collateral. While the Michigan Deed transfers property rights, the Mortgage Agreement outlines the borrower's obligations and the lender’s rights, including foreclosure conditions, exemplifying the intricate legal frameworks surrounding property financing.

An Option Agreement, related yet distinct, grants an individual the right to purchase property within a set time frame but does not obligate them to buy. Like the Michigan Deed, it pertains to real estate transactions but focuses on securing potential future sales. It's a strategic document for buyers needing time to secure financing or sellers looking to lock in a future sale.

The Lease Agreement, while primarily used for renting or leasing rather than selling property, shares a foundational similarity with the Michigan Deed in terms of transferring rights to use property. Instead of transferring ownership, it grants temporary use under specific conditions, reflecting the versatility of documents governing real estate rights and responsibilities.

Dos and Don'ts

When preparing to fill out the Michigan Deed form, it's crucial to ensure accuracy and completeness to avoid any issues that might invalidate the document or cause legal disputes in the future. Below is a comprehensive list of dos and don'ts to guide you through the process:

Dos:- Review the entire form before filling it out to understand all the required information and instructions.

- Use black ink or type the information electronically, as these methods are preferred for legibility and official records.

- Ensure all names are spelled correctly and match the names on the property title and any identification documents.

- Include the property's full legal description as it appears on the current deed or property records to eliminate any ambiguity.

- Verify all financial figures, such as the sale price or transfer tax, to be accurate and correctly calculated.

- Have all parties sign the deed in front of a notary public to validate the document’s execution.

- Keep a copy of the filled-out deed for your records, as this will be valuable for future reference or proof of transaction.

- Submit the deed to the appropriate county Register of Deeds for recording promptly after it’s signed and notarized.

- Check with local offices if additional documents or forms are needed for a complete transfer, as requirements can vary.

- Avoid leaving any blank spaces; if a section doesn’t apply, mark it N/A.

- Don’t use white-out or make cross-outs to correct mistakes; instead, fill out a new form to maintain the document’s integrity.

- Refrain from signing the deed before obtaining a notary’s acknowledgement, as pre-signed documents may not be legally binding.

- Avoid guessing on legal descriptions or financial figures; seek professional advice if unsure.

- Don't underestimate the importance of promptly recording the deed; delaying can lead to potential legal complications.

- Do not ignore state or local specific requirements, such as additional forms or stamps needed upon recording.

- Resist the temptation to alter the deed format unless advised by a professional; incorrect formatting may lead to rejection.

- Don’t overlook the significance of keeping well-organized records related to the property transaction for future needs.

- Avoid managing complex property transfers without consulting with a real estate attorney or a professional in Michigan property law.

Misconceptions

When it comes to transferring property, the Michigan Deed form is an essential document. However, there are several misconceptions about this form that can lead to confusion. Understanding these misconceptions can help ensure the property transfer process goes smoothly.

All deeds are the same. In Michigan, there are several types of deed forms, including warranty, quitclaim, and covenant deeds, each serving different purposes and offering different levels of protection for the buyer.

Once a deed is signed, the property is immediately transferred. The transfer of ownership isn't complete until the deed is delivered to and accepted by the grantee, and in many cases, recorded with the county.

You don't need a lawyer to handle a deed. While it's possible to complete a deed transfer without a lawyer, legal advice can be crucial, especially to understand the type of deed that's best for your situation and to ensure the deed meets all legal requirements.

Any mistakes on a deed can easily be corrected. Correcting an error on a deed often requires executing a new deed or a correction deed, which can be time-consuming and may require legal advice.

Filling out a deed form transfers the property. Filling out the form is just one step in the process. The deed must also be legally delivered to the grantee, and often recorded, to effectively transfer the property.

A quitclaim deed guarantees a clear title. A quitclaim deed actually offers no warranties regarding the quality of the property title; it simply transfers whatever interest the grantor has in the property.

Deeds must be recorded to be valid. While recording a deed with the county provides legal notice of the ownership change, a deed can be valid between the parties involved without being recorded.

All parties need to be present to sign the deed. While all grantors must sign the deed, they don't necessarily need to be in the same place at the same time. Signatures can be obtained separately if necessary.

A deed is only valid if notarized. For a deed to be valid in Michigan, it must be notarized. This helps verify the signature's authenticity and protects against fraud.

You can transfer any property with a deed. Deeds can only be used to transfer real property. To transfer personal property, other methods such as a bill of sale would be more appropriate.

Dispelling these misconceptions is key to understanding the process of transferring property in Michigan. Whether buying, selling, or transferring property for another reason, it's important to know what your deed can and cannot do.

Key takeaways

Filling out and using the Michigan Deed form is an important process in transferring property ownership. With a focus on accuracy and compliance, here are ten key takeaways to guide you through the process:

- Identify the exact type of deed you need. Michigan offers several, including warranty, quitclaim, and lady bird deeds, each serving different purposes and offering varying levels of protection.

- Ensure all parties' names are spelled correctly. The grantor(s) (seller) and grantee(s) (buyer) must be accurately identified for the deed to be valid.

- Provide a complete legal description of the property. This goes beyond the address, requiring a detailed description that usually includes lot numbers, plat books, and other identifiers unique to the property.

- Verify that the deed includes the consideration, the value exchanged for the property. Even if the property is a gift, a nominal consideration should be listed to satisfy legal requirements.

- Signatures must be notarized. This means the parties signing the deed need to do so in front of a notary public, who will verify their identities and affix a seal to the document.

- In Michigan, the original deed must be filed with the local Register of Deeds. The location for filing is typically the county where the property is situated.

- Pay attention to the transfer tax. This tax is based on the sale price of the property and must be paid at the time of filing unless an exemption applies.

- Include a Property Transfer Affidavit. This form must be filed with the local assessor's office whenever real estate is transferred, even if no money changes hands.

- Use the correct deed form to ensure proper conveyance of the property. Using the wrong form could result in unexpected legal difficulties down the line.

- Consult an expert if in doubt. Missteps in filling out or filing the deed can lead to significant legal challenges. Professional advice from a real estate attorney or title company can be invaluable.

Each step in the process is crucial to ensure the legal transfer of property in Michigan. By following these guidelines, you can avoid common pitfalls and ensure a smoother property transaction.

Popular Deed State Forms

Indiana Quit Claim Deed Form - It may include warranties that defend the buyer against future claims on the property by other parties.

How to Get a Copy of My House Deed - Seeking professional advice when dealing with complex property transactions or when unsure which deed form to use is always recommended.

Free Texas Deed Transfer Form - Legal advice might be necessary to ensure that the deed form is filled out and executed correctly.