Free Lady Bird Deed Form for Texas

In the realm of estate planning and property management, individuals are constantly seeking efficient methods to pass on assets to their beneficiaries with minimal legal hurdles and tax implications. The Texas Lady Bird Deed form emerges as a compelling solution, offering a unique approach to property transfer upon the death of the owner. This special type of deed allows property owners in Texas to retain control over their property until their demise, at which point it seamlessly transfers to a designated beneficiary without the need for probate court intervention. Its distinctive feature is the ability to bypass the often lengthy and costly probate process, ensuring the property is transferred swiftly and smoothly to the intended heirs. Furthermore, it preserves the owner's right to use, sell, or mortgage the property during their lifetime, providing them with flexibility and peace of mind. The appeal of the Lady Bird Deed lies in its simplicity and effectiveness, making it a favorable option for many seeking to secure their property's future without sacrificing control during their lifetime.

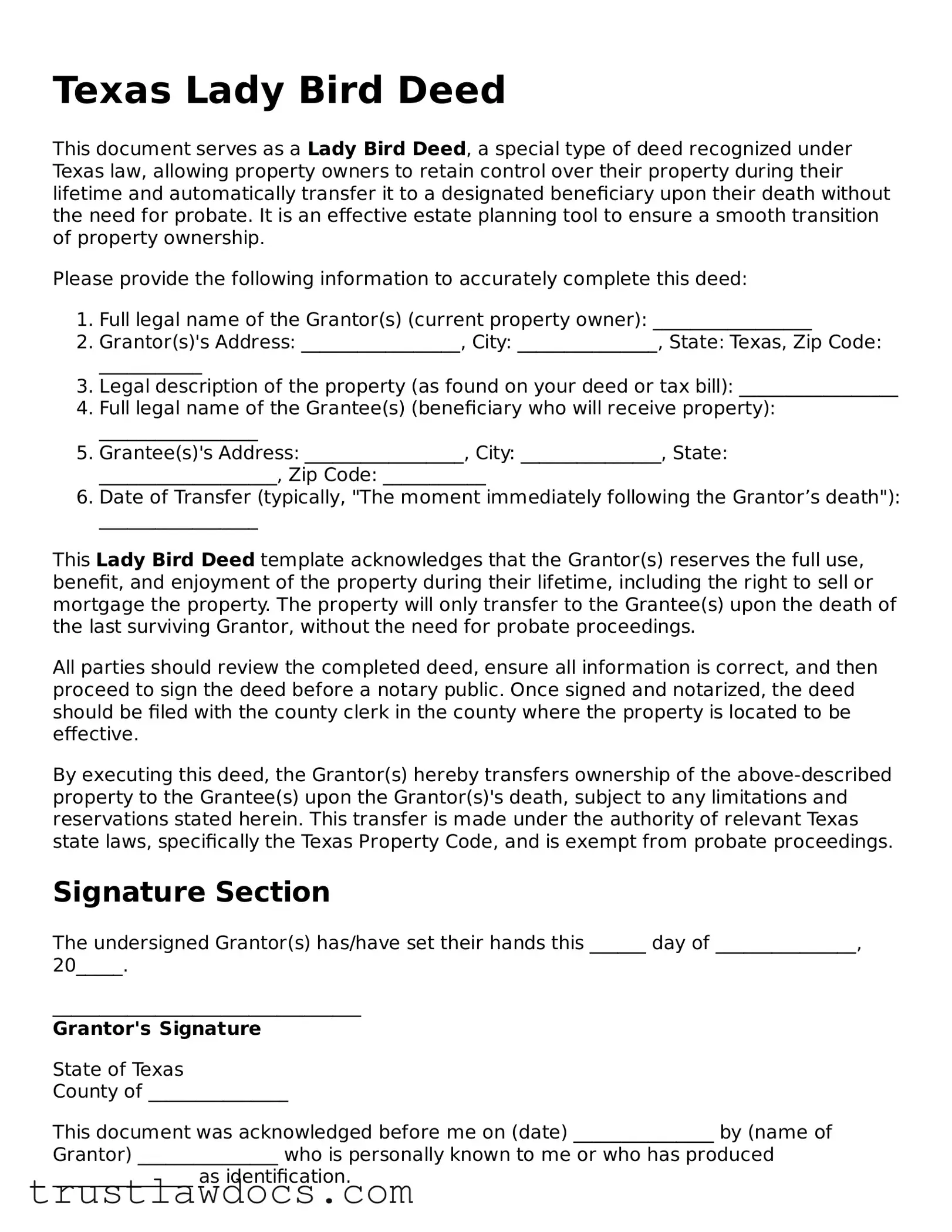

Form Example

Texas Lady Bird Deed

This document serves as a Lady Bird Deed, a special type of deed recognized under Texas law, allowing property owners to retain control over their property during their lifetime and automatically transfer it to a designated beneficiary upon their death without the need for probate. It is an effective estate planning tool to ensure a smooth transition of property ownership.

Please provide the following information to accurately complete this deed:

- Full legal name of the Grantor(s) (current property owner): _________________

- Grantor(s)'s Address: _________________, City: _______________, State: Texas, Zip Code: ___________

- Legal description of the property (as found on your deed or tax bill): _________________

- Full legal name of the Grantee(s) (beneficiary who will receive property): _________________

- Grantee(s)'s Address: _________________, City: _______________, State: ___________________, Zip Code: ___________

- Date of Transfer (typically, "The moment immediately following the Grantor’s death"): _________________

This Lady Bird Deed template acknowledges that the Grantor(s) reserves the full use, benefit, and enjoyment of the property during their lifetime, including the right to sell or mortgage the property. The property will only transfer to the Grantee(s) upon the death of the last surviving Grantor, without the need for probate proceedings.

All parties should review the completed deed, ensure all information is correct, and then proceed to sign the deed before a notary public. Once signed and notarized, the deed should be filed with the county clerk in the county where the property is located to be effective.

By executing this deed, the Grantor(s) hereby transfers ownership of the above-described property to the Grantee(s) upon the Grantor(s)'s death, subject to any limitations and reservations stated herein. This transfer is made under the authority of relevant Texas state laws, specifically the Texas Property Code, and is exempt from probate proceedings.

Signature Section

The undersigned Grantor(s) has/have set their hands this ______ day of _______________, 20_____.

_________________________________

Grantor's Signature

State of Texas

County of _______________

This document was acknowledged before me on (date) _______________ by (name of Grantor) _______________ who is personally known to me or who has produced _______________ as identification.

_________________________________

Notary Public's Signature

My Commission Expires: _______________

After completing this document, ensure to keep a copy for your records and file the original with the appropriate county office. Reviewing this document with a legal professional is highly advised to ensure compliance with Texas law and address any specific circumstances or questions you may have.

PDF Form Details

| Fact | Description |

|---|---|

| 1. Definition | A Texas Lady Bird Deed is a legal document that allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. |

| 2. Name Origin | The deed is nicknamed after Lady Bird Johnson, the former First Lady of the United States, though she never used one herself. It's officially known as an Enhanced Life Estate Deed. |

| 3. Main Purpose | Its primary function is to pass real property directly to a designated beneficiary at the death of the property owner, bypassing the probate process. |

| 4. Control During Lifetime | The property owner retains full control over the property during their lifetime. They can sell, use, or even mortgage the property without requiring consent from the beneficiary. |

| 5. Avoidance of Probate | One of the most significant advantages is avoiding the time-consuming and often costly probate process. |

| 6. Governing Law | In Texas, Lady Bird Deeds are governed by Texas Property Code, which dictates how such deeds are structured and enforced. |

| 7. Not a Guaranty | While a Lady Bird Deed aims to simplify property transfer after death, it does not guarantee avoidance of legal or financial advice. Property owners should consult with legal professionals to ensure accuracy and legality. |

How to Write Texas Lady Bird Deed

Completing a Texas Lady Bird Deed form is a critical process for property owners who wish to seamlessly transfer property upon their death without the need for probate. This form allows the property owner to retain control over the property during their lifetime, including the right to sell or change the terms of the deed. To fill out this form correctly, it is important to follow each step carefully to ensure all legal requirements are met and the property is transferred according to the owner's wishes.

- Identify the parties involved: Enter the full legal name of the current property owner, known as the "grantor," and the full legal names of the beneficiaries, known as the "grantees."

- Describe the property: Include a complete legal description of the property. This information can usually be found on the current deed or property tax statement.

- Specify the retained life estate: Clearly state that the grantor retains a life estate in the property. This means the grantor can use, profit from, and even sell the property during their lifetime.

- Detail the transfer upon death: Mention that upon the death of the grantor, the property will automatically pass to the named grantees without the need for probate.

- Sign and date the deed: The grantor must sign and date the deed in the presence of a notary public. The exact location of the signature lines may vary by form.

- Notarize the deed: The notary public will fill out their section, confirming the identity of the grantor and witnessing the signature.

- File the deed with the county clerk: Once notarized, the deed must be filed with the county clerk's office in the county where the property is located. Filing fees may apply.

By following these steps carefully, a property owner can ensure that their Texas Lady Bird Deed is filled out correctly, legally valid, and effectively communicates their wishes regarding the future transfer of their property. It is also advisable to consult with a legal professional to ensure all aspects of the deed meet state requirements and personal estate planning goals.

Get Answers on Texas Lady Bird Deed

What is a Lady Bird Deed in Texas?

A Lady Bird Deed, often used in Texas, is a special type of property deed that allows a property owner to transfer their real estate to named beneficiaries upon their death without the need for a traditional probate process. This deed grants the owner the right to retain control over the property during their lifetime, including the ability to sell or mortgage the property, with the transfer to the beneficiaries occurring automatically upon the owner's death.

How does a Lady Bird Deed differ from a traditional will?

Unlike a traditional will, a Lady Bird Deed is a non-probate mechanism for transferring property. This means that the property can pass directly to the designated beneficiaries without going through the court-supervised probate process. This can save time and money and avoid the potential for disputes among potential heirs. However, it's important to note that while a Lady Bird Deed transfers real property immediately upon death, a will can cover a broader range of assets and provide more comprehensive estate planning instructions.

Who can use a Lady Bird Deed?

Any property owner in Texas who wants to ensure a smooth and cost-effective transfer of their real estate upon their death may consider using a Lady Bird Deed. This type of deed is particularly useful for individuals seeking to avoid the complexities and expenses of probate, preserve their estate for their beneficiaries, and retain full control over their property during their lifetime.

Are there any restrictions on the type of property that can be transferred using a Lady Bird Deed?

There are no specific restrictions on the type of property that can be transferred using a Lady Bird Deed in Texas. It can be used for residential homes, land, and other types of real property. However, the deed must be properly executed and recorded to be effective. It's important to ensure that the property in question does not have any legal encumbrances that could affect the transfer.

How is a Lady Bird Deed executed?

To execute a Lady Bird Deed in Texas, the property owner must sign the deed in front of a notary public. The deed must include the legal description of the property, the name of the beneficiary, and a statement that grants the owner the right to retain control over the property during their lifetime. Once notarized, the deed needs to be filed with the county recorder’s office in the county where the property is located to be valid.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked at any time during the property owner's lifetime. Because the deed allows the property owner to retain control over the property, including the right to sell or change the designated beneficiary, the owner can also choose to revoke the deed entirely. Revocation requires drafting a new document that explicitly revokes the deed and then recording this document with the county recorder’s office.

What are the tax implications of using a Lady Bird Deed?

The use of a Lady Bird Deed can have several tax implications, most notably related to federal estate taxes and the potential for a step-up in basis for the beneficiaries. Since the property is not considered part of the probate estate, it may help in avoiding estate taxes if applicable. Additionally, beneficiaries might benefit from a step-up in basis, which can reduce capital gains taxes if the property is sold. However, tax laws are complex and subject to change, so it’s wise to consult with a tax professional or estate planning attorney to understand the specific implications for your situation.

Common mistakes

One common mistake individuals make when filling out the Texas Lady Bird Deed form is failing to correctly identify the property. It is crucial to include the complete legal description of the property, not just the address. This description is often found in previous property deeds or tax assessment documents. Without this detailed information, there may be questions about what property is actually being transferred, leading to potential disputes or complications in the future.

Another error occurs when people do not properly identify all the parties involved. The form requires the names of both the grantor—the current owner of the property—and the grantee, the person who will receive the property upon the grantor's death. Mistakes in spelling or failing to use full legal names can cause significant issues in the transfer of the property.

Some individuals mistakenly believe that a Lady Bird Deed must be notarized to be valid. While notarization is not a requirement for the deed to be legal, failing to get the document notarized can lead to challenges in proving its authenticity if it ever comes into question. This step, while seemingly minor, adds a layer of security in affirming the document's legitimacy.

Incorrectly assuming that the Lady Bird Deed automatically overrides all previous deeds is another frequent misstep. If there are existing claims or encumbrances on the property, such as mortgages or liens, these do not magically disappear with the signing of a Lady Bird Deed. Individuals must ensure that these issues are resolved, or at least well understood, as they can affect the transfer of property.

People often omit to specify the type of ownership the grantee will have over the property. In Texas, it's important to declare whether the property will be held as a joint tenancy, tenancy in common, or another form of ownership. Failure to do this can result in confusion about the rights of the grantee or other potential heirs.

Another common mistake is not properly consulting with legal professionals before completing the form. While the Lady Bird Deed is a tool designed to simplify property transfer without the need for probate, its nuances and implications might not be immediately clear to those without legal expertise. This oversight can lead to unintended legal and financial consequences.

Failing to file the deed with the appropriate county office is a critical oversight. For the deed to be effective and to serve its purpose of transferring property upon death, it must be recorded in the county where the property is located. This step finalizes the process and makes the transfer public record.

Last but not least, individuals sometimes misunderstand the tax implications of transferring property through a Lady Bird Deed. Although this method of property transfer can offer certain advantages, such as avoiding probate, it is important to consult with a tax advisor to understand the potential tax responsibilities for both the grantor and the grantee. Unanticipated tax liabilities can arise, impacting the financial well-being of those involved.

Documents used along the form

When dealing with estate planning in Texas, particularly with a focus on the transfer of real property, the Texas Lady Bird Deed form is often highlighted due to its unique ability to retain control over the property during the grantor's lifetime, while ensuring a smooth transition to the designated beneficiaries upon their passing. In conjunction with this document, several other forms and legal documents play critical roles in a well-rounded estate planning strategy. These documents not only complement the Texas Lady Bird Deed but also provide a comprehensive approach to asset management and inheritance planning.

- General Warranty Deed - This document is pivotal in real estate transactions, providing the highest level of buyer protection among property deeds. It guarantees that the grantor (seller) holds clear title to a piece of real estate and has the right to sell it. It also assures the buyer that the property is free from all encumbrances, except those specifically detailed in the deed.

- Durable Power of Attorney - This legal document grants a designated person the authority to act on behalf of the principal in managing their property, financial affairs, and other legal matters, especially during times when the principal is incapacitated. It remains in effect even if the principal becomes mentally incompetent, ensuring that their affairs can be handled according to their wishes.

- Medical Power of Attorney - Similar to the Durable Power of Attorney, this document specifically allows an appointed agent to make healthcare decisions on behalf of the principal if they become unable to do so themselves. It covers a range of decisions from minor treatment choices to end-of-life care, based on the principal's preferences and stipulations.

- Last Will and Testament - This essential estate planning document outlines how the person's assets will be distributed upon their death. By specifying beneficiaries, establishing guardians for minor children, and possibly creating trusts, it complements the Texas Lady Bird Deed by covering assets that are not included under its provisions.

The synergy between the Texas Lady Bird Deed and these additional legal documents creates a fortress of protections and directives around an individual's estate. Such comprehensive planning ensures that property and personal wishes are respected and executed as intended, offering peace of mind to all involved parties. By understanding and utilizing these documents in conjunction, individuals can navigate the complexities of estate planning with greater clarity and confidence.

Similar forms

A Texas Lady Bird Deed is notably similar to a standard Warranty Deed, which is used to guarantee that the title to property is clear and to transfer real estate with warranties from the seller to the buyer. Both documents serve to transfer property, but a Lady Bird Deed uniquely allows the current property owner to retain control and use of the land until their death, at which point it passes directly to the designated beneficiaries without going through probate.

Additionally, it shares some similarities with a Life Estate Deed, where an owner transfers property to a recipient but keeps the right to use the property for their lifetime. Both the Lady Bird Deed and the Life Estate Deed involve life tenancy and post-death property transfer, but the former does not restrict the original owner’s ability to sell or mortgage the property during their lifetime without beneficiary consent.

The Lady Bird Deed is akin to a Transfer on Death (TOD) Deed in its aim to bypass the probate process for real estate upon the owner’s death. Both allow property to be passed directly to a beneficiary without the need for probate court involvement, streamlining the transition of assets. However, they are distinguished by the Lady Bird Deed's unique feature of retaining the owner's right to sell or change the deed without the beneficiary’s permission.

Comparatively, a Revocable Living Trust is another estate planning tool that avoids probate by allowing assets to be transferred to beneficiaries upon death, similar to how a Lady Bird Deed operates for real estate. The major difference lies in the scope; a Revocable Living Trust can include various types of assets beyond real estate, offering a broader estate planning tool.

The Quitclaim Deed also shares certain characteristics with the Lady Bird Deed since both can transfer real estate interests. However, a Quitclaim Deed makes no guarantees about the property title's clarity, significantly differing in the level of protection and assurance offered to the recipient compared to the enhanced benefits of a Lady Bird Deed.

Joint Tenancy with Right of Survivorship (JTWROS) arrangements bear similarity in the instantaneous transfer of property upon death, thus sidestepping probate. In a JTWROS, when one owner dies, their interest automatically passes to the surviving owner(s), akin to the beneficiary designation in a Lady Bird Deed. Nevertheless, the Lady Bird Deed stands apart by not requiring the original owner to share control or ownership prior to their death.

Another related document is the Durable Power of Attorney, which allows an individual to appoint someone to manage their affairs if they become incapacitated. While this document doesn't directly relate to the transfer of property upon death, it represents a planning tool that, like the Lady Bird Deed, can be pivotal in managing assets and ensuring decisions can be made if the individual is unable to do so themselves.

A Special Warranty Deed, which provides a guarantee only against defects that occurred while the seller owned the property, shares the function of transferring property like the Lady Bird Deed. Yet, its guarantee is much more limited compared to the Lady Bird Deed, which allows for continued control over the property by the owner until death, without the same assurances regarding the title as offered in a Special Warranty Deed.

Dos and Don'ts

Filling out the Texas Lady Bird Deed form requires a clear understanding of what should and shouldn't be done to ensure the process is smooth and the document is legally sound. Below are some recommended do's and don'ts to guide you through this process.

Do's:

- Double-check property descriptions: Make certain that the legal description of the property is accurate and matches the description on the property's title documents.

- Consult with a professional: Seek advice from a legal professional to ensure the deed is correctly filled out and meets all legal requirements.

- Use the correct form: Verify that you are using the most current version of the Texas Lady Bird Deed form.

- Include all necessary parties: Make sure to include all relevant parties in the deed, including the grantor(s) and grantee(s).

- Be clear about the life estate: Clearly state that the grantor retains a life estate in the property, which includes the right to use it during their lifetime.

- Sign in the presence of a notary: Ensure the deed is signed in the presence of a notary public to make it legally binding.

- File the deed with the county clerk: After notarization, file the deed with the county clerk in the county where the property is located.

- Keep a copy for your records: Always keep a copy of the filed deed for your personal records.

Don'ts:

- Don't rush through the process: Take your time to carefully complete each section of the deed to avoid any errors.

- Don't use generic descriptions: Avoid using vague or generic descriptions of the property. Be as specific as possible.

- Don't forget to specify the transfer: Be explicit that the property will transfer to the designated grantee(s) upon the grantor's death without going through probate.

- Don't omit key details: Every field in the form is important. Do not leave any section blank unless it is specified as optional.

- Don't disregard state laws: Ensure that the deed complies with all Texas state laws regarding property transfer and deeds.

- Don't neglect to update your estate plan: Incorporate the use of the Lady Bird Deed into your broader estate plan and update as necessary.

- Don't use this deed without legal consultation: Given the potential implications for estate planning and taxes, professional legal advice is crucial.

- Don't assume it's right for everyone: Understand that the Lady Bird Deed may not suit everyone's situation or estate planning goals.

Misconceptions

The Texas Lady Bird Deed is a special type of property deed utilized in estate planning to transfer property upon the death of the owner without the need for probate. It has gained popularity for its simplicity and efficiency but is often misunderstood. Here are nine common misconceptions about the Texas Lady Bird Deed that need clarification:

- It avoids taxes: Many people believe that a Lady Bird Deed can help avoid taxes. While it does bypass the probate process, thereby potentially reducing estate settlement costs, it does not exempt the property from estate or inheritance taxes that may apply.

- It's effective in all states: Another misconception is that the Lady Bird Deed is recognized and effective in all states. In reality, it is a legal instrument specific to a few states, including Texas, and may not be recognized or usable in jurisdictions outside of these areas.

- It grants immediate property rights to beneficiaries: Some individuals misunderstand that beneficiaries gain immediate rights to the property upon the deed's execution. However, the beneficiaries only obtain an interest in the property after the current owner’s death.

- It's irrevocable: There's a false belief that once a Lady Bird Deed is executed, it cannot be changed or revoked. Contrary to this belief, the property owner retains full control over the property and can modify or revoke the deed at any time before death.

- Only for the elderly: A common myth is that the Lady Bird Deed is only suitable for the elderly. While it's beneficial for estate planning later in life, any property owner looking to streamline the transfer of their real estate upon their death can use it, regardless of their age.

- It complicates mortgage issues: Some people incorrectly assume that having a Lady Bird Deed complicates or is incompatible with a mortgage on the property. It does not affect the owner’s ability to mortgage the property; the deed specifically allows the owner to retain full control over the asset, including mortgaging or selling.

- It prevents the owner from selling the property: There is a misconception that once a Lady Bird Deed is in place, the original owner cannot sell the property. This is not true. The deed allows the owner to retain all rights, including the right to sell or otherwise dispose of the property at any time.

- It's a tool for Medicaid fraud: Some believe that the Lady Bird Deed is used to defraud Medicaid by hiding assets. It's important to understand that while it might help with Medicaid estate recovery planning, using it with the intent to deceive federal programs is illegal and unethical.

- It replaces a will: Finally, a widespread misconception is that a Lady Bird Deed replaces a will. While it is a useful tool in estate planning, it only covers real estate and does not substitute for a comprehensive will, which can dispose of other assets and express more detailed wishes.

Understanding the true nature and legal implications of the Texas Lady Bird Deed is crucial for property owners considering it as part of their estate planning strategy. Dispelling these misconceptions allows for a more informed decision-making process, ensuring that the estate planning goals are met effectively and lawfully.

Key takeaways

If you're diving into estate planning in Texas, you might have come across the term "Lady Bird Deed" (LBD). It's a nifty tool for property management and inheritance, which cleverly balances control and future planning. Here are five key takeaways to understand about filling out and using the Texas Lady Bird Deed form:

- Avoiding Probate: One of the standout features of the Lady Bird Deed is its ability to bypass the probate process. When the property owner passes away, the property immediately transfers to the beneficiaries named in the deed. This not only saves time but also reduces the legal expenses associated with probate court.

- Maintaining Control: With a Lady Bird Deed, the property owner retains full control over the property during their lifetime. This means the owner can sell, lease, or mortgage the property without needing to consult the beneficiaries first. It's a blend of flexibility and future-proofing that's hard to beat.

- Simple to Execute: Compared to other estate planning tools, the Lady Bird Deed is relatively straightforward to execute. However, precision in drafting is crucial to ensure the deed's effectiveness and to avoid unintended consequences. Consulting with a legal expert who is familiar with Texas real estate laws is always recommended.

- Medicaid Benefits: The use of a Lady Bird Deed in Texas can have favorable implications for Medicaid planning. Since the property is not considered part of the estate for Medicaid recovery purposes, it allows the individual to apply for Medicaid without the property affecting eligibility. Yet, specific rules and timing are critical here, and professional advice is essential.

- Tax Advantages: Beneficiaries receive a stepped-up basis in the property at the time of the original owner’s death. This means if the property has increased in value, the beneficiaries’ capital gains tax is calculated based on the property's value at the time of inheritance, not when it was originally purchased. It's a significant potential tax benefit that can lead to considerable savings.

When considering a Lady Bird Deed, it's important to weigh these benefits against your specific circumstances and goals. Whether you're looking to streamline your estate, safeguard against Medicaid recovery, or simply ensure your property goes directly to your loved ones, a Lady Bird Deed offers a unique set of advantages that are worth exploring.

Popular Lady Bird Deed State Forms

Lady Bird Deed Texas Pros and Cons - This deed strategy is particularly beneficial for individuals aiming to keep the property within the family and minimize external interference.